Medi-Cal with a Share of Cost (SOC)

Medically Needy

Lower your Share of Cost with Medi Gap or Dental Coverage

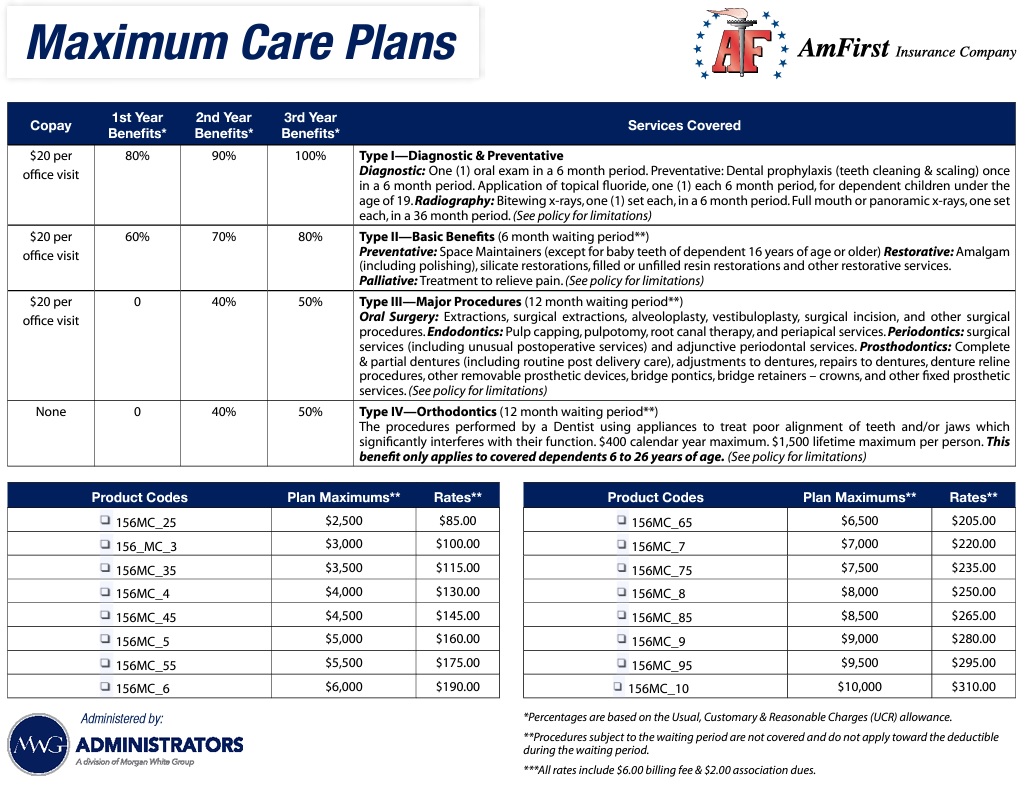

Dental Coverage designed to lower Income for Share of Cost Medi Cal

Our clients express how the plans work, better than we do! Hi Steve, Good Morning! Medi-Cal reviewed my Mom’s case and eliminated her share of cost effective as of February 1. My family is very grateful that this issue was resolved in a very timely manner. Thank you very much again for your assistance in facilitating this effort. I will definitely keep your contact information for any future insurance needs. Sincerely, Don V

****************** Hi Steve, THANK YOU SO MUCH for getting back with me. You are a wealth of knowledge and I am so grateful to connect with you …. Thank you! Carie C |

Need to spend more to comply with Zero Share of Cost?

Contact Us

[email protected]

-

- Upload Confidential Files or

- Send email to [email protected] and PauBox.com will encrypt it.

- Download our information to your contacts

- Medicare Intake Needs Assessment form (Berwick)

Dental For #Everyone,

has an excellent website with full brochures, Instant online quoting and enrollment

- One of our colleagues on how Dental for Everyone Works.

- Some of our webpages on dental

- VSP Vision

General Information on Share of Cost

Ways to lower your Medi-Cal #Share of Cost

If you don’t have Full Scope Medi Cal

Get a Vision, Dental or Medi Gap Policy

You can Avoid a Share of Cost in the (ABD-MN) Aged, Blind and Disabled – Medically #Needy Program (CANHR Fact Sheet 8.14.2023) (My highlighted version) program and then qualify for no-cost A & D FPL.

Just purchase California Code of Regulations :

- dental or vision insurance get quotes Quotit.

- Special Plan for Share of Cost – Maximum Care Plans

- I just heard at a CA Advocates HI CAP webinar that you can get several dental and vision policies. This kind of makes sense as there isn’t a COB Co Ordination of Benefits Clause on Individual Plans, so you could possibly collect more than the actual claim

- Medi-Gap

- Note that if you have Kaiser or another Medicare Advantage Program, you can’t get Medi Gap

- We are NOT telling you to cancel your MAPD program, but you might want to consider it.

- MAPD vs Lower Share of Cost?

