Try turning your phone sideways to see the graphs & pdf's?

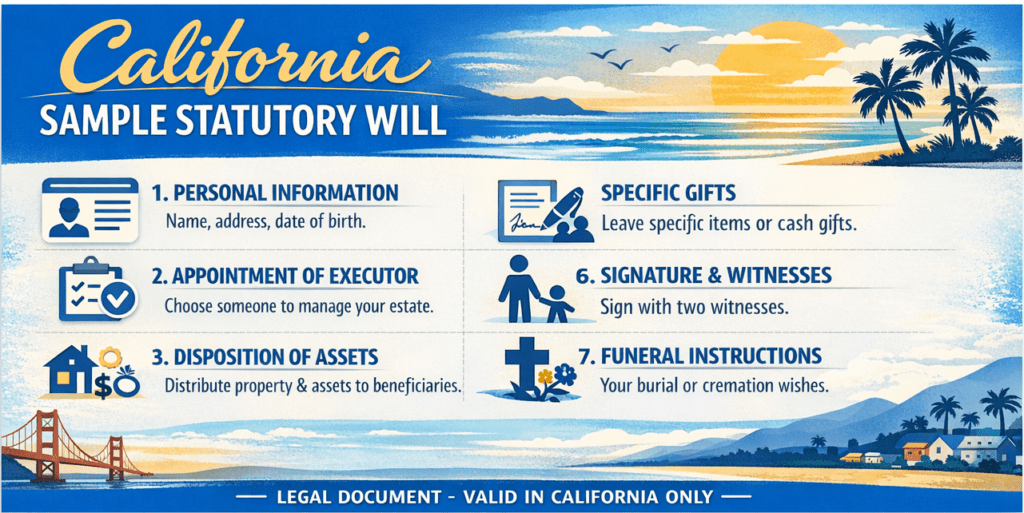

California Statutory – Sample – Just Fill in the Blanks Example #Will

Here’s the California Statutory Will (ab 1986). Sure, it’s boiler plate and may not fit your situation, but it’s a start and works for many people. A will is especially important to properly plan for the future, so that your money, property and care for your children go where you want it or don’t want it to go to. A will will help avoid will contests, litigation and animosity amongst your children, charities, etc, your heirs.

It’s also important to have life insurance * get quotes to pay for your children’s education, food, house payments, burial expense, etc.

California Statutory Sample Will – Just Fill in the Blanks

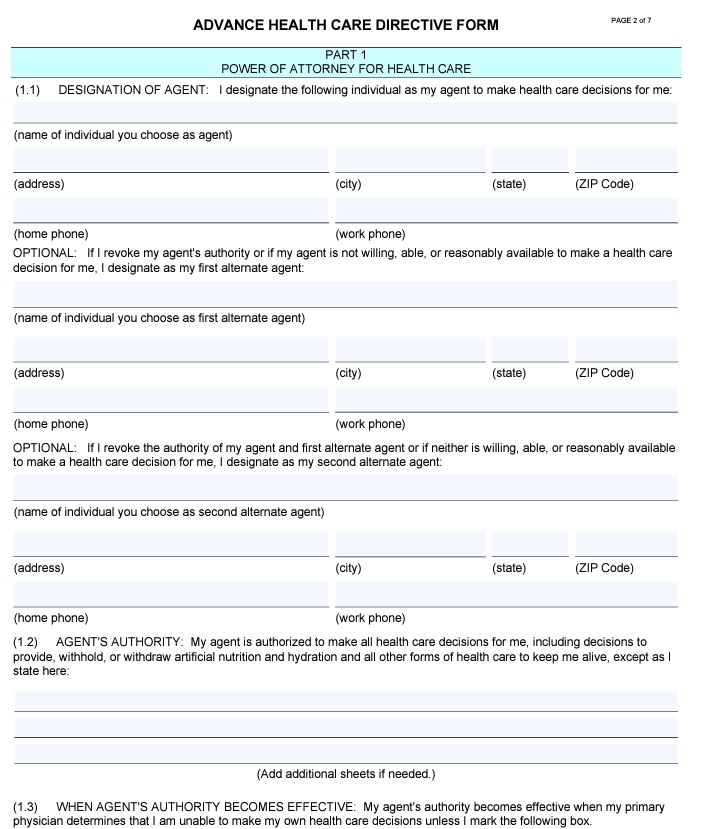

Advance Health Care Directive

QUESTIONS AND ANSWERS ABOUT the

CALIFORNIA #STATUTORY WILL

The following information, in question and answer form, is not a part of the California Statutory Will. It is designed to help you understand about Wills and to decide if this Will meets your needs. This Will is in a simple form. The complete text of each paragraph of this Will is printed at the end of the Will.

1. What happens if I die without a Will?

If you die without a Will, what you own (your “assets”) in your name alone will be divided among your spouse, domestic partner, children, or other relatives according to state law. §6400 – 6414 * Explanation from Nolo.com The court will appoint a relative to collect and distribute your assets.

2. What can a Will do for me?

In a Will you may designate who will receive your assets at your death. You may designate someone (called an “executor”) to appear before the court, collect your assets, pay your debts and taxes, and distribute your assets as you specify. You may nominate someone (called a “guardian”) to raise your children who are under age 18. You may designate someone (called a “custodian”) to manage assets for your children until they reach any age from 18 to 25.

3. Does a Will avoid probate?

No. With or without a Will, assets in your name alone usually go through the court probate process. The court’s first job is to determine if your Will is valid.

A. What about a trust?

4. What is community property?

Can I give away my share in my Will?

If you are married or in a domestic partnership and you or your spouse earned money during your marriage or domestic partnership from work and wages, that money (and the assets bought with it) is community property. Your Will can only give away your one-half of community property. Your Will cannot give away your spouse’s one-half of community property.

IRS Publication 555 on Community Property

5. Does my Will give away all of my assets? Do all assets go through probate?

No. Money in a joint tenancy bank account automatically belongs to the other named owner without probate. If your spouse, domestic partner, or child is on the deed to your house as a joint tenant, the house automatically passes to him or her. Life insurance and retirement plan benefits may pass directly to the named beneficiary. A Will does not necessarily control how these types of “nonprobate” assets pass at your death.

6. Are there different kinds of Wills?

Yes. There are handwritten Wills, typewritten Wills, attorney-prepared Wills, and statutory Wills. All are valid if done precisely as the law requires. You should see a lawyer if you do not want to use this Statutory Will or if you do not understand this form.

7. Who may use this Will?

This Will is based on California law. It is designed only for California residents. You may use this form if you are single, married, a member of a domestic partnership, or divorced. You must be age 18 or older and of sound mind.

8. Are there any reasons why I should NOT use this Statutory Will?

Yes. This is a simple Will. It is not designed to reduce death taxes or other taxes. Talk to a lawyer to do tax planning, especially if

(i) your assets will be worth more than $600,000 or the current amount excluded from estate tax under federal law at your death,

(ii) you own business-related assets,

(iii) you want to create a trust fund for your children’s education or other purposes,

(iv) you own assets in some other state,

(v) you want to disinherit your spouse, domestic partner, or descendants, or

(vi) you have valuable interests in pension or profit-sharing plans.

You should talk to a lawyer who knows about estate planning if this Will does not meet your needs. This Will treats most adopted children like natural children. You should talk to a lawyer if you have stepchildren or foster children whom you have not adopted.

9. May I add or cross out any words on this Will?

No. If you do, the Will may be invalid or the court may ignore the crossed out or added words. You may only fill in the blanks. You may amend this Will by a separate document (called a codicil). Talk to a lawyer if you want to do something with your assets which is not allowed in this form.

10. May I change my Will?

Yes. A Will is not effective until you die. You may make and sign a new Will. You may change your Will at any time, but only by an amendment (called a codicil). You can give away or sell your assets before your death. Your Will only acts on what you own at death.

11. Where should I keep my Will?

After you and the witnesses sign the Will, keep your Will in your safe deposit box or other safe place. You should tell trusted family members where your Will is kept.

12. When should I change my Will?

You should make and sign a new Will if you marry, divorce, or terminate your domestic partnership after you sign this Will. Divorce, annulment, or termination of a domestic partnership automatically cancels all property stated to pass to a former spouse or domestic partner under this Will, and revokes the designation of a former spouse or domestic partner as executor, custodian, or guardian. You should sign a new Will when you have more children, or if your spouse or a child dies, or a domestic partner dies or marries. You may want to change your Will if there is a large change in the value of your assets. You may also want to change your Will if you enter a domestic partnership or your domestic partnership has been terminated after you sign this Will.

13. What can I do if I do not understand something in this Will?

If there is anything in this Will you do not understand, ask a lawyer to explain it to you.

14. What is an executor?

An “executor” is the person you name to collect your assets, pay your debts and taxes, and distribute your assets as the court directs. It may be a person or it may be a qualified bank or trust company.

15. Should I require a bond?

You may require that an executor post a “bond.” A bond is a form of insurance to replace assets that may be mismanaged or stolen by the executor. The cost of the bond is paid from the estate’s assets.

16. What is a guardian? Do I need to designate one?

If you have children under age 18, you should designate a guardian of their “persons” to raise them.

