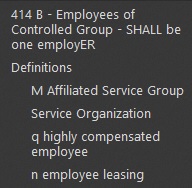

ACA – Affiliated Common Ownership Rules Employee Health Insurance?

Introduction

Common Ownership Rules

Affiliated Groups

Businesses must have matching Health Benefits if they are a controlled group, common ownership – affiliated if they are eligible to file a combined income tax return IRS #1120 for purposes of state taxation they shall be considered one employer. CA Insurance Code 10753 (q) (1) (A) * Revenue & Tax Code 25105 *

Certain affiliated employers with common ownership or part of a #controlled-group must aggregate their employees to determine their workforce size. Proposed regulations (pdf) and FAQs also provide more information about determining the size of your workforce. IRS.Gov

A controlled group means – two or more corporations, trades or businesses (including partnerships and proprietorships) have one of the following relationships:

Parent-subsidiary;

Brother-sister; or

Combination of parent-subsidiary and brother-sister. KtBenefits.com * IRS 414 b & c

So, when you send us your census for a Health Insurance Quote, please include all employees, from all affiliated companies, so we can properly calculate the number of eligible employees, for Health Insurance participation and Employer Mandate requirements.

Management Carve Outs – are where top salaried employees and owners get better benefits, are pretty much out, unlawful under Health Care Reform §2716 click to learn more.

An #affiliated group is one or more chains of includible corporations connected through stock ownership with a common parent corporation. 26 USC §1504(a) and (b). The common parent must be an includible corporation and the following requirements must be met.

1. The common parent must own directly stock that represents at least 80% of the total voting power and at least 80% of the total value of the stock of at least one of the other includible corporations.

2. Stock that represents at least 80% of the total voting power, and at least 80% of the total value of the stock of each of the other corporations (except for the common parent) must be owned directly by one or more of the other includible corporations. (More detail @ IRS Form 851) * 414 m

References

Controlled and Affiliated Service Groups IRS.gov 108 pages

Consumer Resources & Links

View Manual’s & Rules from each of the Companies we represent

I certify that the applicant is a single employer under section 414 of Internal Revenue Code of 1986 (26 U.S.C. § 414 (b), 9c), (m), or (o), and under any applicable state law.

Blue Shield’s rule:

If an owner believes that the structure of his/her holdings produces a single employer/employee relationship, Blue Shield will require copies of all associated Articles of Incorporation, Partnership Agreements, and a letter from the employer’s CPA stating that all business entities are eligible to file a combined tax return. Blue Shield’s determination of whether or not there is one responsible employer will be final. blue shield ca.com

PacifiCare – UHC Common Ownership Form

Notice 2016-03 provides that the Treasury and the IRS will issue guidance with respect to Cycle A elections made by controlled groups and affiliated service groups; expiration dates on determination letters issued prior to January 4, 2016; and the extension of the deadline for certain employers to adopt a defined contribution pre-approved plan and apply, if permissible, for a determination letter with the current 6-year cycle.

Just Enter your census or securely send us an excel spreadsheet or a list of employees and get instant proposals for California

Forms

California Common Ownership Forms

- California Corporate Income Tax Return Form # 100 See questions on Page 3...

- Guidelines for Corps filing a combined report FTB.CA.Gov # 1061

- CA - EDD Unity of Enterprise - Information Sheet DE 231

- Unity of operation is evidenced by central financing, accounting, and management of each business entity which includes, but is not limited to, common management, personnel policies, operating procedures, pricing, collections, and financing.

- Unity of use of two or more business enterprises shall be united if they share a general system of operation and the enterprises are organized for common purposes, and each is coordinated with, or is a part of, the entire operation.

-

A corporation may file a combined report with other members of a unitary group only if the corporations are members of a commonly controlled group as defined by R&TC Section 25105. Generally, a commonly controlled group exists when stock possessing more than 50% of the voting power is owned, or constructively owned, by a common parent corporation (or chains of corporations connected through the common parent) or by members of the same family. A commonly controlled group also includes corporations that are stapled entities, see R&TC Section 25105(b)(3). Special rules are provided in R & T C Section 25105 for partnerships, trusts and transfers of voting power by proxy, voting trust, written shareholder agreement, etc

