Reasons to Buy & What does #Long Term Care Insurance Cover?

- Long Term Care Insurance pays for help both in your home and skilled nursing home, when you can no longer care for yourself, that is you are not able to fully do 2 or more of seven ADL’s, Activities of Daily Living eating, bathing, dressing, toileting, transferring, continence and ambulating, more details.

- Long Term Care includes a wide range of mostly non-medical services that are

- designed to help people maintain the maximum level of independence.

- Care can be custodial, intermediate or skilled in nature and

- can be provided in the home, (most claims are for in home care) community or institutional setting.

- Long term care can be provided in a formal (nursing home) or

- informal manner (home care, family & friends).

- LTC may be mandatory in the very near future Read More CA Department of Insurance

- Nearly half applying for long-term care after 70 are denied, insurance group says

- Medicare Skilled nursing, Home Health are very limited!

The Three main types of coverage are:

- nursing facility, Medicare coverage is limited to 100 days

- home care – how Medicare pays for it

- comprehensive, which includes both nursing and home care coverage. BJFIM.com

- What are the most popular choices of benefits in Long Term Policies?

- Let’s take a look at Taking Care of Tomorrow by CA Department of Aging for definitions and explanations. What is the “most popular” doesn’t necessarily apply to our or your situation. In fact, we are not allowed to say “best” in Medicare Advantage, unless we have facts to show it.

- Long-term care needs will only increase as more Americans age Insurance News Net 12/2024

- What’s on this page?

- CA Dept of Aging – Taking Care of Tomorrow

- Tax Qualified Premiums?

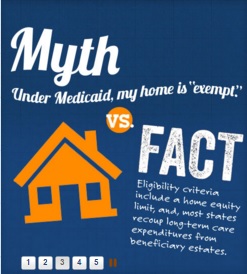

- Medi Cal no $$$ take your home…

- True Freedom Plans – Low Premium Home Health Care only

- 1035 Exchange

- ADL’s Activities of Daily Living

- Medicare Home Health Care Pamphlet

- Employer Groups

- Hospice

- Medicare Coverage for Skilled Nursing

- Low Budget – No money for premiums?

CA Dept of Aging – Home & Long Term Care Booklet

Please note, there are updates all the time, double check everything.

#Taking Care of Tomorrow Booklet

NAIC Shoppers Guide to Long Term Care

More details on #Planning for Long Term Care

- Borden Hamman Long Term Planning Guide

- Nolo Long Term Care

- Medi Cal IHSS In Home Support Services

- Here’s how those looking to ‘age in place’ can fund home health-care services

- Study: 70% Want To Age At Home, But Only 10% Have Long-Term Insurance

- In-Home Supportive Services 101: Opportunities and Challenges Under CalAIM

- Californians who need help paying for ’round-the-clock home care are stuck on a state waitlist

- Long Term Care.gov

- Calculate Cost of Long Term Care in your Area Genworth

- canhr.org/fact-sheets

our webpages on

- Medi-Cal Nursing Home, Long Term Care & Estate Recovery

- Home Health & Long Term Care

- Low Premium Home Health Care ONLY

- Hospice

- How Medicare covers Home Health Care

- Medicare & Skilled Nursing

- For Older Americans Month, questions about aging in place and staying at home

- 5 Wishes Talk to your loved ones today about what matters most. The advance care planning program trusted by more than 40 million people

- Facing Financial Ruin as Costs Soar for Elder Care

- VIDEO’s

-

H. Long-Term Care

Flyer – Americans Unprepared for Future Health Care Expenses

Our Main Webpage on

Long Term Care Nursing & Home Health Care

Long Term Care Brochures

- Outline Of Coverage

- Full Long Term Care Policy 52 pages

- National Assoc of Insurance Commissioners Shoppers Guide to LTC

- California Guide to Long Term Care

- Aging in place (your home) vs COVID sheltering in place

- CA #Law on Long Term Care Insurance §10123 – 10237.6

- FAQ on waiting periods

- Claim benefits are not taxable as income and the premium can be deductible.

- What are your Costs of Long Term Care and chances of needing Long Term Care?

- Medicare may pay for 90 days in a nursing home after 3 days in a hospital. Publication 10153 *

Links & Resources

- CA Health Care Advocates

- Dave Ramsey on when you need Long Term Care

- Rate Increases? Calif. Health Line 3.16.2016

- How will we pay for LTC? CA Health Line 3.16.2016

- Asset & Income Questionnaires? Do you have too much $$$ so you don't need LTC or so little it's Medi-Cal?

- Will annuities take care of your planning needs?

- Long Term Care.Gov

- Genworth - What is long Term Care?

- Total Living Coverage Brochure 20 pages Rev 11.2013

- Privileged Choice Flex Rev 6.2015

- the long term care guy.com

- Life Happens.Org - Long Term Care

- AHIP Who buys Long Term Care Insurance?

- Medicare Website on what Medicare Covers

- American Assoc. for Long Term Care Insurance

- Long Term Care.gov

- Sample Long Term Care Policy

- Genworth - Care & Support for your family

- Long Term Care Fact Sheet

- Veteran's Administration on Long Term Care

- Long Beach Breakers Hotel may lose license

- California Health Insurance Counseling and Advocacy Program (HICAP)

- LTC Consultant’s

- Long Term Care Glossary

- Home Health Care in CA

- long term care.gov

- California Department on Aging

- cal medicare.org/

- Steve Shorr’s Fraud Website

- care giver.org

- CHFC Reports 7.2013

- d i law Group.com/

- You Tube Video's on Mutual of Omaha Long Term Care....

- Borden Hamman Broker Training Video's

How much LTC do you need?

Chances of using the coverage?

