Individual Mandate – Shared Responsibility Penalty ISR

for not having Health Insurance in California!

Try turning your phone sideways to see the graphs & pdf's?

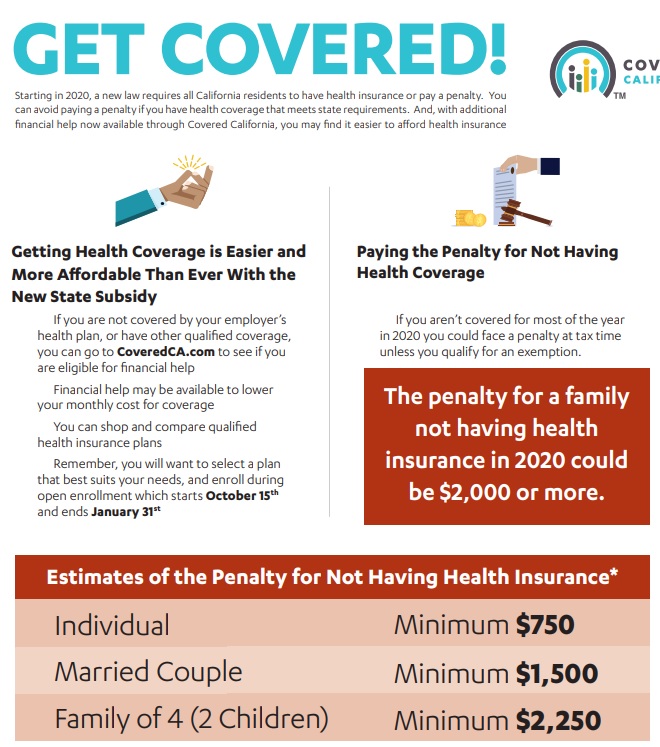

Covered California Mandate Tax Penalty

Fact Sheet

Note Covered CA simply controls the Market. These penalties are for EVERYONE!!!

Even if you are not getting Covered CA Tax Subsidies!

Tax Penalty

The penalty for not having qualifying health insurance has increased. As a reminder, there are two methods of calculating the penalty, and a household will pay whichever calculation yields the larger penalty:

- FTB Tax Penalty Calculator

- A flat amount based on the number of people in the household – $800 per adult 18 years or older and $400 per dependent child for no coverage for an entire year; up to an annual max of $2,400.

- A percentage of the household income – 2.5% of all gross household income over the tax filing threshold. (b) (1) Code

- Covered California Individual Mandate and Penalty Quick Guide April 2024

- Democratic lawmakers press Newsom to spend millions from health insurance fines LA Times May 31, 2023

- promise: The state would levy the fine but use that money to provide financial assistance to offset out-of-pocket costs for Californians purchasing health insurance on the state exchange, Covered California.Newsom isn’t doing that

- California Stockpiles Penalties From Uninsured Residents Instead of Lowering Care Costs Kaiser Health News 11/2022

FAQ’s – Comments

- Is this mandate is unconstitutional, are there any lawsuits filed?

- Heath Reform Upheld as a tax NFIP vs Sebillius

- California vs Texas vs USA Supreme Court – ACA unconstitutional

- Texas vs USA is not based on the legitimacy of the tax, but that the tax was integral and now it’s not there.

- Subsidies Upheld – King v Burwell

- Silver Loading

- California vs Texas vs USA Supreme Court – ACA unconstitutional

- The CA mandate allows CA to fund subsidies to 600%. If you go to our 600% page, check out the links to the actual bill SB 65, AB 190 SB 73 etc. Maybe they address the issue of constitutionality?

- How is CA supposed to pay for Medi Cal , provide subsides & all the people who don’t have insurance with COVID 19?

- Heath Reform Upheld as a tax NFIP vs Sebillius

Jump to section on:

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Videos on how great agents are

Penalty – Exemptions

California Mandate Penalty

#Franchise Tax Board Information

FTB Table of Contents

- Overview

- Make sure you have health care coverage

- Get coverage

- Special enrollment period

- Exemptions

- Financial help

- Penalty

- Insure Me Kevin.com Overview

- CA Healthline Explanation 12.11.2019

- Sacramento Bee 1.17.2020

- Covered CA Summary

- Residency Definition

- Word & Brown – Wholesaler Summary * *

- Kaiser Foundation Mandate Calculator

(Doesn’t account for filing threshold – so subtract that when putting in income) - The 5th U.S. Circuit Court of Appeals in New Orleans ruled that the individual mandate is not constitutional because it cannot be construed as a tax. The case goes back to U.S. District Judge Reed O’Connor in Texas to determine whether the rest of the law can be saved. Modern Health Care 12.19.2019 *