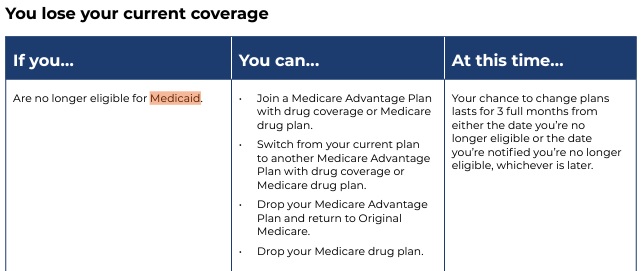

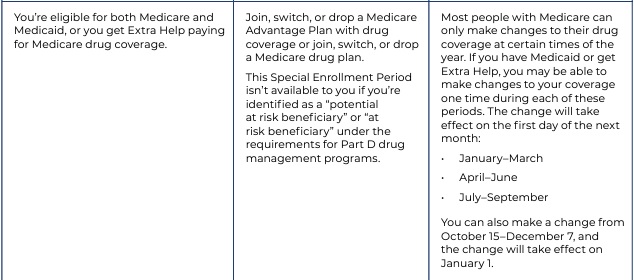

- SEP’s Special Enrollment Periods to drop MAPD if Medi Medi any quarter Medicare.gov

- GET QUOTES & ENROLL Medi Gap Quotit *

- Contact us [email protected] if you want quotes from UHC AARP

- Note that if you have Kaiser or another Medicare Advantage Program, you can’t get Medi Gap

- Part B Medicare

- Part D Rx,

- Do you have this in your Medicare Advantage Program?

How much do I have to spend to eliminate share of Cost?

-

- Yeah, it’s very confusing. Please scroll down and read everything. Send us your paperwork and we can review, [email protected]

- Log into Benefits Cal.org and see if you can find the information there.

- Check with your Medi Cal Social Worker

- See the worksheets below

- Send us your NOTICE OF ACTION, all documents, etc. from Medi Cal

- Understanding the Shared Monthly Cost for Medi-Cal CANHR

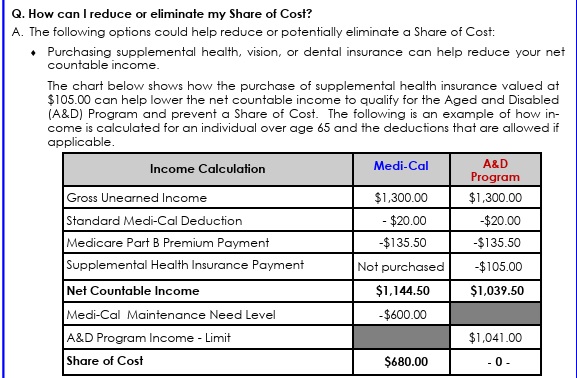

- How can I reduce or eliminate my shared monthly cost?

- The most common way to reduce or avoid a shared monthly cost is to purchase supplemental health insurance policies to lower countable income, such as supplemental dental, vision, or a Medicare Part D prescription drug plan. See above for more. It’s important to note that not everyone can purchase these plans. The monthly cost of these health insurance plans lower your countable income, which may help you qualify for Medi-Cal with no shared monthly cost.

Footnotes * Wikipedia * Investopedia * Merriam – Webster * Things to know about Share of Cost * HICAP *

Share of Cost: “A person’s or family’s net income in excess of their maintenance need that must be paid or obligated toward the cost of health care services before the person or family may be certified and receive Medi-Cal.” 22 CCR § 50090 * Western Poverty Law *

Worksheet for Medi Cal with no share of cost

- Source – ABD FPL Worksheet Single Adult – Not Living in Board & Care Disability Rights

- Aged & Disabled, Medically Needy, and Working Disabled Medi-Cal Programs January 2024 CANHR

- CHCF explanation SOC Share of Cost Rev December 2017

- Includes cost calculation worksheets The most Plain English explanation I’ve found!

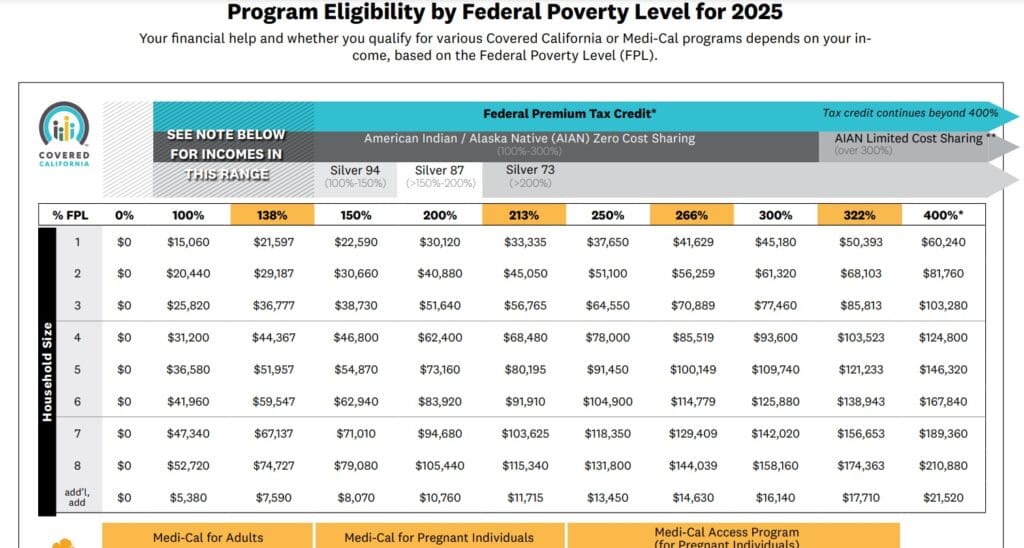

- Is the amount in Step 13 equal to or less than $1,801 effective 4/1/2025 Canhr * That amount is 138% of the FPL.

