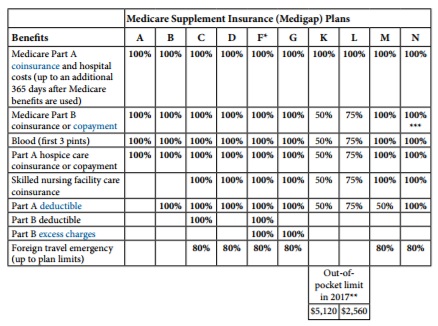

Medi Gap Plan G has better Pricing than F!

Rates Medi Gap Plan F vs G

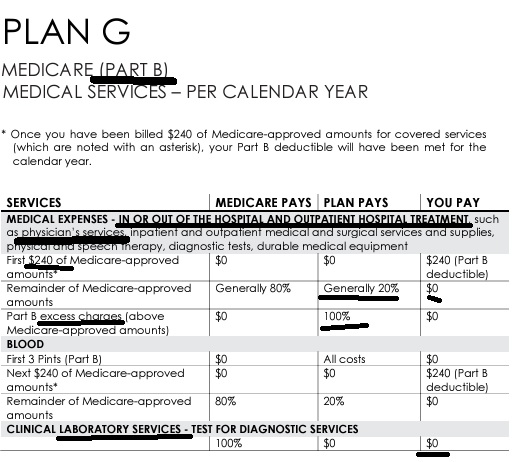

Does it make sense to pay the extra monthly premium when the only difference is the

annual $240 of the Part B Deductible?

Source our Blue Cross Webpage use an actual chart or get a quote – the above chart is for illustration ONLY

Here’s rules on changing from F to G for lower premiums.

