Medi Cal Long Term & Nursing Home Benefits & Qualification

but Beware:

Medi Cal can take your home and assets to pay back Nursing Home & Long Term Care Expenses

How to qualify for Medi Cal Nursing Home Coverage

How to #qualify for

Medi-Cal to pay your Nursing Home Costs

California Advocates for Nursing Home Reform (CANHR)

- Medi-Cal Eligibility Canhr Factsheet

-

#Our Webpage on Redetermination – Requalification MC 262

-

- Share of Cost CANHR Fact Sheet

- Our webpage on lowering Share of Cost

- What Does Medi-Cal Cover?

- Nursing home care is covered if there is prior authorization from the physician/health care provider. Residents are admitted on a doctor’s order and their stay must be “medically necessary“.

- (Clinical Guidelines Explained so much better and in logical order!) Residents are allowed to keep $35 of their income as a personal needs allowance.

- Nursing home care is covered if there is prior authorization from the physician/health care provider. Residents are admitted on a doctor’s order and their stay must be “medically necessary“.

- Resource Limitations (Property/Assets) Assets no longer counted

- Medi-Cal vs. Medicare

- Understanding the Medi-Cal Look-Back Period

- FAQ’s

- Senior Care Action Network – SCAN. Independence at Home (IAH) continues that community service by connecting seniors and their caregivers to the services needed to stay out of healthcare facilities and nursing homes.

- wise and healthy aging.org/

- Overview of Medi-Cal for Long Term Care

Medi-Cal Consulting Services

- Medi Helper.com They can help you qualify – fee charged based on complexity of your case.

- CA Health Care Advocates HI CAP Medicare ONLY

#Understanding Medi-Cal Long Term Care

Archive Rev 2001

- CANHR California Advocates for Nursing Home Reform

- Our Webpage on Redetermination Requalification

- Our webpage on how to qualify for Medi Cal Nursing Home Benefits

- When will California's Medi-Cal Will Pay for a Nursing Home, Assisted Living, or Home Care Nolo.com

- Long-Term Services and Supports in Medi-Cal Fact Sheet CHCF.org

- canhr.org/overview-of-medi-cal-for-long-term-care

Strategic Planning for Nursing Home Benefits

gift in contemplation of death

n. (called a gift causa mortis by lawyers showing off their Latin), a gift of personal property (not real estate) by a person expecting to die soon due to ill health or age. Federal tax law will recognize this reason for a gift if the giver dies within three years of the gift. Treating the gift as made in contemplation of death has the benefit of including the gift in the value of the estate, rather than making the gift subject to a separate federal gift tax charged the giver. If the giver gets over an apparently mortal illness, the gift is treated like any other gift for tax purposes.

See also: gift tax unified estate and gift tax law.com

Medi-Cal FAQ’s DHCS.gov – Look back only 30 month look back in CA

Resources

Contact Us - Ask Questions - Get More Information

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

IHSS Qualification

#IHSS

In Home Supportive Services

If you are aged, blind or disabled * IHSS, having someone help you with your daily tasks, is an alternative to help you stay in your home.

- Who is IHSS For:

- Eligibility criteria for all IHSS applicants and recipients:

- You must also be a California resident.

- You must have a Medi-Cal eligibility determination.

- Benefits Cal.com

- 138% Income Chart Poverty Level

- Check out Share of Cost? If you make more than 138% of Federal Poverty Level FPL

- You must live at home or an abode of your own choosing (acute care hospital, long-term care facilities, and licensed community care facilities are not considered “own home“).

- You must submit a completed Health Care Certification form.

- FYI our webpage on ADL Activities of Daily Living

- Eligibility criteria for all IHSS applicants and recipients:

- L.A. County to set aside money to boost wages for caregivers for elderly and disabled

- Targeted Use of Agencies for Personal Care Services

Resources & Links

FAQ’s

FAQ’s

Can IHSS Providers – Care Workers – Get Medi Cal regardless of their income?

