Covered CA Special Enrollment Rules §6504

only apply to get – enroll – sign up for Health Insurance when it’s NOT Open Enrollment

- Get an instant Quote & Enroll!

- IMHO The simple way to review the Special Enrollment Rules – is the plain English Insurance Company brochures below, rather than reviewing the actual legal code

Covered CA Special Enrollment Qualifying Life Events #QLE

|

|

|

|

|

Get Instant Quotes & Subsidy Calculation Visit our testimonials page

|

|

-

FLASH

- Two new Qualifying Events

- covered ca.com/special-enrollment

- Loss of your Doctor from Provider List?

- Your provider left the health plan network while you were receiving care for one of the following conditions:

- Pregnancy

- Terminal illness

- An acute condition

- A serious chronic condition

- The care of a newborn child between birth and age 36 months

- A surgery or other procedure that will occur within 180 days of the termination or start date. Covered CA Qualifying Events * October 5,2023 email from Covered CA *

- Our web page on Narrow Lists

- Continuity of Care

- Your provider left the health plan network while you were receiving care for one of the following conditions:

- Federal Health & Human Services HHS

- Special Enrollment Rules - Western Poverty Center

- Please note OPEN Enrollment - those rules are used rather than Special Enrollment options!

- Blue Shield Plain English, Effective Dates & Proof Required for Special Enrollment

- Kaiser

Steve’s summary of this page

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Videos on how great agents are

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

Older Special Enrollment Periods

- Open enrollment extended to February 9th. Press Release * Toolkit * Agent Briefing *

- Open Enrollment Toolkit

- Key Details:

- Extended Open Enrollment Period: On-exchange Open Enrollment extended to February 9, 2024.

- Short-Term QLE: New applications between February 10, 2024, and March 26, 2024.

- Applies To: This extension and QLE are specific to Covered California enrollments only.

- Effective Dates: Applications completed on or before February 12, 2024, will have a retroactive effective date of February 1, 2024. Applications completed between February 12, 2024, and March 26, 2024, will be effective on the first day of the next month.

- Open Enrollment Deadline for Off-Exchange Enrollments: The original January 31, 2024, deadline remains in effect for off-exchange enrollments. Blue Shield Bulletin *

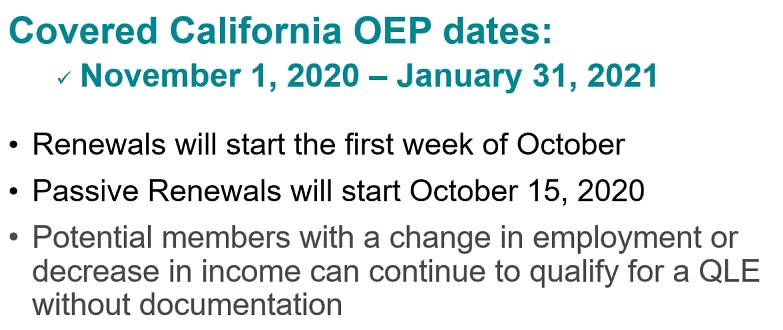

#Open Enrollment in California starts 11.1 and ends 1.31 AB 1309 * CA Insurance Code 10965.3 *

- Covered CA renewals will begin … – rates & subsidy calculation should be available on …

- Please note that Medi-Cal enrollment is year round.

- Conditional Enrollment for 90 days when you don’t have all the documents for Covered CA?

- HISTORICAL

News, Links & Resources

- This Open Enrollment Season, Look Out for Health Insurance That Seems Too Good to Be True

- Why insurers are cutting broker pay for exchange plans

- California Senate Bill 260 (CA SB 260) requires all health plans — to share member contact information with Covered California™ when a member’s health coverage terminates.

Health Insurance unfortunately is very complicated

President Trump February 27, 2017

- Thus, if we haven't simplified and explained in PLAIN ENGLISH what you are looking for:

Find out how, by reading our special enrollment page or email us

VIDEO questions that may come up when you lose their job-based coverage

Permanent Move

#Permanent Move of your home – residence

gives you a Special Enrollment for Health Insurance

- FAQ on “Intends to Reside”

- See module below for more rules on residency

- Exact Codes

CA Residency Guidelines #FTB1031 2023

- See our webpage on lawful presence & public charge

- A California resident is one who is in California for other than a temporary or transitory purpose; or Domiciled in California, but outside California for a temporary or transitory purpose. (ftb.ca.gov).

