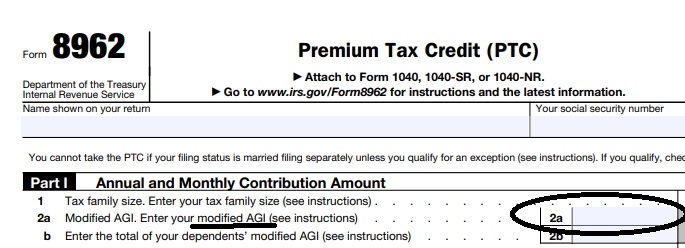

Federal IRS #Form8962 Reconciliation Form for Covered CA Subsidies

attaches to IRS 1040 it all comes out when you file taxes!

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- See below or visit our 8962 Webpage for more information

- MAGI AGI Income, what is it our webpage?

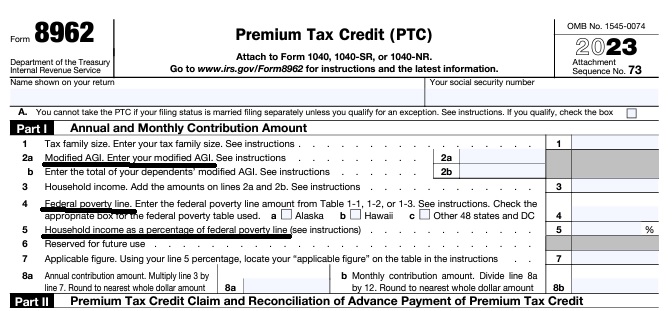

IRS Premium Tax Credit Form #8962 & FTB 3849

is used to reconcile the APTC Advance Premium Tax Credit

subsidy with your IRS # 1040.

More information & Instructions on 8962 Subsidy reconciliation

-

- Instructions for IRS Form #8962 Subsidy Reconciliation

- Tracking Your Covered California Subsidy on your 1040 Federal Tax Return Insure Me Kevin.com

- ARPA & Inflation Reduction Act of 2022

- Instead of increasing taxpayer audits, policymakers should simplify taxes across the board. That way, it would be easier for everyone to pay the correct amount to the government. heritage.org/who-those-87000-new-irs-agents-would-audit

- That 87,000 new tax agents estimate represents everything from IT techs to customer service people who answer the phone and help you file your return. Second, it includes attrition. So, the actual enforcement personnel is 5,000 LA Times * Mother Jones

- IRS backlog hits nearly 24 million returns, further imperiling the 2022 tax filing season

- ARPA Stimulus – you don’t have to pay back 2020 overage on subsidies IRS.Gov *

- InsureMeKevin.com on subsidies & pay backs… 1.25.2022 update ARPA and 600% CA

- 1040 Instructions

- Overview FTB site

- How to Reconcile Subsidies FTB

- Calculate Pay Back

- Assistance Repaying California Subsidies

- covered ca.com/the most you might have to pay back

- 2022 Insure Me Kevin.com

- Our webpage on Form 8962 – Premium Tax Credit Subsidy Reconciliation

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Covered CA Certified Insurance Agent

