California Probate

Introduction to Probate

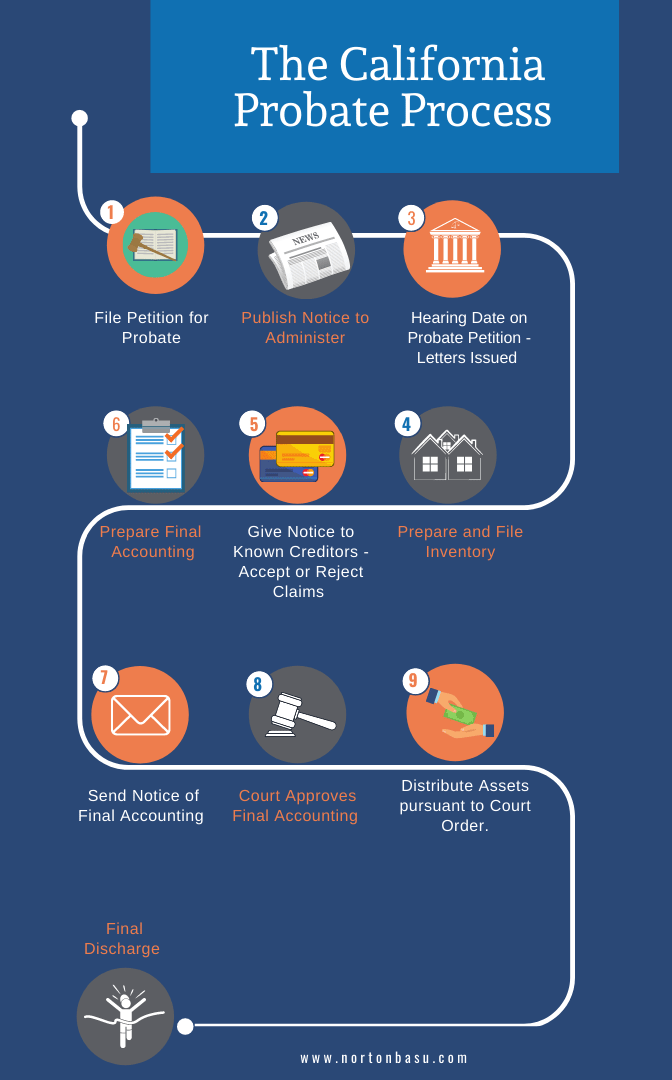

Probate takes place in a special probate court to determine how to distribute the estate of someone who died. Probate of a deceased’s estate is necessary when the person who died did not plan his final affairs beyond preparing a Will. You can avoid probate and the expense by estate planning while providing for the immediate transfer of your estate to your designated heirs.

See our webpages on Medi Cal Recovery for Nursing Home costs and trusts.

Probate proceedings are long, cumbersome and expensive. If you have a small estate you can file a petitions with the court stating that the estate is too small and that it should be distributed without court administration to your heirs. A person whose estate exceeds $166k Sweeney Probate Law * should develop a simple estate plan and avoid probate. (MICHAEL LYNN GABRIEL, Esq.)

Instant Complementary Term Quote & Sign Up

Estate, gift and inheritance taxes are based on the size of the estate and the relationship of the heirs to the deceased.

For example, assume that a person gives $800,000 at his death to his children. It makes no difference if the $800,000 comes to the children from probate or through a revocable living trust. There is greater cost if the estate is probated rather than passing it through a trust, but the tax rates are the same. The tax is on the money and property distributed after death, not whether or not it comes from probate.

See IRS publications 559 & 950 for lifetime federal unified credit for gift and estate taxes. The limitations & maximums mean that no federal estate taxes will be owed unless an estate exceeds the unused portion of the unified credit (the unified credit amount minus the value of lifetime gifts). (MICHAEL LYNN GABRIEL, Esq.)