- Amount of time you spend in California versus amount of time you spend outside California;

- Location of your spouse and children;

- Location of your principal residence;

- Where your driver's license was issued;

- Where your vehicles are registered;

- Where you maintain your professional licenses;

- Where you are registered to vote;

- Location of the banks where you maintain accounts;

- Location of your doctors, dentists, accountants, and attorneys;

- Location of the church, temple or mosque, professional associations, or social and country clubs of which you are a member;

- Location of your real property and investments;

- Permanence of your work assignments in California; and

- Location of your social ties.

-

In using these factors, it is the strength of your ties and closest connections not just the number of ties, that determines your residency (ftb.ca.gov/)

- Sanjiv Gupta CPA reviews rules related to residency in California

FAQ’s “Move – New County, State or Back in USA”

- What does “#intends to reside” mean?

- For the purposes of § 155.305(a),”intends to reside” means that an applicant has a present intent to reside where he or she is living, and intends to remain in the Exchange service area where he or she is seeking coverage. Individuals visiting an Exchange service area for a transitory purpose, for example, to attend to a business matter, obtain medical care, or for personal pleasure, do not have a present intent to reside, and do not meet the residency requirement for Marketplace coverage for the Marketplace service area they are visiting.

- Certain individuals who cannot indicate intent, such as children, can establish residency without showing intent to reside. For more information, see Questions 1 and 4 as well as 45 C.F.R. § 155.305(a)(3) and 42 C.F.R. § 435.403.

- Does an individual’s residence change when he or she leaves an Exchange service area temporarily?

- No. An individual who leaves an Exchange service area temporarily with intent to return to the original Exchange service area continues to be a resident for the purposes of Marketplace coverage during the temporary absence.

- Permanent Move S E P

- How does someone qualify for the Permanent Move S E P to enroll in a QHP or change their enrollment in a QHP?

- To qualify for the Permanent Move S E P under 45 C.F.R. § 155.420(d)(7), a QI or his or her dependent must gain access to new QHPs as a result of a permanent move.

- For the purposes of qualifying for this S E P, a move is considered permanent if a QI (or his or her dependents) moves and meets the Marketplace residency requirement—as described in Questions 1 and 4 with respect to a new location. An individual who moves to a new location temporarily without an intent to reside there or otherwise meeting the Marketplace residency requirement, including for personal pleasure or to obtain medical care, does not qualify for the Permanent Move S E P.

- Similarly, an individual who moves permanently, but does not gain access to new QHPs as a result of the move, would not qualify for the Permanent Move S E P. For example, this may occur if an individual permanently moves within the same apartment building, neighborhood, town, or county, depending on the QHPs offered in the individual’s service area. regtap.info/FAQ_Residency Permanent Move_SEP pdf

- So, if you cancel coverage, I don’t see how you would qualify to get coverage when you come back to USA.

- There are travel policies that you can get.

- Here’s our page on coverage out of country. Do NOT take our summary as Gospel. Read your Evidence of Coverage!

- $235/month sounds very low. Must be a bronze plan for a young person. Get quotes here.

- Don’t forget, if you get hurt, sick, ill, kidney disease, cancer, etc. outside the USA, you can always come back and get follow up treatment here. How much does chronic care treatment cost?

- Blue Shield Proofs Required

- I’m a US Citizen along with my wife and children. We have been living in China the past two years. 1. How do we get Health Coverage when we come back to the USA? 2. How do we get a 1095 A or B so we can file our taxes? 3. What’s this you said on the phone about an exemption?

- 1. When you will come back, if it’s not Open Enrollment, you would qualify for a Special Enrollment CFR 155.420 (d) (7) as it’s a move to a new region. Get FREE no obligation quotes here.

- 2. You don’t need a 1095 A, as your exempt from the mandate and not being in the USA – Service Area, you wouldn’t qualify to buy coverage.

- 3. File form 8965 to show that you are exempt from the mandate. Links and instructions are on this page.

- Citizens living abroad and certain noncitizens—

- You were: A U.S. citizen or a resident alien who was physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months;A U.S. citizen who was a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year; Learn More – 8965 Instructions

- “Federal Qualifying Events, Triggers CFR §155.420

- my daughter is 23 years old and is a full time student. She has a small part time job but she needs insurance because she needs to go to the doctor.

