Covered California Subsidies for someone over 65

if ineligible for Free Medicare Part A Hospitalization

Introduction

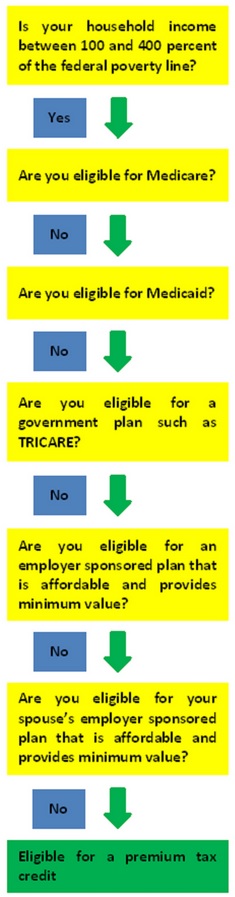

If someone is over 65 and not eligible for no premium Part A Hospital Medicare there once was a BIG debate back when ACA/Covered CA/Obamacare started. It’s now well settled that they can. Scroll down for proof, the 1095 A showing the subsidy!

More info on prohibiting of having Premium Free Part A Medicare & Covered CA

Video about Covered CA – if no Premium Free Part A – jump to 2:30

- Covered CA – Medicare Fact Sheet

- Medicare & the Health Insurance Marketplace (Covered CA) Publication 11694

- When you file form 8962 Premium Tax Credit – you might have to give back ALL subsidies!

Proofs & References

That one can get subsidies even if over 65

- Over 65, but I don’t qualify for Medicare. You can purchase Covered CA coverage and qualify for subsidies based on your income. KFF

- Medicare Part A has a premium: However, if someone qualifies for Medicare but has to pay a premium for Part A and does not enroll in Medicare Part A, they may be eligible for a Covered California health plan. Depending on a consumer’s income, they may be eligible for premium assistance and cost-sharing subsidies for the Covered California health plan. Covered CA – Medicare Info

- Code of Federal Regulations 1.36B-2 Eligibility for Premium Tax Credit Is not eligible for minimum essential coverage [Can’t get Medicare!]

- 26 USC §36B Refundable Credit for Coverage under a QHP Qualified Health Plan

- Eligibility for Minimum Essential Coverage for Purposes of the Premium Tax Credit Notice 2013-41 Latest Info

- CFR §1.37-1 General rules for the credit for the elderly. * §1.37-2 Credit for individuals age 65 or over.

- FAQ’s Medicare & Covered CA CMS.gov

- IRC §5000 A Minimum Essential Coverage

- Medicare Part A has a premium: However, if someone qualifies for Medicare but has to pay a premium for Part A and does not enroll in Medicare Part A, they may be eligible for a Covered California health plan. Depending on a consumer’s income, they may be eligible for premium assistance and cost-sharing subsidies for the Covered California health plan. Covered CA – Medicare Info

