Plain English – How to read an Insurance Policy – EOC Evidence of Coverage

Guide to #Contract Interpretation

#Plain Meaning Rule

How to read a policy

How to read and figure out the law or Insurance Policy Provisions - Evidence of Coverage

- Read the Statute – Policy

- Read the Statute – Policy

- Read the Statute – Policy

- Then when you think you understand it, read it again

-

-

- Then as my cousin reminded me - one needs to check Westlaw, Google or the Talmud to see how the courts have interpreted the law, their might be some jiggery pokery - malarky going on.

- Check your Insurance Company Evidence of Coverage EOC one big advantage of the EOC is that it's in Plain English.

- Scroll down for more...

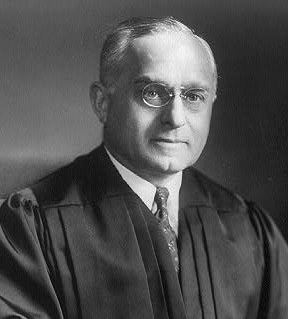

- Felix Frankfurther – Wikipedia

-

-

- Then when you think you understand it, read it again

- Tools to Read a Statute VIDEO

- Contract Interpretation in California: Plain Meaning, Parol Evidence and Use of the Just Result Principle

-

More on How to read a contract - Insurance Policy

-

The language of the text of the statute or Evidence of Coverage EOC should serve as the starting point for any inquiry into its meaning. To properly understand and interpret a statute, [first] you must read the text closely, keeping in mind that your initial understanding of the text may not be the only plausible interpretation of the statute or even the correct one, per Justice Felix Frankfurter . Guide to Reading & Interpreting * American Society of Healthcare Risk Management and * Wikipedia.

-

The starting point in statutory construction is the language of the statute - Evidence of Coverage itself. The Supreme Court often recites the “plain meaning rule,” as in, King vs Burwell Subsidies in Health Care.Gov upheld, that, if the language of the statute is clear, there is no need to look outside the statute to its legislative history in order to ascertain the statute’s meaning.

-

Parol Evidence Rule Wikipedia - Contract stands by itself - can't bring up discussions or agreements that were prior to actually signing the written Contract

-

The plain meaning of the contract will be followed where the words used—whether written or oral—have a clear and unambiguous meaning. Words are given their ordinary meaning; technical terms are given their technical meaning; and local, cultural, or Trade Usage of terms are recognized as applicable. The circumstances surrounding the formation of the contract are also admissible to aid in the interpretation. West’s Encyclopedia of American Law,

-

A cardinal rule of construction is that a statute should be read as a

Harmonious Whole,

with its various parts being interpreted within their broader statutory context in a manner that furthers statutory purposes. A provision that may seem ambiguous in isolation is often clarified by the remainder of the statutory scheme — because the same terminology is used elsewhere in a context that makes its meaning clear, or because only one of the permissible meanings produces a substantive effect that is compatible with the rest of the law.”

-

In Edgar v. MITE Corp., 457 U.S. 624 (1982), the Supreme Court ruled: “A state statute is void to the extent that it actually conflicts with a valid Federal statute.” In effect, this means that a State law will be found to violate the supremacy clause when either of the following two conditions (or both) exist:[3]

- Compliance with both the Federal and State laws is impossible, or

- “…state law stands as an obstacle to the accomplishment and execution of the full purposes and objectives of Congress…”

Supreme Court - FINAL Ruling - Plain Meaning - No Jiggery Pokery 47 Pages, view our highlights, annotations & bookmarks

Our webpage on

- jiggery pokery and contract interpretation

- Evidence of Coverage EOC

- Plain Meaning Rule - How to read Policy - Contract

Jump to section on:

|

Fool & their Folly

|

Plain language makes it easier for the public to read, understand, and use government communications.