17. What is a custodian? Do I need to designate one?

A “custodian” is a person you may designate to manage assets for someone (including a child) who is under the age of 25 and who receives assets under your Will. The custodian manages the assets and pays as much as the custodian determines is proper for health, support, maintenance, and education. The custodian delivers what is left to the person when the person reaches the age you choose (from 18 to 25). No bond is required of a custodian.

18. Should I ask people if they are willing to serve before I designate them as executor, guardian, or custodian?

Probably yes. Some people and banks and trust companies may not consent to serve or may not be qualified to act.

19. What happens if I make a gift in this Will to someone and that person dies before I do?

A person must survive you by 120 hours to take a gift under this Will. If that person does not, then the gift fails and goes with the rest of your assets. If the person who does not survive you is a relative of yours or your spouse, then certain assets may go to the relative’s descendants.

20. What is a trust?

There are many kinds of trusts, including trusts created by Wills (called “testamentary trusts”) and trusts created during your lifetime (called “revocable living trusts”). Both kinds of trusts are long-term arrangements in which a manager (called a “trustee”) invests and manages assets for someone (called a “beneficiary”) on the terms you specify. Trusts are too complicated to be used in this Statutory Will. You should see a lawyer if you want to create a trust.

21. What is a domestic partner?

You have a domestic partner if you have met certain legal requirements and filed a form entitled “Declaration of Domestic Partnership” with the Secretary of State. Notwithstanding Section 299.6 of the Family Code, if you have not filed a Declaration of Domestic Partnership with the Secretary of State, you do not meet the required definition and should not use the section of the Statutory Will form that refers to domestic partners even if you have registered your domestic partnership with another governmental entity. If you are unsure if you have a domestic partner or if your domestic partnership meets the required definition, please contact the Secretary of State’s office. Sample Will, Q & A on Cal Bar Website * Probate Code §6240

- “Do I Need Estate Planning?”

- Do I need a will? CA State Bar

- Legal Match.com Tell your story, attorneys will review and let you know if they are interested in your case. Many will give 1/2 hour consultation.

CA Statutory #Will

Steve Video on CA Statutory Will

Please excuse the sound quality... it gets better after the first 20 seconds

- Our Webpage on Wills

-

Nolo.com Sample Will 11 page pdf

-

Nolo - Quicken WillMaker & Trust $90

- nolo.com/online-will

- nolo.com/quicken-willmake

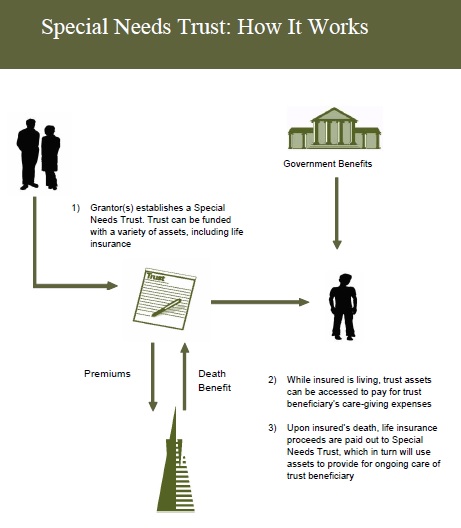

What Parents Need to Know about #Special Needs Trusts

Trans America

Special Needs Trust Brochure

#Nolo Special Needs Trusts

- Get Life Insurance Quote to fund the trust

- Our webpage on Special Needs Trusts

- Social Security Publication 10076 Guide for Representative Payees

- FAQ's

- When does the trust actually get funded, go into place, become effective?

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

- See chapter 2 for what payments and benefits the child can get

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

Where your $$$ goes if you don’t have a will.

-

Rules for if you don’t have a will (Intestate Succession – definition)

- INTESTATE SUCCESSION GENERALLY §6400-6414

- 6400 Any part of the estate of a decedent not effectively disposed of by will passes to the decedent’s heirs as prescribed in this part.

(Enacted by Stats. 1990, Ch. 79.)-

6401. (a) As to community property, [See IRS Publication 555] the intestate share of the surviving spouse is the one-half of the community property that belongs to the decedent under Section 100.

- (b) As to quasi-community property, the intestate share of the surviving spouse is the one-half of the quasi-community property that belongs to the decedent under Section 101.

- (c) As to separate property, the intestate share of the surviving spouse is as follows:

- (1) The entire intestate estate if the decedent did not leave any surviving issue, parent, brother, sister, or issue of a deceased brother or sister.

-

(2) One-half of the intestate estate in the following cases:

-

(A) Where the decedent leaves only one child or the issue of one deceased child.

-

(B) Where the decedent leaves no issue, but leaves a parent or parents or their issue or the issue of either of them.

-

-

(3) One-third of the intestate estate in the following cases:

-

(A) Where the decedent leaves more than one child.

-

(B) Where the decedent leaves one child and the issue of one or more deceased children.

