HSA Health Savings Account – lower premiums and Tax Deductions?

Introduction to Health Savings Accounts HSA

- Health Savings Accounts (HSA’s) IRC 223 * allow you to save money, premium & Federal taxes but apparently not CA taxes, by getting a qualified Silver or Bronze high-deductible health Insurance plan (HDHP).

- (FAQ What is a high deductible plan)

- Trump Big Beautiful Bill any Bronze or Catastrophic plan is considered an HDHP plan HSA Bank

- Our webpage on Trump Great Healthcare Plan – Promoting Subsidies go to your HSA, NOT the Insurance Company!

- FYI Covered CA Countable Sources of Income

.

- So, no, generally a grandfathered plan won’t do that. High deductible Bronze plans have lower premiums than say Silver, Bronze or Platinum. See button below for a proposal. Premiums vs co pays, deductibles etc, are a function of the MLR Medical Loss Ratio, where Insurance Companies are mandated to pay 80c and 85c of every dollar in premium in claims or pay rebates. So, if you don’t think you’ll have tons of low end claims, an HSA might be the thing for you.

- See Introduction in the HSA Guidebook for a simple explanation.

- Sterling Administration You Tube Video Help! What exactly is an HSA Health Savings Account?

- You can put in – deposit any amount at any time, up to the contribution limits. You don’t have to put in deposits if you don’t feel like it. Best of all, you can put in a deposit, just before you pay any part of your deductible.

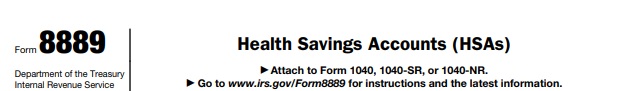

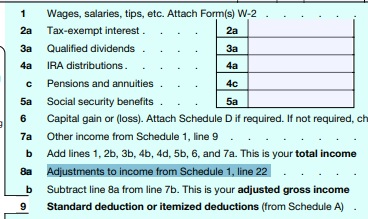

- The contribution to your HSA is tax deductible, lowers your Adjusted Gross Income on line 25 of 1040 with Form 8889 attached. Graph of savings.

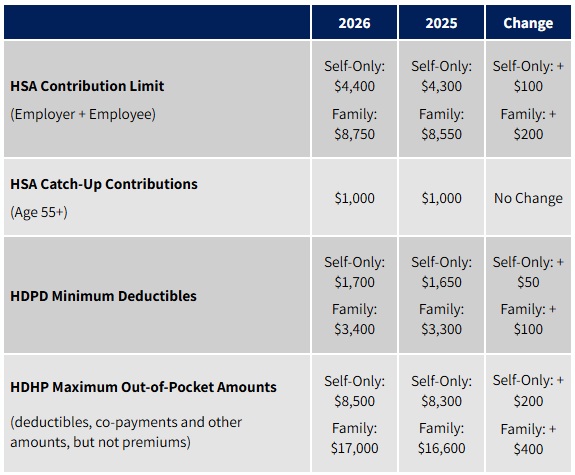

- You can withdraw from your HSA tax free any allowable medical expenses (IRS Publication 502, Internal Revenue Code (IRC) §213 [d])) Aetna even some Health Insurance Premiums through your HSA bank account – debit card. The maximum contributions Wells Fargo * IRS * SHRM * are in the table below. If you are over age 55 an additional $1k can be deposited. An HSA is very similar to an IRA, except that it is for medical expenses.

- When you retire, the money in your account can still be used for medical and some Insurance Premiums, without paying taxes. Check out this article on why you need an emergency fund.

- Without an HSA or having an EmployER sponsored plan, medical expenses are not usually deductible unless they are more that 10% PPACA 9013 of adjusted gross income IRS Publication 969.PDF California tax* IRS publication 502 * Here’s an FAQ on having an Employer Sponsored HSA. Often though Employer’s prefer richer plans – Los Angeles Times.

- One might also consider a supplemental accident plan to cover the deductible in a Bronze HSA Plan.

- ACA Health Reform does not appear to have any effect on HSA’s other than the change from 7.5% to 10% that one would have to otherwise incur for premiums and expenses to be deductible and over the counter medications must have a prescription. PPACA 9013 healthcareexchange.com cigna.com hsawells fargo While there is a $2k deductible limit for individuals and $4k for families, to qualify as an essential benefit, since the HSA account provides reimbursement, 42 USC 18022 (2) there should be no problem. Check with your tax or legal adviser.

Try turning your phone sideways to see the graphs & pdf's?

