“Family Glitch” Exemption – Biden

Covered California Subsidies if your

Employer offers “Affordable Health Coverage?”

Employer Coverage Available?

New rules for subsidies when someone in the Family – Household is offered Employer Coverage KNH *

Resources, Links & Q & A

- What can agents or brokers do to help prepare their clients who may be newly eligible for savings (Offers of Employer Coverage) on Covered CA plans?

- What are an employee’s options if their job-based coverage offer is affordable for them, but is not affordable for their family members?

- Option 1:

- The employee could enroll in their affordable job-based coverage, while their APTC/CSR-eligible family members enroll in a Marketplace plan. In this situation, agents and brokers should advise their clients to keep in mind that:

- This may mean they need to meet multiple deductibles and would have separate out-of-pocket maximums for each policy.

- The separate plans may have different provider networks and coverage for prescription drugs.

- If a consumer has already submitted an application with both the employee and their family members as applicants and wishes to pursue this split coverage option, they will need to update their application so that the employee is no longer seeking coverage in order to enroll only the employee’s family members (and not the employee) in a Marketplace plan. The consumer should report a life change and update the application so that the employee is included on the Marketplace application, but indicates they aren’t applying for coverage for themselves. Agent Broker FAQ *

- The employee could enroll in their affordable job-based coverage, while their APTC/CSR-eligible family members enroll in a Marketplace plan. In this situation, agents and brokers should advise their clients to keep in mind that:

- Will my client be eligible for a Special Enrollment Period (SEP) if their job-based coverage affordability changes outside of the annual Open Enrollment Period?

- Covered CA Tool Kit

- IRS FAQ’s on Shared Responsibility – Mandate – Penalties

- 8% Affordability Rule – Exemption Form #8965?

- Relief for Crippling Employer Health Insurance Premiums – Covered California

- Navigating the Family Glitch Fix: Hurdles for Consumers with Employer-sponsored Coverage KFF

- President Biden statement

- 10 Quick Facts About the New IRS Final Health Premium ‘Family Glitch’ Regs

- Federal Register – 36 B

- Mandate Penalty California – MEC – QHP – 5000 A for Individuals & Families

- JUMP TO SECTION ON:

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

Tax #Estimators

#SNAFU - Situation Normal - All Fouled Up

I learned the word SNAFU Situation Normal, All Fouled Up in the dorm, when I attended San Diego State in the early 70's and earned a degree in Insurance. In all that time, I've never been able to use the word in a sentence, until last 10.1.2013, when Covered CA.com, Health Care.Gov nor the Insurance Company Websites or my own Quote Engine that I pay around $250/month for were supposed to launch, but did not do it properly.

More Explanation of Minimum Value & Affordability

Under the law, those workers whose employers offer “affordable coverage” will not be eligible for subsidies in the exchanges. To be eligible, per the law’s definition, the cost of employer-based health insurance must exceed 9.61% of the worker’s household income. In January 2013 the Internal Revenue Service (CFR 1.36 B 2) ruled that only the cost of covering the individual employee would be considered in determining whether the cost of coverage exceeded 9.5% of income.

Metal Levels – Bronze 60% Actuarial Value –

#Minimum.Value Definition ==>An employer-sponsored plan provides minimum value if it covers at least 60 percent of the total allowed cost of benefits that are expected to be incurred under the plan. AKA Bronze Plan

See Notice 2014-69 for additional guidance regarding whether an employer-sponsored plan provides minimum value coverage if the plan fails to substantially cover in-patient hospitalization services or physician services IRS.gov * Covered CA Bulletin page 2 * Our Ben E Lect Webpage * Employer is mandated to tell you 1095 C * IRS Notice 2012-31 *

Citations & Details

Example 2. Basic determination of affordability for a related individual. The facts are the same as in Example 1, except that C is married to J and X’s plan requires C to contribute $5,300 for coverage for C and J for 2014 (11.3 percent of C’s household income). Because C’s required contribution for self-only coverage ($3,450) does not exceed 9.5 percent of household income, under paragraph (c)(3)(v)(A)( 2 ) of this section, X’s plan is affordable for C and J, and C and J are eligible for minimum essential coverage for all months in 2014 CFR §1.36 B 2 Eligibility for Premium Tax Credit

