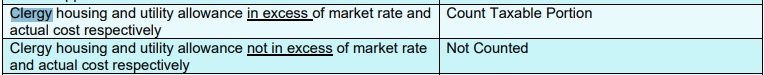

Does Clergy Parsonage – Housing Allowance for Pastors count for

Covered CA & Medi-Cal MAGI Modified Adjusted Gross Income?

Parsonage – Housing Allowance for Clergy, Pastors, #Priests, Rabbi’s, Iman’s

- A minister – pastor ordained, licensed or commissioned who receives a housing allowance may exclude the allowance from gross income to the extent it is used to pay expenses in providing a home. Generally, those expenses include

- rent,

- mortgage interest,

- utilities, repairs, and

- other expenses directly relating to providing a home.

- The amount excluded cannot be more than the reasonable compensation for the pastor – minister’s services.

- If you own your home, you may still claim deductions for mortgage interest and real property taxes. If your housing allowance exceeds the lesser of your reasonable compensation, the fair rental value of the home, or your actual expenses, you must include the amount of the excess in income.

- The minister’s employing organization must officially designate the allowance as a housing allowance before paying it to the minister.

- Thus, parsonage does NOT appear (check with your own CPA or Tax Attorney) to count toward MAGI, subsidies – advance premium tax or Medi-Cal Qualification.

- Learn More IRS Tax Topic 417

- Thus, parsonage does NOT appear (check with your own CPA or Tax Attorney) to count toward MAGI, subsidies – advance premium tax or Medi-Cal Qualification.

- Housing Allowance for Pastors Clergy Video

- irs.gov/Earnings for Clergy Housing Allowance /tc417

- irs.gov/ministers-compensation-housing-allowance

- How to fill out a Minister’s W-2 Form

- ONLINE Worksheet

- Ready-to-use resolution language for church board to set a clergy housing allowance

- Church Law Sample

- church law and tax.com/designating-a-housing-allowance

- HOW MUCH HOUSING ALLOWANCE CAN A PASTOR CLAIM?

FAQ

- Question I am a pastor who is looking to get health insurance for Covered California. Do I have to include my housing allowance as part of my gross income? Do you know anything about applying for Covered California and using the salary only portion of clergy compensation (excluding housing allowance) to qualify for financial assistance for health care?

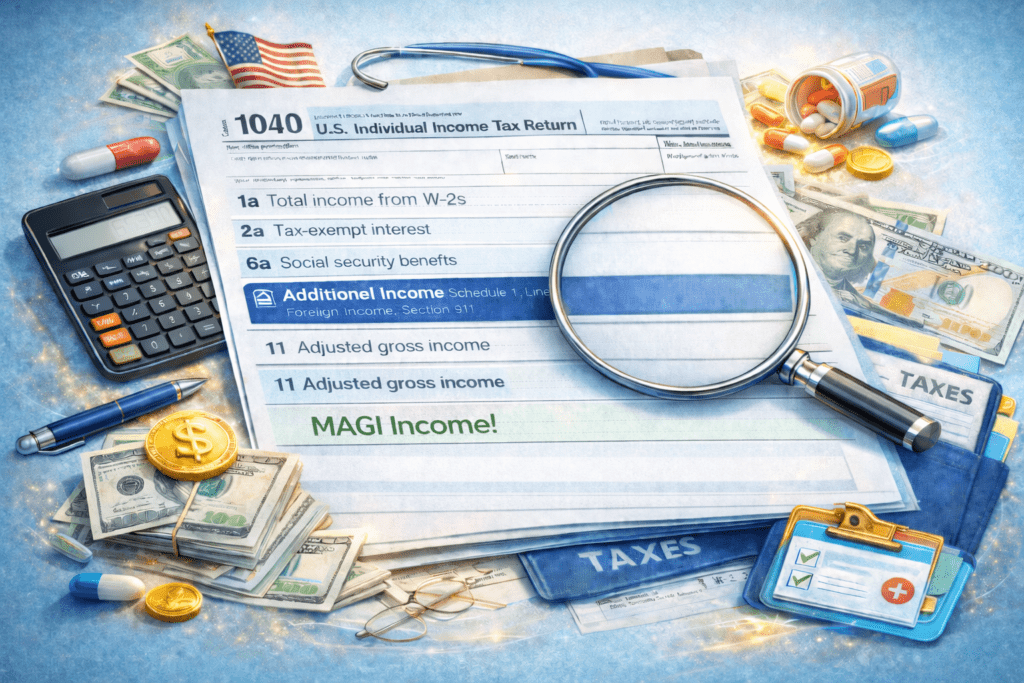

. - Answer What do you expect to show on line 11 adjusted gross income of your 1040 form? MAGI Income.

- Brokers nor Covered CA can give tax advice. However, just follow the rules above and you should be able to exclude your housing allowance.

- Click here for instructions to appoint us as your agent so that we can get compensated for helping you. No extra charge

.

- Click here for instructions to appoint us as your agent so that we can get compensated for helping you. No extra charge

- Brokers nor Covered CA can give tax advice. However, just follow the rules above and you should be able to exclude your housing allowance.

- I’m a minister and receive a salary plus a housing allowance. Is the housing allowance considered income and where do I report it?

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Chat GBT Summary

Yes — there is a specific IRS tax form related to clergy housing, but not for the housing exclusion itself. Here’s how it works:

✅ 1. Housing Exclusion on Your Tax Return

There is no separate IRS form that you file just to claim the clergy housing exclusion on your individual tax return.

- The exclusion is taken on Form 1040 by reducing your taxable income by the amount of the housing allowance that was properly designated by your employer.

- You report your total income on Form 1040, and the housing allowance is generally excluded from gross income on that form, so long as it was properly designated and used for qualifying housing costs.

