Specialty Medicare Coverage..

DME Durable Medical Equipment, Chiropractic, Hearing Aids, Physical Therapy, Ambulance,

#Durable1 medical equipment (DME)

Medicare Coverage of Durable Medical Equipment Publication 11045

- Medicare covers items like oxygen equipment and supplies, wheelchairs, walkers, and hospital beds ordered by a doctor or other health care provider enrolled in Medicare for use in the home. Some items must be rented. You pay 20% of the Medicare-approved amount, and the Part B deductible applies. If you have a Medi Gap plan, that should pay the 20%! Medicare Advantage, check the summary of benefits or EOC Evidence of Coverage.

- Make sure your doctors and DME suppliers are enrolled in Medicare. Doctors and suppliers have to meet strict standards to enroll and stay enrolled in Medicare. If your doctors or suppliers aren’t enrolled, Medicare won’t pay the claims they submit. It’s also important to ask your suppliers if they participate in Medicare before you get DME. If suppliers are participating suppliers, they must accept assignment (that is, they’re limited to charging you only coinsurance and the Part B deductible for the Medicare-approved amount). If suppliers aren’t participating and don’t accept assignment, there’s no limit on the amount they can charge you.

- Prosthetic Limbs – Medical Necessity? Kff.org *

- Why Insurance Companies are denying coverage for Prosthetic Limbs Kff.org *

- To find suppliers who accept assignment, visit Medicare.gov/supplier directory or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048. You can also call 1-800-MEDICARE if you’re having problems with your DME supplier, or you need to file a complaint. Copied from Medicare & You – see link in side panel

What about Stair Lifts?

- acorn stair lifts.com

- Medical Necessity of Stair Lifts & Lifting devices Clinical Bulletin?

- Durable Medical Equipment

- Seat Life Mechanisms

- Pride Mobility.com Steps to get Medicare to pay

- hhs.gov research 1989

Guide Dog or Other Service Animal

You can include in medical expenses [but apparently not as durable medical expense] the costs of buying, training, and maintaining a guide dog or other service animal to assist a visually impaired or hearing disabled person, or a person with other physical disabilities. In general, this includes any costs, such as food, grooming, and veterinary care, incurred in maintaining the health and vitality of the service animal so that it may perform its duties. irs.gov/

- Maybe you can get a grant?

Resources & Links

- Justice in Aging DME for CA Advocates Fact Sheet

- An Advocate’s Guide to Medi-Cal Services January 2020 Chapter X: Durable Medical Equipment, Orthotics and Prosthetics, and Other Non-Pharmaceutical Items Health Law.org *

- CMS discontinues medical device forms to ease physician administrative burdens Fierce Health Care * Rev Cycle Intelligence *

- Biden repeals Trump rule that expedited coverage for “breakthrough technology” Modern Health Care * 9.13.2021 prior article * Federal Register 42 CFR Part 405 [CMS-3372-P2] RIN 0938-AT88 *

- Wheelchair users can face hefty costs not covered by insurance, under age 65… LA Times 11.15.2021 *

- Coverage for catheters?

- wikipedia.org/Certificate_of_medical_necessity

- Adult Diapers?

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Home Infusion

- Home infusion under DME Medicare.gov *

- Medicare Home Infusion PDF CMS.gov

AI Summary

- Medicare Part B: Covers the professional services (nursing, training, monitoring) and the durable medical equipment (DME) like the pump and IV supplies.

- Your Cost: You typically pay 20% of the Medicare-approved amount for these items after your deductible is met.

- Medicare Advantage or Medi Gap should cover the 20%

- Medicare Part D: Covers the actual antibiotic medication.

- Your Specific Plan: Part D costs (and even Part B premiums/deductibles) differ by Medicare Advantage (Part C) or stand-alone Part D plans.

- The Drug: The specific antibiotic’s cost and tier under your Part D plan significantly impact your out-of-pocket cost.

- Provider: Ensure your home infusion supplier is a “qualified” Medicare supplier for the new benefit. [1, 3, 4, 7, 8]

- Check with your supplier: Ask them for the specific codes (HCPCS/CPT) for the services and equipment, and confirm they bill Medicare correctly.

- Contact your Part D plan: Get exact copay/coinsurance details for your specific antibiotic medication.

- Check your Part B: Confirm your deductible status and any premiums. [2, 3, 5, 6, 7]

Incontinence

- health line.com does-Medicare-cover-incontinence-supplies

- Medicare Part B covers durable medical equipment (DME) for incontinence, like pelvic floor stimulators and catheters.

- It does not cover adult briefs or absorbent incontinence supplies, which Medicare considers personal hygiene products.