- See Moulder Law Subsidy chart on this page

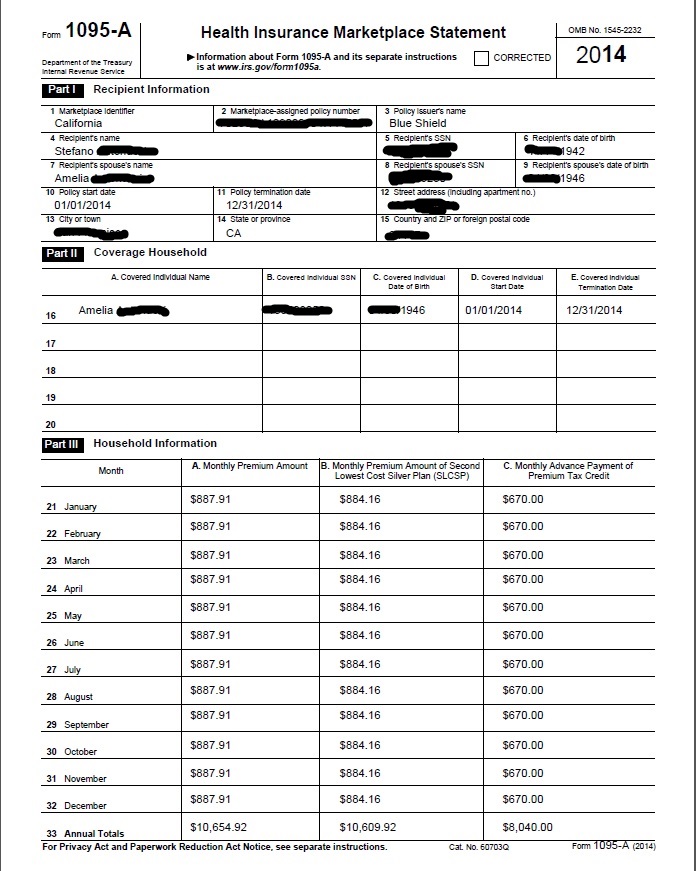

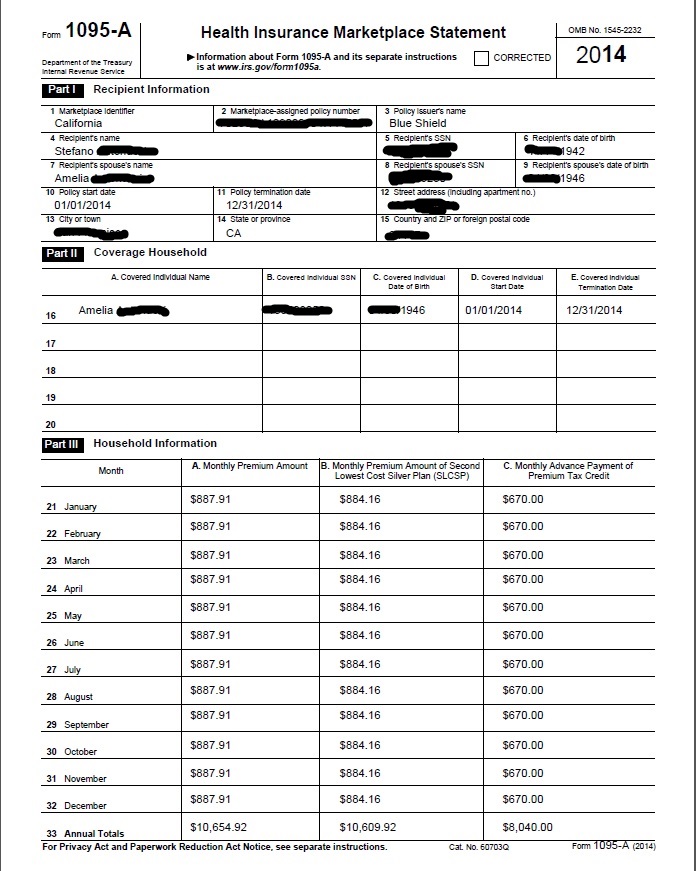

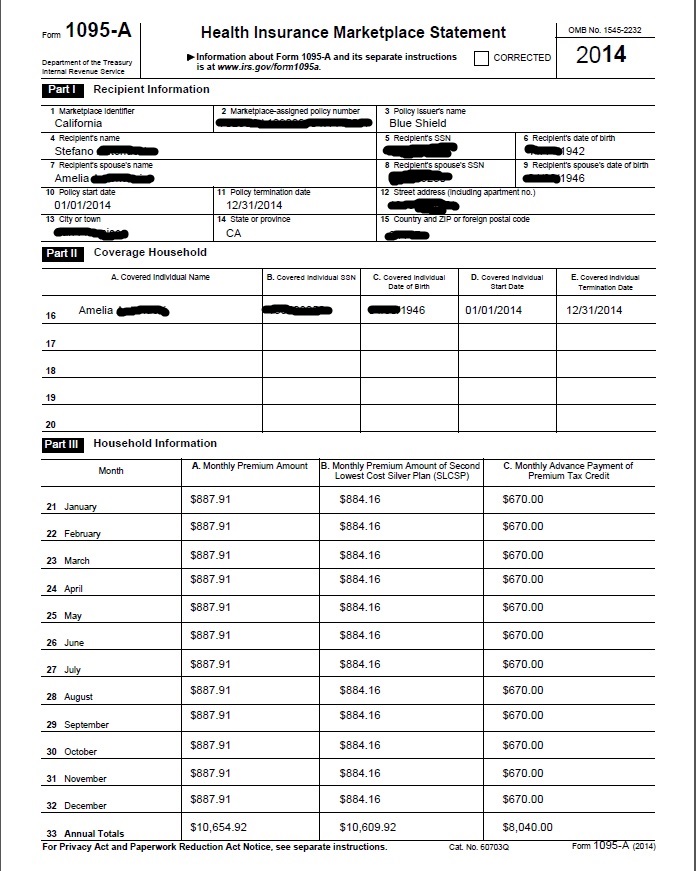

- See actual 1095 below showing the subsidy scroll down

Can’t buy Covered CA – Publication 974 Premium Tax Credit

You cannot buy additional coverage through #Covered California

if you have premium-free Medicare Part A Hospital

Medicare complies with Health Care Reform, so you do NOT need to get a an Individual policy or a subsidized one from Covered CA. It fact, it's illegal for anyone to sell you a policy! Kaiser Health News * Covered CA Medicare Fact Sheet * Medicare.Gov Medicare & Market Place #11694 * CMS.Gov FAQ Medicare & Marketplace * HealthCare.Gov when - how to change from Covered CA to Medicare * Social Security §1882 * Health Care.Gov

NOTE: This information also applies to people younger than 65 whose benefits begin the first month they receive disability benefits because they have Amyotrophic Lateral Sclerosis (ALS), better known as Lou Gehrig’s Disease, and to people younger than 65 who have Medicare because of a disability and are receiving SSDI Social Security Disability Insurance.

