Insurance Premium Rate – Premium Regulation

Department of Insurance Rate Regulation

authority to lower rates

- The CA Department of Insurance (DOI) has authority to “push” rates increase down, as premium increases must be certified to be actuarially sound, but the DOI does not have authority to establish rates. Modern Health Care 4.22.2015 DOI RIPS Anthem Rate Hikes on Grandfathered Plans

- Please note though, under Health Care reform the 80% Medical Loss Ratio (MLR) rule, where rebates must be given if are not enough claims paid out.

The #rate review process of Medical Loss Ratio

The rate review process of Medical Loss Ratio does not presume that an increase above 80% is unreasonable,

***Please note, this may be prior to ACA/Health Care Reform. Check our citations below

nor does it prevent issuers from increasing rates. The process only requires such increases be reviewed and that certain information be made public. When HHS reviews a rate increase, HHS will determine that the rate increase is unreasonable if the increase is:

- Excessive – meaning the increase causes the premium charged for the health insurance coverage to be unreasonably high in relation to the benefits provided.

- Unjustified – meaning the data or documentation the issuer provides to HHS in connection with the increase is incomplete, inadequate or otherwise does not provide a basis upon which the reasonableness of an increase may be determined.

- Unfairly discriminatory – meaning the increase results in premium differences between insured’s within similar risk categories that (1) are not permissible under applicable state law or (2) in the absence of an applicable state law, do not reasonably correspond to differences in expected costs.

The examination must include an analysis of all of the following:

- The impact of medical trend changes by major service categories

- The impact of utilization changes by major service categories

- The impact of cost-sharing changes by major service categories

- The impact of benefit changes

- The impact of changes in enrollee risk profile

- The impact of any overestimate or underestimate of medical trend for prior year periods related to the rate increase

- The impact of changes in reserve needs

- The impact of changes in administrative costs related to programs that improve health care quality

- The impact of changes in other administrative costs

- The impact of changes in applicable taxes, licensing or regulatory fees;

- Medical loss ratio

- The issuer’s risk-based capital status relative to national standards (Blue Cross Memo on Rate Review) 6/2011 Update 154.205 Federal Regulation

- Health Care.Gov Tool to find out about Rate Increases or Loss Ratio for each Insurance Company

- dmhc.ca.gov/rate review/

- Anthem Small Group Rate Review anthem.com

- CA Dept of Insurance

- Misc…

- Should drinkers pay more for health insurance? Surgeon general warning stirs debate USA Today January 2025

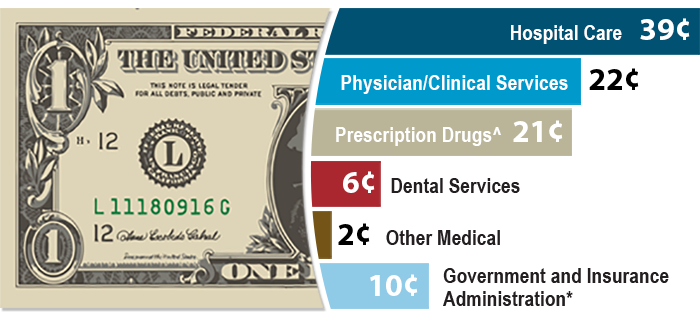

Medical Loss Ratio 80% Claims - 20% Operating Costs & Profit

So, why trade $$$ back and forth if you can afford not to?

Image from BCBS.com

Steve's Explanation of MLR Medical Loss Ratio

More Video's

- Kaiser Health News - Medical Loss Ratio video

- White House – YouTube Channel on Health Care Reform

- Tom Petersen Insurance 101 History of Lloyds to present EXCELLENT!!!

- Our Webpage on MLR & Actuarial Value

Consumer Resources

- View CA DOI Health Insurance Rate Increase requests

- Anthem Blue Cross Bulletin on Rate Review

- Rating Rules – Health Care Reform

- Do you want to put in your 2c and make Comments?

Technical Links & Resources

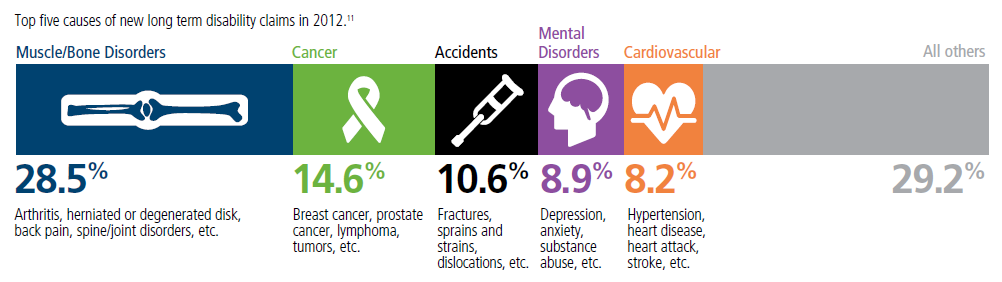

Top 5 - 10 causes of Long Term Disability Claims

Lower back disorders ♦ Depression ♦ Coronary heart disease, arthritis and pulmonary diseases (Met Life) ♦ Disability Can Happen ♦ CDC Statistics

Our webpage on Disability Payments - Insurance

Get Disability Quotes for Parents, Caretakers & Wage Earners

#Advocates Guide to Surprise Medical Bills

- Hidden Cost of Surprise Medical Bills 3.3.2016 Time Magazine

- heart bypass surgery, replacement of one valve and repair of another. raging infection that required powerful IV antibiotics to treat. spent a month in the hospital, some of it in intensive care, before she was discharged home.

- surprise: Bills totaling more than $454,000 for the medical miracle that saved her life. Of that stunning amount, officials said, she owed nearly $227,000 after her health insurance paid its part. Time.com 3.21.2019 *

- heart bypass surgery, replacement of one valve and repair of another. raging infection that required powerful IV antibiotics to treat. spent a month in the hospital, some of it in intensive care, before she was discharged home.

- Newscast about Hospitals being required to post rates - charges VIDEO

- PBS Trump Price Transparency Executive Order VIDEO

- Our webpage on Balance Billing & No Surprises

- Americans often "forced" to pay medical bills they don't owe, feds say CBS News

- Colorado's Supreme Court has ruled in favor of a woman who expected to pay about $1,300 for spinal fusion surgery but was billed more than $300,000 by a suburban Denver hospital that allegedly included charges it never disclosed she might be liable for. Read more: CBS News 5.19.2022

- What the Federal ‘No Surprises Act’ Means in California

- CA Department of Insurance Summary

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance