“Family Glitch” Update

Covered California Subsidies if your

Employer offers “Affordable Health Coverage?”

Covered CA.com Family Glitch Fixed

Affordability Tool Covered CA.com

Do you or your spouse have (Family Glitch) Employer Coverage Available?

- New Family Glitch Rule! CMS

- You could enroll in the affordable 9.96% HealthCare.gov** Covered CA Affordability Calculator job-based coverage,

- while your spouse APTC/CSR Subsidy -eligible family members enroll in a Covered CA plan.

- keep in mind that:

- This may mean they need to meet multiple deductibles and would have separate out-of-pocket maximums for each policy.

- The separate plans may have different provider networks and coverage for prescription drugs.

- Mus update your Covered CA Application Agent Broker FAQ *

- You could enroll in the affordable 9.96% HealthCare.gov** Covered CA Affordability Calculator job-based coverage,

- More information for newly eligible for savings (Offers of Employer Coverage) on Covered CA plans?

- Special Enrollment Period (SEP) if your job-based coverage affordability changes outside of the annual Open Enrollment Period? CMS *

- Family Glitch Covered CA Tool Kit

- Navigating the Family Glitch Fix: Hurdles for Consumers with Employer-sponsored Coverage KFF

- 10 Quick Facts About the New IRS Final Health Premium ‘Family Glitch’ Regs

- Federal Register – 36 B

- Our webpage on Covered CA Subsidies…

- Get Instant Quotes!

- JUMP TO SECTION ON:

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

FAQ?

The definition of Household Income & Taxpayer Family

#Household.income means Code of FEDERAL Regulations – IRS Income Taxes – 1.36B 1 – (e) …(1)

(d) … A taxpayer’s family means the individuals for whom a taxpayer properly claims a deduction for a personal exemption under section 151 for the taxable year.

Family size [Medi-Cal Household Size Flow Chart ♦ Blog – Insure Me Kevin.com] means the number of individuals in the family. Family and family size may include individuals who are not subject to or are exempt from the penalty [mandate] under §5000 A (f) (1) for failing to main

Minimum Essential Coverage which includes most Group Employer Plans

IRS Interactive Tool says OK see video

Affordability and minimum value.

Even if you had the opportunity to enroll in coverage offered by your employer that qualifies as MEC, [Minimum Essential Coverage which includes most Group Employer Plans ] you are considered eligible for an employer-sponsored plan (and cannot get the PTC [subsidies] for your coverage in a qualified health plan) only if the employer-sponsored coverage is affordable (defined later) and the coverage provides minimum value (defined later).

Your tax family members may also be unable to get the PTC for coverage in a qualified health plan for months they were eligible to enroll in employer-sponsored coverage offered to them by your employer but only if the coverage qualifies as MEC and was affordable and provided minimum value for you. In addition, if you or your family member enrolls in the employer coverage that qualifies as MEC, the individual enrolled cannot get the PTC for coverage in a qualified health plan, even if the employer coverage is not affordable or does not provide minimum value IRS Publication 974 page 11 *

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

Tax #Estimators

- turbo tax.com - FREE for simple returns

- H & R Block

- E file.com

- Estimate the Subsidy for Health Insurance, benefits, premiums, etc.

- 8962 ONLINE Calculator

- Our webpage on 8962 Premium Tax Credit Reconciliation

- Tax Form Calculator.com

- e tax.com

- Marriage Higher or Lower Taxes?

ACA What You Need To Know #5187 (2020) is the most recent

- VITA - Volunteers to help you

- Publication 17 - Your Federal Income tax

- Health Savings Accounts HSA our webpage

Federal IRS #Form8962 Reconciliation Form for Covered CA Subsidies

attaches to IRS 1040 it all comes out when you file taxes!

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- See below or visit our 8962 Webpage for more information

- MAGI AGI Income, what is it our webpage?

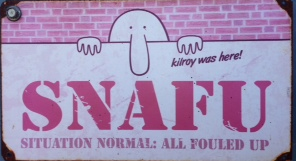

#SNAFU - Situation Normal - All Fouled Up

I learned the word SNAFU Situation Normal, All Fouled Up in the dorm, when I attended San Diego State in the early 70's and earned a degree in Insurance. In all that time, I've never been able to use the word in a sentence, until last 10.1.2013, when Covered CA.com, Health Care.Gov nor the Insurance Company Websites or my own Quote Engine that I pay around $250/month for were supposed to launch, but did not do it properly.

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote