Appeals, complaints or grievances with an Insurance Company?

Introduction

The process of appeals & grievances gets very technical, legal, etc. I won’t even attempt to summarize it here. Please follow the links below, guides & summaries to the right, check your policy – evidence of coverage and check the law.

Medical Procedures?

- Was your procedure Medically Necessary?

- Los Angeles Medical Necessity Denials Lawyer

- Los Angeles Health Insurance Lawyers

- Independent Medical Review IMR

- Did you use the Correct MD or hospital – Provider List and

- Did you Review the procedures in your actual policy, evidence of coverage?

Reasons why the Claim might be denied

- Did you tell the truth on your application?

- Nearly 15% of claims submitted to private payers are initially denied

- Insurers’ denial rates — a critical measure of how reliably they pay for customers’ care — remain mostly secret to the public. Federal and state regulators have done little to change that.

- Claims Denials and Appeals in ACA Marketplace Plans in 2021 kff.org

- Wrestling With a Giant: How to Dispute a Hospital Bill

- Here’s where they write to your MD, prior to ACA/Obamcare before a claim is even turned in.

- How about doing a pros & cons spreadsheet – Ben Franklin method? It’s important to know the other sides point of view and potential arguments & evidence.

- Billing Codes – Satire or how it really works?

- Was the policy in force? Lapse non pay?

- Department of Labor on Filing a Health Claim dol.gov pdf

- View as a webpage dol.gov

- Most U.S. adults don’t know they can fight insurance denials, new study finds

Insurance Company & Regulatory Agency

Grievance Procedures & Forms

- Check your EOC – Evidence of Coverage for procedures & where to get forms.

- Aetna

- Blue Cross Grievance Procedures

- Notice

- Blue Shield – General Info. Appeals & Grievances PO Box 629007 El Dorado Hills , CA 95762 – 9007 Fax: (916) 350 – 7585

- CA Department of Insurance

- IMR – Independent Medical Review

- REQUEST FOR REVIEW Molina Health Care OF CANCELLATION, RECISSION, OR NONRENEWAL OF HEALTH CARE SERVICE PLAN BENEFITS

- hhs.gov/curbing-insurance-cancellations

- DGS Office of Administrative Hearings

- Kaiser Member Grievance Form

- #Appeal Guides

- Navigating the Appeals Process –Patient Advocate Foundation

- NAIC Sample Appeals letter & process

- VIDEO Clark Howard – How to appeal

- LA Times appeal explanation 1.19.2022

- Kantor & Kantor Attorneys VIDEO

- courts.ca.gov/selfhelp-smallclaims

- California Small Claims – Court Site – Self Help

- Fillable Forms

- Small Claims Adviser Los Angeles 213.974.9759

- If you have a claim for more than the Small Claims Limit, you can sue, but you waive the amount over the limit.

- Flyer

-

Small Claim Court Study Guide for temporary – pro tem judges – highly likely you might have an attorney whose volunteering to be a Judge for the day.

- Small Claims Court Procedures & Practices – including training for judges

- Judges Bench Guide for cases involving self represented litigants

- REACHINGOUT OR OVERREACHING Judicial Ethics and Self-Represented Litigants

Department of Consumer Affairs – Mediation Request ONLINE

How Mediation Works & Paper Mediation Request Form

- Fair Shake.com Arbitration – They will send a demand letter!

Appeals? Grievances?

Check the FULL policy, EOC – Evidence of Coverage Also, here’s a guide in how to read and interpret contracts. that’s what an Insurance Policy is.

Then if you do decide to do an appeal, (page 151 in specimen policy) or view our webpage on appeals, you’ll know what to argue about.

See our main webpage on appeals & grievances

Consumer Links & Resources

- How to gather documents to prove your case – Small Claims Manual

- Prove you never got a letter?