- Franchise Tax Board Form & Publication Search

- Common Forms of Ownership FTB Publication 1123

Federal - IRS Forms - Common Ownership

- IRC §414 Single Employer §1563 Definition Controlled Group of Companies

- What about Leased Employees? §414 n

- IRS Form #1120 Corp Income Tax Return

- IRS Form 851 Affiliations Schedule & Instructions

- IRS Form #8869 Qualified Subchapter S Subsidiary Election

- IRS Textbook Training - Controlled & Affiliated Companies 108 Pages pdf

- baker law.com 2012 Explanation, including PPACA - Employer Mandate

Employer Aggregation Rules

Companies with a common owner or that are otherwise related under certain rules of section 414 of the Internal Revenue Code are generally combined and treated as a single employer for determining ALE status. If the combined number of full-time employees and full-time-equivalent employees for the group is large enough to meet the definition of an ALE, then each employer in the group (called an ALE member) is part of an ALE and is subject to the employer shared responsibility provisions, even if separately the employer would not be an ALE.

Example 3 – Employers are Aggregated to Determine ALE Status:

- Corporation X owns 100 percent of all classes of stock of Corporation Y and Corporation Z.

- Corporation X has no employees at any time in 2015. • For every calendar month in 2015, Corporation Y has 40 full-time employees and Corporation Z has 60 full-time employees. Neither Corporation Y nor Corporation Z has any full-time equivalent employees.

- Corporations X, Y, and Z are considered a controlled group of corporations.

- Because Corporations X, Y and Z have a combined total of 100 full-time employees for each month during 2015, Corporations X, Y, and Z together are an ALE for 2016.

- Corporation Y and Z are each an ALE member for 2016.

- Corporation X is not an ALE member for 2016 because it does not have any employees during 2015.

There is an important distinction for employers to keep in mind regarding these aggregation rules. Although employers with a common owner or that are otherwise related generally are combined and treated as a single employer for determining whether an employer is an ALE, potential liability under the employer shared responsibility provisions is determined separately for each ALE member.

Also, a special standard applies to government entity employers in the application of the aggregation rules under section 414. Because section 414 relates to common ownership and ownership isn’t a typical arrangement for government entities, and because specific rules under section 414 of the Code for government entities haven’t yet been developed, government entities may apply a good faith reasonable interpretation of section 414 to determine if they should be aggregated with any other government entities.

See Q&A #s6 and 42 on our employer shared responsibility provisions questions and answers page for more information. Learn More IRS.gov

Excerpt from Blue Cross Administrative Guide

Aggregation rules

- All employers treated as a single employer under section 414(b), (c), (m), or (o) of the Internal Revenue Code are treated as a single employer for purposes of determining group size. Therefore, all employees of a controlled group of entities under section 414(b) or (c), an affiliated service group under section 414(m), or an entity in an arrangement described under section 414(o), are taken into account in determining whether the members of the controlled group or affiliated service group together are an applicable large employer.

- Determining appropriate aggregation is a very fact-specific analysis. You should consult your own attorney, certified public accountant or other authorized consultant or advisor in determining whether and how the aggregation rules apply to you.

- Note: The information provided is to help you determine your group’s size using the same calculation to determine employer liability under the “Shared Responsibility for Employer” provisions of the ACA and the Internal Revenue Code. Pursuant to the ACA, California has adopted the federal definition of who is an employee for purposes of determining your group’s correct market segment (for example, Large Group or Small Group)

Health Coverage #Guide

Art Gallagher

Health Care Reform FAQ's

Understanding Health Reform

***********************************

Compliance #Assistance Guide from DOL.Gov Health Benefits under Federal Law

- Health Care Reform Explained Kaiser Foundation Cartoon VIDEO

- Choosing a Health Plan for Your Small Business VIDEO DOL.gov

- ACA Quick Reference Guide California Small Group Employers Revision 2020 Word & Brown

- kff.org/health-policy-101/

FAQ’s

- Are there Corporate rules of common ownership as it relates to health benefits?

- Insurance Rules, simply follow the tax code. See Blue Cross manual for an example.

.

.

- Insurance Rules, simply follow the tax code. See Blue Cross manual for an example.

- If two or more companies have a common owner or are otherwise related, are they combined for purposes of determining whether they employ enough employees to be subject to the Employer Shared Responsibility provisions?

- Yes, section 4980H (c) (2) (C) includes a longstanding provision that also applies for other tax and employee benefit purposes, under which companies that have a common owner or are otherwise related generally are combined and treated as a single employer, and so would be combined for purposes of determining whether or not they collectively employ at least 50 full-time employees (including full-time equivalents).

