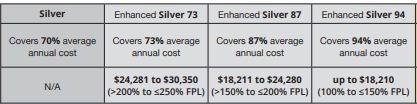

Enhanced Silver Silver 94, 87 & 73 Benefits CSR

Silver Loading?

Silver 87, 94 & 73 Enhanced Silver Benefits

Cost-sharing CSR – subsidies

- Cost-sharing – Enhanced Silver subsidies in the Silver 87, 94 & 73 will reduce your out-of-pocket cost, including your

- by lowering co-pays & deductibles vs the Plain Silver 70. See chart below.

- The amount of the reduction – enhancement (the amount of cost-sharing subsidies) you can receive is based on your income and family size. If you are eligible for premium assistance and your annual household income is between 138% and 250% of the federal poverty Level, you can qualify for enhanced silver – cost-sharing subsidies. Scroll down for the chart showing the 4 Metal Levels, Plain Silver 70, Silver 87, 94 & 73 and the various co-pays, deductibles, etc.

- Enhanced Silver – CSR cost-sharing reductions – subsidies are only available if you enroll in a silver-level plan. Once Covered California determines Get instant quotes here! that you are eligible for cost-sharing subsidies, you will be able to enroll in a Silver Plan with CSR, based on your income level. You can’t just say you want to buy Silver 97, it’s based on FPL Federal Poverty Level. Get instant quotes & Poverty Level Calculation here!

- Scroll down for our Metal Level Chart

Resources & Links

- page 174 of Western Poverty Law for explanation of Cost Sharing Reductions

- If you’re a techy here’s the full code on Cost Sharing Reductions

- Right to change plans when your Silver Level changes – significant income change

What is Silver #Loading?

Silver plans in Covered CA are higher! but…

- Silver loading means that Silver Plans in Covered CA are around 10 to 12% higher than outside of Covered CA, due to the House vs Price lawsuit below.

- In very short summary, the court found that the extra premium to give you Silver 94, which is better than Platinum was not properly authorized in the budget that Congress laid out. To get around that ruling, Covered CA simply raised the premium for Silver plans. If you’re getting subsidies, the subsidy pays it. It’s a complicated formula CFR 1.36 B-3. That why I use a quote engine.

- So, if you are not getting subsidies and are sure that you won’t, that’s a BIG reason to go direct to the Insurance Company. We can help you direct with the Insurance Company or Covered CA. We are paid by the Insurance Company at no extra charge to you.

Further reading, Resources & Links

- California Slaps Surcharge On Silver ACA Plans CA Health Line

- In the face of major premium hikes, state insurance regulators urge Congress to act quickly LA Times 9.6.2017

- What is Silver Loading? Insure Me Kevin.com

- Blue Shield PPO Covered California Rate Increase 2022 vs 2023

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Videos on how great agents are

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

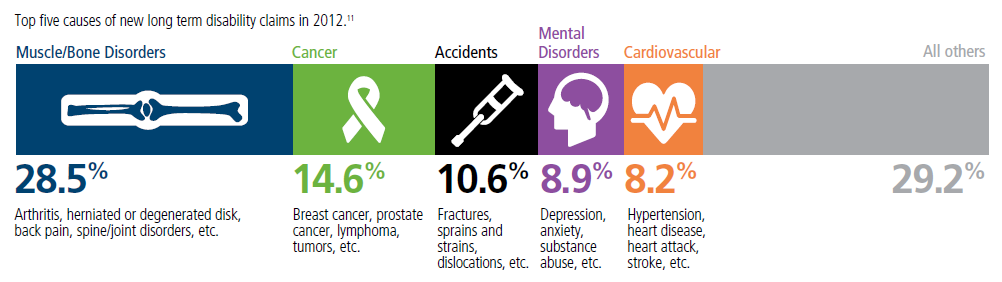

Top 5 - 10 causes of Long Term Disability Claims

Lower back disorders ♦ Depression ♦ Coronary heart disease, arthritis and pulmonary diseases (Met Life) ♦ Disability Can Happen ♦ CDC Statistics