However, the cost of a family plan is often higher, but the ruling means that those higher costs will not be considered even if the extra premiums push the cost of coverage above the 9.5% income threshold. The New York Times said this could leave 2–4 million Americans unable to afford family coverage under their employers’ plans and ineligible for subsidies to buy coverage elsewhere.[136][137] Wikipedia

Alternatives – Solutions?

One possible solution to the Family Issue would be to have the Employer get a program thru the SHOP exchange, Kaiser Direct or check with us [email protected] many other companies may do it, exclude dependents, then they are NOT eligible and can then select “None of the Above” and get subsidies based on household income.

Insure Me Kevin.com Explanation 9.29.2015

Self Employed Health Care Deduction?

FAQ?

Question

What about an adult child under 26 * filing their own taxes, are they subject to affordability rule, being as they could go on the parents policy?

Are they a member of the household?

Dependent?

Answer

We are not authorized to give tax advise, however check out:

The definition of Household Income & Taxpayer Family

#Household.income means Code of FEDERAL Regulations – IRS Income Taxes – 1.36B 1 – (e) …(1)

(d) … A taxpayer’s family means the individuals for whom a taxpayer properly claims a deduction for a personal exemption under section 151 for the taxable year.

Family size [Medi-Cal Household Size Flow Chart ♦ Blog – Insure Me Kevin.com] means the number of individuals in the family. Family and family size may include individuals who are not subject to or are exempt from the penalty [mandate] under §5000 A (f) (1) for failing to main

IRS Tools and Publication 974 Premium Tax Credit See Page 5 for chart on who can take premium tax credit.

Minimum Essential Coverage which includes most Group Employer Plans

IRS Interactive Tool says OK see video

Affordability and minimum value.

Even if you had the opportunity to enroll in coverage offered by your employer that qualifies as MEC, [Minimum Essential Coverage which includes most Group Employer Plans ] you are considered eligible for an employer-sponsored plan (and cannot get the PTC [subsidies] for your coverage in a qualified health plan) only if the employer-sponsored coverage is affordable (defined later) and the coverage provides minimum value (defined later). Your tax family members may also be unable to get the PTC for coverage in a qualified health plan for months they were eligible to enroll in employer-sponsored coverage offered to them by your employer but only if the coverage qualifies as MEC and was affordable and provided minimum value for you. In addition, if you or your family member enrolls in the employer coverage that qualifies as MEC, the individual enrolled cannot get the PTC for coverage in a qualified health plan, even if the employer coverage is not affordable or does not provide minimum value IRS Publication 974 page 11 *

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Videos on how great agents are

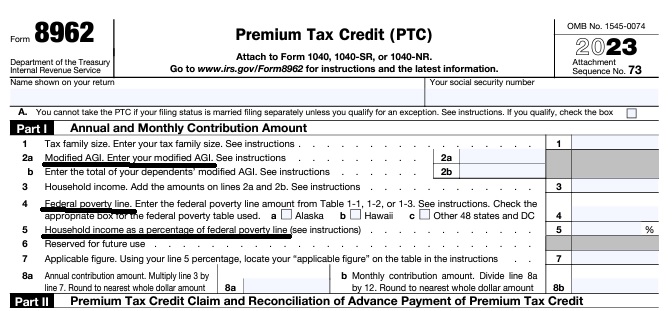

Federal IRS #Form8962 Instructions Premium Tax Credit

Reconciliation Form for Covered CA Subsidies attaches to 1040

Subsidy is IMHO hocus pocus - smoke & mirrors

it all comes out when you file taxes!

-

Introduction

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- Instructions for IRS Form #8962 Subsidy Reconcilation

- Tracking Your Covered California Subsidy on your 1040 Federal Tax Return Insure Me Kevin.com

- ARPA & Inflation Reduction Act of 2022

- Instead of increasing taxpayer audits, policymakers should simplify taxes across the board. That way, it would be easier for everyone to pay the correct amount to the government. heritage.org/who-those-87000-new-irs-agents-would-audit

- That 87,000 new tax agents estimate represents everything from IT techs to customer service people who answer the phone and help you file your return. Second, it includes attrition. So, the actual enforcement personnel is 5,000 LA Times * Mother Jones

- IRS backlog hits nearly 24 million returns, further imperiling the 2022 tax filing season

- ARPA Stimulus - you don't have to pay back 2020 overage on subsidies IRS.Gov *

- InsureMeKevin.com on subsidies & pay backs... 1.25.2022 update ARPA and 600% CA

- 1040 Instructions

- Overview FTB site

- How to Reconcile Subsidies FTB

- Calculate Pay Back

- Assistance Repaying California Subsidies

- covered ca.com/the most you might have to pay back

- 2022 Insure Me Kevin.com

- Our webpage on Form 8962 - Premium Tax Credit Subsidy Reconciliation

Historical

Exemption

If your employer health plan offers you affordable coverage and it has

-

- “minimum value [Bronze 60%]” and

- your contribution is less than 9.61% of income for employee SELF ONLY in 2022 SHRM * (CFR 1.36 B 2 * ThomsonReuters * Revenue Procedure 2018-34 * Revenue Procedure 2014-62) * Western Poverty Law * Health Care.gov * Publication 974 * Revenue Procedure 2020-36 * Covered CA *

neither you or your dependents – family qualifies for the APTC Advance Premium Tax Credit-subsidy from Covered CA, Health Care.Gov or any exchange. Covered CA FAQ

FLASH!!!

Biden admin plots to fix Obamacare’s ‘family glitch,’ expand coverage

The move would target loophole that keeps about 5 million people from qualifying for subsidized health plans Politico 4.4.2022 *

The Treasury Department and the Internal Revenue Service are proposing to eliminate the “family glitch.” Should today’s proposed rule be finalized, family members of workers who are offered affordable self-only coverage but unaffordable family coverage may qualify for premium tax credits to buy ACA coverage. White House.gov Fact Sheet * The rule would begin to take effect beginning Jan. 1, 2023, if enacted, and Americans will be able to sign up to get financial assistance during the next open enrollment period. ABC News *

Resources & Links

- time.com/biden-affordable-care-act-family-glitch

- whitehouse.gov/2021/01/28/executive-order-on-strengthening-medicaid-and-the-affordable-care-act

- whitehouse.gov/2022/04/05/fact-sheet-proposes-rule-to-fix-family-glitch-and-lower-health-care-costs

- Kaiser Foundation – ACA Family Glitch & Affordability of Employer Coverage

- Proposed Rule – Federal Register

- chcf.org/biden-administration-proposes-fix-family-glitch

- seattle times.com/glitch-may-soon-be-fixed

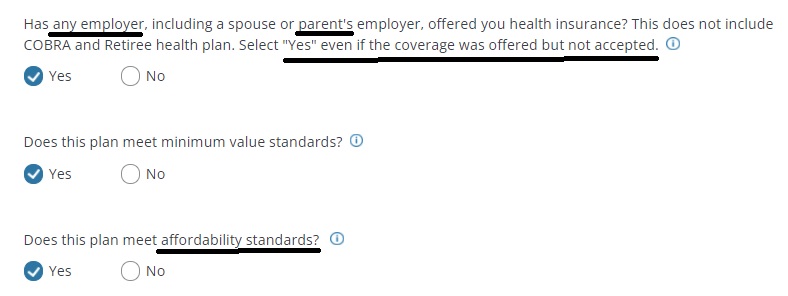

Here’s the questions the Covered CA Application asks…

This employee only contribution percentage is all the Employer Shared Responsibility Mandate Provision requires to avoid penalties for employers with over 50 employees.

