Disabled Adult Children can stay on Parent’s Health Plan past age 26

California Law – Disabled Child – Health Insurance

CA law allows your incapacitated, handicapped, mentally ill or #disabled child over 26 to remain on the parents group or individual policy, indefinitely, as long as they were disabled before that.

-

- An individual or group health insurance [“Health Insurance” … shall mean a policy that provides coverage for hospital, medical, or surgical benefits. §106 ] policy that provides that coverage of a dependent child shall terminate when the child reaches age 26 under ACA for dependent children specified in the policy, shall also provide that attainment of the limiting age shall not operate to terminate the coverage of the child while the child is and continues to meet both of the following criteria:

- Incapable of self-sustaining employment by reason of a physically or mentally disabling injury, [AB 88] illness, or condition.

- Chiefly dependent upon the policyholder or subscriber for support and maintenance. Wikipedia Child Support – Maintenance * CA Insurance Code § 10278 * §10277 * for Group Policies Self Insurance Plans §10124 10118

- An individual or group health insurance [“Health Insurance” … shall mean a policy that provides coverage for hospital, medical, or surgical benefits. §106 ] policy that provides that coverage of a dependent child shall terminate when the child reaches age 26 under ACA for dependent children specified in the policy, shall also provide that attainment of the limiting age shall not operate to terminate the coverage of the child while the child is and continues to meet both of the following criteria:

FAQ’s

-

- Before asking us about this law or if you qualify.

- Please read the law above THREE times and the definition of chiefly dependent below

- Ask your employer’s HR department for the relevant forms and a copy of your evidence of coverage

- For Individual & Family, ask your current broker or Insurance Company to send you the Disabled Dependent Certification and Evidence of Coverage.

- Review the FAQ’s

-

- What about getting disability income protection for the parents & caretakers?

- What about when employee retires?

- Dual Coverage – Medi Cal?

- I don’t understand all this and I need private tutoring, education or research, can we arrange that?

- How to get documents from the US Department of Labor – ERISA

- Must the Insurance Company give me notice that they won’t be coverage my child after age 26?

- Yes, see CA Insurance Code 10277 3 B

-

What about #Selfb Insured Plans?

- Check out our webpage on evidence of coverage – EOC say?

- ADA The Americans with Disabilities Act in a Health Care Context NCBI.NLM.NIH.gov

- CA Department of Insurance does not regulate Self Insured Plans Insurance.CA.Gov

-

- Before asking us about this law or if you qualify.

What do the Big Words Above Mean?

What does #ChieflyDependent mean?

- “Chiefly dependent” means that the person receives fifty per cent or more of his/her support from his/her parent(s), the insurance contract itself does not define “dependent.”

- The United States Court of Claims held in Odlin v. U.S., NY.Gov * Covered CA that “chiefly dependent” does not have an explicit definition but rather “each case…must stand upon its own particular facts, and that no hard and fast rule can be laid down arbitrarily fixing the value of property, or the amount of income received…as entirely determinative of the question as to whether [a person] is ‘dependent’ within the meaning of the law.”

- While the company’s interpretation of the phrase “chiefly dependent” doesn’t appear to be unreasonable, only a court of competent jurisdiction may make a conclusive determination. Odlin v. U.S. New York State Analysis *

- IRS Definition of Dependent section §152. * IRS Interactive Assistant * IRS Publication 501 on Dependents

- If your child is dependent on you, consider life insurance to take care of your child when you are gone. Disability in case you get ill and can’t work and Long Term Care, in case you can’t take care of yourself.

- In Covered CA, (we are authorized agents) there may be issues with subsidies – MAGI Income.

- Considering that everything is guaranteed issue, with no Pre X starting 1.1.2014, I didn’t think this page would be relevant anymore, but it gets a ton of hits!

Excerpt from “typical” Group plan:

4) If coverage for a Dependent child would be terminated because of the attainment of age 26, and the Dependent child is disabled and incapable of self-sustaining employment, Benefits for such Dependent child will be continued upon the following conditions:

a) the child must be chiefly dependent upon the Subscriber, spouse, or Domestic Partner for support and maintenance;

b) the Subscriber, spouse, or Domestic Partner must submit to Blue Shield a Physician’s written certification of disability within 60 days from the date of the Employer’s or Blue Shield’s request; and

c) thereafter, certification of continuing disability and dependency from a Physician must be submitted to Blue Shield on the following schedule:

i. within 24 months after the month when the Dependent child’s coverage would otherwise have been terminated; and

ii. annually thereafter on the same month when certification was made in accordance with item (1) above. In no event will coverage be continued beyond the date when the Dependent child becomes ineligible for coverage for any reason other than attained age. * [See also Conditions of Enrollment Page B 56 * Dependent Definition Page B 70] EOC

Get the EOC, Evidence of coverage FULL Policy from your own Insurance Company, HR, # on back of your ID Card and see what it says! Visit our webpage on EOC, Plain Language, etc.

