Try turning your phone sideways to see the graphs & pdf's?

Calculate your Covered CA MAGI Income

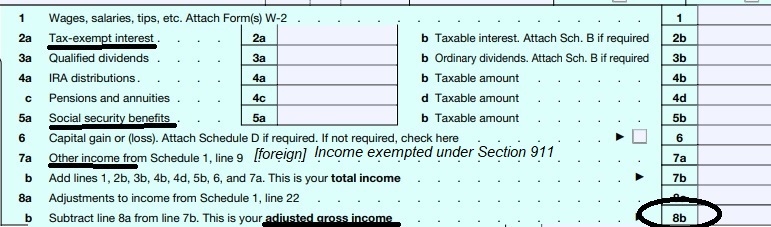

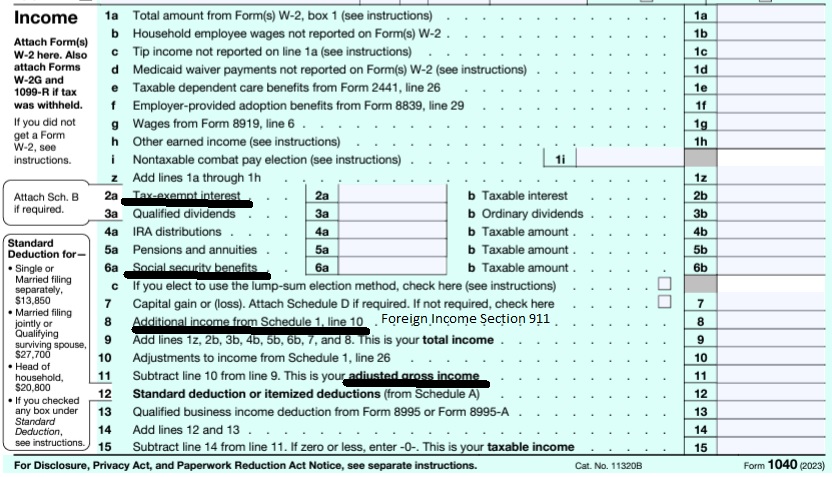

take #Line8b 11 Adjusted Gross income then add line 2a, 6a & 8 (Foreign Income)

- 1040 IRS Annual Tax Form

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

- Estimate next years MAGI Income?

- Get instant quotes, subsidy calculation and coverages

- NO ASSET TEST for MAGI based subsidies in Covered CA or MAGI Medi Cal Qualification. Steve's VIDEO

- Nor is there a lien against your estate for Covered CA or MAGI Medi Cal

Scroll down for a comprehensive list and details of all the ins and outs of the definition of MAGI Income

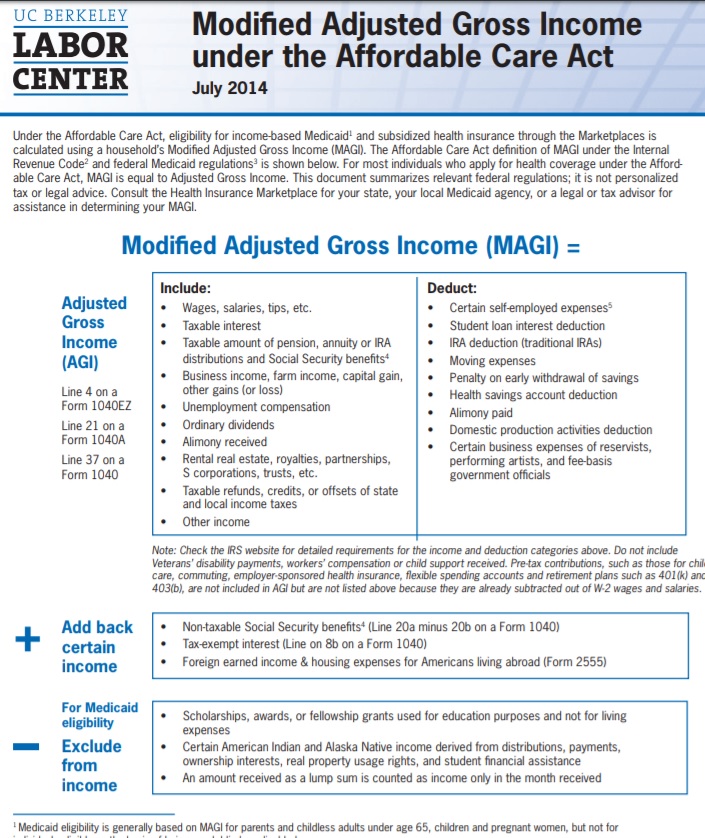

Modified Adjusted Gross Income (MAGI) (2) … means

adjusted gross income – Line 11 of the 1040 Form * Health Care.Gov * 26 USC §62 *

*Plus +

(i) Amounts excluded from gross income under IRC §911 * Foreign Exempted * IRS Form 2555 * CFR 1.36 B – 1 *

(ii) Tax-exempt interest [IRS Coursework] [Form 8815 * Interest Income * Investing Answers.com] the taxpayer receives or accrues during the taxable year; and

(iii) some Social Security Benefits Western Poverty & Law Explanation of MAGI ♦ (UC Berkely One Page Summary) ♦ CFR 1.36 B 1 * IRS Publication 974 ♦ George Town.edu

Get even more details & definitions of MAGI Income

Jump to the section you want:

IMPORTANT!!!

The upcoming year – the future for what you tell Covered CA!

Sure, many people think it’s the past as Covered CA may ask for last years paperwork, but that’s BS! You might have to give back all the subsidies when you file Subsidy Reconciliation form #8962!

Try turning your phone sideways to see the graphs & pdf's?

Official Publications on MAGI

UC Berkeley explains MAGI Modified Adjusted Gross Income –

Click on image to enlarge and for a more clear picture

- Western Poverty & Law Explanation of MAGI – IMHO one of the most authoritative publications I’ve ever seen!

- It’s important to read the all material & links as one can’t rely on Covered CA to give you the correct answer.

- How to estimate your MAGI income?