Get Covered CA quotes and Direct Quotes too

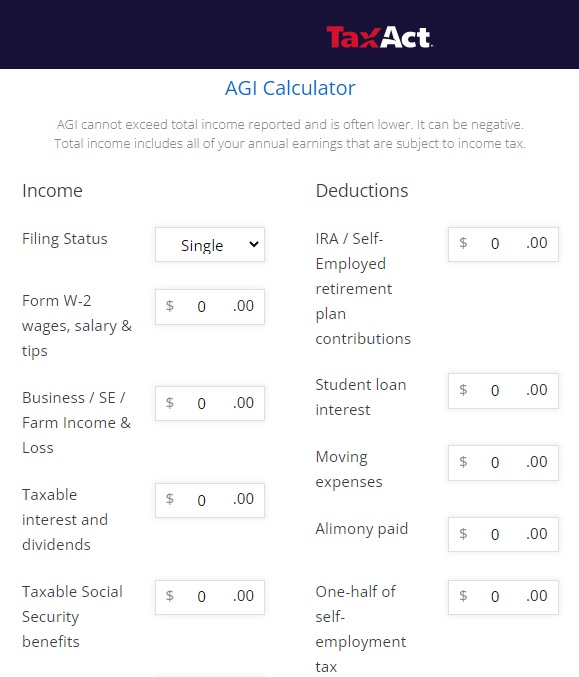

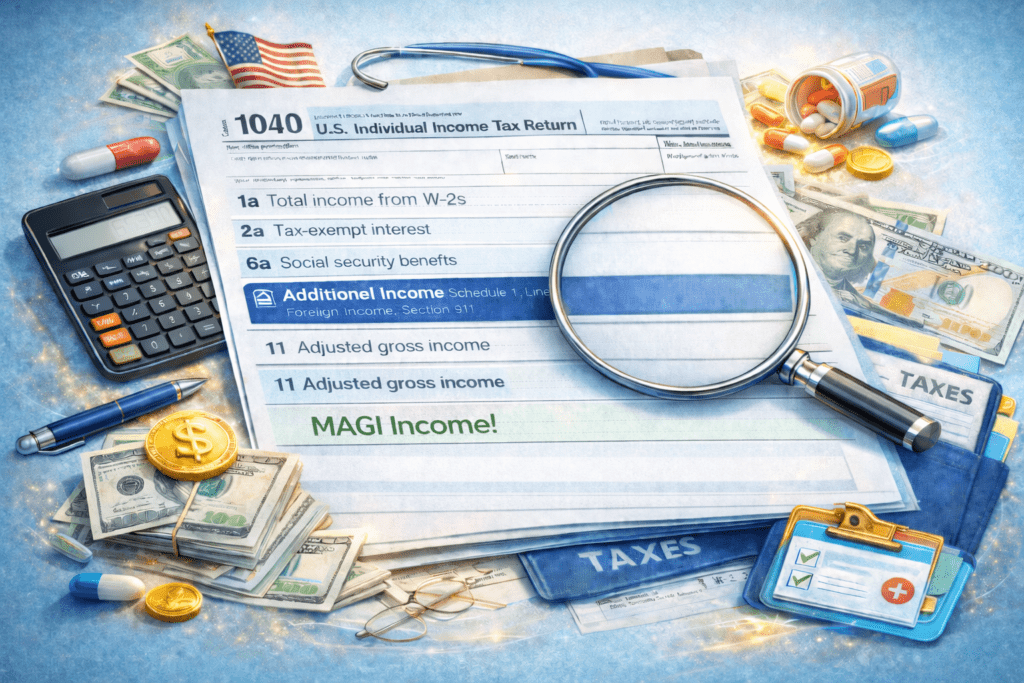

How to #Estimate MAGI Income for Covered CA?

Covered CA bases your subsidies on what you expect your household income will be for the upcoming coverage year, not last year’s income. When you calculate your income, you’ll need to include the incomes of you, your spouse, and anyone you claim as a dependent when you file taxes.

You can start by using your adjusted gross income (AGI) from your most recent federal income tax return, located on line 11 on the Form 1040.

taxact.com/adjusted-gross-income-calculator

- From the AGI above, Add back in any foreign income, Social Security benefits and interest that are tax-exempt. Then, add or subtract any income changes you expect in the next year.

- Health Care. Gov on estimating income

- Scroll down for more information on estimating income.

- Our main webpage on estimating Income

Calculate your Covered CA MAGI Income

Take #Line8b 11 or your projected IRS 1040 Adjusted Gross income for the upcoming year then

add line 2a, 6a & 8 (Foreign Income)

Chat GBT isn't showing the numbers quite right, but you get the idea.

-

-

IMPORTANT!!!

The upcoming year - the future for what you tell Covered CA!

Sure, many people think it’s the past as Covered CA may ask for last years paperwork, but that’s BS! You might have to give back all the subsidies when you file Subsidy Reconciliation form #8962!

- Visit our MAIN webpage on MAGI Income

-

Schedule 2 1040 Additional Taxes

- Part I Tax

- Part II Other Taxes

- 4 Self-employment tax. Attach Schedule SE

- 5 Social security and Medicare tax on unreported tip income. Attach Form 4137

- 17 Other additional taxes:

More Instructions

- Covered CA Video on tax forms

- See form 2210 Underpayment of tax and the instructions for more details.

- Form # 8962 Instructions HTML * pdf *

- but first you need the Proof of Coverage Form 1095 A from Covered CA

- and B if applicable – like if you had Covered CA part of the year and other coverage the rest of the year, from an Insurance Company, Government – Like Medicare or Medi-Cal or your Employer.

- When you are done completing # 8962, enter the calculation on line 46 and/or 69 of 1040 form.

- Schedule 1 Additional Income & Adjustments to Income

- Do you think this process is complicated?

- See what my CPA thinks.

- Colleagues explanation of how to reconcile

- I got a new job.. why aren’t I getting subsides anymore?

