Padding Income or Deductions?

Covered CA Subsidies

What happens if you knowingly put down the wrong income information?

Here’s some research below, about what might happen if you use the wrong income to obtain subsidies or special enrollment.

One may correct their MAGI Income Line 37 + by reading the instructions and then logging into their Covered CA Account or appoint us to do it.

We are NOT tax accountants. Please check with your own CPA, Attorney, IRS or tax adviser. Here’s a memo we just got Sept. 2018, prohibiting us from giving ANY tax advice or guidance and suggestions of where you can get guidance. I do NOT want to hear that you are self-employed and can put in ANY number you want. Please ask a professional to help you with the number you want to put in the application, under penalty of perjury….

Resources & Links

- Fraud in Federal & Covered CA Market Places CNBC 9.12.2016 *

- Covered CA Application (see what you are declaring under Oath)

- tax-whistle blower.com *

- Our webpage on Fraud, Waste & Abuse

- agents and brokers who suspect or know a fraudulent application for insurance has been submitted to report the potential fraud to the California Department of Insurance Fraud Division. Read more >>> Wshblaw.com

- Tools to estimate income

Don’t Fake Income

- Some people falsely increase the income they report to the IRS. This scam involves inflating or including income on a tax return that was never earned, either as wages or as self-employment income, usually in order to maximize refundable credits.

- Just like falsely claiming an expense or deduction you did not pay, claiming income you did not earn in order to secure larger refundable credits such as the Earned Income Tax Credit [or Covered CA Subsidies] could have serious repercussions.

- See tax form 8962 subsidy reconciliation – Premium tax credit

- This could result in taxpayers facing a large bill to repay the erroneous refunds, including interest and penalties. In some cases, they may even face criminal prosecution. Taxpayers may encounter unscrupulous return preparers, Covered CA agents, navigators or Covered CA telephone reps who make them aware of this scam.

- Remember: Taxpayers are legally responsible for what’s on their tax return even if it is prepared by someone else. Make sure the preparer you hire is ethical and up to the task. IRS.Gov

Falsely Padding Deductions on Returns

Avoid the temptation of falsely inflating deductions or expenses on their returns to under pay what they owe and possibly receive larger refunds. Falsely claiming deductions, expenses or credits on tax returns is on the “Dirty Dozen” tax scams list. Taxpayers should think twice before overstating deductions such as charitable contributions, padding their claimed business expenses or including credits that they are not entitled to receive – like the Earned Income Tax Credit, Covered CA Subsidies or Child Tax Credit.

The IRS can normally audit returns filed within the last three years. Additional years can be added if substantial errors are identified or fraud is suspected. Significant civil penalties may apply for taxpayers who file incorrect tax returns including:

- 20 percent of the disallowed amount for filing an erroneous claim for a refund or credit.

- $5,000 if the IRS determines a taxpayer has filed a “frivolous tax return.” A frivolous tax return is one that does not include enough information to figure the correct tax or that contains information clearly showing that the tax reported is substantially incorrect.

- In addition to the full amount of tax owed, a taxpayer could be assessed a penalty of 75 percent of the amount owed if the underpayment on the return resulted from tax fraud.

Taxpayers even may be subject to criminal prosecution (brought to trial) for actions such as:

- Tax evasion

- Willful failure to file a return, supply information, or pay any tax due

- Fraud and false statements

- Preparing and filing a fraudulent return, or

- Identity theft.

Criminal prosecution could lead to additional penalties and even prison time. Using tax software is one of the best ways for taxpayers to ensure they file an accurate return and claim only the tax benefits they’re eligible to receive.

IRS Free File is an option for taxpayers to use online software programs to prepare and e-file their tax returns for free.

Community-based volunteers at locations around the country also provide free face-to-face tax assistance to qualifying taxpayers helping make sure they file their taxes correctly, claiming only the credits and deductions for which they’re entitled by law.