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

California Mandate Penalty #Exemptions

Exemptions Claimed on #State Tax Return

Forms * Form 3853 Exemptions & Penalty * Instructions FTB 3853

- Income is below the tax filing threshold

- VITA Free Tax Assistance

- IRS Do I need to File a Return Tool

- HR Block Listings

- Health coverage is considered unaffordable (exceeded 8.24% of household income for the 2020 taxable year)

- Families’ self-only coverage combined cost is unaffordable

- Short coverage gap of 3 consecutive months or less

- Certain non-citizens who are not lawfully present

- Certain citizens living abroad/residents of another state or U.S. territory

- Members of health care sharing ministry

- Members of federally-recognized Indian tribes including Alaskan Natives

- Incarceration (other than incarceration pending the disposition of charges)

- Enrolled in limited or restricted-scope [Share of Cost?] Medi-Cal or other coverage from the California department of Health Care Services FTB.Gov *

Exemptions Processed by Covered California

- Religious conscience exemption

- Affordability hardship

- General hardships

Minimum Essential Coverage

CA Individual Mandate

#SB78 requires an individual who is a California resident and any spouse or dependent of the individual, is enrolled in and maintains minimum essential coverage health insurance for each month beginning on and after January 1, 2020, except as specified.

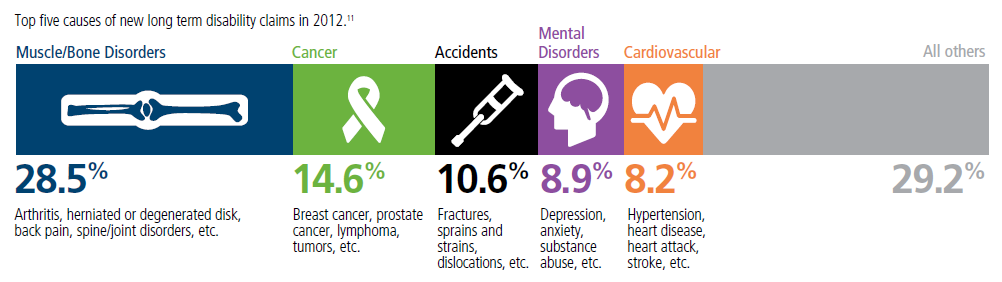

Top 5 - 10 causes of Long Term Disability Claims

Lower back disorders ♦ Depression ♦ Coronary heart disease, arthritis and pulmonary diseases (Met Life) ♦ Disability Can Happen ♦ CDC Statistics

Our webpage on Disability Payments - Insurance

Get Disability Quotes for Parents, Caretakers & Wage Earners

Minimum Essential Coverage

What is Minimum #Essential Coverage (MEC)?

26 USC §5000 A

(a) Requirement to #maintain minimum essential coverage

While there may no longer be a Federal Penalty for not having health insurance, we are showing you this page, as we expect California’s mandate to have the same rules.

The individual shared responsibility provision aka mandate requires you and each member of your family to have basic health coverage – also known as

Minimum Essential Coverage –(Bronze Plan) “§5000 A (f) (1) pdf Cornel HTML * Publication 974 *

or qualify for a health coverage exemption, or make an individual shared responsibility payment mandate for months without coverage or an exemption when you file your federal income tax return.

Many people already have minimum essential coverage and do not need to do anything more than maintain that coverage and report their coverage when they file their tax returns. Most taxpayers will simply check a box to indicate that each member of their family had qualifying health coverage for the whole year.

See also,

- minimum [Mandated] essential benefits

- Minimum Value Notice 2012-31

- 36B c 2 c ii (60% rule)

- Metal Levels (Bronze)

- coveredca.com/documents-to-confirm-eligibility/minimum-essential-coverage/

Here are some examples of coverage that qualify as minimum essential coverage:

Employer-sponsored coverage

- Group health insurance coverage for employees under

- a governmental plan such as the Federal Employees Health Benefit program

- a plan or coverage offered in the small or large group market within a state

- a grandfathered health plan offered in a group market

- Self-insured group health plan for employees

- COBRA coverage

- Retiree coverage

- Health insurance you purchase directly from an insurance company

- Health insurance you purchase through the Health Insurance Marketplace

- Health insurance provided through a student health plan

Coverage under government-sponsored programs:

- Medicare Part A coverage

- Medicare Advantage plans

- Most Medicaid Medi Cal coverage

- C-CHIP County Children’s Health Initiative Program

- Most types of TRICARE coverage

- Comprehensive health care programs offered by the Department of Veterans Affairs

- Department of Defense Nonappropriated Fund Health Benefits Program

- Refugee Medical Assistance

U.S. citizens, who are residents of a foreign country for an entire year, and residents of U.S. territories, are considered to have minimum essential coverage for the year.

For more information on the types of coverage that qualify as minimum essential coverage and those that do not, as well as information on certain coverage that may provide limited benefits, visit the MEC page on IRS.gov/aca.

If you need health coverage, visit HealthCare.gov to learn about health insurance options that are available for you and your family, how to purchase health insurance, and how you might qualify to get financial assistance with the cost of insurance.