- Modern insurance policies, as a result of state statutes, are required to be written in plain language or easy to read language sufficient for anyone with a fourth-grade education can understand. “Sesame Street English.” Merlin Law Group

- The Plain Writing Act of 2010 was signed on October 13, 2010. The law requires that federal agencies use clear government communication that the public can understand and use.

- While the Act does not cover regulations, three separate Executive Orders emphasize the need for plain language: E.O. 12866, E.O. 12988, and E.O. 13563.

- plain language.gov/law/

- Training Videos

- plain language.gov/guidelines/

- California Globe – Plain English

- CA Government Code 11340 – 11342.4

- Contra proferentem is a rule of contract interpretation that states an ambiguous contract term should be construed against the drafter of the contract. The term contra proferentem is derived from a Latin phrase meaning “against the offeror.”Contra proferentem has become increasingly important with the rise of contracts of adhesion. Contracts of adhesion involve pre-written contracts which are offered on a strict take-it or leave-it basis, leaving no opportunity for a party to bargain over specific contractual terms. Because the party does not have an opportunity to negotiate, they may reasonably interpret a term in a different manner than the contract offeror intended. Contra proferentem exists to place the burden of ambiguity on the party most capable of mitigating that ambiguity – the person who wrote it.

-

The doctrine of contra proferentem is also especially important in the field of insurance law due to the generalized nature of many of its terms. For example, it may be unclear if a policy that covers “water damage” will cover damage caused by a rainstorm induced mudslide. The doctrine of contra proferentem encouraged insurance providers to create enumerated lists of events that are excluded under a given policy, ultimately increasing clarity for insurance purchasers. Source Cornell Law *

- Health insurance illiteracy costs employees, study finds Despite spending more than $1 trillion on health insurance each year, many U.S. consumers are making poorly informed decisions – and paying for their lack of understanding.

Policy – Evidence of Coverage

The EOC Evidence of Coverage is the CONTRACT #between you and the Insurance Company

Every policy has a written Evidence of Coverage (EOC). The EOC is your guide to what is covered and what is excluded, how much you will pay depending on the circumstances, what your cost sharing will be, and other information about using your coverage. Keep this document handy for when you have questions about your policy. Insurance.CA.Gov *

Introduction to EOC Evidence of Coverage

So many questions are answered right in the Full Policy the evidence of coverage – EOC, in

- PLAIN English, as mandated by law.

- Along with your duty to read the policy!

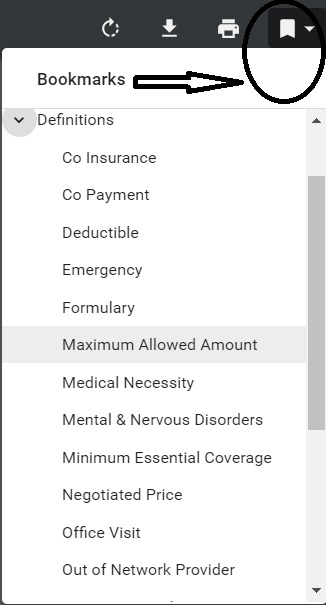

Sure beats reading the law and then trying to see for sure if the law applies to you. When you have your actual EOC, a couple of easy ways to find stuff in the policy is the bookmarks, table of contents and the search feature.

The Evidence of Coverage (EOC) is a document that describes in detail the health care benefits covered by the health plan. It provides documentation of what that plan covers and how it works, including how much you pay. The EOC can also refer to a certificate or contract provided to a health plan member that contains information about coverage and other rights. National Disability Rights *

Here’s where to find your EOC Evidence of Coverage for:

- Individual & Family Plans

- Employer Group Plans

- Medi-Cal

- Medicare Advantage Co Ordination Plan –

- Email us if you are in CA and have any questions.

Must #read your policy

A court “must hold the insured bound by clear and conspicuous provisions in the policy even if evidence suggests that the insured did not read or understand them.”