- When one needs Medical Services, is not a reason to be able to get Insurance. One purchases coverage beforehand to cover unexpected losses. This is the whole purpose of limited open enrollment periods, strict special enrollment times, avoidance of adverse selection, etc. Learn More

- In the time before ACA – Obamacare, there was medical underwriting and pre-existing condition clauses.

- 1. I ran across your website while trying to educate myself on health insurance. My situation is a bit unique, so let me explain: 2. I live in [redated] with my wife and 2 boys ([redated] years). 3. I ended my COBRA in mid-March and need to pick up alternate insurance. 4. Our Blue Cross coverage was great because I could use it in [redacted] (80% covered, I think). 5. We return to California during Summers, and I am there for about 2 weeks per quarter otherwise. 6. While we have about $[redacted] in assets, we currently have very little income. 7. My wife is starting a company out here and I’m working part time, so our combined income is about $40k. 8. I have 2 recurring medications (high blood pressure and high cholestrol) and I don’t mind paying out of pocket so long as I ride on some negotiated insurance price. 9. Are you able to act as an insurance agent for me or can you recommend a policy? 10 The Blue Shield Silver Plans (how I found you) seem to be about $600-$700 per month for the family, which is fine.

- 3 Since you lost COBRA – loss of minimum essential coverage, that gives you a Special Enrollment Period to purchase coverage, even though it’s not open enrollment.

- 4 A PPO plan should be able to be used anywhere. The problem would be using out of network MD’s. That isn’t always 80%. Check the Specimen Evidence of Coverage, our Quote Engine and the brochures.

- Also check our International and Foreign Visitor Website for full information, enrollment and pricing.

- 5 So, you have residency here and a California address we can use. See page 25 of the specimen policy as one must reside in the service area to get coverage.

- This could get confusing, as it’s not really defined what reside means. Here’s the closest definition I’ve found, from the CA Franchise Tax Board. also, check your evidence of coverage.

- You are not out of country long enough to qualify for an exemption from the Health Insurance Mandate.

- 7 Is that MAGI income? See definition. It’s line 37 plus adding back in Foreign Income, Social Security and Tax Exempt Interest. If it is, then you may qualify for subsidies. Please use our FREE Quote Engine, which will not only show you Blue Shield PPO, but all the other plans as well, both in and out of Covered CA.

- 8 This is the beauty of our quote engine. It will show the reimbursement levels for your Rx – Drugs. I guess you could do them mail order.

- 9 Yes, I can be your agent. Please enter your information into our FREE Quote Engine, so that we can review your options and possible subsidy.

- 10 I’m not sure if the $600/month is with subsidies or not. Please use our quote engine. We also need to verify MAGI income

- “Open Enrollment & Special Enrollment”

- We qualify for Medi-Cal based on our family income. We’ll just wait till November all the 2021 information is released to apply and it’s officially Open Enrollment.

- I see no reason for you to delay enrolling in Medi-Cal. One never knows when they might get ill or have an accident. Medi Cal has year around enrollment.

- It’s my understanding that one can change Medi-Cal providers any time, there is no annual open enrollment for Medi Cal.

- HMO – Managed Care Providers

- When you start making too much $$$ to qualify for Medi-Cal they will notify you that you are ineligible. Notification when you make too much $$$ for Medi-Cal

- Then contact me and I get barely minimum wage to help people with Covered CA insure me kevin.com/how-much-do-health-insurance-agents-earn/

- Don’t forget, you are mandated to let Medi Cal know of changes within 10 days. report-a-change/

- I’m NOT an authorized Medi Cal agent. Covered CA might try to bully me with their one door policy, but I get no training or compensation to enroll people in Medi-Cal. I just know how to read and analyze.

- I’m not working, and am wondering when is the next enrollment period, and if there is a more affordable PPO plan (I’m in a grandfathered Plan Now that is based upon the income I earn?

- If your income is zero, there is Medi-Cal

- Medi Cal enrollment is anytime you become “poor.” I don’t get compensated to help you with Medi-Cal. You can place your questions in the comments area on my Medi-Cal website, on the page most relevant. Your Social Worker gets paid to help you along with whatever Medi Cal HMO that you select.

- Assets are no longer an issue with Medi-Cal for health insurance and there is no estate recovery. Unless you go into a nursing home.

