Educational Tax Credits

Student Loan Interest

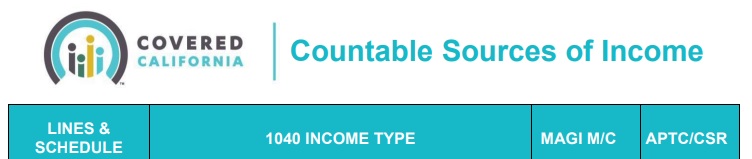

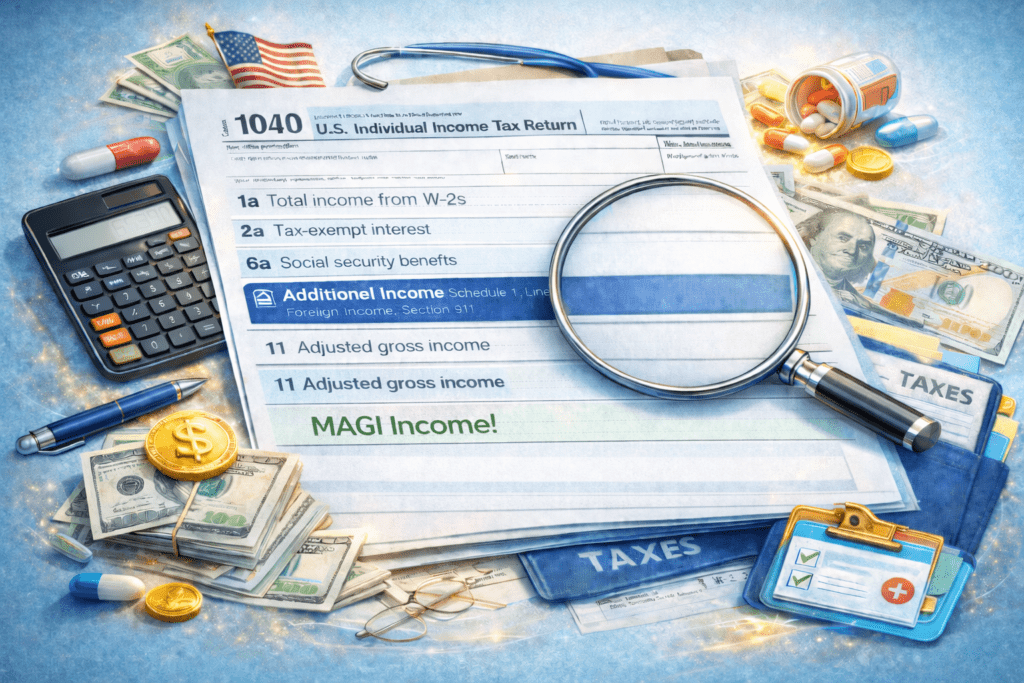

Covered CA MAGI Income

Publication 970

Covered CA (& Medi Cal) - Calculate - #Countable Sources of MAGI Income

Short Summary

You may be able to deduct interest you pay on a qualified student loan. Generally, the amount you may deduct is the lesser of $2,500 or the amount of interest you actually paid and it is subject to a phaseout, which means the amount of the deduction gradually decreases and phases out completely if and when your modified adjusted gross income (MAGI) amount reaches the annual limit.You claim this deduction as an adjustment to income so you do not need to itemize your deductions on Form 1040, Schedule A (PDF), Itemized Deductions.You can claim the deduction if all of the following apply:

- You paid interest on a qualified student loan in tax year 2014

- You are legally obligated to pay interest on a qualified student loan

- Your filing status is not married filing separately

- Your MAGI is less than a specified amount which is set annually, and

- You or your spouse, if filing jointly, cannot be claimed as dependents on someone else’s return

A qualified student loan is a loan you took out solely to pay qualified higher education expenses. See

Publication 970, Tax Benefits for Education, and the

Form 1040 Instructions (PDF) to determine if your expenses qualify.

If you file a Form 2555 (PDF), Foreign Earned Income, Form 2555-EZ (PDF), Foreign Earned Income Exclusion, or Form 4563 (PDF), Exclusion of Income for Bona Fide Residents of American Samoa, or if you exclude income from sources inside Puerto Rico, refer to Worksheet 4-1, Student Loan Interest

Deduction Worksheet in Publication 970, instead of the worksheet in the Form 1040 Instructions. If you paid $600 or more of interest on a qualified student loan during the year, you will receive a

Form 1098-E (PDF), Student Loan Interest Statement,

from the entity to which you paid the student loan interest.

For more information about the student loan interest deduction and how your MAGI affects the deduction amount, refer to Publication 970.

IRS Offers Tips for Teenage Taxpayers with Summer Jobs

Other pages in MAGI and FAQ Section

Introduction

The beginning of the school year is a good time for a reminder of the tax benefits for education. These benefits can help offset qualifying education costs.

Here is information about two tax credits available to those who pay higher education costs for themselves, a spouse or a dependent.

The American Opportunity Tax Credit (AOTC) is:

- Worth a maximum benefit up to $2,500 per eligible student.

- Only available for the first four years at an eligible educational or vocational school.

- For students pursuing a degree or other recognized education credential.

- Partially refundable. Eligible taxpayers can get up to $1,000 of the credit as a refund, even if they do not owe any tax.

The Lifetime Learning Credit (LLC) is:

- Worth up to $2,000 per tax return, per year, no matter how many students qualify.

- Available for all years of postsecondary education and for courses to acquire or improve job skills.

- Available for an unlimited number of tax years

Taxpayers should use Form 8863, Education Credits, to claim these education credits.

Additionally:

- A student is required to have Form 1098-T, Tuition Statement, to be eligible for an education benefit. They receive this form from the school attended.

- Taxpayers may use only qualified expenses paid to figure a tax credit. These include tuition and fees and other related expenses for an eligible student.

- Eligible educational schools are those that offer education beyond high school. This includes most colleges and universities.

- Taxpayers may only claim qualified expenses in the year paid.

- Taxpayers can’t claim either credit if someone else claims them as a dependent.

- Income limits could reduce the amount of credits.

- Taxpayers can’t claim either the AOTC or LLC for the same student or for the same expense in the same year.

- The Interactive Tax Assistant tool on IRS.gov can help determine eligibility for certain educational credits including the American Opportunity Credit and the Lifetime Learning Credit.

See IRS Publication 970, Tax Benefits for Education, for details, rules, examples and a complete explanation of benefits.

Avoid scams. The IRS does not initiate contact using social media or text message. The first contact normally comes in the mail. Those wondering if they owe money to the IRS can view their tax account information on IRS.gov to find out.

Additional IRS Resources:

- Education Credits – AOTC and LLC

- American Opportunity Tax Credit: Questions and Answers

- Interactive Tax Assistant, Am I Eligible to Claim an Education Credit?

- Tax Topic 310, Coverdell Education Savings Accounts

Share this tip on social media — #IRSTaxTip: Learn about Tax Benefits for Education. https://go.usa.gov/xRAHe

WASHINGTON ― With back-to-school season in full swing, the Internal Revenue Service reminds parents and students about tax benefits that can help with the expense of higher education.

Two college tax credits apply to students enrolled in an eligible college, university or vocational school. Eligible students include the taxpayer, their spouse and dependents.

American Opportunity Tax Credit

The American Opportunity Tax Credit, (AOTC) can be worth a maximum annual benefit of $2,500 per eligible student. The credit is only available for the first four years at an eligible college or vocational school for students pursuing a degree or another recognized education credential. Taxpayers can claim the AOTC for a student enrolled in the first three months of 2018 as long as they paid qualified expenses in 2017.

Lifetime Learning Credit

The Lifetime Learning Credit, (LLC) can have a maximum benefit of up to $2,000 per tax return for both graduate and undergraduate students. Unlike the AOTC, the limit on the LLC applies to each tax return rather than to each student. The course of study must be either part of a post-secondary degree program or taken by the student to maintain or improve job skills. The credit is available for an unlimited number of tax years.

To claim the AOTC or LLC, use Form 8863, Education Credits (American Opportunity and Lifetime Learning Credits). Additionally, if claiming the AOTC, the law requires taxpayers to include the school’s Employer Identification Number on this form.

Form 1098-T, Tuition Statement, is required to be eligible for an education benefit. Students receive this form from the school they attended. There are exceptions for some students.

Other education benefits

Other education-related tax benefits that may help parents and students are:

- Student loan interest deduction of up to $2,500 per year.

- Scholarship and fellowship grants. Generally, these are tax-free if used to pay for tuition, required enrollment fees, books and other course materials, but taxable if used for room, board, research, travel or other expenses.

- Savings bonds used to pay for college. Though income limits apply, interest is usually tax-free if bonds were purchased after 1989 by a taxpayer who, at time of purchase, was at least 24 years of age.

- Qualified tuition programs, also called 529 plans, are used by many families to prepay or save for a child’s college education. Contributions to a 529 plan are not deductible, but earnings are not subject to federal tax when used for the qualified education expenses.

To help determine eligibility for these benefits, taxpayers should use tools on the Education Credits Web page and IRS Interactive Tax Assistant tool on IRS.gov.

Keep A Copy of Tax Returns

Taxpayers should keep a copy of their tax return for at least three years. Copies of tax returns may be needed for many reasons. If applying for college financial aid, a tax transcript may be all that is needed. A tax transcript summarizes return information and includes adjusted gross income. Get one from the IRS for free.

The quickest way to get a copy of a tax transcript is to use the Get Transcript application. After verifying identity, taxpayers can view and print their transcript immediately online. The online application includes a robust identity verification process. Those who can’t pass the verification must request the transcript be mailed. This takes five to 10 days, so plan ahead and request the transcript early.

Additional IRS Resources:

Tax Benefits Education Publication 970

Related Webpages

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health, Dental & Vision Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

Dental For #Everyone,

has an excellent website with full brochures, Instant online quoting and enrollment

- Dental for Everyone includes quotes from

- Careington Discount Plan

- Bright Benefits

- Renaissance Dental

- Delta Dental

- AmFirst

- One of our colleagues on how Dental for Everyone Works.

- Some of our webpages on dental

- VSP Vision

Calculate your Covered CA MAGI Income

Take #Line8b 11 or your projected IRS 1040 Adjusted Gross income for the upcoming year then

add line 2a, 6a & 8 (Foreign Income)

Chat GBT isn't showing the numbers quite right, but you get the idea.

-

-

IMPORTANT!!!

The upcoming year - the future for what you tell Covered CA!

Sure, many people think it’s the past as Covered CA may ask for last years paperwork, but that’s BS! You might have to give back all the subsidies when you file Subsidy Reconciliation form #8962!

- Visit our MAIN webpage on MAGI Income

-