HSA Health Savings Account – lower premiums and Tax Deductions?

Introduction to Health Savings Accounts HSA

Health Savings Accounts (HSA’s) IRC 223 * allow you to save money, premium & Federal taxes but apparently not CA taxes, by getting a qualified Silver or Bronze high-deductible health Insurance plan (HDHP). So, no, generally a grandfathered plan won’t do that. High deductible Bronze plans have lower premiums than say Silver, Bronze or Platinum. See button below for a proposal. Premiums vs co pays, deductibles etc, are a function of the MLR Medical Loss Ratio, where Insurance Companies are mandated to pay 80c and 85c of every dollar in premium in claims or pay rebates. So, if you don’t think you’ll have tons of low end claims, an HSA might be the thing for you.

See Introduction in the HSA Guidebook for a simple explanation.

Sterling Administration You Tube Video Help! What exactly is an HSA Health Savings Account?

You can put in – deposit any amount at any time, up to the contribution limits. You don’t have to put in deposits if you don’t feel like it. Best of all, you can put in a deposit, just before you pay any part of your deductible.

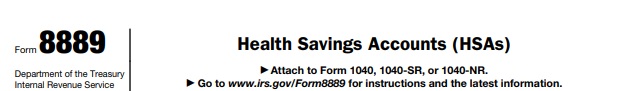

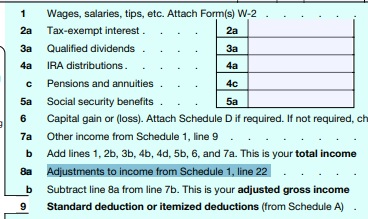

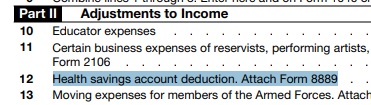

The contribution to your HSA is tax deductible, lowers your Adjusted Gross Income on line 25 of 1040 with Form 8889 attached. Graph of savings.

You can withdraw from your HSA tax free any allowable medical expenses (IRS Publication 502, Internal Revenue Code (IRC) §213 [d])) Aetna even some Health Insurance Premiums through your HSA bank account – debit card. The maximum contributions Wells Fargo * IRS * SHRM * are in the table below. If you are over age 55 an additional $1k can be deposited. An HSA is very similar to an IRA, except that it is for medical expenses.

When you retire, the money in your account can still be used for medical and some Insurance Premiums, without paying taxes. Check out this article on why you need an emergency fund.

Without an HSA or having an EmployER sponsored plan, medical expenses are not usually deductible unless they are more that 10% PPACA 9013 of adjusted gross income IRS Publication 969.PDF California tax* IRS publication 502 * Here’s an FAQ on having an Employer Sponsored HSA. Often though Employer’s prefer richer plans – Los Angeles Times.

One might also consider a supplemental accident plan to cover the deductible in a Bronze HSA Plan.

ACA Health Reform does not appear to have any effect on HSA’s other than the change from 7.5% to 10% that one would have to otherwise incur for premiums and expenses to be deductible and over the counter medications must have a prescription. PPACA 9013 healthcareexchange.com cigna.com hsawells fargo While there is a $2k deductible limit for individuals and $4k for families, to qualify as an essential benefit, since the HSA account provides reimbursement, 42 USC 18022 (2) there should be no problem. Check with your tax or legal adviser.

Try turning your phone sideways to see the graphs & pdf's?

#Sales Brochures

Learn More

- Typical HSA usage & Savings See someone Save

- Ask for the Cash Discount and other ways to save with a high deductible plan CA Health Line 5.1.2017

- Cal Choice

- HSA Fast Facts

- The California Choice® HSA & Banking Partners United Health Care HSA brochures & information

- Health Net HSA for Life

- Anthem Blue Cross

- United Health Care

- Sutter – HDHP High Deductible Health Plans

- Blue Shield Bronze HDHP EOC Explanation VIDEO

HSA #Guidebook

Visit Our main webpage on HSA Health Savings Accounts - High Deductible Health Plans with Tax Advantaged Spending Account

IRS Publication 502 pdf * html

Medical & Dental #Expenses

- Aetna Listing of HSA allowable expense

- Corona Virus Costs IRS HDHP

- Can one pay Health Insurance Premiums from an HSA?

- Medical Necessity?

- Insurance Premiums? Deductibility? Publication 502

- Medical expenses include the premiums you pay for insurance that covers the expenses of medical care, and the amounts you pay for transportation to get medical care.

- Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract.

- Turbo Tax

- Schedule A 1040 Itemized Deductions

- HSA Bank – Is an HSA Right for me?

- HSA Savings Calculator Tax Savings & Growth

- IRS Withholding Calculator

- Tax Estimating Tools

| #Contribution and Out-of-Pocket Limits for Health Savings Accounts and High-Deductible Health Plans

$4,300 self only $8,550 Family

IRS 2023-23

The Internal Revenue Service (IRS) today (Friday, May 10, 2024) announced the 2025 calendar year limits for high-deductible health plans (HDHP). The new limits include cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs). The only exception is for the HSA catch-up contributions for those aged 55 or older, which will not change. Here are the 2025 limits: HDHP – Maximum annual out-of-pocket limit (excluding premiums) Self-only coverage 2024 – $8,050 2025 – $8,300 Self-only coverage 2024 – $1,600 2025 – $1,650 Self-only coverage 2024 – $4,150 2025 – $4,300 |

|---|

|

HSA catch-up contributions (age 55 or older)

|

Links & Resources

- IRS Notice 2020-15 allows HSA’s to cover Corona Virus testing as Preventative. Connect Your Care.com

- Los Angeles Times 5.6.2013 on High Deductible Plans and HSA’s

- Our webpage on OOP Out of Pocket Maximum, Deductibles & Co Pays

Kaiser & Blue Shield

Treatment Cost #Estimator Tool

requires sign in

The tool is for all Kaiser Members that are enrolled on Deductible or Health Savings Account Plans. The cost estimates are for services that are marked "after deductible" to give members an idea of the cost of those services.

- 2021 Kaiser Sample Fee List

- How do I know what level of service I will get billed for?

- BLUE SHIELD Treatment Cost Estimator – for PPO Members

- Cost Helper.com what people are paying for health services

FAQ’s

- Question If I’m over 65 and no #longer eligible to contribute to an HSA, what about my spouse?

. - Answer: Qualifying for an HSA

- To be an eligible individual and qualify for an HSA, you must meet the following requirements.

- You are covered under a high deductible health plan (HDHP), described later, on the first day of the month.

- You have no other health coverage except what is permitted under Other health coverage, later.

You aren’t enrolled in Medicare. - You can’t be claimed as a dependent on someone else’s tax return.

- If another taxpayer is entitled to claim an exemption for you, you can’t claim a deduction for an

HSA contribution. Publication 969 *

- If another taxpayer is entitled to claim an exemption for you, you can’t claim a deduction for an

- On the other hand:

- Question? Can I contribute to my spouse’s HSA if I’m enrolled in Medicare and no longer HSA eligible? IRS (Sec. 223(c)(1)(A)(ii))

. - Answer Yes. If your spouse is HSA-eligible and has an HSA, you – or anyone else – can contribute to his HSA. Your enrollment in Medicare doesn’t disqualify him from contributing to (or accepting contribution from others into) his HSA. Read More HSA’s & Medicare *

. - Question My spouse is already on Medicare and I will be covered by a consumer driven health plan this year. How much will I be able to contribute to my HSA?

. - Answer If you are covering both your spouse and yourself on your consumer driven health plan (CDHP), you will be able to contribute up to the IRS family maximum to an HSA in your name

. - Question – If I go on Medicare Mid year… How do I report the contributions for when I was eligible to contribute

. - Answer Form 8889 Part 1 Question # 2 and Q 9 Catch Up is allowed Q 7

- If you are 55 or older, you will also be able to make the $1,000 catch-up contribution to an HSA established in your name. If you are covering yourself only on the CDHP, you will be able to contribute up to the IRS individual maximum plus the $1,000 catch-up (if eligible), into an HSA in your name. Your spouse on Medicare is not eligible to contribute to an HSA in his or her name, regardless of whether he or she is covered on your medical plan

- HSA & Medicare

- Enroll-in-Part-A-and-B

- Section 223 – Health Savings Accounts—HDHP Family Coverage Rev. Rul. 2005-25

- See above for Publication 969

- Medicare & You Handbook

- Is a spouse a dependent?

