Covered CA Joint or Separate Filing if Married

Unless you meet one of the exceptions below

Married Couples must file Jointly to get ACA Subsidies

Source Publication 974 Premium Tax Reconciliation PAGE # 5

- Our page on Registered Domestic Partners

- Calculator for if taxes be higher if we filing jointly, as mandated?

- Subsidy Calculator for premiums with and without subsidy

- Medi – Cal flow chart for married couples – whose in household

- Publication 501, Exemptions, Standard Deduction and Filing Information.

(2) Married taxpayers must file joint return. A taxpayer who is married (within the meaning of section 7703) at the close of the taxable year is an applicable taxpayer only if the taxpayer and the taxpayer’s spouse file a joint return for the taxable year. GPO.Gov Final Regulations Page 11 * Turbo Tax Calculator Tax Policy Center….. Joint or separate?

Married Filing Separately.

Not Considered Married

Single.

Normally this status is for taxpayers who aren’t married, or who are divorced or legally separated under state law.

Head of Household.

In most cases, this status applies to a taxpayer who is not married, but there are some special rules. For example, the taxpayer must have paid more than half the cost of keeping up a home for themselves and a qualifying person. Don’t choose this status by mistake. Be sure to check all the rules.

Qualifying Widow(er) with Dependent Child

This status may apply to a taxpayer if their spouse died and they have a dependent child. Other conditions also apply.

The “Filing” tab on IRS.gov can help with many taxpayers’ federal income tax filing needs. The Interactive Tax Assistant tool can help taxpayers choose the right filing status.

Scroll down for more details on the exceptions.

Try turning your phone sideways to see the graphs & pdf's?

IRS Publication # 504

#Divorced or Separated Individuals

pdf * (HTML)

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

Jump to section on:

| Estranged Spouse |

What if I don’t have contact with my #estranged spouse,

do we still have to file jointly to get the tax subsidies?

Exception 1—Certain married persons living apart.

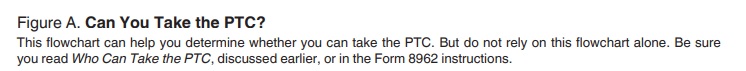

You may file your return as if you are unmarried and take the PTC if one of the following applies to you.

- You file a separate return from your spouse on Form 1040 or Form 1040A because you meet the requirements for Married persons who live apart under Head of Household in the instructions for Form 1040 or Form 1040A.

- You file as single on your Form 1040NR because you meet the requirements for Married persons who live apart under Were You Single or Married? in the instructions for Form 1040NR..

- Exception 1—Certain married persons living apart.

Exception 2—Victim of domestic abuse or spousal abandonment.

If you are a victim of domestic abuse or spousal abandonment, you can file a return as married filing separately and take the PTC if all of the following apply to you.

- You are living apart from your spouse at the time you file your 2016 tax return.

- You are unable to file a joint return because you are a victim of domestic abuse (described next) or spousal abandonment (described below).

- You check the box on your Form 8962 to certify that you are a victim of domestic abuse or spousal abandonment.

Records of domestic abuse and spousal abandonment.

If you checked the box in the upper right corner of Form 8962 indicating that you are eligible for the PTC despite having a filing status of married filing separately, you should keep records relating to your situation, like with all aspects of your tax return. What you have available may depend on your circumstances. However, the following list provides some examples of records that may be useful. (Do not attach these records to your tax return.)

- Protective and/or restraining order.

- Police report.

- Doctor’s report or letter.

- A statement from someone who was aware of, or who witnessed, the abuse or the results of the abuse. The statement should be notarized if possible.

- A statement from someone who knows of the abandonment. The statement should be notarized if possible.

- Records of domestic abuse and spousal abandonment.

This all goes beyond our pay grade. Click on the link for VITA.

- Example.

- Rules for the Married Taxpayers Not Filing a Joint Return and Also Allocating With Another Taxpayer.

- Health Care.gov says you don’t have to include a legally separated spouse!.

- Publication 974 Premium Tax Credit pdf HTML.

