GUARANTEED, Graded Premium & Simplified issue Life – Burial Insurance

Introduction

Guaranteed issues plan generally pay after you’ve had the policy for 3 years. You do get your premium back though. See actual brochures and EOC Evidence of Coverage for exact details.

- Fidelity Life Brochure – Simplified Medical Questions – Graded Death Benefit

- Gerber Life -We don’t get paid if you do it on their website directly so email us [email protected] for further details and enrollment.

- North Coast Life.com Graded Death Benefit – Simplified Issue – 5 questions

- United (Mutual) of Omaha – Living Promise (Website General Info)

- Highlight Sheet

- direct.mutualofomaha.com/wholelife3/N51

- Email us for more details [email protected]

- Questionnaire’s to see if you might qualify for a rated policy, rather than simplified or guaranteed graded benefits. These policies should work for terminally ill, obesity, HIV and cancer as long as one lives long enough and can answer the questions favorably.

- Reasons to buy and how it works – Insure Me Kevin.com

- Email us for more information

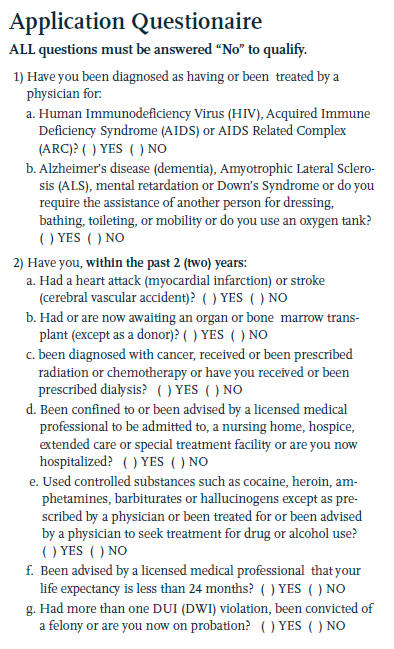

Simplified Sample Questions

If the answer to any of the following questions is “YES”, the proposed insured is not eligible for the insurance applied for.

Is the proposed insured currently: Bedridden at home or confined in a hospital, nursing home, or long term care facility?

Has a member of the medical profession ever diagnosed or treated the Proposed Insured for Acquired Immune Deficiency Syndrome (AIDS) or AIDS Related Complex (ARC)?

Within the past year has the Proposed Insured:

(a) had a stroke, angina, heart attack or failure, cardiac or circulatory surgery, or Diabetes (requiring shots)?

(b) had or been treated for internal cancer or melanoma, leukemia, kidney failure, Alzheimer’s disease, alcoholism, drug dependence, or liver cirrhosis?

(c) used oxygen equipment to assist in breathing or had any amputation caused by disease? (nc life.com)

Estate Planning - Life Insurance & Long Term Care Related Pages

- Estate Planning

- Life Insurance – Instant Quotes – Universal – Key Man Life

- Long Term Care Nursing & Home Health Care

Funeral Guide PDF

- chevra kadisha.com Traditional Jewish Burial

- Basic Laws of Cemeteries Stimmel Law *

- Cemeteries §8100 to 9703

- Family Interment Plots [8650 - 8653]

- Sale of Plots [8570 - 8574]

- Can you sell or transfer a cemetery plot?

- Yes in Illinois Illinois Cmptroller.gov *

- Can you sell or transfer a cemetery plot?

Life Insurance without the Covered Person knowing

Be sure to put in our Producer # 30410

- #Confidential Life Insurance – Can I Insure someone without them knowing about it?

- Yes, you can now insure against financial loss as a result of the death of another person, with whom there is an INSURABLE interest, like alimony or child support without the insured person’s knowledge.

- Additional examples would be Bank Loans, Divorce Settlements, Investors, Business Managers/Agents, Movie Productions, Business Buy Outs/Buy Ins, Surrogate Mother Contracts

- Before asking us for quotes…. let us know if you are at least willing to pay the standard premium for the persons age and amount that you want. Get Standard Quotes

https://newgenerationins.com/