- CHCF 2 page summary on what is MAGI

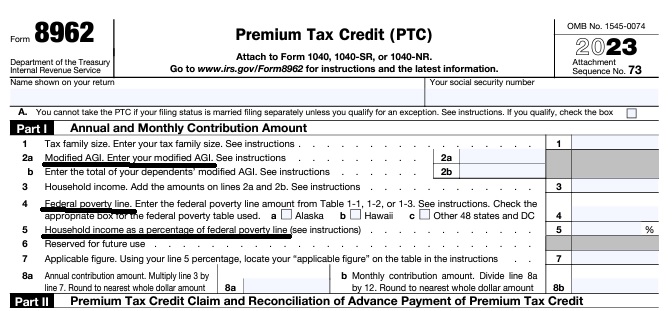

Federal IRS #Form8962 Instructions Premium Tax Credit

Reconciliation Form for Covered CA Subsidies attaches to 1040

Subsidy is IMHO hocus pocus - smoke & mirrors

it all comes out when you file taxes!

-

Introduction

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- Instructions for IRS Form #8962 Subsidy Reconcilation

- Tracking Your Covered California Subsidy on your 1040 Federal Tax Return Insure Me Kevin.com

- ARPA & Inflation Reduction Act of 2022

- Instead of increasing taxpayer audits, policymakers should simplify taxes across the board. That way, it would be easier for everyone to pay the correct amount to the government. heritage.org/who-those-87000-new-irs-agents-would-audit

- That 87,000 new tax agents estimate represents everything from IT techs to customer service people who answer the phone and help you file your return. Second, it includes attrition. So, the actual enforcement personnel is 5,000 LA Times * Mother Jones

- IRS backlog hits nearly 24 million returns, further imperiling the 2022 tax filing season

- ARPA Stimulus - you don't have to pay back 2020 overage on subsidies IRS.Gov *

- InsureMeKevin.com on subsidies & pay backs... 1.25.2022 update ARPA and 600% CA

- 1040 Instructions

- Overview FTB site

- How to Reconcile Subsidies FTB

- Calculate Pay Back

- Assistance Repaying California Subsidies

- covered ca.com/the most you might have to pay back

- 2022 Insure Me Kevin.com

- Our webpage on Form 8962 - Premium Tax Credit Subsidy Reconciliation

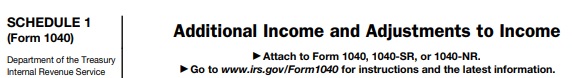

#Adjustments to Income - Schedule 1

#Schedule1 1040

- Part I Additional Income

- 2a Alimony received

- 3 Business income or (loss). Attach Schedule C

- Get Health Quote for your business

- 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

- 7 Unemployment compensation

- 8 Other income:

- a Net operating loss

- b Gambling income

- c Cancellation of debt

- d Foreign earned income exclusion from Form 2555

- e Taxable Health Savings Account distribution

- Part II Adjustments to Income

- 11 Educator expenses

- 13 Health savings account deduction. Attach Form 8889

- 15 Deductible part of self-employment tax. Attach Schedule SE

- Learn more about your Social Security Benefits

- 16 Self-employed SEP, SIMPLE, and qualified plans -

- 17 Self-employed health insurance deduction

- 19a Alimony paid

- 20 IRA Individual Retirement Account deduction

- 21 Student loan interest deduction

- Instant Business Health Insurance Proposals

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

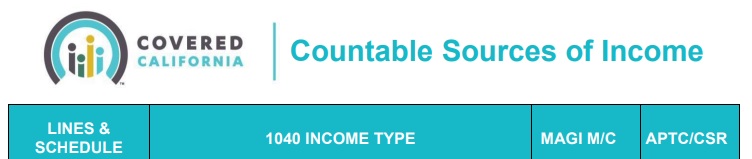

Covered CA (& Medi Cal) - Calculate - #Countable Sources of MAGI Income

Short Summary

MAGI details from a Higher Up at Medi Cal

Good morning,

For Modified Adjusted Gross Income (MAGI) Medi-Cal income and deductions policy, DHCS published All County Welfare Director’s Letter (ACWDL 21-04).

Page 2, Section 1 provides guidance on policy for countable income for MAGI program calculation, which is federal taxable income minus any allowable (post-tax) deductions under federal code. Page 3 links to an Income and Deductions chart tool to determine if a post-tax deduction can be used for MAGI-based Medi-Cal and for Covered California eligibility. Please note that the chart and the Covered California website deductions are post-tax deductions, and pre-tax deductions are already included when calculating AGI.

Tax loss is not considered an acceptable post-deduction for MAGI Medi-Cal or Covered California per federal code. The Centers for Medicare and Medicaid Services (CMS) has also published a document detailing MAGI rules with deduction information on page 7.

If the tax loss is considered as more of a capital gains/loss, or other loss such as real estate reported on Schedule E, then this amount should be entered into the system as an income with a negative (for example: -819,988). This will tell the system the income is actually at a loss and will reduce the income.

I would be happy to research your client’s case specifically if you can provide identifying information for me to look her up (name, DOB, SSN). Please let me know if you or your client are interested and I can initiate a secure e-mail and send over appropriate documents to share private information for your client to fill out in order for me to share back any results.

Thank you, and please let us know if you have any further questions.

Kathryn Floto, MPA | Health Program Specialist II

Medi-Cal Eligibility Division

California Department of Health Care Services

- Source - Covered CA

- Covered California’s Rates and Plans for 2025: The Most Financial Support Ever to Help More Californians Pay for Health Insurance Press Release 7/24/2024

- When Your Tax Return Income Makes You Medi-Cal Eligible Insure Me Kevin

- American Rescue Plan of 2021 (APRA) aka Covid Relief Bill - MORE subsidies!

- See footnotes & FAQ's below!

- Divide by 12 for monthly Medi Cal Figure $1,731.91

How does #Foreign Income get added back in, for Covered CA?

If you live and work abroad, you may be able to claim the foreign earned income exclusion. If you qualify, you won’t pay tax on up to $100,800 of your wages.