- If the combined total meets the threshold, then each separate company is subject to the Employer Shared Responsibility provisions, even those companies that individually do not employ enough employees to meet the threshold. (Note that these rules for combining related employers do not apply for purposes of determining whether a particular company owes an Employer Shared Responsibility payment or the amount of any payment. That is determined separately for each related company). IRS.Gov Question # 6

CA Definition of Common Controlled group

California #Revenue & Tax Code §25105 pdf

(a) For purposes of this article, other than Section 25102, the income and apportionment factors of two or more corporations shall be included in a combined report only if the corporations, otherwise meeting the requirements of Section 25101 or 25101.15, are members of a commonly controlled group.

(b) A “commonly #controlled group” means any of the following:

(1) A parent corporation and any one or more corporations or chains of corporations, connected through stock ownership (or constructive ownership) with the parent, but only if—

(A) The parent owns stock possessing more than 50 percent of the voting power of at least one corporation, and, if applicable,

(B) Stock cumulatively representing more than 50 percent of the voting power of each of the corporations, except the parent, is owned by the parent, one or more corporations described in subparagraph (A), or one or more other corporations that satisfy the conditions of this subparagraph.

(2) Any two or more corporations, if stock representing more than 50 percent of the voting power of the corporations is owned, or constructively owned, by the same person.

(3) Any two or more corporations that constitute stapled entities.

(A) For purposes of this paragraph, “stapled entities” means any group of two or more corporations if more than 50 percent of the ownership or beneficial ownership of the stock possessing voting power in each corporation consists of stapled interests.

(B) Two or more interests are stapled interests if, by reason of form of ownership restrictions on transfer, or other terms or conditions, in connection with the transfer of one of the interests the other interest or interests are also transferred or required to be transferred.

(4) Any two or more corporations, all of whose stock representing more than 50 percent of the voting power of the corporations is cumulatively owned (without regard to the constructive ownership rules of paragraph (1) of subdivision (e)) by, or for the benefit of, members of the same family. Members of the same family are limited to an individual, his or her spouse, parents, brothers or sisters, grandparents, children and grandchildren, and their respective spouses.

Common Control

Common Control means

a condition where two or more Persons, either through ownership, management, contract, or otherwise, are under the Control of one group or Person. Two or more Licensees are presumed to be under Common Control if they are Affiliates of each other by reason of common ownership or common officers, directors, or general partners; or if they are managed or their investments are significantly directed either by a common independent investment advisor or managerial contractor, or by two or more such advisors or contractors that are Affiliates of each other. This presumption may be rebutted by evidence satisfactory to SBA.

Licensee means either a corporation (Corporate Licensee), or a limited partnership organized pursuant to § 107.160 (Partnership Licensee), to which a license has been granted pursuant to the Act. For certain purposes, the Entity General Partner of a Partnership Licensee is treated as if it were a Licensee (see § 107.160(b)(2)).

*********

law.cornell.edu/cfr/779.221

§ 779.221 “Common control” defined.

Under the definition the “enterprise” includes all related activities performed through “common control” for a common business purpose. The word “control” may be defined as the act of fact of controlling; power or authority to control; directing or restraining domination. “Control” thus includes the power or authority to control. In relation to the performance of the described activities, the “control,” referred to in the definition in section 3(r) includes the power to direct, restrict, regulate, govern, or administer the performance of the activities. “Common” control includes the sharing of control and it is not limited to sole control or complete control by one person or corporation. “Common” control therefore exists where the performance of the described activities are controlled by one person or by a number of persons, corporations, or other organizational units acting together. This is clearly supported by the definition which specifically includes in the “enterprise” all such activities whether performed by “one or more corporate or other organizational units.” The meaning of “common control” is discussed comprehensively in part 776 of this chapter.

(c)

(1) If, in the application of subdivision (b), a corporation is eligible to be treated as a member of more than one commonly controlled group of corporations, the corporation shall elect to be treated as a member of only one commonly controlled group. This election shall remain in effect unless revoked with the approval of the Franchise Tax Board.

(2) Membership in a commonly controlled group shall be treated as terminated in any year, or fraction thereof, in which the conditions of subdivision (b) are not met, except as follows:

(A) When stock of a corporation is sold, exchanged, or otherwise disposed of, the membership of a corporation in a commonly controlled group shall not be terminated, if the requirements of subdivision (b) are again met immediately after the sale, exchange, or disposition.

