Patient Protection and Affordable Care Act

Obamacare Health Care Reform

Main Features of PP-ACA – Health Reform

- kff health news.org/affordable-care-act-aca-obamacare-new-gop-republican-attacks

- CHCF Comparison of CA and Federal Essential Health Benefits

- Guaranteed Issue and NO Pre Existing Condition Clause! PHSA 2704 (a), 42 USC 300 gg IRC 9815 ERISA 715national underwriter.com Health Reform Facts Q & A 252

- Peter Lee of Covered CA on what’s next for ACA 4.2022 Listen * Read

- 2014 – Requirement to have Health Insurance – CA Mandate

Require U.S. citizens and legal residents – Federal Mandate no longer in effect, but CA has one – to have qualifying health coverage (phase-in tax penalty for those without coverage).- An insurance-less person would have to pony up whichever is greater: $695 for each uninsured family member, up to a maximum of $2,085; or 2.5 percent of household income. (Christian Science Monitor, Section 1501, 5000A, HR 3590 Page 124, Section 1002 HR 4872 Page 4)

Constitutionality? - Government Subsidy & CA Premium calculator

- An insurance-less person would have to pony up whichever is greater: $695 for each uninsured family member, up to a maximum of $2,085; or 2.5 percent of household income. (Christian Science Monitor, Section 1501, 5000A, HR 3590 Page 124, Section 1002 HR 4872 Page 4)

- SMALL BUSINESS TAX CREDITS

Offers tax credits to small businesses to make employee coverage more affordable. Tax credits of up to 35 percent of premiums will be available to firms that choose to offer coverage. Effective beginning calendar year 2010. (Beginning in 2014, the small business tax credits will cover 50 percent of premiums.) This is in addition to IRS Section 106 - NO DISCRIMINATION AGAINST CHILDREN under 19 WITH PRE-EXISTING CONDITIONS—Prohibits new health plans in all markets plus grandfathered group health plans from denying coverage to children with pre-existing conditions. Effective 6 months after enactment. (Beginning in 2014, this prohibition would apply to all persons.) CA Assembly Bill 2244

- HELP FOR UNINSURED AMERICANS WITH PRE-EXISTING CONDITIONS UNTIL EXCHANGE IS AVAILABLE (INTERIM HIGH-RISK POOL)—

- Provides access to affordable insurance for Americans who are uninsured because of a pre-existing condition through a temporary subsidized high-risk pool. Effective in 2010.

National Conference of State Legislatures

Choice Administrators on Exchanges

Christian Science Monitor

Our Website for information quotes

Individuals & Families

Employer Groups 2 – 50

- Provides access to affordable insurance for Americans who are uninsured because of a pre-existing condition through a temporary subsidized high-risk pool. Effective in 2010.

- ENDS RESCISSIONS—Bans insurance companies from dropping people from coverage when they get sick. Effective 6 months after enactment.

- BEGINS TO CLOSE THE MEDICARE PART D DONUT HOLE—Provides a $250 rebate to Medicare beneficiaries who hit the donut hole in 2010. Effective for calendar year 2010. (Beginning in 2011, institutes a 50% discount on prescription drugs in the donut hole; also completely closes the donut hole by 2020.)

- FREE PREVENTIVE CARE UNDER MEDICARE

- —Eliminates co-payments for preventive services and exempts preventive services from deductibles under the Medicare program. Effective beginning January 1, 2011.

- EXTENDS COVERAGE FOR YOUNG PEOPLE UP TO 26TH BIRTHDAY THROUGH PARENTS’ INSURANCE

- —Requires new health plans and certain grandfathered plans to allow young people up to their 26th birthday to remain on their parents’ insurance policy, at the parents’ choice. Effective 6 months after enactment.

- HELP FOR EARLY RETIREES—Creates a temporary re-insurance program (until the Exchanges are available) to help offset the costs of expensive premiums for employers and retirees for health benefits for retirees age 55-64. Effective in 2010.

