How does Child Support MAGI Income Line 11* of 1040 – count for Covered CA Subsidy calculation?

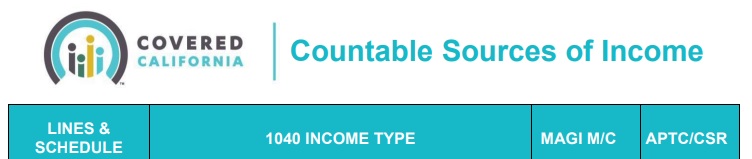

Covered CA (& Medi Cal) - Calculate - #Countable Sources of MAGI Income

Short Summary

Child Support doesn’t count as Income

- Child Support doesn’t show as income on the 1040, but alimony shows on line 11, thus child support doesn’t count toward subsidies, Health Care.Gov * IRS.Gov per MAGI definition.

- Who is taking the deduction for the children?

- A taxpayer’s family means the individuals for whom a taxpayer properly claims a deduction for a personal exemption under section 151.

- See the definition of MAGI – Modified Adjusted Gross Income (CFR 36B) on our website.

- Thus, if the non-custodial parent is claiming the deduction for the children, the subsidies would be worked out on their income, not the parent who has primary custody.

- So, the parent taking the deduction, would have the subsidies based on their income and deductions. Child support would still be included in income, as it’s not deductible.

- Alimony would be though.

- Is there Employer coverage available?

- 9.66% Affordability Rule CFR 1.36B2 (a) (2) That might knock out subsidies too.

For a full analysis it’s imperative that you view our other pages on the Advance Premium Tax Credit and check with competent legal and tax professionals. If you would like to talk to a professional tax advisor about this try Bruce Bialosky [email protected] 310.273.8250

Did this page answer all your questions? Scroll down to our Q & A section to ask them and we will respond. You do not have to leave your name.

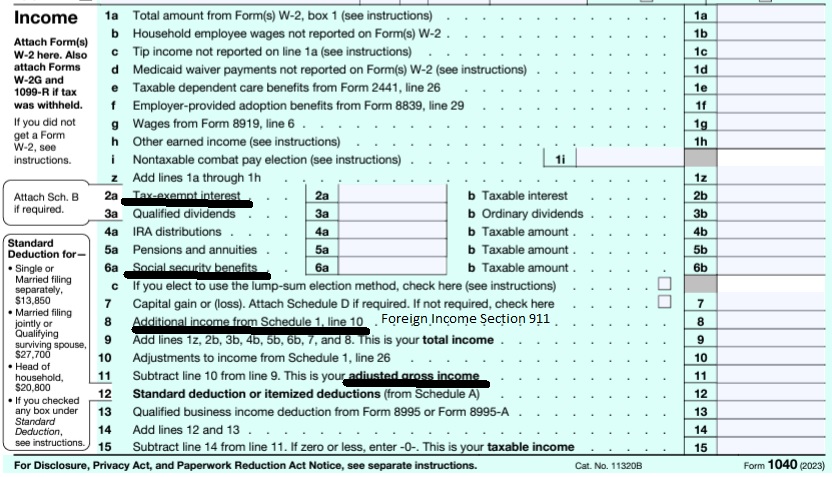

Calculate your Covered CA MAGI Income

take #Line8b 11 Adjusted Gross income then add line 2a, 6a & 8 (Foreign Income)

- 1040 IRS Annual Tax Form

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

- IRA Retirement

- Health Savings Account

- Trumps Big Beautiful Bill - may lower line 6 A Social Security Income Learn More >>> Newsweek * PBS *

- Estimate next years MAGI Income?

- Get instant quotes, subsidy calculation and coverages

- NO ASSET TEST for MAGI based subsidies in Covered CA or MAGI Medi Cal Qualification. Steve's VIDEO

- Nor is there a lien against your estate for Covered CA or MAGI Medi Cal

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

IRS Publication # 504

#Divorced or Separated Individuals

pdf * (HTML)

California Child #Handbook - Support Publications

- VIDEO Modify or Establish a Child Support Order

- Courts Self Help Section on Child Support

- Nolo CalSupport Software to calculate support

- Military Families & Veterans

- CA Court Forms

- Child Support

- Enforcement if parent moves out of USA

- Avoid Problems - Enforcement Loss of Drivers License - Liens

- Court Website on enforcement

- Attorney Nathan Website on enforcement

- Child Support - Medi Cal

- Why flush California still takes child support from low-income families LA Times 2.28.2022

- FAQs / Ask Us a Question

- Nolo - Child Support & Custody

- Find an Attorney - Legal Match.com

Military Service

Child Support?

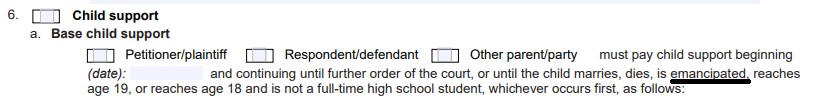

Court-ordered child support in CA usually ends when the child:

- marries,

- dies,

- Age 19 or 18 and not a full time high school student, whichever occurs first

- is emancipated,

- See Fl 342 Child Support Order screen shot below

What is an #Emancipated minor?

A person under the age of 18 years is an emancipated minor if any of the following conditions is satisfied:

(a) The person has entered into a valid marriage, whether or not the marriage has been dissolved.

(b) The person is on active duty with the armed forces of the United States.

ROTC is not active duty VA.Gov *

(c) The person has received a declaration of emancipation pursuant to Section 7122.

Explanation of Emancipation on CA Courts Self Help Site §7002.

FAQ’s on Child Support & Military Service

FAQ's Military Child Support

Open up the FAQ’s below

Military Child Support

“Child Support – End – Military Service”

- Child in military – He can stay on health coverage? dependent-definition/#comment-107755

Karen R Rymer says:

- This comment is from a “spammer?” I’m leaving it in as the website looks decent and if you’re in Canada could be quite useful.

- This article helps me a lot. Thanks for sharing valuable information. As I was looking for such information, I have found an article useful like this; you can check it out here. Not Paying Child Support I hope you get more information.

- FAQ’s “Emancipation of a Minor”

- My soon is 18 years of age and a senior in high school. He has just joined the National Guard. He will be 19 in May 2017. He starts boot camp in July. I am currently paying child support and my question is will I be continuing the child support. The court order is in the state of Oregon. He also only attends 2 classes in school this year. ?

- This website is just for general and educational purposes. I’m not an attorney and thus cannot answer your specific question as that might be considered the unlawful practice of law.

- Here is the answer on the Oregon Courts website.

- How long does child support have to be paid?

- In Oregon, a child is entitled to be supported by his or her parents until the age of 18. Also, the Courts and the Child Support Program http://www.oregonchildsupport.gov/ have the power to order that support continue when the child is 18, 19, and 20 years old if the child is attending school according to legal standards. But if a child is married, self-supporting, or in the military, the child is usually considered to be emancipated and the parents support obligation ends.

- My daughter is in the process of joining the Air Force as an active duty airman. Her mother and I divorced in Mississippi and our divorce decree specifies I’m to pay child support until she is age 20 but shouldn’t the fact she is joining the Air Force as an active duty personnel change her responsibility to the government and cause the child support to end?

- Is there an agency I can call in Mississippi to clarify this?

- Child Support, SNAP/TANF and Aging Services Call Center

Phone: 877-882-4916

Mississippi Dept of Human Services - Mississippi Bar on Child Support Phone 601-948-4471 Attorney Search

- Child Support, SNAP/TANF and Aging Services Call Center

- I’m in NY state, my son inlisted in the army national guard when he was 17.He did 9 weeks of boot camp, his dad who has nothing to do with him does pay child support. My son is now 18, still a full time high school student. My son doesn’t plan on going active duty for a few years or if at all, My son still lives with me,I still very much support him as far as clothes,food and roof over his head.His dad found out he joined the reserves and wants to emancipated him. My son is no where near able to support himself nor is he ready to move out on his own ( not for a few years.He Is still very immature . Can my son be emancipated?

- The research I did above says that emancipation doesn’t end a child support order. Please check with a qualified attorney in New York. Try this link for a referral

- I live in San Diego. My daughter who is 17, a Senior in a High School at a Community college where she takes both high school and college courses). She joined the Army reserve over the summer as part of her post-high school plans. She is currently drilling with the local reserve unit. She turns 18 in Feb and grad High School in June. Since she is actively drilling with the reserves, am I obligated to continue paying child support?

- I’m not an attorney and can’t give you legal advise. See above cases that I found. They say that even active duty doesn’t relieve you of child support right? I suggest you read your court order and ask the attorney that helped you with it, this question.

- I live in california. The judge ordered me to pay child support for my 7 year old daughter and my 18 year old son who is not a full time student. He attends school once a week for his GED. The judge said in court we are just going to say he is a full time student. I have always payed child support without a court order. The judge also reduced visitation time because my 18 year old son does not want to visit me. He is an adult and he would rather spend his weekends with his girlfreind so i have to pay more. Can i apeal this? Is there anything i can do to change this order?

- Here’s the Los Angeles County Child Support Services website on how to change – modify an order. There must be a change in circumstances.

- Here’s the court’s website.

- Attorney Dopplet website on appeals

- Attorney Temko on Appeals

- CA Court Website on appeals

- I am trying to find a number to where I can call and discuss the ending of child support since my daughter is 18 and going into the armed services

- What State & County are you in? Were you represented by an attorney when the child support was awarded?

- Try Legal Match.com

Resources & Links

- Emancipation Pamphlet MC-301* * FAQ

- Emancipation Manual 77 Pages

- Can a minor request Emancipation to be treated as an adult? VIDEO

- FAQ’s on emaciated minors –

- EMANCIPATION OF MINORS LAW

CA Family Law Code

Support of Minor Child §3900 – 3902

§4007 (a) If a court orders a person to make specified payments for support of a child during the child’s minority, or until the child is married or otherwise emancipated, or until the death of, or the occurrence of a specified event as to, a child for whom support is authorized under Section 3901 or 3910, the obligation of the person ordered to pay support terminates on the happening of the contingency. The court may, in the original order for support, order the custodial parent or other person to whom payments are to be made to notify the person ordered to make the payments, or the person’s attorney of record, of the happening of the contingency.

3901 (a) The duty of support imposed by Section 3900 continues as to an unmarried child who has attained the age of 18 years, is a full-time high school student, and who is not self-supporting,

***Might Active Duty Military Service be considered self supporting?

until the time the child completes the 12th grade or attains the age of 19 years, whichever occurs first. (Court Self Help Site)

CA Family Law Code §3900. Subject to this division, the father and mother of a minor child have an equal responsibility to support their child in the manner suitable to the child’s circumstances.

Resources & Links

Armed Forces Tax Guide IRS Publication # 3

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

Custody?

What factors are considered in granting #custody?

If a parent has a sexual relationship outside of marriage, how does that affect a court’s decision on custody?

In most states, affairs or nonmarital sexual relations are not a factor in deciding custody unless it can be shown that the relationship has harmed the child. A discreet affair during the marriage might not be a significant factor. Similarly, if, after the marriage is over, a parent lives with a person to whom he or she is not married, the live-in relationship by itself may not be a major factor in deciding custody, although the quality of the relationship between the child and the live-in partner can be an important factor in a custody dispute.

If the parent’s nonmarital sexual relationship or relationships have placed the child in embarrassing situations or caused significant, provable stress to the child, then the relationship(s) would be a negative factor. In a few states, courts are more inclined to assume that a parent’s nonmarital sexual relationship is harmful to the child. The issue of a parent’s sexual conduct can be one in which individual judges may have personal biases that influence their decisions. public.findlaw.com/

Child Custody and Visitation Rights

To win a child custody case, you must usually demonstrate that you and your environment are most likely to serve the best interests of the child. Determining what constitutes ?best interest? is often an elusive question. Certainly, it includes the educational best interest of the child. The court will be interested in knowing which parent, and which household, is most likely to promote the academic objectives and educational success of the child. It also certainly includes the health, safety and welfare of the child.