Subscribe to IRS Tax Tips to get easy-to-read tips via e-mail from the IRS.

1095 B Rules & Information confirmation of employer coverage

(A) Government sponsored programs

Coverage under—

(i) the Medicare program under part A of title XVIII of the Social Security Act,

(ii) the Medicaid program under title XIX of the Social Security Act,

(iii) the CHIP program under title XXI of the Social Security Act,

(iv) medical coverage under chapter 55 of title 10, United States Code, including coverage under the TRICARE program; [2](v) a health care program under chapter 17 or 18 of title 38, United States Code, as determined by the Secretary of Veterans Affairs, in coordination with the Secretary of Health and Human Services and the Secretary,

(vi) a health plan under section 2504 (e) of title 22, United States Code (relating to Peace Corps volunteers); [2] or

(vii) the Nonappropriated Fund Health Benefits Program of the Department of Defense, established under section 349 of the National Defense Authorization Act for Fiscal Year 1995 (Public Law 103–337; 10 U.S.C. 1587 note).

(B) Employer-sponsored plan

Coverage under an eligible employer-sponsored plan.

Lowest MEC price & coverage

.

(C) Plans in the individual market

Coverage under a health plan offered in the individual market within a State.

.

(D) Grandfathered health plan

Coverage under a grandfathered health plan.

.

(E) Other coverage

Such other health benefits coverage, such as a State health benefits risk pool, as the Secretary of Health and Human Services, in coordination with the Secretary, recognizes for purposes of this subsection.

.

(2) Eligible employer-sponsored plan

The term “eligible employer-sponsored plan” means, with respect to any employee, a group health plan or group health insurance coverage offered by an employer to the employee which is—

(A) a governmental plan (within the meaning of section 2791(d)(8) of the Public Health Service Act), or

(B) any other plan or coverage offered in the small or large group market within a State.

Such term shall include a grandfathered health plan described in paragraph (1)(D) offered in a group market.

(3) Excepted benefits not treated as minimum essential coverage

The term “minimum essential coverage” shall not include health insurance coverage which consists of coverage of excepted benefits—

(A) described in paragraph (1) of subsection (c) ofsection 2791 of the Public Health Service Act; or

(B) described in paragraph (2), (3), or (4) of such subsection if the benefits are provided under a separate policy, certificate, or contract of insurance.

(4) Individuals residing outside United States or residents of territories

Any applicable individual shall be treated as having minimum essential coverage for any month—

(A) if such month occurs during any period described in subparagraph (A) or (B) of section 911 (d)(1) which is applicable to the individual, or

(B) if such individual is a bona fide resident of any possession of the United States (as determined under section 937 (a)) for such month.

(5) Insurance-related terms

Any term used in this section which is also used in title I of the Patient Protection and Affordable Care Act shall have the same meaning as when used in such title.

Resources & Links

- Kaiser Foundation FAQ’s

- Center on Budget & Policy Priorities

- IRS Website on MEC

- Request for your Social Security # so that the Insurance Company can report proof of Insurance to the IRS Form # 1095 A Covered CA B All other Insurance Companies or C Large Employers

- IRS Chart of Minimum Essential Coverage

- Publication 974 Premium Tax Credit

Code of Federal Regulations

Subpart G—Minimum Essential Coverage

§156.600 The definition of minimum essential coverage. §5000 A (f)

§156.602 Other coverage that qualifies as minimum essential coverage.

§156.604 Requirements for recognition as minimum essential coverage for types of coverage not otherwise designated minimum essential coverage in the statute or this subpart.

42 U.S. Code § 18021 –

#Qualified health plan defined

While there may no longer be a Federal Penalty and there are issues with Constitutionality Texas vs USA for not having health insurance, we are showing you this page, as we expect California’s mandate to have the same or very similar rules as the Feds did. We are waiting to hear from the FTB Franchise Tax Board on the details.

(i) is licensed and in good standing to offer health insurance coverage in each State in which such issuer offers health insurance coverage under this title;

(2)Inclusion of CO–OP plans and multi-State qualified health plans

(3)Treatment of qualified direct primary care medical home plans

Subpart C—Qualified Health Plan Minimum Certification Standards

§156.200 QHP issuer participation standards.

§156.210 QHP rate and benefit information.

§156.215 Advance payments of the premium tax credit and cost-sharing reduction standards.

§156.220 Transparency in coverage.

§156.225 Marketing and Benefit Design of QHPs.

§156.230 Network adequacy standards.

§156.235 Essential community providers.

§156.245 Treatment of direct primary care medical homes.

§156.250 Meaningful access to qualified health plan information.

§156.255 Rating variations.

§156.260 Enrollment periods for qualified individuals.

§156.265 Enrollment process for qualified individuals.

§156.270 Termination of coverage or enrollment for qualified individuals.

§156.275 Accreditation of QHP issuers.