Taxpayers should remember that they are legally responsible for what is on their tax return even if it is prepared by someone else, so they should be wise when selecting a tax professional. The IRS offers important tips for choosing a tax preparer at IRS.gov.

More information about IRS audits, the balance due collection process and possible civil and criminal penalties for noncompliance is available at the IRS.gov website.

Sheriff’s deputies charged with perjury after stopping cops for speeding, then citing for only not having proof of Insurance LA Times 12.14.2019 *

Try turning your phone sideways to see the graphs & pdf's?

#Report changes as they happen - within 30 days! 10 CCR California Code of Regulations § 6496

10 days for Medi Cal 22 CCR § 50185

Our webpage on ARPA & Unemployment Benefits - Silver 94

IRS Form 5152 - Report Changes

- Our VIDEO on how to report changes to Covered CA

- Lost your job? How to keep your Health Insurance. Shelter at Home VIDEO

- References & Links

- Here's instructions, job aid, reporting change in income

- Our webpage on the exact definition of MAGI Income

- If you've appointed us - instructions - as your broker, no extra charge, we can do it for you.

- Voter Registration

- Denial of benefits and possible criminal charges if you don't report changes in income!

- When Increasing Your Covered California Income Estimate Creates an Ethical Dilemma Insure Me Kevin.com

- Fudging Income?

- Western Poverty Law on reporting changes

- How to cancel coverage.

- agents and brokers who suspect or know a fraudulent application for insurance has been submitted to report the potential fraud to the California Department of Insurance Fraud Division. Read more >>> Wshblaw.com

- Visit our webpage on how to report changes

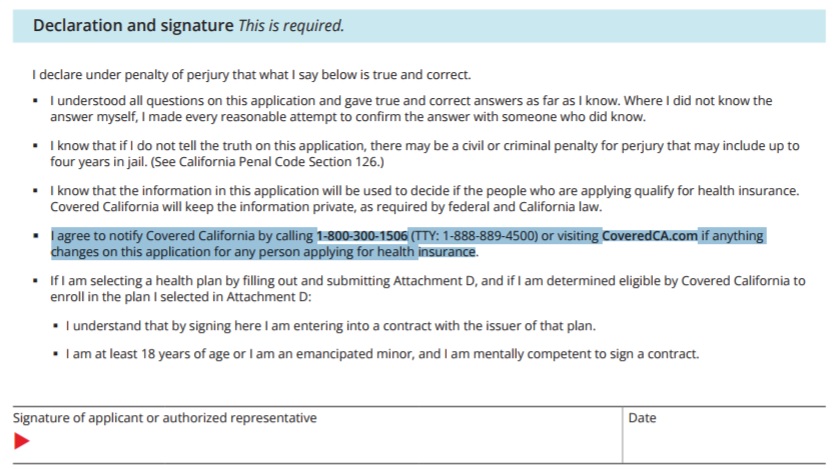

Fraud and #false statements

Any Person who…

(1) Declaration under penalties of perjury – Willfully makes and subscribes any return, statement, or other document, which contains or is verified by a written declaration that is made under the penalties of perjury, and which he does not believe to be true and correct as to every material matter; shall be guilty of a felony and, upon conviction thereof;

- Shall be imprisoned not more than 3 years

- Or fined not more than $250,000 for individuals ($500,000 for corporations)

- Or both, together with cost of prosecution Title 26 USC § 7206(1) *

(2) Aid or assistance – Willfully aids or assists in, or procures, counsels, or advises the preparation or presentation under, or in connection with any matter arising under, the Internal Revenue laws, of a return, affidavit, claim, or other document, which is fraudulent or is false as to any material matter, whether or not such falsity or fraud is with the knowledge or consent of the person authorized or required to present such return, affidavit, claim, or document; shall be guilty of a felony and, upon conviction thereof:

- Shall be imprisoned not more than 3 years

- Or fined not more than $250,000 for individuals ($500,000 for corporations)