- Medicare’s tricky rules on HSAs after age 65 Journal of Accountancy

- Question? Can I contribute to my spouse’s HSA if I’m enrolled in Medicare and no longer HSA eligible? IRS (Sec. 223(c)(1)(A)(ii))

- (2) Married dependents

An individual shall not be treated as a dependent of a taxpayer under subsection (a) if such individual has made a joint return with the individual’s spouse under section 6013 for the taxable year beginning in the calendar year in which the taxable year of the taxpayer begins.

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

Tax #Estimators

FAQ’s

- Question Can one pay Health Insurance Premiums from an HSA?

. - Answer Yes???, however the rules get technical and you really need to check with your CPA for your specific situation. In my own case, I didn’t think they were as that’s what my own CPA said for MY situation, as I can deduct premiums as a business expense.

- Paying for some insurance premiums

- (IRC Sec. 223(d)(2)(C); IRS Notice 2004-2 Q&A 27; IRS Notice 2005-59 Q&A 29) Generally, you cannot use your HSA to pay medical insurance premiums, but there are some exceptions.

- Medicare premiums

- Once you are 65 and eligible for Medicare, you can use your HSA to pay Medicare premiums (A, B, C, and D), out-of-pocket expenses that Medicare does not pay, and Medicare HMO premiums.

- You cannot pay Medigap premiums with your HSA. Medigap is insurance that individuals can buy to cover out-of-pocket costs that are not covered by Medicare.

- Premiums for employer-based coverage after age 65

- If you are 65 or older and still work, you can pay your share of premiums for employer-based coverage out of your HSA (you cannot pay for these premiums before age 65).

- If you are 65 or older and do not work, you can pay your share of any premiums your employer requires you to pay from your HSA for employer-sponsored retiree healthcare coverage.

- Premiums when you are unemployed

- You can pay for healthcare coverage while receiving unemployment compensation under federal or state law.

- You can also pay COBRA premiums with HSA dollars if you are eligible for COBRA benefits.

- Long-term care insurance

- You may use your HSA to pay premiums for qualified long-term care insurance. To be qualified, a long-term care insurance plan must meet criteria determined by federal law (see IRS Publication 969). guidebook on HSA page 73

- Here’s a cut & paste from IRS Publication 502

- Insurance Premiums

- However, in publication 502 they are qualified Medical & Dental Expenses

- You can include in medical expenses insurance premiums you pay for policies that cover medical care. You can’t include in medical expenses insurance premiums that were paid and for which you are claiming a credit or deduction. Medical care policies can provide payment for treatment that includes:

- Hospitalization, surgical services, X-rays;

Prescription drugs and insulin;

Dental care;

Replacement of lost or damaged contact lenses; and

Long-term care (subject to additional limitations). - Does your employer pay your premiums?

- Medicare B

- Medicare B Out patient & doctor visits is a supplemental medical insurance. Premiums you pay for Medicare B are a medical expense.

- Medicare D Rx Prescriptions

- Medicare D is a voluntary prescription drug insurance program for persons with Medicare A or B. You can include as a medical expense premiums you pay for Medicare D.

Resources & Links

- High-Deductible Health Plans Make Income Inequality Worse

They can leave patients with crippling medical bills. Why are high-deductible insurance plans becoming so popular with employers? - Concerns rising about drug management in HDHPs

Employees are dissatisfied with this aspect of HDHPs and employers are starting to pay attention. - Effect on premiums ‘relatively small’ when expanding pre-deductible coverage to HSA plans, study finds

- FSA vs. HSA: What’s The Difference?

- Give Americans the right to save on health care

FAQ

- Question If my Insurance Company refuses to pay a claim, stating it wasn’t medically necessary, out of network or a Rx not in the formulary, can I pay it out of my HSA?

. - ANSWER It looks that way. Please note we are not attorney’s or CPA’s.

- What Are Medical Expenses?

- Medical expenses are the costs of diagnosis, cure, mitigation, treatment, or prevention of disease, and for the purpose of affecting any part or function of the body. These expenses include payments for legal medical services rendered by physicians, surgeons, dentists, and other medical practitioners. They include the costs of equipment, supplies, and diagnostic devices needed for these purposes.

- Medical care expenses must be primarily to alleviate or prevent a physical or mental disability or illness. They don’t include expenses that are merely beneficial to general health, such as vitamins or a vacation.

- (2)Qualified medical expenses

- (A)In general The term “qualified medical expenses” means, with respect to an account beneficiary, amounts paid by such beneficiary for medical care (as defined in section 213(d))

- (d)Definitions For purposes of this section—

(1)The term “medical care” means amounts paid—- (A)for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body,

- (B)for transportation primarily for and essential to medical care referred to in subparagraph (A), https://www.law.cornell.edu/uscode/text/26/213

- for such individual, the spouse of such individual, and any dependent (as defined in section 152, determined without regard to subsections (b)(1), (b)(2), and (d)(1)(B) thereof) of such individual, but only to the extent such amounts are not compensated for by insurance or otherwise. Such term shall include an amount paid for medicine or a drug only if such medicine or drug is a prescribed drug (determined without regard to whether such drug is available without a prescription) or is insulin. https://www.law.cornell.edu/uscode/text/26/223

- Our webpage on Medical Necessity

.

- ISSUE

Are amounts paid by individuals for breast reconstruction surgery, vision correction surgery, and teeth whitening medical care expenses within the meaning of § 213(d) and deductible under § 213 of the Internal Revenue Code?

. - FACTS

Taxpayer A undergoes mastectomy surgery that removes a breast as part of treatment for cancer and pays a surgeon to reconstruct the breast. Taxpayer B wears glasses to correct myopia and pays a doctor to perform laser eye surgery to correct the myopia. Taxpayer C’s teeth are discolored as a result of age. C pays a dentist to perform a teeth-whitening procedure. A, B, and C are not compensated for their expenses by insurance or otherwise.

. - HOLDING

Amounts paid by individuals for breast reconstruction surgery following a mastectomy for cancer and for vision correction surgery are medical care expenses under § 213(d) and are deductible under § 213 (subject to the limitations of that section). Amounts paid by individuals to whiten teeth discolored as a result of age are not medical care expenses under § 213(d) and are not deductible.

. - The qualified medical expenses are broader than what most health plans cover

- 78 Page Law Journal discussion

- See publication 502 Medical & Dental Expenses

- What Are Medical Expenses?

FAQ

Employer Administered Plans

- Question What are the administration requirements for an employer that has an HSA for employees?

. - Question Are Employer contributions to HSA for adult dependents spouses or children under age 26 who filing their own tax returns deductible?

. - Question Are employer contributions to the HSA of an employee’s spouse (who is not an employee of this employer) excluded from the employee’s gross income and wages?

. - Answer No. The exclusion under §106(d)(1) is limited to contributions by an employer to the HSA of an employee who is an eligible individual. Any contribution by an employer to the HSA of a non-employee (e.g., a spouse of an employee or any other individual), including salary reduction amounts made through a § 125 cafeteria plan, must be included in the gross income and wages of the employee. Notice 2008-59, 2008-29 I.R.B. 123, questions 23 through 27

- Question I am employer that funds a HDHP [High Deductible Health Plan] and HSA’s [Health Savings Accounts] for all employees.

- Have employee with an adult child who can no longer be considered a dependent.

- Adult child needs to open her own HSA but is still covered on HDHP for two more years.

- Can employer contribute to adult child’s HSA? If so, are there any tax advantages?

- As the employer, I have employee that has an adult child who needs to set up her own HSA account because she graduated college and got married. Adult child is covered on parent’s HDHP funded by my company. Can employer contribute to adult child’s account? If so, does employer receive any tax advantage?

- I have been all over the internet for two days about this. Yes adult child is 23, graduated college, married and is living on her own. I understand she can not file a joint tax return in order to remain eligible to fund the HSA. I am not able to find information on whether the employer can fund adult child’s HSA if covered under the employer’s HDHP.

- Qualifying for an HSA

- To be an eligible individual and qualify for an HSA, you must meet the following requirements.