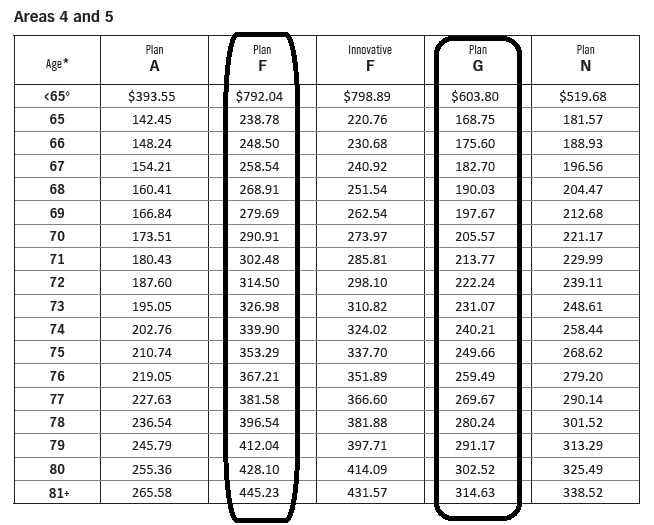

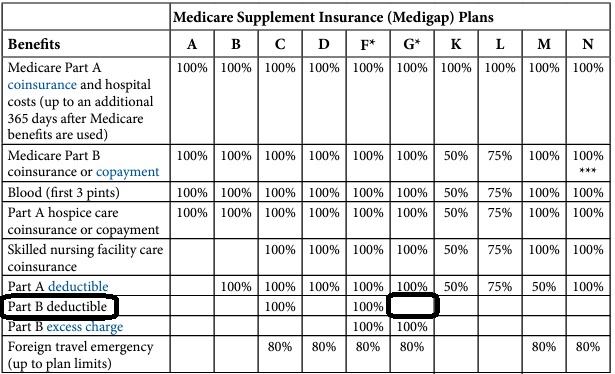

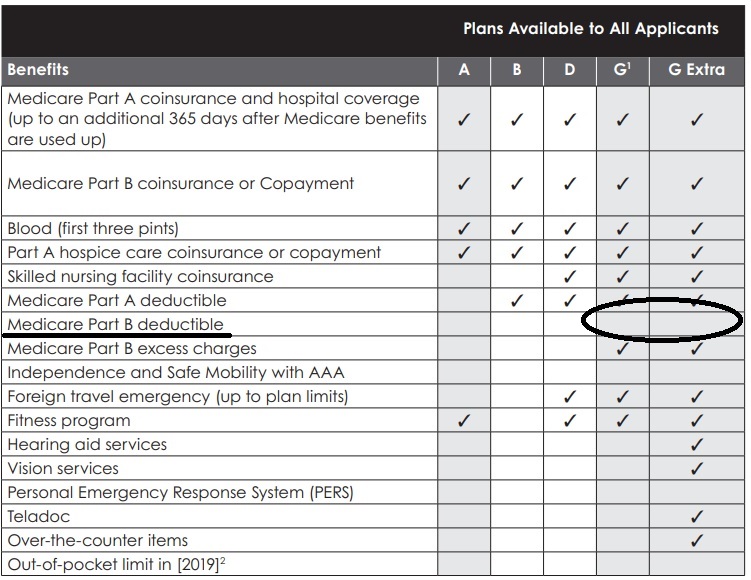

Compare Coverage F to G

The ONLY difference is the Part B (Doctor Visits – Out of Hospital) Deductible 2024 $240 Medicare Fact Sheet

Source Page 11 of Medi Gap Manual

- Seniors Find Medicare Enrollment Confusing, Avoid Changing Plans

- How does that compare to the premium?

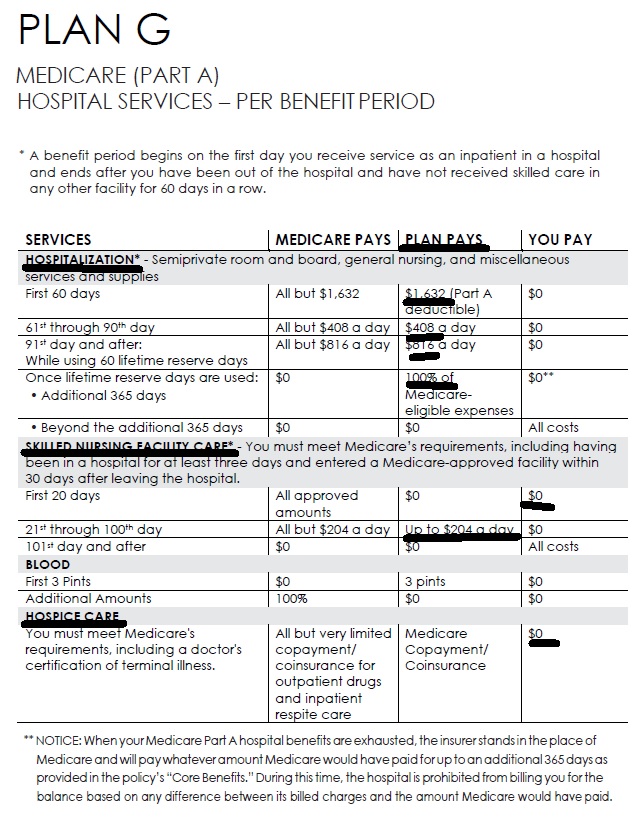

Medicare Part A

(#Hospital Insurance)

Medicare Part A Hospital coverage helps pay for care in hospitals as an inpatient,... skilled nursing facilities, hospice care, and some home health care (see publication # 10969) but not Long Term Care.

Most people get Part A automatically when they turn age 65 at no charge, since they or a spouse paid Medicare taxes while they were working. You need to sign up close to your 65th birthday, even if you will not be retired by that time. (If you are getting Social Security benefits when you turn 65, your Medicare Hospital Benefits - Part A - start automatically.)

Here's a chart it's just a illustration and is NOT official that shows what Medicare pays, the gaps in Medicare and what you may get when you add a Medi Gap Plan or Medicare Advantage to cover those gaps

-

See full brochure I cut and pasted this from

-

Pays on top of Medicare Parts A & B – Any Medicare Provider

Part B - Outpatient helps Pay For Doctors' services, outpatient hospital care, and some other medical services that Part A does not cover, such as the services of physical and occupational therapists, and some home health care see publication 10969, but not Long Term Care. Part B helps pay for these covered services and supplies when they are medically necessary.

The chart below is a very brief summary. Check the actual Evidence of Coverage for the plan you want to enroll in, Medicare & You or actual Medicare documents.