- If yes, then you qualify for Medi-Cal with no share of cost.

- 2024 Covered CA Chart for 138% FPL

- Two years ago, California state officials agreed to change the $600-a-month allocation for other needs to match 138% of the federal poverty level. (That figure, which changes annually, is the same one California generally sets as the income limit for Medi-Cal.) This year, that would amount to over $1,700 a month.The new level was supposed to go into effect in January 2025, but the plan was jettisoned amid a state budget deficit. Groups that advocate for the elderly and disabled are now asking the state to make it happen in 2026. Read More >>> LA Times 11.27.2024

- Aged & Disabled Federal Poverty Level Medi-Cal (A&D FPL).

If you are aged or disabled, and are not eligible for SSI, you may be able to get Medi-Cal through the Aged & Disabled Federal Poverty Level (A&D FPL) program. You must:- Be either aged (65+), or disabled (meet Social Security’s definition of disability, even if your disability is blindness)

- Have less than $1,732 in countable monthly income for an individual ($2,351 for a couple).

- canhr.org/aged-disabled-medi-cal-program/

- If you are single and live on your own, follow these steps to figure out if your countable income makes you eligible for A&D FPL Medi-Cal. If you live with others, you should use DB101’s Benefits and Work Estimator.

- Find your total countable income using Social Security’s rules. DB 101

- Source - Covered CA

- Covered California’s Rates and Plans for 2025: The Most Financial Support Ever to Help More Californians Pay for Health Insurance Press Release 7/24/2024

- When Your Tax Return Income Makes You Medi-Cal Eligible Insure Me Kevin

- American Rescue Plan of 2021 (APRA) aka Covid Relief Bill - MORE subsidies!

- See footnotes & FAQ's below!

- Divide by 12 for monthly Medi Cal Figure $1,731.91

More explanation, details & Faq’s

Explanation of Share of Cost #SOC

If your monthly income is higher than the limits to qualify for SSI or the A&D FPL program, but you meet the criteria of the low asset-level requirements, you may still qualify and be eligible for Medi-Cal with a share of cost (SOC).

SOC functions like a deductible, it’s not a percentage, like a Co-Pay. You must pay this amount in any month you incur medical costs. After your SOC is paid, Medi-Cal will pay the remaining amount of your medical bills for that month.

Note: A SOC is not a monthly premium. It is more like a deductible. It is the amount of medical expenses you are responsible to pay for before you can get full Medi-Cal coverage for the remainder of the month. If you have no medical expenses, you pay nothing.

More detail on how & where to pay your share of cost when you have IHSS In-Home Supportive Services Scroll down and see our references & links too.

Income Limits

To be eligible for the A&D FPL or the Blind FPL Medi-Cal programs, an applicant’s Countable Income for SSI Program cannot exceed a level set by the state that is based on the Federal Poverty Level. The countable monthly income limit for an individual adult or child is based upon the Federal Poverty Level (100% FPL), plus $230.37 Welf. & Inst. Code § 14005.40(c)(1) See Western Poverty Law Page 91 for what seems like the best and understandable explanation

Cal Matters – Problems with Income Limits – Inflations – Numbers haven’t changed in 30 years.

References & Links

- CHCF explanation SOC Share of Cost Rev December 2017

- Includes cost calculation worksheets

- CANHR Aged & Disabled Program

- CA Health Care Advocates

- Health Consumer Alliance Fact Sheet

- Disability Rights CA Share of Cost – Nursing Home Resident

- Bridget MacKay Law

- Medi-Cal What it means to you Phamplet outdated?

- Covered CA Agent Certification Circa 11.2013 Page 5 et seq)

- Health Rights Hotline. Our number is 1-888-354-4474.