Our webpage on Disability Payments - Insurance

Get Disability Quotes for Parents, Caretakers & Wage Earners

- 2025 Source

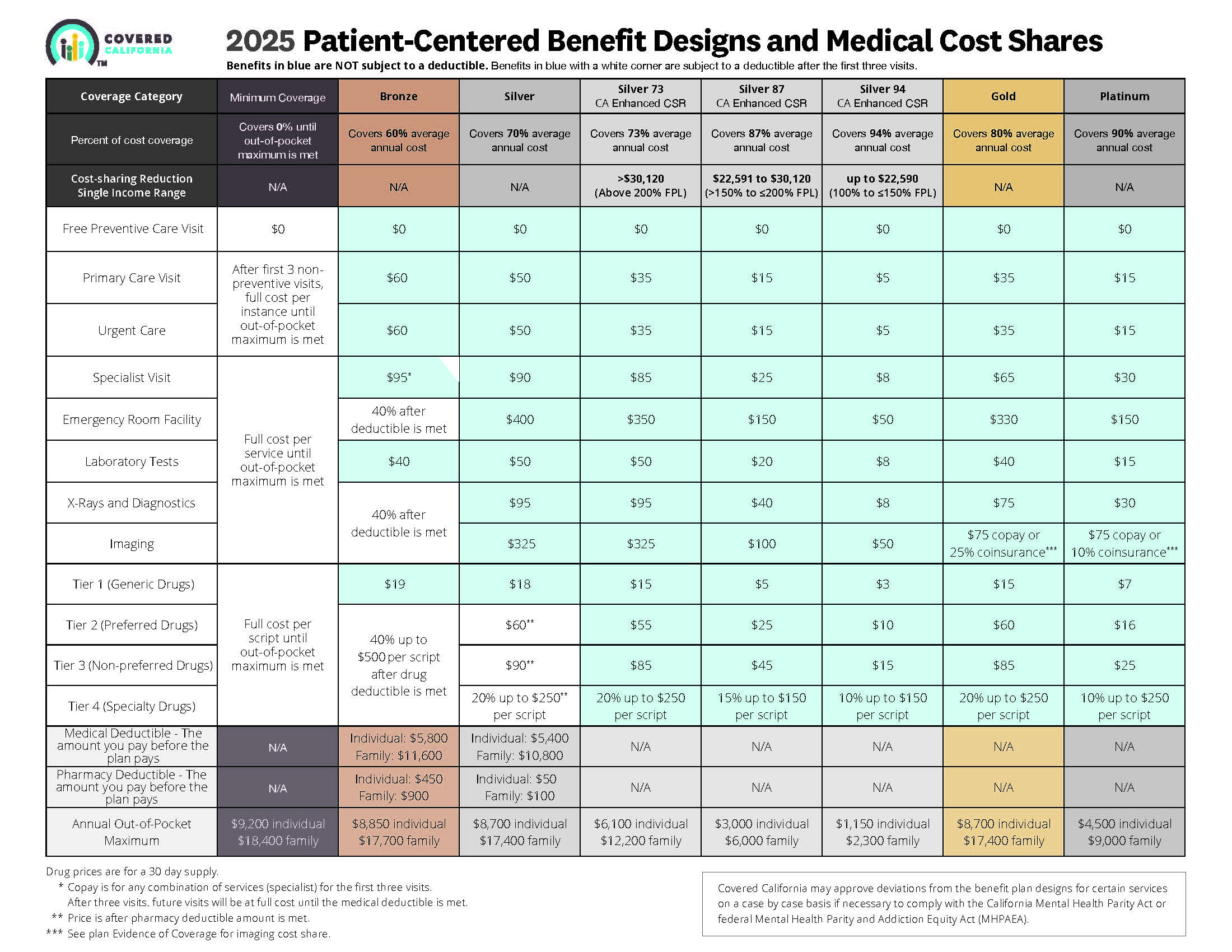

- Source and see a sharper image 2024 Patient Centered Designs * *

- Covered CA bulletin on new and improved Enhanced Silver CSR Cost Sharing Reduction

- Do you think your medical bills will be higher or lower than average for your age & zip code?