There are a lot of ands, if or buts in this complex issue. Please refer to the source material below. There are some exceptions, but they are very complex. Don't even think of getting a 1/2 correct answer over the phone. If you have to pay for Part A Hospital, then are options, like subsided Covered CA Plans. Email us [email protected] or ask a question below.

Video about Covered CA – if no Premium Free Part A – jump to 2:30 Medicare & the Marketplace (Covered CA

Medicare vs Covered CA - Publication 11694

Links & Resources

- Medicare Publication # 11694 Medicare & Covered CA

- Covered CA Medicare Fact Sheet

- InsureMeKevin.com

(3)(A)

(i) It is unlawful for a person to sell or issue to an individual entitled [no premium] to benefits under part A or enrolled under part B of this title (including an individual electing a Medicare+Choice plan [MAPD] under section 1851)—

(I) a health insurance policy with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled under this title or title XIX,

(II) in the case of an individual not electing a Medicare+Choice plan, [aka MAPD Medicare Advantage] a medicare supplemental policy with knowledge that the individual is entitled to benefits under another medicare supplemental policy or in the case of an individual electing a Medicare+Choice plan, a medicare supplemental policy with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled under the Medicare+Choice plan or under another medicare supplemental policy, or

(III) a health insurance policy (other than a medicare supplemental policy) with knowledge that the policy duplicates health benefits to which the individual is otherwise entitled, other than benefits to which the individual is entitled under a requirement of State or Federal law.

(ii) Whoever violates clause (i) shall be fined under title 18, United States Code, or imprisoned not more than 5 years, or both, and, in addition to or in lieu of such a criminal penalty, is subject to a civil money penalty of not to exceed $25,000 (or $15,000 in the case of a person other than the issuer of the policy) for each such prohibited act. Sec. 1882. [42 U.S.C. 1395ss]

Our webpages that touch on this Issue:

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

Tax #Estimators

FAQ’s

- My father and mother have had Covered CA Silver 94 PPO plan, with APTC – Advanced Premium Tax Credit since ACA – ObamaCare went into effect. Their income is below FPL – Federal Poverty Level but through two years of consecutive appeals hearing, the Judge had ordered Covered CA that they are eligible for APTC since they are not eligible for non-MAGI Medi-Cal (since both my dad and mom are above 65, and have assets more than Medi-Cal limits, and they cannot spend down).

- ***But does the IRS agree with that when they file 1040 and 8962 Premium Tax Credit I would like to see that order.

- Both my dad and mom have been legal permanent residents (green card) at the time of the appeals in 2016 and in 2015. They are eligible for Medicare but are not eligible for premium-free Medicare, and Covered CA did send them a letter stating that people who are not eligible for premium-free Medicare and who dont enroll in Medicare could be eligible for APTC. Just like last two years, again for 2017, Covered CA has told them that we are not eligible for APTC for 2017 coverage. My dad became a US citizen late 2016. But they continue to be ineligible for Medi-Cal, or premium-free Medicare. And without APTC,

- ***What if they just take the credit when they file their taxes at the end of the year?

- they cannot afford to get an affordable minimum qualified health plan – minimum essential coverage.

- They have filed for an appeal, but if you can point us to any sections of the ACA, or Federal Code of Regulations

- ***CFR §1.37-1 General rules for the credit for the elderly. * §1.37-2 Credit for individuals age 65 or over.

- or California regulations, or special rules/clarifications, or IRS notes that we can represent to the judge during our hearing, it would be really helpful.

- It is strange that while they would be eligible for APTC as non-citizen aliens (as decided by the Judge last 2 years), their becoming a citizen makes it worse for them.

- ***How so?

- I think Covered CA is getting too expensive. I’m thinking of enrolling and paying for Part A, then Part B like everyone else, then enrolling in Medi Gap and Part D. What are the costs? Pros & Cons?

- Please note, that you can’t get Part A till next July… and you have to enroll January through March

- Part B Doctor Visits would run $135/month

- We may have a Part B Late Enrollment Penalty That’s a whole separate issue. Please ask that question on that page. You don’t qualify for the Covered CA waiver…???