Probate costs include:

- court fees,

- appraisal fees,

- attorney fees and

executor fees. Court costs and appraisal fees are modest: a couple of hundred dollars for an average estate. The real costs are the attorney and executor fees. (Lawyer at large.com)

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

More on Probate & FAQ’s

Probate FAQ’s

California Court’s Web Site

Family Law – Schedule of Assets & Debts

- Los Angeles Superior Court – Probate Section

- Free Advise.com Probate

- California Probate Code

- PROBATE CODE

DIVISION 1. PRELIMINARY PROVISIONS AND DEFINITIONS [1 – 88]

DIVISION 2. GENERAL PROVISIONS [100 – 890]

DIVISION 3. GENERAL PROVISIONS OF A PROCEDURAL NATURE [1000 – 1312]

DIVISION 4. GUARDIANSHIP, CONSERVATORSHIP, AND OTHER PROTECTIVE PROCEEDINGS [1400 – 3925]

DIVISION 4.5. POWERS OF ATTORNEY [4000 – 4545]

DIVISION 4.7. HEALTH CARE DECISIONS [4600 – 4806]

DIVISION 5. NONPROBATE TRANSFERS [5000 – 5705]

DIVISION 6. WILLS AND INTESTATE SUCCESSION [6100 – 6806]

DIVISION 7. ADMINISTRATION OF ESTATES OF DECEDENTS [7000 – 12591]

DIVISION 8. DISPOSITION OF ESTATE WITHOUT ADMINISTRATION [13000 – 13660]

DIVISION 9. TRUST LAW [15000 – 19530]

DIVISION 10. PRORATION OF TAXES [20100 – 20225]

DIVISION 11. CONSTRUCTION OF WILLS, TRUSTS, AND OTHER INSTRUMENTS [21101 – 21700]

- PROBATE CODE

- WHAT IS “PROBATE”?

- WHY IS PROBATE NECESSARY?

- DOES ALL A PERSON’S PROPERTY HAVE TO GO THROUGH PROBATE?

- WHAT IF THE DECEDENT OWNED LAND IN MORE THAN ONE STATE?

- DO WE HAVE TO GO THROUGH PROBATE IF THERE IS A WILL? WHY CAN’T WE JUST DISTRIBUTE THE ASSETS AS THE WILL SAYS?

- WHO IS RESPONSIBLE FOR HANDLING THE PROBATE PROCESS?

- WHAT GOES ON IN THE PROBATE OF AN UNCONTESTED WILL?

- CAN I HANDLE PROBATE WITHOUT A LAWYER?

- WHAT IS THE BASIS FOR A WILL CONTEST?

- WHAT IF THERE IS NO WILL?

- HOW CAN I FIND OUT IF THERE WAS A WILL?

- HOW MUCH DOES PROBATE COST?

- HOW LONG DOES PROBATE TAKE?

- HOW ARE ESTATE CREDITORS HANDLED?

- DO BENEFICIARIES HAVE TO PAY CREDITORS OUT OF THEIR OWN POCKET IF THE ESTATE IS INSOLVENT?

- HOW ARE TAXES HANDLED IN PROBATE?

- MY DECEASED AUNT HAD A COPY OF HER ORIGINAL WILL FROM A LAW FIRM THAT EXECUTED HER WILL. THE LAW FIRM NOW STATES THAT THEY ONLY HAD A DRAFT; HOWEVER, OUR COPY HAS TWO WITNESSES SIGNATURES, MY AUNT’S SIGNATURE, THE NOTARY’S PUBLIC SIGNATURE AND THE LAW FIRM’S BUSINESS STAMP. MOREOVER, WE ARE TOLD THAT THE COPY IS INVALID AND THERE IS NO WILL AND THE ORIGINAL CANNOT BE FOUND. THUS, THE PROBATE COURT WILL DECIDE WHO THE ESTATE WILL GO TO. WHAT CAN WE DO TO ENSURE THAT MY AUNT’S WILL IS CARRIED OUT AS SHE REQUESTED?