- Expected Payout (AV)

- MLR Medical Loss Ratio

- Bronze 60%

- Enhanced Silver 70% - 94% Gold 80% Platinum 90%

- Metal Levels are based on Expected Claims Payment - that is the actuarial value (AV).

- Renewal Tool Kit

- Did you notice LOWER deductibles & Co Pays???

- This is one way Health Care Reform hopes to make shopping and comparing Instantly - easier. So, if you get a lower priced plan with less or fewer benefits, co-pays, deductibles you simply pay more when you have a claim. Don't worry, there is a stop loss - maximum out of pocket OOP, of say $7k so that you won't break the bank.

- All plans cover the 10 Federal essential benefits and CA mandated benefits.

- Our main webpage on Metal Levels

FAQ’s “Enhanced Silver – Cost Sharing Reductions”

- The plan says 87% cost share reduction, does that mean the plan covers 87% of the medical costs?

- 87% is the actuarial value The actuarial value of a health insurance policy is the percentage of the total covered expenses that the plan covers, on average for a typical population. [Age & Zip Code] For example, a plan with a 70% actuarial value means that consumers would on average pay 30% of the cost of health care expenses through features like deductibles and coinsurance. The amount that each enrollee pays will vary substantially by the amount of services they use.

- To find out what the actual expenses are for your plan, click where it says “plan details” and you’ll see the detail on your deductibles, co pays, etc. If you look at the chart on the top of this page, it will show Silver 87 with a $15 office co-pay, $1,400 deductible and the maximum out of pocket of $2,700. Click here for definitions of deductible and OOP Out of Pocket maximum.

- I was wondering what is the urgency – deadline to change my plan. My income has increased from $17k to 100k so I no longer qualify for Silver 94 or subsidies. So I’m seeing my doctors for $5 co-pay at the moment, does it mean that I’m going to have to pay Blue Shield back the $295/visit of remaining amount that the doctor actually charges (before the negotiated rate) or pay it back in taxes, when I file a 1040 and 8962?

- Whenever you have a change, you are required to report it to Covered CA within 30 days. Once you have a qualifying event, there is 60 days to change your plan. Covered CA Site…

- The Covered CA application and subsidies are under penalty of perjury… Since, the subsidies are a tax thing… one might call not reporting income and collecting benefits you are not entitled to, tax fraud.

- The payment that Blue Shield makes is probably not $295 on the Doctors bill, but a much lower negotiated rate. I don’t know of any procedure that Blue Shield would recalculate the claim payments. It would just be on the new plan, that you get within 60 days, after the 30 days to report.

- In the past, enhanced silver was funded separately so you didn’t pay that part back, just the subsidy. Now, with the enhanced silver being declared by the courts illegal, the amount of subsidy you pay back, includes the cost of enhanced silver. These calculations are beyond my pay grade. Thus, here’s a calculator.

- When you file taxes, you’ll pay back all the subsidies. Check these pages 1040 8962 and those previously referenced if there are any other penalties.

- What happens if I qualify and sign up for the enhanced silver plan and receive all of the benefits of said plan. However, my income is increased at some point in the year for whatever reason and as a result when I file my taxes I am over the income threshold requiring me to pay some of the excess premium payments back with my taxes. Is there a penalty for all of the lower deductibles/copays I was able to utilize under the Enhanced silver plan?

- No, however you are mandated to report income changes within 30 days. You also promised in the Covered CA application to report income changes within 30 days. Use the search feature ctrl – f and put in “changes.” It’s used 14 times.

House vs Price

The budget reconciliation process allows legislation to advance through the Senate on a simple majority vote. The process can be used to target aspects of the ACA that address spending and revenue, meaning the technique could not uproot the entire law.

