How is cancer covered under ACA Obamacare, Medi Cal, Denti Cal, Medicare, Dental Plans???

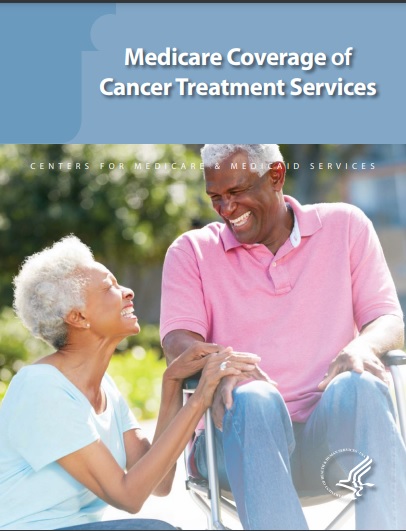

Medicare Coverage of #Cancer Treatment # 11931

- Our FAQ Cancer Experimental Rx

- 15 Cancer Symptoms WebMd.com *

- Some early forms of breast cancer may not need treatment Study says Time.com *

- Visit our webpage on cancer

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

More FAQ’s

More FAQ and Information on Cancer

- New 1-day surgery removes cancer and reconstructs the breast in the same operation ABC News 10.2025 *

- Chemotherapy covered under Part B and not Part D Forbes *

- Cancer patients could save over $7,000 with $2k Cap

- Your rights after a Mastectomy DOL.org *

- Revolutionizing Cancer Care Kaiser Permanante.org *

- Cancer Care Kaiser Permanante.org *

- Prior authorizations mess up cancer care ajmc *

- FAQ on cancer coverage in ACA/Obamacare plans

- Kaiser Health News – Cancer & Medical Debt

- Cancer is top health care premium increaser – Prevention is the best thing to do Kaiser Permanente.org *

- Upcoming Medi Cal Restrictions Could Trigger 1M Missed Cancer Screenings KFF.org January 2026

- HHS finalizes cervical cancer screening coverage rules for insurers Beckers payer.com January 2026

- Update to the Women’s Preventive Services Guidelines Federal Register.gov

- Our webpage on Medical Necessity

- ESMO Clinical Practice Guideline for the diagnosis, staging and treatment of patients with metastatic breast cancer

- Chemotherapy (Medicare.Gov)

- Mammograms

- Comparison of Treatment Costs for Breast Cancer, by Tumor Stage and Type of Service

- Cancer Care.org

- How Cancer Treatment Is Improving for People Living in Rural Areas Healthline.com 5.19.2022

- Medicare Dental Care

- Why Are So Many Young People Getting Cancer? It’s Complicated Time.com

- Mental Health Toll cancer takes Kaiser Permanante.org

- How to support an employee with cancer Kaiser Permanente.org *

- Normalizing cancer conversations in the workplace Kaiser Permante.org *

- Professor Longo’s New Book: “Fasting Cancer”

Part B & D Rx Coverage for Cancer

- Medicare covers chemotherapy if you have cancer.

- Medicare Part A (Hospital Insurance) covers it if you’re a hospital inpatient.

- Medicare Part B (Medical Insurance) covers it if you’re a hospital outpatient or get services in a doctor’s office or freestanding clinic.

- Your costs in Original Medicare

- If you get Part-B covered chemotherapy in a hospital outpatient setting, you pay a copayment.

- For chemotherapy given in a doctor’s office or freestanding clinic, you pay 20% of the Medicare-approved amount after you meet the Part B deductible. Learn More >>> Medicare.Gov

- MEDICARE DRUG COVERAGE UNDER PART A, PART B, AND PART D

- Medicare Part B (Medical Insurance) covers a limited number of outpatient prescription drugs under certain conditions.

Usually, Part B covers drugs you wouldn’t typically give to yourself, like those you get at a doctor’s office or in a hospital outpatient setting.

Here are some examples of Part B-covered drugs: Learn More>>>Medicare.Gov

- ncoa.org/ what-does-medicare-cover-for-cancer/

- Medicare Part B (Medical Insurance) covers a limited number of outpatient prescription drugs under certain conditions.

- medical news today.com/chemotherapy#coverage

- Intravenous immunoglobulin (IVIg) treatment can help you fight off infections if you have a weakened immune system or other diseases.

- Part D Rx Prescriptions

ACA Coverage – Misc.

