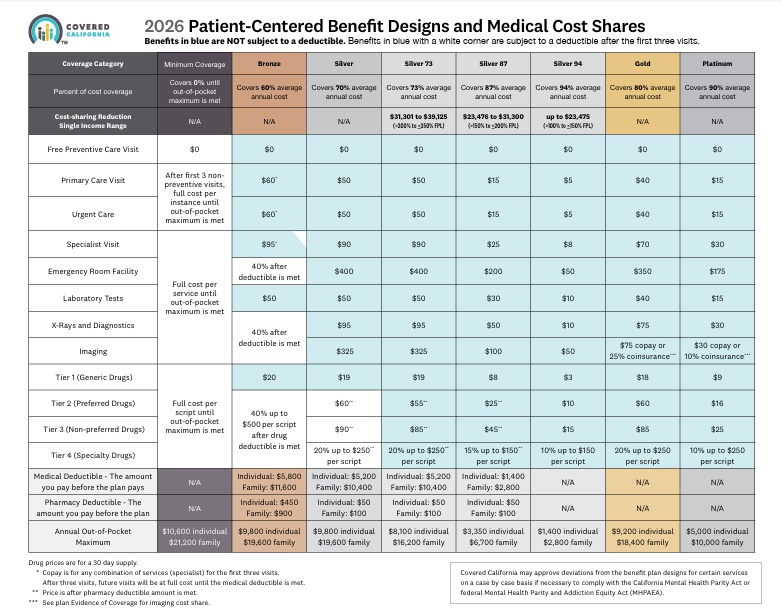

- 2026 Covered California 2026 Patient-Centered Benefit Plan Designs Final Approval 7/28/2025

- Get Instant Quotes & Subsidy Calculation

- Covered CA bulletin on new and improved Enhanced Silver CSR Cost Sharing Reduction

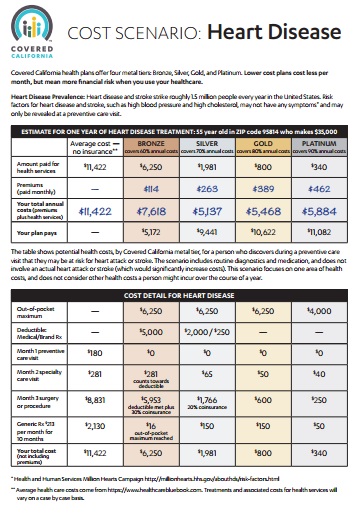

- Do you think your medical bills will be higher or lower than average for your age & zip code?

- Expected Payout (AV)

- MLR Medical Loss Ratio

- Bronze 60%

- Out-of-Pocket Pain From High-Deductible Plans Means Skimping on Care Kff 12/2025 *

- Enhanced Silver 70% - 94% Gold 80% Platinum 90%

- Metal Levels are based on Expected Claims Payment - that is the actuarial value (AV).

- Renewal Tool Kit

- Patients often can’t afford to pay off what their insurance leaves behind

- This is one way Health Care Reform hopes to make shopping and comparing Instantly - easier. So, if you get a lower priced plan with less or fewer benefits, co-pays, deductibles you simply pay more when you have a claim. Don't worry, there is a stop loss - maximum out of pocket OOP, of say $7k so that you won't break the bank.

- Lessons from the ACA: Simplifying Choices to Optimize Health Coverage 12/2025 Commonwealth Fund *

- All plans cover the 10 Federal essential benefits and CA mandated benefits.

- Team Trump’s Answer to Ballooning Obamacare Premiums: Less Generous Coverage KFF.org *

- Our main webpage on Metal Levels

#Examples of how claims get paid by Metal Level

There is no free lunch, it’s all a function of the Medical Los Ratio.

- What is your ability to pay a higher deductible or any deductible and co pay?