Sometimes, a parent is troubled by the fact that the children’s father or mother is now living with a new girlfriend or boyfriend who poses a danger or a risk to the children. ca divorce solutions.com/

Will it affect the custody decision if I live with my boyfriend?

Alex’s Question: My child is 9 months old and I am currently going though a child visitation/custody case with the father. I am now dating someone else and have been for a year. Will it be okay if I start to live with this person or will it affect the courts opinion of me?

Brette’s Answer: Whenever you live with someone it becomes a consideration in custody because that person is part of the child’s environment.

woman’s divorce.com/

Best interests or best interests of the child

is the doctrine used by most courts to determine a wide range of issues relating to the well-being of children. The most important of these issues concern questions that arise upon the divorce or separation of the children’s parents: With whom will the children live?; How much contact (previously termed “access”, or in some jurisdictions, “visitation”) will the parents, legal guardian, or other parties be allowed (or required) to have?; and To whom and by whom will child support be paid and in what amount?

en.wikipedia.org

Safety & Welfare: The court’s “primary concern” is to assure the child’s health, safety and welfare. kinseylaw.com/

What is the best interest of the child?

It is what judges must consider to make their decisions about custody and visitation. To decide what is best for a child, the court will consider:

| the age of the child, | |

| the health of the child, | |

| the emotional ties between the parents and the child, | |

| the ability of the parents to care for the child, | |

| history of family violence and/or substance abuse, and | |

| the child’s ties to school, home, and his or her community. |

Family Law Code §3030 to 3204 Right to custody of minor child

Adoption

#Adoption Tax Credit Facts to Consider

Taxpayers who have adopted or tried to adopt a child in 2016 may qualify for a tax credit. Here are ten important things about the adoption credit:

- The Credit. The credit is nonrefundable, which may reduce taxes owed to zero. If the credit exceeds the tax owed, there is no refund of the additional amount. In addition, if an employer helped pay for the adoption through a written qualified adoption assistance program, that amount may reduce any taxes owed.

- Maximum Benefit. The maximum adoption tax credit and exclusion for 2016 is $13,460 per child.

- Credit Carryover. If the credit exceeds the tax owed, taxpayers can carry any unused credit forward. For example, the unused credit in 2016 can reduce taxes for 2017. Use this method for up to five years or until the credit is fully used, whichever comes first.

- Eligible Child. An eligible child is an individual under age 18 or a person who is physically or mentally unable to care for themselves.

- Qualified Expenses. Adoption expenses must be reasonable, necessary and directly related to the adoption of the child. Types of expenses may include adoption fees, court costs, attorney fees and travel.

- Domestic or Foreign Adoptions. Taxpayers can usually claim the credit whether the adoption is domestic or foreign. However, there are different rules regarding the timing of expenses for each type of adoption.

- Special Needs Child. A special rule may apply if the adoption is of an eligible U.S. child with special needs. Under this special rule, taxpayers can claim the tax credit, even if qualified adoption expenses were not paid.

- No Double Benefit. In some instances both the tax credit and the exclusion may be claimed but not for the same expenses.

- Income Limits. The credit and exclusion are subject to income limitations. These may reduce or eliminate the claimable amount..

- IRS Free File. Use IRS Free File to prepare and e-file federal tax returns for free. File Form 8839, Qualified Adoption Expenses, with Form 1040. Free File is only available on IRS.gov/freefile.

Beginning in 2017, taxpayers using a software product for the first time may need their Adjusted Gross Income (AGI) amount from their prior-year tax return to verify their identity. Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return.

