TSA Teacher’s Retirement Plans

Tax Sheltered Annuities

TSA’s Teacher Savings Account

Tax Sheltered Annuities

If you are a Teacher or an employee of many tax exempt organizations you are encouraged, permitted and allowed by the Internal Revenue Code §403 (b) to save for your retirement with a Tax Sheltered Annuity.

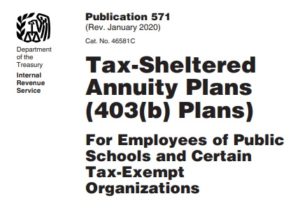

A 403(b) plan (tax-sheltered annuity plan or TSA) is a retirement plan offered by public schools and certain charities. It’s similar to a 401(k) plan maintained by a for-profit entity. Just as with a 401(k) plan, a 403(b) plan lets employees defer some of their salary into individual accounts. The deferred salary is generally not subject to federal or state income tax until it’s distributed. However, a 403(b) plan may also offer designated Roth accounts. Salary contributed to a Roth account is taxed currently, but is tax-free (including earnings) when distributed.

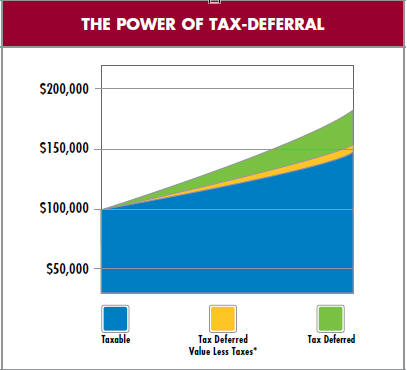

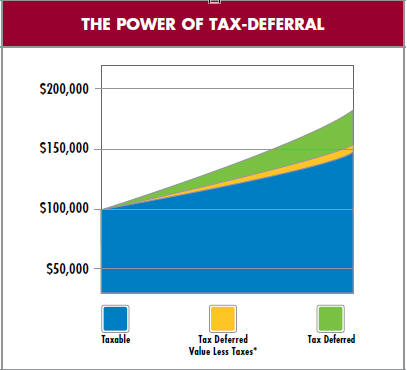

Take a look at the chart on the right or below to see how much more money you will have saved at Retirement, by using the power of Tax Deferral. North American Brochure

Eligible employers are a:

- public school, college, or university,

- church; or

- charitable entity tax-exempt under Section 501(c)(3) of the Internal Revenue Code

Email us for a complementary analysis & quote

Pros and Cons:

- Flexibility in contributions

- Investment options are limited to those chosen by the employer

- may have high administrative costs

- optional loans and hardship distributions add flexibility for employees

Additional resources & Links

- Annuities & MAGI Income Taxation Exemption Our webpage

- irs.gov/403b-tax-sheltered-annuity-plans

- FAQ’s 403 B Plans IRS.gov

- 403 B Plan Checklist IRS.gov

- Types of Retirement Plans IRS.gov

- Business Retirement Plans – Our webpage

- IRA – Individual Retirement Account Tax Deductible & Roth Our Webpage

- Social Security – Retirement Benefits Our Webpage

- 403b Play Book Steve’s Hard Drive Life Estate Planning – Annuities

- Fact Finder

- Email us [email protected] to get a plan going for you.

Power of Tax Deferral -

from North American Brochure

- IRS 403 b summary for participants publication # 4482

- Our main webpage on TSA Tax Sheltered Annuities - Teacher Savings Plans

- A 403(b) plan (also called a tax-sheltered annuity or TSA plan) is a retirement plan offered by public schools and certain 501(c)(3) tax-exempt organizations. Employees save for retirement by contributing to individual accounts. Employers can also contribute to employees' accounts.

- National Center for Education Statistics

FAQ’s

- How to recover from withdrawls to your Teacher’s Retirement Plan?

- used my retirement to try to save my husbands business

- I am beginning again and going into my second year of teaching along with years recently of long term and daily substitute teaching (not sure if any was put in for those years).

- I need to quickly get the most retirement I can.

- Which is better, faster, more;

- calstrs.com appears to be mandatory and automatic for you. Contributions are limited to a percentage of your earnings.

- Tsa’s, Tax Sheltered Annuities

- Please email us your date of birth, last years tax return, estimated earnings for 2016 and beyond, all relevant documents you’ve received from the school district, when you plan to retire and anything else that might be relevant.

- We need to figure out the maximum you can contribute to a TSA – Tax Sheltered Annuity. IRS Publication # 571 Page 4

- Email us [email protected] and give us your information, we will get you quotes and proposals..

- am a first grade teacher at xyz Elementary. I spoke with Curr HR about my plan about a year ago or a little over. My pay stub is currently showing that I pay $75 and it’s labeled TSA LIFE INS CO.

.- Try asking is this a life insurance policy or is a retirement plan policy?

- Try asking your HR Human Resources – Employee Benefits department

- I don’t see a such company as TSA Life Insurance.

- If Curr H was a licensed insurance agent, check the department of insurance website to locate him.

- If you can locate your policy or any illustrations, then we could review and let you know. See our page on finding a lost policy.

.

- What is the minimum contribution, premium or investment/month?

. - With Jackson National, it’s $5k/year. Let us know what you can afford and we can check out other plans for you.

. - If I have structured settlement that I took early due to disability do I have to pay tax on it?

. - Here’s my page on taxation of miscellaneous income.

- What kind of disability? Accident? Emotional distress? Work related?

- Publication 525 Taxation of Taxable and Non Taxable Income. Page 30 emotional distress Page 32 Lost Wages – Physical Injury

- Publication 575 Pension and Annuity Income.

- Paperwork & Rules for Yosemite.edu

- Allows TSA’s

- Won’t make recommendations or advice

- Salary Reduction Agreement

- Full time Certificated Employees Faculty & Counselors

- FAQs / Ask Us a Question

- CalSTRS.com

- More forms or make sure you get the latest form

- Get a TSA Tax Sheltered Annuity "Teachers Savings Plan"