Special Needs Trust for Disabled Adults – Heirs

in California

Get a term life quote here,

to protect your loved one

A Special Needs Trust (SNT)

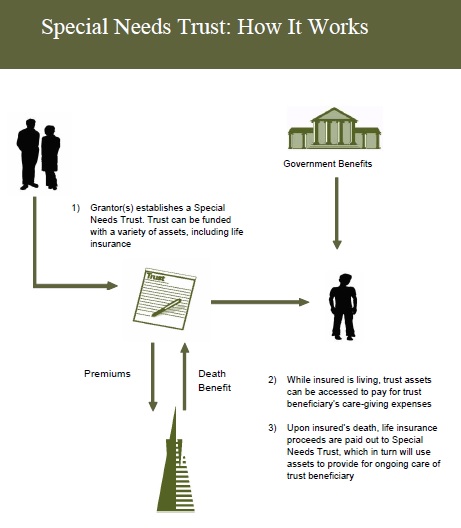

A Special Needs Trust (SNT), sometimes called a Supplemental Needs Trust, is a legal arrangement in which a person or organization (like a bank) manages assets for a person with a disability. The person with the disability is called the “beneficiary” and the person who is managing the assets is the “trustee.” Many kinds of assets can be put into a trust, such as cash, stocks, bonds, and real estate. An SNT provides for the needs of a person with a disability without losing or reducing their benefits such as

- Supplemental Security Income (SSI),

- Medi-Cal,

- In-Home Support Services (IHSS), and HUD housing assistance.

Assets in an SNT won’t be counted toward the SSI, Medi-Cal and IHSS asset limit of $2000 for an individual.

Links & References

- CA Disability Benefits 101

- Transamerica Special Needs Trust Brochure

- kaiden elder law.com/special-needs-trusts

- Avoid taxes on earnings? FAQ

- Jewish LA Trust & Services * FAQ’s *

- South Eastern Trust Company

- CA Department of Health Care Services – Special Needs Trusts

- Abusive Trust Tax Evasion Schemes – Questions and Answers

- Earn your The Chartered Special Needs Consultant® (ChSNC®) Designation

- YouTube Videos on Special Needs Trusts & ABLE Accounts

What Parents Need to Know about #Special Needs Trusts

VIDEO

Trans America

Special Needs Trust Brochure

#Nolo Special Needs Trusts

- Get Life Insurance Quote to fund the trust

- Our webpage on Special Needs Trusts

- Social Security Publication 10076 Guide for Representative Payees

- FAQ's

- When does the trust actually get funded, go into place, become effective?

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

- See chapter 2 for what payments and benefits the child can get

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

Contact Us

[email protected]

-

- Upload Confidential Files or

- Send email to [email protected] and PauBox.com will encrypt it.

- Download our information to your contacts

- Medicare Intake Needs Assessment form (Berwick)

#SSI-Related Programs, Private Disability & Coverage Groups

Our web pages on:

- Aged and Disabled Federal Poverty Level Program

- Disability Income – Pay Check Protection

- Part D Rx Low Income Subsidy – LIS – Extra Help

- Hospice Coverage – Medicare

- SSI for Groups & Organizations Publication # 11015

- Regional Centers Department of Developmental Services

- City of Los Angeles - Disability

- Access - Transportation for disabled

- Law Research Guides Library of Congress

SSI #Resources & Income Limits

The Aged & Disabled Medi-Cal program uses SSI countable income rules as well as a few extra rules you should know. For more information, visit our webpages on the SSI & Medi Cal programs, and follow the various links on this page

- Medi-Cal section of the

- Countable resources are the things you own that count toward the resource limit. Many things you own do not count.

FLASH!!!

The asset limit in the Medi-Cal programs serving older adults and people with disabilities has been eliminated! CA Health Care Advocates * DHCS *

Have less than $2,000 in Countable assets for an individual ($3,000 for a couple).- Medi-Cal property limitations.

- asset questionnaire

- CANHR simpler list

- CANHR Fact Sheet

- Understanding Medi-Cal’s Asset Test for Seniors and People With Disabilities

- Western Poverty Law

- Nolo - SSI Income & Asset Limits

- Income SSA.Gov

- Will my settlement affect my government benefits? VIDEO

- dhcs.ca.gov/Asset-Limit-Changes-for-Non-MAGI-Medi-Cal

- california healthline.org/sset-test-elimination

- FAQ's

- Our webpage on SSI Resources & Income

- Have less than $1,271 - 123% of FPL in countable monthly income for an individual ($1,719 for a couple). ca health advocates.org ADFPL * AB 715 Fact Sheet * Western Poverty Law *

- Share of Cost if income is too high, but you qualify on asset test?

#Attorney 's that can help you through the Social Security Disability maze

- west coast disability.com/

- CA State Bar Attorney Referral Service

- Legal Match.com

- Sellers Law

- Hill & Ponton

- premier disability.com

- Cantrell & Green

- We don't necessarily know these attorney's...

- Editorial: Lawyers are fighting innovative proposals for more affordable legal assistance. That’s wrong LA Times 1.30.2022

- We don't necessarily know these attorney's...

#My Medi-Cal

How to get the Health Care

You Need

24 pages

Smart Phones - try turning sideways to view pdf better

-

- More explanation

- Enroll with Benefits Cal

- What is Medi Cal - VIDEO

-

How to VIDEO

-

Medi-Cal Managed Care HMO – Health Care Options

- Benefits Cal is a one-stop-shop to apply for...

- Cal Fresh

- Ages 26 through 49 Adult Full Scope Medi-Cal Expansion regardless of immigration status

- Cal WORKs

- Medi-Cal

- CMSP (County Medical Services Program)

- Disaster Cal Fresh

- GA/GR (General Assistance and General Relief )

- Briefing — Medi-Cal Explained: An Overview of Program Basics

- chcf.org/medi-cal-explained/

- #BenefitsCal is a one-stop-shop to apply for...

- Medi-Cal

- County Medical Services Program (CMSP),

- Food Assistance - Cal Fresh (formerly known as Food Stamps)

- How to use Eat Fresh.org VIDEO

- Cooking & Nutrition

- California Work Opportunity and Responsibility to Kids (CalWORKs) or check their other website

- Medi-Cal

-

Here you can review and choose the HMO that you want to deliver your Medi-Cal health Care.

-

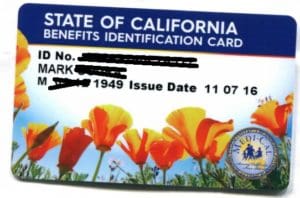

BIC Benefits Identification Card

https://youtu.be/gpQQuGHD73Q?si=W5O6N-91jfrRLBaN

I have an Adult child that seems to be “losing it” and can’t really manage their money.

Would a Special Needs Trust be appropriate?

Try checking out a Probate Conservatorship to protect the adult child’s current assets.

See also Court Website for FAQ’s

Probate resources

Will a Special Needs Trust avoid income taxes on the earnings of the assets in the trust?

No,

I’m not a CPA, but here’s authoritative sites that say the income in a trust gets taxed.

After money is placed into the trust, the interest it accumulates is taxable as income—either to the beneficiary or the trust. The trust is required to pay taxes on any interest income it holds and doesn’t distribute past year-end. Interest income the trust distributes is taxable to the beneficiary who gets it. Campbell Law

Investopedia

See the Nolo book for more detail, like the tax rates