What ACA/Obamacare plan – Metal Level has the “best” most diverse Comprehensive coverage For #breast cancer care

- Cancer costs for Americans with private health insurance rose after the ACA rollout and fell for those with Medicaid – Medi Cal Read more>>>> The Conversation.com

- ACA/Obamacare pretty much made the coverage for all plans and all companies, exactly the same. It’s a function of Metal Levels, Platinum, Gold, Silver & Bronze. Silver 73, 87 & 94 are only available if your income is low. Get a quote to see.

- There are 10 essential benefits under ACA/Obamacare. Namely:

- (H?) Cancer and other life threatening disease – clinical trials

- CA Essential Benefits

- Prescription Rx Formularies All Companies

- Options are few for poor cancer patients Many under Medi-Cal cannot get the best of care, even when it’s a matter of life or death.

- Chemotherapy medications for breast cancer include:

- Abraxane (chemical name: albumin-bound or nab-paclitaxel)

Adriamycin (chemical name: doxorubicin)

carboplatin (brand name: Paraplatin)

Cytoxan (chemical name: cyclophosphamide)

daunorubicin (brand names: Cerubidine, DaunoXome)

Doxil (chemical name: doxorubicin)

Ellence (chemical name: epirubicin)

fluorouracil (also called 5-fluorouracil or 5-FU; brand name: Adrucil)

Gemzar (chemical name: gemcitabine)

Halaven (chemical name: eribulin)

Ixempra (chemical name: ixabepilone)

methotrexate (brand names: Amethopterin, Mexate, Folex)

Mitomycin (chemical name: mutamycin)

mitoxantrone (brand name: Novantrone)

Navelbine (chemical name: vinorelbine)

Taxol (chemical name: paclitaxel)

Taxotere (chemical name: docetaxel)

thiotepa (brand name: Thioplex)

vincristine (brand names: Oncovin, Vincasar PES, Vincrex)

Xeloda (chemical name: capecitabine)

- Abraxane (chemical name: albumin-bound or nab-paclitaxel)

- Check out these comparisons of major claims by metal level.

- Should I buy extra Insurance for Cancer?

FAQ’s

- How would gum cancer be treated? Do you need dental coverage or health coverage?

Our Other Webpages, Resources & Links on Cancer

- Shop Medicare Rx Plans & Part B Cancer

- Cervical cancer treatment

- Cancer screening tests

- Cancer clinical trials

- Prostate cancer treatment

- Cancer and other life threatening disease – clinical trials

- Medical Necessity — Clinical Guidelines

- Colorectal Cancer Screening (CG024) English PDF

- USA Today – Health insurer delayed her MRI. Meanwhile, the cancer that would kill her was growing. Delays in health care are not unusual. Insurance companies control access to tests and procedures through a process known as prior authorization.

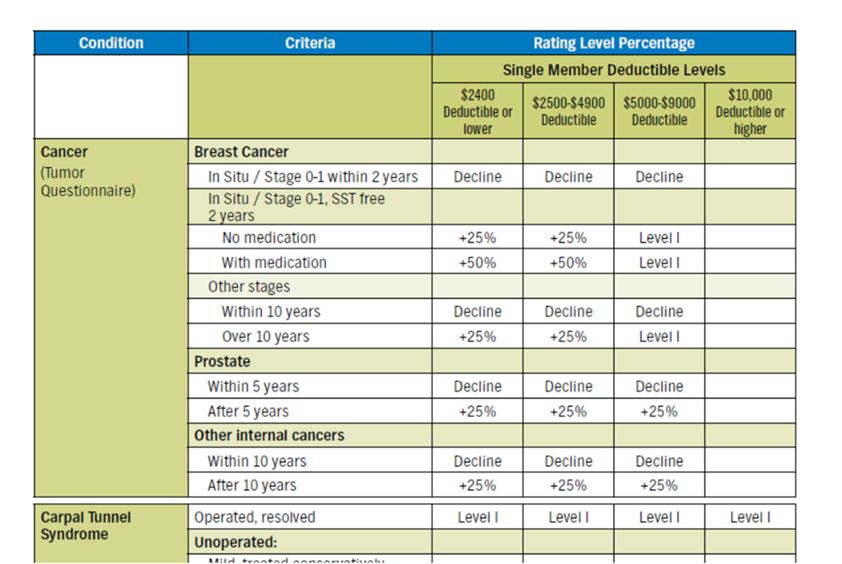

- Life Insurance – Rated Policies

- Cancer Patients Endure Debt on Top of Disease

- After a cancer diagnosis, how do you tell your kids, relatives, friends and coworkers?