Questions to ask yourself to figure out what you might need?

- If you were unable to fully take care of yourself, that is you had along term care problem, claim or event, what are your plans to deal with the costs, emotional issues and stress on your loved ones?

- Where will the money to deal with a disability come from to pay for your care and/or assistance?

- How will this impact your retirement nest egg?

- And that of your spouses along with leaving money for your children? Building a Long Term Strategy

- Would an extra bill for $60-$80k/year in your retirement be a problem for you?

Financial Resources Questionnaire

to get the right coverage for your situation

Long Term Care

Cut & Paste these questions into an email and send to us at [email protected]

1. Seven percent of my annual income is approximately $_______________. (This is the maximum amount of annual income experts advise spending on a premium.)

2. The cash value of my non-housing assets* is $____________. (This is the amount you would otherwise have to spend for long-term care.)

3. My non-housing assets would last _____________ years if I needed care today. (This is the approximate number of years of coverage you might consider buying.)

4. I can afford to pay $____________ a day towards the cost of my own care. The difference between the amount I can afford and the cost of care today is $_________. (This is the approximate amount of daily benefit you will need.)

5. I can afford to pay a total of $____________ for the first days of care in a nursing home. Therefore, I will need a waiting period no longer than:

30 days $__________ 60 days $__________ 90 days $____________.

(To determine the amount you would pay, multiply the daily nursing home cost times the number of days in the waiting period.) Copied from Taking Care of Tomorrow *

Elimination Period Explanation

LTC proposals usually show a 90 day wait for reimbursement. Cash benefits don’t have a waiting period. If you want a lower premium, you can have a longer wait.

Calendar Day Elimination Period –

Your policy has a waiting period before policy benefits begin. The elimination period starts on the first day you are chronically ill and you receive a covered service. Once the elimination period has been satisfied, benefits for covered services are paid to you each month, up to the maximum monthly benefit you select. Your options include:

• 90, 180 or 365 calendar days

On LTC policies, you only have to show you can’t do two of these 7 things (Activities of Daily Living).

What Is Long-Term Care?

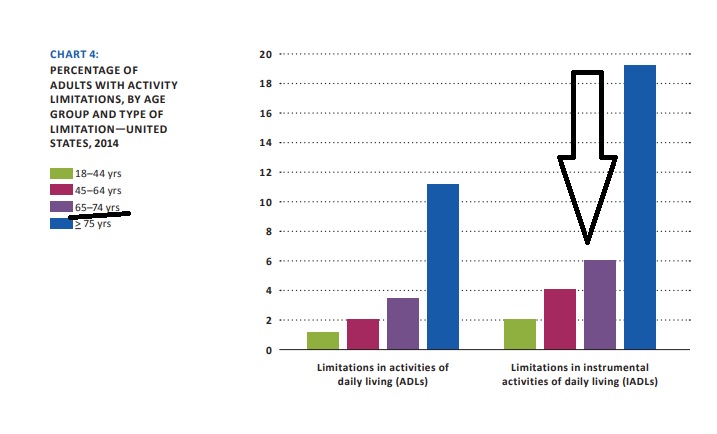

Long-term care is the kind of personal care needed for tasks like bathing, dressing, eating, continence, toileting, and transferring (getting in or out of a bed or chair). These six basic needs are commonly referred to as Activities of Daily Living or ADLs. You might need help with one or more of these tasks because of a chronic medical or physical condition, or for an injury like Martha had. Frequently, people with Alzheimer’s disease or other dementias, also referred to as a cognitive impairment, need ongoing supervision. People who can no longer drive, manage their medications, or their finances need help with these tasks, which are referred to as Instrumental Activities of Daily Living or IADLs. These needs often occur first, before someone needs formal long-term care services.

Long-term care covers a broad range of needs and related services people receive in several

types of places. Services may include care at home or in a community program like adult day care, as well as care in an Assisted Living Facility (also known as a Residential Care Facility) or in a nursing home (also known as a Skilled Nursing Facility). Because long-term care is provided through a wide variety of services, it is also known as long-term services and supports, or LTSS. Taking Care of Tomorrow

Benefit Eligibility Triggers

Eligibility for accessing the benefits of a longterm care insurance policy depends on your inability to perform two “activities of daily living” (ADLs) out of a list of six, or when your cognitive ability is impaired. These are referred to as “benefit eligibility triggers.”

To be eligible for benefits you generally have to meet one of the two benefit eligibility triggers listed below. In addition, your doctor or other health care professional must draw up a Plan of Care, and certify that you are expected to need care for 90 days or more.

ADL’s – See above

Impairment of Cognitive Ability This is another benefit eligibility trigger that causes a person to need substantial supervision because of a severe cognitive impairment. People with Alzheimer’s disease or other types of dementia often need substantial supervision to protect themselves or others around them. Taking Care of Tomorrow

There is 50 % Chances of you Needing long term care

- Almost 70% of those over age 65 will require some form of long term care during their lives.

- Source: 2015 Medicare & You, page 63 Center for Medicare & Medicaid Services

- The odds of winning the PowerBall jackpot are 1 in 292 Million.

- 1 in 20,000,000: Dying in a terrorist attack

- 1 in 3,748,067: Dying from a shark attack

- 1 in 3,000: Having a residential fire

- 1 in 84: Being in a car accident

- US long-term care insurers see large spike in new customers in 2021

- 100 Must-Know Statistics About Long-Term Care: 2023 Edition A compendium of data about long-term-care usage and costs, the state of insurance, and the toll on caregivers.

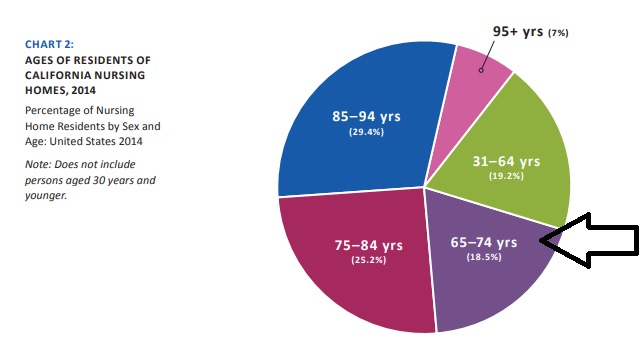

Almost 20% of people in nursing homes are within 10 years of your age

Even if you don’t buy Long Term Care – don’t you think it would be wise to read The State of CA – Taking Care of Tomorrow and do what planning you can?

How to complete the Proposal Request and which options might you take to be most cost effective?

- How Much Will A Policy Pay?

- That depends on the benefits you choose. Most policies pay daily amounts (sometimes

times called “daily benefits” or “daily benefit maximums”) from $80 a day to more than $300 a day for the covered services described in the policy. - For Example:

- If you choose a daily maximum of $150 per day and your nursing home expenses are $200 per day, you will be responsible for the difference, $50 per day, or $1,500 a month. (This is your co-payment.)

- While you may have the income to pay this co-payment today, you need to be sure that you can pay it in the future too. Nursing home costs have increased 5.4 percent annually since 1980 and will continue to increase each year due to inflationary increases in the cost of providing care (refer to Chart #6 in taking care of tomorrow brochure above

- This means that the co-payment you choose will also increase. Once you qualify for benefits, many companies will pay your benefits on a monthly or weekly basis, which allows you or your caregiver to organize your care more efficiently.

- NOTE:

- Some companies pay you for the cost of your covered expenses only “up to” the daily benefit

amount that you chose when you bought your policy. In that case you will be responsible for any amounts greater than the daily benefit. - In Another Example:

- If you choose a daily maximum of $200 and your nursing home expenses are $275, you will be responsible for the difference ($75).

- Conversely, if you choose a daily benefit of $200 and your nursing home expenses are only $150, a company that reimburses for covered expenses will only pay $150, the actual cost of your care.

- NOTE – more modern plans use the concept of a “Pool of Money”

- Inflation Protection I think is pretty much self explanatory. Learn more

- That depends on the benefits you choose. Most policies pay daily amounts (sometimes

- How long might you need to use LTC?

- We can reduce the premium/benefits. If we cut the benefits – potential payout to half that will still provide half the monthly LTC Long Term Care benefit and in in some policies 1/2 the death benefit.

- Even a small LTC benefit is still a huge value due to the leverage

- One has 70% chance they will need LTC services in their lifetime… That’s a greater risk than car accident, home damage, or pretty much anything else they already are paying insurance premium for.

- How about instead of self-insuring and paying dollar for dollar for care if needed, use the monthly pay AssetcareIV which has guaranteed premium and unlimited claim period. That way one might pay for example $1,208/mo click here for a specific quote for you – now which will provide them with 10,000/month combined LTC benefits (5k/mo each). That is leverage of 827% on the dollar. And if you never need care and both the husband and wife passed away their beneficiary(ies) get the $166,667 tax free death benefit. OR, if they want to cash out one day for some reason, the policy builds cash value which they could tap for any reason.

- More Clarification of Leverage

- When you pay a premium and it is buying you coverage worth more than you paid, that is leverage on your dollar. For example, paying $500/month in LTC premium for a monthly benefit of $5,000 for LTC is leverage of 10 times your premium

- Need to relay the severity of the risk, and the power of the leverage, so it’s a no brainer versus self-insuring. Then it’s just, finding the premium to fit their budget and refining the coverage to maximize the benefits they can afford on their budget.

- severity of the risk, and the power of the leverage, so it’s a no brainer versus self-insuring

- finding the premium to fit their budget and refining the coverage to maximize the benefits they can afford on their budget.

- We will research and update this….

xxx

Mandatory Long Term Care Coverage through your Employer?

Ball Park Premiums

How much does Home & Long Term Care (Planning Guide) Coverage Cost?

proposal and needs assessment forms

Long Term Care Expenses?

- The median cost of a private room in a nursing home is about $104,000 in California,

- The median cost of a semi-private room in a nursing home is about $86,800 in California,

- The median cost of a single-occupancy room in an assisted living facility is $45,000 in California,

- Adult day health care, with a median cost of $76 per hour in California,

- Homemakers services, with a median cost of $22 per hour in California,

- Home health aide services, with a median cost of $23 per hour in California, the median annual cost of a private or semi-private room in a nursing home in Sacramento is about $116,000 and $92,500, respectively

- Cost of Care Tool – Nationwide – Genworth

- Nursing Homes Are Suing the Friends and Family of Residents to Collect Debts Kff 7.2022

- Middle-Income Seniors Will Struggle to Afford Paid Caregiving in 2033

- ‘Impending Intergenerational Crisis’: Americans With Disabilities Lack Long-Term Care Plans

-

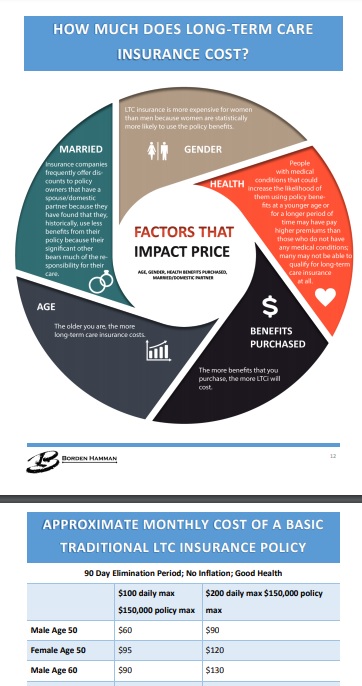

How Much Does Long-Term Care Insurance Cost?