§156.280 Segregation of funds for abortion services.

§156.285 Additional standards specific to SHOP.

§156.290 Non-renewal and decertification of QHPs.

§156.295 Prescription drug distribution and cost reporting.

§156.298 Meaningful difference standard for Qualified Health Plans in the Federally-facilitated Exchanges.

Historical

Tax Cuts & Jobs Act

Federal Mandate penalty drops to Zero

The New Tax Bill HR 1 Tax Cuts & Jobs act drops the mandate penalty to zero, but many would argue the mandate is still valid. Congress could put a financial tax penalty back in, see Texas v USA – CA brief page # 34.

PART VIII—INDIVIDUAL MANDATE

SEC.11081. ELIMINATION OF SHARED RESPONSIBILITY PAYMENT FOR INDIVIDUALS FAILING TO MAINTAIN MINIMUM ESSENTIAL COVERAGE.

(a) In General.—Section 5000A(c) is amended—

(1) in paragraph (2)(B)(iii), by striking “2.5 percent” and inserting “Zero percent”, and

(2) in paragraph (3)—

(A) by striking “$695” in subparagraph (A) and inserting “$0”, and

(B) by striking subparagraph (D).

(b) Effective Date.—The amendments made by this section shall apply to months beginning after December 31, 2018.

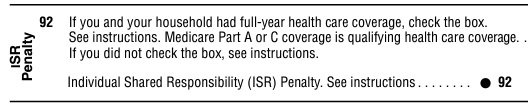

Obama Care imposes a Individual Mandate – Tax Penalty of 2.5% of income (calculate it) on just about ALL legal residents, if you don’t Purchase Health Insurance. Your coverage must include the 10 Essential Minimum Benefits and meet the definition of Minimum Essential Coverage (MEC), unless you qualify for an exemption, (§5000 A). Just check off on line 61 of your 1040 that you complied. You will also get a 1095 from your Insurance Company.

The Health Care Law provides for subsidies and tax Credits to help you pay the premium. We can help you with that at no additional charge. Complementary quotes for compliant guaranteed issue plans.

You might also talk to your Employer about providing Coverage. Tell him he can get a FREE Quote and it’s tax deductible for him and tax free to you §106 IRC.

CA fights Trumps attacks on ACA/Obamacare LA Times 8.15.2019 *

Federal Individual Shared Responsibility Provision

Historical – Penalty is just in CA

The individual shared responsibility provision requires everyone on your tax return to have qualifying health care coverage for each month of the year or have a coverage exemption. Otherwise, you may be required to make an individual shared responsibility payment.

HIGHLIGHTS

- If you maintain qualifying health care coverage for the entire year, you don’t need to do anything more than report that coverage on your federal income tax return by simply checking a box. Qualifying coverage includes most employer-sponsored coverage, coverage obtained through a Health Insurance Marketplace, coverage through most government-sponsored programs, as well as certain other specified health plans.

- If you go without coverage or experience a gap in coverage, you may qualify for an exemption from the requirement to have coverage. If you qualify for an exemption, you use Form 8965, Health Coverage Exemptions, to report a coverage exemption granted by the Marketplace or to claim a coverage exemption on your tax return.

- If for any month during the year you don’t have qualifying coverage and you don’t qualify for an exemption, you will have to make an individual shared responsibility payment when you file your federal income tax return.

- The payment amount for 2015 is the greater of 2 percent of the household income above the taxpayer’s filing threshold, or $325 per adult plus $162.50 per child (limited to a family maximum of $975). This payment is capped at the cost of the national average premium for a bronze level health plan available through Marketplaces that would provide coverage for the taxpayer’s family members that neither had qualifying coverage nor qualify for a coverage exemption. The instructions for Form 8965, Health Coverage Exemptions, provide the information needed to calculate the payment that will be reported on you federal income tax return.

- Form 1095-B will be sent to individuals who had health coverage for themselves or their family members that is not reported on Form 1095-A or Form 1095-C. Form 1095-A will be sent to individuals who enrolled in health coverage for themselves or their family members through the Marketplace. Form 1095-C will be sent to certain employees of applicable large employers.

- Some taxpayers may not receive a Form 1095-B or Form 1095-C by the time they are ready to file their 2015 tax return. It is not necessary to wait for Forms 1095-B or 1095-C in order to file. Taxpayers may instead rely on other information about their health coverage and employer offer to prepare their returns

Here are some basic facts about the individual shared responsibility provision.

What is the individual shared responsibility provision?

The individual shared responsibility provision calls for each individual to have qualifying health care coverage – known as minimum essential coverage – for each month, qualify for an exemption, or make a payment when filing his or her federal income tax return.

What do I need to do if I am required to make a payment with my tax return?

If you have to make an individual shared responsibility payment, you will use the worksheets found in the instructions to Form 8965, Health Coverage Exemptions, to figure the shared responsibility payment amount due. You only make a payment for the months you did not have coverage or qualify for a coverage exemption.

