Introduction to Subsidies – Premium Tax Credit

- ACA/Obamacare and tax subsidies APTC are one of the most confusing things you’ll ever come across. The simplest thing to do is just get an Instant quote.

- Enter your projected AGI Adjusted Gross Income, line 11 of your tax return, note that MAGI Modified Adjusted Gross Income has a few other things,

- your date of birth, zip code and

- then we can set a Zoom Meeting to go over all of it.

- 2026 loss of ARPA subsidies???

- Latest Status as of 12/21/2025

- Congress Is Ending the Year Without a Health Care Deal. What Comes Next? Time 12/21/2025

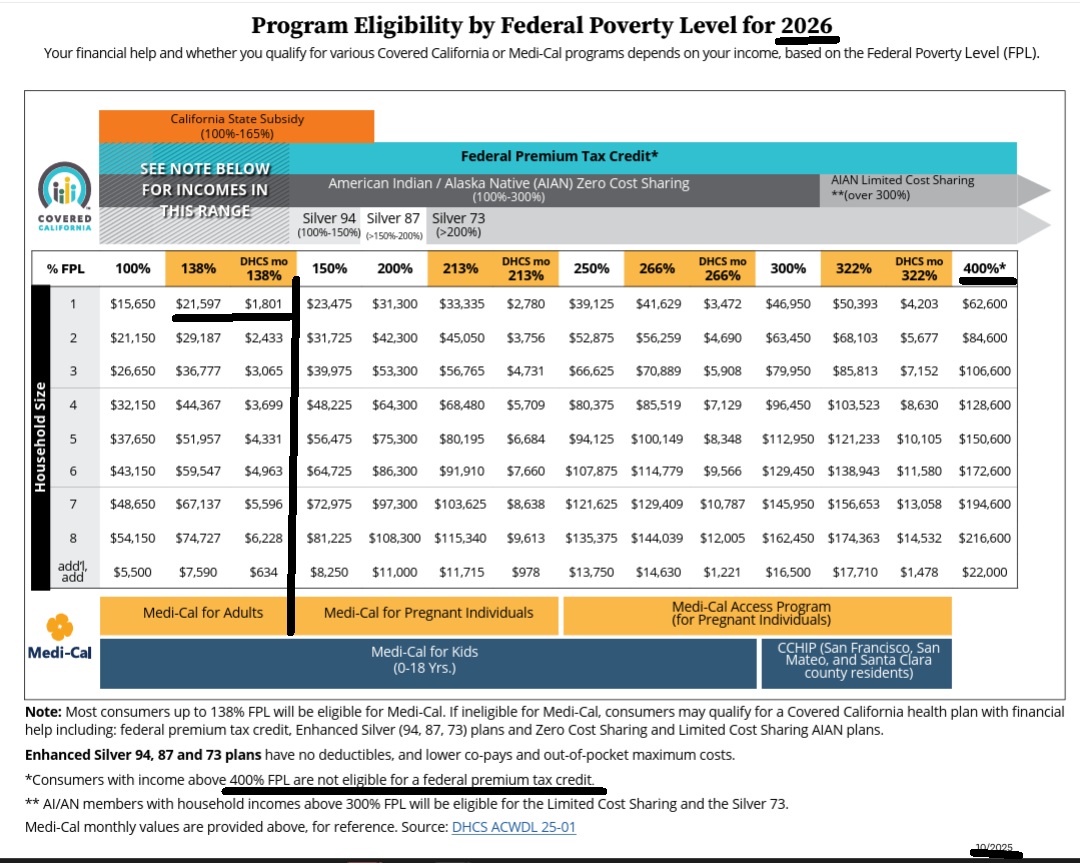

- Basically Time says it won’t pass. Don’t for get though that the original subsidies for those between 138% and 400% of FPL are still there.

- California will continue the enhanced subsidies for those earning up to 150% of FPL… Hey, it’s confusing… see links to get an instant quote. Covered CA.com 10/25/2025

- Agent Briefing * Covered California Rates and Plans for 2026: Consumer Affordability on the Line with Uncertainty Surrounding Federal Premium Tax Credit Extension * coveredca.com/important-changes

- White House circulates a plan to extend Obamacare subsidies as Trump pledges health care fix Pbs.org *

- Anthem Explanation

- How the Change in Enhanced ACA Tax Credits Could Impact You

- Your ACA health insurance premiums for the remainder of 2025 will stay the same.

- Since 2021, enhanced premium tax credits have increased the financial help available to individuals to pay their Affordable Care Act (ACA) health insurance premiums.

- If enhanced premium tax credits are not extended, they will expire on December 31, 2025.

Premium tax credits, also known as subsidies, will still be available in 2026, but the amounts may be lower. This means you could pay more out of pocket for Covered CA coverage - These changes impact those enrolling in or renewing a Covered CA health insurance plan for 2026 coverage.

- Kaiser Foundation calculator till Quotit gets updated

- kff.org/payments–double if-enhanced-premium-tax-credits-expire

- How do you get the premium tax credit?

- Check out our quote engine, to get a preliminary indication of the amount of subsidies you’ll qualify for. There is no extra charge for our services, just appoint us as your broker.

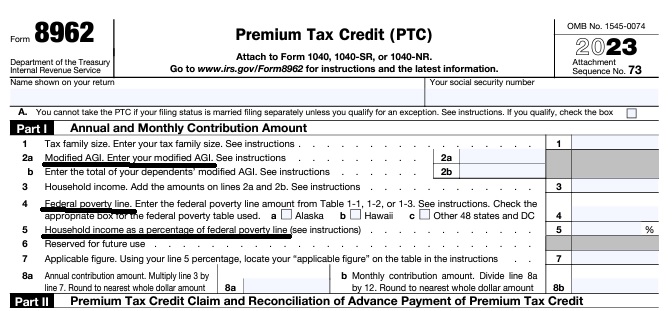

- In a lot of ways subsidies are hocus pocus smoke & mirrors as you have to file Form 8962, Premium Tax Credit, with your tax return at the end of the year. You are also mandated to report changes within 30 days. So, at the end of the year if you make too much $$$ you might have to give it back. If you make less, you get money back on your taxes.

- Failing to file your tax return will prevent you from receiving advance credit payments in future years and can cause MAJOR PROBLEMS and coverage CANCELLATION!

- The premium tax credit is refundable so even if you hardly pay any taxes, you still benefit. The credit is generally paid in advance to a taxpayer’s insurance company to help cover the cost of premiums. IRS Website on “The Basics“

- Covered CA step by step guide to Health Insurance

FAQ’s, Links & Resources

- What can agents or brokers do to help prepare their clients who may be newly eligible for savings (Offers of Employer Coverage) on Covered CA plans?

- FAQ’s on IRS website

- Covered CA Brochure

- Tax Subsidy vs $1 Premium Credit

- What is Covered CA? Insure Me Kevin.com

- Covered CA Technical Broker Bulletins…

- If you qualify for Medicare… no subsidies

- Understanding Reasonable Opportunity Period (ROP) & Auto Discontinuance

- Portal Alert Notices Guide for Certified Enrollers

- Online Application Task Guide

- covered ca.com/documents-to-confirm-eligibility

- Tool Kits

- KFF Foundation FAQ’s

- irs.gov/affordable-care-act-tax-provisions

- VIDEO Introduction to Individual Plans for those coming from Employer Group Plans

- Pros – Cons – Complicated FAQ’s Research on staying with under 65 plan? Covered CA? vs Medicare

- Simple calculator to figure out your subsidy and enroll Online

- insure me kevin.com/did-your-covered-california-subsidy-suddenly-vanish

- insure me kevin.com/your-tax-return-is-not-linked-to-your-covered-california-account

- The Untold Story of the Workers Who Make the Affordable Care Act Work | Opinion

- Renewal Toolkit

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

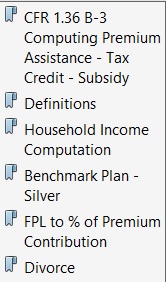

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Thanks! Just saw your video [above] and your explanation was spot on.

Have a good evening,

J H

Sat 1/3/2026 5:47 PM

See more unsolicited testimonials our webpage

https://developers.facebook.com/docs/plugins/page-plugin/

Why Is Covered California So

Confusing?

Understanding Income, Subsidies, Networks & Enrollment Rules

Why Is Covered California So Confusing?

If you’ve ever tried to enroll in a plan through Covered California and felt overwhelmed, you’re not alone. Many California residents find the process confusing — not because it’s poorly designed, but because it sits at the intersection of tax law, state regulations, federal law, income rules, and private insurance contracts.

Here’s why Covered California can feel complicated.

Even President Trump said so!

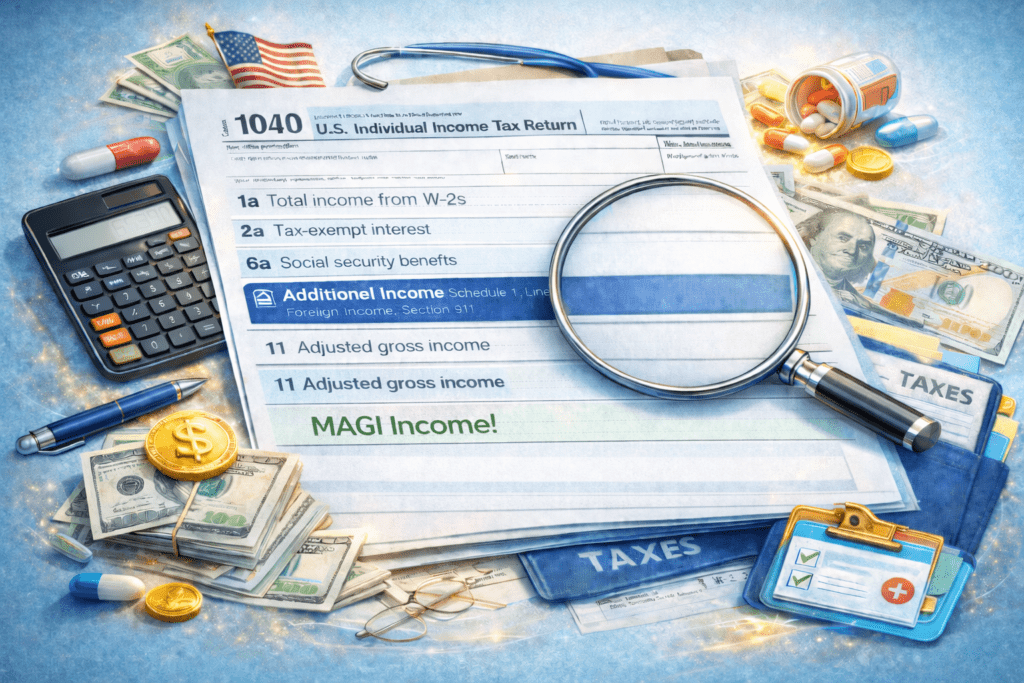

1. Income Rules Are Based on MAGI (Not Take-Home Pay)

Covered California eligibility and subsidies are based on Modified Adjusted Gross Income (MAGI) — not your net income or what you deposit in the bank.

- Wages

- Self-employment income

- Social Security (in some cases)

- Investment income

- Retirement distributions (sometimes)

- Capital gains

Your projected annual income determines:

- Whether you qualify for premium tax credits

- Whether you qualify for Enhanced Silver 87, 94 & 73 cost-sharing reductions

- Whether you are eligible for Medi-Cal instead

Small changes in income can significantly change your subsidy. Get Instant subsidy, quote and plan information Quotit.com

Check out this entire webpage for more

Covered California Income Guidelines Chart

2. Subsidies Are Estimates — and Reconciled at Tax Time

When you enroll, your subsidy is based on projected income for the year.

Our tool on estimating income

At tax time, you must reconcile the amount received using IRS Form 8962. If your income ends up higher than projected, you may need to repay part of the subsidy. If lower, you may receive additional credit.

That tax reconciliation step is one of the biggest sources of confusion.

Visit our IRS Form 8962 Subsidy Tax Reconciliation webpage.

3. Plan “Metal Levels” Don’t Mean What People Think

Covered California plans are categorized as:

- Bronze

- Silver

- Gold

- Platinum

These metal tiers reflect how costs are shared between you and the insurance company — not the quality of care.

For example:

- Bronze = lower premiums, higher deductibles

- Gold = higher premiums, lower out-of-pocket costs

Silver plans are especially confusing because only Silver plans qualify for Enhanced Silver – enhanced cost-sharing reductions if your income falls within certain ranges.

Visit our Metal Levels Webpage

4. Medi-Cal Integration Creates Overlap

Covered California also screens for Medi-Cal eligibility.

Depending on your income:

- You may be enrolled in a private plan with subsidies

- You may be transferred to county Medi-Cal

- You may move between systems during the year

The rules for income reporting and eligibility differ between Covered California and Medi-Cal, which can create confusion.

Check out our Special Enrollment webpage

Visit our Medi Cal webpage

5. Special Enrollment Period Rules Are Strict

Outside of Open Enrollment, you must qualify for a Special Enrollment Period (SEP).

Common qualifying life events include:

- Loss of employer coverage

- Marriage or divorce

- Birth or adoption

- Permanent move

- Material violation by a carrier

Each SEP has documentation requirements and deadlines (typically 60 days).

Check out our Special Enrollment Webpage

6. Provider Networks Vary by Plan

Not every plan works at every hospital or physician group.

Many California consumers assume:

“If the insurance company name is the same, my doctor must accept it.”

But network contracts vary by:

- Region

- Metal tier

- Product line (HMO, EPO, PPO)

Always verify provider participation directly with the medical group and the specific plan ID.

Use this link!

7. California Adds Its Own Rules on Top of Federal Law

Covered California operates under the Affordable Care Act (ACA), but California adds additional protections and, at times, additional subsidies.

That combination of federal and state oversight increases complexity.

Check out this webpage for more information

In Plain English

Covered California is confusing because it combines:

- Federal tax law

- State insurance regulations

- Income forecasting

- Private insurance contracts

- Medi-Cal eligibility rules

- Provider network differences

All in one application system.

The Bottom Line

Covered California isn’t “bad” — it’s complex because healthcare financing in the United States is complex.

Understanding:

- Your income structure

- Your provider preferences

- Your risk tolerance

- Your tax implications

…can make a major difference in choosing the right plan.

We can help… Contact us. [email protected]

Calculate your Covered CA MAGI Income

Take #Line8b 11 or your projected IRS 1040 Adjusted Gross income for the upcoming year then

add line 2a, 6a & 8 (Foreign Income)

Chat GBT isn't showing the numbers quite right, but you get the idea.

-

-

IMPORTANT!!!

The upcoming year - the future for what you tell Covered CA!

Sure, many people think it’s the past as Covered CA may ask for last years paperwork, but that’s BS! You might have to give back all the subsidies when you file Subsidy Reconciliation form #8962!

- Visit our MAIN webpage on MAGI Income

-

Federal IRS #Form8962 Reconciliation Form for Covered CA Subsidies

attaches to IRS 1040 it all comes out when you file taxes!

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- See below or visit our 8962 Webpage for more information

- MAGI AGI Income, what is it our webpage?