The cost of long-term care policies varies according to the type of policy, the coverage provided, and the choices you make when you buy the policy. Some of the factors that can influence the cost of long-term care insurance include:

• Your age and your health at the time you apply for coverage;

• Inflation protection and what kind you buy;

• The deductible, waiting period, or elimination period you choose before the policy begins paying benefits;

• The combination of the benefits you want included in the policy;

• The daily or monthly benefit amount you want the company to pay when you need care; and

• The number of years or total dollar amount you want the company to pay in benefits.

Low Budget – Alternatives if you can’t afford Premium?

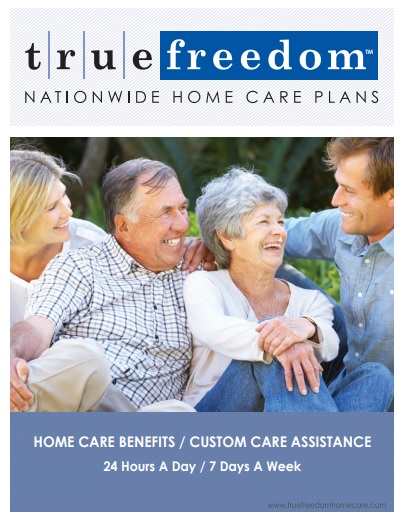

True Freedom – Home Health Care

True #Freedom Home Health Plans

True Freedom Plan Details - Brochure 1/2025

- Enrollment Form

- email [email protected] for fillable pdf

- Rate Chart

- One page brochure

- VIDEO Explanation on True Freedom Plan

- The Long Road Ahead Video

- The application disclaimers

- FAQ's

- True Freedom website, but be sure to enroll with us!

"Prepaid Home Health Care?"

Watch 3 minute simple plain English Video

- Email us for more information [email protected]

- Our webpage on Long Term & Home Health Care

- Our webpage on True Freedom

Medicare & #HomeHealth Care # 10969

TRUE FREEDOM - Home Health Care

No health questions asked

- Our webpage on Home Health & Long Term Care

- Medicare.Gov Home Health Provider Finder

- Resources to find Home Health & Nursing Care

- FAQ on Home Health Care Nurse - Medical Necessity - Wound Care

- The Medicare Home Health Benefit: An Unkept Promise

- Study Finds Medicare Advantage Patients Experience Worse Home Care Kff

- "Hospital at Home" Programs Improve Outcomes, Lower Costs But Face Resistance from Providers and Payers

- California Guide for Care Givers

Introduction – True Freedom

True Freedom is a Home Health Care plan only. It doesn’t ask Health Questions and is priced for those that can’t qualify and/or afford standard Long Term & Home Care coverage.

Why True Freedom

Medicare coverage does NOT include non-medical home care hours.

In the event of an unexpected injury or illness, True Freedom plans allow you to:

A) Delay or avoid having to move to a rehab unit/assisted living facility/nursing home?

B) Receive custom home care assistance from either a licensed home care agency or compensate a friend or neighbor willing to provide assistance to them?

C) Avoid becoming a burden to a spouse or adult children who would have limited time or ability to meet all of your home care needs?

D) Have an affordable alternative option to traditional long term care insurance?

Be sure to review the brochure and other details below or to the right.

VIDEOS:

- The Long Road Ahead to explain more.

- Explanation on True Freedom Plan

- 20 minute detailed review VIDEO

- Power Point

- We do have additional brochures. Just email us [email protected] to request them.

- Some of the participating caregivers

- BROKER ONLY

- On Line Enrollment: https://vimeo.com/637478958/549dd7d4d1

- Home Care Plan Product Review: https://vimeo.com/592294130/fb75a029a8

- Value Training for an agent: https://vimeo.com/705467577/995fb6a79f

- Power Point

#Low Budget – Premium Resistance –

Can’t Qualify Health Issues?

Questions to ask yourself to figure out what you might need?

- If you were unable to fully take care of yourself, that is you had along term care problem, claim or event, what are your plans to deal with the costs, emotional issues and stress on your loved ones?

- Where will the money to deal with a disability come from to pay for your care and/or assistance?

- How will this impact your retirement nest egg?

- And that of your spouses along with leaving money for your children? Building a Long Term Strategy

- Would an extra bill for $60-$80k/year in your retirement be a problem for you?

- Check out CA Department of Aging for their Taking Care of Tomorrow booklet for more information

Other Options & Ideas?

Medical History Problems?

Here’s a short term highly liquid MYGA Multi Year Guaranteed Annuity for those who prefer to pay out of pocket instead of going with a lifetime income solution to pay for care at point of need. For someone already diagnosed as impaired a pre-planning solution like the FG isn’t an option really, so I thought you may like to see this.

It has an optional ROP rider, pays full account value at death, and has a 15% annual penalty free withdrawal available yr one. So, as an alternative to a bank account this is much more attractive as they client can get more interest on their funds while maintaining a high level of access and an exit strategy via the ROP feature. We would typically make the impaired the annuitant so at their death, the funds are 100% payable to the bene including interest.

• Preferred Series Annuity (Principal) – This is a super liquid fixed rate deferred annuity for those who opt to continue taking regular withdrawals from a lump sum they have set aside to pay for care)

I’ve also included links to other solutions for your convenience.