#Sales Brochures

Learn More

- Typical HSA usage & Savings See someone Save

- Ask for the Cash Discount and other ways to save with a high deductible plan CA Health Line 5.1.2017

- Cal Choice

- Health Net HSA for Life

- Anthem Blue Cross

- UnitedHealthcare

- Sutter – HDHP High Deductible Health Plans

- Blue Shield Bronze HDHP EOC Explanation VIDEO

- Kaiser HSA Savings Account Kaiser.org

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

HSA #Guidebook

Visit Our main webpage on HSA Health Savings Accounts - High Deductible Health Plans with Tax Advantaged Spending Account

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

| #Contribution and Out-of-Pocket Limits for Health Savings Accounts and High-Deductible Health Plans

Source Keenan.com |

|---|

|

HSA catch-up contributions (age 55 or older)

|

Reference & Tax Publications

IRS Form 8889 HSA Health Savings Account #Deduction

Visit our Main Webpage on HSA Health Savings Accounts

IRS Publication 502 pdf * html

Medical & Dental #Expenses

-

- Aetna Listing of HSA allowable expense

- Topic no. 502, Medical and dental expenses IRS.Gov

- expenses exceed 7.5% of your adjusted gross income for the year may be deductiblexxx

- Medical Necessity? Our webpage

- The Tax Definition of "Medical Care:" Repository Law.com

- Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract.

- Turbo Tax

- Schedule A 1040 Itemized Deductions

FAQ’s Etc.

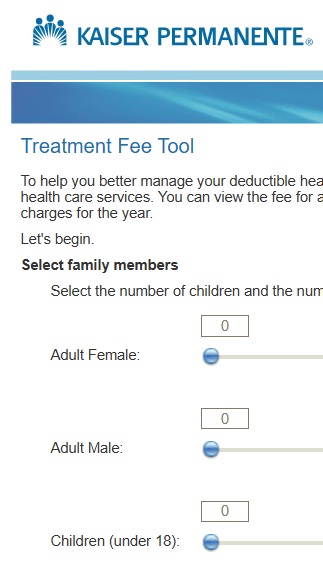

Kaiser Treatment Cost #Estimator Tool

requires sign in kp.org

The tool is for all Kaiser Members that are enrolled on Deductible or Health Savings Account Plans. The cost estimates are for services that are marked "after deductible" to give members an idea of the cost of those services.

- Kaiser Northern CA Sample fee list kp.org

- Southern CA 2024 list kp.org

- How do I know what level of service I will get billed for?

- Northern CA Treatment Fee Tool Kp.org

- Cost Helper.com what people are paying for health services

- If you have questions about the tool, send an email to [email protected]

FAQ’s

- Question If I’m over 65 and no #longer eligible to contribute to an HSA, what about my spouse?

. - Answer: Qualifying for an HSA

- To be an eligible individual and qualify for an HSA, you must meet the following requirements.

- You are covered under a high deductible health plan (HDHP), described later, on the first day of the month.

- You have no other health coverage except what is permitted under Other health coverage, later.

You aren’t enrolled in Medicare. - You can’t be claimed as a dependent on someone else’s tax return.

- If another taxpayer is entitled to claim an exemption for you, you can’t claim a deduction for an

HSA contribution. Publication 969 *

- If another taxpayer is entitled to claim an exemption for you, you can’t claim a deduction for an

- On the other hand:

- Question? Can I contribute to my spouse’s HSA if I’m enrolled in Medicare and no longer HSA eligible? IRS (Sec. 223(c)(1)(A)(ii))

. - Answer Yes. If your spouse is HSA-eligible and has an HSA, you – or anyone else – can contribute to his HSA. Your enrollment in Medicare doesn’t disqualify him from contributing to (or accepting contribution from others into) his HSA. Read More HSA’s & Medicare *

. - Question My spouse is already on Medicare and I will be covered by a consumer driven health plan this year. How much will I be able to contribute to my HSA?

. - Answer If you are covering both your spouse and yourself on your consumer driven health plan (CDHP), you will be able to contribute up to the IRS family maximum to an HSA in your name

. - Question – If I go on Medicare Mid year… How do I report the contributions for when I was eligible to contribute

. - Answer Form 8889 Part 1 Question # 2 and Q 9 Catch Up is allowed Q 7

- If you are 55 or older, you will also be able to make the $1,000 catch-up contribution to an HSA established in your name. If you are covering yourself only on the CDHP, you will be able to contribute up to the IRS individual maximum plus the $1,000 catch-up (if eligible), into an HSA in your name. Your spouse on Medicare is not eligible to contribute to an HSA in his or her name, regardless of whether he or she is covered on your medical plan

- HSA & Medicare

- Enroll-in-Part-A-and-B

- Section 223 – Health Savings Accounts—HDHP Family Coverage Rev. Rul. 2005-25

- See above for Publication 969

- Medicare & You Handbook

- Is a spouse a dependent?