- You must be covered under a high deductible health plan (HDHP), described later, on the first day of the month.

- You have no other health coverage except what is permitted under Other health coverage, later.

- You are not enrolled in Medicare.

- You cannot be claimed as a dependent on someone else’s tax return. IRS Publication 969 Page 3

. - High deductible health plan (HDHP).

- An HDHP has:

- Employer Contributions

- You can make contributions to your employees’ HSAs.

- Does this mean employee’s HSA, but not dependents?

- You deduct the contributions on your business income tax return for the year in which you make the contributions. If the contribution is allocated to the prior year, you still deduct it in the year in which you made the contribution. IRS # 969

- Links & Resources

- No permission or authorization from the IRS is necessary to establish an HSA. You set up an HSA with a trustee. A qualified HSA trustee can be a bank, an insurance company, or anyone already approved by the IRS to be a trustee of individual retirement arrangements (IRAs) or Archer MSAs. The HSA can be established through a trustee that is different from your health plan provider.

- you have to report the distribution on Form 8889.

https://www.irs.gov/pub/irs-pdf/p969.pdf - See the HSA Guidebook above

https://emma-assets.s3.amazonaws.com/vxnbb/da824298cb71b9c29385ae8e3d8750b3/PM-MK-24-079_2025_HDHP_Flyer_WEB.pdf

https://abc.anthem.com/Page/HsaContributionLimits

https://abc.anthem.com/Page/HsaTaxSavings

https://floridianpress.com/2025/04/bean-introduces-bill-allowing-americans-to-save-more-money-for-healthcare/

https://www.trustmarkbenefits.com/trustmark-benefits-web/media/files/sbb/b680-1628-br.pdf

Level Funding

Blue Shield Bronze 60 HDHP says both Deductible and Max Out of Pocket are $7000.

If we use up Deductible, we don’t need to pay any more?

Am I correct?

If so, how can I use HSA to save tax?

Here’s our webpage to explain OOP in more detail See also page 38 of the EOC.

So, the most you pay is the first $7,000 of annual claims for covered in network services.

So, how will you pay the first $7,000?

Having an HSA allows you to contribute $3,600 for an individual. The lowers your taxable income by $3,600 right? Since you are over 65 you no longer qualify for an HSA but the younger spouse does.

So, let’s say you make $500k/year, that would put you in the 37% federal tax bracket, right? I’m not a CPA so check these numbers with your CPA. So, 37% of $3,600 is around $1,300 a year savings, right? Not only that, but if you don’t withdraw tax free to pay allowable medical expenses Publication 502 $$$ look at the money you accumulate!

hsabank.com/Savings-Calculator

Why you shouldn’t put hospital bill on a credit card

https://www.latimes.com/business/story/2020-09-19/unemployed-uninsured-big-hospital-bill

I have an HSA with Oscar. What’s the about Oscar no longer doing HSA, as they have Free Tele Med doctor visits? Where else can I get an HDHP policy so that I can contribute to my HSA?

Here’s an excerpt of the email we got from Oscar about their no longer offering HSA, so that they can offer Telehealth

Sample member notification

Click here to see what HDHP plans are available for you and the prices.

SHRM on telemed & HSA problems & issues

Doctor on call VIDEO

If I have Medi Cal Share of Cost, can I still have an HSA?

No. You must have a HDHP plan

I know that if your over 65 and on Medicare, you can’t contribute to an HSA. What about your spouse if she’s under 65 and you file jointly?

We’ve answered that question above

I have a grandfathered high deductible plan. Can I get an HSA with that?

It’s possible that the plan you have meets the HSA qualifications, but I’m not an authorized CPA. As a licensed agent, I can only tell you that for a health plan to qualify for HSA it has to say HDHP on it. If I were to ask any Insurance Company if their plan qualifies, they would probably say the same thing. Even if the PPO Share plan qualifies, I doubt their legal department would let them tell you that. Thus, the plans that qualify say they are HDHP.

To set up an HSA account, if you and your CPA believe your PPO Share Plan qualifies, just go to your own bank or one of these banks and set it up.

The Tax Form 8889 requires that you certify your plan qualifies.