2024 Fact Sheet Medicare Costs

Our Webpages with more detail:

- Coverage in Part A Hospital & B Doctor Visits? Part D Rx

- Chiropractic – Medicare A & B – MAPD

- Diabetes – Prevention & Coverage under Medicare & ACA

- Durable Medical Equipment

- End Stage Renal – Kidney Failure

- Hearing Aids

- Physical therapy – occupational speech

- Skilled Nursing SNF & Home Health What Medicare Pays

- Togetherness – Loneliness Social Determinants of Health

- Mental Health

- How to sign up for Medicare?

- FAQ Medical Necessity our Medical Necessity Webpage

- Original Medicare & Medi-Gap – Supplement vs Medicare Advantage MAPD

- Medicare Beneficiaries’ Out-of-Pocket Spending for Health Care AARP

Video Explanation of F vs G Pricing

Introduction to #MediGap

Our video explaining the Governments brochure on choosing a Medi Gap Policy. Click the little square on the right, to enlarge the video.

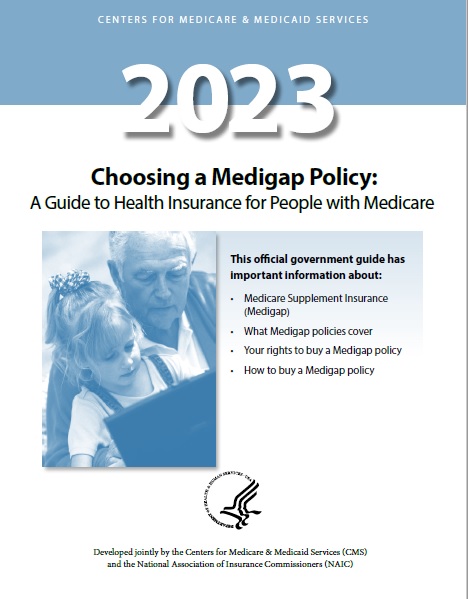

- 2023 Official Medicare Guide to choosing a Medi Gap Policy # 02110

- Get Quotes for Medi Gap Quotit

- Medicare Supplement Policies CA Insurance Code §§10192.1 - 10192.24

- CA Health Care Advocates HI CAP Fact Sheet

- Supplementing Medicare: An Overview 10-30-20 Hi Cap

- Supplementing Medicare: Medigap Plans 12-14-23 Hi Cap

- Your Rights to Purchase a Medigap 12-14-23 HI Cap

- Search for Participating Doctors & Hospitals - Just about ALL of them!

- Anthem Blue Cross Information & Enrollment

- United Health Care

- Blue Shield – Medi-Gap Information & Enrollment

- Health Net

-

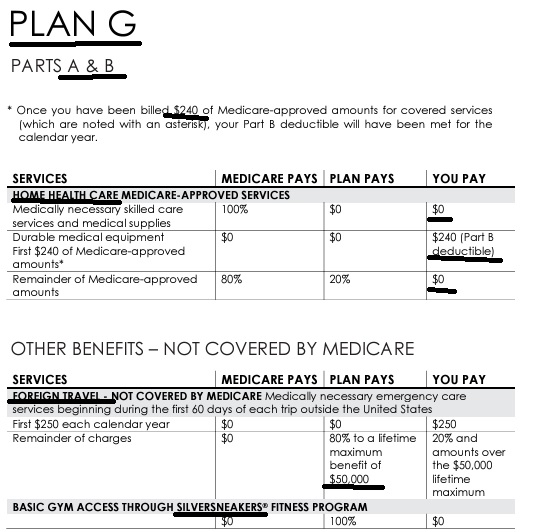

Medi Gap pays the medical expenses that Original Medicare Part A (Hospital) and Part B (Doctor) doesn't. Check out the chart on this page to see what Medicare Pays, what you pay and what a Medi Gap plan pays.

- If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medi-gap policy will pay its share. You’re responsible for any costs that are left. Medicare.Gov *

-

Original Medicare, Medicare Advantage nor Medi Gap pay for long term care either in a nursing home or at home care. Get more information on Long Term Care here. Even if you think you can't afford any extra premiums, there's a lot of valuable information to help with planning.

