Advantages of getting an Annuity

Safety of Principal!

Annuity Introduction

Most people have worked hard all their life accumulating their “nest-egg”. They should not put their money in risky investments, especially our senior citizens. Most seniors are more concerned about the “return OF their money than the return ON their money”. Annuities are considered to be safe investments for the following reasons:

- No market risk

- Backed by the financial strength of large life insurance companies who are required to set aside a portion of their assets (reserves) to cover claims.

- They also spread their risk through the industry’s reinsurance network, i.e. several companies share in a particular risk.

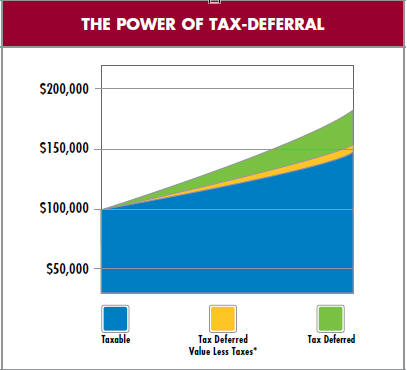

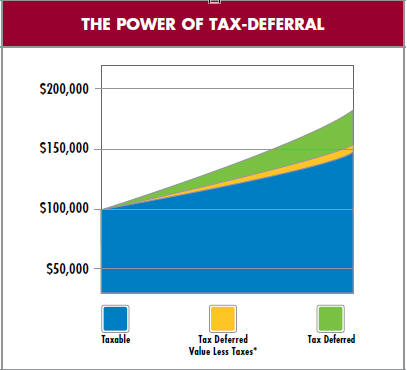

- Tax Deferral – Taxes are paid only when money is received. IRC Section 72 This results in a much faster cash build-up. Your principal grows because you receive:

- 1) interest on the principal;

- 2) interest on the interest;

- 3) interest on the money that normally would have been paid in taxes.

- Competitive Interest Rates – At present, and historically, annuities outperform CD’s and money market accounts.

- Accessibility– One of the biggest concerns, especially with seniors, is “Do I Have Access to My Money, Should I Need It?” There are a number of choices:

- Withdraw interest as needed, monthly, quarterly, etc.

- Exercise free withdrawal privilege

- Total surrender

- Annuitize (choose one of a number of income options)

- Lifetime Income – Annuity Calculator

- Get your annuity from [email protected] just use the tool to get an instant idea of what the market is.

- Lifetime Income – Annuity Calculator

- Avoids Probate – By naming a beneficiary, your annuity account is paid directly to a named individual, making it accessible and eliminating probate costs.

- Interest Rate Guarantees – Almost all annuity contracts have minimum rate guarantees…the rate can never go below a specified amount.

- Current Income Reduction – CD’s, money market accounts, savings accounts, etc. require current taxation of interest earned even if it is not taken. Annuities are taxed only upon receipt of interest.

- Lifetime Income Option – Annuities are the only investment vehicles available that guarantee you cannot outlive your monthly payments

- Retirement Annuities: Know the Pros and Cons Investopedia

- General Information on Annuities Annuity.org

Avoid Risk and invest in a tax deferred annuity!

Your PRINCIPLE & INTEREST is FULLY GUARANTEED at all times!!

You get:

- Triple Compounding

- Tax Savings

- No Fees or Load Charges

- Competitive Interest

- Probate Avoidance

- No Market Risk

- Does not affect taxation of your social security

- Liquidity (Ability to withdraw funds) (Brsan)