The House last month voted 240-189 to approve HR 3762, which aims to dismantle the ACA by repealing the law’s:

- “Cadillac” and medical device taxes; and

- Individual and employer mandates.

- Learn More CA Health Line 11.20.2015

The Senate parliamentarian ruled that a budget reconciliation measure (HR 3762) that would dismantle the Affordable Care Act by repealing some of its major provisions can move forward, CA Health Line 11.11.2015

The suit, authorized by House lawmakers in July 2014, contends that Congress never authorized the Department of Treasury’s payments to insurers for cost-sharing reductions enhanced-silver.com to help low-income consumers pay for out-of-pocket costs such as coinsurance, copayments and deductibles. While the case likely would not greatly affect the ACA, some consumers’ out-of-pocket spending could increase sharply if the cost-sharing subsidies are invalidated (California Healthline, 9/22). “The House lawsuit undermines centuries of historical practice and the fundamental principles of our system of democratic government.” She added, “We are confident that the courts ultimately will dismiss this taxpayer-funded political stunt, which would make health care more expensive for millions of Americans” (The Hill, 10/19). CA Health Line 10.20.2015

The House suit asks the court to declare that the president acted unconstitutionally in making payments to insurance companies under Section 1402 of the health care overhaul (PL 111-148, PL 111-152) and to stop the payments.

The dispute focuses on two sections of the health care law. The administration said it could make Section 1402 Offset Program payments from the same account as Section 1401 Refundable Tax Credit Program payments. House Republicans say the health care law doesn’t permit that. Rollcall 9.21.2015

Links & Resources

- Insure Me Kevin.com

- FAQ’ more detail & Example

- chlpi.org/Cost-Sharing-Reduction-issue-brief_July-2017

Motion to Intervene – Stop the lawsuit

Why is it less $$ to buy a Silver Plan direct from an Insurance Company rather than Covered CA if you don’t qualify for subsidies?

Note that there is no extra charge to use an agent, either way.

In this litigation, (read full motion 179 pages) the House of Representatives attacks a critical feature of the Patient Protection and Affordable Care Act—landmark federal legislation that has made affordable health insurance coverage available to nearly 20 million Americans, many for the first time. If successful, the suit could—to use the President’s expression—“explode” the entire Act. Until recently, States and their residents could rely on the Executive Branch to respond to this attack. Now, events and statements, including from the President himself, have made clear that any such reliance is misplaced. The States of California, New York, Connecticut, Delaware, Hawaii, Illinois, Iowa, Kentucky, Maryland, Massachusetts, Minnesota, New Mexico, Pennsylvania, Vermont, and Washington, and the District of Columbia move to intervene to ensure an effective defense against the claims made in this case and to protect the interests of millions of state residents affected by this appeal.

The ACA was designed to create state-based markets presenting affordable insurance choices for consumers. A central feature of that design is federal cost-sharing reduction subsidies – Enhanced Silver backed by mandatory payment provisions, giving insurers and state regulators the stability they need to maintain functional markets. The district court’s ruling would destroy this design by eliminating the permanent appropriation Congress intended for cost-sharing reduction payments. Payments would cease immediately in the absence of a specific appropriation; and any future payments would be subject to the unpredictability of the appropriations process. That would directly subvert the ACA, injuring States, consumers, and the entire healthcare system.

The States thus have a vital interest in seeking reversal or vacatur of the district court’s decision. In California and New York alone, the ACA provides access to health coverage for 8.9 million people. The loss of funds and financial uncertainty threatened by this case would lead at least to higher health insurance costs for consumers, and more likely to many insurers abandoning the individual health insurance market. The number of uninsured Americans would go back up, hurting vulnerable individuals and directly burdening the States. The wrong decision could trigger the very system-wide “death spirals” that central ACA features, such as stable financing, were designed to avoid. See King v. Burwell, 135 S. Ct. 2480, 2493 (2015). At a minimum, the annual uncertainty created by the district court’s decision would make the States’ tasks in regulating and providing health insurance to their residents more complex, unpredictable, and expensive.

