Employers with over 50 employees

ACA Health Coverage Mandate & Penalties

Employer over 50 lives MANDATE

Employer Shared Responsibility – Mandate Provisions

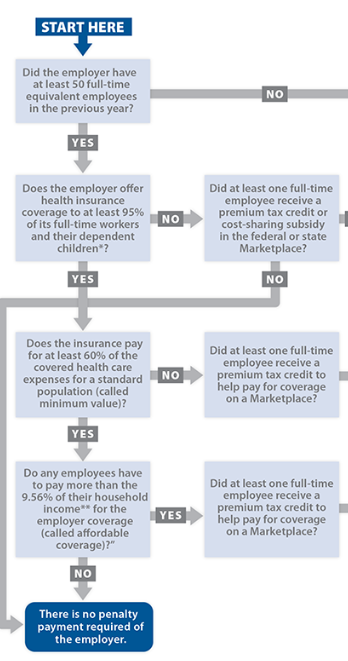

Health Care Reform includes the employer mandate – shared responsibility mandate provisions, which require applicable large employers (IRS Website to determine if you are an ALE) to offer health coverage to full-time employees and their dependents. Those that do not offer coverage might be subject to the employer shared responsibility payment.

I’ll grant you, this can be quite confusing.

- These provisions apply to applicable large employers, which includes tax-exempt and federal, state, local and Indian tribal government employers. You’re an applicable large employer if you have 50 or more full-time employees, including full-time equivalents.

- ARPA new rules?

ACA non – compliance is at risk Benefit Pro * - If you have fewer than 50 full-time employees, including full-time equivalents, you are not an applicable large employer and are generally not subject to these provisions. However, you are subject to the rules for large employers if you have fewer than 50 employees, but are a member of an ownership group that has 50 or more full-time equivalent employees,

- You are subject to the payment if any employee receives the premium tax credit from Covered CA and any one these conditions apply. Your organization:

failed to offer coverage to full-time employees and their dependents

offered coverage that was not affordable

offered coverage that did not provide a minimum level of coverage – Bronze

- You do not report or include an employer shared responsibility payment with any information return you file.

-

Some of the provisions of the Affordable Care Act only affect your organization if it’s an applicable large employer. An ALE is generally one with 50 or more full-time employees, including full-time equivalent employees. The vast majority of employers will fall below the ALE threshold number of employees and, therefore, will not be subject to the employer shared responsibility provisions.

- Applicable large employers have annual reporting responsibilities. You will need to provide the IRS and employees information returns concerning whether and what health insurance you offered to your full-time employees.

- If you’re an applicable large employer that provides self-insured health coverage to your employees, you must file an annual return reporting certain information for each employee you cover.

- ALEs must either offer minimum essential coverage that is affordable and that provides minimum value to their full-time employees and their dependents, or potentially make an employer shared responsibility payment to the IRS.

- Learn more about the employer shared responsibility provision.

- You may be required to report the value of the health insurance coverage you provided to each employee on their Form W-2.

- If you’re an applicable large employer with exactly 50 employees, you can purchase affordable insurance through the Small Business Health Options Program (SHOP). Or directly with an Insurance Company, no charge for our services. See button above or below to get a quote.

For more information, see

- ACA 101 Toolkit 2023 Edition

- ACA’s Employer Mandate: IRS announces higher penalties for noncompliance

- Jump to section on:

FAQ’s, Resources & Links

ADP.com Final Regulations, Delays & Transitional Relief

IRS FAQ‘s

Feb. 10, 2014, final regulations on the Employer Shared Responsibility provisions under section 4980H of the Internal Revenue Code.

IRS employer shared responsibility page.

The following questions and answers provide helpful information about the guidance:

- Basics of the Employer Shared Responsibility Provisions: Questions 1-3

- Which Employers are Subject to the Employer Shared Responsibility Provisions: Questions 4-14

- Identification of Full-Time Employees: Questions 15-17

- Liability for the Employer Shared Responsibility Payment: Questions 18-23

- Calculation of the Employer Shared Responsibility Payment:Questions 24-26

- Making an Employer Shared Responsibility Payment: Questions 27-28

- Transition Relief: Questions 29-39

- Basics for Small Employers: Questions 40-42

- Related Provisions: Questions 43-47

- Additional Information: Questions 48-56

Minimum Essential Coverage

Penalty

#Penalty for not providing Health Insurance –

Minimum Essential Coverage (MEC) is

$2,000/employee

Basically the penalty for not providing Minimum Essential Coverage (MEC) is $2,000/employee.