Here’s what the PASC-SEIU Homecare Workers website says –

As long as you are authorized work 74 hours or more per month for two consecutive months. You will continue to be eligible as long as you continue to be authorized to work at least 74 hours per month. View actual wording

On the other hand:

IHSS workers would be presumptively eligible, for 6 months – you can get temporary coverage until official eligibility is determined Law Insider * for full [Medi Cal] benefits and there would be no means test – they won’t look at your income, resources – assets or your ability to pay for health insurance. Sooner or later though, A Medi Cal application would eventually have to be completed. Investopedia * Dhcs * Report to CA Health Care Foundation by USC June 2000

On the other hand:

Here’s an optometrist making $200k that was the IHSS caretaker for his mother. He states:

i was never asked about income if i remember correctly email dated 5.9.2022

On the other hand:

I don’t do phone calls – especially when I don’t get compensated to help people with IHSS – here’s a number to call

Providers who are eligible for the plan will automatically be sent an enrollment packet that describes what the PASC- SEIU Homecare Workers Health Care Plan provides. If you are eligible for the health plan, you may contact the PASC Health Plan Call Center at 1-855-PASC-PLN, (1-855-727-2756), to request an enrollment form.

If you are already enrolled in L.A. Care plan and have additional questions about specific benefits provided by the Plan, please call L.A. Care at 1-844-854-7272, or go to their website at www.lacare.org/members/ihss.

- Visit our historical webpage on IHSS

What are Home and Community-Based Services?

Medicaid-covered HCBS are services that support older adults and people with disabilities with activities of daily living in settings of their choice, including their homes, assisted living facilities, and adult day health centers. Supports include, for example, personal care assistance, care coordination, medically-tailored nutrition, transportation, medication management, home modifications, and, for individuals with high care needs, 24-hour nursing and supervision. California’s HCBS programs include:

- Assisted Living Waiver provides care and supervision in licensed board and care settings such as Residential Care Facilities for the Elderly and at a limited number of public subsidized housing sites.

- Community-Based Adult Services Program provides social, therapeutic, nutrition, and personal care services at adult day health centers.

- California Community Transitions/Money Follows the Person assists residents in skilled nursing facilities transition to community housing by identifying, adapting, and setting up housing.

- Home and Community-Based Alternative Waiver provides personal care, 24-hour nursing, and other supports to people with complex needs.

- Home and Community-Based Services for the Developmentally Disabled coordinates and purchases support services for consumers with developmental disabilities through the Department of Developmental Services’ Regional Centers.

- In-Home Supportive Services (IHSS), a consumer-directed personal care program serving over 800,000 older adults and people with disabilities, provides assistance with activities of daily living like dressing, bathing, eating, and household chores.

- Medi-Cal Waiver Program provides case management and personal care services to individuals living with HIV/AIDS as an alternative to nursing facility care.

- Multipurpose Senior Services Program includes intensive care and service coordination, social supports, home repairs, and adult day programs for older adults age 65 and over.

- Program of All-Inclusive Care for the Elderly (PACE) provides coordinated health and home and community-based services to older adults at site-based PACE centers. Source Justice in Aging *

Medi Cal Estate Recovery

CANHR

Overview of Medi Cal for Long Term Care Canhr.org

Medi Cal Nursing Home Estate Recovery

Medi Cal can take your home for nursing care! There are ways to plan for this to comply with all the new laws. Read this entire page along with our pages on Long Term Care Insurance for information or details.

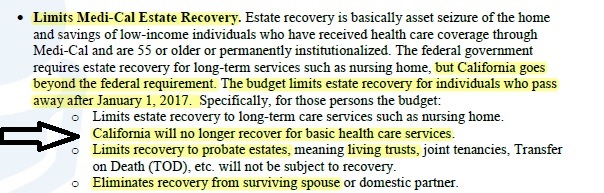

MAGI Medi Cal under ACA – No longer has premium recovery for Health Insurance

ACA Obamacare Medi-Cal no longer has asset recovery for Health Insurance Premiums – Capitation. under MAGI Medi-Cal.