- Or both, together with cost of prosecution Title 26 USC § 7206(2) *

- IRS Form1040 Instructions

- See below on perjury

- Get Instant Quotes for Health Insurance

Conspiracy to commit offense or to defraud the United States

If two or more persons conspire either to commit any offense against the United States, or to defraud the United States, or any agency thereof in any manner or for any purpose, and one or more of such persons do any act to effect the object of the conspiracy, each:

- Shall be imprisoned not more than 5 years

- Or fined not more than $250,000 for individuals ($500,000 for corporations)

- Or both Title 18 USC § 371 *

IRS Volunteer Income Tax #Assistance (VITA ) program offers free tax help

Covered CA prohibits agents giving tax advice

IRS Volunteer Income Tax Assistance (VITA)

The IRS Volunteer Income Tax Assistance (VITA) program offers free tax help & Covered CA Subsidy compliance to individuals who generally make $54,000 or less, persons with disabilities, the elderly and individuals with limited English proficiency who need assistance in preparing their taxes.

The Tax Counseling for the Elderly (TCE) program offers free tax help for all taxpayers, particularly those who are 60 and older. The IRS certified VITA and TCE volunteers are trained to help with many tax questions, including credits such

- Child and Dependent Care Credit. publication 503

- ACA/Obamacare Subsidies

- How to file taxes and get your refund for free

Warning we just got from Covered CA

Per law and regulation, agents cannot initiate conversations regarding whether or not the consumer is a non-tax filer.

Do not provide any tax filing advice under any circumstance or answer any tax filing questions – refer them to the consumer service center at 1-800-300-1506 with the Primary Tax Filer (or their Authorized Representative) on the line. 9.14.2018 Agent Bulletin *

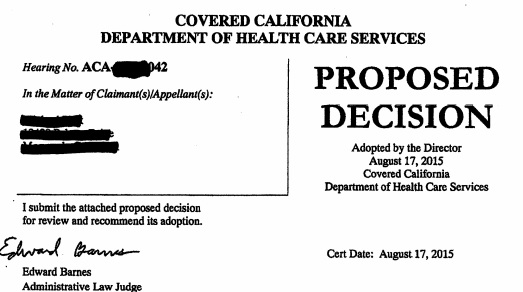

Check out where administrative law judge said he wished he could make Covered CA pay the costs of their bogus advise but didn’t have that authority click to scroll down – view more commentary in our FAQ on Form # 8962 Polk Case.

We are willing though to do research and show you what the law, rule, IRS Publication is. That way IMHO we don’t give advise and aren’t practicing law or accounting.

What happens if you actually call the Covered CA Consumer Center and ask a tax question?

FAQ’s

Covered California Representatives are not permitted to offer tax advice. If an Agent or Consumer have any tax inquires, they are advised to contact their tax professional regarding Federal tax regulations or requirements.

However, the Covered California Website [and ours] has 12 pages of what is MAGI countable income:

And Healthcare.gov – can also be used as a resource for countable income:

You can find examples on the following:

- Question: Is Alimony taxable and considered income?

- Answer: Divorces and separations finalized before January 1, 2019: Include as income. Divorces and separations finalized on or after January 1, 2019: Don’t include as income.

- Question: I have a 25 year old son that lives at home. Should I claim him as a dependent and put him on my Covered California Application?

- Answer: You would need to refer to a tax specialist if you need to claim him as a dependent. Anyone that is claimed as a tax dependent, needs to be listed on the Covered California Application whether they want coverage or not. Email dated Thu 12/30/2021 5:00 PM *

#VITA Volunteers Income Tax Assistance

get your taxes done Free

- Publication 3676 with more details on VITA

- Our Webpage on VITA & Covered CA prohibition to give tax advice

- More places to find FREE tax help Covered CA list

- Turbo Tax -

- See more tax calculation links in the section on IRS Publication 974 Premium Tax Credit

**********************************

Covered CA Appeals Decision #Polk Case

- Sample Letter for Appeal

- Explanation on Insure Me Kevin . com - Polk Case

- Check out where administrative law judge said he wished he could make Covered CA pay the costs of their bogus advise but didn't have that authority

- Doesn't matter what Covered CA says, it's what the IRS says Form 8962 attaches to Form 1040

Perjury

What is #Perjury?