It doesn’t matter if covering your whole family coverage would go over the 9.83% limit. That just the way the law and rulings work. Some call this the “Family Glitch.”

There is some talk about fixing this SNAFU, but it would likely involve changing the eligibility calculation for marketplace subsidies — pegging the affordability standard to the coverage cost of the whole family rather than just an individual’s coverage. Doing so would increase federal spending by about $9 billion or $10 billion, since many more people would qualify for subsidies. CA Health Line *

Note that if rates increase or employer contribution lowers, that may trigger a special enrollment period, rather than wait for open enrollment.

See also the 8% rule if you want an exemption from the individual mandate or permission to get a catastrophic – minimum coverage plan.

Cal Choice Premium Affordability Calculator

Note also, that ARPA the 2021 American Rescue Plan limits your family contribution to 8.5% for all income limits – Income Chart – Premium, Benefit & Subsidy calculator.

Resources & Links

- coveredca.com/employer-coverage-and-financial-help

- Job Aid Income Section

- Commonwealth Fund – Eliminating the family glitch

- FAQ on how employer might eliminate coverage for dependents to avoid “Family Glitch“

Process to fix Family Glitch

https://www.commonwealthfund.org/blog/2025/proposed-rule-will-make-consumers-pay-more-health-insurance-and-care-aca-marketplaces

My wife and I are covered under my companies insurance, but are wondering if covered cal. would be less.

Our combined income is around $90,000.00 a year.

Please provide what the cost for insurance would be if we switched.

Besides income and family size, Income Chart, rates go by zip code and your age.

Here’s our instant quote engine

See above about the family glitch and the questions Covered CA asks if you have employer coverage available.

Let us know what employer coverage you have and what your contribution is and we can see if you’re eligible or not. Our email is encrypted and we have confidential upload.

How is this rule enforced? I don’t see any place on my tax return 1040 or #8962 Premium Tax Credit asking about if coverage was offered to my whole family, at a ridicules’ price?

Here’s the reply we got from Covered CA on 1.27.2020

Maybe the IRS would know if they match up the 1095’s A Individual **** B Employer?

Here’s a bulletin we just got today on a proposed CMS rule:

end automatic enrollment for low-income exchange enrollees who receive $0 premium plans with tax credits.

automatic re-enrollment may lead to incorrect expenditures of (advanced premium tax credit), some of which cannot be recovered through the reconciliation process due to statutory caps.

health insurers to implement copay accumulator programs to prevent drug manufacturer coupons from going toward a patient’s annual limit on out-of-pocket costs when a generic drug is available.

Am I eligible for a subsidy if I elect and am on COBRA coverage?

Even if I have a poverty-level income for the year?

I don’t know why you would want to have COBRA and a Covered CA plan. Seems like too much expense on premiums and you would probably not be able to collect twice – Dual Coverage Rules – Coordination of Benefits.

Here’s our page on how to determine if you are eligible for the premium subsidy. How does the full premium for COBRA compare to 9.86% of your MAGI income?

While you were employed and your employer paid the premium for group health coverage, those months you probably won’t qualify for the subsidy. When you file IRS form #8962, that when the IRS will reconcile everything. Note too that changes are mandated to be reported within 30 days.

I’m not sure what you mean by poverty level. If you’re expected MAGI income is less than 138% of Federal Poverty Level, see chart, then you would not qualify for subsidies, but for Medi Cal. We don’t get paid to help you with Medi Cal. When you report your income to Covered CA as mandated, if Covered CA thinks you qualify, they will notify Medi Cal. Medi Cal will then finish up the investigation to see if you qualify.

My wife, son (age 11) and I have marketplace – Covered CA Oscar insurance this year. The premium is $175/month after ACA subsidy based on projected 2018 income of $75k for 3-person household.

My employer just offered us medical insurance, which means family glitch. However, there is no employer contribution to the premium for my dependents.

Can I get a hardship exemption and get catastrophic minimum coverage for my dependents?

What you are asking is way more complicated than it sounds.