- For Covered CA subsidies, you need to have MAGI Income of say at least $18K

- See income chart or get an instant subsidy calculation and proposal.

- If you want to do a zoom meeting see our scheduler in the menu above

- It’s real easy to change your estimated income in our quote engine. If your income drops to Medi-Cal eligibility, then the subsidy will go away. Just put in the new estimate and click update.

- See above for the Open Enrollment dates according to AB 1309 – the problem is, myself and one other agent are the only ones that read the law. Covered CA often makes up their own rules. We asked on June 17 and they said they didn’t know, but would send out a bulletin when they did.

- When is a good time to come by and sign up for open enrollment, for medical insurance?

- Website visitors can set a time for Face to Face, Skype, Facetime or phone by going to our scheduler

- Does having a newborn affect my chances of getting individual health coverage during this AEP – Open Enrollment Period?

- Nope. Under Health Care Reform 45 CFR Section 147.108 and Section 2701 there are no pre-existing clauses. It’s all guaranteed issue. Learn more

- “2021 Rates & Benefits – average 0.6% premium increase”

- I opened my blue shield portal to pay my bill and lo and behold my rate more than doubled. What gives? You told me that by doing nothing my premium and plan would not change. I can understand a rate hike but this is ridiculous. Anything we can do at this late date?

- Generally, when someone with Covered CA has a huge increase, it’s because their income dropped to Medi Cal level and they no longer qualify for subsidies.

- insure me kevin.com/why-did-my-california-health-insurance-rates-spike-up/

- See the Income Chart /income-chart/

- Use our quote engine to verify income, age, zip code, subsidies, etc quotit.net/

- Unfortunately, we did have another client recently that really did have say a 50% rate increase. It came as quite a surprise to us to, considering the announcement from Covered CA that the average rate increase would be less than 1%. For those people that did shop, we didn’t see any significant rate increases.

- Let’s check out your specific situation:

- We see that you have an HDHP plan allowing you to qualify for a Health Savings Account HSA hsa/

- Well, you’re making a lot more now than last year, thus much lower subsidies.

- Here’s quotes and alternatives based on $73k income. Will you income hold out with COVID?

- What did you actually make in 2020? Subsidies IMHO are all hocus pocus and jiggery pokery, until the day of reckoning when you actually file your taxes. premium-tax-credit-8962/

- subsidies-upheld/

- My income will probably be the same as last year (50K AGI) Can we get this fixed?

- Yes, I’ll go in and change it for you. /report-a-change/

- Please note also, that IMHO it’s better to just give Covered CA your MAGI income = AGI plus Social Security… rather than fill out every single question they ask/magi/#comment-102936

- Wow, that went easier, quicker and more straight forward than I thought it would.

- chcf.org/how-many-your-area-are-covered-affordable-care-act/

- I want to get an Individual plan that UCLA accepts. I went to their webpage ucla health.org/health-plans and they accept WAY MORE plans than just Blue Shield PPO and Oscar EPO!!! They also told me this over the phone. What’s the problem? Are you trying to sell me just the plans you make the most commission on?

- First off, we have to accept that Covered CA controls the CA marketplace, even if you get a plan directly from an insurance company. Check my website for the citation.

- Here’s the companies that write Individual Coverage in CA for 2020

- 1. Anthem Blue Cross of California. 2. Blue Shield of California. 3. Chinese Community Health Plan. 4. Health Net. 5. Kaiser Permanente. 6. L.A. Care Health Plan. 7. Molina Healthcare. 8. Oscar Health Plan of California. 9. Sharp Health Plan. 10. Valley Health Plan. 11. Western Health Advantage. Source – Covered CA.com

- Go to this link https://individuals.healthreformquotes.com/companies/ and then scroll down for information on each company. You can get quotes here for 2020 on 11.1.2019 Sure you can get quotes from Covered CA or on each companies affliate link – no extra charge for our services, they pay us. It’s just that if you want us to help you compare, our tools won’t be ready till 11.1.2019.

- So, sure UCLA lists a lot of plans they accept, but how are you as an Individual going to buy them?