- How to tell your story, timeline and background

- How to create a TIMELINE in Word, Excel, PowerPoint

- Health Net faces suit over refusal to cover treatments LA Times 9.13.2012

- Appeal Guide – Washington State Department of Insurance 62 pages pdf

- Nolo – Medical Malpractice Basics

- Todd Friedman, Esq. can help if debt collectors are harassing you when you don’t owe the $$$

- Find an Attorney

- Health Consumer Alliance HCA

Part of Department of Managed Health Care - Patient Advocate.org

- Health Consumer Alliance

- Center for Health Care Rights

- National Association of Health Care Advocacy

- California Health Consumer Advocacy Coalition

- CA Health Care Advocates

- HICAP

- Legal Brief Blue Shield allegations about Narrow Networks

- Los Angeles Times how to fight back

- Register an account with CDSS

Reasons to file a Claim

Procedures

#Reasons for filing a Covered CA appeal

Your eligibility notice explains what you are eligible for and the programs for which you do not qualify. Depending on your eligibility results, you may appeal any of the following (check as many boxes as you would like):

- I was denied enrollment into a Covered California health plan

- The amount of Premium Assistance (tax credits that help pay my monthly premium) is not correct – Get Calculation

- The level of Cost Sharing Reduction (help paying my out of pocket expenses) is not correct

- I was denied eligibility for an exemption from the individual responsibility CA Mandate Penalty

- Covered California did not process my information in a timely manner

- Covered California stated that I am not a US Citizen or US National or a lawfully present individual living in the United States

- Covered California stated that my application was incomplete

- I do not have other health coverage (such as free Medi-Cal or employer sponsored insurance) that prevents me from qualifying for insurance through Covered California

- Covered California stated that I am not a California Resident

- Covered California stated that I did not pay my premiums by my due date

- Covered California stated that my MAGI income is too low chart to qualify for Covered California coverage Get Calculation

- Other Tell us more about why you disagree with Covered California’s decision. You may attach additional sheets of paper if you need more space to write. Covered CA Appeals Request Form *

We STRONGLY suggest you attach additional sheets of paper and explain your case, with citations, evidence & exhibits. Be sure to read all the helpful aids we have on this page. You are going up against well versed opponents!