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

What is

#Self Sustaining Employment?

- maintaining or able to maintain oneself or itself by independent effort – a self-sustaining community

- maintaining or able to maintain itself once commenced – a self-sustaining nuclear reaction Webster *

- 603. Definition of Substantial Gainful Activity from Social Security Manual

- capable of Self Sustaining Employment?

- 603.1 What Does Substantial Gainful Activity Mean?

- The term “substantial gainful activity” is used to describe a level of work activity and earnings.

- Work is “substantial” if it involves doing significant physical or mental activities, or a combination of both.

- “Gainful” work activity is either of the following:

- Work performed for pay or profit;

- Work of a nature generally performed for pay or profit; or

- Work intended for profit, whether or not a profit is realized.

- 603.2 Does Work Need To Be Performed On A Full-Time Basis To Be Considered Substantial Gainful Activity?

- 603.1 What Does Substantial Gainful Activity Mean?

IRC Internal Revenue Code §152(c)(3)(B):

Definition of Dependent

Special rule for disabled.

In the case of an individual who is permanently and totally disabled (as defined in section 22(e)(3)) at any time during such calendar year, the requirements of subparagraph (A) shall be treated as met with respect to such individual.

IRC §22(e):

(3) Permanent and total disability defined.

An individual is permanently and totally disabled if he is unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment which can be expected to result in death or which has lasted or can be expected to last for a continuous period of not less than 12 months. An individual shall not be considered to be permanently and totally disabled unless he furnishes proof of the existence thereof in such form and manner, and at such times, as the Secretary may require. The ABD Team *

- New York State Analysis if Insurer must continue coverage beyond age 26 for disabled child

- IRS Interactive Assistant — who can be claimed as a dependent

- IRS Publication 501 – Tax Filing Status – Search for rules on determining support

FAQ’s

- Legal Duty to support adult disabled children?

Visit our Webpage Social Security Disability –

Definitions of how to determine if your Disabled &

Can’t Work?

FAQ’s

Would an immediate annuity help your situation?

Benefits of Retirement Planning & Effect on MAGI Income

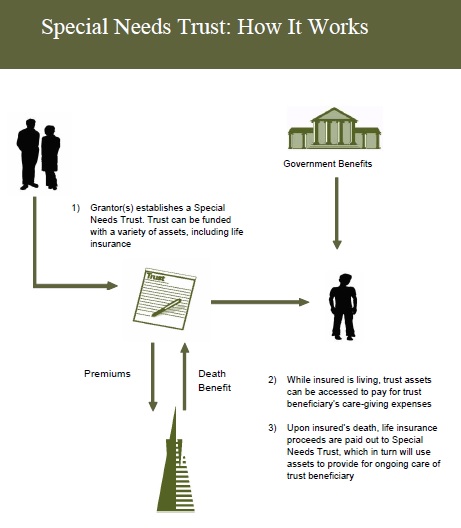

What Parents Need to Know about #Special Needs Trusts

Trans America

Special Needs Trust Brochure

#Nolo Special Needs Trusts

- Get Life Insurance Quote to fund the trust

- Our webpage on Special Needs Trusts

- Social Security Publication 10076 Guide for Representative Payees

- FAQ's

- When does the trust actually get funded, go into place, become effective?

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

- See chapter 2 for what payments and benefits the child can get

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

Links & Resources

- Mental Health Benefits are an essential benefit under Health Care Reform.

- kff.org/medicare/medicares-role-for-people-under-age-65-with-disabilities

Related Pages

Medi-Cal – MAGI Income Eligibility Criteria

- Aged and Disabled Federal Poverty Level Program

- Contact Info – Complex Questions – Reference Materials Medi-Cal

- Dual Coverage? Medi Cal, Employer Group, Individual, Cal Medi Connect & Medicare

Definition of who is a dependent? Brother – Sister, etc?

- Dental Coverage can be purchased here.

- Dual Coverage – Which Insurance Company pays first? Medi-Cal, SSI, SSDI? Medicare, Private, Employer?

- Special Needs Trusts

View older pages, archives and Historical Archive.org