- 1-800-952-5253 to get a fair hearing

- Medi-Cal Contact Info

- Working Disabled Program – Premium may be less than Share of Cost

- Nolo – Spend Down

- Health Consumer Alliance Helping Californians get the health care they need

- McKay Law Medicaid Qualification

- CA Department of Aging Find Services

- This overview of the Medi-Cal program addresses issues relevant to older adults and persons with disabilities. At the end of this chapter is a listing of other sources of information about Medi-Cal, including information about consumer informational fliers and Medi-Cal mental health services. Bet Tsezak

- Eligibility Procedure Manual dhsc.gov

- Medi Cal Provider Manual SOC

- IHSS Share of Cost

- AB 1900 to Relieve California’s Seniors, the Disabled, and Low-Income Families from the Hardship of Medi-Cal ‘Share of Cost’ Expenses

- Ways to Lower or Stop your Medi-Cal Share of Cost

- Medi-Cal Notice of Action (NOA) – Frequently Asked Questions

- Medi Cal Forms

FAQ’s

Getting additional Insurance to #lower SOC Share of Cost

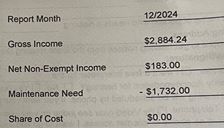

Question Hi, My father was approved for IHSS In Home Supportive Services under Medi-Cal with share of cost. His SOC is $1723 which extremely high. His income from SS and pension is about $2,500. He currently has senior advantage with Kaiser. NO additional insurance. How could he spend $646 in insurance premium to eliminate his share of cost?

Answer – Please send us [email protected] all the paperwork from Medi Cal so that we can review it. We will not post any confidential or identifying information. Would you consider dropping Kaiser to get a Medi Gap plan?

FAQ’s

- Question – What proof do I need to show I have extra coverage to lower share of cost?

. - Answer – Submit proof of your health insurance premiums to the county Medi-Cal office, and ask them to recalculate your shared monthly cost. Canhr.org *

- Question If my father has private pay providers in the home or 160 hours per week and IHSS has granted him 90 hours per month how is the share of cost met?

. - Answer Visit the IHSS webpage

- Twice a month, both you and your provider who works for you will receive an “Explanation of IHSS SOC” letter that will tell you how much money to pay the provider. Remember, the SOC is part of provider’s salary. You, as the IHSS recipient, must pay the SOC, if any, to the provider monthly. The SOC may change from month to month.

- For questions regarding SOC, contact your Social Worker at (888) 822-9622,.

.

.

- Question With SOC Share of Cost at 770.00 do I need to present the card at routine office visits, or present it only if medical expense is greater than 770.00. ?

. - Answer Yes, that way you get the Medi-Cal Negotiated Rate.

- Do you have another ID card to present to get services?

- Are you in a Managed Care Plan?

- Also, it let’s Medi-Cal keep track of the “deductible”

- Yes, Medicare.

- If the medical cost is 1000.00, Medicare would pay 80% .

- Is the 770.00 covered by that, then, Medi-cal would pay the 20% ?

- I do not have part D. Would Medi-cal cover prescriptions for the above situation?

- Yes, but check, Medi Cal may have assigned you to a Part D Plan

- And, if I have a routine office visit and present the Medical card, do I have to pay 770.00 for that one visit during the month?

- Let’s check our page on Dual Coverage & Medicare

- You’re question goes beyond my pay grade (Zero, I don’t get paid) Try asking [email protected] Please post her response in comments below. Or Medi Cal and Social Service agencies.

.

- Question My Dad is in skilled nursing but WILL be coming home in a few months.

- Medi-Cal says his share of cost is all of his income, less $50 (he gets to keep $50).

- The problem with this is that he and I share a rented house. He also has a car payment. Neither of these things are taken into account?

- So they don’t take into account that he needs a home to go home to?

.

- Answer You’re questions probably goes beyond my pay grade (Zero).

- We’ve done a lot of updating to this page, since the question was originally asked. Please review the entire page

.

- We’ve done a lot of updating to this page, since the question was originally asked. Please review the entire page

- Question If I have Share of Cost, can I get a Covered CA plan with Subsidies? APTC

. - Yes, since SOC is NOT minimum essential coverage so they can qualify for financial assistance through Covered California.

- Minimum essential coverage includes:

- Full-scope Medi-Cal programs, including the Targeted Low-Income Children’s Program (former Healthy Families program),43 Medi-Cal Access Program (MCAP – former AIM program), and Refugee Medical Assistance programs administered by Medi-Cal;44

- Medi-Cal Share of Cost programs and programs with limited scope of services such as Minor Consent), individuals enrolled in these programs can simultaneously enroll in a Covered California plan with advanced premium tax credits so long as they meet Covered California’s eligibility criteria.

- Medi-Cal only covers what Covered California does not, such as In-Home Supportive Services, adult dental, or long-term care, so individuals should check provider networks before picking a Covered California plan for most regular health services. Western Poverty Law *

- Plans with Covered CA subsidies? Get quote…

- Get Covered CA quotes.

.

- Question How does Medi-Cal share of cost work with Medicare Part D Rx Prescription coverage?

. - Answer If you are receiving both Medicare and Medi-Cal benefits, the Medicare Part D drug benefit will provide your prescription-drug coverage instead of Medi-Cal.

- You must be enrolled in a Medicare Part D drug plan or a Medicare Advantage prescription drug plan to get these benefits. Medi-Cal, however, will pay for certain categories of drugs not covered by Part D, including:

- Drugs used for smoking cessation

- Certain cough and cold drugs

- Certain over-the-counter drugs

- Vitamins and minerals

- With Medicare Part D drug coverage, you must make copayments of no more than $1.30 for generic drugs and $8.95 brand name drugs in 2020. The Low-Income Subsidy (LIS) program, also known as the “Extra Help” program, will pay for part or all Medicare Part D drug-benefit plan premiums, depending on the plan in which you are enrolled. Learn more about the Extra Help program and the Medicare Part D drug benefit.