- MY HUSBAND DIED RECENTLY. HIS DENTIST WANTS ME TO PAY THE REMAINDER OF HIS BILL. AM I LIABLE?

- MY FATHER JUST DIED AND OUT OF NOWHERE MY YOUNGEST BROTHER POPS UP WITH A WILL NAMING HIM AS PERSONAL REPRESENTATIVE. THOUGH IT APPEARS THE WILL WAS DRAWN UP BY AN ATTORNEY, THERE ARE A NUMBER OF ERRORS, SUCH AS REFERENCE TO A NONEXISTENT BROTHER AND THE REPEATED USE OF MY FATHER’S NAME WITH THE WRONG MIDDLE INITIAL. IS THERE ANY WAY WE CAN HAVE CHALLENGE THE VALIDITY OF THIS WILL?

- THE BANK HOLDING MY DECEASED MOM’S CD WILL NOT DISTRIBUTE THE FUNDS TO HER ESTATE WITHOUT HER WILL BEING PROBATED. CAN THE BANK REQUIRE MY FAMILY TO GO THROUGH THAT PROCESS?

- Probate process

- HOW LONG DOES PROBATE TAKE?

- HOW MUCH DOES PROBATE COST?

- MY RELATIVE LEFT ONLY A VERY SMALL ESTATE. IS THERE ANYTHING EASY?

- MY FATHER JUST DIED AND OUT OF NOWHERE MY YOUNGEST BROTHER POPS UP WITH A WILL NAMING HIM AS PERSONAL REPRESENTATIVE. THOUGH IT APPEARS THE WILL WAS DRAWN UP BY AN ATTORNEY, THERE ARE A NUMBER OF ERRORS, SUCH AS REFERENCE TO A NONEXISTENT BROTHER AND THE REPEATED USE OF MY FATHER’S NAME WITH THE WRONG MIDDLE INITIAL. IS THERE ANY WAY WE CAN HAVE CHALLENGE THE VALIDITY OF THIS WILL?

- THE BANK HOLDING MY DECEASED MOM’S CD WILL NOT DISTRIBUTE THE FUNDS TO HER ESTATE WITHOUT HER WILL BEING PROBATED. CAN THE BANK REQUIRE MY FAMILY TO GO THROUGH THAT PROCESS?

- Purpose of probate

- WHAT IS “PROBATE”?

- WHY IS PROBATE NECESSARY?

- DO WE HAVE TO GO THROUGH PROBATE IF THERE IS A WILL? WHY CAN’T WE JUST DISTRIBUTE THE ASSETS AS THE WILL SAYS?

- HOW CAN AN ESTATE PLAN PREVENT A CONSERVATORSHIP PROCEEDING?

- The other 49 States

- Ways to avoid probate

- WHAT PROTECTION IS AVAILABLE BY A REVOCABLE “LIVING” TRUST?

- Executor or administrator

- WHO IS RESPONSIBLE FOR HANDLING THE PROBATE PROCESS?

- WHAT ARE THE MAIN DUTIES OF A PERSONAL REPRESENTATIVE?

- I WAS NAMED AS THE EXECUTOR IN MY SISTER’S WILL. DO I HAVE TO SERVE?

- IF I SERVE AS AN EXECUTOR, DO I GET PAID?

- WHAT HAPPENS IF THE PERSONAL REPRESENTATIVE FAILS TO PERFORM HIS OR HER DUTY?

- WHAT GOES ON IN THE PROBATE OF AN UNCONTESTED WILL?

- Creditors

- DO BENEFICIARIES HAVE TO PAY CREDITORS OUT OF THEIR OWN POCKET IF THE ESTATE IS INSOLVENT?

- MY HUSBAND DIED RECENTLY. HIS DENTIST WANTS ME TO PAY THE REMAINDER OF HIS BILL. AM I LIABLE?