Point of Need Care Funding Solutions:

• Income Assurance (Genworth) – Underwritten SPIA to maximize income for the impaired

• LifecareXchange (GWG) – Turn Life insurance into cash even if the policy has no cash value

• Reliable Living Plan (Legacy/Americo) – 1st ever guaranteed issue single premium LTCi

- Medi-Cal Medicaid

- Social Security or Pension

- IRA

- Veteran’s Aid & Attendance

- Forgotten Assets & Life Policies Sell home or Reverse Mortgage Charity – Faith Community Low amount of Long Term Care to fill gaps

- Medicare.Gov other long term care choices

Bibliography

7 ADL Activities of Daily Living

“7 Seven #Activities of daily living” ADL’s –

nursing Long Term Care which include

- (1) Eating, which shall mean reaching for, picking up, and grasping a utensil and cup; getting food on a utensil, and bringing food, utensil, and cup to mouth; manipulating food on plate; and cleaning face and hands as necessary following meals.

- (2) Bathing, which shall mean cleaning the body using a tub, shower, or sponge bath, including getting a basin of water, managing faucets, getting in and out of tub or shower, and reaching head and body parts for soaping, rinsing, and drying.

- (3) Dressing, which shall mean putting on, taking off, fastening, and unfastening garments and undergarments and special devices such as back or leg braces, corsets, elastic stockings or garments, and artificial limbs or splints.

- (4) Toileting, which shall mean getting on and off a toilet or commode and emptying a commode, managing clothing and wiping and cleaning the body after toileting, and using and emptying a bedpan and urinal.

- (5) Transferring, which shall mean moving from one sitting or lying position to another sitting or lying position; for example, from bed to or from a wheelchair or sofa, coming to a standing position, or repositioning to promote circulation and prevent skin breakdown.

- (6) Continence, which shall mean the ability to control bowel and bladder as well as use ostomy or catheter receptacles, and apply diapers and disposable barrier pads.

- (7) Ambulating, which shall mean walking or moving around inside or outside the home regardless of the use of a cane, crutches, or braces. CA Insurance Code 10232.8 *

Learn More

- wikipedia.org ADL’s

- Katz ADL scale

- Lawton IADL scale 3- point check list & scale..

- California Insurance Code

The California Partnership for Long-Term Care

The California Partnership for Long-Term Care (Partnership) is dedicated to educating Californians on the need to plan ahead for their future long-term care and to consider private insurance as a vehicle to fund that care. The California Partnership for Long-Term Care is an innovative program of the State of California, Department of Health Care Services in cooperation with a select number of private insurance companies. These companies have agreed to offer high quality policies that must meet stringent requirements set by the Partnership and the State of California. These special policies are commonly called “Partnership policies”. Partnership policies take the guesswork out of ensuring you purchased a quality policy. In addition to many other consumer protection features, Partnership policies offer the special benefit of Medi-Cal Asset Protection.

WHAT’S NEW!

The Partnership has launched www.RUReadyCA.org an independent, easy-to-use website that offers a host of tools, information and calculators to help each Californian plan for their individually unique long-term care needs.

- SB 1384 Task Force

- Agent Tools and Resources

- Brochures

- Consumer Information

- Contact Us

Learn more about the California Partnership for Long-Term Care on Facebook

Miscellaneous Information

- Children can pay the premium on their parents policy.

- Double check that your Long Term Carrier remains solvent and can hold their prices & promises Cal Broker Magazine *

- Husband & Wife Planning – 2 page brochure

- Benefits are generally income tax free, see the Taking Care of Tomorrow brochure for more details.

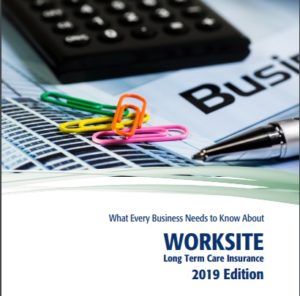

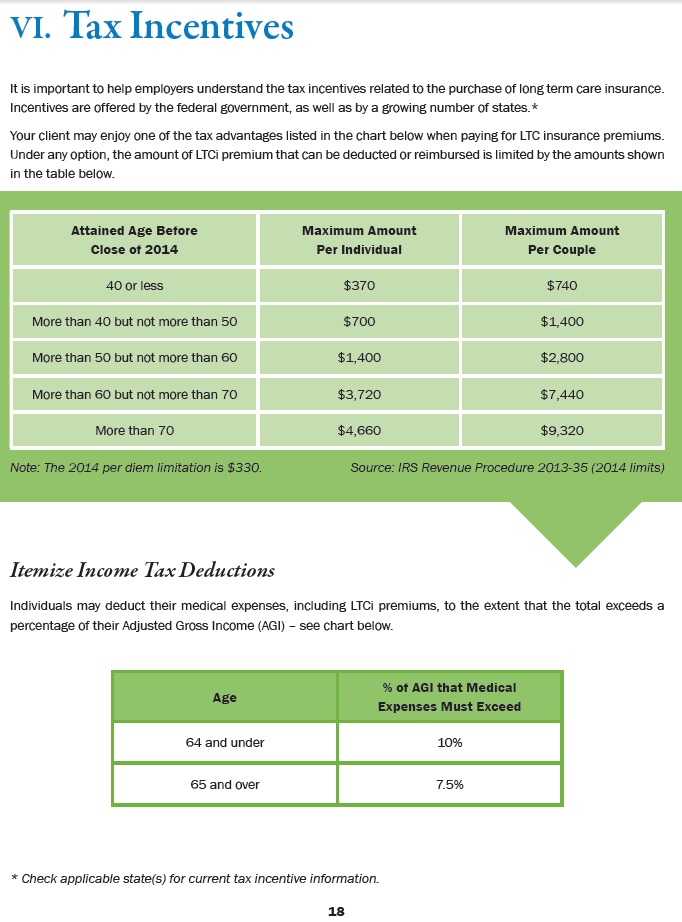

- Premium Tax deduction if medical expenses exceed 10% or 7.5% if over 65 Mutual of Omaha

- If your employer pays, it’s no income to you and the employer gets a deduction.

