Individual Mandate – Shared Responsibility Penalty ISR

for not having Health Insurance in California!

Try turning your phone sideways to see the graphs & pdf's?

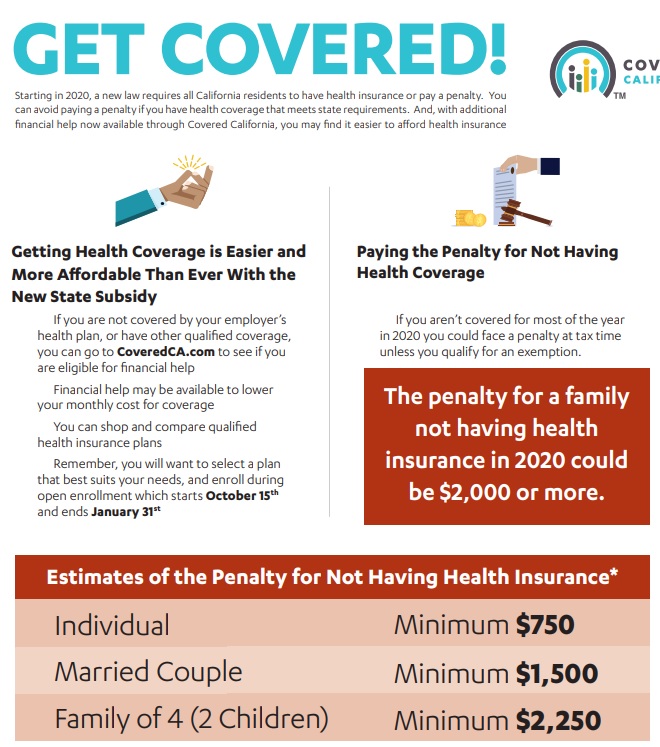

Covered California Mandate Tax Penalty

Fact Sheet

Note Covered CA simply controls the Market. These penalties are for EVERYONE!!!

Even if you are not getting Covered CA Tax Subsidies!

Tax Penalty

The penalty for not having qualifying health insurance has increased. As a reminder, there are two methods of calculating the penalty, and a household will pay whichever calculation yields the larger penalty:

- FTB Tax Penalty Calculator

- A flat amount based on the number of people in the household – $800 per adult 18 years or older and $400 per dependent child for no coverage for an entire year; up to an annual max of $2,400.

- A percentage of the household income – 2.5% of all gross household income over the tax filing threshold. (b) (1) Code

- Covered California Individual Mandate and Penalty Quick Guide Covered CA 10/2025

- Tools to estimate income for next year.

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Jump to section on:

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Penalty – Exemptions

California Mandate Penalty

#Franchise Tax Board Information FTB Website

FTB Table of Contents

- Insure Me Kevin.com Overview

- CA Healthline Explanation 12.11.2019

- Covered CA Summary

- Word & Brown – Wholesaler Summary * *

- Kaiser Foundation Mandate Calculator

(Doesn’t account for filing threshold – so subtract that when putting in income) - The 5th U.S. Circuit Court of Appeals in New Orleans ruled that the individual mandate is not constitutional because it cannot be construed as a tax. The case goes back to U.S. District Judge Reed O’Connor in Texas to determine whether the rest of the law can be saved. Modern Health Care 12.19.2019 *

California Mandate Penalty #Exemptions

Exemptions Claimed on #State Tax Return

Forms * Form 3853 Exemptions & Penalty * Instructions FTB 3853

- Income is below the tax filing threshold

- VITA Free Tax Assistance

- IRS Do I need to File a Return Tool

- HR Block Listings

- Health coverage is considered unaffordable Tool to calculate affordability

- Families’ self-only coverage combined cost is unaffordable

- Short coverage gap of 3 consecutive months or less

- Certain non-citizens who are not lawfully present

- Certain citizens living abroad/residents of another state or U.S. territory

- Members of health care sharing ministry

- Members of federally-recognized Indian tribes including Alaskan Natives

- Incarceration (other than incarceration pending the disposition of charges)

- Enrolled in limited or restricted-scope [Share of Cost?] Medi-Cal or other coverage from the California department of Health Care Services FTB.Gov *

Exemptions Processed by Covered California

- Religious conscience exemption

- Affordability hardship

- General hardships

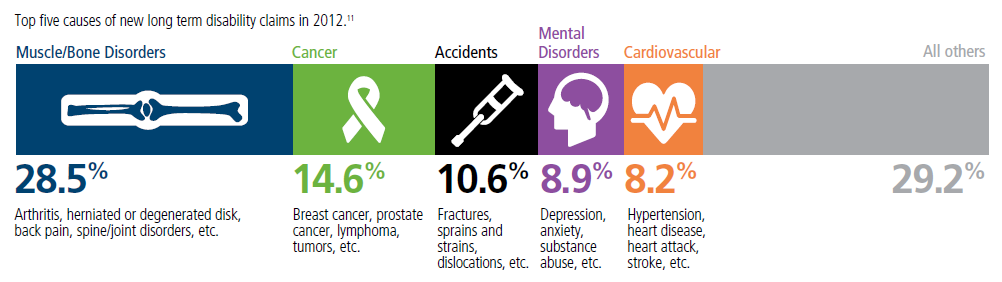

Top 5 - 10 causes of Long Term Disability Claims

Lower back disorders ♦ Depression ♦ Coronary heart disease, arthritis and pulmonary diseases (Met Life) ♦ Disability Can Happen ♦ CDC Statistics

Our webpage on Disability Payments - Insurance

Get Disability Quotes for Parents, Caretakers & Wage Earners

Tax Cuts & Jobs Act

Federal Mandate penalty drops to Zero

The New Tax Bill HR 1 Tax Cuts & Jobs act drops the mandate penalty to zero, but many would argue the mandate is still valid. Congress could put a financial tax penalty back in, see Texas v USA – CA brief page # 34.

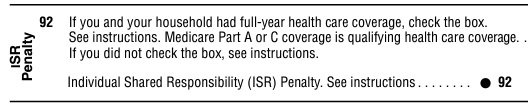

PART VIII—INDIVIDUAL MANDATE

SEC.11081. ELIMINATION OF SHARED RESPONSIBILITY PAYMENT FOR INDIVIDUALS FAILING TO MAINTAIN MINIMUM ESSENTIAL COVERAGE.

(a) In General.—Section 5000A(c) is amended—

(1) in paragraph (2)(B)(iii), by striking “2.5 percent” and inserting “Zero percent”, and

(2) in paragraph (3)—

(A) by striking “$695” in subparagraph (A) and inserting “$0”, and

(B) by striking subparagraph (D).

(b) Effective Date.—The amendments made by this section shall apply to months beginning after December 31, 2018.

Obama Care imposes a Individual Mandate – Tax Penalty of 2.5% of income (calculate it) on just about ALL legal residents, if you don’t Purchase Health Insurance. Your coverage must include the 10 Essential Minimum Benefits and meet the definition of Minimum Essential Coverage (MEC), unless you qualify for an exemption, (§5000 A). Just check off on line 61 of your 1040 that you complied. You will also get a 1095 from your Insurance Company.

The Health Care Law provides for subsidies and tax Credits to help you pay the premium. We can help you with that at no additional charge. Complementary quotes for compliant guaranteed issue plans.

You might also talk to your Employer about providing Coverage. Tell him he can get a FREE Quote and it’s tax deductible for him and tax free to you §106 IRC.

CA fights Trumps attacks on ACA/Obamacare LA Times 8.15.2019 *

Resources & Links

- Los Angeles Times 1.10.2015 Explanation

- Health Net Brochure Individual Mandate & Subsidies

- CA Health Line 1.29.2015 6 M households could face penalties

What is Minimum #Essential Coverage (MEC)?

26 USC §5000 A

(a) Requirement to #maintain minimum essential coverage

While there may no longer be a Federal Penalty for not having health insurance, we are showing you this page, as we expect California’s mandate to have the same rules.

The individual shared responsibility provision aka mandate requires you and each member of your family to have basic health coverage – also known as

Minimum Essential Coverage –(Bronze Plan) “§5000 A (f) (1) pdf Cornel HTML * Publication 974 *

or qualify for a health coverage exemption, or make an individual shared responsibility payment mandate for months without coverage or an exemption when you file your federal income tax return.