- Preferred Provider Organizations (PPOs) Aetna – Left CA! Anthem Blue Cross Left CA in 2018 but came back for 2020 Blue Shield of California CIGNA – Left CA First Health Health Net of California OK, but not on the list for Individual Plans Interplan (a HealthSmart product) MultiPlan UFCM Health System, Inc. dba California Foundation Medical Care (CFMC) Prime Health Services Private Healthcare Systems (PHCS) TriCare Are you Military? UnitedHealthcare – Left CA for Individual Plans

- https://www.uclahealth.org/health-plans If you have Medicare we can help you on this website.

- If you have a business with at least one non-spousal employee, we can help you here. Group Employer Quotes

- It might often depend on the question you ask. You might not be asking the right question. Sure, UCLA accepts a lot of Insurance Companies. The question is, what companies can you buy as an individual that they accept?

- What does Off Exchange mean?

- Exchange is a term for the entire United States. It means Health Care . gov or Covered CA, where you can get subsidies. Off Exchange, means that your not in Covered CA, but direct with an Insurance Company. Agent support at no additional charge! Pretty much, the rates and benefits in or out of Covered CA are exactly the same. Same crappy networks, etc. Due to a lawsuit to end subsidies for enhanced silver, direct is less $$$ if you want a silver plan and are not getting subsidies. Direct – some of the companies offer plans not available in Covered CA. BUT, they must meet Actuarial Value for the Metal Levels, have essential benefits, be guaranteed issue and no pre X! We do not care or want to comment about what anyone said over the phone. It’s just too unreliable. The courts won’t even accept hearsay evidence. Here’s where we spent an hour with our crystal ball, coming up with reasons why someone over the phone said something…

Technical Law

#CCR.10 California Code of Regulations

§6504 Special Enrollment Periods Cornel Law

FYI Federal §155.420 Special enrollment periods.

- Health & Safety Code 1399.849 (d)

Virtually the same rules

- The actual law, rules and regulation is just too much to read and for me to try to find official interpretations. If you need the law… see the links above.

- Definitions 155.20]

- lawfully present error, misrepresentation, misconduct, substantially violated a material provision of its contract in relation to the enrollee.

- (7) An enrollee Definition, or his or her dependent enrolled in the same QHP – Qualified Health Plan, is determined newly eligible or ineligible for APTC (Subsidies) or has a change in eligibility for CSR. [Cost Sharing Reductions – Enhanced Silver] RIGHT to change Silver Plans!

- A change in income is not a Qualifying life event. If you select “other qualifying life event,” it puts a hold on the account. In the future, for income changes you need to select “none of the above.” Email dated 03/26/2018 11:57 AM from Covered CA *

- (d) § 155.420 The Exchange must allow a qualified individual or enrollee, and, when specified below, his or her dependent, to enroll in or change from one QHP to another if one of the following triggering events occur:

- (4) The qualified individual’s or his or her dependent’s, enrollment or non-enrollment in a QHP is unintentional, inadvertent, or erroneous and is the result of the error, misrepresentation, misconduct, or inaction of an officer, employee, or agent of the Exchange or HHS, its instrumentalities, or a non-Exchange entity providing enrollment assistance or conducting enrollment activities. For purposes of this provision, misconduct includes the failure to comply with applicable standards under this part, part 156 of this subchapter, or other applicable Federal or State laws as determined by the Exchange.

- Email clarification from Covered CA Broker Support

- Hi Steve,

- Basically the children lost subsidy eligibility because they actually qualify for Medi-Cal so they were removed from the policy. Unfortunately, even though this would seem to be an involuntary loss of coverage, it’s not considered a Qualifying Event because the children are not losing coverage; [minimum essential coverage] they are merely losing the private insurer coverage they preferred and instead getting state-sponsored Medi-Cal coverage. If later the children are denied Medi-Cal or lose eligibility for Medi-Cal, either situation would be a Qualifying Event. Email dated 9.12.2016 5:01 PM from a major insurance company manager

- Adverse selection a situation where an individual’s demand for insurance is positively correlated with the individual’s risk of loss.

- CMS.Gov 45 CFR on non calendar year renewals – to qualify for Special Enrollment, like COBRA and Grandfathered plans.

FAQ

From Tom

- Question I quit my job in April and lost employer coverage on May 1st.

- For the month of May I was covered by a Bronze Kaiser plan with subsidies from CoveredCA..

- In June CoveredCA deemed my income to be too low and they referred and approved me for Medi-Cal in June.

