Rated policies – Pre-Existing Medical Conditions can be underwritten for Life Insurance at the

Preferred Price or with a Surcharge (Rate)

Instant Term Life Insurance Quote #naaipquote

- Schedule Zoom consultation

- Tools - Calculator to help you figure out how much you should get

- How much life insurance you really need?

Life Insurance Buyers Guide

If you have any of the #conditions below, please complete our

Life Insurance Health History Form

|

A – C Arthritis Bladder Skin Cancer – Pre Underwriting Form C – E Cholesterol – Lipid Underwriting Questionnaire |

Heart Attack Bypass Coronary Artery Disease H – J Hematuria |

Stones L – Z Liver Enzyme Elevations |

- Please complete our Life Insurance Health History Form

- If all else fails, check our

- Our webpage on

- Sample Underwriting Guide LGA America we underwrite individuals, not impairments.

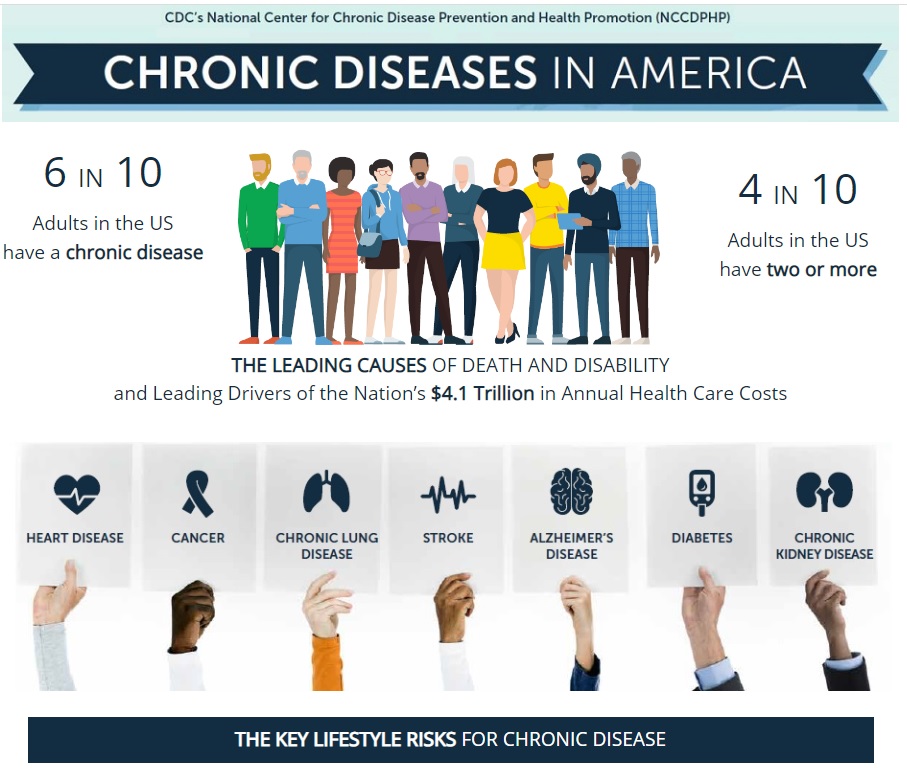

#chronic disease

- A chronic condition is a human health condition or disease that is persistent or otherwise long-lasting in its effects or a disease that comes with time. Common chronic diseases include arthritis, asthma, cancer, chronic obstructive pulmonary disease, diabetes and some viral diseases such as hepatitis C and acquired immunodeficiency syndrome.

- Chronic diseases constitute a major cause of mortality, and the World Health Organization (WHO) attributes 38 million deaths a year to non-communicable diseases

- While risk factors vary with age and gender, most of the common chronic diseases in the US are caused by dietary, lifestyle and metabolic risk factors that are also responsible for the resulting mortality.wikipedia.org

- cdc.gov/chronic disease

- One might not die directly from a chronic illness, but there is an increased risk of suicide!

- Increased risk of Cancer:

- heart disease markers, diabetes, chronic kidney disease markers, pulmonary disease and gout (a form of arthritis).

- The study found that each of these chronic diseases or markers was individually linked with a 7- to 44-percent increased risk of developing cancer, and a 12- to 70-percent increased risk of dying from cancer.