- property casualty 360.com/is-there-a-duty-to-read-insurance-contracts

- IRMI duty to read

- Is there a duty to read? Hastings College of Law

- Fordham Law Review Duty to read a changing concept 1974

- Kenny & Sams Law Firm

The Hadlands, having failed to read the policy and having accepted it without objection, cannot be heard to complain it was not what they expected. Their reliance on representations about what they were getting for their money was unjustified as a matter of law.Sarchett v. Blue Shield of California (1987) 43 Cal.3d 1, 15, 233 Cal.Rptr. 76, 729 P.2d 267

Hadland v. NN Investors Life Ins. Co. (1994) 24 Cal.App.4th 1578 , 30 Cal.Rptr.2d 88(Findlaw.com requires free registration)

STORY of what happened in this lawsuit

In the fall of 1985, the Hadland’s were notified of a 10 percent increase in the premiums for their health insurance under a policy with Reliance Standard Life Insurance Company. The Reliance major medical policy paid 80 percent of medical and hospital expenses, subject to a $250 deductible. The Hadland’s began to look for less expensive coverage. When they received a mailing from NASE describing low-cost group hospital insurance available to NASE members through NN, they sent in a postcard asking for further information. Kevin Winn, associated with NASE, NN and United Group Association (UGA) (a company that markets NN insurance), contacted the Hadland’s and, on December 5, came to their place of business to make a sales presentation. According to the Hadland’s, Winn told them coverage under the NN policy was “as good if not better” than coverage under the Reliance policy, at half the premium cost. Promotional materials described the policy as offering major hospital benefits. The Hadland’s joined NASE and applied for NN coverage. As it turned out, the NN policy was, as Winn had stated, half as expensive as the Reliance policy, but it did not cover most outpatient medical expenses. Moreover, NN’s benefits were paid according to a maximum benefit schedule which, in some cases, covered less than 50 percent of the actual charge for a surgical procedure. For instance, the maximum surgical benefit available under the policy was $6,000, regardless of the actual cost, and the maximum hospital room and board benefit for nonintensive care was $300 a day.

In January 1986, the Hadland’s received a certificate of insurance indicating their coverage benefits under the NASE group policy. In an attached letter, they were asked to read the certificate and call the NN office if they had any questions. The first page of the certificate advised them that if the policy did not meet their needs, they could return it within 10 days for a full refund. fn. 1 NN sent the Hadland’s a second letter to confirm their receipt of the certificate and to ask them to contact the insurer if they had any questions concerning coverage. The Hadland’s did not read the insurance contract. In November, Mary Jane Hadland was hospitalized for a surgical procedure. She incurred nearly $26,000 in medical and hospital bills. NN paid less than one-half, which, the Hadland’s concede, was the total of benefits due under the policy.

To take their fraud cause of action to the jury, the Hadland’s had to prove not only defendants’ false representations, but their own justifiable reliance

‘A reasonable person will read the coverage provisions of an insurance policy to ascertain the scope of what is covered. [Citation.]’ … Generally the insured is ‘bound by clear and conspicuous provisions in the policy even if evidence suggests that the insured did not read or understand them.’

NN (NASE prior Insurance Company) policy’s schedule of benefits expressly provided, for instance: an entirely unambiguous maximum surgical benefit of $6,000, regardless of whether the surgery consisted of an organ transplant, a partial or radical mastectomy or the amputation of a toe; [FN12] a maximum nonintensive care hospital room and board benefit of $300 a day; and a maximum benefit of **95$300 a day for outpatient hospital charges. The Reliance (the company the Hadland’s had before NASE) policy provided unqualified benefits of 80 *1589 percent of covered expenses. Thus, any representations by defendants of “full protection” under the NN policy, or coverage “as good or better” as the Reliance policy, were patently at odds with the express provisions of the written contract. If the Hadland’s had read it, they would have discovered its limitations, rejected it, and continued to pay the higher premium for the increased security of Reliance’s more comprehensive coverage.

View Entire Case on Findlaw.com Hadland v. NN Investors Life Ins. Co.