- HOW ARE ESTATE CREDITORS HANDLED?

- IF MY PARENTS DIE WITH A MOUNTAIN OF DEBT, MORE THAN THE ESTATE IS WORTH, IS THE PAYMENT OF THE DEBT THE RESPONSIBILITY OF THE CHILDREN?

- Legal help

- CAN I HANDLE PROBATE WITHOUT A LAWYER?

- Property outside probate

AFFIDAVIT #PROCEDURE FOR

REAL [your home & land] PROPERTY OF SMALL VALUE 13200-13210

13200. (a) No sooner than six months from the death of a decedent, a person or persons claiming as successor of the decedent to a particular item of property that is real property may file in the superior court in the county in which the decedent was domiciled at the time of death, or if the decedent was not domiciled in this state at the time of death, then in any county in which real property of the decedent is located, an affidavit in the form

prescribed by the Judicial Council pursuant to Section 1001 stating all of the following:

(1) The name of the decedent.

(2) The date and place of the decedent’s death

. (3) A legal description of the real property and the interest of the decedent therein.

(4) The name and address of each person serving as guardian or conservator of the estate of the decedent at the time of the decedent’s death, so far as known to the affiant.

(5) “The gross value of all real property in the decedent’s estate located in California, as shown by the inventory and appraisal attached to this affidavit, excluding the real property described in Section 13050 of the California Probate Code, does not exceed twenty thousand dollars ($20,000).”

(6) “At least six months have elapsed since the death of the decedent as shown in a certified copy of decedent’s death certificate attached to this affidavit.”

(7) Either of the following, as appropriate:

(A) “No proceeding is now being or has been conducted in California for administration of the decedent’s estate.”

(B) “The decedent’s personal representative has consented in writing to use of the procedure provided by this chapter.”

(8) “Funeral expenses, expenses of last illness, and all unsecured debts of the decedent have been paid.”

(9) “The affiant is the successor of the decedent (as defined in Section 13006 of the Probate Code) and to the decedent’s interest in the described property, and no other person has a superior right to the interest of the decedent in the described property.”

(10) “The affiant declares under penalty of perjury under the law of the State of California that the foregoing is true and correct.”

(b) For each person executing the affidavit, the affidavit shall contain a notary public’s certificate of acknowledgment identifying the person.

(c) There shall be attached to the affidavit an inventory and appraisal of the decedent’s real property in this state, excluding the real property described in Section 13050. The inventory and appraisal of the real property shall be made as provided in Part 3 (commencing with Section 8800) of Division 7. The appraisal shall be made by a probate referee selected by the affiant from those probate referees appointed by the Controller under Section 400 to appraise property in the county where the real property is located. (d) If the affiant claims under the decedent’s will and no estate proceeding is pending or has been conducted in California, a copy of the will shall be attached to the affidavit. (e) A certified copy of the decedent’s death certificate shall be attached to the affidavit. If the decedent’s personal representative has consented to the use of the procedure provided by this chapter, a copy of the consent and of the personal representative’s letters shall be attached to the affidavit. (f) The affiant shall mail a copy of the affidavit and attachments to any person identified in paragraph (4) of subdivision (a).

Estate Planning - Life Insurance & Long Term Care Related Pages

- Estate Planning

- Life Insurance – Instant Quotes – Universal – Key Man Life

- Long Term Care Nursing & Home Health Care

-

#Estate & Gift Taxes Publication 559

- Introduction to Estate & Gift Taxes Publication 950

- IRS Form #706 Estate Tax Return

- What Financial Professionals Need to Know About the Final Reconciliation Bill 7/3/2025. NAIFA *

Our Webpages:

Instant Term Life Insurance Quote #naaipquote

- Schedule Zoom consultation

- Tools - Calculator to help you figure out how much you should get

- How much life insurance you really need?

Place Obituary? Legacy.com