(B) The Franchise Tax Board may treat the commonly controlled group as remaining in place if the conditions of subdivision (b) are again met within a period not to exceed two years.

(d) A taxpayer may exclude some or all corporations included in a “commonly controlled group” by reason of paragraph (4) of subdivision (b) by showing that those members of the group are not controlled directly or indirectly by the same interests, within the meaning of the same phrase in Section 482 of the Internal Revenue Code. For purposes of this subdivision, the term “controlled” includes any kind of control, direct or indirect, whether legally enforceable, and however exercisable or exercised.

(e) Except as otherwise provided, stock is “owned” when title to the stock is directly held or if the stock is constructively owned.

(1) An individual constructively owns stock that is owned by any of the following:

(A) His or her spouse.

(B) Children, including adopted children, of that individual or the individual’s spouse, who have not attained the age of 21 years.

(C) An estate or trust, of which the individual is an executor, trustee, or grantor, to the extent that the estate or trust is for the benefit of that individual’s spouse or children.

(2) Stock owned by a corporation, or a member of a controlled group of which the corporation is the parent corporation, is constructively owned by any shareholder owning stock that represents more than 50 percent of the voting power of the corporation.

(3) Stock owned by a partnership is constructively owned by any partner, other than a limited partner, in proportion to the partner’s capital interest in the partnership. For this purpose, a partnership is treated as owning proportionately the stock owned by any other partnership in which it has a tiered interest, other than as a limited partner.

(4) In any case where a member of a commonly controlled group, or shareholders, officers, directors, or employees of a member of a commonly controlled group, is a general partner in a limited partnership, stock held by the limited partnership is constructively owned by a limited partner to the extent of its capital interest in the limited partnership.

(f) For purposes of this section, each of the following shall apply:

(1) “Corporation” means a subchapter S corporation, any other incorporated entity, or any entity defined or treated as a corporation pursuant to Section 23038 or 23038.5.

(2) “Person” means an individual, a trust, an estate, a qualified employee benefit plan, a limited partnership, or a corporation.

(3) “Voting power” means the power of all classes of stock entitled to vote that possess the power to elect the membership of the board of directors of the corporation.

(4) “More than 50 percent of the voting power” means voting power sufficient to elect a majority of the membership of the board of directors of the corporation.

(5) “Stock representing voting power” includes stock where ownership is retained but the actual voting power is transferred in either of the following manners:

(A) For one year or less.

(B) By proxy, voting trust, written shareholder agreement, or by similar device, where the transfer is revocable by the transferor.

(g) The Franchise Tax Board may prescribe any regulations as may be necessary or appropriate to carry out the purposes of this section, including, but not limited to, regulations that do the following:

(1) Prescribe terms and conditions relating to the election described by subdivision (c), and the revocation thereof.

(2) Disregard transfers of voting power not described by paragraph (5) of subdivision (f).

(3) Treat entities not described by paragraph (2) of subdivision (f) as a person.

(4) Treat warrants, obligations convertible into stock, options to acquire or sell stock, and similar instruments as stock.

(5) Treat holders of a beneficial interest in, or executor or trustee powers over, stock held by an estate or trust as constructively owned by the holder.

(6) Prescribe rules relating to the treatment of partnership agreements which authorize a particular partner or partners to exercise voting power of stock held by the partnership.

(h) This section shall apply to taxable years beginning on or after January 1, 1995.

(Amended by Stats. 2000, Ch. 862, Sec. 215. Effective January 1, 2001.)

Related Pages

Carve Outs & Common Ownership

- Common Ownership – Affiliated Companies – Corporations

- Our webpage on Section 125 POP Premium Only Plans

I work with doctors and they have separate PAs.

The staff is under an LLC. They all work together in the same office.

Is this a controlled group or an affiliated service group?

What do you mean by “PA?” Physician’s Assistant?

Who owns the LLC?

What State are you in?

Why are you asking the question? Retirement? Health Insurance?

Who owns the doctors “PA?”

Are they eligible to file a combined return 1120?

Did you want to check out Health Insurance plans from us?

Determining whether two or more organizations must be treated as a single employer under the controlled group or affiliated service group rules involves a complex analysis of ownership interests, including constructive ownership. Ktbenefits *