- There’s no special schedule or line item name titled “housing exclusion”; rather, you reduce your income accordingly when you complete Form 1040.

- Employer-designated housing allowance is excluded from box 1 wages if your employer reported it correctly, but you still attach a statement to your return outlining the amount excluded, how it was designated, and how it was spent. No official IRS form number exists for that statement itself.

In short:

➡ No IRS form number exists that you file solely for claiming the housing allowance exclusion on Form 1040.

✅ 2. If You Want the Self-Employment Tax Exemption

If you want exemption from self-employment tax on your ministerial income (including housing allowance), you must file a separate IRS form:

- IRS Form 4361, “Application for Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders, and Christian Science Practitioners.”

Filing Form 4361 is voluntary and is required only if you want to elect exemption from SE tax on your ministerial income. This is not the same as the income tax exclusion itself — it’s specifically for self-employment tax.

Summary

| Tax Result | IRS Form Needed? | Form Number |

|---|---|---|

| Clergy housing allowance income tax exclusion | No specific form; report on Form 1040 with required statement | N/A (reported on Form 1040) |

| Clergy exemption from self-employment tax | Yes | Form 4361 |

References

This treatment is based on IRS guidance on clergy income and housing allowance rules, including reporting on Form 1040 and the use of Form 4361 for self-employment tax exemption.

If you want, I can walk through exactly how to enter this on your Form 1040 based on sample numbers (with line references).

Great — I’ll walk you through this step-by-step using clean numbers and current form structure so you can see exactly how it flows through the return.

I’ll assume:

- W-2 minister (most common situation)

- Housing allowance properly designated in advance

- You did not file Form 4361 (so you still pay SE tax)

Example Scenario

- W-2 Salary (cash compensation): $50,000

- Housing allowance designated by church: $20,000

- Actual housing expenses: $18,000

- Fair rental value (including utilities & furnishings): $19,000

Step 1: Determine the Excludable Amount

You may exclude the lowest of:

- Amount designated by church → $20,000

- Actual housing expenses → $18,000

- Fair rental value → $19,000

✅ Excludable housing allowance = $18,000

The excess $2,000 ($20k designated – $18k actual) becomes taxable income.

How It Shows Up on the Tax Return

Step 2: Look at the W-2

Most churches:

- Report $50,000 in Box 1 (taxable wages)

- Do NOT include the housing allowance in Box 1

- May list housing allowance in Box 14 (informational only)

If reported correctly, you don’t “subtract” anything on the 1040 — the exclusion already happened at the payroll level.

Step 3: Form 1040 Income Section

On Form 1040 Line 1a (Wages)

You enter the W-2 Box 1 amount.

In this example:

Line 1a = $50,000

If the church mistakenly included the housing allowance in Box 1, then you would:

- Include full amount

- Subtract the excludable housing allowance on Schedule 1 Part II (Adjustments to Income)

labeled:“Clergy housing allowance exclusion”

But properly prepared W-2s avoid that extra step.

⚠️ Important: Self-Employment Tax

Even though the housing allowance is excluded from income tax, it is included for SE tax unless you filed Form 4361.

So for SE tax:

Compensation subject to SE tax =

- $50,000 salary

-

- $18,000 housing allowance

= $68,000

You compute SE tax on:

Schedule SE

- $68,000 × 92.35%

- Apply 15.3% SE tax rate

- That result flows to:

- Schedule 2 Line 4

- Then to Form 1040 Line 23

- Half of SE tax is deducted on:

- Schedule 1 Line 15

- Flows to Form 1040 Line 10

What You Attach to the Return

You attach a written statement (not an IRS form) that includes:

- Amount designated by church

- Amount actually spent

- Fair rental value

- Amount excluded

Example wording:

“The church designated $20,000 as housing allowance for 2025. Actual housing expenses were $18,000. Fair rental value including utilities and furnishings was $19,000. The excluded amount is $18,000 pursuant to IRC §107.”

Special Case: If You Filed Form 4361

If you were approved for exemption:

- No Schedule SE

- No SE tax on salary or housing allowance

- Housing allowance remains excluded from income tax

Quick Flow Summary

| Item | Income Tax | SE Tax |

|---|---|---|

| Salary | Taxable | Yes |

| Housing Allowance | Excluded (up to limit) | Yes (unless Form 4361 approved) |

If you’d like, tell me:

- Are you W-2 or 1099?

- Did the church include the housing allowance in Box 1?

- Did you file Form 4361?

And I’ll tailor the line-by-line exactly to that fact pattern.

Tax Guides – Covered CA Certified Agent – Etc.

Calculate your Covered CA MAGI Income

Take #Line8b 11 or your projected IRS 1040 Adjusted Gross income for the upcoming year then

add line 2a, 6a & 8 (Foreign Income)

Chat GBT isn't showing the numbers quite right, but you get the idea.

-

-

IMPORTANT!!!

The upcoming year - the future for what you tell Covered CA!

Sure, many people think it’s the past as Covered CA may ask for last years paperwork, but that’s BS! You might have to give back all the subsidies when you file Subsidy Reconciliation form #8962!

- Visit our MAIN webpage on MAGI Income

-

#VITA Volunteers Income Tax Assistance

get your taxes done Free

- Publication 3676 with more details on VITA

- Our Webpage on VITA & Covered CA prohibition to give tax advice

- Find a local VITA FREE Provider locator tool

- Turbo Tax -

- See more tax calculation links in the section on IRS Publication 974 Premium Tax Credit

**********************************

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health, Dental & Vision Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

Brother - Sister - Sibling Side Pages Subpages

- View our website with your Desktop or Tablet for the most information