(NASE’s prior Carrier, as pointed out by UICI’s 4/6/2006 letter) This case shows that one must read the ACTUAL policy and can’t rely on Agent’s statements or brochures. There are some exceptions… This doesn’t just apply to NASE, but to ANY Insurance Contract. See attorney Keler.com for more explanation.

Plain Language – Read Policy THREE times

Specimen Individual Policy #EOC with Definitions

Employer Group Sample Policy

It's often so much easier and simpler to just read your Evidence of Coverage EOC-policy, then look all over for the codes, laws, regulations etc! Plus, EOC's are mandated to be written in PLAIN ENGLISH!

- Find your own Individual EOC Evidence of Coverage

- It' important to use YOUR EOC not just stuff in general!

- Obligation to READ your EOC

- Plain Meaning Rule - Plain Writing Act

- Our Webpage on Evidence of Coverage

- OOP Out of Pocket Maximum - Many definitions are explained there.

VIDEO Steve Explains how to read EOC

Jiggery Pokery

King v Burwell – Subsidies Upheld – ScotusCare –

Plain Meaning Rule – Interpretive Jiggery Pokery

Slip Opinion

The

doctrine of privity in contract law

provides that a contract cannot confer rights or impose obligations arising under it on any person or agent except the parties to it.

The premise is that only parties to contracts should be able to sue to enforce their rights or claim damages as such. However, the doctrine has proven problematic due to its implications upon contracts made for the benefit of third parties who are unable to enforce the obligations of the contracting parties. en.wikipedia.org

In tort law, a duty of care is a legal obligation imposed on an individual requiring that they adhere to a standard of reasonable care while performing any acts that could foreseeably harm others. It is the first element that must be established to proceed with an action in negligence. The plaintiff must be able to show a duty of care imposed by law which the defendant has breached. In turn, breaching a duty may subject an individual to liability in tort. The duty of care may be imposed by operation of law between individuals with no current direct relationship (familial or contractual or otherwise), but eventually become related in some manner, as defined by common law (meaning case law). wikipedia.org/

Elements

| the foreseeability of harm to the injured party; |

| the degree of certainty he or she suffered injury; |

| the closeness of the connection between the defendant’s conduct and the injury suffered; |

| the moral blame attached to the defendant’s conduct; |

| the policy of preventing future harm; |

| the extent of the burden to the defendant and the consequences to the community of imposing a duty of care with resulting liability for breach; |

| and the availability, cost, and prevalence of insurance for the risk involved.[6] |

| the social utility of the defendant’s conduct from which the injury arose.[7]wikipedia.org/ |

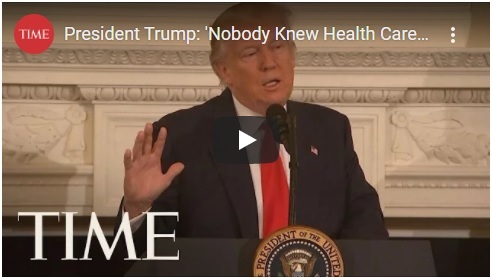

Health Insurance unfortunately is very complicated

President Trump February 27, 2017

- Thus, if we haven't simplified and explained in PLAIN ENGLISH what you are looking for:

#Insubuy Travel Health Insurance

Instant Quotes, Details and ONLINE Enrollment

Steve talks about International Travel Insurance VIDEO

US State Department - Travel - Insurance

Our webpage on Travel Insurance

Testimonials & Accolades

Thank you so much for your assist in navigating this complicated insurance process.

I feel so lucky to find you!

I would like to contact you if I have any questions in the future because you are the only one who can give me a clear answer in this field.

I really, really appreciate you. 🙏

Julie L

Read our other clients testimonials and/or write one

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

Resources & Links

- Wikipedia PDF Congressional Research Service on plain meaning rule

- Our webpage on mandated privacy notices – scroll down to section on writing in plain English.