- High chronic disease risk scores were also linked with a 13-year reduction in life span for men and a 16-year reduction in life span for women. live science.com chronic-diseases-cancer

- iii.org/facts-statistics-mortality-risk

- California to Potentially Implement a Long-Term Care Payroll Tax

What are the Names, #Classifications of premiums & Table Ratings?

The healthiest people with the safest lifestyles are considered the least risky, so they are placed in the categories that qualify them for the lowest rates. Although the exact names differ from one company to the next, here’s a introduction to the names.

- Preferred Plus

- Sometimes called Preferred Elite, Super Preferred, or Preferred Select, this is the best classification you can get and comes with the lowest premiums.

- You’re in excellent health, your height-to-weight ratio falls into the insurance company’s desired range, and your family history is as squeaky clean as your lifestyle.

- Applicants in excellent health who typically haven’t smoked for at least five years may land in this category and get the best possible rates. You’ll need normal weight for height, normal blood pressure and cholesterol readings, and a clean medical history. Generally there can be no death due to heart disease or cancer of a parent or sibling before age 60. Your driving record counts, too. Generally you won’t make it into the top class if you’ve had a DUI conviction within the past five years. You also will be disqualified if your license has been suspended or you have had more than two moving violations or accidents within the past three years.

- Sometimes called Preferred Elite, Super Preferred, or Preferred Select, this is the best classification you can get and comes with the lowest premiums.

- Preferred

- Outside of a few minor factors, like high cholesterol or high blood pressure, you’re in very good health. You won’t get Preferred Plus rates, but your premiums will still be very competitive.

- Preferred nonsmoker: The second-best category is also associated with excellent health, although you will get a little more leeway on blood pressure, cholesterol and weight. A premature death of a parent or sibling from cancer or heart disease typically isn’t acceptable. You don’t have to look like a fitness model to qualify for these good rates. A 5-foot-10-inch man can weigh 129 to 210 pounds, and a 5-foot-5-inch woman can weigh 102 to 178 to qualify for “preferred” rates with AIG, for example.

- Standard Plus

- You’re in good health, but you might have a few outliers to keep an eye on or your height-to-weight ratio doesn’t fall into the insurer’s range for Preferred classifications. Your family history is unremarkable, so you shouldn’t have any surprises in your future.

- This category is for nonsmokers who are generally in good health but don’t quite make the preferred category. Treatment for high blood pressure may be acceptable, for instance, as long as readings are in a normal range.

- Standard

- A common difference between Standard and Standard Plus is that your family history plays a role, and your family members probably had medical issues before age 60. You will see higher life insurance premiums in this class, but you’re still able to get insured.

- Standard nonsmoker: The average person falls into this category. Being overweight or being treated for elevated blood pressure may be acceptable, as would the death of one parent or sibling before age 60 from heart disease or cancer.

- Preferred smoker: This category is for smokers who otherwise would qualify for preferred rates. If you have recently quit smoking, you still may get smoker rates. Typically you must be a nonsmoker for at least five years to qualify for the best nonsmoking rates, at least three years for the second-best rates and one year for standard nonsmoker rates.

- Standard smoker:This is for smokers who otherwise would fall into the standard nonsmoker category. nerd wallet.com

- A common difference between Standard and Standard Plus is that your family history plays a role, and your family members probably had medical issues before age 60. You will see higher life insurance premiums in this class, but you’re still able to get insured.

- Table ratings

- This isn’t a specific rating classification like the others; instead, based on your health history, you’re placed in the Substandard category, which is graded by either letters or numbers (typically A to J or 1 to 10). This reflects a complicated health history or recent health issues, such as a heart attack.

- Your premium will, on average, be the Standard price plus 25% for every level down the table ratings:

- A = Standard + 25%

- B = Standard + 50%

- C = Standard + 75%

- D = Standard + 100% – Explanation

- E = Standard + 125%

- F = Standard + 150%

- G = Standard + 175%

- H = Standard + 200%

- I = Standard + 225%

- J = Standard + 250%

- You could pay an extra 250% on your premiums at a Table J/Table 10 health classification, which isn’t ideal. But you can still get insured and provide for your dependents when you die. Policy Genius.com

- Broker ONLY – Field Underwriting Guide LG America

- Banner Underwriting

- We would need you to complete an application or at least the life screening form and any of the above conditions

- Banner Underwriting

#Prostate Issues?