- Medi-cal (Medicaid) Welfare, might pay, however if you have $$$ or Property, they might put a lien on your home.

- The average cost for a private room in a nursing home in Los Angeles is $175/day. Average hourly home heath care is $15.

- Genworth Calculator

- Please email us [email protected] for more details.

FAQ’s

More and ask your own question

Can I be denied because of genetic testing?

No.

The Genetic Information Nondiscrimination Act of 2008 (Pub.L. 110–233, 122 Stat. 881, prohibits the use of genetic information in health insurance and employment. The Act prohibits group health plans and health insurers from denying coverage to a healthy individual or charging that person higher premiums based solely on a genetic predisposition to developing a disease in the future. The legislation also bars employers from using individuals’ genetic information when making hiring, firing, job placement, or promotion decisions.[1] The Act contains amendments to the Employee Retirement Income Security Act of 1974[3] and the Internal Revenue Code of 1986.[4]

CA Law – genomics law report.com * SB 559 – 2011 Padilla

Details True Freedom

This is our cut & paste to 12 point type and adding line spacing to the official Terms & Conditions. NOTHING here changes anything in the official document!!!

The following Terms and Conditions (the “Terms and Conditions”) are hereby incorporated as an integral part of the True Freedom Enrollment and Service Contract (collectively, the “Agreement”), between American Senior Services, Inc. a Florida Corporation (“ASSI”), and the member named in and who signed the Agreement (“you”).

THIS AGREEMENT IS NOT INSURANCE, BUT RATHER CONSTITUTES A SERVICE CONTRACT. THIS IS NOT A REPLACEMENT OF ANY INSURANCE POLICY. IT IS NOT INTENDED TO BE UTILIZED AT THE TIME OF ENROLLMENT. (REVIEW SUITABILITY TO VALIDATE YOUR PURCHASE BELOW.)

A member must be able to live independently at the time of enrollment and cannot currently be in need of or receiving any assistance (including from family members) with activities such as bathing, dressing and transferring at the time of enrollment. If the intent upon enrollment is to go on service for a current condition following the initial 90-day Waiting Period, that would not be a suitable membership.

|

[Suitability Survey copied from enrollment form |

||

|

Question? Are you currently able to perform daily activities such as bathing, dressing, and transferring Are you able to live independently at this time? Are you aware that the True Freedom Homecare Plans are NOT insurance? If you answer NO to any of the above questions, DO NOT submit the enrollment. All of the benefits and membership terms & conditions in this field issued Contract that I selected were explained to me

|

Yes | No |

ASSI’s membership program arranges for non-medical services to be provided in the comfort of your own home, either:

ANYTIME Home Care Services can be utilized any day/ evening/ night, including weekends and overnight service (or 24 hours/ 7 days a week live-in service), up to the total number of hours specified under the plan that you purchase.

At the time that you designate a friend or neighbor for the ANYTIME Home Care Service, you will sign a release of ASSI from any liability for injuries or damages caused by your friend or neighbor.

The selected friend or neighbor must also be approved by American Senior Services, Inc. Pre-authorized requests of 8 hours or more will be considered as 24-hour live-in services for that day. Payment will not exceed $150 for a live-in friend or neighbor in any given 24-hour period.

AGENCY Home Care Service Up to five (5) hours a day, Monday through Friday between 9:00 a.m. and 5:00 p.m. by a network agency excluding National Holidays. Payments to network agency cannot exceed $150.00 a day. ASSI may change AGENCY service providers at any time.

In order to receive the AGENCY Home Care Service hours or the ANYTIME Home Care Service hours, your membership must be in effect for ninety (90) days (the “Waiting Period”), during which you cannot use any of the hours. Once the Waiting Period has elapsed, AGENCY Home Care Service hours and ANYTIME Home Care Service hours can be mixed and matched, up to the total number of hours specified under the plan that you purchase: provided however, that both AGENCY Home Care Service hours and ANYTIME Home Care Service hours cannot be utilized in any single 24 hour period.

Notwithstanding the preceding paragraph, at any time after your membership has been active for ten (10) days, if a temporary situation arises during the remainder of the Waiting Period, then you may request EMERGENCY CARE BENEFITS during the Waiting Period, which may be AGENCY Home Care Services or ANYTIME Home Care Services, with the maximum service hours available being ten percent (10%) of the initial total number of hours specified under your plan.

The Lifetime Membership Hours of each plan are equally divided into ten (10) separate bundles.

Once the service hours in the initial bundle have been exhausted, following a 90-day Rejuvenation Period (of non-use), the 2nd bundle of plan hours of a membership can be accessed.

A total of nine (9) Rejuvenation Period occur separating each bundle of hours that add up to the total Lifetime Membership Hours of a contract. All plans cover a period of twelve (12) months (each a “Term”). Unused hours from a preceding term will roll over and must be utilized before service hours in a new bundle can be accessed following a 90-day Rejuvenation Period. The Home Care Hours of any plan can rejuvenate for up to the “Maximum Lifetime Membership Hours” which is a total of 10 times the initial bundle of hours of your chosen plan. Multiple bundles of hours can be utilized within a twelve (12) month term within the parameters of the contract. Contracts must be kept current through all periods of membership and continued access to any unused service hours in a chosen plan.