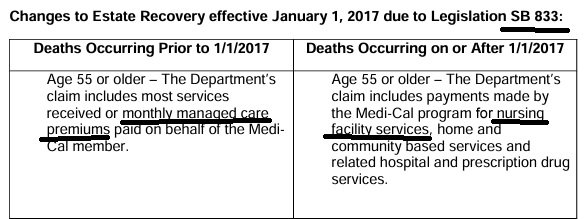

CA changed the law as CA had extra $$$ pre COVID and the new budget includes $30 million to limit Medi-Cal estate recovery only to that required by federal law. Based on the definition of what “Health Care Means.” actual code SB 833 14009.5 . KQED News 6.16.2016 * 3.24.2015 * SB 33 * SB 833 * Simple Explanation CA HealthLine 12.23.2016 * DHCS.CA.Gov

- California’s Medi-Cal Recovery Program Frequently Asked Questions Canhr.org Fact Sheet

- Medi-Cal Recovery Recovery rules for Medi-Cal beneficiaries who die on or after January 1, 2017

- Avoiding Estate Recovery Canhr.org

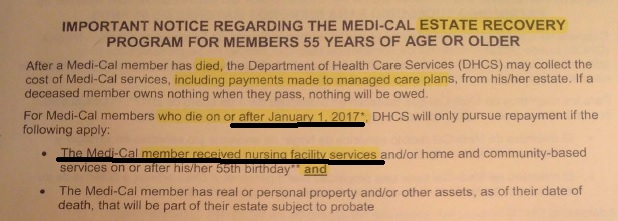

- The Medi-Cal program must seek repayment from the estates of certain deceased Medi-Cal beneficiaries. Repayment only applies to benefits received by these beneficiaries on or after their 55th birthday and those who owned assets at the time of death. If a deceased beneficiary owns nothing when they die, nothing will be owed. dhcs.gov

- What you need to know and how to avoide Medi Cal Estate Recovery canhr

Learn More at Long Term Care.Gov

Find an Attorney

- Legal Match

- Findlaw.com

- American Bar Association

- Attorney Search Network

- Follow the links on this webpage. Many of them go to articles on Attorney Websites

- Also, see our appeals webpage

- Medi Cal Contact

- State Bar of California Attorney Referral Service

#Attorney 's --- Social Security Disability maze

- Sellers Law

- Hill & Ponton

- premier disability.com

- Cantrell & Green

-

- We don't necessarily know these attorney's...

- Editorial: Lawyers are fighting innovative proposals for more affordable legal assistance. That’s wrong LA Times 1.30.2022

Estate Planning

- We don't necessarily know these attorney's...

FAQ’s

- Question I getting a divorce and my x spouse has a chronic debilitating illness. Is my share of the equity in the family home subject to Medi Cal recovery?

- ANSWER The general rule is that there must be an “equitable distribution” of the assets and income of the couple REad More .

- agingcare.com/divorce-husband-eligible-for-medicaid

- Divorce: Allows a married couple to divide their assets equally. Thus, the at-home spouse can keep half of the property outside the reach of Medi-Cal. (This makes sense (if at all!) only for persons with substantial assets or for an at-home spouse with substantial separate property in a new marriage.) glantzlegal.com/tips

- Transferring assets to certain recipients will not trigger a period of Medicaid ineligibility even if the transfers occurred during the look-back period. These exempt recipients include the following:

- A spouse (or a transfer to anyone else as long as it is for the spouse’s benefit)

- A blind or disabled child

- A trust for the benefit of a blind or disabled child

- A trust for the sole benefit of a disabled individual under age 65 (even if the trust is for the benefit of the Medicaid applicant, under certain circumstances). elderlawanswers.com/how-does-the-medicaid-look-back-period-work

FAQ’s Estate Recovery

- Can Estate Recovery take a home if there is a surviving spouse?

- MAGI Medi Cal 1095 B no longer relevant… Insure Me Kevin.com

- Are you responsible for an X Spouse who goes into Medi Cal Nursing home? That is, can Medi Cal take recovery from the family home?

Limitations on Medi Cal Estate Recovery

Medi-Cal #Recovery Health Premiums

for Medi Cal premiums

-

- More CANHR.org Publications

- canhr.org/fact-sheets

- CANHR Matrix Federal Law - Current CA Law -- SB 833 provisions canhr.org

- DHCS Comparison. before & after SB 833 January 2017

- Western Poverty Law - Summary new rules under SB 826 & SB 833

- MAGI Medi Cal 1095 B no longer relevant... Insure Me Kevin.com

- FYI Web Visitor that doesn't believe there is no more estate recovery for Medi Cal Health Insurance capitation

- Medi Cal still takes estate recovery during Covid (Share of Cost) i newssource 5.20.2022

- Text of SB 833

- Medi Cal updated notice for April 2022 Clean Copy without our markup

- Note that AFTER 2017, the notice does NOT say payments to managed care plans.