#Report changes as they happen - within 30 days! 10 CCR California Code of Regulations § 6496 10 days for Medi Cal 22 CCR § 50185

Instant Quotes & Subsidy Calculation Email Us [email protected]

IRS Form 5152 - Report Changes

- Our Steve's - VIDEO on how to report changes to Covered CA

- Steve's Video on MAGI Income

- Covered CA Video on how to report changes

- Visit our webpage on how to report changes

Subsidy Calculation Rules §1.36 B

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Health Insurance unfortunately is very complicated

President Trump February 27, 2017

- Thus, if we haven't simplified and explained in PLAIN ENGLISH what you are looking for:

Technical Links for

Premium Tax #Credits §136 B

CFR 136 B 3 – How is Tax Credit #Calculated

- § 1.36B-1 Premium tax credit definitions.

§ 1.36B-2 Eligibility for premium tax credit.

§ 1.36B-3 Computing the premium assistance credit amount.

§ 1.36B-4 Reconciling the premium tax credit with advance credit payments.

§ 1.36B-5 Information reporting by Exchanges.

§ 1.36B-6 Minimum value. - CFR 155.305 HTML Eligibility Standards

- §1.36b-1 Premium tax credit definitions

- law.cornell.edu/uscode 1396a

- Notice 2013-41, whether or when individuals are considered eligible for coverage under certain Medicaid, Medicare, CHIP, TRICARE, student health or

- HR 3590 Section 1001 HR 4872

- Code of Federal Regulations §1.36b-2Eligibility for premium tax credit.

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

Tax #Estimators

- turbo tax.com - FREE for simple returns

- H & R Block

- E file.com

- Estimate the Subsidy for Health Insurance, benefits, premiums, etc.

- 8962 ONLINE Calculator

- Our webpage on 8962 Premium Tax Credit Reconciliation

- Tax Form Calculator.com

- e tax.com

- Marriage Higher or Lower Taxes?

ACA What You Need To Know #5187 (2020) is the most recent

- VITA - Volunteers to help you

- Publication 17 - Your Federal Income tax

- Health Savings Accounts HSA our webpage

Sorry, this webpage is just getting too big.

For information on ARPA, Inflation Reduction Act, etc. that lapsed 12/31/2025 and Native Americans visit this page on ARCHIVE.org

Trump Make America Healthy Again

- RFK Jr.’s MAHA Movement Has Picked Up Steam in Statehouses. Here’s What To Expect in 2026 Kff.org January 2026

- The Supreme Court has determined that health insurance plans under the Affordable Care Act (ACA), also known as Obamacare, must continue to fully cover preventative services, including cancer screenings, HIV prevention medication, and mental health counseling, without co-pays or deductibles. Forbes *

- Nearly half of the U.S. population is pre-diabetic or has type-2 diabetes. Every month, diabetes causes 13,000 new amputations, 5,000 new cases of kidney failure and up to 2,000 new cases of blindness in our country. In 1960, approximately 13 percent of American adults were obese. Now, more than 40 percent of Americans are obese, and more than 70 percent are either obese or overweight.

- Even more shockingly, one-quarter of our teenagers today are pre-diabetic or have type-2 diabetes, and obesity is the leading medical reason that 71 percent of young Americans are disqualified from military service. Learn More >>> The Hill 11/2024 * Listing of the 6 Points Beckers Hospital Review 12/2024 *

- Federal Changes Toolkits pdf

- Covered CA Toolkits

- Open Enrollment Tool Kit

- Enrollment Dashboard Guide for Certified Enrollers

- FPL Income Chart

- Strike & Lockout

- QLE Major Life Changes

- SEP FAQ's for brokers Covered CA.com

- Documents to Confirm Eligibility

- Income Section

- social press kit.com/lets-talk-health

- Daily Summary Notices Broker Portal

- Medi Cal to Covered CA

- Forms - Including Paper Application

- 1095 toolkit

- how to generate and print plan summaries

- Service & Operating Hours Covered CA.com

- Social Media Toolkit Covered CA.com