To learn more, visit the Reporting and Calculating the Payment page on IRS.gov/aca, or use our interactive tool, Am I Eligible for a Coverage Exemption or Required to Make an Individual Shared Responsibility Payment?

What happens if I owe an individual shared responsibility payment,

but I cannot afford to make the payment when filing my tax return?

The IRS routinely works with taxpayers who owe amounts they cannot afford to pay. The law prohibits the IRS from using liens or levies to collect any individual shared responsibility payment. However, if you owe a shared responsibility payment, the IRS may offset that liability against any tax refund that may be due to you.

For more information about the Affordable Care Act and your income tax return, visit IRS.gov/aca.

FAQ’s

7.5 million paid an average of $200 in penalties for not having coverage in 2014 per Kaiser Health News 7.22.2015

White House.Gov Affordable Health Care Act YouTube Channel

California – REVENUE AND TAXATION CODE

Individual Shared Responsibility #Penalty [61000 – 61045]

61000. For the purposes of this part, the following definitions shall apply:

(a) “Applicable entity” means the following:

(1) A carrier licensed or otherwise authorized to offer health coverage with respect to minimum essential coverage, including coverage in a catastrophic plan, that is not described in paragraph (3) or (4).

(2) An employer or other sponsor of an employment-based health plan with respect to employment-based minimum essential coverage

(3) The State Department of Health Care Services and county welfare departments with respect to coverage under a state program.

(4) The Exchange with respect to individual health plans, except catastrophic plans, on the Exchange.

(5) Any other provider of minimum essential coverage, including the University of California with respect to coverage under a student health insurance program.

(b) “Applicable dependent” has the same meaning as defined in Section 100710 of the Government Code.

(c) “Applicable household income” means, with respect to a responsible individual for a taxable year, an amount equal to the sum of the modified adjusted gross income of all applicable household members who were required to file a tax return under Chapter 2 (commencing with Section 18501) of Part 10.2 for the taxable year.

(d) “Applicable household members” means, with respect to a responsible individual, all of the following persons:

(1) The responsible individual.

(2) The responsible individual’s applicable spouse.

(3) The responsible individual’s applicable dependents.

(e) “Applicable individual” has the same meaning as defined in Section 100710 of the Government Code.

(f) “Applicable spouse” has the same meaning as defined in Section 100710 of the Government Code.

(g) “Dependent” has the same meaning as defined in Section 17056 of the Revenue and Taxation Code.

(h) “Exchange” means the California Health Benefit Exchange, also known as Covered California, established pursuant to Title 22 (commencing with Section 100500).

(i) “Household size” means, with respect to a responsible individual, the number of applicable household members.

(j) “Modified adjusted gross income” means adjusted gross income, as defined in Section 17072, increased by both of the following:

(1) The amount of interest received or accrued by the individual during the taxable year that is exempt from tax, unless the interest is exempt from tax under the United States Constitution or the California Constitution.

(2) Foreign-earned income, foreign housing exclusion, or foreign housing deduction under Section 911 of the Internal Revenue Code.

What about Social Security?

(k) “Premium assistance” means the amount of credit allowable under Section 36B of the Internal Revenue Code of 1986 and any premium assistance subsidies administered pursuant to Title 25 (commencing with Section 100800) of the Government Code.

(l) “Qualified health plan” has the same meaning as defined in Section 1301 of the federal Patient Protection and Affordable Care Act (Public Law 111-148), as amended by the federal Health Care and Education Reconciliation Act of 2010 (Public Law 111-152).

(m)

(1) Except as provided in paragraphs (2) and (3), “responsible individual” means an applicable individual who is required to file a return under Chapter 2 (commencing with Section 18501) of Part 10.2 and who is either of the following:

(A) An applicable individual required to be enrolled in and maintain minimum essential coverage, pursuant to subdivision (a) of Section 100705 of the Government Code.

(B) An applicable individual required to ensure that a person who qualifies as the applicable individual’s applicable spouse or applicable dependent is enrolled in and maintains minimum essential coverage for that month, pursuant to subdivision (b) of Section 100705 of the Government Code.

(2) If two applicable individuals file a joint return, only one shall be considered the responsible individual for purposes of calculating the penalty as determined by the Franchise Tax Board.

(3) If a dependent files a return, only the dependent or the individual claiming the dependent, but not both, shall be considered the responsible individual for purposes of calculating the penalty as determined by the Franchise Tax Board.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61005.

(a) The Legislature finds and declares both of the following:

(1) The reporting requirement provided for in this section is necessary for the successful implementation of the penalty imposed by Section 61010. In particular, this requirement provides the only widespread source of third-party reporting to help applicable individuals and the Franchise Tax Board verify whether an applicable individual maintains minimum essential coverage. There is compelling evidence that third-party reporting is crucial for ensuring compliance with those tax provisions.

(2) The reporting requirement in this section has been narrowly tailored to support compliance with the penalty imposed by Section 61010, while imposing only an incidental burden on reporting entities. In particular, the information required to be reported under this section is limited to the information already required to be reported under a similar federal reporting requirement under Section 6055 of the Internal Revenue Code of 1986. In addition, this section provides that its reporting requirement may be satisfied by providing the same information that is currently reported under that federal requirement.

(b) For purposes of administering the penalty imposed by this part on applicable individuals who fail to maintain minimum essential coverage as required by Title 24 of the Government Code:

(1) An applicable entity that provides minimum essential coverage to an individual during a calendar year shall, at the time the Franchise Tax Board prescribes, make a return to the Franchise Tax Board in the form and manner described in subdivision (c) or (d) on or before March 31 of the year following the calendar year for which the return is required.

(2) An applicable entity described in paragraph (2) of subdivision (a) of Section 61000 shall not be required to make the return specified in paragraph (1) if the applicable entity that is described in paragraph (1) of subdivision (a) of Section 61000 makes that return.

(c) Except as provided in subdivision (d), an applicable entity shall make a return that complies with all of the following:

(1) Is in the form as the Franchise Tax Board prescribes.

(2) Contains the name, address, and taxpayer identification number of the applicable individual and the name and taxpayer identification number of each other individual who receives coverage under the policy.

(3) Contains the dates during which the individuals specified in paragraph (2) were covered under minimum essential coverage during the calendar year.

(4) Contains any other information as the Franchise Tax Board may require.

(d) Notwithstanding the requirements of subdivision (c), a return complies with the requirements of this section if it is in the form of, and includes the information contained in, a return described in Section 6055 of the Internal Revenue Code of 1986, as that section is in effect on December 15, 2017.

(e) Except as provided in subdivision (g), an applicable entity required to make a return under subdivision (b) shall provide to each primary subscriber, primary policyholder, primary insured, employee, former employee, uniformed services sponsor, parent, or other related person named on an application who enrolls one or more individuals, including themselves, in minimum essential coverage a written statement in the form and manner described in subdivision (f) on or before January 31 of the year following the calendar year for which the return is required under subdivision (b).

(f) The written statement required by subdivision (e) shall include both of the following:

(1) The name and address of the person required to make the return and the telephone number of the contact information for that person.

(2) The information required to be shown on the return, as specified in subdivision (c).

(g) Notwithstanding subdivisions (e) and (f), the requirements of this section may be satisfied by a written statement provided to an individual under Section 6055 of the Internal Revenue Code of 1986, as that section is in effect and interpreted on December 15, 2017.

(h) In the case of coverage provided by an applicable entity that is a governmental unit or an agency or instrumentality of that unit, the officer or employee who enters into the agreement to provide the coverage, or the person appropriately designated for purposes of this section, shall be responsible for the returns and statements required by this section.

(i) An applicable entity may contract with third-party service providers, including insurance carriers, to provide the returns and statements required by this section.

(j) Except for the applicable entities described in paragraphs (3) and (4) of subdivision (a) of Section 61000, a penalty shall be imposed on an applicable entity that fails to make a return as required by subdivision (b) in an amount of fifty dollars ($50) per applicable individual covered by the applicable entity for a taxable year in which the failure occurs.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61010.

(a) A penalty in the amount determined under Section 61015 shall be imposed on a responsible individual for a failure by the responsible individual, the applicable spouse, or an applicable dependent to enroll in and maintain minimum essential coverage pursuant to Section 100705 of the Government Code for one or more months, except as provided in Section 61020 and 61023. This penalty shall be referred to as the Individual Shared Responsibility Penalty.

(b) A penalty imposed by this section with respect to any month shall be included with a responsible individual’s return under Chapter 2 (commencing with Section 18501) of Part 10.2 for the taxable year that includes that month.

(c) If an individual with respect to whom a penalty is imposed by this section for any month is a dependent of another individual for the other individual’s taxable year, including that month, the other individual shall be solely liable for that penalty.

(d) If a responsible individual with respect to whom a penalty is imposed pursuant to this section for any month files a joint return for the taxable year, including that month, that responsible individual and the spouse or domestic partner of the individual shall be jointly and severally liable for the penalty imposed.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61015.

(a) The amount of the Individual Shared Responsibility Penalty imposed on a responsible individual for a taxable year with respect to the failures described in Section 61010 shall be equal to the lesser of either of the following amounts:

(1) The sum of the monthly penalty amounts determined under subdivision (b) for months in the taxable year during which one or more of the failures described in Section 61010 occurred.

(2) An amount equal to one-twelfth of the state average premium for qualified health plans that have a bronze level of coverage for the applicable household size involved, and are offered through the Exchange for plan years beginning in the calendar year with or within which the taxable year ends, multiplied by the number of months in which a failure described in Section 61010 occurred.