Resources & Links

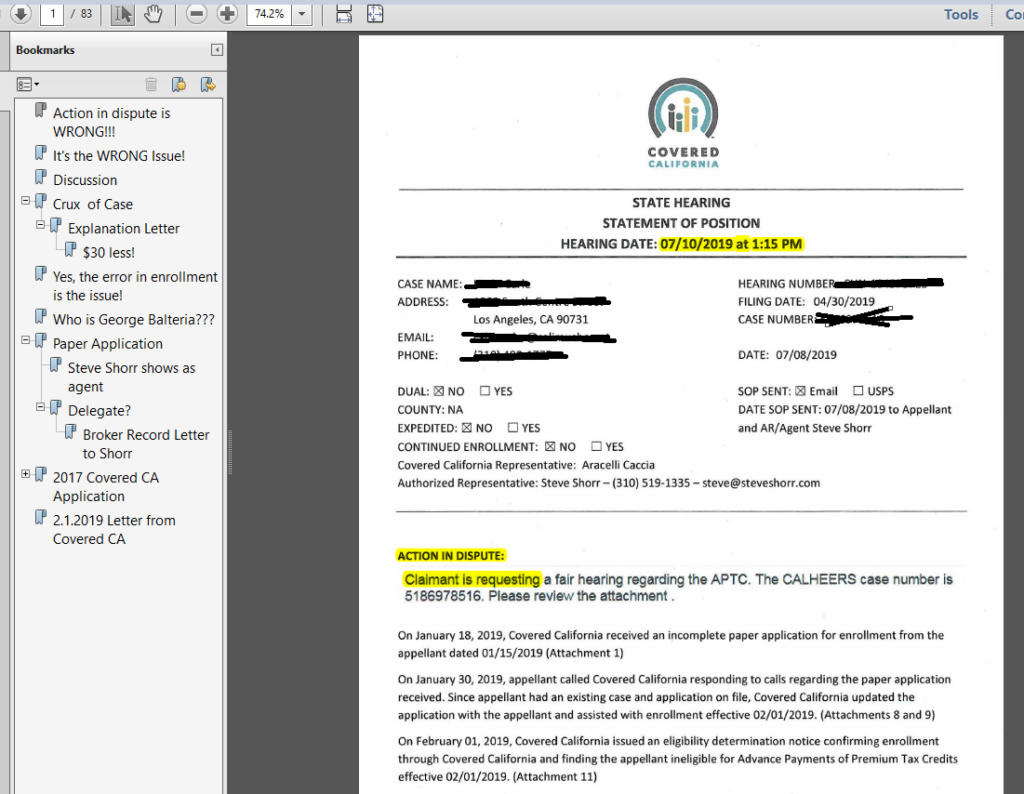

Cover Page for Covered CA’s Brief to the Administrative Law Court

Administrative Law – Prepare to Win

Writing a better brief – Law Repository – UAir University

CDSS State Hearings Division’s Decision Registry – Read prior cases – names are redacted

Covered CA Appeals Decision #Polk Case

- Sample Letter for Appeal

- Explanation on Insure Me Kevin . com - Polk Case

- Check out where administrative law judge said he wished he could make Covered CA pay the costs of their bogus advise but didn't have that authority

- Doesn't matter what Covered CA says, it's what the IRS says Form 8962 attaches to Form 1040

California Administrative Procedure Act 119 pages

Overview of Administrative Hearing Procures 12 pages

Western Center on Law & Poverty

California Code of Regulations

Article 7. Appeals Process for the Individual Exchange

-

§ 6600. Definitions.

- cdss.ca.gov/state-hearings

Medicare Appeals

How to file #Medicare appeals, deal with issues, claims, problems, etc.

- Medicare Appeals can get complex, so we won’t really try to summarize it. Please review the brochures, information and links below and on your right. Appeals are a complex subject we are giving you mostly official guides and not our summary, advise or essays.

- Medicare Complaint Form on Medicare.Gov

- See also Fillable pdf 10287 pdf

- How to file a complaint – Medicare.Gov

- Medicare Advantage – Livanta

- Medicare Appeals Publication # 11525 60 pages

- File complaint against Medicare itself?

- Medicare Contact Info * More * Forms *

- HICAP CA * Rest of USA * (Health Insurance Counseling and Advocacy Program)

- National Center on Law & Elder Rights – Case Consultation for Professionals

- Sample Evidence of Coverage – Medicare Advantage

- This is NOT sales literature, but is provided as a public service for educational purposes.

More on Medicare Appeals

- Livanta ONLINE Appeal System

- AHA wants False Claims Act enforcement of Medicare Advantage care denials Modern Health Care 5.20.2022 See also Beckers Hospital Review

- False Claims Act – Whistle Blower.com

Filing an appeal with Medicare

- Official Medicare Advantage Plan Appeals VIDEO

- How to Appeal a Denial of your Health Claim – VIDEO Kantor & Kantor Attorneys

- Medicare Appeals Fact Sheet – CA Health Care Advocates Hi Cap

- See our other page on appeals

- the exact proper terms.

- Grievance—A complaint about the way your Medicare health plan or Medicare drug plan is giving care. For example, you may file a grievance if you have a problem calling the plan or if you’re unhappy with the way a staff person at the plan has behaved towards you. However, if you have a complaint about a plan’s refusal to cover a service, supply, or prescription, you file an appeal.

- Appeal—An appeal is the action you can take if you disagree with a coverage or payment decision made by Medicare, your Medicare health plan, or your Medicare Prescription Drug Plan. You can appeal if Medicare or your plan denies one of these:

■ Your request for a health care service, supply, item, or prescription drug that you think you should be able to get

■ Your request for payment for a health care service, supply, item, or prescription drug you already got

■ Your request to change the amount you must pay for a health care service, supply, item or prescription drug

You can also appeal if Medicare or your plan stops providing or paying for all or part of a health care service, supply, item, or prescription drug you think you still need. - medicare.gov/Appeals.pdf

- Will see how my Appeal for a TKR now goes, since I’ve met the qualifications of “conservative treatments” over the course of the last 2-3 years!!!

- Please when using technical terms, define them and provide a URL.