Perjury is Breaking an oath to tell the truth, the whole truth, and nothing but the truth is perjury. Wikipedia

Telling the truth is good for your health

- Penal Code §118. (a)& 125 provides that:

- a) Every person who, having taken an oath that he or she will testify…before any competent tribunal…willfully and contrary to the oath, states as true any material matter which he or she knows to be false…is guilty of perjury.

- Under California law, falsity element of the crime of perjury requires that a statement be literally false; misleading and nonresponsive testimony that is literally true cannot support a perjury conviction. Chein v. Shumsky,* West’s Ann.Cal.Penal Code § 118 California Criminal Jury Instruction Perjury 2640 * shouselaw.com

- An unqualified statement of that which one does not know to be true is equivalent to a statement of that which one knows to be false.

- In order to lawfully hold a person to answer on the charge of perjury under [California Penal Code] section 118, evidence must exist of a “willful statement, under oath, of any material matter which the witness knows to be false.” Cabe v. Superior Court, (1998) 63 Cal.App.4th 732

- in order for there to be a lawsuit in the first place, somebody involved somewhere along the line is not telling the whole truth. power of attorney.com

- the crime of perjury depends not only upon the clarity of the questioning itself, but also upon the knowledge and reasonable understanding of the testifier as to what is meant by the questioning, we hold that a defendant may be found guilty of perjury if a jury could find beyond a reasonable doubt from the evidence presented that the defendant knew what the question meant and gave knowingly untruthful and materially misleading answers in response. USA v. Dezarn

- Chief Justice Burger emphasized that the perjury statute refers to what the witness “states,” not to what he “implies.” source Bronson v US?

- As the California Supreme Court has stated:

- W]hen ··· a witness’ answers are literally true he may not be faulted for failing to volunteer more explicit information. Although such testimony may cause a misleading impression due to the failure of counsel to ask more specific questions, the witness’ failure to volunteer testimony to avoid the misleading impression does not constitute perjury because the crucial element of falsity is not present in his testimony. Chein v. Shumsky

- a) Every person who, having taken an oath that he or she will testify…before any competent tribunal…willfully and contrary to the oath, states as true any material matter which he or she knows to be false…is guilty of perjury.

Links & Resources

- Crime Victim Restitution Form Interrogatories – CR 200

- The Free Library.com/

- No one should benefit from their own wrong.” Civil Code 3517

- Bronston_v._United_States

- Perjury under Federal Law – Overview

- See above on Fraud & False Statements

Witness Impeachment

Impeaching a witness The Art of Trial Advocacy Faculty, The Judge Advocate General’s School, U.S. Army

Probable cause exists when the officer, at the time of arrest, has knowledge of facts and circumstances which would warrant a reasonable person to believe that the defendant committed the crime. Sears v. State, 668 N.E.2d 662, 667 (Ind. 1996). The determination of probable cause is not one of mathematical precision, but rather is grounded on notions of common-sense. Illinois v. Gates, 462 U.S. 213, 235-36, 103 S.Ct. 2317, 2330-31, 76 L.Ed.2d 527, 546 (1983). The quantum of evidence necessary for probable cause is determined on a case-by-case basis. Peterson v. State, 674 N.E.2d 528, 536 (Ind. 1996), cert. denied, ___ U.S. ___, 118 S.Ct. 858, 139 L.E.2d 757 (1998). Ogle v Indiana

Perjury Declaration - Signature - Agree to notify changes

and that the application is correct in the first place

What is #Hearsay ?

Hearsay is something that you have heard from someone else. You cannot use hearsay evidence in court.

***Nor with Steve Shorr Insurance

For example, you cannot talk about a conversation between your sister and ex-partner, which happened when you were not there.

