Short Term Private Individual & Small Business

Disability Income Protection

Introduction Private Income Protection

A Disability Insurance Policy can provide you with up to 1/2 of your regular paycheck or business earnings (Schedule C – Section 106) . Social Security Disability, SDI for Biz Owners nd SDI for employees might not be enough or work for you. Having coverage is very important as 1/2 of all bankruptcies involve medical issues.

Coverage up to 50% of earnings should come close to being equal to your current income, as you don’t have the expenses of going to work and lower taxes. One in Four of today’s 20 year olds will become disabled before age 67 and the length of time one is disabled is getting longer too. Standard Flyer *

The benefits are usually Income Tax free and of course, the Insurance Company wants to encourage you to go back to work, so they don’t want you to make too much by not working.

- Questions to ask yourself

- Is your risk protection package coverage up to date?

- How much in US Dollars of protection do you need?

- Planning vs Policy

- What are your Goals, desire, action

- wealth replacement strategy

- How would you pay your mortgage, bills, food if you were not able to work?

- What medications do you take?

- What conditions are you monitoring?

- What is your most valuable asset?

- Videos and brochures

- Disability can Happen.org * Blog *

- Where did your paycheck go – living confidently.com/protect-your-paycheck learn more about disability.

- 5 myths of pay check protection?

- Medical coverage under Health Care Reform only pays for 10 essential benefits, not lost income.

- MetLife Brochure – Will your coverage be enough?

- Met Life Income Guard Brochure

- policy genius.com/long-term-disability-insurance-faqs

Group and Employer Disability Paycheck Protection

Reasons to get Disability Coverage for your employees:

- It replaces a portion of an employee’s income if they should ever become ill or injured and unable to work.

- SDI State Disability Insurance may not be enough!

- Around 90 percent of all workers consider their ability to earn an income as their most important financial resource.

- Increased benefit choices can increase employee loyalty to the employer.

- Around 75 percent of employees consider benefits extremely important.

- Around 80 percent of employees say benefits provide peace of mind.

- Learn More – Blog Disability Can Happen.org *

- Standard Business Overhead Protector – Expenses

Steve on Disability Income Protection

Video

- Email [email protected]

- Statistics from Disability Can Happen.org

- Our other Webpages on Disability & Unemployment Coverage

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

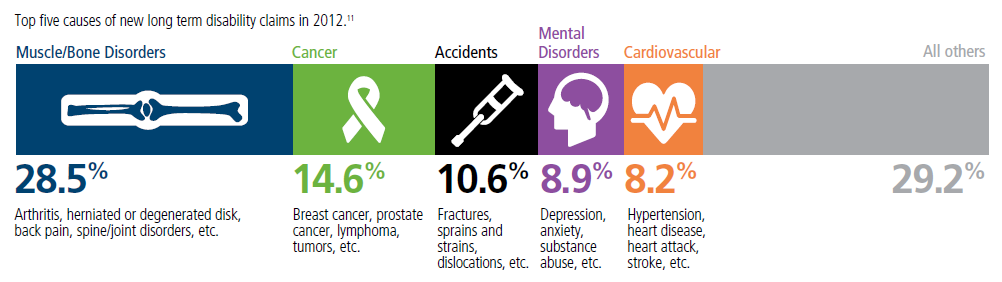

Top 5 - 10 causes of Long Term Disability Claims

Lower back disorders ♦ Depression ♦ Coronary heart disease, arthritis and pulmonary diseases (Met Life) ♦ Disability Can Happen ♦ CDC Statistics

Brochures

Standard Insurance Company

Business Owner – Overhead Expense Coverage

Blue Cross Long & Short Term, Voluntary and Employer Paid

Short.Term.Disability.Guide.to.Benefits.51.pages.

guide.to.benefits.voluntary.short.term.49.pages.

Long Term

Voluntary.Long.Term.Guide.to.beneifts.64.pages.

Group.Long.Term.Disability.Guide.to.Benefits.

General

Summary.BC.Disabilty.Guide. Quick reference guide

Life and Disability products Sales guide 24.pages

Insurance – Disability Calculators

- calculate your chances of being disabled and how much income loss there might be?