- BANS LIFETIME LIMITS ON COVERAGE—

- Prohibits health insurance companies from placing lifetime caps on coverage. Effective 6 months after enactment. health care.gov Blue Cross Flyer HHS Memo 12/9/2010

- Los Angeles Times $21m claim to Medi-Cal poses huge challenge 7.17.2017

- BANS RESTRICTIVE ANNUAL LIMITS ON COVERAGE

- —Tightly restricts the use of annual limits to ensure access to needed care in all new plans and grandfathered group health plans. (Beginning in 2014, the use of any annual limits would be prohibited for all new plans and grandfathered group health plans.) health care.gov * Blue Shield – info – NOTE definition of Essential Benefits Blue Cross Flyer

- Mandated 10 Essential Benefits California has even more

- FREE PREVENTIVE CARE UNDER NEW PRIVATE PLANS—Requires new private plans to cover preventive services with no co-payments and with preventive services being exempt from deductibles.

- NEW, INDEPENDENT APPEALS PROCESS—Ensures consumers in new plans have access to an effective internal and external appeals process to appeal decisions by their health insurance plan. Effective 6 months after enactment.

- ENSURES VALUE FOR PREMIUM PAYMENTS—Requires plans in the individual and small group market to spend 80 percent of premium dollars on medical services, and plans in the large group market to spend 85 percent.

- COMMUNITY HEALTH CENTERS—Increases funding for Community Health Centers to allow for nearly a doubling of the number of patients seen by the centers over the next 5 years. Effective beginning in fiscal year 2011.

- INCREASES THE NUMBER OF PRIMARY CARE PRACTITIONERS—Provides new investments to increase the number of primary care practitioners, including doctors, nurses, nurse practitioners, and physician assistants. Effective beginning in fiscal year 2011.

- PROHIBITS DISCRIMINATION BASED ON SALARY

- —Prohibits new group health plans from establishing any eligibility rules for health care coverage that have the effect of discriminating in favor of higher wage employees. Effective 6 months after enactment.

- HEALTH INSURANCE CONSUMER INFORMATION (Web Portal)—Provides aid to states in establishing offices of health insurance consumer assistance in order to help individuals with the filing of complaints and appeals. Effective beginning in fiscal year 2010.

- Section 2793 Page 20 HR 3590

More info on Web Portals Health Care.gov

- Section 2793 Page 20 HR 3590

- HOLDS INSURANCE COMPANIES ACCOUNTABLE FOR UNREASONABLE RATE HIKES

- —Creates a grant program to support States in requiring health insurance companies to submit justification for all requested premium increases, and insurance companies with excessive or unjustified premium exchanges may not be able to participate in the new Health Insurance Exchanges. Starting in plan year 2011.

Rate Review SB 1163 - 80% Medical Loss Ratio (MLR) – Actuarial Value

- CA Insurance Rate Regulation

- Premium increases? Why are they always going up?

- Financial Impact of Health Care Reform on Premiums

- —Creates a grant program to support States in requiring health insurance companies to submit justification for all requested premium increases, and insurance companies with excessive or unjustified premium exchanges may not be able to participate in the new Health Insurance Exchanges. Starting in plan year 2011.

- Grandfathering Exemption

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Jump to section on:

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

VIDEO’s

- Kaiser Foundation – Health Care Reform Explained Cartoon VIDEO

- Hitler’s plot to put ObamaCare on the American People – Parody VIDEO

- President Obama Explains How ObamaCare (the ACA) Helps Americans VIDEO

- We disagree about just buying online…

- PBS News Hour President Obama on ACA VIDEO

- All White House You Tube VIDEOs on ObamaCare

- Overview of ACA Taxes & Fees

- Patient Choice, Affordability, Responsibility and Empowerment Act Fix Obama Plan