(i) IRC §911 [foreign income] Form 2555

***However, Foreign Income count’s towards Covered CA MAGI income, if you want subsidies! So you have to add back in Line 8 d of Schedule 1 to AGI Adjusted Gross Income to get Modified AGI

Foreign Earned Income IRS Form # 2555

Foreign Earned Income Instructions for # 2555 & Exclusion

Reporting Foreign Income:

Tax Tips from the IRS

Did you receive income from a foreign source? Are you a U.S. citizen or resident who worked abroad last year? If you answered ‘yes’ to either of those questions, here are eight tips to keep in mind about foreign income:

- Report Worldwide Income. By law, U.S. citizens and residents must report their worldwide income. This includes income from foreign trusts and foreign bank and securities accounts.

- File Required Tax Forms. You may need to file Schedule B, Interest and Ordinary Dividends, with your U.S. tax return. You may also need to file Form 8938, Statement of Specified Foreign Financial Assets. In some cases, you may need to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts. Visit IRS.gov for more information.

- Review the Foreign Earned Income Exclusion. If you live and work abroad, you may be able to claim the foreign earned income exclusion. If you qualify, you won’t pay tax on up to $100,800 of your wages

- ***However, it count’s towards Covered CA MAGI income, if you want subsidies!

- and other foreign earned income in 2015. See Form 2555, Foreign Earned Income, or Form 2555-EZ, Foreign Earned Income Exclusion, for more details.

- Don’t Overlook Credits and Deductions. You may be able to take a tax credit or a deduction for income taxes paid to a foreign country. These benefits can reduce your taxes if both countries tax the same income.

- Additional Child Tax Credit. You cannot claim the additional child tax credit if you file Form 2555, Foreign Earned Income, or 2555-EZ, Foreign Earned Income Exclusion.

- Use IRS Free File. Almost everyone can prepare and e-file their federal tax returns for free, using IRS Free File. If you make $62,000 or less, you can use brand-name tax software. If you earn more, you can use Free File Fillable Forms, an electronic version of IRS paper forms. Some Free File software products and fillable forms also support foreign addresses. Free File is available only through IRS.gov.

- Tax Filing Extension is Available. If you live outside the U.S. and can’t file your tax return by the April 18 due date, you may qualify for an automatic two-month extension until June 15. This extension also applies to those serving in the U.S. military abroad. You will need to attach a statement to your tax return explaining why you qualify for the extension.

- Get IRS Tax Help. Check the international services site for the types of help the IRS provides, including how to contact your local office internationally. All IRS tax tools and products are available at IRS.gov.

- Do you need USA health coverage, as a resident? Get quotes

- Travel Insurance? Get Quotes

- Do you qualify for an exemption?

- Do you have a USA residence?

- For more information – See Tax Guides & Publications

#Insubuy Travel Health Insurance

Instant Quotes, Details and ONLINE Enrollment

Steve talks about International Travel Insurance VIDEO

US State Department - Travel - Insurance

Our webpage on Travel Insurance

Medicare A & B if you don't #live in USA

Publication 11871

Medicare just visiting Out of County Publication # 11037

- Medicare Abroad: Travel and Living Coverage Explained The Street.com

- medicare.gov/travel-outside-the-u.s.

- Our webpage on Medicare Coverage outside of USA

- FAQ - Buying Medi Gap if you live outside USA

- Get Travel Quotes & Information

*********Social Security*****

Payments if you are living outside of USA # 10137

- What if you work in two or more different Countries?

- International Social Security agreements, “Totalization agreements,” have two main purposes.

-

- First, they eliminate dual Social Security taxation, the situation that occurs when a worker from one country works in another country and is required to pay Social Security taxes to both countries on the same earnings.

- Second, the agreements help fill gaps in benefit protection for workers who have divided their careers between the United States and another country.

- Payments Abroad Screening Tool

- Learn More

Our Webpages on:

IRS Publication #Interest Income 550

HTML PDF

-

- Interest subject to penalty for early withdrawal.

- Money borrowed to invest in certificate of deposit.

- U.S. Savings Bonds

- Education Savings Bond Program

- U.S. Treasury Bills, Notes, and Bonds

- Bonds Sold Between Interest Dates

- Insurance

- State or Local Government Obligations

- Original Issue Discount (OID)

- When To Report Interest Income

- How To Report Interest Income

Nonresident aliens are not taxed on certain kinds of interest income as follows, per Internal Revenue Code subsections 871(h) and (i), provided that such interest income arises from one of the following sources:

- A U.S. bank

- A U.S. savings and loan association

- A U.S. credit union

- A U.S. insurance company

- Portfolio Interest (Described in Chapter 3 “Exclusions From Gross Income” – “Interest Income” – “Portfolio interest” of Publication 519, U.S. Tax Guide for Aliens) IRS.gov *

Interest on a bond that is used to finance government operations generally is not taxable if the bond is issued by a state, the District of Columbia, a U.S. possession, or any of their political subdivisions. Political subdivisions include:

- Port authorities,

- Toll road commissions,

- Utility services authorities,

- Community redevelopment agencies, and

- Qualified volunteer fire departments (for certain obligations issued after 1980).

Obligations that are not bonds. Interest on a state or local government obligation may be tax exempt even if the obligation is not a bond. For example, interest on a debt evidenced only by an ordinary written agreement of purchase and sale may be tax exempt. Also, interest paid by an insurer on default by the state or political subdivision may be tax exempt.

Indian tribal governments. Bonds issued after 1982 by an Indian tribal government are treated as issued by a state. Interest on these bonds is generally tax exempt if the bonds are part of an issue of which substantially all of the proceeds are to be used in the exercise of any essential government function. However, interest on private activity bonds (other than certain bonds for tribal manufacturing facilities) is taxable.

Original issue discount (OID) on tax-exempt state or local government bonds is treated as tax-exempt interest.

This information is found in IRS Publication 550 HTML PDF. IRS.gov

Schedule D - Capital #Gains

- You tube VIDEO on Schedule D

- Schedule 1040 D Capital Gains & Losses

- Net Operating Losses 536

- Sales and Disposition of Assets 544

- HTML

- Learn More ⇒IRS Tax Topic 409

- Report most sales and other capital transactions and calculate gain or loss on Form 8949 (PDF), Sales and Other Dispositions of Capital Assets, then summarize capital gains and deductible capital losses on

- Form 1040, Schedule D (PDF), Capital Gains and Losses.

- Publication 505, Tax Withholding and Estimated Tax

- Publication 550, Investment Income and Expenses

- 551 - Basis of Assets

- Publication 544, Sales and Other Dispositions of Assets

- Topics 701 and 703, and Publication 523, Selling Your Home.

- How much does Term Life Insurance to cover any loans and protect your family run?

- A “paper loss” – a drop in an investment’s value below its purchase price – does not qualify for the deduction. The loss must be realized through the capital asset’s sale or exchange.

- Publication 544, Sales and Other Dispositions of Assets (PDF 321K)

- Form 1040, U.S. Individual Income Tax Return (PDF 136K)

- Publication 505, Tax Withholding and Estimated Tax (PDF 367K)

- Publication 550, Investment Income and Expenses (PDF 516K)

- Publication 17, Your Federal Income Tax (PDF 2075K)

- Publication 564, 551 - Mutual Fund Distributions (PDF 178K)

- Publication 547, Casualties, Disasters, and Thefts (PDF 133K)

- Publication 527, Residential Rental Property (Including Rental of Vacation Homes)

- Schedule B (Form 1040), Interest and Ordinary Dividends General Information

Details… of MAGI

#Household.income means Code of FEDERAL Regulations – IRS Income Taxes – 1.36B 1 – (e) …(1) … the sum of—

(i) A taxpayer’s modified adjusted gross income; (Line 37 Line 11 1040) plus

(ii) The aggregate modified adjusted gross income of all other individuals who—

(A) Are included in the taxpayer’s family under paragraph (d) [below] of this section; and

(B) Are required to file a return of tax imposed by section 1 for the taxable year (determined without regard to the exception under section (1)(g)(7) to the requirement to file a return). [26 USC §6012 ♦ IRS tool to see if you must file a return ♦ Medi-Cal Household Size Flow Chart ♦ Blog – Insure Me Kevin.com] DHCS *

(f) Dependent has the same meaning as in section §152. * IRS Interactive Assistant *

(d) … A taxpayer’s family means the individuals for whom a taxpayer properly claims a deduction for a personal exemption under section 151 for the taxable year.

Family size [Medi-Cal Household Size Flow Chart ♦ Blog – Insure Me Kevin.com] means the number of individuals in the family. Family and family size may include individuals who are not subject to or are exempt from the penalty [mandate] under §5000 A (f) (1) for failing to maintain minimum essential coverage. Health Care.gov explanation *

26 USC § 151 – Allowance of deductions for personal exemptions pdf

(a) Allowance of deductions

In the case of an individual, the exemptions provided by this section shall be allowed as deductions in computing taxable income.

To be more clear — (2) Married taxpayers must file joint return. A taxpayer who is married (within the meaning of section 7703) at the close of the taxable year is an applicable taxpayer only if the taxpayer and the taxpayer’s spouse file a joint return for the taxable year. GPO.Gov Final Regulations Page 11 * Turbo Tax Calculator * Tax Policy Center….. Joint or separate? * Estranged Spouse?

Premium Tax Credit Form 8962 & Instructions

Get a Free No Obligation Calculation of your Tax Credit, Premiums and see the benefit brochures.

View other pages & resources in this section…

- Getting MAGI Right – 23 page primer by George Town University on differences that apply to Medicaid (Medi-Cal) and CHIP Children’s Health Insurance Program Insure Kids now CA

- Power Point presentation CMS Income Counting MAGI

- InsureMeKevin.com analysis

- See also this article on Kevin’s site

- If you would like to talk to a professional tax adviser about this try Bruce Bialosky [email protected] 310.273.8250

- Agent Training – MAGI and APTC PowerPoint Presentation

#Report changes as they happen - within 30 days! 10 CCR California Code of Regulations § 6496

10 days for Medi Cal 22 CCR § 50185

Our webpage on ARPA & Unemployment Benefits - Silver 94

IRS Form 5152 - Report Changes

- Our VIDEO on how to report changes to Covered CA

- Lost your job? How to keep your Health Insurance. Shelter at Home VIDEO

- References & Links

- Here's instructions, job aid, reporting change in income

- Our webpage on the exact definition of MAGI Income

- If you've appointed us - instructions - as your broker, no extra charge, we can do it for you.

- Voter Registration

- Denial of benefits and possible criminal charges if you don't report changes in income!

- When Increasing Your Covered California Income Estimate Creates an Ethical Dilemma Insure Me Kevin.com

- Fudging Income?

- Western Poverty Law on reporting changes

- How to cancel coverage.

- agents and brokers who suspect or know a fraudulent application for insurance has been submitted to report the potential fraud to the California Department of Insurance Fraud Division. Read more >>> Wshblaw.com

- Visit our webpage on how to report changes

“MAGI Income – FAQ’s

- Question Will not filing a tax return affect my Medi Cal application for claiming my daughter as a dependent.

- Question If one no longer has his job and expects his income for this year to be low (pursuing a new self-employment business) and thus qualify for Medi-Cal, how can one prove this in applying in order to be accepted for Medi-Cal. (The tax returns would show too much income from the previous year in order to qualify.)

- Answer

- See our webpage on Estimating MAGI Income and accepted proofs of income

- Question I have a part time job and earn less than $2k/month, do I still qualify for Medi-Cal? I have over $3k in assets, is that relevant to getting Medi-Cal?

- Question If you earn more than Medi Cal Limits 138% of income, do you have to repay the premiums that Medi Cal paid to the HMO, if you didn’t tell Medi Cal that you were earning more?

- Answer ***Usually no. Learn More @ Insure Me Kevin.com

- Question Can I get Medi-Cal if I get unemployment?

- Answer ***Depends on your estimated MAGI Income. Qualifying for MAGI Medi-Cal a function of the number of people in your family – your tax return and your expected MAGI income for the upcoming – current tax year.

- Please use our complementary subsidy, premium and benefits calculator and then we can help you better. Medi-Cal has year around enrollment.