How to report changes

12c Letter

What to Do if You Get a 12c #Letter about the Premium Tax Credit

or your missing form 8962?

#Report changes as they happen - within 30 days! 10 CCR California Code of Regulations § 6496 10 days for Medi Cal 22 CCR § 50185

Instant Quotes & Subsidy Calculation Email Us [email protected]

IRS Form 5152 - Report Changes

- Our Steve's - VIDEO on how to report changes to Covered CA

- Steve's Video on MAGI Income

- Covered CA Video on how to report changes

- Visit our webpage on how to report changes

Tax Return Deadline

CFR 155.305 (f) (4)

Eligibility Standards

Compliance with filing requirement.

(i) Covered CA may not determine a tax filer eligible for advance payments of the premium tax credit if HHS notifies the Exchange as part of the process described in § 155.320(c)(3) that advance payments of the premium tax credit were made on behalf of the tax filer or either spouse if the tax filer is a married couple for a year for which tax data would be utilized for verification of household income and family size in accordance with § 155.320(c)(1)(i), and the tax filer or his or her spouse did not comply with the requirement to file an income tax return for that year as required by 26 U.S.C. 6011, 6012, and implementing regulations and reconcile the advance payments of the premium tax credit for that period.

(ii) Notwithstanding the requirement in paragraph (f)(4)(i) of this section, the Exchange may not deny eligibility for advance payments of the premium tax credit under paragraph (f)(4)(i) of this section unless direct notification is first sent to the tax filer, consistent with thestandards set forth in § 155.230, that his or her eligibility will be discontinued as a result of the tax filer‘s failure to comply with the requirement specified under paragraph (f)(4)(i) of this section.

FAQ’s

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

Tax #Estimators

- turbo tax.com - FREE for simple returns

- H & R Block

- E file.com

- Estimate the Subsidy for Health Insurance, benefits, premiums, etc.

- 8962 ONLINE Calculator

- Our webpage on 8962 Premium Tax Credit Reconciliation

- Tax Form Calculator.com

- e tax.com

- Marriage Higher or Lower Taxes?

ACA What You Need To Know #5187 (2020) is the most recent

- VITA - Volunteers to help you

- Publication 17 - Your Federal Income tax

- Health Savings Accounts HSA our webpage

Eligibility for other health coverage MEC Minimum Essential Coverage, makes you #ineligible for subsidies

FAQ’s

- I have coverage with “Medi Cal?” as I’m taking care of my Mom under In Home Supportive Services IHSS. Can I keep my Covered CA subsidies APTC?

- It’s my understanding [I’m not a CPA or Attorney] that if one has coverage or is eligible for coverage with MEC Minimum Essential Coverage, then they wouldn’t qualify for subsidies. You are mandated to report MEC to Covered CA.

- Here’s a VIDEO to explain all the reasoning.

- It’s a stretch, maybe you could argue that LA Care is NOT MEC, based on the huge fine they just got! See LA Times article.

- It’s my understanding [I’m not a CPA or Attorney] that if one has coverage or is eligible for coverage with MEC Minimum Essential Coverage, then they wouldn’t qualify for subsidies. You are mandated to report MEC to Covered CA.

- What is Minimum Essential Coverage (MEC)?

-

- For more information on what is MEC, see our webpage or irs.gov/Individual-Shared-Responsibility-Provision

- Your MEC may be reported to you on Form 1095-A, Form 1095-B, or Form 1095-C.

-

FAQ’s

How to Get an #exemption for Illness?

Here’s ways and reasons you might get penalties waived

- Read more USA Today

- Read more

- More specific information – citation for Covered CA?

- See the rules above on duty to Report Changes within 30 days

- If your MAGI is below 400% of the federal poverty level, there is a cap on the amount you must pay back, even if you received more in assistance than the amount of the cap. However, at higher income levels you’ll have to pay back the entire amount you received, which could be a lot. 8962 Instructions – Payback limitations

- you have until the due date of your return (April 15 plus extensions) to make a traditional IRA contribution and deduct the amount from your taxes. Likewise for contributions to a 401(k), SEP-IRA, SIMPLE Plan, or other tax qualified retirement plan for the self-employed. You also have until the due date of your return to make a contribution to a health savings account. Moreover, you have until the due date of your return to establish a traditional IRA or SEP-IRA account if you don’t already have it. Read more IRS Publication 590A * Nolo – what to do if you owe subsidy repayments?

-

CA Couple must pay back $13k in Advance Subsidies

- Quicken – Intuit.