- Prostate

- Cancer.net

- John Hopkins

- Prostate Cancer Foundation

- Does your PSA indicate cancer?

- Normal PSA levels in the blood are very small amounts between 0-2.5 ng/ml. Levels greater than 2.5 ng/ml, can have many different causes. Prostate Cancer is one cause. Higher levels of PSA can be found in the blood as prostate cancer cells begin to proliferate in an uncontrolled way. But elevated PSA levels doesn’t necessarily mean prostate cancer. PSA can also rise for benign, non-cancerous conditions such as enlarged prostate, prostate inflammation, infection, or trauma. Get checked by your doctor.

- IMPORTANT: All elevated readings of PSA should be checked.

- Prostate Specific Antigen – PSA

- Normal PSA levels in the blood are very small amounts between 0-2.5 ng/ml. Levels greater than 2.5 ng/ml, can have many different causes. Prostate Cancer is one cause. Higher levels of PSA can be found in the blood as prostate cancer cells begin to proliferate in an uncontrolled way. But elevated PSA levels doesn’t necessarily mean prostate cancer. PSA can also rise for benign, non-cancerous conditions such as enlarged prostate, prostate inflammation, infection, or trauma. Get checked by your doctor.

- Gleason Score

- Typical Gleason Scores range from 6-10. The higher the Gleason Score, the more likely that the cancer will grow and spread quickly.

- Scores of 6 or less describe cancer cells that look similar to normal cells and suggest that the cancer is likely to grow slowly.

- A score of 7 suggests and intermediate risk for aggressive cancer. Scoring a 7 means that the primary score (largest section of the tumor) scored a 3 or 4. Tumors with a primary score of 3 and a secondary score of 4 have a fairly good outlook, whereas cancers with a primary Gleason Score of 4 and a secondary score of 3, are more likely to grow and spread.

- Scores of 8 or higher describe cancers that are likely to spread more rapidly, these cancers are often referred to as poorly differentiated or high grade.

- Understanding Your Pathology Report:

- How to get coverage, after Prostate Cancer?

- Underwriting Information to get Life Insurance PSA Elevation

- After reviewing the article, be sure to come back and email us [email protected]

Underwriting FAQ’s

- Question Crohn ‘s Disease

- Answer The annual mortality rate in Crohn’s disease was 1.6% compared with 1.0% in age, sex, and practice matched controls. After adjusting for age, sex, and cigarette smoking, it appeared that the risk of death was 73% higher in Crohn’s disease patients than in controls NCBI.Gov Learn more on the Potential Underwriting Outcomes Crohn’s at pinney insurance.com

- Question What’s the difference between super preferred and super preferred plus?

- Answer See above Chart

- Question Sure, I have some of the above medical #problems, but they are all under control. My blood and hormone levels are fine. My medications are doing their job. Why should I have to pay extra. My chances of dying are not higher than anyone else’s.

- Answer See above on Chronic Disease

- Question I got surcharged for being #overweight. How do I go about losing 10 pounds and reapplying?

- Answer Our Research:

- BMI Calculator The reason people associate extra weight with higher insurance premiums is because pre-existing medical conditions often go hand in hand with with larger sizes. Overweight and obesity may increase the risk of many health problems, including diabetes, heart disease, and certain cancers. If you are pregnant, excess weight may lead to short- and long-term health problems for you and your child. National Institute of Diabetes and Digestive and Kidney DiseasesMost people who don’t watch what they eat or rarely exercise will drop 5-10 pounds in approximately two weeks. Simply cut down calories and fatty food, and workout at least 5 days per week. Your exercise routine should also include cardio!When your life insurance agent fills out your application, they will ask “have you gained or lost 10 lbs. or more in the last 12 months?”IF you answer yes, which the man in our example will have to do, the insurance company will give him the benefit of only 50% of his weight loss.Unfair right?Not really. Life insurance companies are looking for stable, and lasting weight loss, so they require 1-2 years of maintained weight before they give you full credit. We often get clients who say, they’ve lost weight, and the doctor has reduced their meds as a result. This is great news – but I still have to explain the 50% credit issue. If they’ve lost 20 – 30 lbs over the past 12 months they unfortunately will only be credited with half that weight loss.