- Medi Gap Plan G runs say $150/month + for someone in their 70’s

- Part D Rx Runs $30 to $100/mth

- So that totals $752

- Covered CA PPO in San Francisco for a 73 year old earning $35K with a household of two works out like this:

- Get a personalized quote here.

- Plus a Part A late enrollment penalty?

FPL & Subsidy Calculation

Quote Engine – Input

Zip Code – Date of Birth

1095 Showing Tax Subsidy

https://www.dhcs.ca.gov/services/Pages/TPLRD_MOU_cont.aspx#:~:text=The%20Medicare%20Premium%20Payment%20Program,the%20payer%20of%20last%20resort.

Can someone age 78 on a B 2 tourist visa get Covered CA or direct coverage with an Insurance Company with or without subsidies on a tourist visa get coverage?

Eligibility for this plan

Covered California determines if you are a Qualified Individual eligible to enroll and continue enrollment in this plan. To enroll in this plan, you must be a Resident of California.

Definitions: Resident of California An individual who spends in the aggregate more than 180 days each year within the State of California and has not established a permanent residence in another state or country EOC

Check our Travel Insurance Page

Covered CA Eligibility Page

Our lawful presence webpage

Our webpage on residency

I have had anthem blue cross insurance for as long as I can remember, both before Obamacare and now currently through Covered CA. I was approved for SSDI in 2014 for bipolar disorder, and denied [I declined] coverage with Medicare part B immediately as anthem through the marketplace is much, much more affordable and covers all my meds with minimal co-pays, in addition to my psychiatrist of over 10 years who I’ve partnered with for my care.

Apparently when on disability, you cannot drop medicare part A, and the fact that I have been receiving it free since 2016 has now caused me to lose my eligibility for APTC, rendering my anthem plan without subsidies unaffordable at nearly 600 a month.

I appealed this eligibility decision, and just received the administrative law judge’s decision yesterday which confirmed denial of APTC in my case. I have called social security, and they stated I don’t qualify for an SEP because my marketplace plan was individual, not from an employer.

Therefore, I would only be eligible to sign up for part B medicare in October, with my coverage starting next year.

All of this has put me in a severe depression, I’ve quit my self employment work I was doing, and I’m having an incredibly difficult time sorting out all of this. I am on 8 different psych meds, which are life threatening to go off of cold turkey ….

None of this info, including severity of my condition, was even mentioned in the hearing. I was basically told to go try and sign up for Medicaid, then medicare when eligible…. Case closed, and continuing enrollment on my anthem marketplace plan will be terminated (no date given, but I’m guessing by 1st of next month?).

I would like to know if there are any rights I may have of which I am unaware of? For our government to boast such support for “mental health awareness and access for treatment,” the current rules regarding such are not in line with increasing access to mental health services – mine were just jerked away.

I would appreciate any advice you may have. Thank you

I was able to help someone with almost the exact same case that you had. They were able to show though that they were “misinformed…” They were not getting subsidies. They did understand that part.

You can read my draft trial brief here.

We were able to get Covered CA to maintain coverage until our client can get on Part B during the General Enrollment Period. I’m on vacation out of country and unfortunately can’t take on your case. You might try the referral you got in my autoresponder question.

The law is clear, black and white, etc. that you can’t get subsidies if you are eligible for Premium Free Part A Medicare.

What do you mean SEP Special Enrollment in October?

Are you thinking of AEP Annual Election Period where you can sign up for Medicare Advantage or a Part D plan and be effective in January?

It’s my understanding that you have to wait for GEP General Enrollment Period next January through March and then you’re effective in July. I do not like phone calls! This is an example why I virtually only do zoom meetings or email. I want to make sure that my clients and prospects have and understand the exact correct official information.

Hello – I am looking for medical insurance alternatives for my 78 year old aunt. She currently has Covered CA but I am interested to learn more. Thank you!

See our reply to a very similar question below.

How long has your Aunt lived in the USA?

Less than 5 years, try Bridge Plan?

Did she work 10 years in USA?

Her husband?

Was the marriage over 10 years?

What is her MAGI Income?

The subsidies for Covered CA would be calculated on the family-household income for your two aunts. Is there anyone else in the household?

In addition to the costs of going on Medicare A Hospital, Part B Doctor Visits there is also a Part A Late Enrollment Penalty.

Was she disabled? SSI or SSDI?

Covered CA open enrollment is on till tomorrow 1.31.2020, so you can shop those plans. Click here

How do I apply for Medicare and what are the cost and coverage differences?

See our Medicare Introduction webpage

Here’s our quote engine for under 65 health plans