- California Civil Code 1635 et seq – Interpretation of Contracts

- Caminetti_v._United_States

- Thomas v Quintero

- Must read policy or you can’t complain it wasn’t what you expected.

Appeals & Grievances

#Advocates Guide to Surprise Medical Bills

- Hidden Cost of Surprise Medical Bills 3.3.2016 Time Magazine

- heart bypass surgery, replacement of one valve and repair of another. raging infection that required powerful IV antibiotics to treat. spent a month in the hospital, some of it in intensive care, before she was discharged home.

- surprise: Bills totaling more than $454,000 for the medical miracle that saved her life. Of that stunning amount, officials said, she owed nearly $227,000 after her health insurance paid its part. Time.com 3.21.2019 *

- heart bypass surgery, replacement of one valve and repair of another. raging infection that required powerful IV antibiotics to treat. spent a month in the hospital, some of it in intensive care, before she was discharged home.

- Newscast about Hospitals being required to post rates - charges VIDEO

- PBS Trump Price Transparency Executive Order VIDEO

- Our webpage on Balance Billing & No Surprises

- Americans often "forced" to pay medical bills they don't owe, feds say CBS News

- Colorado's Supreme Court has ruled in favor of a woman who expected to pay about $1,300 for spinal fusion surgery but was billed more than $300,000 by a suburban Denver hospital that allegedly included charges it never disclosed she might be liable for. Read more: CBS News 5.19.2022

- What the Federal ‘No Surprises Act’ Means in California

- CA Department of Insurance Summary

Major Insurance Company

Asserting the #Wrong Answer!

I just let my contract go with a certain well know and respected Insurance Company, as their RSM Regional Sales Manager told me THREE times, that I couldn’t write a medi-gap plan for someone whose MAPD plan non renewed. Even though I emailed her the official proofs. She even kept this up at a sales meeting and told the other agents there the same thing.

When my client complained as I suggested to the CA Department of Insurance, the Insurance Company denied responsibility as they said they never received an application. They didn’t mention anything about telling their agent that he would be wasting his time sending it in.

Email chain available on request. I have this posted as I’m mandated to report ethical issues.

- #Appeal Guides

- DOI Washington State

- Navigating the Appeals Process -Patient Advocate Foundation

- NAIC Sample Appeals letter & process

- VIDEO Clark Howard - How to appeal

- LA Times appeal explanation 1.19.2022

- Kantor & Kantor Attorneys VIDEO

CA #SmallClaims Court Guide 56 Pages

Gathering the documents you need

- courts.ca.gov/selfhelp-smallclaims

- Nolo Guide to Small Claims in CA

- California Small Claims – Court Site – Self Help

- Fillable Forms

- Small Claims Adviser Los Angeles 213.974.9759

- If you have a claim for more than the Small Claims Limit, you can sue, but you waive the amount over the limit.

-

Small Claim Court Study Guide for temporary – pro tem judges – highly likely you might have an attorney whose volunteering to be a Judge for the day.

Department of Consumer Affairs - Mediation Request ONLINE

How Mediation Works & Paper Mediation Request Form

- Fair Shake.com Arbitration - They will send a demand letter!

Appeals? Grievances?

Check the FULL policy, EOC - Evidence of Coverage Also, here's a guide in how to read and interpret contracts. that's what an Insurance Policy is.

Then if you do decide to do an appeal, (page 151 in specimen policy) or view our webpage on appeals, you'll know what to argue about.

See our main webpage on appeals & grievances

30 Day Free Look

Free Look Period #view FULL Policy – E O C (Evidence of Coverage) when you purchase Health Insurance and full return privileges’

California Insurance Code §10276.

Every individual accident and health policy or contract, except single premium nonrenewable policies or contracts, issued for delivery in this state on or after July 1, 1962, by an insurance company, nonprofit hospital service plan or medical service corporation, shall have printed thereon or attached thereto a notice stating that the person to whom the policy or contract is issued shall be permitted to return the policy or contract after its delivery to the purchaser and to have the premium paid refunded if, after examination of the policy or contract, the purchaser is not satisfied with it for any reason.

The period time set forth by the insurer, nonprofit hospital service plan or medical service corporation for return of the policy or contract shall be clearly stated on the notice and such period shall not be less than 10 days nor more than 30 days. The policyholder or purchaser may return the policy or contract to the insurer, plan or corporation at any time during the period specified in the notice. If a policyholder or purchaser pursuant to such notice, returns the policy or contract to the company or association at its home or branch office or to the agent through whom it was purchased, it shall be void from the beginning and the parties shall be in the same position as if no policy or contract had been issued. California Insurance Code §10276.

Check your evidence of coverage for the exact provisions!

Covered CA has a different Opinion. IMHO they are in violation of law!

See § 155.430 * Termination of Exchange enrollment or coverage

(b)Termination events –

(1)Enrollee-initiated terminations.

(i) The Exchange must permit an enrollee to terminate his or her coverage or enrollment in a QHP through the Exchange, including as a result of the enrollee obtaining other minimum essential coverage. To the extent the enrollee has the right to terminate the coverage under applicable State laws, including “free look” cancellation laws, the enrollee may do so, in accordance with such laws.

FAQs “30 Day Free Look – Right to view EOC”

It’s not just the law, but the EOC Evidence of Coverage should state the same provision, in plain English.

Who is “They?”

We don’t like hearsay evidence!

You might want to file a grievance.

Are “They” subject to the provisions of this law?

Did you have a special enrollment period?

I’m curious, paid for Cobra on for May on 6/30 and was told I cannot get a refund because its past 7 days. There was a holiday and the weekend, so I called today 7/8 twice to speak with a supervisor and was told “They didn’t have one available” .

Is there not a 30 day free look period?

3rd How about getting an individual plan with us. Get quotes here.

4th The free look from my reading and you’re welcome to check with legal counsel says it’s only for INDIVIDUAL plans. COBRA and Cal COBRA are group plans, as best I can determine.

Do you have a copy of your Evidence of Coverage?

When did you receive your policy?

Why did it take so long for you to pay your May premium?

Fool & Folly – Proverbs Maxims of Law

#Fool & Folly

The purpose of the book of Proverbs is to transmit insights whereby one might learn to cope with life (1.2-6). Its emphasis is on teachings gathered from tradition of the elders (e.g., 4.1-4) and from experience (e.g., 6.6-11).

- “Fool” is the word used over and over again in Proverbs for one who lacks sense, who does not judge things according to their proper value.

- What good will it do to argue with a fool?

- “Do not answer a fool according to his folly, Lest you also be like him.” Prv. 26.4

- No matter how many defenses you come up with …, no matter how many times you deny or refute his accusations, he has more. If you multiply words in return, you are answering him like a fool (according to his folly)

Every language has pithy sayings or maxims that express a truth crisply and forcefully. Because proverbs frequently express only one side of a truth, it happens that mutually contradictory proverbs may circulate, each of which is true when applied to the appropriate life-setting. The common saying, “Penny wise, pound foolish,” correctly describes one who is scrupulous about small transactions, but is extravagant in great ones. On the other hand, the proverb, “Take care of the pennies, and the dollars will take care of themselves,” is also true.

More than once the Bible presents two proverbs that, though contradictory, are both true when applied to appropriate circumstances. In Proverbs 26.4 the writer cautions his reader, “Do not answer fools according to their folly, or you will be a fool yourself”; in the very next verse, however, he advises, “Answer fools according to their folly, or they will be wise in their own eyes.”Prv. 26.5 It is left to the reader to know when it is appropriate to heed one or the other of these two antithetical proverbs. missouriwestern.edu

Other sayings about Fools

The more someone says and the louder he says it, the less likely his words are worth listening to (which is why he’s talking so loud). Speech is a gift – not to be wasted or overused. We learned recently: “say little and do much” (1:15 Mishna 15) We are ultimately judged, both by G-d and by man, not by our big talk and brash promises but by our deeds and accomplishments. Torah.org

Voltaire

- It is dangerous to be right in matters on which the established authorities are wrong.