- Medicare Advantage (Part C) plans must cover the same incontinence services as Original Medicare but may offer additional benefits, such as coverage for over-the-counter items like adult briefs.

- Part D prescription drug plans can help cover incontinence medications, but it does not cover adult briefs or other absorbent supplies.

- Medicare Part B covers durable medical equipment (DME) for incontinence, like pelvic floor stimulators and catheters.

- hdis.com/ incontinence

- Medi Cal coverage for Incontinence 13 page complex pdf document

- Medi-Cal covers incontinence medical supplies WIC Section 14125.1[a]) when prescribed by a physician, nurse practitioner, clinical nurse specialist or a physician assistant within the scope of practice for use in chronic pathologic conditions that cause the recipient’s incontinence

- Can you write off Incontience Supplies? Our webpage

Chiropractic Coverage

#Chiropractic coverage in Medicare

- VIDEO explanation Chiropractic

- Here’s how Medicare A & B and the a Typical MAPD Plan. and Medi Gap would pay the 20% that Medicare allows, but leaves as a co payment.

- Medicare Part B pays 80% for spinal manipulation if medically necessary. Thus, Medi Gap and Medicare Advantage only pay, if Medicare does.

- Medicare doesn’t cover other services or tests ordered by a chiropractor, including X-rays, massage therapy, and acupuncture. If you think your chiropractor is billing Medicare for chiropractic services that aren’t covered, you can report suspected Medicare fraud Medicare.gov *

Medical Necessity get’s quite complicated.

Here’s more detailed definitions:

- Here’s a Medicare Fact Sheet, something a little easier to read for the lay person.

- For chiropractic services, medically necessary means the patient must have “a significant health problem in the form of a neuromusculoskeletal condition necessitating treatment, and the manipulative services rendered must have a direct, therapeutic relationship to the patient’s condition and provide a reasonable expectation of recovery or improvement of function. The patient must have a subluxation of the spine, as demonstrated by x-ray or physical exam.”

- Treatment by means of manual manipulation of the spine to correct a subluxation (incomplete or partial dislocation of a joint or organ.[1] Wikipedia ) (that is, by use of the hands).

- Patient must require treatment by means of manual manipulation.

Manipulation services rendered must have direct therapeutic relationship to the patient’s condition.

There must be a reasonable expectation of recovery or improvement of function resulting from the planned treatment. CMS.gov * - Medicare Exclusions from Coverage

- Note that the specimen Medicare Advantage policy we used to analyze coverage has exclusions on page 115 for chiropractic, they only cover what Medicare covers, nothing extra!

- For those of you who think that “Medicare for All” will be the solution to every health problem and that Medicare pays everything, take a look at this NINE page bulletin on the the Medicare records required from your chiropractor.

- Sample Medicare Advantage Plan

- Use Ctrl F & Search adobe.com/searching-pdfs

- Sample Medi Gap EOC Plan G

- Medi Gap will provide coverage for the coinsurance amount or, in the case of hospital outpatient Services, the copayment amount of Medicare Eligible Expenses under Part B …, subject to the Medicare Part B Deductible provided the Subscriber is receiving concurrent benefits from Medicare for the same Services. Blue Shield EOC *

FAQ Chiropractor

- Does blue shield 65 plus cover any chiropractor care as basic Medicare does?

- How do I find a Chiropractor for the Inspire Plan?

.

- How do I find a Chiropractor for the Inspire Plan?

- Here’s our webpage on what Medicare offers for chiropractic. If you have further questions, please post in the ask a question section on that page. MAPD plans are required to offer at least as much coverage as Medicare does.

- See the summary of benefits for the Blue Shield plan you are interested.

- See link at top of page to enroll. No extra charge for our help.

- call ASH American Specialty Health Network customer service at (800) 678-9133

Do #Health Care Reform compliant plans cover chiropractic?

- No, Chiropractic is Excluded on page 106 of the Specimen policy, Page 14 brochure It’s not an essential benefit, in CA

- Here’s the CA Kaiser Benchmark Plan which is the “model” for ACA compliant plans

- Other States may cover chiropractic, but CA doesn’t. Here’s a report from dynamic chiropractic.com

- However,

- Blue Shield INDIVIDUAL

- Chiropractor benefits available for Silver 1950 PPO and Silver 2600 HDHP PPO plans as of Jan 1, 2021

- We are the first off-exchange health plan to offer embedded chiropractic services to members through the American Specialty Health (ASH) network with Silver 1950 PPO and Silver 2600 HDHP PPO plans.

- Benefits include:

- $15 copayments for Silver 1950 PPO

35% coinsurance for Silver 2600 HDHP PPO

Both plans have an annual limit of 15 visits

- Blue Shield INDIVIDUAL

At one time you could Buy your OWN Chiropractic Plan!