(b) For purposes of subdivision (a), the monthly penalty amount with respect to a responsible individual for any month during which a failure described in Section 61010 occurred is an amount equal to one-twelfth of the greater of either of the following amounts:

(1) An amount equal to the lesser of either of the following:

(A) The sum of the applicable dollar amounts for all applicable household members who failed to enroll in and maintain minimum essential coverage pursuant to Section 100705 of the Government Code during the month, except as provided by Section 61023.

(B) Three hundred percent of the applicable dollar amount determined for the calendar year during which the taxable year ends.

(2) An amount equal to 2.5 percent of the excess of the responsible individual’s applicable household income for the taxable year over the amount of gross income that would trigger the responsible individual’s requirement to file a state income tax return under Section 18501, also referred to as the applicable filing threshold, for the taxable year.

(c) For purposes of subdivisions (a) and (b):

(1) Except as provided in paragraph (2) and subdivision (d), the applicable dollar amount is six hundred ninety-five dollars ($695).

(2) If an applicable individual has not attained 18 years of age as of the beginning of a month, the applicable dollar amount with respect to that individual for that month shall be equal to one-half of the applicable dollar amount as provided in paragraph (1) or subdivision (d).

(d) In the case of a calendar year beginning after 2019, the applicable dollar amount shall be equal to six hundred ninety-five dollars ($695) and increased as follows:

(1) An amount equal to six hundred ninety-five dollars ($695) multiplied by the cost-of-living adjustment determined pursuant to paragraph (2).

(2) A cost-of-living adjustment for a calendar year is an amount equal to the percentage by which the California Consumer Price Index for all items in the preceding calendar year exceeds the California Consumer Price Index for all items for the 2016 calendar year.

(3) If the amount of an increase under paragraph (1) is not a multiple of fifty dollars ($50), that increase shall be rounded down to the next multiple of fifty dollars ($50).

(4) No later than August 1 of each year, the Department of Industrial Relations shall annually transmit to the Franchise Tax Board the percentage change in the California Consumer Price Index for all items from June of the prior calendar year to June of the current calendar year, inclusive.

(e) For taxable years during which the Franchise Tax Board determines that a federal shared responsibility penalty applies, the Individual Shared Responsibility Penalty shall be reduced, but not below zero, by the amount of the federal penalty imposed on the responsible individual for each month of the taxable year during which the Individual Shared Responsibility Penalty is imposed.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61020.

An Individual Shared Responsibility Penalty shall not be imposed on a responsible individual for a month in which any of the following circumstances apply:

(a) If the responsible individual’s required contribution, determined on an annual basis, for coverage for the month exceeds 8.3 percent of that responsible individual’s applicable household income for the taxable year.

(1) For purposes of applying this subdivision, an individual’s applicable household income shall be increased by any exclusion from gross income for any portion of the required contribution made through a salary reduction arrangement.

(2) For purposes of this subdivision, the term “required contribution” means either of the following:

(A) In the case of a responsible individual eligible to purchase minimum essential coverage consisting of coverage through an eligible employer-sponsored plan, the portion of the annual premium that would be paid by the responsible individual, without regard to whether paid through salary reduction or otherwise, for self-only coverage.

(B) In the case of a responsible individual eligible only to purchase minimum essential coverage in the individual market, the annual premium for the lowest cost bronze plan available in the individual market through the Exchange in the rating area in which the individual resides, reduced by any premium assistance for the taxable year determined as if the responsible individual was covered by a qualified health plan offered through the Exchange for the entire taxable year.

(3) For purposes of subparagraph (A) of paragraph (2), if a responsible individual is eligible for minimum essential coverage through an employer by reason of a relationship to an employee, the determination under paragraph (1) shall be made by reference to the portion of the premium required to be paid by the employee for family coverage.

(4) In the case of plan years beginning in any calendar year after 2019, this subdivision shall be applied by substituting for “8.3 percent” an amount equal to 8 percent increased by the amount the United States Secretary of Health and Human Services determines reflects the excess of the rate of premium growth between the preceding calendar year and 2013 over the rate of income growth for that period. If the United States Secretary of Health and Human Services fails to determine this percentage for a calendar year, the Exchange shall determine the percentage.

(b) If the responsible individual’s applicable household income for the taxable year containing the month is less than the amount of adjusted gross income specified in paragraph (1) or (2) of subdivision (a) of Section 18501 for that taxable year.

(c) If the responsible individual’s gross income for the taxable year containing the month is less than the amount specified in paragraph (3) of subdivision (a) of Section 18501.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61023.

An Individual Shared Responsibility Penalty shall not be imposed with respect to an applicable household member for a month if the last day of the month occurred during a period in which the applicable household member did not maintain minimum essential coverage for a continuous period of three months or less.

(a) The length of a continuous period shall be determined without regard to the calendar years in which months in that period occur.

(b) If a continuous period is greater than the period allowed under this subdivision, an exception shall not be provided under this subdivision for any month in the period.