Blue Shield of California Authorized Agent - Broker

![]()

Medi Gap Plans from Anthem Blue Cross –

Click for Information and ONLINE enrollment

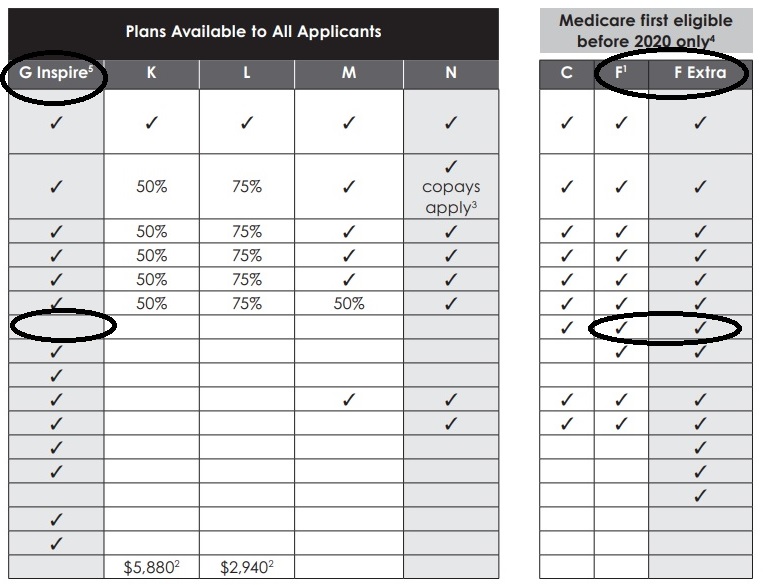

Medi Gap A - N #Chart

From Blue Shield Enrollment Guide

Click link or image to enlarge

|

|

- Our webpage on F vs G

- 2024 Fact Sheet Medicare Costs

- Fact Sheet Innovative Benefits Hi Cap

“Plan F vs G FAQ’s

Plus Hi F & Extra

- Pros and Cons of Hi F with a $2,300 deductible vs Plan F with no deductible or G with $233 deductible.

- How much extra will you pay in premiums compared to eliminating around $2k of deductible.

- Instant Price Premium comparison quote engine

- See our page on MLR Medical Loss Ratio – the Insurance Companies pay out 80% of premiums and keep 20% for profit and administration. Is it worth it to trade dollars?

- Here’s a comparison with Metal Levels for under 65 plans

- Steve’s Video on taking a lower deductible – even when you know you will have big claims next year – Metal Level under 65 plans

.

- Blue Shield Extra F has vision and dental.

- What does it NOT have that Anthem Blue Cross F has

- There must be difference in premiums or something?

- Take a look at the chart above. The Federal Government sets the standards for what the 10 Medi Gap plans cover. See publication 02110 – Choosing a Medi Gap Policy for more detail.

- Thus, F Extra has to have everything that F has.

- get instant premium quotes & comparisons

- If you want to stay with Blue Cross Medi Gap they will probably have a plan G Extra in March.

- The point of Blue Shield Extra, is that they are having a special promotion and offering it to anyone who has a Medi Gap plan NOW, with any company.

- Normally, one must wait till their birthday to change to an equal or lesser plan. In 2020 Innovative and Extra doesn’t count as better.

- So, you could wait till your birthday and stay with Blue Cross.

- Underwriting Holiday for Medicare Supplement Plans

- We’re kicking off the holiday season with a holiday of our own. We’re happy to announce that for a limited time, current Medicare Supplement members from other carriers and from Blue Shield of California can enroll in Blue Shield’s Medicare Supplement Plan F Extra and Plan G Extra without underwriting approval.

- Why plan F cost more than F extra please?

- Click here to get Medi Gap Quotes.

- For 2020 F won’t be sold to new customers at all, right? See our page on that… F extra was low priced to have a “fire sale.” To get as many people into F before sales were mandated to be closed by the Federal Government.

- Social Determinants of Health

.

- optometrists and benefits Blue Shield Medi Gap

- Where is the information listed?

- You can find optometrists by using Blue Shield’s provider finder. Or calling Member Services at (800) 248-2341

- You can get details from the Summary of Benefits evidence of coverage

- How about appointing us as your broker, no extra charge, Blue Shield pays us, so that we can get compensated for helping you?

.

- I just turned 85. My premium for Hi-F changed in October to $133 from $126.

- Do you have any info on significant premium jumps for my continuing on Hi-F?

- Do you have any guess on whether Hi-F will continue to be available to me?

- In my experience with Hi-F there have been two years where I received a rebate in excess of $100

- So I hope I can stay with Hi-F.