- I didn’t want Medi-Cal because of the strict income requirements so I went to Blue Shield in June and I signed up for a Silver Plan effective July since I was still within the 60 day period of losing my job based insurance.

- I have a few questions

- Currently I have both Medi-Cal and Blue Shield. Is this legit?

- 1) Was it ok to sign up for Blue Shield in June when I already had Medi-Cal. I did inform the agent and he said it’s ok

- 2) I had initially selected a Bronze Kaiser plan from CoveredCA in May but I switched over to a Silver Blue Shield Plan for July. Am I allowed to change metals for a SEP.

- I have read someplace that it’s not

- 3) Is it ok to keep both Blue Shield and Medi-Cal. I intend to use Blue Shield as primary and Medi-Cal as secondary insurance.

- I have a few questions

- Answer We’ve answered maybe all of your questions on our Dual Coverage page. Please check there and if we didn’t clarify dual coverage, ask there. Use this page to ask about “SEP Special Enrollment.”

- My question is regarding Change of Plan Type [Metal Level] in a Special Enrollment Period due to loss of job based insurance

- My concern is that in May I had a Bronze Kaiser Plan thru CoveredCA but I switched over to a private Silver Blue Shield plan in July.

- As per this article you cannot change metal types in a Special Enrollment Period use to job loss –

- https://www.healthcare.gov/coverage-outside-open-enrollment/changing-plans/

- However this article says you can but looks like this is only referring to the extended Special Enrollment Period for CoveredCA

- https://www.cms.gov/CCIIO/Resources/Regulations-and-Guidance/2021-SEP-guidance.pdf

- Am I ok in what I did?

- When I enrolled in the Blue Shield plan in June I used the loss of job based insurance Special Enrollment Period to qualify since Open Enrollment had already ended for Private Insurance, I don’t remember doing that for CoveredCA probably because it was still open and I enrolled at the beginning of the month.

- Am I ok because I had selected the Bronze Kaiser plan in CoveredCA but the Silver plan from Blue Shield directly?

- My concern is that in May I had a Bronze Kaiser Plan thru CoveredCA but I switched over to a private Silver Blue Shield plan in July.

- See our answer above, dated July 11 at 6:49 AM. It doesn’t matter what you had or what you did! If you were in the 60 days to pick a plan, then you can pick a plan. I don’t see anywhere that says you get only one pick!

- ********************

- President Trump was not kidding when he said Insurance was very complicated and no one knew, except Steve Shorr…

- Health Care.Gov web information?

- In your case, we are talking about losing Employer Coverage, NOT exchange coverage, right. So, it doesn’t look to me like this Health Care.Gov link is relevant. Don’t forget, Covered CA makes up their own rules. Under the Supremacy Clause of the US Constitution, that’s OK when they give you better benefits.

- *****************

- You lost Employer Coverage, right?

- So, I do not see any relevance is the 7 Page Guidance SEP for COVID that you cited above.

- Updated and New 2021 Special Enrollment Period for COVID-19 Public Health Emergency

Technical Stakeholder Guidance

Published March 23, 2021 - You’re questions are quite technical. We are not attorneys. Did you want to check with legal counsel?

- Be sure to read each law or Insurance Rule and this website 3 times. Then when you think you understand it, read it again.

- Maybe not for you, but ARPA American Rescue Plan allows tons of changes and higher subsidies for the next two years. Covered CA allows till December 31st to enroll based on ARPA. The whole point, it seems of ARPA is to move to Silver, so that if you received any unemployment, you get Silver 94 with $1 or Zero premium!

- However, since your income is Medi Cal, I guess the “revelation” I just had, upon waking up, doesn’t apply to you.

Verification of Special Enrollment

Consumers and brokers completing an online application will be notified in the application that Covered California may seek to verify the validity of their self-attested Qualifying Life Event (QLE) in order to be eligible for Special Enrollment.

Covered California will contact a random sample of consumers who enrolled during a Special Enrollment Period (SEP) to request proof of the QLE. If the consumer does not provide acceptable documentation of their QLE within 30 days of the date on the original notice, their coverage can be terminated.

If a consumer is found to have been fraudulently enrolled in a Covered California health insurance plan without a Qualifying Life Event, the broker who assisted the consumer could potentially lose their certification. Brokers don’t risk losing your certification with Covered California and ensure all consumers who attest to having experienced a QLE are able to provide proof that they qualify for special enrollment. February 10, 2021 Bulletin *

- CMS awards $18 million contract to verify special enrollments Modern Health Care 2.2.2018

FAQ

Change more than one time within the 60 day period?