- Please review the special enrollment qualifications.

- Questions I’m on Medi-Cal as I have no income. I just turned 65.

- Do I have to apply for Medicare A Hospital? Part B Doctor Visits?

- I can’t afford the Part B premium.

- Answer ***How to get help with Part B Costs Publication # 10126

- If you’ve worked and paid into Social Security for 10 years, Part A Hospital shouldn’t be any charge. Here’s the link to Enroll in Medicare

- Once you get Medicare A & B we can set you up with a Medicare Advantage Plan with Blue Shield, AARP or Blue Cross. Most of these plans have ZERO premium and all include Part D Rx. See Western Poverty Law Page 2.36 for more details

- Question I got a new job in April. My company will be offering me health benefits starting in June. But job is not certain, they might let me go anytime.

- What do you recommend regarding Medi-Cal? can i continue with Medi cal?

- if i cancel medi cal do you think if i loose my job i will be again eligible for the medi cal?

- Answer ***Glad to hear you got a new job with benefits. Medi-Cal and Covered CA require that you report changes within 10 – 30 days.

- Do you have a Medi Cal ONLINE account? If your income is below 138% of poverty level, I guess you could have both Medi Cal and your Group Coverage. Here’sinformation on dual coverage. Yes, you can continue with Medi Cal depending on your income. If you lose your job, report that to Medi-Cal. BTW, I don’t get paid to help the public with Medi-Cal. Here’s Medi Cal’s contact page.

- Question If the Company you worked at got bought out by another company, and your status changes from contractor to full time employee, are you still eligible for Medical [Medi-Cal] if you can’t afford the premiums or out of pocket [deductibles, co-pays] insurance plans they offer, based on your annual [MAGI} income?

- My position is outside sales, with a home office, now I am having even more expenses than before, due to the new company’s contract. I can not afford what they offer in regards to healthcare coverage.

- Answer ***If you qualify for Medi-Cal is based on your MAGI income being above or below 138% of Federal Poverty Level FPL. If your income is between 138 and 400% of FPL, you can probably get Covered CA subsidies to help pay your premium.

- Use our complementary instant quote engine to find out.

- Your statement about affordability of health insurance premiums for your employers plan has to do with getting Covered CA subsidies, not Medi-Cal. Basically, it depends on if the premiums are more or less than 9.66% of income. We deal with the affordability issue for Covered CA subsidies on this page.

- ***FYI Kentucky Gets exemptions so that they can require Medicaid recipients to work La times

- Question I am 70 years of age and have been on medi cal due to low income. I recently applied for my ex husbands social security and my income increased to $1379.10. Can I still qualify for medi cal?

- Answer ***See our Medi-Cal Qualification for Seniors – Aged & Disabled.

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

https://steveshorr.com/steveshorr/individual_and_family/HSA/Tax%20Guide%20for%202024.pdf

Itemize costs? A $13,850 question for tax filers

https://edition.pagesuite.com/popovers/dynamic_article_popover.aspx?guid=cea44ef5-b85b-4f2d-9c8e-a967677fd10e&v=sdk

Is MAGI Adjusted Gross Income before or after taxes?

Is it net or gross income?

Please see above, it’s line 8b, + Social Security, Foreign Income & Tax Exempt Interest. = Modified Adjusted GROSS Income

The lines below 8b don’t count!

We have a ton of $$$ in various bank account savings — does this count against us for Medi-Cal or Covered California coverage?

There is NO ASSET TEST for MAGI based subsidies in Covered CA or MAGI Medi Cal Qualification.

See the VIDEO we just produced for more details and possible solutions.

I applied for Covered CA and it asks for the adjusted gross income also it asks for

itemized deductions

Is it true that these are itemized deductions that I can enter onto the Covered CA application?

How about appointing us as your Covered CA broker, being as here is where you come for reliable answers with a citation? No extra charge!

The only thing that matters is line 11 of the 1040 form Unless you have Tax Exempt Interest, Social Security or foreign income.

I do grant that Covered CA has an entire JOB aid on filling out all the “stupid” Questions. But what matters is, the #’s you have when you file taxes at the end of the year on form 8962! Then you get more subsidies or have to GIVE back if you got too much.

Insure Me Kevin.com on crazy convoluted method to get estimated MAGI Income

IMHO use an official tax estimator and just put in your MAGI Income, see above and don’t get caught in the trap of filling out everything with Covered CA. You could easily make a mistake and wind up in Medi Cal.

Don’t forget the mandate to report changes of income within 30 days.

Please note too, that Covered CA nor I are permitted to give you tax advice! Covered CA recommends VITA

This is a comment from a “culled” webpage.

What happens if I overstated my income.

I’m self employed and my month to month income is not consistent.

I’ve been covered with a PPO using APTC Advance Premium Tax Credit – subsidy for 2014-16.

The first two years I made less than $5K and in 2016 I had no income at all. I’ve been borrowing to pay premiums.

Each year I’ve “projected” approx $18K income partially to prevent falling into the Medi-Cal zone and I also naturally expected to do much better financially.

CoveredCA has extended my coverage but they need to see evidence by March when checking with the IRS that all years have been filed. I’m just now filing my returns.

Will I be able to keep my PPO the APTC for this year (2017) and how will the IRS and CoveredCA interpret all this?

One might argue that you’ve committed tax fraud & perjury.

You might also have to pay back the subsidies! See our page on Form 8962 about reconciling the APTC.

Our page on what if your income drops to Medi-Cal level and do you have to pay back subsidies. Note the requirement to report income changes within 30 days. Citation on duty to report from Western Poverty

I doubt that you can keep your subsidies.

I retired from my company on Jan 1, 2020. I have received a severance pay which will end shortly.

I also enrolled in [Federal] COBRA until June, 2021.

I plan to enroll in ACA after COBRA ends.

Starting November of this year, I will have very low income.

MAGI uses the tax return from previous year (2020) which is way over 600% of Federal Poverty Level $76k for a single

https://individuals.healthreformquotes.com/covered-ca-tax-credits-subsidies-aptc/magi/income-chart/ but does not reflect next year income which is very low.