.

- You must be enrolled in a Medicare Part D drug plan or a Medicare Advantage prescription drug plan to get these benefits. Medi-Cal, however, will pay for certain categories of drugs not covered by Part D, including:

- Question My elderly mother has dementia and we applied to In home supportive services with a Medi Cal share of cost of $993 dollars

- to qualify for full medi cal she would need to purchase $111 in extra insurance a month and

- she currently has AARP united healthcare Medicare Advantage insurance.

- Due to pre existing conditions and medical underwriting we are having trouble trying to switch to traditional Medicare with a Medicap supplement and

- we are wondering what other insurance options could qualify her for full medi cal with no share of cost.

..

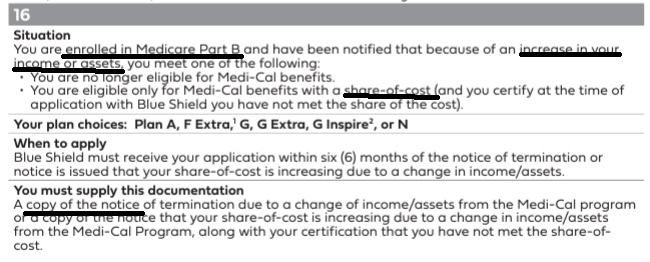

- See situation # 16 above, it looks to me like you can get Medi Gap guaranteed issue.

- Here’s a video explanation of our research and answer to your question.

- You can also get dental & vision coverage.

- I will grant that it’s very confusing on the time periods that you can enroll or exit a Medicare Advantage Plan.

- So, if you want Medi Gap, you might enroll in a Part D Rx plan. That would then cancel your MAPD with AARP. Then you could enroll in Medi Gap guaranteed issue.

- Let me know if you want to do this, send all of the documentation from Medi Cal and I will double check with the higher ups in the “Chain of Command.”

- Do you have LIS Low Income Subsidy, to help with Part D Rx costs?

- Excerpt from Medicare.Gov Publication 11219.

.

- Question Does veteran aid & attendance or death benefits as unearned income count towards share of cost?.

. - Answer Your question is beyond our pay grade. Which is Zero. We don’t make a nickel unless you were to get a Medi Gap plan where we make say a 10% commission, paid by the Insurance Company, so there is no additional charge to you.

- Thus, here’s our research, not legal advise.

- The simple answer is MAGI Income, what’s on the Tax Return…

- What if one has a million dollar income from investments? That’s unearned, right?

- Income Limits.

- To be eligible for the A&D FPL or the Blind FPL Medi-Cal programs, an applicant’s countable income cannot exceed a level set by the state that is based on the Federal Poverty Level. The countable monthly income limit for an individual adult or child is based upon the Federal Poverty Level (100% FPL), plus $230.37 Welf. & Inst. Code § 14005.40(c)(1)

- See Western Poverty Law Page 91 for what seems like the best and understandable explanation

- Countable Income for SSI Program

- Income definition

- Income is anything you receive during a calendar month and can use to meet your needs for food or shelter. It may be in cash or in kind.

- In-kind income is not cash; it is food or shelter, or something you can use to get food or shelter.

- Countable Income definition

- Countable income is the amount left over after:

- Eliminating from consideration all items that are not income; and

Applying all appropriate exclusions to the items that are income.

Countable income is determined on a calendar month basis. It is the amount actually subtracted from the maximum Federal benefit to determine your eligibility and to compute your monthly payment amount. - (a) Gross unearned income includes:

- (6) Veterans payments which include:

- (A) Pensions based on need.

- (B) Compensation payments.

- (C) Educational assistance.

- Section 50507 – Gross Unearned Income

- California Code of Regulations Article 10 Income Section 50501 – 50571

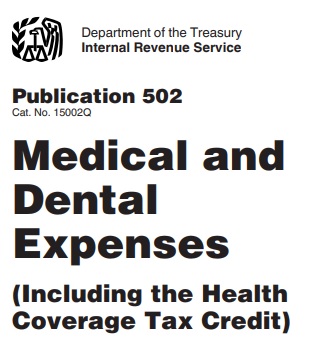

IRS Publication 502 pdf * html

Medical & Dental #Expenses

- Aetna Listing of HSA allowable expense

- Corona Virus Costs IRS HDHP

- Can one pay Health Insurance Premiums from an HSA?

- Medical Necessity?

- Insurance Premiums? Deductibility? Publication 502

- Medical expenses include the premiums you pay for insurance that covers the expenses of medical care, and the amounts you pay for transportation to get medical care.

- Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract.

- Turbo Tax

- Schedule A 1040 Itemized Deductions

Clarification from Hi Cap

Hello Mr. Shorr,

Mrs. Burns shared your latest email with me, and I will respond.

- First, California Health Advocates (CHA) focuses primarily on Medicare issues. We leave the topic of Medi-Cal calculations and regulations for share of cost determination to the appropriate county Medi-Cal office.