The penalty if coverage is not affordable 9.83% or does not provide minimum value – Bronze Plan is $3k/employee. The details get quite confusing… so follow the links in the right hand column and below to see how it would apply to your group, situation, what you are offering and if any of your employees apply to Covered CA for subsidies. An Employer only has to offer affordable coverage – which is less than 9.86% of income for employee coverage and 60% AV Bronze Plan –§4980 H (a) (b) to avoid the penalty.

Learn More⇒

- Penalty letters to start going out July 15th, 2020 ACA Times *

- CNBC News 3.11.2015. *

- IRS Penalty Calculator

- CA has an individual penalty for your employees, even there there are less than 50 employees!

- SHRM explanation for 2021

The IRS is taking the responsibility of enforcing the ACA ACA Times *

How Coverage You Offer (or Don’t Offer) May Mean an Employer Shared Responsibility Payment for Your Organization

Under the Affordable Care Act, certain employers, based on workforce size – called applicable large employers – are subject to the employer shared responsibility provisions. The vast majority of employers fall below the workforce size threshold and, therefore, are not subject to the employer shared responsibility provisions.

If you are an employer that is subject to the employer shared responsibility provisions, you may choose either to offer affordable minimum essential coverage that provides minimum value to your full-time employees and their dependents, or to potentially owe an employer shared responsibility payment to the IRS. Many employers already offer coverage that is sufficient to avoid owing a payment.

If your organization is an applicable large employer, and you choose not to offer affordable minimum essential coverage that provides minimum value to your full-time employees and their dependents, you may be subject to one of two potential employer shared responsibility payments.

More specifically, you may need to make an employer shared responsibility payment to the IRS if you are an applicable large employer and either of these circumstances applies for 2015:

- You offered minimum essential coverage to fewer than 70 percent of your full-time employees and their dependents, and at least one full-time employee enrolled in coverage through the Health Insurance Marketplace [Covered CA] and received the premium tax credit.

- You offered minimum essential coverage to at least 70 percent of your full-time employees and their dependents, but at least one full-time employee enrolled in coverage through the Health Insurance Marketplace [Covered CA] and received the premium tax credit. A full-time employee could receive the premium tax credit because the coverage that was offered was not affordable, did not provide minimum value, or was not offered to the full-time employee.

For both of these circumstances, the 70 percent threshold changes to 95 percent after 2015.

The terms “affordable” and “minimum value” have specific meanings under the Affordable Care Act that are explained in questions 19 and 20 on the employer shared responsibility provision questions and answers page on IRS.gov/aca. Transition relief for offers of coverage to dependents for 2015 is described in question 33 on the same page.

For more information on the information reporting responsibilities that apply to applicable large employers see IRS’s Questions and Answers on Reporting of Offers of Health Insurance Coverage by Employers.

Enforcement

On April 7, 2017 TIGTA issued its, “Assessment of the Efforts to Implement the Employer Mandate under the Affordable Care Act.” In this report, TIGT explained that the IRS has developed an ACA Compliance Validation (ACV) System. It will be used to identify potentially non-compliant Applicable Large Employers and calculate the “A” penalty under the Employer Mandate. The IRS has been developing the ACV system since July 2015 with a scheduled completion date of January 2017. However, “the implementation of the ACV System has been delayed to May 2017.”

The report states that once the systems are in place, the IRS will be able to mass identify noncompliant employers. This will allow the IRS to send notices to noncompliant employers for any and all reporting years.

This means that time is up for employers who were delaying. The current lack of IRS notices for noncompliance with the Employer Mandate does not imply that the IRS does not intend to enforce the Employer Mandate. The IRS will come knocking, they are just running behind schedule. freedom care benefits.com

Click here for census forms or enter it ONLINE so that we can get you a FREE proposal.

Just Enter your census or securely send us an excel spreadsheet or a list of employees and get instant proposals for California

Solutions

Just Enter your census or securely send us an excel spreadsheet or a list of employees and get instant proposals for California

Health Coverage #Guide

Art Gallagher

Health Care Reform FAQ's

Understanding Health Reform

***********************************

Compliance #Assistance Guide from DOL.Gov Health Benefits under Federal Law

- Health Care Reform Explained Kaiser Foundation Cartoon VIDEO

- Choosing a Health Plan for Your Small Business VIDEO DOL.gov

- ACA Quick Reference Guide California Small Group Employers Revision 2020 Word & Brown

- kff.org/health-policy-101/

Low Premium Alternatives for Employers to Provide MEC Minimum Essential Coverage

Optimed

- OptiMed Health Plans is a national Third Party Administrator, bringing service to its proper dimension. We provide a complete range of benefit products, and administrative services to both corporate and public entities, including the States of Florida and Ohio. We work directly with consultants to simplify, standardize and automate time-consuming human resource functions. Our services can directly impact a client’s bottom line by the freeing up internal resources removing the need for expensive benefit management systems, improving employee satisfaction and thereby increasing employee retention, while helping to reduce cost. We are dedicated to service and reliability. Our staff is professional, knowledgeable and efficient.