How do I modify MAGI form to reflect actual 2021 income?

First off, MAGI is NOT and never was based on last years income!!!

See above, MAGI is what you estimate your income to be at the end of the year when you file taxes.

Asking for last years taxes or other documents is just to verify what you are saying. It’s hocus pocus!

If you get too much in subsidies or too little, the IRS either makes you give back the subsidies or gives you additional credit when you file your taxes, including form 8962 https://individuals.healthreformquotes.com/covered-ca-tax-credits-subsidies-aptc/intro/premium-tax-credit-8962/

Right in the Covered CA ONLINE Application, it says “Projected Income.”

Jump to the rest of the Covered CA questions on estimating your projected MAGI income for the upcoming or remainder of the year

https://individuals.healthreformquotes.com/covered-ca-tax-credits-subsidies-aptc/magi/#comment-102936

See FAQ about being unemployed & looking for a job

When you do apply, how about appointing us as your broker, no extra charge. That way we get compensated for helping you.

I retired from my company which was not located in CA nor did I live in CA so I don’t think I can get Cal COBRA

Other States might have an extension to COBRA like CA does for Cal COBRA but I’m not familiar with that.

Here’s a chart from an “non-official” website

insure.com

hr knowledge.com

As far as switching to ACA immediately, I am concerned that Supreme Court invalidate the ACA and I end up with no coverage.

At least with COBRA, I have another 8 months to come up with alternative to ACA.

We are following the Supreme Court case – Texas vs USA

Here’s our webpage on Pre-Existing Conditions

Here’s another agent’s thoughts on what might happen in CA if the Court rules ACA/Obamacare unconstitutional.

our Cal COBRA webpage

People were concerned the ACA would end immediately when Trump took office.

I did go to Washington DC as a tourist in January 2017….

Check this out – Picture with President Trump

Here’s a picture with my Congresswoman

Justice Scalia who taught be the word Jiggery Pokery

My son and I in front of the White House

I’m not sure about the rest of the Country, but CA Open Enrollment lasts till January 31st. https://individuals.healthreformquotes.com/aca/enrollment/

Nationally, Health Care.gov says deadline is December 15th https://www.healthcare.gov/quick-guide/dates-and-deadlines/

It’s my understanding the Supreme Court will hear the case on November 10th. So, we’ll watch and see what happens. ACA has gone through SEVERAL challenges!

Cost Sharing Reductions… Covered CA simply raised the Silver Level rates and one barely notices any change

https://individuals.healthreformquotes.com/aca/metal-levels/enhanced-silver-cost-sharing-reductions/%c2%a7156-410-cost-sharing-reductions-enhanced-silver/constitutional-extra-costs/

Subsidies in Health Care . Gov Upheld King v Burwell

https://individuals.healthreformquotes.com/covered-ca-tax-credits-subsidies-aptc/intro/calculation/36-b-tax-credit-calculation-technical-stuff/subsidies-upheld/

Health Mandate Penalty Upheld as a tax NFIP vs Sebelius

https://individuals.healthreformquotes.com/aca/heath-reform-upheld-tax/

I didn’t know I signed up as a Constitutional Lawyer to do Covered CA at minimum wage and Medi Cal for free. Keeping track of these cases has been interesting.

Watch our webpage on Texas vs USA…

Health Care Reform changed WAY MORE than just giving guaranteed issue and subsidies in Covered CA or Health Care . Gov

CA passed AB 1083 to make Employer Plans up to 100 lives conform to ACA

I lost my job due to COVID 19, I reported that to Covered CA and I was transferred to Medi-Cal.

I don’t really want to be on Medi-Cal.

I have a new job starting in June.

What about the $600/week from the Feds? Does that count as Income for Covered CA? Medi-Cal? I reported the $600 but I heard from Covered CA that that income doesn’t count toward MAGI.

How much $$$ does one need to earn, to qualify for Covered CA rather than Medi-Cal?

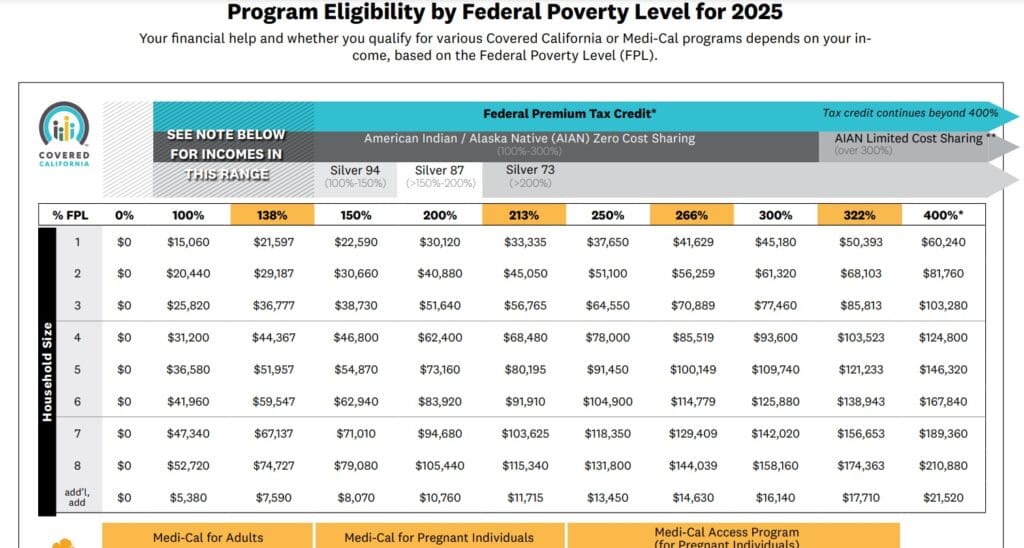

Here’s the income chart for Medi-Cal vs Covered CA and Enhanced Silver Levels

So, for a single, as of March 2020 it would be around $18k. Please use an accurate estimate and be sure to update any changes within 30 days. 10 days for Medi Cal.

Here’s guidance that is quite confusing about getting back into Covered CA if you reported the incorrect income.

We have a VERY confusing situation here on the $600/week PUC Pandemic Unemployment Compensation!