These concerns are concrete and immediate. Insurers are currently deciding whether to participate in ACA Exchanges in 2018. Some have already withdrawn because of uncertainty over funding for cost-sharing reduction payments, and others are threatening to follow suit. Meanwhile, the President has increasingly made clear that he views decisions about providing access to health insurance for millions of Americans—including the decision whether to continue defending this appeal—as little more than political bargaining chips. The States and their residents cannot continue to rely on the Executive Branch to represent them in this appeal.

BACKGROUND

Congress enacted the Affordable Care Act “to increase the number of Americans covered by health insurance and decrease the cost of health care.” Nat’l Fed’n of Indep. Bus. v. Sebelius, 132 S. Ct. 2566, 2580 (2012). The ACA adopted a “series of interlocking reforms” to achieve these goals. King, 135 S. Ct. at 2485. It provides for the “creation of an ‘Exchange’ in each State—basically, a marketplace that allows people to compare and purchase insurance plans.” Many States, including proposed intervenors, play an integral role in bringing plans to market through these Exchanges.

To make healthcare more affordable, the Act provides for billions of dollars in federal funding. Section 1401 provides tax credits that reduce monthly insurance premiums for eligible individuals. 26 U.S.C. § 36B. Section 1402 provides for federal payments to insurers to fund cost-sharing reductions (CSRs) for eligible consumers, which reduce out-of-pocket costs by lowering deductibles, co-payments, and similar expenses. 42 U.S.C. § 18071. The ACA requires insurers to cover CSR costs upfront when eligible consumers receive services at reduced cost. Id. § 18071(a)-(c). The Secretary of Health and Human Services must “make periodic and timely payments to the [insurer] equal to the value of the reductions.” Id. § 18071(c)(3)(A). CSR subsidies will total $9 billion in 2017, and are expected to rise to $16 billion by 2026. 3

Since the Exchanges began operating in January 2014, the Treasury has made CSR reimbursement funds available on the authority of the permanent appropriation provided by 31 U.S.C. § 1324. See Exec. Branch Opening Br. 9-10. In this suit, the House argues that the ACA’s permanent appropriation does not extend to CSR payments, making them unconstitutional without specific later appropriations. Id. at 11-12. The district court held that the House had standing to maintain this suit and enjoined the Executive Branch from making CSR payments without specific appropriations, but stayed its injunction pending this appeal. Id. at 13-16.

The Executive Branch appealed that decision under the prior Administration, filing its opening brief on October 24, 2016. On November 21, 2016, the House moved to hold briefing in abeyance in light of the “significant possibility of a meaningful change in policy” by the new Administration. ECF No. 1647228. This Court granted that motion on December 5, 2016. On February 21, 2017, the new Administration joined a motion to continue the abeyance period, which this Court granted on March 2, 2017.

ARGUMENT

I. THE STATES ARE ENTITLED TO INTERVENE TO DEFEND CONTINUED IMPLEMENTATION OF THE AFFORDABLE CARE ACT A party is entitled to intervene in an appeal as of right if:

(1) its motion is timely;

(2) it has a legally protected interest in the action;

(3) the outcome of the action threatens to impair that interest; and

(4) no existing party adequately represents that interest. (read full motion 179 pages)

Learn More==>

CA and 13 other states file lawsuit (173 page motion to intervene) to maintain Cost Sharing Subsidies – Enhanced Silver LA Times 5.19.2017 * Kaiser Health News *

House vs Price Lawsuit

A Federal Judge Ruled that President Obama overstepped his authority in funding the Extra Benefits of Enhance Silver 94, 87 & 73 – Cost Sharing Reductions. (CSR) (§1402 of PPACA).

There can be no more reimbursements to the Insurance Companies for Enhanced Silver’s extra benefits – see chart until Congress appropriates the $$$.