- Broad Ridge Advisors Tool

- Income Needs

- Chances of Becoming Disabled Quiz

- Social Security Administration – Estimate Your Potential Benefit Disability & Retirement Benefit

- whats my Earned Income Quotient.org How much might you earn in your future?

How to prove loss and amount of Income at #Claim Time?

How disabled are you – what restrictions and limitations are preventing you from performing your regular occupation or gainful occupation so you can file the “proof of claim” – “proof of loss” for you occupation and earnings.

The main reason that an insurer denies a claim for long-term disability or short-term disability benefits is because they don’t think there is enough medical evidence that your really unable to return to your job and do the substantial and material duties of your occupation. mslawllp.com

Links & Resources

How do I show that I’m not able to do a sedentary job – computer work?

- Check your actual policy – evidence of coverage

- See our webpage on Long Term Care and various scales of disability

#SocialSecurityDisability

Factors in Evaluating

Parents & Care Givers

Check out our webpage on getting your own private disability coverage, in addition to Social Security Disability or SDI State Disability Coverage

- Disability Income – Pay Check Protection

- SSI – Supplemental Security Benefits – Automatic Medi Cal – SSDI

FAQ's

- Deafness?

- Mental Health – ACA/Health Reform Mandated Essential Benefit

- nolo.com/guide-to-social-security-disability

Disability Income Video's

- Monica Soltes story VIDEO as she did NOT have Disability Coverage

- More Disability Video's from Life Happens.org

- More Video's from Ameritas

-

Barry Shore - no relation - Real Estate Executive

VideoBarry Shore, a 55-year-old real estate executive, was enjoying a normal life when a rare neurological disorder struck suddenly, causing him to lose all movement in his body.

Throughout his ordeal, money is one thing Barry and his family haven't worried about thanks to smart insurance planning. Disability insurance payments have replaced more than half of Barry's income. And long-term care insurance has provided more than enough to pay for in-home care as well as physical, occupational and water therapy.

-

Definition Total Disability - VIDEO

Own Occupation...

Private Disability Insurance

Links & Resources

- Disability can Happen.org * Blog *

- Where did your paycheck go - living confidently.com/protect-your-paycheck learn more about disability.

- Other stories from Life-Happens.org

- Disability Can Happen.org

- Disability Insurance 101 Six Page pdf

- defend your income.org/ ♦

- Los Angeles Department on Disability

Disability Buy – Sell

- Disability Benefits cannot be liened against, garnished or taken in Bankruptcy ( CCP §704.130, CA JCC Form EJ 155, CA Claim of Exemption Info.,)

- Guaranteed-Issue Multi-Life Disability Insurance Petersen

Consumer Links

- Other Coverage’s to pay for various types of Disability

- Mental Health Resources – Essential Benefit

- 106. (a) Disability Definition CA Insurance Code

- "health insurance" specified disease insurance workers' compensation Long-term care.

- policygenius.com/long-term-disability-insurance-faqs

- Disability Income – Pay Check Protection

Claims

- Art Fries claim advise can help you

- Disability Concepts.com - Gerry Katz - Disabilty Claim Consultant

- Top 10 Disability Claim Mistakes LA Times.com

- long term disability lawyer.com FAQs

- Covid - Long Haulers - Frustration

Technical Resources

- Law Help.org Disability

- Mortgage Loan.com on buying a home for people with Disabilities.

- Unum/Provident

- 2013 Disability Divide Employer Research Report

- BROKER ONLY

#SSI-Related Programs, Private Disability & Coverage Groups

Our web pages on:

- Aged and Disabled Federal Poverty Level Program

- Disability Income – Pay Check Protection

- Part D Rx Low Income Subsidy – LIS – Extra Help

- Hospice Coverage – Medicare

- SSI for Groups & Organizations Publication # 11015

- Regional Centers Department of Developmental Services

- City of Los Angeles - Disability

- Access - Transportation for disabled

- Law Research Guides Library of Congress

Broker only

- Council for Disability Awareness website

- kouz financial.com