4. Will the extra $600 per week Pandemic Unemployment Compensation (PUC) payments be considered countable income for purposes of determining eligibility for financial help and premium assistance available through Covered California?

Yes, all unemployment benefits (including the extra $600 per week PUC payment) are included in the recipient’s income for purposes of eligibility for financial help available through Covered California (APTC, CSR, and state subsidy).

5. Will the extra $600 per week Pandemic Unemployment Compensation (PUC) payments be considered countable income for purposes of determining Medi-Cal and CHIP eligibility?

No, the extra weekly $600 PUC payments are not included in the recipient’s income for purposes of eligibility determination for Medi-Cal and CHIP (C-CHIP and MCAP). However, traditional ununemployment benefits are still considered income for Medi-Cal and CHIP purposes. source

So, what do you expect your Annual MAGI income to be for 2020?

PUC counts for Covered CA.

How much will you be making at your new job?

How much PUC will you get?

How much did you earn on your old job?

Please let us enter the numbers for you, AFTER you provide them in WRITING!

Covered CA’s income, expense & deduction questions are very confusing!

My divorce agreement provides that my X Spouse must provide lifetime housing in one of her rental units or bedroom.

More specifically – My ex-wife is providing me one room for my living space which values around $450 per month.

She also allows me to use her car.

Does that count as alimony even though it’s non cash?

Does that count as MAGI income for Covered CA subsidies?

See our webpage on Alimony

Does it show on line 11 of your 1040 Adjusted Gross Income?

Hi,

My mom has been told that she is no longer eligible for Medi-Cal because of her Alimony. She’s been on Medi-Cal for close to 3 years with this alimony and is just now being told that she doesn’t qualify.

My mom is self employed and reported a loss of $6000 on her federal taxes as part of her schedule C. Her alimony is $20,0000 annually. Her AGI based on line 37 is around $14,000. She has been repeatedly told that her loss of $6000 and the fact that her AGI based on line 37 of her 1040 is under the income limit for Medi-Cal do not matter, and that her alimony is higher than the income limit and that is all that matters.

Based on everything that I’ve found online, including what is on your website, it seems like she should be eligible for Medi-Cal. She has been told on the phone and in person at the Medi-Cal office that she is not eligible and will not have Medi-Cal as of the end of August.

Is there any advice you can give us?

Thank you!

Here’s our page on Alimony.

Near as I can tell and I’m not allowed to give tax advice, if the divorce settlement was done before 12.31.2018, alimony counts as income.

But you are right, Medi Cal is based on MAGI income as defined above. Line 37 – now 7 + …

$14k qualifies one for Medi Cal see chart above

Check out our webpage on MAGI income qualification for Medi Cal.

Here’s our contact page for Medi Cal Try emailing your question and my research to this address [email protected]

B. Counting Income

MAGI Medi-Cal and MCAP use largely the same MAGI methodology that is used by Covered California for counting income. Taxable income, Social Security benefits, tax-exempt interest and foreign earned income are all included.

2. Income Threshold for Financial Assistance

Most adults with household incomes up to 138% FPL in California are eligible for Medi-Cal (for children, the income standard is set at 266% FPL), and as described above, eligibility for Medi-Cal precludes eligibility for Covered California. In the vast majority of cases, an individual must have household income above 138% FPL to qualify for premium tax credits – and most children must be in families with incomes above 266% FPL in order to obtain premium tax credits. Western Poverty Law *

What is your Mother’s expected income for 2019? 2020? When income gets too high, then you can get subsidized coverage with Covered CA. Get quotes here. No charge to have us as your broker.

the IRS does often rely on what is known as the “3-of-5 test.” This means that a successful small business should typically earn a profit three of every five years. If you have attempted to turn your hobby into a profitable business for seven years with no success, it may become difficult to claim profit as your true motivation. biz fluent.com

Our webpage on hobby or business

when calculating MAGI when the client has W2 wages plus a Schedule F Farming —

please tell me how the MAGI would be figured when applying for health insurance.

The bottom line is, what do you expect the MAGI income to be when you file the current years or the next years taxes? What do you expect on Line 7?

W 2 Wage income counts, so does net profit from Farming. It’s countable income. If things change, just comply with the law and notify Covered CA or the Exchange within 30 days.

Do you expect the farming income to be income or a loss?

Schedule 1 see line 18

1040 Instructions

Farming & Fishing Income

We are having technical difficulties with replies being indented.

Here’s the question, I’m answering:

Anonymous Asks:

I called Covered CA and told them my income was the following:

To date Jan thru Feb 25, 2018 for Bxx Hxxx I have received 4 paychecks. YTD gross for them is $3838.00.

Txxx On Rxxx less than $500.00 this year.

Just started with CxxC on Feb 26, 2018 and so far received a check for approximately $274.02 from them.

My premium just took a drastic jump, Why?

*************************************************************

Our Reply

First of all, while Covered CA did add all the entry pages for ones income and deductions, IMHO (In my Humble Opinion) it’s best to just figure out what you are going to have as MAGI income at the end of the year on your tax return. It’s basically line 37. Scroll to the top of this page for more detail.

If you are going to fill out the entire form, then again IMHO it’s best to log into your Covered CA account and complete the form yourself. Here’s our webpage on how to update, change your income.

I do not recommend just calling and having someone else enter information for you. This is also why, we prefer that you email us rather than call. This is how someone whose income went from $15/hour to $15.20/hour gets hit with $40k in income, when it should be closer to $25k, being as she’s a teacher and doesn’t work summers.

Here’s our free quote engine to figure your subsidy based on the income you project for the current year. The PAST is not relevant, unless your projected income is in question and Covered CA wants some kind of proof.

Excerpt of Covered CA Income Entry Page

i am head of household (IRS and CA FTB – CA Taxes) for my daughter and grandson who are both adults and grandaughter who is 2 yo.

The three live full time with me, they have no income, and are all on medi-cal (no special circumstances).

my AGI in 2016 will be approximately $78,000.

can i claim them as dependents for tax purposes and still keep them on medi-cal?