CHCF California Health Policy Survey

- 1/2 of California's skipped health care in the past year, due to cost

- 1/4 themselves or knew someone who had problems paying a bill

- 1/5 had someone close to them experience homelessness

- 1/2 have used telehealth - phone or video

- 6 in 10 think there is racial or ethnic disparity

Health Coverage #Guide

Art Gallagher

Health Care Reform FAQ's

Understanding Health Reform

***********************************

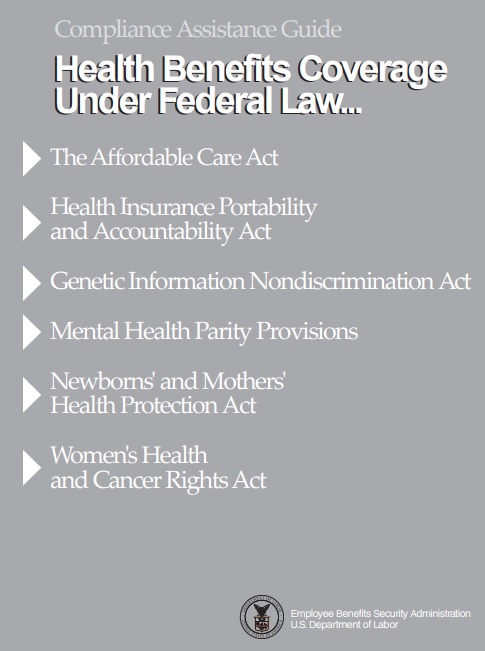

Compliance #Assistance Guide from DOL.Gov Health Benefits under Federal Law

- Health Care Reform Explained Kaiser Foundation Cartoon VIDEO

- Choosing a Health Plan for Your Small Business VIDEO DOL.gov

- ACA Quick Reference Guide California Small Group Employers Revision 2020 Word & Brown

- kff.org/health-policy-101/

- Health Savings Accounts

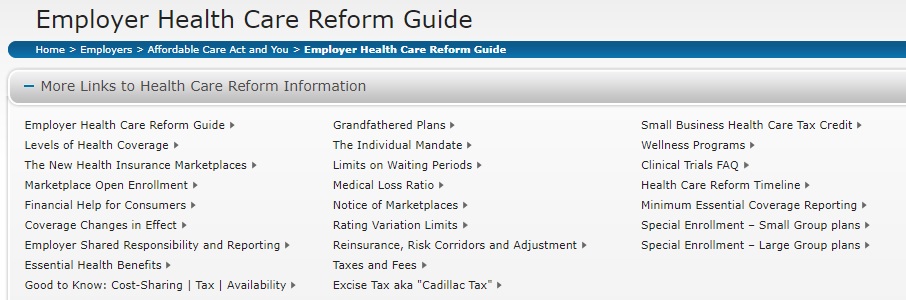

Health Reform Guides

-

Employer Group Changes – ACA/Obama Care

- Kaiser Health Care Reform 34 pages Rev 4.2013

- UNUM Guide to Health Care Reform Rev 4.2013

- More info on Small Group Definitions vs. Large Group

- Aetna Website

- 3/2012 Generic Summary

-

- Health Reform in a Nutshell

- UHC 2013 Guide

- HELP FOR EARLY RETIREES—The new Early Retiree Reinsurance Program is a temporary program that will provide reimbursement to participating employers with 51 or more covered employees for a portion of the cost of health coverage to early retirees. To participate, the plan must provide coverage for retired employees who are 55-64 years of age who are not eligible for Medicare.

- Early Retiree Reinsurance Program * FAQ’s

- Fact Sheet HCTC Health Coverage Tax Credit Regulations

- Blue Shield FAQ’s Program Regulations Fact Sheet checklist

- Application instructions regulations

- Aetna’s Website

Resources on the New Health Reform Law

- Private Health Insurance Provisions in the Patient Protection and Affordable Care Act (PPACA) Congressional Research Service

- PPACA/Health Care Reform_What’s Next_050213.webinare

- Obama Care Facts.com

- medical xpress.com/ gaps-native-americans-largely-unused

- Register to vote

Consumer Links

ACA ObamaCare Horror Stories

Rhonda R

February 17, 2014

This process of applying for this supposedly money saving health care reform is utterly a complete nightmare. Insurance companies have let go of health plans that used to be offered that were nothing to brag about but yet would keep the average hard working American from filing bankruptcy because of medical debts.

