IRS 6055 and 6056 Employer Reporting Requirements

for ACA Obamacare

Introduction

The Affordable Care Act (ACA) added Section 6056 to the Internal Revenue Code (IRC) requiring annual information reporting to the Internal Revenue Service (IRS) by applicable large employers with fully insured plans relating to the health insurance that the employer offers (or does not offer) to full-time employees and their dependents.

Section 6055 requires annual information reporting to the IRS by health insurance issuers, employers with self-insured plans, government agencies, and other providers of health coverage.

- IRS Website on ACA Reporting Requirements

- Health Net Bulletin on 6055 MEC Minimum Essential Coverage

Word & Brown Webinar on 6056 Reporting

Our Webpage on 1095 C form to be give to employees

Form 1094-C, Transmittal of Employer-Provided Health Insurance Offer and Coverage -

Visit our webpage on Minimum Essential Coverage

What forms must employers complete to comply with ObamaCare?

- 1095 B Confirmation of Coverage to employees so they can comply with Individual Mandate

- W-2 Federal Wage and Tax Statement to employees, must include value of Health Insurance Benefits if over 250 employees

- Covered CA – Model Exchange – Notice Technical Release 2013-02 Fair Labor Standards Act §18b & COBRA 1985

- Summary of Benefits – Generally 12 pages of standardized coverage language to make benefits more understandable.

- ACA Calculators

- advanced benefit consulting.com

- ERISA – SPD Summary Plan Description

-

Guidance for Notice to Employees of Coverage Options (DOL #2013-02 6 Pages)

-

Sample Notice for EmployER’s that offer Health Coverage 3 Pages

- Don’t offer – 2 Pages

- What’s on this page?

SPD #Summary Plan Description

The Employee Retirement Income Security Act (ERISA) requires plan administrators the people who run plans to give plan participants in writing the most important facts they need to know about their retirement and health benefit plans including plan rules, financial information, and documents on the operation and management of the plan. Some of these facts must be provided to participants regularly and automatically by the plan administrator. Others are available upon request, free-of-charge or for copying fees. The request should be made in writing.

One of the most important documents participants are entitled to receive automatically when becoming a participant of an ERISA-covered retirement or health benefit plan or a beneficiary receiving benefits under such a plan, is a summary of the plan, called the summary plan description or SPD. The plan administrator is legally obligated to provide to participants, free of charge, the SPD. The summary plan description is an important document that tells participants what the plan provides and how it operates. It provides information on when an employee can begin to participate in the plan, how service and benefits are calculated, when benefits becomes vested, when and in what form benefits are paid, and how to file a claim for benefits. If a plan is changed, participants must be informed, either through a revised summary plan description, or in a separate document, called a summary of material modifications, which also must be given to participants free of charge.

In addition to the summary plan description, the plan administrator must automatically give participants each year a copy of the plan’s summary annual report. This is a summary of the annual financial report that most plans must file with the Department of Labor. These reports are filed on government forms called the Form 5500. The summary annual report is available at no cost. To learn more about the plan assets, participants may ask the plan administrator for a copy of the annual report in its entirety.

If participants are unable to get the summary plan description, the summary annual report or the annual report from the plan administrator, they may be able to obtain a copy by writing to the U.S. Department of Labor, EBSA, Public Disclosure Room, Room N-1513, 200 Constitution Avenue, N.W., Washington, D.C. 20210, for a nominal copying charge. Participants should provide their name, address and phone number to enable EBSA to contact them to follow up on the request. dol.gov/health-plans/planinformation