/cgsmedicare.com/

-

-

Medicare Billings And Claims

- G-001-Organizing Your Medical Bills – 07-19-12

- G-002-How Medicare Claims Are Processed – 07-19-12

- G-003-Instructions For Creating a Claims Record – 07-19-12

- See our webpage on

- Medicare Appeals & Grievances

- Fraud

- Attorneys – We don’t know them… Found on Google

- Medicare Appeals & Grievances

-

Medicare Technical & Research Links

- Medicare Claims Processing Manual Technical 319 Pages

- Parts C & D Enrollee Grievances, Organization/Coverage Determinations, and Appeals Guidance Effective August 3, 2022 Table of Contents

- One hour webinar by an attorney, on how to do claims & appeals – You Tube

- 42 CFR Part 422, Subpart M – Grievances, Organization Determinations and Appeals

Find an Attorney

- Legal Match

- Findlaw.com

- American Bar Association

- Attorney Search Network

- Follow the links on this webpage. Many of them go to articles on Attorney Websites

- Also, see our appeals webpage

- Medi Cal Contact

- State Bar of California.com Attorney Referral Service

#Attorney 's --- Social Security Disability maze

- Sellers Law

- Hill & Ponton

- premier disability.com

- Cantrell & Green

-

- We don't necessarily know these attorney's...

- Editorial: Lawyers are fighting innovative proposals for more affordable legal assistance. That’s wrong LA Times 1.30.2022

Estate Planning

- We don't necessarily know these attorney's...

Medi Cal Appeals

#Medi-Cal Appeal & Hearing Rights

Health Care Services and Benefits

- Medi-Cal Fair Hearing Dhcs.ca.gov

- You have the right to ask for an appeal if you disagree with the denial of a health care service or benefit.

-

- You can also file a hearing request online at:

- cdss.ca.gov/hearing-requests

-

- MyMedi-Cal Pamphlet *

#My Medi-Cal

How to get the Health Care

You Need

24 pages

Smart Phones - try turning sideways to view pdf better

Customer Service – Enforcement

Dealing with Customer Service Issues

- First and foremost, be polite.

- These are crazy days as well for service reps, nearly all of whom aren’t to blame for their companies’ penny-pinching practices.

- A little civility goes a long way.

- Don’t be shy about escalating.

- Front-line service reps are frequently not given the power to resolve matters on their own and will often give an unsatisfactory response. Ask to speak with a supervisor.

- If that doesn’t work, write to the company’s chief executive or president, detailing the nature of the problem and providing as much documentation as possible. Most big companies have special dispute-resolution departments at senior levels.

- Be persistent. If it becomes clear that you’re not going away, some companies will finally throw in the towel and offer the response you’re seeking. Squeaky wheels and all that. LA Times 8.8.2020 *

#SNAFU - Situation Normal - All Fouled Up

I learned the word SNAFU Situation Normal, All Fouled Up in the dorm, when I attended San Diego State in the early 70's and earned a degree in Insurance. In all that time, I've never been able to use the word in a sentence, until last 10.1.2013, when Covered CA.com, Health Care.Gov nor the Insurance Company Websites or my own Quote Engine that I pay around $250/month for were supposed to launch, but did not do it properly.

Unauthorized Practice of Law

What is the #unauthorized practice of law?

Unlawful Practice of Law [§6125 – 6133]

California broadly defines the “practice of law” as dispensing legal advice or service, even if the advice or service does not relate to any matter pending before a court. * Legal Advice vs Legal Information * Shouse Law * (Mickel v. Murphy (1957) 147 Cal.App.2d 718, 721.) Davis Stirling.com * Advising HOA boards on how the statutes pertain to them or what actions would violate the law or the governing documents. * Supreme Court opinion. * Davis Stirling.com *1. Advising HOA boards about rights, duties and liabilities. That includes but is not limited to:

- Interpreting the Davis-Stirling Act,

- Interpretation of contract provisions,

- Disputed maintenance and repair issues,

- Settlement issues.

