Late Enrollee for Group Employer Plans

SEP’s Special Enrollment?

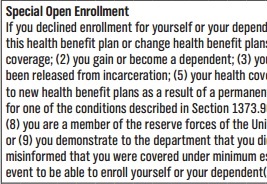

Special Open Enrollment – Late Enrollee

Employer Group Plans

- If you or your dependent(s) (including a spouse/domestic partner), didn’t enroll in an Employer Group plan when you were first employed, you may be able to enroll yourself or your dependent(s) in this health benefit plan or change health benefit plans as a result of certain “triggers” or events.

- Check our listing of the most common employee applications…You may find an easier to read list there.

- Special Annual Open Enrollment for entire group – Don’t have to meet contribution or Participation requirements

- You may not quote this page. Follow the links and make sure the reference applies to you. Email us at [email protected] for assistance.

- Individual & Family SEP – Covered CA

.

- Qualifying triggering events, Special Enrollment including:

. - (1) you or your dependent loses minimum essential coverage;

- A. Voluntary loss doesn’t count into the Individual Market and probably not for group. Health Care.Gov * As President Trump said Insurance is very complicated.

- Per Blue Cross webinar – have to actually receive Medi Cal disenrollment to qualify

- Special enrollment (for qualifying events)

- Employees and/or dependents that experience a qualifying event have 60 days to submit a completed application. Coverage will begin on the event date.

- Below lists examples of qualifying events:

- Open enrollment (not applicable for life and disability coverage)

- Marriage or Declaration of Domestic Partnership

- Birth or adoption of a child

- Involuntary loss of coverage

- Death Divorce or legal separation Blue Cross Administrative Manual

- (2) you gain or become a dependent;

- (3) you are mandated to be covered as a dependent pursuant to a valid state or federal court order;

- (4) you have been released from incarceration;

- (5) your health coverage issuer substantially violated a material provision of the health coverage contract;

- (6) you gain access to new health benefit plans as a result of a permanent move;

- I don’t see a move in the CFR maybe it’s just a CA rule? Just a Blue Cross rule, in their application.

- Individual Rules on permanent moves. It’s virtually the same wording, gain access as a result of a permanent move. See also the Insurance Company Interpretations available on that page.

- (7) you were receiving services from a contracting provider under another health benefit plan, for one of the conditions described in Section 1373.96(c) of the Health and Safety Code and that provider is no longer participating in the health benefit plan;

- See our webpage on continuity of care

- (8) you are a member of the reserve forces of the United States military or a member of the California National Guard, and returning from active duty service;

- or

- (9) you demonstrate to the department that you did not enroll in a health benefit plan during the immediately preceding enrollment period because you were misinformed that you were covered under minimum essential coverage.

- You must request special enrollment within 60 days from the date of the triggering event to be able to enroll yourself or your dependent(s) in this health benefit plan or change health benefit plans as a result of a qualifying triggering event. Specimen Policy Page 121 * Blue Cross Group Employee Application * CFR 54.9810-6 Health Care Reform Regulation on Special Enrollment for Employer Plans

- Learn more

- Code of Federal Regulations CFR §146.117 Special enrollment periods.

- Special Enrollment Periods ECFR.gov

- Qualifying Life Events – insurance.ca.gov

- Section 125 Cafeteria Plans Cornell Law What changes are permitted – Special Enrollment Periods?

- CFR 147.104 Guaranteed Availability of coverage

- A. Voluntary loss doesn’t count into the Individual Market and probably not for group. Health Care.Gov * As President Trump said Insurance is very complicated.

- 1357.500. definitions shall apply:

- (f) “Late enrollee” means an eligible employee or dependent who has declined enrollment in a health benefit plan offered by a small employer at the time of the initial enrollment period provided under the terms of the health benefit plan consistent with the periods provided pursuant to Section 1357.503 and who subsequently requests enrollment in a health benefit plan of that small employer, except where the employee or dependent qualifies for a special enrollment period provided pursuant to Section 1357.503.

- 10753 (l) “Late enrollee” means

- an eligible employee or dependent who has declined health coverage under a health benefit plan offered by a small employer at the time of the initial enrollment period provided under the terms of the health benefit plan consistent with the periods provided pursuant to Section 10753.05 and who subsequently requests enrollment in a health benefit plan of that small employer, except where the employee or dependent qualifies for a special enrollment period provided pursuant to Section 10753.05.

- It also means any member of an association that is a guaranteed association as well as any other person eligible to purchase through the guaranteed association when that person has failed to purchase coverage during the initial enrollment period provided under the terms of the guaranteed association’s health benefit plan consistent with the periods provided pursuant to Section 10753.05 and who subsequently requests enrollment in the plan, except where the employee or dependent qualifies for a special enrollment period provided pursuant to Section 10753.05.

Learn more⇒

Anthem Blue Cross

Group #Administrator Manual

- Authoritative answers to questions like:

- Adding or Terminating Employees

- Our Video explanation - 2nd Video

- Late Enrollee's Page 32

- Cal COBRA Information

- Our Video explanation - 2nd Video

- Adding or Terminating Employees

- New Enrollment Checklist

- Eligibility Guidelines

Health Coverage #Guide

Art Gallagher

Health Care Reform FAQ's

Understanding Health Reform

***********************************

Compliance #Assistance Guide from DOL.Gov Health Benefits under Federal Law

- Health Care Reform Explained Kaiser Foundation Cartoon VIDEO

- Choosing a Health Plan for Your Small Business VIDEO DOL.gov

- ACA Quick Reference Guide California Small Group Employers Revision 2020 Word & Brown

- kff.org/health-policy-101/

- Health Savings Accounts

Can one #change plans if they have a qualifying event like a new born or only enroll or add dependents?

Question

I have a PPO through my employer, and I am having a baby in September of this year. I thought that it was either a California or Federal law that this was a qualifying event and meant that I could change health plans. The screenshot from the CA department of Insurance that I’ve enclosed seems to say that. However, my employer says that isn’t the case and that only applies to individual plans.

What do you think?

Answer

- It appears that unlike Individuals who can change plans during a qualifying event – trigger, group plans only allow dependents to be added or new enrollment, not to change plans. This opinion is based on:

- Insurance Company Administrative Pages

- shrm.org/

- Qualifying Life Events – insurance.ca.gov

- Individual/Family and Group health coverage sold in California only allows new membership during an annual open enrollment period. Enrollment works this way because if people were allowed to purchase insurance anytime, people could wait until they got sick and the system wouldn’t work.

- There are exceptions to the annual open enrollment period. These are called qualifying life events and if you experience one or more of them, you can buy new coverage or change your existing coverage.

- Below is a list of the qualifying life events:

- Individuals *

- Employer Group

Just Enter your census or securely send us an excel spreadsheet or a list of employees and get instant proposals

for all these companies that we are Authorized Agents for in California