29 CFR 2520.102-3 – Contents of summary plan description

29 U.S. Code § 1022 – Summary plan description

Other forms for employers to file or keep

See our Site Map for our Employer Group Website

See also Summary of Benefits

Health Coverage #Guide

Art Gallagher

Health Care Reform FAQ's

Understanding Health Reform

***********************************

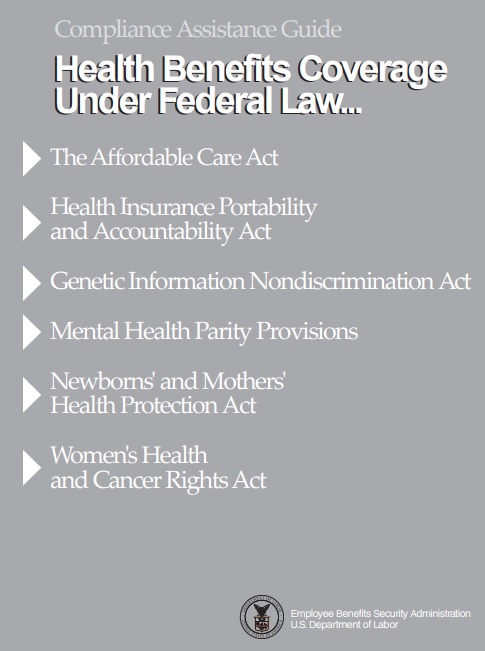

Compliance #Assistance Guide from DOL.Gov Health Benefits under Federal Law

- Health Care Reform Explained Kaiser Foundation Cartoon VIDEO

- Choosing a Health Plan for Your Small Business VIDEO DOL.gov

- ACA Quick Reference Guide California Small Group Employers Revision 2020 Word & Brown

- kff.org/health-policy-101/

W -2 Must show dollar benefit of Health Insurance

- Employers with more than 250 employees are required to file a W-2 showing aggregate cost of employer-sponsored group health plan coverage, under Health Reform, Obama Care – PPACA

- The premiums are still NOT taxable as income to the employee and a deduction for the employer (IRC 106), the purpose is to provide useful and comparable information to employees on the cost of their health care coverage. (Notice 2012-9, Q&A2).

- Consumer Resources & Links

- How to file W-2 online #10033 (Small Biz?)

- IRS Website on W – 2

- hse law.com Guidance

- IRS Notice 2012 – 9

- UHC Video W – 2 Reporting

- W-2 Reporting Requirements – Anthem Summary

FAQ’s

- IRS Questions and Answers on Reporting of Offers of Health Insurance Coverage by Employers (Section 6056)

- The health care law requires applicable large employers to file information returns with the IRS and provide statements to their full-time employees about the health insurance coverage the employer offered. An applicable large employer is an employer that employed an average of at least 50 full-time employees on business days during the preceding calendar year.

- Is an ALE member that sponsors a self-insured health plan required to file Form 1094-C and Form 1095-C

if the ALE member has no full-time employees?- Generally, yes. An ALE member that sponsors a self-insured health plan in which any employee or employee’s spouse or dependent has enrolled is required to file Form 1094-C and Form 1095-C, whether or not that employer has any full-time employees and whether or not that individual is a current employee or a full-time employee. For an individual who enrolled in coverage who was not an employee in any month of the year, the employer may file Forms 1094-B and 1095-B for that individual.

- Is an employer that is not an ALE member required to file under the Affordable Care Act

if the employer sponsors a self-insured health plan that provides minimum essential coverage?- No; however, such an employer is subject to the reporting obligations under the Affordable Care Act. An employer that is not an ALE member that sponsors a self-insured health plan in which any individual has enrolled is not subject to the reporting requirements of ACA. Such an employer will generally satisfy its reporting obligations by filing Form 1094-B and Form 1095-B.

- Is an ALE member required to report under the Affordable Care Act

with respect to a full-time employee who is not offered coverage during the year?- Yes. An ALE member is required to report information about the health coverage, if any, offered to each of its full-time employees, including whether an offer of health coverage was – or was not – made. This requirement applies to all ALE members, regardless of whether they offered health coverage to all, none, or some of their full-time employees. For each of its full-time employees, the ALE member is required to file Form 1095-C with the IRS and furnish a copy of Form 1095-C to the employee, regardless of whether or not health coverage was or was not offered to the employee. Therefore, even if an ALE member does not offer coverage to any of its full-time employees, it must file returns with the IRS and furnish statements to each of its full-time employees to report information specifying that coverage was not offered.

- Our webpage on 1095

- Affordable Care Act Information Reporting (AIR) Program page on IRS.gov and in Publications 5164 and 5165.

Related Pages

Carve Outs & Common Ownership

- Common Ownership – Affiliated Companies – Corporations

- Our webpage on Section 125 POP Premium Only Plans