2. Preparing documents that alter rights, duties and liabilities. Managers and management companies can prepare documents that are incidental to the regular course of their business. Anything beyond that must be prepared by legal counsel. That includes but is not limited to:

- Amendments to CC&Rs, Bylaws, and Articles of Incorporation,

- Contracts and contract provisions,

- Election rules,

- Rules enforcement policies,

- Settlement agreements, and Davis Stirling.com *

What is “#Advice?”

Legal advice refers to the written or oral counsel about a legal matter that would affect the rights and responsibilities of the person receiving the advice. In addition, actual legal advice requires careful analysis of the law as it applies to a person’s specific situation – as opposed to speculation based on generic facts. From a legal standpoint, the giving of legal advice is tantamount to the practice of law, In a nutshell, legal advice has the following characteristics:

- Requires legal knowledge, skill, education and judgment

- Applies specific law to a particular set of circumstances

- Affects someone’s legal rights or responsibilities

- Creates rights and responsibilities in the advice-giver

Unlike legal information – such as information posted on a street sign – legal advice proposes a specific course of action a client should take. For instance, it’s the difference between telling someone what to do (legal advice) as opposed to how to do it (legal information). Examples:

- Selecting, drafting, or completing legal documents or agreements that affect the legal rights of a person

- Negotiating legal rights or responsibilities on behalf of a person

- Speculating an outcome

- Selecting or filling out specific forms on behalf of a client Findlaw.com *

Webster Definition

The hourly rates for HOA lawyers typically range from $175 to $350, whereas legal advice from a manager is free. It is understandable that boards would try to save money by seeking free legal counsel from their managers. However, doing so exposes directors to significant risk. By statute, directors are protected from personal liability for errors in judgment if they follow the Business Judgment Rule, which requires that decisions by directors be:

- In good faith,

- In a manner which the director believes to be in the best interests of the corporation, and

- With such care, including reasonable inquiry, as an ordinarily prudent person in a like position would use under similar circumstances. (Corp. Code §7231(c).)

If a board relies on legal counsel from a manager and things go awry, directors will have difficulty convincing a jury that seeking legal advice from a manager was prudent. Davis Stirling.com Los Angeles County Bar Assoc. – lacba.org

Legal Document Assistant

It is unlawful for any person engaged in the business or acting in the capacity of a legal document assistant or unlawful detainer assistant to do any of the following:

(d) Provide assistance or advice which constitutes the unlawful practice of law pursuant to Section 6125, 6126, or 6127.

(e) Engage in the unauthorized practice of law, including, but not limited to, giving any kind of advice, explanation, opinion, or recommendation to a consumer about possible legal rights, remedies, defenses, options, selection of forms, or strategies. §6411 *

Links & Resources

- hirealawyer.findlaw.com/

- 12 page booklet from CA Courts Legal Advice vs Legal Information

- California State Bar – File a Complaint

- California Bar – Cease & Desist Notices

- Supreme Court of Florida Ruling

County of Los Angeles

District Attorney

*****************

Technical Stuff for Attorneys

Appeals Law

Interim Final Rules for Group Health Plans and Health Insurance Issuers Relating to Internal Claims and Appeals and External Review Processes Under the Patient Protection and Affordable Care Act

- June 22, 2011 CMS-9993-IFC2: Group Health Plans and Health Insurance Issuers: Rules Relating to Internal Claims and Appeals and External Review Processes – Opens in a new window

- July 26, 2011 CMS-9993-CN: Group Health Plans and Health Insurance Issuers: Rules Relating to Internal Claims and Appeals and External Review Processes; Correction – Opens in a new window (PDF – 184 KB)

From CMS Site

- Regulations & Guidance

- Fact Sheets & FAQs

- Letters & News Releases

- State External Appeals Review Processes

Resources, Child Pages & Links

- Insure Me Kevin.com

- Patient Advocate.org

- Prove you never got a letter?

- Medical Necessity Grievances

- Appeal & Grievances?

#Advocates Guide to Surprise Medical Bills

- Hidden Cost of Surprise Medical Bills 3.3.2016 Time Magazine

- heart bypass surgery, replacement of one valve and repair of another. raging infection that required powerful IV antibiotics to treat. spent a month in the hospital, some of it in intensive care, before she was discharged home.

- surprise: Bills totaling more than $454,000 for the medical miracle that saved her life. Of that stunning amount, officials said, she owed nearly $227,000 after her health insurance paid its part. Time.com 3.21.2019 *

- heart bypass surgery, replacement of one valve and repair of another. raging infection that required powerful IV antibiotics to treat. spent a month in the hospital, some of it in intensive care, before she was discharged home.

- Newscast about Hospitals being required to post rates - charges VIDEO

- PBS Trump Price Transparency Executive Order VIDEO

- Our webpage on Balance Billing & No Surprises

- Americans often "forced" to pay medical bills they don't owe, feds say CBS News

- Colorado's Supreme Court has ruled in favor of a woman who expected to pay about $1,300 for spinal fusion surgery but was billed more than $300,000 by a suburban Denver hospital that allegedly included charges it never disclosed she might be liable for. Read more: CBS News 5.19.2022

- What the Federal ‘No Surprises Act’ Means in California

- CA Department of Insurance Summary

Technical Links – Appeals & Grievances

- Page 19 Section §2719 of Health Care Reform -Appeals Process

- 45 CFR Part 147 Interim Final Rules for Group Health Plans and Health Insurance Issuers – Appeals

- § 147.136 — Internal claims and appeals and external review processes.

- 7/26/2011 – Final Rules – EBSA – Group Health Plans and Health Insurance Issuers: Rules Relating to Internal Claims and Appeals and External Review Processes; Correction [PDF]

See also Medical Necessity

California Insurance Code §790.03 (h) Knowingly committing or performing with such frequency as to indicate a general business practice any of the following unfair claims settlement practices: Calif. Code of Regulations TITLE 10. CHAPTER 5 ADOPT SUBCHAPTER 7.5 with new 2004 amendments on CA Department of Insurance Site

Claim Splitting Res Judicata

Claim Splitting – #Res Judicata

you can’t just sue someone two or more times to get around the small claims court limit.

Laws Against

Claim Splitting – Preclusion – Res Judicata

You Tube Video’s on Res Judicata (Double Jeopardy)

- Rule:

- If judgment is rendered in favor of a plaintiff in a particular suit, the plaintiff is precluded from raising claims (in any future litigation) which were raised in (or could have been raised) in that lawsuit.

- Elements:

- Before a court will apply the doctrine of res judicata to a claim, three elements must be satisfied:

- There must have been prior litigation in which identical claims were raised (or could have been raised). In general, claims are sufficiently identical if they are found to share a “common nucleus of operative fact.”

- scope:

- Res judicata bars relitigating of claims that were previously litigated as well as claims that could have been litigated in the first lawsuit. Up Counsel.com caught.net

- Before a court will apply the doctrine of res judicata to a claim, three elements must be satisfied:

If your claim is over the small claims monetary limit,you may file a case in the regular superior court, where you can either represent yourself or hire an attorney to represent you. Instead of doing that,you may choose to reduce the amount of your claim and waive(give up) the rest of the claim in order to stay within the small claims court’s monetary limit on claims. Before reducing your claim, discuss your plans with a small claims adviser or an attorney. Once the dispute is heard and decided by the small claims court, your right to collect the amount that you waive will be lost forever.

Definition – Claim Splitting lectlaw.com Dividing a single or indivisible claim or cause of action into separate parts and bringing separate suits upon it, either in the same court , or in separate courts or jurisdictions.

Res Judicata

You cannot divide a claim into 2 or more claims (called claim splitting) just to avoid the limit…..Or, lower the amount you ask for and give up (or waive) the rest. That way you can keep your claim in Small Claims court.