- Second, when Medicare beneficiaries request help from the local HICAP, we encounter the fact that many beneficiaries are very much connected to their Medicare Advantage Plan, and often that works against them if they have a large Medi-Cal Share of Cost (SOC) . Sometimes the only option is to return to Original Medicare during the Open Enrollment (October 15 to December 7), or other Special Enrollment Periods, and try to get a Medi gap with a premium that will help them with reducing their countable income. But then as you know, their situation would have to meet one of California’s Guarantee Issue regulations, otherwise they’d be subject to underwriting.

- Third, if a beneficiary feels that their SOC was not calculated correctly, the HICAP can refer the beneficiary to their

- Area Agency on Aging partner – Legal Services – for assistance. [Bet Tzedek – Los Angeles]

- This is the proper referral as established under the Older Americans Act.

I hope this helps with your concerns, and have to emphasize that CHA does NOT do policy or advocacy work on Medi-Cal related issues.

All the best,

Tatiana

Tatiana Fassieux

Education & Training Specialist

California Health Advocates (CHA)

FAQ’s

- IHSS In Home Supportive Services

- My son is disabled, he has a developmental and mental condition. He receives medicare and medi-cal. Could you please let me know if he is eligible for Full Scope Medicare [Medi-Cal].

- This is beyond our pay grade. Fill out the application for Medi Cal and see.

- He needs dental work and according to the dentist he is not covered.

- Mother and care taker.

. - Does he get SSI? That would qualify him for full scope Medi Cal.

- See above for information on Dental for Medi Cal

- See our IHSS FAQ Section

- Did your son qualify for Medi Cal under the aged and disabled program?

- See the rules in Western Poverty Guide Page 78

- This page might be easier to read on CA Health Care Advocates. Do you meet the qualifications?

- Here’s contact information for Medi Cal. Do you have an online portal with them? What county are you in?

- Try calling Denti Cal 1-800-322-6384

.

.

- Does Full Scope Medi-Cal work as HMO plan or not?

. - See above about Mandatory HMO Enrollment

.

. - if I got full scope medi cal do I have to purchase supplemental insurance

.- Depends on what you mean by “supplemental?” The “health” insurance portion of Medi-Cal is pretty comprehensive. Most everything is zero co-pay. Even dental is covered. Take a look at the Summary of benefits for the HMO you get assigned to. See if there are any gaps your concerned about.

- I don’t know why they want Medicare for All, with 30 percent of California’s on Medi-Cal, it might look more like Medi Cal for all. Did we get to keep our doctors?

- You might want to look at:

- Life Insurance, you can get a quote right on this page.

.

.

- Life Insurance, you can get a quote right on this page.

- My child wants to play sports at his public school. They are telling me that Medi-Cal isn’t good enough. What can I do?

- We are unable to find anything online about high schools requiring health insurance. Please send us they letter from your school.

.

.

- We are unable to find anything online about high schools requiring health insurance. Please send us they letter from your school.

- 3. What is the difference in coverage between Medi-Cal and Covered California?

.- Medi-Cal is health coverage, just like the coverage offered through Covered California. Medi-Cal provides benefits similar to the coverage options available through Covered California, but often at lower or no cost to you or your family. All of the health plans offered through Covered California or by Medi-Cal include the same comprehensive set of benefits known as “essential health benefits.”

- Essential health benefits . dhcs.ca.gov/Medi-Cal FAQs

.

.

- My client has a share of cost with Medi-Cal of $439, and they currently have IHSS. and IHSS states NO SHARE OF COST

- Here’s my question, that is complicated to me.

- They also qualify under the Aged-FPL Program which is has NO share of cost.

- So does that mean they do not have to Pay the $439 to their Care-provider.

- They have a Medicare Part B premium,

- an additional policy for vision, and dental as a medical deduction.

- Please advised.

.

.

- Do they have to pay in sharing the cost for a CAREGIVER $439 or NOT We are in Alameda County.

- See our IHSS FAQ Section

- See our Medi Cal related pages above

Resources & Links

- Worksheets for Determining Eligibility Under the Aged & Disabled Federal Poverty Level (A&D FPL) Medi-Cal Program Disability Rights CA

- CHCF explanation SOC Share of Cost Rev December 2017

- Includes cost calculation worksheets

- Chapter 2 – DETERMINATION OF MEDI-CAL ELIGIBILITY AND SHARE OF COST

- Medically #Needy Program (CANHR Fact Sheet 8.14.2023) (My highlighted version)

- ABD FPL Worksheet Adult with an Ineligible Spouse and/or Children Disability Rights

- ABD FPL Worksheet Eligible Couples – Not living in Board & Care

- Western Poverty Law *

- CA Health Care Advocates * Read the full article from CHCF *

- AB 715 Fact Sheet *

- CHCF for 3 other examples!