- Question If I lose Employer Coverage, enroll in Cal COBRA or COBRA, but want to get a private – direct individual plan or Covered CA, can I do that, if I decide within 60 days of losing coverage?

- Answer Here’s Blue Shields’ rule

- a qualified individual, enrollee, or his or her dependent shall have 60 days from the date of a triggering event to select a QHP. § 6504. Special Enrollment Periods (f)

- I don’t see anything limiting you to only have ONE choice! It may be difficult dealing with the “Rando’s” that don’t look up the law or rules…

- Does the new ARPA rule about no premium COBRA help you?

- Question termination of employment….” does that include quitting a job?

- Answer Yes.

- You can double check the actual CA law on the link above for § 6504. Special Enrollment Periods (f)

- However, since you voluntarily left employment, you wouldn’t get “Free” COBRA for 6 months under ARPA

- Thank you for your answers. They were quick and to the point.

Historical

Covered CA 2021 Individual Plans, Rates & #Information

Less than 1% premium increase

2021

- The preliminary rate change for California’s individual market will be 0.6 percent in 2021, which marks a record low for the second consecutive year and follows California’s reforms to build on and strengthen the Affordable Care Act.

- Covered California’s increased enrollment, driven by state policies and significant investments in marketing and outreach, has resulted in California having one of the healthiest individual market consumer pools and lower costs for consumers.

- The impact of COVID-19 on health plans’ costs has been less than anticipated as many people deferred or avoided health care services in 2020, and while those costs are rebounding, it now appears the pandemic will have little effect on the total costs of care in California’s individual market for 2020 and 2021.

- All 11 health insurance companies will return to the market for 2021, and two carriers will expand their coverage areas, giving virtually all Californians a choice of two carriers and 88 percent the ability to choose from three carriers or more. Covered CA Press Release * CA HealthLine *

IMHO it would be best to just wait till 11.1.2020. That’s when we will have ALL the bulletins & materials for 2021. Open Enrollment starts then, not this “crazy” thing with early renewals.

Insure Me Kevin.com 2021 analysis

Historical

We are still in a public health emergency (PHE), Bloomberg reports on 7.11.2022 that President Biden will extend the emergency! Bloomberg * phe.gov * covid19.ca.gov * US News.com * Court Case on definition *

February through May 15th Special Enrollments

- If you are uninsured and eligible aka “2021 COVID SEP Extension” until 05/15/2021. Covered CA email dated 2.1.2021 * The Hill * KFF.org * hhs.gov *

- “Learned of new state penalty” or get subsidies until 04/30/2021, See Quick Guide for more details

- Uber/Lyft driver special enrollment

HISTORICAL

CA Healthline Open Enrollment – What you need to know for 2021

Health Net Webinar

HN Email dated 10.8.2020

Sutter’s Underwriting Guide for 2021

SEP Special Enrollment Period Consumers Auto-Renewing for 2021

The renewal period [as opposed to brand new coverage] for 2021 coverage begins October 1.

After October 1, if you have NEW consumers purchasing coverage for the remainder of 2020 after experiencing a Qualifying Life Event (QLE) that triggers a Special Enrollment Period (SEP), and those consumers want to have 2021 coverage also, do not actively enroll them in 2021 coverage.

CalHEERS will process auto-renewals of existing 2020 enrollments, and actively purchasing 2021 coverage for a new enrollee who has purchased any portion of 2020 coverage after October 1 may create a duplicate enrollment or renewal fallout.

We will work on getting the above in plain English. See button above or below for FAQ’s or email us [email protected]

Enrollments after the 14th of the month must acknowledge in writing that they understand they might not have their ID cards by the effective date. Please don’t wait till the last minute!

Please note that CA now has an individual mandate penalty! $695 per adult and $347.50 per child or 2.5 percent of your gross income that is above the filing threshold based on your tax filing status and number of dependents.

Subsidy eligibility for APTC has increased from 400 to 600% of FPL Federal Poverty Level.

If you need coverage NOW and it’s not Open Enrollment –

Please review all the Qualifying Events

§6504 CA CCR’s for Special Enrollment and let’s see if you are eligible

Appoint us as your Covered CA Agent – NO CHARGE!