I don’t think so. According to the income chart, you are at 322% of FPL-Federal Poverty Level. This is too high, even for the granddaughter to qualify as a child under 18 at 266% or less of FPL.

Please get a complementary quote here and with subsidies your premium might be very low.

The adult children might consider applying direct to Medi-Cal and seeing if they qualify.

I don’t get paid to help you with Medi-Cal so contact your local office. See Western Poverty Law Center 375 page booklet for more details, namely page 45 – 2.32

thank you Steve.

unfortunately our experience with medi-Cal over the last 2 years has been more than frustrating–no one knows anything but they think maybe they do!

with that history of innumerable dead-end contacts, we are reluctant to call for reliable info.

The most reliable information that I’ve found is the 375 page booklet from Western Poverty Law Center. See links above.

I still cringe when I reflect back when my local Congresswoman put on a introduction to ACA around September 2013 and when her speakers gave WRONG information about the current system, information for which I could lose my license, if I said it, her aides told me I was never allowed to interupt a well – respected member of congress.

See our contact page, I do have some email addresses there.

What are the ages of everyone in the household? What county are you in? How did they get Medi-Cal in the first place? I wouldn’t expect anyone to know the answer to your question over the phone. When you look at the Western Poverty Law Center booklet, do you expect a telephone employee in India to understand the tax code? Here’s a flow chart for calculating household size, this might be simpler.

Don’t you think it’s a shame, that Medi-Cal won’t pay agents to help you enroll?

Read everything VERY carefully, it looks like the adults over 21 could still qualify for Medi-Cal.

When does your redetermination come up?

Really Listen Article

1. Yes, it’s line 11 of your 1040. See our page on spousal support for more detail

2. No. See our Gift page for more detail

3. It’s what you expect that your 2016 1040 return will show for line 37 AGI Adjusted Gross Income, then add in, Social Security Line 20…, Foreign Income and Exempt Interest line 8b. Review this page…

Get free quote, subsidy calculation, Enhanced Silver Level here, once you have your estimated MAGI Income. You can easily change the income amount and see if you get Medi-Cal, Enhance Silver, etc. There is no extra charge for our help. We get paid, when you appoint us as your agent.

On Covered CA MAGI I do long form taxes, [1040]

can I deduct car registrations,

home property taxes,

amortization from rental and expenses on rental to lower my MAGI – AGI income.

MAGI income is defined at the top of this page.

See our webpage on Rental Income,

We are happy to be your agent for Covered CA and there is no additional charge. Here’s the Instructions to appoint us.

Here’s how adjusted gross income affects taxes

• AGI is your income from all sources minus any Schedule 1 adjustments or deductions to your income.

I am currently receiving Medi-Cal and have had an increase in wages which has brought me above the 138% of Federal Poverty Level in annual income and I no longer qualify for Medi Cal.

Will the increase in wages be considered a qualifying event?

If I were to have you assist me would that remove the DHCS caseworker from determining approval or speed up the process?

Please see the income chart above and report the increase in earnings to Medi Cal.

Please get a complementary quote and subsidy calculation here so we can double check.

Yes, an increase in income is a qualifying event CFR 156.425

I would suggest that you get the complementary quote above, send us the proofs that you expect your MAGI Income line 37* on your tax return to be over 138% of FPL then we can either start your Covered CA account or appoint us and we should be able to get you going. If not, we need to wait till Medi Cal kicks you out for making too much $$$

I am moving and am using special enrollment to change my healthcare coverage. According to the rules, if I apply before the 15th of a month, coverage begins on the 1st of the following month. If I apply after the 15th, then coverage begins on the 1st of the second month after I apply. Thus coverage can start up to a maximum of 45 days or so after I apply.

In applying, I was declared as conditionally eligible” due to them requiring that I “verify income” by 90 days after my application date.

My question is:

Will I be uninsured for the period after my coverage is suppose to start up until the day the approve my attempt to verify income? This could be a 45 day period in which I need medical care. Or will I be covered for those 45 days and if they reject my verification of income – then will they drop me from my new plan?

Thanks for all the help on your website!

You will be covered when the coverage says it will start, given the 15th of the month rule… 155.420 (d) (b)

If you don’t verify income, then you might get a cancellation notice, as the sample notice says on page 2. If you do get cancelled the policy EOC Evidence of Coverage requires at least 30 days notice. It’s a CA law too, let me know if you need that citation.

If you’re income is below 138% of Federal Poverty Level – Free Quote, FPL & Subsidy calculator, then you can get Medi-Cal, which has year around enrollment. If your income at the end of the year is too low or too high for subsidies (chart) you might have to pay them back when you do your taxes.

The rule about when coverage starts and if you apply before or after the 15th has nothing to do with subsidies or verifying income. That period is there partly because a lot of people have other coverage, like COBRA or their prior individual plan to carry them through the end of the month. Take a look at our Temporary Plan Page

Instructions on how to appoint us as your Covered CA Certified Agent – No Extra Charge. We only get compensated when you appoint us.

I’m enrolled in anthem blue cross via California Covered Care.

I get letters that contradict each other routinely. One letter says I’m covered , the other says I’m not.

I’ve spent hours on phone with California covered care with people who have questionable English literacy.

I need a professional to deal with California Covered as they are too disorganized for a non insurance specialist to deal with all their idiosyncratic behavior.

Can you help me ?

Yes, we would be glad to help you. Two things that you need to do to transfer your case to us.

1. Change your Covered CA agent delegation to use. Here are the instructions. If you have trouble, just send us your user name and password and we can do it.

2. Email us for the Blue Cross Change of Broker Form Blue Cross though has tricky rules and if you are a “house account” they might not pay us.

Once we have access to your Covered CA account, we can view all the letters they send you. If Blue Cross won’t recognize us as your agent, then:

3. Get an ONLINE Member Account and give us the user name and password for that.

Then we should be fully able to help you. If you were to get additional coverage, like Life Insurance, Long Term Care or Disability that would be a way to compensate us for our time, if you are a “House Account” or you had coverage with Blue Cross prior to 1.2014.

Steve

Can I keep MAGI Medi Cal after turning 65?

Check our webpage on Medi Cal Aged & Disabled