- Get a quote quotit.net/

Contact Us - Ask Questions - Get More Information

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Video’s

- What are the four metal levels? VIDEO

- Steve Explains Enhanced Silver – CSR Cost Sharing Reductions VIDEO

- Explanation of the Rate Difference for Silver between Covered CA and direct – Plain English

- Summary of the litigation

- How to find plan that fits budget VIDEO

- what plan to take if you know you will have a BIG surgery or expense coming up VIDEO

- Maximum OOP Out of Pocket? VIDEO

- View our webpage on OOP Maximum Out of Pocket

- Understanding Health Care Costs Health Net VIDEO

All our Health plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

Watch our 10 minute VIDEO

that explains everything about getting a quote

-

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

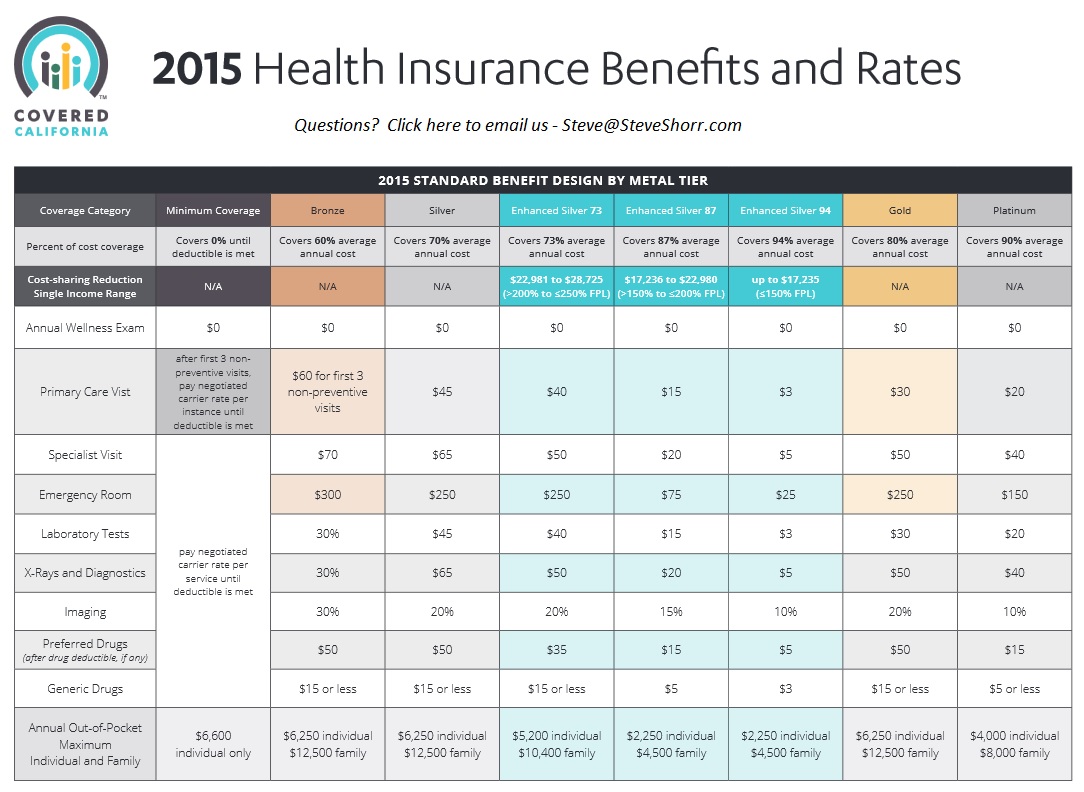

What are Covered California standard benefit designs?

- Health insurance plans must follow Covered California’s standard benefit designs.

- With standardized benefits, consumers can accurately compare health insurance plans, because the benefits are the same for all plans offered in the Covered California marketplace. Additionally, standardizing benefits ensures that the selected health insurance plans define what the consumers get and limit the consumer’s out-of-pocket costs by type of service.

- I agree it will stifle innovation, so do you want same o same o or to be able to get a plan that fits your needs. On the other hand isn’t it just a mathematical calculation to see what the actuarial value and essential benefits is?

§156.140 Metal Levels of coverage.

Code of Federal Regulations

- (b) The levels of coverage are:

- (1) A bronze health plan is a health plan that has an AV of 60 percent.

- (2) A silver health plan is a health plan that has an AV of 70 percent.

- (3) A gold health plan is a health plan that has an AV of 80 percent.

- (4) A platinum health plan is a health plan that has as an AV of 90 percent.

- get quotes

Copied from Facebook Post

Rick Sanders

I had quadruple bypass in 2014 had a covered California bronze plan it cost me 6200.00 I picked my doctor and hospital, Best system in the world by far