I was on a plan that seemed a bit high for what I was actually getting from it. I was paying $464.00 in monthly premiums with a $14,000 total out of pocket (which is easier to foresee paying off in payments than hundreds of thousands of dollars), if something major might have happened to cover myself, my son and two daughters; this plan was no longer offered when Obama care/ Covered Ca. took effect.

Now this process of trying to get Health Insurance coverage has been stressful and frustrating and an utterly disappointing process that has gone on since December 2013. Talking with different representatives that have no idea what is going on, so they think they are trying to help and change things on your application. Now my application has been through the ringer numerous of times and still no affordable rates for the amount of my income. You are not assigned one person to handle your case so it turns into one hand does not know what the other hand is doing. From the start of applying Dec. 2013 there has been obstacles thrown at us from left to right, first application we used our taxes from 2012, they had to verify it no problem, than verify kids birthdays, citizenships, residency, and etc… This seemed to be a lengthy process and we ended up going to an Insurance agent that was trained to handle Covered CA. / Obama Care for help in Jan. 2014 submitted everything by the Jan 15th deadline so we could get insurance by Feb. 1, 2014. Had a plan chosen still no replies? I made numerous calls to Covered Ca. and the Insurance Company that I chose Blue Shield Silver 87 PPO, supposedly Covered Ca. did not send the papers for approval over to them; called Covered Ca. they said that they did. Then all of a sudden now they cannot use my taxes, so I gave them my husband’s 2013 W-2 amounts Gross income they adjusted everything and again still no communication from the insurance company. So I called again now they cannot use the W- 2’s from 2013, they needed an estimated amount of what we think we might be making for 2014 income. We submitted what we calculated with one of the representatives she was having a hard time with making adjustments to the application and said she would have to call me back later. When I received the call back it was that they could not use those number amounts and was figuring our income on one pay stub for a monthly income and calculated it for the year of 2014. My husband’s paychecks fluctuate and as of the end of May 2014 he will be fully retired.

A $601.00 monthly insurance payment, plus $40.00 per visit for a general doctor, $65 for a specialist, this policy will only cover three of us because my husband is on Medicare and my other daughter is only seventeen, so they said everyone under eighteen enrolls in Medi-Cal. Now if I due a Bronze plan it will cost $462 plus a month but co-pays to the doctors are outrageous and before you can get any medications that would be $19.00 dollars one person would have to pay $5,000 towards the deductible or if there is more than one it is $10,000.

This whole Covered Ca. Obama Care backed program is totally out of control and hurts the average hard working American.

Have you really looked at what these insurance companies are really offering people? We are receiving a lot less than what was offered before. This is supposed to be better than what we had before, no way is this benefiting the average hard working American. We will have to put more money up front before we get any justifiable medical help. Insurance Companies have found even a better opportunity to take advantage of ripping off the American people. Maybe before you ever had an idea of putting this health care reform in action you really should have looked at the big picture of who is this going to affect. Our Government legislation from the President, to Senator’s, House of Representatives, and Governors of our States and etc…, are all sitting in their luxurious comforts with the best Insurance policies that the people of the United States are funding through all of our taxes we pay. . Remember people of the United States voted for everyone in these offices, it is our money that pays for the legislator’s paychecks, insurance, and etc… So they approve a health care reform that they will not even accept to sign up for. This is a health reform that is not a benefit to all people because still it gears towards helping low income, and illegals. Everyone else that works hard for their money will still be paying for everyone that is in lower income brackets. Truth is what happens if a lower income person gets hurt or someone that does not have citizenship they will automatically get the heath bills paid for? The working consumer may receive health care but will be paying the health debt off for many years. This is not to say we want free health care, but we need something we can afford with the benefits that are affordable. What happened to our Constitutional Rights, we now are told you will be on a health plan or you will be fined. The Subsidies they say are federal subsidies the consumer’s tax dollars pay for all of this. Maybe the government should realize what is good for one is good for all; they need to be on this Obama Care too.