Here’s what sounds like the relevant exemptions:

Coverage considered unaffordable—The required contribution is more than 8.16% of your household income.

Please enter your information, so that we can see what you have to pay for coverage.

Aggregate self-only coverage considered unaffordable—Two or more family members’ aggregate cost of self-only employer-sponsored coverage was more than 8.16% of household income, as was the cost of any available employer-sponsored coverage for the entire family.

Coverage considered unaffordable based on projected income—The Marketplace determined that you didn’t have access to coverage that is considered affordable based on your projected household income.

How is affordable coverage defined?

Coverage is considered unaffordable for individuals if their cost of coverage exceeds 8 percent of annual household income.

If an individual is eligible for employer coverage, affordability is determined by comparing the “employee share” of the premium cost of self-only coverage for the employer’s cheapest coverage option that achieves minimum value (i.e., 60% actuarial value) to the taxpayer’s household income.

If the individual is not eligible for employer coverage, affordability is determined by comparing to household income the lowest cost bronze plan (taking into consideration any applicable federal premium subsidies) offered in the Exchange where the individual would purchase coverage. BCBCM.com

Even considering all that, does the premium difference between bronze and catastrophic make sense to do all the paperwork and hassle?

One way to eliminate the Family Glitch

You might ask your employer to change his rules and not allow any dependents on the plan, as he’s not making any contribution anyway. Then you wouldn’t have the “family glitch.” Read above carefully for the citation.

Affordability “Glitch”: This is only applicable to individuals that have an offer of coverage from their spouse’s employer. copied from Covered CA memo 1.31.2014

See more on our Employer Covered CA SHOP webpage

What if the employer doesn’t offer family coverage?

Some employers offer coverage for employees only, or for employees and their children, and do not offer spousal coverage. Large employers will face a penalty for failing to offer coverage to full-time employees and their children under the age of 26 if at least one employee receives a premium tax credit for marketplace coverage. There is no penalty for failure to offer coverage to the employee’s spouse. If no plan offered by the employer covers the spouse or children, the spouse or children may purchase insurance in the Marketplace and qualify for premium tax credits, assuming all other eligibility rules are met.

Example

It’s a new plan year and Jose’s employer has changed its coverage options. Now, Jose’s employer offers employee-only and employee-plus-children coverage. They’ve dropped the family coverage option so Alma no longer has an offer of coverage. Employee-only insurance costs $2,500 per year (7.1 percent of income) and coverage for the employee plus children costs $4,500 per year (12.8 percent of income). The “employee plus children” option is considered affordable, even though it costs more than 9.56 percent of income, because Jose’s employee-only insurance is affordable. This means that Jose and his children are not eligible for premium tax credits, whether or not they accept this coverage option. Alma doesn’t have an offer of coverage through her own or Jose’s employer so she may be eligible for premium tax credits to purchase coverage in the marketplace. Health Reform Beyond the Basics

Here’s how an Insurance Company might ask the question on their Employer Application…

See also https://insuremekevin.com/helping-small-group-dependents-get-covered-california-tax-subsidy/

My employer will be providing a MEC – Minimum Essential Coverage plan through https://theamericanworker.com/ or Ben E Lect

Does that keep me from the individual mandate penalty?

If I don’t feel the coverage meets my needs, can I still get subsidies from Covered CA?

See the information above on “minimum value.”

The American Worker website states that MEC is not minimum value, thus one would still be eligible for Covered CA subsidies.

MEC [Minimum Essential Coverage] plans help employers meet one of the Employer Mandate penalties. By offering this level of qualifying coverage, employers will meet the requirement of offering “qualifying” coverage but not the requirement of “affordable” coverage. Employers must offer a Minimum Value Plan that meets the 60% Actuarial Value rule [Bronze] and affordability rules in order to avoid a $3,390 tax penalty for each employee who enrolls in a plan from the Exchange and receives a tax subsidy.

See our webpage on budget plans for employers over 50 lives to avoid the tax penalties.