Additional IRS Resources:

- Tax Topic 607– Adoption Credit and Adoption Assistance Programs

- Adoption Tax Credit Form # 8839

IRS YouTube Video:

- Welcome to Free File – English

Court Order for Health Insurance

Court Order fl 470 to provide Health Insurance for #children

Divorce

Parental Medical #Rights?

- The court shall require that health insurance coverage for a supported child shall be maintained by either or both parents if that insurance is available at no cost or at a reasonable cost to the parent.

- Here’s an explanation from Attorney Robert Farzad. *

- California Family Law Code §3750 – 3733 Health Coverage for Supported Child, assignment.

- §3750. “Health insurance coverage” as used in this article includes all of the following:

- (a) Vision care and dental care coverage whether the vision care or dental care coverage is part of existing health insurance coverage or is issued as a separate policy or plan.

- (2) the court shall require that health insurance coverage for a supported child shall be maintained by either or both parents if that insurance is available at no cost or at a reasonable cost to the parent.

- Court Forms –

- Health Care Orders for Children FL 192

- HEALTH INSURANCE FL 470

- Email us [email protected] if you need any INSURANCE help complying with these orders. – for legal help – contact an attorney

- Get a quote for your child(ren) only

- Quotes for Yourself & Children, Family or X & Children

- Are you losing Medical Coverage?

- COBRA?

- Right of child under 19 to get GUARANTEED coverage!

- Right to stay on parent’s plan to age 26

- Right of Disabled child to stay on plan indefinitely

- If I receive CalWORKS or KinGAP (government cash assistance/welfare), does this affect how much child support I can receive?

- Yes. By law, you can EITHER receive the court ordered child support OR the cash assistance, but not both. As long as you are receiving cash assistance, you will receive $50.00 of the ordered child support payment and the remainder will go to the state to repay the cash assistance you were given. Child Support.CA.Gov *

- Question Can Medi Cal get reimbursed for children’s premiums where the parents have a health insurance order or from an estranged father?

-

Answer In accordance with the Social Security Act section 1902(a)(25)(E), and 42 CFR 433.152(b), the Department receives data from The Department of Child Support Services on a regular basis to obtain information for those with a medical support order. Currently, medical child support services are paid within 30 days as it has determined it is cost effective and necessary to ensure access to care; however, the service is “chased” after the fact, unless there is good cause.

Including Links to our State Plan for more information.

Attachment 4.22-A (ca.gov) – data processing described on page 2.

Attachment 4.22-B (ca.gov) – claims processing for Medical Child support services

Lindsey Wilson, Chief

Coordination of Benefits and Administration

Third Party Liability and Recovery Division

-

Videos on Health Insurance Orders

- Health Insurance Order FL 470

- Application and Order for Health Insurance

- California Form FL 470

- VIDEO Must the children be covered by health insurance?

- Same thing, different attorney VIDEO

Child Tax Credit

What is the #Child Tax Credit (CTC)?

- This credit is for individuals who claim a child as a dependent if the child meets additional conditions. It is in addition to the credit for child and dependent care expenses (on Schedule 3 (Form 1040), line 49, or Form 1040NR, line 47) and the earned income credit (on Form 1040, line 17a).

- The maximum amount you can claim for the credit is $2,000 for each child who qualifies you for the CTC.

- Child Tax Credit does not count as MAGI Income, per 7.12.2021 email from Covered CA.

- IRS.Gov FAQ on 2021 Child Tax Credit

- Claiming the CTC and ODC 8812

- Limits on the CTC and ODC,

- Child Tax Credit Schedule 8812

- irs.gov/advance-child-tax-credit-payments-in-2021

https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/qualified-medical-child-support-orders.pdf

https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications

Online divorce services in California have truly transformed the way couples navigate the legal process of ending their marriage. Platforms like provide a convenient and efficient solution, saving time and reducing stress. I highly recommend considering these services for a simpler divorce process.

My X wife and I have one child with 50/50 custody.

She send me some forms to fill out:

Notice & Agreement for Child, Spousal & Medical Support

Support Questionnaire

What are they?