- Medicare’s tricky rules on HSAs after age 65 Journal of Accountancy

- Question? Can I contribute to my spouse’s HSA if I’m enrolled in Medicare and no longer HSA eligible? IRS (Sec. 223(c)(1)(A)(ii))

- (2) Married dependents

An individual shall not be treated as a dependent of a taxpayer under subsection (a) if such individual has made a joint return with the individual’s spouse under section 6013 for the taxable year beginning in the calendar year in which the taxable year of the taxpayer begins.

FAQ’s

- Question Can one pay Health Insurance Premiums from an HSA?

. - Answer Yes???, however the rules get technical and you really need to check with your CPA for your specific situation. In my own case, I didn’t think they were as that’s what my own CPA said for MY situation, as I can deduct premiums as a business expense.

- Paying for some insurance premiums

- Generally, you cannot use your HSA to pay medical insurance premiums, but there are some exceptions.

- Medicare premiums

- Once you are 65 and eligible for Medicare, you can use your HSA to pay Medicare premiums (A, B, C, and D), out-of-pocket expenses that Medicare does not pay, and Medicare HMO premiums.

- You cannot pay Medigap premiums with your HSA. Medigap is insurance that individuals can buy to cover out-of-pocket costs that are not covered by Medicare.

- Premiums for employer-based coverage after age 65

- If you are 65 or older and still work, you can pay your share of premiums for employer-based coverage out of your HSA (you cannot pay for these premiums before age 65).

- If you are 65 or older and do not work, you can pay your share of any premiums your employer requires you to pay from your HSA for employer-sponsored retiree healthcare coverage.

- Premiums when you are unemployed

- You can pay for healthcare coverage while receiving unemployment compensation under federal or state law.

- You can also pay COBRA premiums with HSA dollars if you are eligible for COBRA benefits.

- Long-term care insurance

- You may use your HSA to pay premiums for qualified long-term care insurance. To be qualified, a long-term care insurance plan must meet criteria determined by federal law (see IRS Publication 969). guidebook on HSA page 73

- Here’s a cut & paste from IRS Publication 502

- Insurance Premiums

- However, in publication 502 they are qualified Medical & Dental Expenses

- You can include in medical expenses insurance premiums you pay for policies that cover medical care. You can’t include in medical expenses insurance premiums that were paid and for which you are claiming a credit or deduction. Medical care policies can provide payment for treatment that includes:

- Hospitalization, surgical services, X-rays;

Prescription drugs and insulin;

Dental care;

Replacement of lost or damaged contact lenses; and

Long-term care (subject to additional limitations). - Does your employer pay your premiums?

- Medicare B

- Medicare B Out patient & doctor visits is a supplemental medical insurance. Premiums you pay for Medicare B are a medical expense.

- Medicare D Rx Prescriptions

- Medicare D is a voluntary prescription drug insurance program for persons with Medicare A or B. You can include as a medical expense premiums you pay for Medicare D.

- See HSA Guidebook page 101 Health Equity.com

- (IRC Sec. 223(d)(2)(C); IRS Notice 2004-2 Q&A 27; IRS Notice 2005-59 Q&A 29)

Resources & Links

- High-Deductible Health Plans Make Income Inequality Worse

They can leave patients with crippling medical bills. Why are high-deductible insurance plans becoming so popular with employers? - Concerns rising about drug management in HDHPs

Employees are dissatisfied with this aspect of HDHPs and employers are starting to pay attention. - Effect on premiums ‘relatively small’ when expanding pre-deductible coverage to HSA plans, study finds

- FSA vs. HSA: What’s The Difference?

- Give Americans the right to save on health care

- IRS Notice 2020-15 allows HSA’s to cover Corona Virus testing as Preventative. Connect Your Care.com

- Los Angeles Times 5.6.2013 on High Deductible Plans and HSA’s

- Our webpage on OOP Out of Pocket Maximum, Deductibles & Co Pays

https://www.ajmc.com/view/5-faqs-about-ichras-what-to-know-as-aca-subsidy-extensions-stall

https://youtu.be/iO4rhE9JQe8?si=rWNZHB_XJiYIgGKV