TO ACTIVATE SERVICES

To receive services, call the ASSI toll free customer service number: 1-888-245-9001

Please allow between 24 and 72 hours after your call for ASSI to coordinate services. Requests should be prudent and necessary. All service requests must be pre-authorized by ASSI. All unauthorized claims will be denied, and member will be responsible for payment of those services. Contract must be paid in full if service is activated within the first 12 months. (Any membership fee discounts for non-use will discontinue when home care service is activated and will return to the original membership fee on the next payment due for the remainder of the membership.)

CANCELLATION

Non-payment of fees will result in cancellation of your membership, with cancellation occurring if a monthly bank draft fee is not paid by the due date of the contract. If a membership invoice isn’t paid within 30 days of its due date, membership will be cancelled. In addition, all memberships include a one-time 10-day cancellation period. The cancellation notice must be submitted to ASSI in writing in a signed letter (no faxes or emails), post-marked within 10-days from the effective date of your membership. Full refunds will be made during this time only.

After 10-days, you may cancel your membership at any time; however; ASSI is under no obligation to refund any portion of your membership fee.

In the event of death, your estate will be refunded on a prorated basis. Death certificate must be received within 90 days from the date of passing.

MAIL LETTER TO:

American Senior Services, Inc., 8250 Bryan Dairy Road Suite 350, Largo, FL 33777

MISCELLANEOUS

These Terms and Conditions may be amended from time to time by ASSI upon thirty (30) days prior written notice to you, sent to your home address as shown on the Enrollment Form. In the event of such unilateral amendment by ASSI, you have the right to terminate the Agreement by giving written notice of such termination to ASSI as specified above within ten (10) days after your receipt of the notice from ASSI of the amendment to these Terms and Conditions. If ASSI determines that misstatement, fraud or misappropriation of service was intended or utilized, ASSI reserves the right to terminate or revoke a membership contract.

This Agreement is made in and shall be governed by and construed under the laws of the State of Florida.

The failure of either of us to exercise any of our rights or to enforce any of the provisions of the Agreement on any occasions shall not be a waiver of such right or provision, nor affect the right of such party thereafter to enforce each and every provision of the Agreement. If any provision of the Agreement is held to be invalid, illegal, or unenforceable under any applicable statute or rule of law, then that provision shall be reformed to the maximum extent permitted to preserve the parties’ original intent as agreed by the parties; failing which, such provision shall be severed from the Agreement, with the balance of the Agreement continuing in full force and effect. This Field Issued Agreement is retained by you at the time of purchase, with a signed copy being delivered to ASSI, as well.

I have read and understand the Terms and Conditions in full.

See Enrollment form for original copy – Be sure to send the application back to us [email protected] * Secure upload

Official Medicare #Hospice Publication # 02154

- Palliative Care VIDEO

- Palliative care, which focuses on providing relief from the symptoms and stress of serious illness, offers an extra layer of support. Learn more at chcf.org

Costs of the last 2 months of life

See our webpage on

- Long Term Care

- Final Expense Policies

- Hospice End of Life Care

- Set a Zoom Meeting

- Our main webpage on Hospice

Broker Information – ONLY

some links that will help brokers market the True Freedom Plans.

On Line Enrollment: https://vimeo.com/637478958/549dd7d4d1

Home Care Plan Product Review: https://vimeo.com/592294130/fb75a029a8

Value Training for an agent: https://vimeo.com/705467577/995fb6a79f

Skilled Nursing

How does Medicare pay for #SkilledNursing Homes - 10153 11359

Our Introductory You Tube VIDEO based on this manual

- Your costs for Skilled Nursing in Original Medicare You pay:

-

Days 1–20: $0 for each benefit period .

- Days 21–100: $194.50 coinsurance per day of each benefit period.

-

Days 101 and beyond: All costs. Medicare.gov *

-

- Clinical Guidelines explain the coverage so much better and in logical order!

- The two-midnight rule and Medicare Advantage: 7 updates Beckers Payer.com 2/2024

- Medi Cal Payments Fall Far Short of Covering Care Costs at Nursing Homes Skilled Nursing News.com 11/2024

- Medicare's VIDEO Nursing Home / Long-Term Care

- Planning for Discharge from a Health Care Setting VIDEO

- Long Term #Acute Care Publication # 11347

- Long-Term Acute Care Hospital (LTACH) Clinical Guidelines - Oscar

- Differences between Skilled Nursing, Long Term Acute Care & Inpatient Rehabilitation Facility

- Our FAQ on Sub Acute Care

- Find & compare nursing homes, hospitals & other providers near you Medicare.Gov

- Learn more about providers

- Calculate Cost of Long Term Care in your Area Genworth

- "Hospital at Home" Programs Improve Outcomes, Lower Costs But Face Resistance from Providers and Payers

- Pro Seniors Medicare & Skilled Nursing

- Medicare doesn't pay for:

- Our Webpagse on Long Term Care

Employer Groups

Long Term Care Plans for #Employer Groups

- Long Term Care for Employer Groups is a business expense deduction and the benefits are received tax free. bjfim.bordenhamman.com ♦ §7702 B ♦ §104 * IRC §104 (a) (3) (a) * IRS Publication 502 Medical & Dental Expenses * Internal Revenue Code §7702 b Long Term Care treated as Accident & Health, just like Section 106 * Bulletin 97-31

- Email us [email protected] for complementary quotes & information.

- C-Corps can benefit from complete (100%) deductibility of the tax-qualified long term care insurance premiums as a business expense. Long Term Care Insurance (LTCi) can be purchased for employees and owners.

- Premiums are not included as part of the employees gross income

- Coverage can be offered to spouses/domestic partners and retirees

- Payroll taxes are not required for premiums paid

- Executive carve-outs may be established to pay all or a portion of the premium for key employees

- S-Corps Partners or More Than 2% Shareholders

- Premiums paid for an owner are included in individual gross income.