Check the box to indicate your coverage under a high-deductible health plan (HDHP) during 2018 (see instructions)

https://www.irs.gov/pub/irs-pdf/f8889.pdf

High Deductible Health Plan

An HDHP is a health plan that meets the following requirements.

Self-only coverage Family coverage

Minimum annual deductible $1,350 $2,700

Maximum annual out-of-pocket expenses* $6,650 $13,300

* This limit does not apply to deductibles and expenses for out-of-network services if the plan uses a network of providers. Instead, only deductibles and out-of-pocket expenses (such as copayments and other amounts, but not premiums) for services within the network should be used to figure whether the limit is reached.

An HDHP can provide preventive care and certain other benefits with no deductible or a deductible below the minimum annual deductible. For more details, see Pub. 969. An HDHP does not include a plan if substantially all of the coverage is for accidents, disability, dental care, vision care, or long-term care. See Other Health Coverage next.

When I say the HDHP label is important, take a look at the results of using our instant no obligation quote engine.

Sure, all the Bronze Plans have high deductibles, but those that don’t qualify as HDHP to get an HSA have OOP’s Out of Pocket Maximums the most you pay… and then the insurance company pays 100%, that go over the allowance that the IRS has set of $6,650.

When using our quote engine, the easy way to find qualifying HSA plans, is to just click HSA.

I have had California covered for the past three years and always end up having to pay back the subsidy due to my income

I am self-employed in my income is somewhat variable and it’s hard to estimate what I’m going to make in the coming year.

So would like to get health insurance with no subsidy something around $700 a month.

$700 premium for three people is difficult. You can get Bronze with Oscar. Click here for quotes & proposals, with all plans and companies.

What about writing the premium off on your taxes line 29?

See above on Health Savings Account to write off the deductible.

I am comparing the Blue Shield Bronze PPO plans one at $287/mo/person and the other at $283/mo/person.

I understand the differences in terms of deductibles and copays that each plan offers but the first one is not HSA compatible while the second at $283/mo is HSA compatible.

I know that HSA is a health savings account but I don’t know how that practically applies.

What is the significance of the HSA compatibility?

I’m not sure where you are getting the per person premium amount. It sounds like you are using the child premium only and not including yours and your husbands too. The screen shot above shows unsubsized outside of Covered CA using our free instant quote engine with subsidy calculation.

Covered CA subsidies are available if your income is less than 400% of Federal Poverty Level – Income Chart or use our quote engine. Covered CA would pay advance subsidies, to be reconciled at tax time form 8962 which gets attached to your 1040. If you are not sure of your income, you can elect not to take subsidies and take them as a tax credit when you file your 2018 taxes.

If you are getting subsidies due to low income, I doubt that a HSA would be much value as there wouldn’t be a lot of tax write off. I’m not a CPA or Attorney. Please read and review the above webpage and seek proper legal and tax counsel.

There must be a better HSA plan. 40%!?

Can you suggest an HSA plan with better coverage?

It looks like the 2016 plan has $1000 more deductible and 10% higher co pay? Seems like poor coverage to me.

Even if the premiums are higher we need to consider a better plan with lower deductible etc.

Boy Obama care – should be called Give Me More Money for less Coverage Care

Let’s take a look at the detailed HSA United Health Care HSA $4,500/60% brochure from our FREE Almost Instant Small Group Quote Engine.

1st off, if you are buying an HSA Health Savings Account it’s because one doesn’t think they are going to have much in the way of claims and you want to save premium $$$ by having a high deductible. The premium savings goes into your HSA account Tax Free and rolls over to the next year and even into retirement if you don’t use it.

As we see from the online brochure, this plan has a $4,500 deductible and a Maximum Out of Pocket of $6,500 in network for individuals. Thus, the co-insurance amount of 40% only applies to $2,000 worth of claims between $6,500 and $4,500.

I will send you quotes for alternate HSA plans in a private email. Please note the differences in networks as show on page 4 & 5 of the United Health Care brochure.

All rates are based on an 80% loss ratio rule, so basically any premium one sends to an Insurance Company under ObamaCare, you get back 80% and the Insurance Company keeps 20% for overhead and profit. Why pay them to keep your money on small claims?

Thanks Steve. Your explanation now makes it all clear. I think we should stay right where we are.

Al