NEWS FLASH – Open Enrollment extended to December 30th for a January start date. Covered CA.com *

FLASH

President Biden is signing an order to have a Special Open Enrollment from February 15th to May 15th! The Hill * KFF.org * Covered CA is calling it Special Enrollment. Some Insurance Companies are allowing anyone to enroll, calling it Open Enrollment. Get a quote, email us [email protected] and we will check & verify for you.

AB 1309

California Insurance Code § 10965.4 or 10965 – 10965.18

Supremacy Clause?

The core message of the Supremacy Clause is simple:

the Constitution and federal laws (of the types listed in the first part of the Clause) take priority over any conflicting rules of state law. This principle is so familiar that we often take it for granted.

Pandemic SEP

Covered California will allow an SEP Special Enrollment Period due to the COVID pandemic emergency through May 31, 2023 as that is what President Biden said and Covered CA liberalized or interpreted email dated 5.11.2023 * 2.6.2023 and 3.28.2023. * Modern Health Care * Gov.CA.Gov * HHS.Gov * So there is now an Pandemic (e.g.COVID-19) or national public health emergency which can be used to submit enrollments via Covered California for the reminder of the public health emergency. Covered CA Email 2.2.2023 * Blue Shield email 3.3.2022 One can also change their plan too Covered CA Email 4.4.2022

COVID – #Pandemic Special Enrollment

- If you experience a qualifying life event, you can enroll in a Covered California health insurance plan outside of the normal open-enrollment period. Most special-enrollment periods last 60 days from the date of the qualifying life event.

- A pandemic or national public health emergency resulting in a declaration of a state of emergency at the state or national level. coveredca.com/qualifying-life-events

- (11) A qualified individual or enrollee, or his or her dependent, demonstrates to the Exchange, in accordance with guidelines issued by HHS and as determined by the Exchange on a case-by-case basis, that the individual meets other exceptional circumstances. Such circumstances include, but are not limited to, the following:

- (E) In case of a national public health emergency or a pandemic that results in a declaration of a state of emergency at the state or national level, a qualified individual or enrollee, or his or her dependent, shall be eligible for a special enrollment period if otherwise eligible for enrollment in a QHP. This triggering event shall be ongoing throughout the state of emergency. law.cornell.edu/10-CCR-6504 ****modernhealthcare.com joe-biden-covid-national-public-health-emergencies-end-may

- (11) A qualified individual or enrollee, or his or her dependent, demonstrates to the Exchange, in accordance with guidelines issued by HHS and as determined by the Exchange on a case-by-case basis, that the individual meets other exceptional circumstances. Such circumstances include, but are not limited to, the following:

- Get Instant Quotes and Enroll

- A pandemic or national public health emergency resulting in a declaration of a state of emergency at the state or national level. coveredca.com/qualifying-life-events

#ARPA American Rescue Plan Act

Enrollment from April 12th through 12.31.2021

- Covered California will open a new special-enrollment period on April 12, for May 1, coverage for the estimated 1.2 million uninsured Californians who are eligible as well as the 430,000 people currently insured off-exchange who will qualify for the new financial help.

- uninsured can get coverage that is more affordable than ever before Covered CA.com *

- While you are allowed to enroll on the last day of the month – DO NOT EVEN THINK ABOUT getting your ID Cards on the first Monday of the next month. If you enroll past the 15th of the month, we’ve been forced to have you sign an acknowledgement that you understand you won’t have all the paperwork on the 1st of the month, even though you have coverage and premiums are due.

- See our Main COVID ARPA page on uninsured and those who qualify for more subsidies.

- If you received Unemployment — Silver 94 Zero Premium

- Get instant quote & subsidy calculation

FAQ

Change in Household Size?

- Question if there is a change in household size, spouse moving to medicare,

- does this qualify for special enrollment for the spouse that is staying on covered california to change plans within covered california

- Answer While a spouse moving to Medicare might change the number of people on Covered CA, it does NOT change household size.

- You still get the lower FPL Federal Poverty level to get higher tax subsidies.

- Here’s the exact definition of household income & tax payer family

- Flow chart to calculate household size

- See above for all QLE Qualifying Life Events

- See our webpage on Medicare

- See above about using the Pandemic Emergency to make a change in plans.