Here’s the Actual NEW CA Law

#SB 833 §14009.5. Effective 1.1.2017

Federal and State laws #require DHCS to seek recovery

from the estates of deceased Medi-Cal beneficiaries, or from any recipient of the decedent’s property by distribution or survival, for services and premiums paid on behalf of the decedent on or after age 55.

- California Code of Regulations (CCR) sections 50960-50966

- Welfare and Institutions Code (W&IC) section 14009.5

- Probate Code section 215

- Probate Code section 9202

- Probate Code section 19202

- United Stated Code (USC) section 1396

MISC & Historical

CA Dept of Aging – Home & Long Term Care Booklet

Please note, there are updates all the time, double check everything.

#Taking Care of Tomorrow Booklet

NAIC Shoppers Guide to Long Term Care

What is the

CA Assisted Living Waiver?

Participants in the ALW have access to the following services:

- Assisted Living Services: The following is a list of some of the services that must be provided to ALW participants. These services may be provided in an RCFE, or by a licensed Home Health Agency to residents in public housing.

- Assisting in developing and updating an individualized care plan for each resident

- Personal care and assistance with activities of daily living

- Laundry

- Housekeeping

- Maintenance of the facility

- Providing intermittent skilled nursing care

- Meals and snacks

- Providing assistance with self-administration of medications

- Providing or coordinating transportation

- Providing recreational activities

- Providing social services

- Care Coordination: These services include identifying, organizing, coordinating and monitoring services needed by participants .

- Nursing Facility Transition Care Coordination: These services help transition participants from a nursing home to the community. CA Assisted Living Waiver

Resources & Links

- DHCS.CA.Gov – CA Department of Health Care Services

- Assisted Living Waiver

- Elder Options – Private Website – DHCS subcontractor that can help people in Sacramento Area

- Nolo Press

FAQs / Ask Us a Question

Question

My 92 year old mother is on Medi-cal and Scan, but needs to go into assisted living with waiver application. They won’t accept Scan. They said she has to drop it. Does she automatically go on Medi–Medi and will her new doctor take it? The application takes 3-6 months for approval but I have to drop her from Scan insurance before I fax over the waiver form…

Answer

***I don’t have enough background to answer your question. I did learn though, my first day at my Father’s & Grand Fathers Insurance Agency, to NEVER cancel coverage till new coverage was confirmed!

Links & Resources

- Daily Kos

- CA Health Care Foundation

- Simple Explanation CA HealthLine 12.23.2016

- Insure Me Kevin.com –

- Check out Long Term Care Coverage

- DHCS.CA.Gov Explanation

- Set up an Advance Directive 5 Wishes

- Visit our Webpages

Low Income – Assets – Alternatives

Resources & Links

- Veteran’s Home Health Care

- Jewish Free Loan Assoc.

- Medicare.Gov Home Health Compare

This is an OLD Question from July 2016, before SB 833 became effective and various news articles and pamphlets cited above became available to make it CLEAR that there is no estate recovery for premiums under MAGI Medi-Cal.

**************************

I read your helpful links carefully. I read them VERY CAREFULLY. I STILL run into the medical estate recovery situation, even after it was changed to hide that it still continues to leave out most people in my age group.

The only asset I have is my home. It is the only asset I have built (literally, by hand, to the point of breaking two ribs working on the construction site while pregnant) over the last 30+ year of my life. I don’t have a disabled child or meet the “home worth 50% less than the homes in my area” test. The only equitable situation would be for the state to follow its own laws and not create government programs that discriminate on the basis of age. I’m sorry if this sounds like a rant, is not your problem and there is nothing you can do about the regulations as they now stand.

I am not on disability and I don’t collect one thin dime from the state. I have a life-threatening medical condition but I will literally choose to stay home and die rather than hand all I own to the state as punishment for seeking health care. If I can avoid medical care until I am 65, the state fails to become my heir.

I cannot die in peace knowing the state would take the only inheritance I could muster for my children during my entire life.

Because of my age, the state has specially selected people in my decade of age to be treated differently when it comes to health care and estate recovery rules. Obama-Care is theft-care which targets people on the verge of retirement and their heirs.

If I were under 55 or over 65, I could consider medi-cal and would have applied last year, when my income took a nose-dive, but I held off.

The old AND “NEW” rules STILL discriminate against me until I am 65.