Power of Tax Deferral -

from North American Brochure

-

What Seniors Need to know #about Annuities - HTML CA DOI Pamphlet

- Buyer's Guides NAIC - National Association of Insurance Commissioners

- Our webpages on Annuities & Retirement

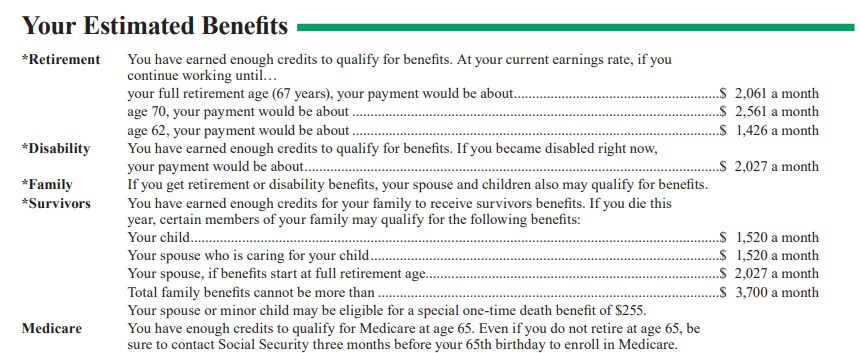

Social Security Retirement

Social Security #Retirementa Benefits

Publication # 10035

- Social Security Understanding the Benefits Publication # 10024 25 pages

- Self Employed & Social Security # 10022

- Retirement Check List # 10377

- Top Ten Facts about Social Security Center on Budget & Policy Priorities

- 2.5% increase for 2025

- Get an estimate of your Retirement benefits!

- 1st set up an ONLINE Social Security Account -

- You also need it to get enrolled in Medicare Parts A & B

- Your benefits will be in your account - example

- Or use this estimator on Social Security's Website

- Sample Your Social Security Statement

- Expand Social Security December 2024 - Double Dipping? Social Security Fairness Act

- 1st set up an ONLINE Social Security Account -

- 2022 COLA Cost of Living to increase 5.9% NewsMax.com *

- possible 9.6% Social Security cost-of-living adjustment in 2023 CNBC.com *

- Provisions Affecting Cost-of-Living Adjustment SSA.gov

- Money Geek - Introduction

- Links & Resources

- What you should know about your Retirement Plan DOL

- Proof of who you are

- History of Social Security

- History of Medicare on cms.gov

- govbooktalk.gpo.gov happy-birthday-medicare/

- Nolo - Social Security, Medicare, Medi Cal & Government Pensions Buy Book

- Our Webpages on Retirement

Resources & Links

- 2 page summary that comes with the policy

- Minimum Reserves required by California DOI

- Met Life Annuity Definitions – Glossary

- Annuity.com

- Annuities – CA Dept. of Insurance – What Seniors need to know

- IRS FAQ Required Minimum Distributions

- The wealth advisor.com new-irs-rule-lets-early-retirees-take-more-money-plans

- North American Life

- BROKER ONLY

IRS Tax Publications

Publication 590 A

#Contributions to IRA's

-

Publication 590 Individual Retirement Arrangements (IRAs)

- Traditional IRAs

- Who Can Open a Traditional IRA?

- When Can a Traditional IRA Be Opened?

- How Can a Traditional IRA Be Opened?

- How Much Can Be Contributed?

- When Can Contributions Be Made?

- How Much Can You Deduct? What if You Inherit an IRA?

- Can You Move Retirement Plan Assets? When Can You Withdraw or Use Assets?

- What Acts Result in Penalties or Additional Taxes?

- What assets can you put into your IRA?

- Roth IRAs

- Publication 590-A HTML

-

and Publication 590-B Distributions from Individual Retirement Arrangements (IRAs)

- Simple IRA for Small Biz # 4334

- Payroll Deduction IRA for Small Biz # 4587

- Payroll Deduction IRAs

- Simple IRA Plan Checklist Publication # 4284

- SEP Retirement Plans for Small Biz # 4333

- SEP Check list # 4258

- Individual Retirement Arrangements (IRAs)

- Roth IRAs 401(k) Plans 403(b) Plans

- SIMPLE IRA Plans (Savings Incentive Match Plans for Employees)

#Pension & Annuity Income

Publication 575 pdf * HTML

- VIDEO Basic taxation of annuities BROKER ONLY

- About 1099-R

- Required Minimum Distributions FAQ's IRS.Gov

- Lifetime Income - Annuity Calculator

- Get your annuity from [email protected] just use the tool to get an instant idea of what the market is.