- Modified Adjusted Gross Income Definition – Line 37* 1040

- 1040 Instructions

- VITA free-tax-return-preparation-for-you-by-volunteers

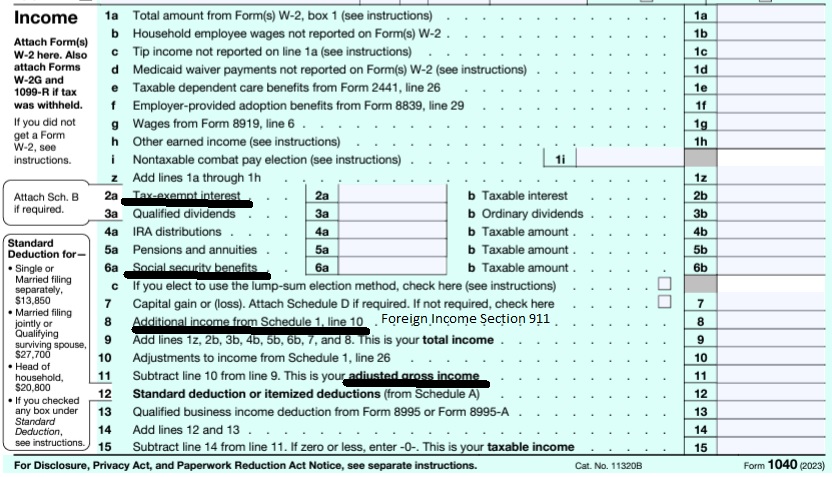

Calculate your Covered CA MAGI Income

take #Line8b 11 Adjusted Gross income then add line 2a, 6a & 8 (Foreign Income)

- 1040 IRS Annual Tax Form

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

- Estimate next years MAGI Income?

- Get instant quotes, subsidy calculation and coverages

- NO ASSET TEST for MAGI based subsidies in Covered CA or MAGI Medi Cal Qualification. Steve's VIDEO

- Nor is there a lien against your estate for Covered CA or MAGI Medi Cal

FAQ’s

- Question How do I keep my separated spouse from hiding all our assets?

. - Answer

- a Los Angeles family court judge ruled that a woman had violated state asset disclosure laws because she neglected to reveal she had won $1.3 million in the California state lottery . . . just 11 days before she filed for divorce!

- According to the Los Angeles Times, the judge in this case determined that the wife had acted out of fraud or malice, and as a result, he awarded all of the winnings to the ex-husband. Forbes.com *

- hiding assets, income and debt is not only unethical; it’s also illegal and subject to severe penalties IF discovered. forbes.com *

- contempt of court or criminal charges for fraud or perjury.

- An investigator or forensic accountant can thoroughly examine income tax returns, public records and bill statements. Your attorney can submit questions to your spouse, through written interrogatories and oral depositions, in an attempt to find hidden assets. However, as a “The New York Times” article notes, although your suspicions might be justified, it’s “what you can prove that counts.”

- a husband who repeatedly failed to produce current financial statements so angered the judge that he allocated 90 percent of the marital assets to the wife.

- Depending on the laws of your state, if you refuse to disclose assets or information requested by the court, you might be held in contempt of court, a misdemeanor which can result in fines or even jail time. If you lie about your assets in court, you might be charged with perjury for testifying falsely under oath. In California, for example, you can serve up to four years in jail for perjury. You might be charged with fraud, a criminal act, if a prosecutor decides to charge you with deceiving the other party by hiding assets. Penalties include restitution and jail time. legal zoom

- a Los Angeles family court judge ruled that a woman had violated state asset disclosure laws because she neglected to reveal she had won $1.3 million in the California state lottery . . . just 11 days before she filed for divorce!

California Tax Information Registered Domestic Partners

2021 #737

Federal IRS

- Q1. Can registered domestic partners file federal tax returns using a married filing jointly or married filing separately status?

- A1. No. Registered domestic partners may not file a federal return using a married filing separately or jointly filing status. Registered domestic partners are not married under state law. Therefore, these taxpayers are not married for federal tax purposes. IRS.gov *

- More Federal IRS FAQ's

- Our webpage on Registered Domestic Partners – Spousal Health Coverage?

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

My divorce was just finalized.

My ex-spouse has been giving me 1/2 of his pension each month. We have filed joint returns every year since separation.

How do I navigate the application process with covered california with regards to tax returns and income?

1st thing is to appoint us as your broker on your Covered CA application. There is no extra charge. Covered CA pays us, as it saves them time and effort.

Past returns and past income don’t really mean much for Covered CA and your tax return to reconcile if you got the right amount of subsidies. Form 8962

Are you still getting 1/2 of your husbands pension?

Do you plan to work?

What do you expect to make?

What do you expect to earn in 2024?

Here’s information to help you estimate future income.

You can get instant quotes and subsidy calculations here.

My husband is turning 65 in November and going on Medicare.

• how do we deal with the income reporting for Covered CA since Bob (primary tax payer) will no longer be on CC or alternatively –

• how does estimating income change when only one person is applying for CC (not the primary tax payer)??

Being as your mandated to file jointly – see above. I don’t see any difference in your MAGI Income. Thus, there is no change in estimating income.

Please note, Covered CA does not permit agents to give tax advise.

I am 65, with Medicare, self employed not retired.

My husband is 53. with Covered California, self employed.

We file jointly. what income should we declare for my husband?

It’s not income for your husband, it’s both of yours as you’re mandated to file jointly.

Put down the MAGI Income number on line 37 or the new form line 7. You must also add in, foreign income, tax exempt interest and Social Security benefits.

Click here for quotes and subsidies calculation.

Here’s instructions to appoint us as your agent, no extra charge.