.occourts.org

fees charged by the attorney for private assistance are not recoverable as court costs or damages. (dca.ca.gov)

Small Claims Procedures & Practices

§6.14 Res Judicata

- Under the doctrine of res judicata, a small claims court judgment is a bar to a second suit on the same cause of action. [Pitzen v Superior ; Allstate Ins. Co. v Mel Rapton, Inc. (2000) 77 CA4th 901, 905.] * Allstate v Rapton – waiver of damages over $5k limit,

- A small claims judgment for a plaintiff, however, is not given collateral estoppel issue-preclusion effect on other actions against the defendant. It would be unfair to have plaintiff’s choice of small claims court bind the defendant when the record does not fully reflect the issues raised and decided there. [Sanderson v Niemann]

- But a defendant may raise collateral estoppel issue preclusion if the defendant prevailed in a previous small claims action. There is no rationale for refusing to afford collateral estoppel effect to issues litigated and decided against a plaintiff. Fundamental fairness dictates that a plaintiff who chose to litigate in small claims court cannot cite the informality of that forum to gain a second chance to litigate a decided issue. Relitigating decided issues is also inconsistent with the public policy that a small claims plaintiff is bound by an adverse judgment. [Bailey v Brewer; Pitzen v Superior Court] §6.14 Res Judicata

- If you do try to unlawfully collect a debt by claim splitting – you might get busted under Fair Debt Collection Laws!

“Dismissed Without Prejudice” – What does it mean? Shouse Law.com

FAQ’s

- not to let your illness get worse. There is a duty to mitigate your damages, not to let your health get worse. Insurance Companies are NOT your parents!

-

- You should always take reasonable steps towards resolving your injuries and the suffering caused by your injuries, for three reasons:

- 1) for your own well-being, you should pursue proper medical care and therapy as soon as possible;

- 2) you are entitled to damages for any expenditures put towards reasonable mitigation efforts; and

- 3) if you do take reasonable steps to mitigate, then the defendant will have an excellent defense argument that may ultimately reduce their damages liability and leave you with a much smaller damages award. Kopp Law *

- Jury Instructions Mitigate Damages

- You should always take reasonable steps towards resolving your injuries and the suffering caused by your injuries, for three reasons:

- Check out our tools to find providers for most Insurance Companies in CA

-

- #primary physician after 3 yrs without. Various tests were done to assess my current health.

- I was surprised that all were not covered as part of a well woman visit or as preventative screenings.

- Abdominal Aortic Aneurysm Here’s what is listed as preventative care:

- Sample clinical Bulletin on Wound Care This bulletin is beyond our paygrade… Try the links above.

- Medicare Benefit Policy Manual

- Medstarvna.org Wound Care at Home

- Medically Necessary – means health care services, supplies, or drugs needed for the prevention, diagnosis, or treatment of your sickness, injury or illness that are all of the following as determined by us or our designee, within our sole discretion:

- partment of Managed Health Care or Small Claims Court, the burden of proof is on you.

- Appeals Guides above.

- Small Claims Guide

- Please also review these other pages on our website:

- Read the policy, denial letters and other correspondence like where the Insurance Company said that your coverage was lapsed three times and then when you think you understand it, read it again.

- Our webpage on the important of reading the EOC Evidence of Coverage

- Court case stating a policyholder must read their policy.

- Insurance Companies give the wrong answer and then tell the Department of Insurance that an application was never sent in, when they told the agent it would be denied and not sent in

- I’m not practising law or giving legal advice. I’m just showing you research.

- make sure you have the evidence that the Insurance Company will show to defend their denial of your claim

https://www.beckershospitalreview.com/finance/13-top-reasons-for-claims-denials/

wmar2news.com/local/maryland-recovers-2-6-million-for-consumers-fighting-denied-health-insurance-claims#google_vignette

Yeah!!!! You did it!!! I’m so thankful!!!

You are not superman but SuperSteve!!!!!

You have done the impossible!!!

I know I know, I shouldn’t be celebrating until I get the insurance. Even coming this far was impossible for me. Without your help, I would have just accept their decision and gone without insurance for a year. I either would have used our savings to pay for surgery or have to wait until next year while suffer the consequences.

I couldn’t thank you enough. I’m so grateful to you.

Thank you for the Kudo’s.

Here’s the Draft Appeals Brief had we needed to actually go before the Judge. All your personal information has been redacted