- California Code of Regulations

- Chapter 2 – DETERMINATION OF MEDI-CAL ELIGIBILITY AND SHARE OF COST

- CHFC explanation of Share of Cost

- Legal Aid of San Mateo is your Share of Cost Calculated Correctly

- CA Code of Regulations Article 10 Income

- Phone Call Catherina Lukas @ Dept of Managed Health Care Notice of Action

- 138% net non exempt

- $600 maintenance

- $1233

- -20 any income deduction

- $1213

- -174.70 Medicare Part B Premium

- 1039

- 1617 2023 Federal Poverty Level

- Hi, Mr. D needs $508 or more of health insurance each month to qualify for free Medi-Cal.

- He does have Medicare B. The Medicare B premium of $175 is used as a deduction.

- This is the calculation:

- His income is $2434- $175 (Medicare B)- $20 (unearned income deduction) = $2239 – $1732 (Aged and Disabled Income limit) = $507 +$1= $508.

- He has over $508 of medical related expenses each month, so it is worthwhile to purchase the insurance. bet tzedek.org/get-help/

- Phone Call Catherina Lukas @ Dept of Managed Health Care Notice of Action

Resources & Links

- How share of cost works and suggestions to eliminate it. HI Cap Contra Costa County

- CANHR Aged & Disabled

- Medi Helper Medi Cal Consulting

- Scroll down and see more explanations and our other references & links.

- If you are in share of cost, you get fee for service, not mandatory HMO

- CA Health Care Advocates Webinars

More information on Medi Gap Plans & Quotes

Guaranteed Right to get Medi Gap if your #Medi-Cal benefits change...

- You can deduct the cost of that policy or product and that may help them get under the strict income limit in the Aged & Disabled Federal Poverty Level FPL and Blind FPL programs. See above, you must have original Medicare, A & B not Medicare Advantage. Learn More Medicare.gov

- You may be able to drop Medicare Advantage - but that is up to YOU! We are not telling you to do it!

- If your purchase private health insurance with coverage that duplicates Medi-Cal coverage, the private health coverage would be billed first and then Medi–Cal would pay for the services it covers after the private health carrier pays or denies a claim. Our webpage on Dual Coverage * Western Center Law & Poverty Guide for Low Income Americans * CA Code of Regulations 22 § 50555.2 * Health Care Rights.org *

Guaranteed Issue Rules to Get Medi Gap

- Here’s a video explanation of our research on how one might get Medi Gap even if they are not healthy. If you have a Medicare Advantage plan, see also Situation # 17

- Visit our Medi Gap Guaranteed Issue Page

- Problems getting Medi Gap if you have full benefits Medi Cal?

Right to Opt out of Medicare Advantage

Introduction to #MediGap

Our video explaining the Governments brochure on choosing a Medi Gap Policy. Click the little square on the right, to enlarge the video.

- 2025 Official Medicare Guide to choosing a Medi Gap Policy # 02110

- Spanish

- Get Quotes for Medi Gap Quotit

- Medicare Supplement Policies CA Insurance Code §§10192.1 - 10192.24

- CA Health Care Advocates HI CAP Fact Sheet

- If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered health care costs. In most Medigap policies, you agree to have the Medigap insurance company get your Part B claim information directly from Medicare. Then, your Medigap policy will pay your doctor whatever amount you owe under your policy and you’re responsible for any costs that are left. Learn More >>> Medicare.Gov

- Prior Authorization NOT Required! Askchapter.org *

- Supplementing Medicare: An Overview 10-30-20 Hi Cap

- Supplementing Medicare: Medigap Plans 12-14-23 Hi Cap

- Your Rights to Purchase a Medigap 12-14-23 HI Cap

- Search for Participating Doctors & Hospitals - Just about ALL of them!

- Anthem Blue Cross Information & Enrollment

- United Health Care

- Blue Shield – Medi-Gap Information & Enrollment

- Health Net

-

Medi Gap pays the medical expenses that Original Medicare Part A (Hospital) and Part B (Doctor) doesn't. Check out the chart on this page to see what Medicare Pays, what you pay and what a Medi Gap plan pays.

- If you have a Medigap policy and get care, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medi-gap policy will pay its share. You’re responsible for any costs that are left. Medicare.Gov *

- More than half of all fee-for-service Medicare enrollees without any additional coverage chose a Medicare Supplement plan in 2021 Health Care Finance *

-

Original Medicare, Medicare Advantage nor Medi Gap pay for long term care either in a nursing home or at home care. Get more information on Long Term Care here.

-

Even if you think you can't afford any extra premiums, there's a lot of valuable information to help with planning.

-

Share of Cost

Reform

Problems with Share of Cost and spending $500 on a $2,500 Social Security Check

- I have already written to Steve lopez [Los Angeles Times]. I am looking to make a difference here and I have explained this to the social worker who called me just now from Medi-Cal. I asked her to pass the information up to her supervisor and to her supervisor supervisor and to the mayor of this city and to the representatives of this District until we get some satisfaction. Steve has already shown me that 70 organizations have already written to the governor on this matter.

- Further the social worker informed me that it is not retroactive meaning that I am responsible for the $1812 in April that were not paid to the IHSS caregiver involved at the time.