(c) If there is more than one continuous period described in this subdivision covering months in a calendar year, the exception provided by this subdivision shall only apply to months in the first of those periods.

(d) The Franchise Tax Board may prescribe rules for the collection of the penalty imposed by this section in cases where continuous periods include months in more than one taxable year.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61025.

(a) The Franchise Tax Board’s civil authority and procedures for purposes of compliance with notice and other due process requirements imposed by law to collect income taxes shall be applicable to the collection of the Individual Shared Responsibility Penalty.

(b) The Individual Shared Responsibility Penalty shall be paid upon notice and demand by the Franchise Tax Board, and shall be assessed and collected pursuant to Part 10.2 (commencing with Section 18401), except as follows:

(1) If an applicable individual fails to timely pay the Individual Shared Responsibility Penalty, the applicable individual shall not be subject to a criminal prosecution or penalty with respect to that failure.

(2) The Franchise Tax Board shall not file a notice of lien with respect to any real property of an applicable individual by reason of any failure to pay the Individual Shared Responsibility Penalty, or levy any real property with respect to that failure.

(3) For the purpose of collecting the Individual Shared Responsibility Penalty, Article 1 (commencing with Section 19201) of Chapter 5 of Part 10.2 shall not apply.

(c) The Franchise Tax Board shall integrate enforcement of the Individual Shared Responsibility Penalty into existing activities, protocols, and procedures, including audits, enforcement actions, and taxpayer education efforts.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61030.

(a) The Franchise Tax Board may, in consultation with the Exchange, adopt regulations that are necessary and appropriate to implement this part.

(b) It is the intent of the Legislature that, in construing this part, the regulations promulgated by under Section 5000A of the Internal Revenue Code as of December 15, 2017, notwithstanding the specified date in paragraph (1) of subdivision (a) of Section 17024.5, shall apply to the extent that those regulations do not conflict with this part or regulations promulgated by the Franchise Tax Board pursuant to subdivision (a) in consultation with the Exchange.

(c) Until January 1, 2022, the Administrative Procedure Act (Chapter 3.5 (commencing with Section 11340) of Part 1 of Division 3 of Title 2 of the Government Code) shall not apply to any standard, criterion, procedure, determination, rule, notice, guideline, or any other guidance established or issued by the Franchise Tax Board pursuant to this part.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61035.

Moneys collected from the Individual Shared Responsibility Penalty shall be deposited into the General Fund.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61040.

The provisions of this part are severable. If any provision of this part or its application is held invalid, that invalidity shall not affect other provisions or applications that can be given effect without the invalid provision or application.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61045.

The Franchise Tax Board shall annually publish on its internet website all of the following information:

(a) The number of applicable households paying the penalty and the average penalty amount by applicable household income level.

(b) The number of applicable households paying the penalty in each county and statewide.

(c) The total penalty amount collected.

(d) The number and type of most commonly claimed exemptions.

(e) The number and total penalty amounts collected under subdivision (j) of Section 61005.

(Added by Stats. 2019, Ch. 38, Sec. 42. (SB 78) Effective June 27, 2019.)

61050.

(a) On or before March 1, 2022, and annually on or before March 1 thereafter, the Franchise Tax Board shall report to the Legislature on information regarding this part and Title 24 (commencing with Section 100700) and Title 25 (commencing with Section 100800) of the Government Code, including all of the following:

More Detailed (Child) Pages on Individual & Employer Mandate

https://hbex.coveredca.com/toolkit/downloads/Individual_Mandate_and_Penalty_Quick_Guide.pdf

https://www.ftb.ca.gov/file/personal/filing-situations/healthcare/estimator/

https://www.ftb.ca.gov/about-ftb/newsroom/health-care-mandate/personal.html#Exemptions

What about estimating income, if I’m unemployed and looking for work?

We will answer that in our webpage on reporting changes and estimating income.

I haven’t used my health insurance at all this past year, and I’m planning to move abroad January 2020.

Not sure this is the best use of funds.

There is now a tax penalty if you don’t have coverage! Will you be gone the entire tax year to avoid penalties? See our exemptions page.

If you knew when your were going to have a claim and should buy coverage, would the Insurance Companies sell it to you?

You should be thankful you didn’t have a claim last year. While you might not have made a claim, that doesn’t mean the Insurance Company kept the $$$. Insurance Companies are mandated to pay out 80% of the premiums in claims. Someone else got your $$$. Same as if you had a claim. Insurance just spreads out the loss, so that you can pay a small premium and if you have a serious claim, don’t have to go without treatment or face bankruptcy. https://en.wikipedia.org/wiki/Insurance

How will you get coverage in a foreign country?

Is this a permanent move?

Do you want to keep the option to come back to USA for treatment?

There are only certain times you can buy insurance, considering no medical or health questions are asked. No Pre X clause!

Click here for quotes