L.A.Care Health Plan, which was awarded nearly $6 million on Feb. 14 by Judge Thomas C. Wheeler of the Court of Federal Claims. Observing that the money was promised by the ACA and that Trump had no right to stiff the insurers, Wheeler wrote that “L.A. Care should not be left ‘holding the bag’ for taking our Government at its word.” LA Times *

The ruling is stayed, until the time for appeal, which seems likely – see video from the White House at right. On the other hand, with Donald Care coming, the appeal could be dropped on his inauguration 1.20.2017 * CA Healthline 8.2.2017 States can file lawsuits… * Actual Court Order * NPR 11.9.2016 * Health Affairs.org

Appeals court rules that Trump violated the law when the Feds stopped paying the subsidies, however insurers are not entitled to the full amount as they raised premiums to cover the loss. Maine Community Health Options v. United States Modern Health Care *

See also our webpage on Risk Corridors.

Learn More ==>

President Trump just announced that Cost Sharing Subsidies will end!!! Modern Health Care *

Covered CA will wait till 9.30.2017 to deciede on CSR Rates – Surcharge * 8.17.2017 Covered CA Press Release * CBO Report – Effect of Terminating CSR * Marketing Matters * Insure Me Kevin.com *

A federal appeals court has granted House Republicans a delay in their lawsuit seeking to halt certain federal payments to health plans under the Affordable Care Act. That delay buys time for the Trump administration to find a way to avoid throwing the individual insurance market into chaos. Modern Health Care 12.5.2016 * Actual Order * Delayed again – Now House v Price US News 2.21.2017 * Six changes Trump can still make to ACA NPR 3.29.2017 * LA Times Editorial 3.31.2017 * * Video on if there would be an appeal in the first place

Status Conference set for 5.22.2017 The House and the DOJ made the request in a joint motion Tuesday… The motion Tuesday grants the House and the DOJ until May 22 to file a status report with the court and establishes 90-day deadlines after that. US Gateway.com * Lifezette.com

7.19.2017 Trump still threatens to stop Cost Sharing Reductions – Enhanced Silver * Politico 7.19.2017 August payments could stop this Thursday! Bloomberg 7.19.2017

Trump askes for 90 day extension. “Clearly by today’s action and their decision to make the next payment, the White House realizes that eliminating cost sharing reduction payments would cause chaos in the markets, and they would get the blame,” The Hill.com 5.22.2017

CA and 13 other states file lawsuit (173 page motion to intervene) to maintain Cost Sharing Subsidies – Enhanced Silver LA Times 5.19.2017 * Kaiser Health News *

8.16.2017 If President Donald Trump were to follow through on his threats to cut federal cost-sharing subsidies, health insurance premiums for silver plans would soar by an average of 20 percent next year and the federal deficit would rise by $194 billion over the next decade, the nonpartisan Congressional Budget Office said Tuesday 8.15.2016 CA Health Line * CBO Analysis

4.28.2017 Sacramento Bee CA Dept of Insurance (DOI) will allow Insurance Companies to file two sets of rates

One set would reflect the rates that insurance companies project if former President Barack Obama’s health care law remains in effect and is enforced.

The other set would be based on an assumption that President Donald Trump and the Republican Congress follow through on their pledges to repeal the Affordable Care Act, or that the Trump administration declines to enforce the law.

Jones’ office – DOI is expected to begin reviewing proposed 2018 health insurance rates next week. They’ll be released to the public on July 17.

The insurance commissioner can ask for changes to the proposed rates, or pressure companies to lower them by declaring them “unreasonable.”

The rates are finalized in October before open enrollment begins Nov. 1.

4.14.2017 Covered CA analysis CBO predicting rate increases….

Covered CA advises insurance companies to file contingent set of rates CA Health Line 6.2.2017

Some States extending deadlines for Insurance Companies to submit 2018 rates, amid the uncertainty. CA must file this week. Modern Health Care 4.20.2017

San Francisco Chronicale 4.11.2017 status in limbo

CA Insurance Dept. opposes loss of cost sharing reductions – enhanced silver 4.13.2017

Washington Post 5.12.2016 * 12.22.2016 Enhanced Silver could end immediately! * Commonweatlh Fund Analysis 12.21.2016

38 Page Ruling with our Annotations, Links & Bookmarks

Find it on Pacer.Gov – Requires Log In

1.20.2017 Trump Executive Order

Budget Reconcilation S. Con Res 3 Section 3001

The 7.7.2016 edition of the New York Times summarizes the 7.2016 Joint Congressional Source of Funding on ACA -CSR – Enhanced Silver report that the Obama administration knowingly spent billions for Enhanced Silver, without proper allocations. See also, The Hill.com.