***Or what some CSR – Customer Service Representative told you over the phone or something that happened 10 years ago…

There are exceptions to this rule. Evidence about a conversation might be allowed if it is to work out the time and place of an event or why a person acted in such a way. So, you can say that a conversation took place, but not what was said.

You can also call the person who made the statement as a witness so that they can provide evidence. Legal Aid Victoria.Gov

***I’m only interested if they can cite the exact law, rule or Insurance Company bulletin where it says it!

More legalize definition

Hearsay evidence is evidence of a statement that was made other than by a witness while testifying at the hearing in question and that is offered to prove the truth of the matter stated. Evid. Code § 1200 a (The 24 exceptions in the federal rules that do not require a showing that the declarant is unavailable are listed below. Analogous provisions in California’s Evidence Code are also noted. Criminal Findlaw Hearsay

Resources

- Learned treatises used to question an expert witness. Dicarlo Law

- Findlaw.com – Hearsay & 6th Amendment

- Findlaw – Rules of Evidence

- Hearsay Graphic Flow Chart

- Free Dictionary.com

- shouse law.com/hearsay

Our feelings on the situation

We resent it when our Insurance Clients – try and tell us the wrong information that someone on the phone is alleged to have said. This caused me a ton of grief in my HOA when State Farm sent a letter that our building values were going to double. Thus, the premium would just about double. It took me and the State Farm agent a year to explain it to the Board of Directors. The Board never understood what they were being told….and were putting in the minutes, what the president said the State Farm agent said. Not the actual printed things! It took a year!

- Here’s someone who made a comment on our website and I went in and added the exact links to show that they really had the correct answer!

- money.com/social-security-advice-wrong/

- pbs.org/when-social-securitys-advisers-get-it-wrong

- fool.com/why-most-social-security-advice-is-wrong

#Slander

The common law origins of defamation lie in the torts of “slander” (harmful statement in a transient form, especially speech), each of which gives a common law right of action.

“Defamation” is the general term used internationally, and is used in this article where it is not necessary to distinguish between “slander” and “libel”. Libel and slander both require publication.[7] The fundamental distinction between libel and slander lies solely in the form in which the defamatory matter is published. If the offending material is published in some fleeting form, as by spoken words or sounds, sign language, gestures and the like, then this is slander.

Libel

Libel is defined as defamation by written or printed words, pictures, or in any form other than by spoken words or gestures.[8] The law of libel originated in the 17th century in England. With the growth of publication came the growth of libel and development of the tort of libel.[9]

Learn More ===> wikipedia.org/Defamation

Jewish Law on Proper Speech – Lashon Ha-Ra

- Introduction to LaShon Ha-Ra www.JewFaq.org

- Online Course – www.Torah.org

- Article on Gossip & Speech wiley.com/

Resources & Links

Nolo on Social Media & Defamation

Cyber Investigations – Facebook

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

Tax #Estimators

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

a workers’ comp attorney, created Adelante Interpreting Inc., a translation and interpreting company, and then fraudulently billed 20 separate insurance carriers for translation and interpreting services. was arrested this week on 20 felony counts of insurance fraud after allegedly billing 20 separate insurance companies for translation and interpreting services to collect over $310,000 in workers’ compensation fees.

allegedly failed to disclose his financial interest in the company, as required by law, and used his daughter’s name on corporate paperwork to hide his ownership of the company. Although his daughter’s name was used for the paperwork, Luna controlled all aspects of Adelante Interpreters including, but not limited to: administrative protocols, employee protocols, independent contractor protocols, as well as billing and collection protocols.

https://www.insurancejournal.com/news/west/2020/12/04/592941.htm

Is there a risk of my being in legal trouble if the income information to Covered CA for APTC Advanced Premium Tax Credit – Subsidy that we reported was incorrect earlier in the year?

I don’t think so. Just send a correction within 30 days of the discovery of the error

On the other hand, here’s where someone pissed off Medi Cal for not reporting the wife’s new job

It’s not like there’s intent to commit fraud Shouse Law