-

(C) Where the decedent leaves issue of two or more deceased children. §6400-6414

-

-

- Unmarried Couples & Wills

- Nolo.com PARENT AND CHILD RELATIONSHIP §6450-6455

- Jewish Law and the Conventional Last Will & Testament

- Our webpage on California Probate

- Our webpage on how to find a Lost Will, escheated funds and lost insurance policies

Find an Attorney

- Legal Match

- Findlaw.com

- American Bar Association

- Attorney Search Network

- Follow the links on this webpage. Many of them go to articles on Attorney Websites

- Also, see our appeals webpage

- Medi Cal Contact

- State Bar of California.com Attorney Referral Service

#Attorney 's --- Social Security Disability maze

- Sellers Law

- Hill & Ponton

- premier disability.com

- Cantrell & Green

-

- We don't necessarily know these attorney's...

- Editorial: Lawyers are fighting innovative proposals for more affordable legal assistance. That’s wrong LA Times 1.30.2022

Estate Planning

- We don't necessarily know these attorney's...

Health Care #Directive

A power of attorney for health care

A Health Care Directive is a written document someone to make health care decisions for you, whereas an individual health care instruction is your written or oral directions for your decisions on health care. Health Directive P.J Hoskins, Esq. Site * Fillable Statutory Form *

The Five Wishes document helps you express how you want to be treated if you are seriously ill and unable to speak for yourself. It is unique among all other living will and health agent forms because it looks to all of a person’s needs: medical, personal, emotional and spiritual. Five Wishes also encourages discussing your wishes with your family and physician.

Five Wishes lets your family and doctors know:

-

Which person you want to make health care decisions for you when you can’t make them.

-

The kind of medical treatment you want or don’t want.

-

How comfortable you want to be.

-

How you want people to treat you.

-

What you want your loved ones to know.

Resources & Links

- ADVANCE HEALTH CARE DIRECTIVE Statutory FORM OAG.CA.Gov

- Simplified Issue, No Medical Exam Life Insurance

- UNIFORM ANATOMICAL GIFT ACT (1987) Wikipedia

- CA State Registry of Advance Health Care Directives

- California DMV information on Organ Donations

- leginfo.legislature.ca.gov/ Health Care Decisions

- ssrplaw.com/ca_stautory_power of attorney.

- nolo.com/power-of-attorney-health-finances

- americanbar.org/power_atty_guide_and_form

- Jewish Law – Halachic Living Will

Health Care Instructions

There are two primary choices of health care instructions used by most people. You can select one of them for inclusion in your health care directive:

(a) Choice Not To Prolong Life

I do not want my life to be prolonged if

(1) I have an incurable and irreversible condition that will result in my death within a relatively short time,

(2) I become unconscious and, to a reasonable degree of medical certainty, I will not regain consciousness, or

(3) the likely risks and burdens of treatment would outweigh the expected benefits, OR

(b) Choice To Prolong Life

I want my life to be prolonged as long as possible within the limits of generally accepted health care standards. this is basically the I want to keep the artificial means going? provision

Other Types of Instructions

Another commonly used instruction is:

RELIEF FROM PAIN:

I direct that treatment for alleviation of pain or discomfort be provided at all times, even if it hastens my death.

Other instructions may be added to reflect your specific wishes. P.J Hoskins, Esq. Statutory Form

Advance Health Care Directive Statutory Form oag.ca.gov

Medicare

Advance Directives

Medicare covers voluntary #advance care planning as part of the yearly “Wellness” visit.

This is planning for care you would want to get if you become unable to speak for yourself. You can talk about an advance directive with your health care professional, and he or she can help you fill out the forms, if you want to. An advance directive is an important legal document that records your wishes about medical treatment at a future time, if you’re not able to make decisions about your care. You pay nothing if it’s provided as part of the yearly “Wellness” visit and the doctor or other qualified health care provider accepts assignment.

Note: Medicare may also cover this service as part of your medical treatment. When advance care planning isn’t part of your yearly “Wellness” visit, the Part B deductible and coinsurance apply.

See also

- our Introduction to Medicare *

- Preventative Care – Wellness Visit

- Bone Density – Osteoporosis

- Glaucoma & Eye Exams

- Mammograms – Breast Cancer

When a loved one dies AIG

Steps to settling an estate

Locating Important Papers

Medicare #Preventative Services & Wellness Visit Publication # 10110

Visit our main webpage on preventative services

Taking Care of yourself – Aging – Long Term Care

Technical on Health Care Directive

CA Dept of Aging – Home & Long Term Care Booklet

Please note, there are updates all the time, double check everything.

#Taking Care of Tomorrow Booklet

NAIC Shoppers Guide to Long Term Care