- She now tells me that she is suing me and taking me to court to get the money. She also asked me to lie and approve all of her hours the rest of April even though she did not work those hours. She quit and abandoned me on April 23rd at 12:30 p.m.. I texted her as she going to return? The answer was unfortunately no.

- I did some calculations today and what we have done in terms of the expenses I now will have for the insurances to lower my income so that I don’t have an $1,800/month share of cost is going to eat up my fixed income per month.

- $2,500 Social Security Income

- – 430 Medi Gap Premium

- – 93 Dental

- This is a huge tragedy that is going to prohibit me from having a caregiver until the earliest in July and maybe not even then. I can’t begin to tell you how much I have been suffering and now I have to pay my caregiver to come here privately to give me a shower and take care of some other things that I’m just unable to do now. The last shower I had taken before today was last Sunday. And I literally have worn the same clothes and had no shower until today, friday, and now he will return on Tuesday evening because I have another medical appointment on Wednesday.

- My strength and stamina are being depleted more and more each day. I believe that what is necessary is that if you can and are willing, please call and describe to my Social Worker at Bet Tzedek what I’m experiencing and see if we can’t get some reporter to come here and interview me and make this story and travesty go Nationwide and also let me demand that this insanity of not taking into account a senior’s income level in the calculation of the share of cost.

- I literally am unable to pay what I already owe and I’m being dug into a deeper and deeper hole each month. The nation must be awakened to the fact that Medicaid and Medi-Cal are stifling out the lives of seniors like me and perhaps even killing them if stamina gives out and their life ends. I’ve already had three strokes. I have avoided a fourth since 2015 because of the excellent medical care I have received from Dr Leonard scuderi cardiologist and many others.

- How much stress can I take before the 4th stroke does occur and I become more debilitated than I am or in fact die? Has my time now caught up with me and my end of life is in sight?

- Feel free to send this email to G-d and everyone see if there isn’t a way to stir up notoriety about this mess of my life now.

- I’m happy to represent any and every senior across this country who is facing the same insanity.

Resources & Links

- Using Your Medi-Cal Share of Cost if You are a Nursing Facility Resident April 2017 Disability Rights

- Important Health Care Changes Coming in 2022 for Low-Income Older Californians Justice in Aging

- In-Home Supportive Services (IHSS)

- Jewish Family Service LA – open to everyone

- UNDERSTANDING THE SHARED MONTHLY COST FOR MEDI-CAL CANHR

Pending Legislation Links

- AB 1900 (Arambula) Fact Sheet Problem: Increase Maintenance Need Income Levels Make the Medi-Cal Share-of-Cost Program Affordable Justice in Aging

- California Health Advocates, along with 70 other advocacy organizations statewide, submitted a letter to Governor Newsom requesting that implementation of Medi-Cal Share of Cost reform be included in his January 2024-25 Budget Proposal.

- Proposed State Legislation Aims to End Medi-Cal’s Senior Penalty April 2018

- Mandatory payroll deduction for retirement Cal Savers

- California Proposes State-Wide Long Term Care Insurance Program January 2024

- Find and contact elected officials

- Conlan v. Shewry, Medi-Cal may be able to reimburse you for covered medical and/or dental expenses you paid.

- Thirty-year-old Medi-Cal income limit leaves some seniors without needed care June 2022 Cal Matters

- Asset Limits

- Medicare Savings Programs

- Our Webpage on LIS Low Income Subsidy – Extra Help

- Determination of Medi-Cal Eligibility and Share of Cost Westlaw

I appreciate your guidance on getting to zero share of cost, very informative! 🌟

Thank you for your help – I’ve spent years trying to figure this out and I’m glad you were able to help me.

https://tinyurl.com/ShareOfCost

Hi Steve,

Thank you for the nice presentation, [Loom explanation of an email] very helpful to see everything onscreen.

Best regards,

Leslie

UHC dental

Hi Steve,

Our zoom meeting this morning was very much appreciated.

I really benefited a lot from our discussion

Thank you very much for your assistance.

Sincerely,

Don V

Hi Steve,

I need to reduce the “share of cost” with Medi-Cal by insurance premiums by $257.66 or thereabouts for my 67 yo brother who has dementia, left eye blindness, insulin dependent diabetes and goes to dialysis 3 times a week.

We are comfortable with Kaiser. We also purchase Kaiser Senior Advantage plus for $21 and AARP Delta Dental PPO for $75.

I am currently waiting for an APPEAL to reduce or eliminate the Medi-Cal SOC

On what basis are you filing an appeal?

How about lowering share of cost by getting additional health coverage?

Please send us all documents rec’d from Medi Cal. [email protected] Our email is encrypted by Paubox.

https://www.dhcs.ca.gov/provgovpart/Pages/Medicare-Advantage-Information-for-Dual-Eligible-Beneficiaries.aspx

Hi, will share of cost maintenance fee increase from $600 to 1732 in California?

Maximum amount of spousal impoverished from 3850 to 3950?

Thank you

Katie

No

There was a bill to increase the maintenance to 138% of Federal Poverty Level – Covered CA Chart – or $1,732 but it didn’t pass. Learn More… CA Health Care Advocates Justice in Aging