- But Landmark Health Plan has discontinued selling for individuals. Employer Groups can still enroll.

- Provider Directory

Physical Therapy, Ambulance, Cancer

#Physical therapy/occupational therapy/speech-language pathology services

- Medicare Part B (Medical Insurance) helps pay for medically necessary, see clinical guidelines!,

- outpatient physical medicare.gov/physical-therapy

- and Occupational therapy

- and. Speech-language pathology services

- Your medical record must include information to explain why the services are medically necessary

- A Medicare contractor like Livanta may review your medical records to be sure your therapy services were medically necessary. This happens when your bills go over say $2k cms.gov/theraphy caps

- Your therapist or therapy provider must give you a written notice before providing services that aren’t medically necessary. This includes therapy services that are generally covered but aren’t medically reasonable and necessary for you at the time.

- This notice is called an “Advance Beneficiary Notice of Noncoverage” (ABN). The ABN lets you choose whether or not you want the therapy services. If you choose to get the medically unnecessary services, you agree to pay for them.

Who’s eligible?

All people with Part B Out Patient are covered as long as the services are medically reasonable and necessary.

Your costs in Original Medicare

You pay 20% of the Medicare-approved amount, and the Part B deductible applies. If you have a Medi Gap or Medicare Advantage plan, those will pay all or part of the 20%.

Resources & Links

- The Best Quadriceps Exercises to Build Stronger Thighs Very Well.com

- Your Medicare Benefits Page 91

- Medicare & Home Health Care

- kindred health care.com your-guide-to-medicare-and-transitional-care

- torrance memorial.org/transitional-care/

- MLN Transitional Care Management Services pdf

- medicare.gov/transitional-care-management-services html

- 42 CFR § 410.60 – Outpatient physical therapy services: Conditions

- The complete Medicare guide for physical, occupational, and speech therapy.

- What does Medicare cover for outpatient rehabilitation therapy? Medicare Made Clear

- CMS.gov Physical Therapy – Home Health

- medicare.gov/physical-therapy-services

Oscar #Clinical Guideline

Physical & Occupational Therapy

Closest thing to Plain English I’ve found!

- CMS.gov complex explanations

- Skilled Physical Therapy requirements §30.4.1

- Guidelines §30.4.1.2

- Inpatient 70.3

- OUTPATIENT REHABILITATION THERAPY SERVICES:

COMPLYING WITH DOCUMENTATION REQUIREMENTS

Medicare Coverage – #Ambulance # 11021

Resources & Links

- forbes.com/insurance-for-ambulance-rides/

- New California Law Offers Fresh Protection From Steep Ambulance Bills KFF.org – no balance billing – out of network

FAQ’s

- Question: Non-emergency ambulance transportation

. - Answer You may be able to get non-emergency ambulance transportation if you need it to treat or diagnose your health condition and the use of any other transportation method could endanger your health — Get the details on page 6 of the above publication, even MORE details Medicare Benefit Policy Manual Chapter 10 – Ambulance Services

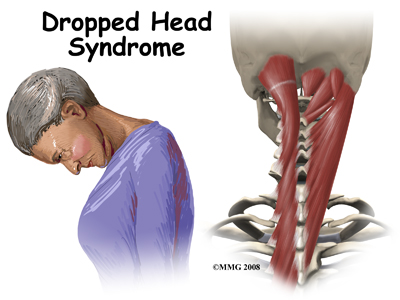

#DROPPED HEAD SYNDROME

One of the extra things we do for our clients, friends & web visitors who post questions in the comments below, is extensive internet research. Here we go…

In addition to the physical therapy benefit in Medicare, Employer Group or Individual & Family plans, how about doing physical therapy at home, the gym and using silver sneakers?

- humpal physical therapy.com/Dropped-Head-Syndrome photo credit too

- spine-health.com/easy-chest-stretches-neck-pain

- mayfield clinic.com/neck stretches & strengthening

- Impact physical therapy

- Caring Medical.com

#Medicare10050 and You 2025

Spanish

Everything you want to know

- Steve's Video Seminar Introduction to Medicare & You

- Clear View to Medicare Patient Advocate.org - 36 pages

- Get Ready for Medicare * Spanish

***********

- Your Medicare #Benefits # 10116

- Inpatient ONLY - How Medicare Pays for your Surgery Part A vs Part B Very Well Health.com

- Enroll in Blue Cross

- Use our scheduler to Set a phone, Skype or Face to Face meeting

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

- Get more information and FAQ's

- #Intake Form - We can better prepare for the meeting (National Contracting Center)

https://www.medicare.gov/coverage/continuous-positive-airway-pressure-devices