Covered CA

Social Security & Retirement Income

MAGI Calculation

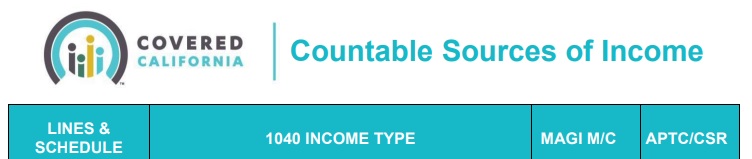

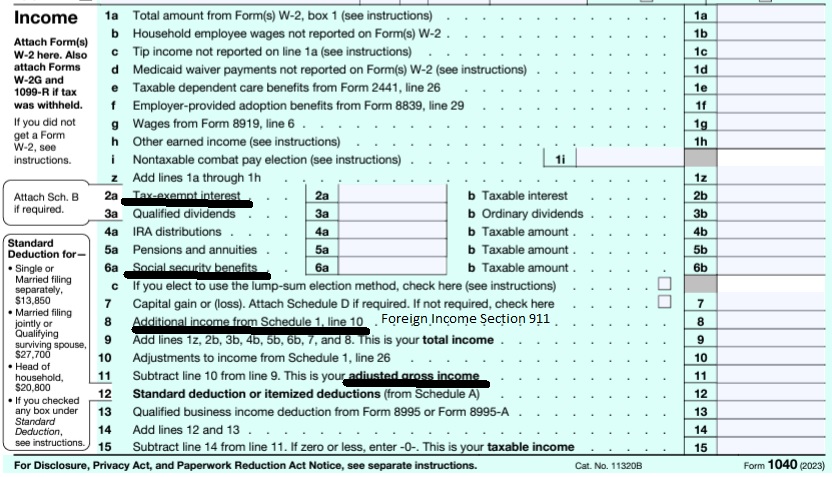

How much of your #Pension & Annuity Income goes on line 5a of IRS 1040 and

thus counts towards MAGI Income for Covered CA subsidies?

Covered CA (& Medi Cal) - Calculate - #Countable Sources of MAGI Income

Short Summary

Just the Count Taxable Portion of your Pension

- Reported on

Calculate your Covered CA MAGI Income

take #Line8b 11 Adjusted Gross income then add line 2a, 6a & 8 (Foreign Income)

- 1040 IRS Annual Tax Form

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

- IRA Retirement

- Health Savings Account

- Trumps Big Beautiful Bill - may lower line 6 A Social Security Income Learn More >>> Newsweek * PBS *

- Estimate next years MAGI Income?

- Get instant quotes, subsidy calculation and coverages

- NO ASSET TEST for MAGI based subsidies in Covered CA or MAGI Medi Cal Qualification. Steve's VIDEO

- Nor is there a lien against your estate for Covered CA or MAGI Medi Cal

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

Health Insurance unfortunately is very complicated

President Trump February 27, 2017

- Thus, if we haven't simplified and explained in PLAIN ENGLISH what you are looking for:

I’m under 65. Healthy. I get MAGI Medicaid in AZ.

What if I take my savings and put into an annuity?

Nothing will be considered MAGI income until I withdraw or take pay out,, correct??

If I buy annuity, will my MAGI Megicaid” free health insurance” be affected by any growth, until I cash it out.

MAGI Income is Line 11 Adjusted Gross income plus a couple of other minor things. See definition above.

What you have in Savings would not be income, except for the interest.

An Annuity would only be taxable on the interest when taken out.

Are you looking to lower your AGI – MAGI by having an IRA?

As far as Medicaid is concern, I don’t see any point in transferring $$$. Assets don’t count toward MAGI

MAGI Medi-Cal programs (including MCAP) and Covered California have no eligibility requirements related to assets – sometimes also called “property” or “resources.” Western Poverty Law

What other advantages were you looking for in an annuity.

No, you don’t pay taxes on the interest until you withdraw the $$$

Please note, I’m not a tax professional.

When taking withdraws from a NON-QUALIFIED ANNUITY:

Does ONLY the interest earned on the non-qualified annuity count towards the MAGI?

Or, does the principal(cost basis or purchase price) PLUS the interest earned count towards the MAGI?

We are not giving tax or legal advise. Here’s our research. Check with your CPA. This is really a question for your CPA as Covered CA MAGI goes mainly by what is your adjusted gross income.

A non-qualified annuity is purchased with after-tax dollars that were not from a tax-favored retirement plan. Non-qualified annuity premiums are not deductible from gross income.

Only your earnings are taxed as income; principal is not. Annuity.org

The amount of taxes on non-qualified annuities is determined by something called the exclusion ratio. The exclusion ratio is used to determine what percentage of annuity income payments is taxable and how much is not.

The idea is to determine the amount of a withdrawal or payment from an annuity is from the already-taxed principal and how much is considered taxable earnings. Read more Annuity.org

See page 18 of Publication 575