Many people already have minimum essential coverage and do not need to do anything more than maintain that coverage and report their coverage when they file their tax returns. Most taxpayers will simply check a box to indicate that each member of their family had qualifying health coverage for the whole year.

See also,

- minimum [Mandated] essential benefits

- Minimum Value Notice 2012-31

- 36B c 2 c ii (60% rule)

- Metal Levels (Bronze)

- coveredca.com/documents-to-confirm-eligibility/minimum-essential-coverage/

Subscribe to IRS Tax Tips to get easy-to-read tips via e-mail from the IRS.

(5) Insurance-related terms

Any term used in this section which is also used in title I of the Patient Protection and Affordable Care Act shall have the same meaning as when used in such title.

Resources & Links

- Center on Budget & Policy Priorities

- IRS Website on MEC

- Request for your Social Security # so that the Insurance Company can report proof of Insurance to the IRS Form # 1095 A Covered CA B All other Insurance Companies or C Large Employers

- IRS Chart of Minimum Essential Coverage

- Publication 974 Premium Tax Credit

Code of Federal Regulations

Subpart G—Minimum Essential Coverage

§156.600 The definition of minimum essential coverage. §5000 A (f)

§156.602 Other coverage that qualifies as minimum essential coverage.

§156.604 Requirements for recognition as minimum essential coverage for types of coverage not otherwise designated minimum essential coverage in the statute or this subpart.

-

42 U.S. Code § 18021 –#Qualified health plan defined

More Detailed (Child) Pages on Individual & Employer Mandate

Great question — and this is exactly the right way to think about insurance: **What’s the real risk?**

I’ll give you a practical, real-world answer based on population data for U.S. women in their late 50s and 60s.

—

## Short Answer

For a healthy 58-year-old woman:

* **Chance of having $10,000+ in medical expenses in any single year:**

👉 Roughly **10%–20% per year**

* **Chance of having at least one $10,000+ year over the next 10 years:**

👉 Approximately **60%–85% cumulative probability**

That’s much higher than most people expect.

—

## Why the Risk Is That High

Medical spending isn’t linear — it’s **lumpy**.

You may have:

* 5–7 very low-cost years

* 1 year with surgery, cancer, hospitalization, or cardiac issue

* 1 year with unexpected diagnostic workups

It only takes **one event** to cross $10,000.

—

## What Typically Pushes Someone Over $10,000?

Here are common triggers for women age 58–68:

### 1. Cancer Diagnosis

* Breast cancer treatment can easily exceed $50,000–$150,000

* Even with early detection, surgery + radiation often exceeds $10,000

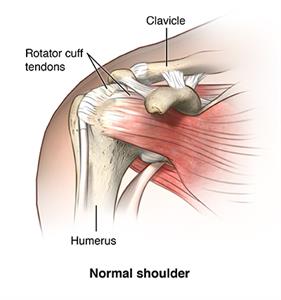

### 2. Orthopedic Surgery

* Knee replacement: $30,000+

* Hip replacement: $35,000+

* Even arthroscopic repairs can hit $10,000

### 3. Cardiac Events

* ER visit + stress test + angiogram = $10,000+

* Stent placement: $25,000+

### 4. Gallbladder or Appendectomy

* Very common in this age group

* Hospital + surgery = $15,000–$40,000

### 5. Auto Accident

* Even minor trauma with imaging + ER visit can hit $10,000 quickly

—

## Statistical Perspective

Healthcare cost studies consistently show:

* The **top 10% of patients account for ~70% of costs**

* By your 60s, the chance of landing in that top 10% at least once increases significantly

* Average annual spending for women 55–64 is already around $7,000–$9,000 — and averages hide spikes

You’re not buying insurance for the average year.

You’re buying it for the **spike year**.

—

## A Simple Way to Think About It

If your risk is roughly 15% per year, over 10 years:

The chance you *avoid* a big year every year =

0.85 × 0.85 × 0.85 × … (10 times)

That equals about **20%–40%**

Meaning there’s a **60%–80% chance you’ll have at least one big year**.

—

## The Bigger Question

The real issue isn’t:

> “Will I spend $10,000?”

It’s:

> “If I do, can I comfortably write that check without stress?”

If yes → high deductible strategy may make sense.

If no → insurance is protecting liquidity and assets, not routine care.

—

If you’d like, I can:

* Compare that risk to a $900/month premium scenario

* Run a break-even analysis

* Show you catastrophic-only strategy math

* Or look at what self-insuring actually requires in reserves

Just tell me which direction you want to explore.

Totally fair question — and honestly, a lot of people your age who are healthy are asking the *exact* same thing right now. You’re not missing something obvious; the system just isn’t built for people who rarely use care.

Let me break it down cleanly and without the marketing fluff.

—

## Why would someone like you even use Covered California?

### The **only real reasons** are:

1. **Subsidies (APTC)**

If you qualified for subsidies, Covered California would usually make sense.

You don’t anymore — so this benefit is gone.

2. **Guaranteed issue & protections**

* No medical underwriting

* No exclusions for pre-existing conditions

* Caps on out-of-pocket costs

These matter *only if* something big and unexpected happens.

3. **Future-proofing**

If your income drops mid-year, Covered California can **restart subsidies immediately**.

Off-exchange plans cannot retroactively give you APTC.

That’s it. If none of those matter to you right now, Covered California loses most of its value.

—

## “I’m healthy, I use Teladoc once or twice a year — why pay $900/month?”

From a **pure cash-flow perspective**, it doesn’t make sense.

At 58, you’re paying for:

* Age-rated premiums (steep jump after 55)

* ACA-required benefits you don’t use (maternity, mental health parity, etc.)

* Risk pooling (you’re subsidizing sicker members)

If you’re spending:

* $0–$300/year on actual care

and

* $10,000+ per year on premiums

That’s not insurance — that’s prepaying for something you don’t consume.

—

## The silver plan issue — yes, it’s infuriating, and here’s why it happens

> **“How dare they charge more in Covered California than direct?”**

You’re not imagining it. This is real, and it’s called **Silver Loading**.

### What’s going on:

* Insurance companies must offer **extra cost-sharing reductions (CSR)** to lower-income silver plan members

* The federal government stopped reimbursing insurers for those CSRs

* Insurers recoup the cost by **loading it onto silver plans sold through Covered California**

So:

* **On-exchange Silver = more expensive**

* **Off-exchange Silver = cheaper**

* **Gold plans can sometimes be cheaper than Silver on-exchange**

It’s backwards. And yes, it feels like punishment for buying the “official” way.

This pricing strategy is used by carriers like:

* Blue Shield of California

* Kaiser Permanente

* Health Net

Covered California allows it. They don’t control base premiums — insurers do.

—

## So what *actually* makes sense for someone like you?

Here are the **rational options**, not the brochure answers:

### 1. Off-exchange ACA plan (same coverage, lower price)

* Same doctors, same benefits

* No silver loading penalty

* No subsidies, but you already lost those anyway

### 2. Bronze or catastrophic-style strategy

* You’re insuring against a *disaster*, not routine care

* Pair it with Teladoc + cash-pay urgent care

* Accept higher deductible intentionally

### 3. Self-insure + plan for worst-case risk

Some healthy, high-income 50-somethings do this:

* Pay cash for routine care

* Keep a large emergency fund

* Understand the risk if something catastrophic happens

Not for everyone — but financially coherent.

### 4. Short-term or alternative coverage (California = very limited)

California heavily restricts this, so options here are slim — but worth understanding the limits before dismissing it.

—

## The uncomfortable truth

Covered California is **not designed** for:

* Healthy

* High-income

* Low-utilization

* Pre-Medicare adults in their late 50s

It’s designed for:

* Subsidized buyers

* Chronic conditions

* People who need predictable care

If you don’t fit that profile, you’re paying a premium to support the system — not because it’s the best deal for *you*.

—

If you want, I can:

* Compare **on-exchange vs off-exchange pricing** side-by-side for your age

* Show when it *does* make sense to switch back to Covered California

* Help you think through a **“bridge to Medicare at 65”** strategy so you don’t overpay for the next 7 years

You’re asking the right questions — most people don’t.

https://www.healthinsurance.org/faqs/which-states-offer-their-own-health-insurance-subsidies/