On the one hand, if the extra cost for enhanced silver isn’t subsidized, then the premium would be higher and so would the subsidy.

§156.410 Cost-sharing #reductions – Enhanced Silver

(a) General requirement. A QHP [Qualified Health Plan] issuer must ensure that an individual eligible for cost-sharing reductions, as demonstrated by assignment to a particular plan variation, pays only the cost sharing required of an eligible individual for the applicable covered service under the plan variation. The cost-sharing reduction for which an individual is eligible must be applied when the cost sharing is collected.

(b) Assignment to applicable plan variation. If an individual is determined to be eligible to enroll in a QHP in the individual market offered through an Exchange and elects to do so, the QHP issuer must assign the individual under enrollment and eligibility information submitted by the Exchange as follows—

(1) If the individual is determined eligible by the Exchange for cost-sharing reductions under §155.305(g)(2)(i), (ii), or (iii) of this subchapter (subject to the special rule for family policies set forth in §155.305(g)(3) of this subchapter) and chooses to enroll in a silver health plan, the QHP issuer must assign the individual to the silver plan variation of the selected silver health plan described in §156.420(a)(1), (2), or (3), respectively.

(4) If the individual is determined by the Exchange not to be eligible for cost-sharing reductions (including eligibility under the special rule for family policies set forth in §155.305(g)(3) of this subchapter), and chooses to enroll in a QHP, the QHP issuer must assign the individual to the selected QHP with no cost-sharing reductions. ECFR.Gov

See also our Enhanced Silver Page and FAQ on if you have to pay back Silver Enhanced Benefits if your income drops

Subpart E—Health Insurance Issuer Responsibilities With Respect to Advance Payments of the Premium Tax Credit and Cost-Sharing Reductions

§156.400 Definitions.

§156.410 Cost-sharing reductions for enrollees.

§156.420 Plan variations.

§156.425 Changes in eligibility for cost-sharing reductions.

§156.430 Payment for cost-sharing reductions.

§156.440 Plans eligible for advance payments of the premium tax credit and cost-sharing reductions.

§156.460 Reduction of enrollee’s share of premium to account for advance payments of the premium tax credit.

§156.470 Allocation of rates for advance payments of the premium tax credit.

§156.480 Oversight of the administration of the cost-sharing reductions and advance payments of the premium tax credit programs.

https://hbexstorage.blob.core.windows.net/regulations/PDFs/Covered%20California%20Comment%20Letter%20re%20CMS%20Marketplace%20Integrity%20and%20Affordability%20Proposed%20Rule%200.pdf

https://www.cms.gov/newsroom/fact-sheets/2025-marketplace-integrity-and-affordability-proposed-rule

The new state-enhanced cost-sharing program will strengthen these Silver CSR plans, increasing the value of Silver 73 plans to approximate the Gold level of coverage and increasing Silver 87 plans to approximate the Platinum level of coverage. Silver 94 plans already exceed Platinum-level coverage. About 40 percent of Covered California’s 1.6 million enrollees will be eligible for these cost-sharing reduction benefits.

Deductibles will be eliminated entirely in all three Silver CSR plans, removing a financial barrier to accessing health care and simplifying the process of shopping for a plan. Other benefits will vary by plan but will include a reduction in generic drug costs and copays for primary care, emergency care and specialist visits and a lowering of the maximum out-of-pocket cost.

https://www.coveredca.com/newsroom/news-releases/2023/07/20/covered-california-to-launch-state-enhanced-cost-sharing-reduction-program/