- A self-employed health insurance deduction can be taken for tax-qualified LTCi premiums paid. LTCi premiums are considered a medical expense and are subject to the IRS age-based limits found in the first chart on the previous page.

- Self employed individuals can deduct tax-qualified LTCi premiums as a trade or business expense similar to traditional health and accident insurance premiums. A tax deduction is allowed for the self employed individual, for his or her spouse and other tax dependents. The annual deductible maximum for each covered individual is subject to the IRS age – based limits found in this chart. (Agent Manual)

- Technical Links & Resources

- 26 U.S. Code § 7702 B – Treatment of qualified long-term care insurance

- (a) (3) any plan of an employer providing coverage under a qualified long-term care insurance contract shall be treated as an accident and health plan with respect to such coverage [Section 106 tax deductibility of Medical Insurance Premiums]

- b (1) The term “qualified long-term care insurance contract” means – click on link above to view full code & definition.

- Revenue Procedure 2013 – 35 Maximum Contribution

- IRS Publication 502 Medical & Dental Expenses

Tax Incentives – Maximum Deduction For Individuals – Click to ENLARGE – from Agent Manual

Tax Incentives – Maximum Deduction For Individuals – Click to ENLARGE – from Agent Manual

Tax Qualified

WHAT IS A TAX #QUALIFIED LONG-TERM CARE POLICY?

Premiums may be tax deductible

Long-term care policies that use the federal standards to cover benefits are labeled as “Federally Tax Qualified”. Some or all of the premiums for these federally tax qualified policies may be deductible as a medical expense (over 7 or 10% of income & a maximum schedule for individuals) Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract. Publication 502 on your federal and California income tax returns (depending on your age and the amount of annual premium). Health Insurance Portability and Accountability Act or HIPAA

Policies sold as federally tax qualified long-term care insurance use a standard of eligibility for benefits that may be stricter than the standards established in California for non-qualified policies. It may be easier to qualify for benefits from non-tax qualified policies that use the standards established by California. insurance.ca.gov *

Benefits are not taxable as income

Since the benefits – claims payments are treated the same as accident & health insurance Taking Care of Tomorrow Pages 29-31, 37-40 * Indiana.Gov * * our webpage * Indiana.Gov

Qualified Long-Term Care Services

Qualified long-term care services are necessary diagnostic, preventive, therapeutic, curing, treating, mitigating, rehabilitative services, and maintenance and personal care services (defined later) that are:

1. Required by a chronically ill individual, and

2. Provided pursuant to a plan of care prescribed by a licensed health care practitioner.

Chronically ill individual.

An individual is chronically ill if, within the previous 12 months, a licensed health care practitioner has certified that the individual meets either of the following descriptions.

1. He or she is unable to perform at least two activities of daily living without substantial assistance from another individual for at least 90 days, due to a loss of functional capacity. Activities of daily living are eating, toileting, transferring, bathing, dressing, and continence.

2. He or she requires substantial supervision to be protected from threats to health and safety due to severe cognitive impairment.

Maintenance and personal care services.

Maintenance or personal care services is care which has as its primary purpose the providing of a chronically ill individual with needed assistance with his or her disabilities (including protection from threats to health and safety due to severe cognitive impairment).

Qualified Long-Term Care Insurance Contracts

A qualified long-term care insurance contract is an insurance contract that provides only coverage of qualified long-term care services.

The contract must:

1. Be guaranteed renewable,

2. Not provide for a cash surrender value or other money that can be paid, assigned, pledged, or borrowed,

3. Provide that refunds, other than refunds on the death of the insured or complete surrender or cancellation of the contract, and dividends under the contract must be used only to reduce future premiums or increase future benefits, and

4. Generally not pay or reimburse expenses incurred for services or items that would be reimbursed under Medicare, except where Medicare is a secondary payer, or the contract makes per diem or other periodic payments without regard to expenses.

The amount of qualified long-term care premiums you can include is limited. You can include the following as medical expenses on Schedule A (Form 1040).

1. Qualified long-term care premiums up to the following amounts.

a. Age 40 or under – $410.

b. Age 41 to 50 – $770.

c. Age 51 to 60 – $1,530.

d. Age 61 to 70 – $4,090.

e. Age 71 or over – $5,110.

2. Unreimbursed expenses for qualified long-term care services.

Note. The limit on premiums is for each person.

Also, if you are an eligible retired public safety officer, you can’t include premiums for long-term care insurance if you elected to pay these premiums with tax-free distributions from a qualified retirement plan made directly to the insurance provider and these distributions would otherwise have been included in your income.

Resources & Links

- Taking Care of Tomorrow Pages 29-31, 37-40

- Wikipedia

- IRS Publication 502 Medical & Dental Expenses

1035 Exchange

Long Term Care Planning using 1035 #Exchange

United States Code §1035 Exchange – Long Term Care Planning

Broker ONLY

Asset-Care in California

Care Solutions Whole Life Core Brochure I-27754 (CA)

Asset-Care I I-28644 (CA)

Asset-Care II/III I-29681 (CA)

Asset Care IV I-29508 (CA)

Care Solutions Materials

The OneAmerica Difference (I-33305)

Care Solutions Process Guide (I-32803)

Claims 3-Step Process Flyer (I-27660)

Claims Concierge Brochure (I-27661)

Asset Care 2019

Care Solutions Product Guide (I-31591)

Asset Care Core Brochure (I-32407)

Care Solutions Product Overview (I-32414)

Plan for Care (I-36333)

Child & Sibling Pages

Site Map

[sibling-pages]