How do we get our daughter on Medi-Cal.

I lost my job and my X isn’t working and has no income.

Boy, this is a mouthful and we don’t get compensated one nickel for helping people enroll in Medi-Cal.

We cannot give you any advice on child support, we are not attorneys.

We are only directing you to public information on that. Make your own decision if you will fill out the forms or check with your own attorney.

Here’s the publications pages for CA Child Support Services

Here’s the overview brochure

Assignment and Cooperation Rules

You must assign (give to) the county any rights you may have for:

• Any child or spousal support payments you get while receiving cash aid.

• Medical support you get while getting Medi-Cal.

The receipt of a cash aid payment and/or Medi-Cal Benefits Identification Card (BIC) will assign the past and present support rights of all persons for whom you are requesting cash aid and/or medical assistance. You will be sent facts on the amount of support the county gets from the noncustodial parent(s).

Why must your X wife assign your child support payments to Los Angeles County?

Here’s the Medi-Cal eligibility manual.

Here’s the 101 pages of the Medi-Cal – Medical Support Enforcement Program

So, basically, while your X wife might have zero income and qualify for Medi-Cal, the county wants to know if you are rich and then they can make you pay the premiums or just kick your X and your child off Medi-Cal if the income is too high.

Here’s the income chart https://individuals.healthreformquotes.com/subsidies/magi/income-chart/ for Medi-Cal, Covered CA programs and if the household has more than 600% of Federal Poverty Level, there are no subsidies.

There is also a law that says the court must order a parent to put the child on THEIR medical plan if it can be done at no cost or a reasonable cost https://individuals.healthreformquotes.com/subsidies/magi/categories/alimony-child-support/child-support/health-insurance-order/ So, while you might be unemployed now, when you had a job, if your child could be added to the Group Plan, for no or reasonable cost, it’s MANDATED that you add her.

How is the county to know what your situation is, if you don’t fill out the forms?

***************

Individuals with other health coverage may be eligible for Medi-Cal, but they must apply for and use other health coverage that they have or that is available to them. Medi-Cal beneficiaries who are enrolled in managed care are also subject to this requirement due to current contracting provisions, which can make coordination difficult between the Medi-Cal managed care plan and the other health coverage plan.

California is obligated to seek other sources of health coverage and to collect payment from liable third parties. As such, California requires that applicants and beneficiaries assign rights to medical support and help locate liable third parties, even going so far as to helping to establish paternity of children born outside of marriage so that the state may seek payment for medical services provided to the child.

42 U.S.C. § 1396a(a)(25); Welf. & Inst. Code § 10020; 22 CCR § 50763(a)

22 CCR § 50761

42 U.S.C. § 1396a(a)(25); 42 C.F.R. §§ 433.137-433.140

Welf. & Inst. Code § 14008.6

See the Western Poverty Law Guide page 1.27

Being as you are getting these forms to make sure that you can’t put your child on your Employer Health Plan for zero premium, it looks to me like your X has already applied for Medi-Cal for your daughter.

This is NOT legal advice! I’m not making any recommendations on what you should do or not do! I’ve only directed you to websites that seem to have relevant information.

Covered CA does a piss poor job of doing any training for agents that they are asking to work for FREE to help their brand.

My x husband went back to his country of origin. Does a California order apply overseas? What if he won’t pay?

Here’s an excerpt from the CA Child Support Handbook above

Here’s some links I googled on collecting out of country:

Israel and the U.S. entered into a federal-level Memorandum of Understanding (MOU) under the terms of which Israel and the United States each express its intent to process child support requests for the other. acf.hhs.gov

43 percent of divorced fathers in Israel don’t pay child support haaretz.com

US State Department on International Child Support

Hague Convention

Practical Handbook for Caseworkers under Hague Convention

Prohibition on Leaving the Country

For parents who fear that the other parent will leave the country, some safeguards are already in place. If the obligated parent owes $4,000 or more in child support arrears, his or her passport application will be denied and any existing passports can be revoked.HG.org