- The October 2019 edition of Cal Broker Magazine has that, pages 8 & 9. The magazine states that the Insurance Companies are still mandated to offer the coverage in the future for those who reached 65 by 12.31.2019 or qualified through SSDI.

- See the rate chart above. It shows the premium changing by age from $126 to $133. The advantage here for you is that at 85 there are no more increases due to age.

- I was recently told at a Blue Shield Agent meeting that F & Hi F would be offered – continued – grandfathered in the future for those that have it. Hi F won’t be available to new people, but you can keep it. High F is available from Health Net.

- If the group of those you have high f and f have too many claims, than instead of rebates, there could be rate increases. It’s a function of Medical Loss Ratio. – Rebates

.

- Would you please clarify the changes I got on my Hi F plan for 2020?

- What is the premium change?

- What is the deductible change?

- Here’s Medicare.Gov on the cost sharing changes

- Does that “beg” the question, I paid so much into Medicare, why do they keep raising the costs?

- The deductible where Hi F starts paying goes from $2,300 to $2,340. Sure it’s a High Deducible when so many people want FREE everything, but look at the rate chart and you’re saving $1,200 or more per year. At higher ages around $3,500/year. More than you would get on claims!

- Any downside to all these extra benefits?

- It’s not one of the 10 standardized plans. Birthday Rule Guaranteed Issue? Rate Changes and switching?

medicarequick.com/the-downside-of-medigap-plan-f-with-extra-or-innovative-benefits/

.

- Do I have to actually buy plan F now to be grandfathered in

- or if I’m 65 now but I have a group plan

- when I no longer am working will I still be able to buy plan f?

- MACRA prohibits the sale of Medigap Plans C and F beginning in 2020, but only to newly eligible Medicare beneficiaries.

- Only people who become 65 in 2020 or later, or anyone who becomes eligible for Medicare in 2020 or later because of disability or ESRD, can’t buy it. An individual who becomes eligible for Medicare before 2020, continues to work and delays enrollment in Part B, may buy Medigap Plan C or F if they leave that employment and enroll in Part B in 2020 or later. CA Health Care Advocates *

Medi-gap Plans C and F

Medi-gap Plans C and F will no longer be available to newly eligible Medicare beneficiaries beginning in January 2020.This is because CMS-Medicare decided they want those on Medicare to have more at stake when using benefits, so the Part B Deductible is no longer covered. Those who have previously purchase or were able to purchase Plan F, Innovative F, High F or F Extra, prior to January 1, 2020 can keep (Grandfathered) or enroll in the older plans!

For new enrollees, Plan G has same comprehensive benefits as Medicare Supplement Plan F, but Plan G does not cover the Part B deductible amount. Medicare now requires new people to pay the Part B deductible. Blue Shield Email dated 9.20.2017 * Choosing a Medi Gap Policy # 02110 * CA Health Advocates * AAFP.org * CMS.gov * CMS FAQ’s * AHCA of 2017 §102 would add $422,000,000 for 2017 * Small practices to be exempt? Modern Health Care 6.20.2017

Here’s rules on changing from F to G for lower premiums.

Medicare Access and CHIP Reauthorization Act of 2015 (MACRA),

(H.R. 2, Pub.L. 114–10)

commonly called the Permanent Doc Fix,

establishes a new way to pay doctors who treat Medicare patients, revising the Balanced Budget Act of 1997. The reform is the largest in scale on the American health care system since the Affordable Care Act in 2010. It fixes the way Medicare doctors are reimbursed, fills in a funding gap and extends a popular children’s insurance program, CHIP.[1]

There MACRA related regulations also address incentives for use of health IT by physicians. Wikipedia

Resources & Links

- CMS.gov

- CA Health Care Advocates

- NAIC – National Assoc of Insurance Commissioners – Guidance for MACRA * FAQ’s *

- Section 401 of MACRA – Sec. 1882. [42 U.S.C. 1395ss] (z) prohibits the sale of Medigap policies that cover Part B deductibles to “newly eligible” Medicare beneficiaries defined as those individuals who:

- (a) have attained age 65 on or after January 1, 2020; or

- (b) first become eligible for Medicare due to age, disability or end-stage renal disease, on or after January 1, 2020. NAIC * SSA.gov *