- Note: It makes sense to lose a few pounds to meet weight chart requirements, but losing more than 10 pound will be counter- productive. So no crash dieting please. More is not always better.

- They haven’t lost the weight AND they are still uninsured. These are people with kids, mortgages and debt. The primary breadwinners of their family – which means they are putting everyone they love at risk. chris.com

- If you do intend to lose weight, make sure that you do it well in advance of applying for a life insurance policy. For starters, losing weight can take anywhere from a few weeks to a couple of months, just to lose a few pounds. For another, the insurance company will want to know what your weight is as of the date that you made your application – losing weight afterwards will not benefit you.

- There is at least one more timing issue in regard to losing weight. If your weight at the time of your last medical encounter was 20 pounds heavier than what you are at application, the insurance company will often average the two weights, rather than giving you the full benefit of your current weight. They’ll do that under the assumption that your weight tends to fluctuate, and the average is more accurate than the current reading. mcmha.org/lower-life-insurance-quote-losing-weight/

- See our webpage on nutrition & weight control

- Question Why do they ask for #credit scores?

- Answer negative items included in your credit report — for example, a past bankruptcy — might have an impact on your life insurance premiums. Insurers consider the factors that contribute to your credit score, not the specific number. Policy Genius *

- many insurers analyze self-reported lifestyle and health information and pair it with third-party data sources that provide insights about your prescription history, past applications for life insurance, driving records, and criminal history. Once a life insurance application is submitted, an insurer reviews these public records to determine if they need to ask follow-up questions to understand more about your financial or health picture. Your credit attributes, not your credit score, may be one of the things they will review in the underwriting process. An example of a credit attribute that life insurance companies would look at is whether or not you have filed for bankruptcy. While for many people, bankruptcy can be a result of unfortunate events beyond their control, for others it can indicate poor decision-making or even be a red flag for medical problems because many bankruptcies are the result of medical bills. Haven Life.com *

- If your credit is strong, it could potentially help you save money on life insurance premiums. Poor credit, on the other hand, could serve as a red flag and result in higher premium costs. Fool.com *

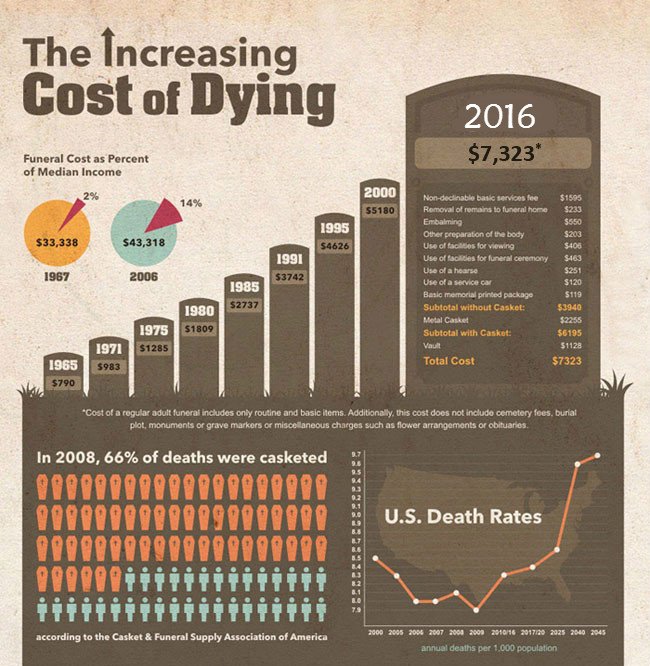

When a loved one dies AIG

Steps to settling an estate

Locating Important Papers

Funeral Guide PDF

- chevra kadisha.com Traditional Jewish Burial

- Basic Laws of Cemeteries Stimmel Law *

- Cemeteries §8100 to 9703

- Family Interment Plots [8650 - 8653]

- Sale of Plots [8570 - 8574]

- Can you sell or transfer a cemetery plot?

- Yes in Illinois Illinois Cmptroller.gov *

- Can you sell or transfer a cemetery plot?

CA Statutory #Will

Steve Video on CA Statutory Will

Please excuse the sound quality... it gets better after the first 20 seconds

- Our Webpage on Wills

-

Nolo.com Sample Will 11 page pdf

-

Nolo - Quicken WillMaker & Trust $90

- nolo.com/online-will

- nolo.com/quicken-willmake