- All the reasoning’s of men are not worth one sentiment of women.

- He must be very ignorant for he answers every question he is asked.

- He who thinks himself wise, O heavens! is a great fool.

- I do not agree with what you have to say, but I’ll defend to the death your right to say it.

- Judge a man by his questions rather than his answers.

- Man is free at the moment he wishes to be.

- Now, now my good man, this is no time for making enemies.

- The art of medicine consists in amusing the patient while nature cures the disease.

- The safest course is to do nothing against one’s conscience. With this secret, we can enjoy life and have no fear from death

- To hold a pen is to be at war.

- We have a natural right to make use of our pens as of our tongue, at our peril, risk and hazard keepinspiring.me/voltaire-quotes

Resources & Links

- bible hub.com/proverbs/9-8

- View our webpage on the 10 commandments

- Three types of fools Harbor Honolulu.org

- got questions.org/fool-Proverbs

- wisdom knowledge five-categories-of-fool

Maxims of Law – Proverbs

Calif. Civil Code §3509 – 3548

The maxims of jurisprudence hereinafter set forth are intended not to qualify any of the foregoing provisions of this Code, but to aid in their just application.

3510. When the reason of a rule ceases, so should the rule itself.

3511. Where the reason is the same, the rule should be the same.

3512. One must not change his purpose to the injury of another.

3513. Any one may waive the advantage of a law intended solely for his benefit. But a law established for a public reason cannot be contravened by a private agreement.

3514. One must so use his own rights as not to infringe upon the rights of another.3515. He who consents to an act is not wronged by it.

3516. Acquiescence in error takes away the right of objecting to it.

3517. No one can take advantage of his own wrong.

3518. He who has fraudulently dispossessed himself of a thing may be treated as if he still had possession.

3519. He who can and does not forbid that which is done on his behalf, is deemed to have bidden it.

3520. No one should suffer by the act of another.

3521. He who takes the benefit must bear the burden.

3522. One who grants a thing is presumed to grant also whatever is essential to its use.

3523. For every wrong there is a remedy.

3524. Between those who are equally in the right, or equally in the wrong, the law does not interpose.

3525. Between rights otherwise equal, the earliest is preferred.

3526. No man is responsible for that which no man can control.

3527. The law helps the vigilant, before those who sleep on their rights.

3528. The law respects form less than substance.

3529. That which ought to have been done is to be regarded as done, in favor of him to whom, and against him from whom, performance is due.

3530. That which does not appear to exist is to be regarded as if it did not exist.

3531. The law never requires impossibilities.

3532. The law neither does nor requires idle acts.

3533. The law disregards trifles.

3534. Particular expressions qualify those which are general.

3535. Contemporaneous exposition is in general the best.

3536. The greater contains the less.

3537. Superfluity does not vitiate.

3538. That is certain which can be made certain.

3539. Time does not confirm a void act.

3540. The incident follows the principal, and not the principal the incident.

3541. An interpretation which gives effect is preferred to one which makes void.

3542. Interpretation must be reasonable.

3543. Where one of two innocent persons must suffer by the act of a third, he, by whose negligence it happened, must be the sufferer.

3545. Private transactions are fair and regular.

3546. Things happen according to the ordinary course of nature and the ordinary habits of life.

3547. A thing continues to exist as long as is usual with things of that nature.

3548. The law has been obeyed.

Links & Websites to explain what the above means…

The law says to return the policy.

They never sent one. I didn’t get any. They play a game that they sent it. I can’t review it. Its been 21 days. They say I will now get a refund less 150.

That is not the same position I was in when I started.

Why do you publish the 1962 law.