- EDIS – Employer Driven Insurance Services

- Matrix Brochure

- ICHRA.com

- Our webpage on ICHRA Individual Coverage Health Reimbursement Arrangement (ICHRA)

- Minimum Essential Coverage MEC VIDEO

No charge for our broker service and consultation 42 U.S. Code § 18021 - CA has an individual penalty

- Our webpage on “affordable” coverage

Solutions, Resources & Links

- IRS Website on Shared Responsibility Provisions – Mandate Penalties

- Penalty Calculator

- NAHU Analysis of Tax Penalties newsmanager.commpartners.com

- Affordable Health Insurance 9.5% of employee only cost

- If you have Employees working over 30 hours/week Notice 2011-36 2012-01 this would include Part Timers as there is a formula called FTE Full Time Equivalents there is a requirement under Health Care Reform to purchase Health Insurance coverage for their employees or pay penalties of $2k/employee.Covered CA will send letters to employers who have employees getting subsidies to warn them… https://insuremekevin.com/covered-california-demands-employer-information-for-health-insurance-subsidy/As of November 2017, employers started being penalized by the IRS for failing to comply with the ACA’s Employer Mandate. Under the Employer Mandate, Applicable Large Employers (ALEs), organizations with 50 or more full-time employees and full-time equivalent employees, are required to offer Minimum Essential Coverage to at least 95% of their full-time workforce (and their dependents) whereby such coverage meets Minimum Value and is affordable for the employee or be subject to IRS 4980H penalties. Scroll down for more details.

- The focus of these initial Letter 226J penalty notices was ACA compliance for the 2015 reporting year. However, the IRS is now laying the groundwork to issue Letter 226J notices for future years, with an anticipated greater focus and significantly higher penalties while the agency continues to issue Letter 226J notices for 2015.

- As adjustments to the ACA continue, make sure your organization is in compliance with the law. It is not going away and penalties are still being issued by the IRS.

-

ObamaCare mandate NOT a job killer – Washington Post 8.12.2015

-

health reform.kff.org

Related Pages

Carve Outs & Common Ownership

- Common Ownership – Affiliated Companies – Corporations

- Our webpage on Section 125 POP Premium Only Plans

https://www.fundamentalcare.com/limited-day-plans

What is the State of California’s Health Insurance Assistance Program?

Is that where Covered CA is giving subsidies to an employee of a large employer and now we are getting fined?

At first glance, I would think it’s part of the mandate penalty for large employers… But upon further research it looks like a program to help AIDS patients with the employee portion of group health coverage.

On May 15, 2018, the Office of AIDS (OA) and AIDS Drug Assistance Program (ADAP) announced the implementation of an employer-based health insurance premium payment (EB-HIPP) Program. New and existing ADAP clients who are enrolled in an employer-based health insurance plan are now eligible to receive premium assistance for their portion of their insurance premium.

EB-HIPP will pay medical and dental premiums, and it will also pay for vision premiums that are included in a medical or dental premium. EB-HIPP It will also pay the even pays for medical out of pocket (MOOP) expenses!

Eligibility for EB-HIPP is based on the following requirements:

Be enrolled in ADAP

Be employed and enrolled in an employer-based insurance program

Employment verified with paystub dated within last three months

The employer must agree to participate in the EB-HIPP program

The Health Insurance Premium Payment program pays for health insurance premiums and certain outpatient medical out-of-pocket costs for eligible California residents co-enrolled in the ADAP Program. Kern County * CDPH.CA.Gov *

People with HIV/AIDS generally need to take a lot of prescription drugs. Many of these drugs are expensive. Some people get help paying for them through private or public health coverage programs. But some people aren’t on those programs and even those who are sometimes still have drug costs beyond what their health coverage will pay for. There’s a program called the AIDS Drug Assistance Program (ADAP) that helps people with HIV/AIDS pay for the costs of some prescription drugs. DB 101*