Why Plan for Retirement?

Retirement planning is more important that ever, considering longer life spans, Long Term Care needs and potential Medicare cut backs. Employer Pension plans are great but many are being cut back L.A Times or converted to 401k rather than defined benefit. So, it’s more and more important to save on your own.

Check the links below email [email protected] or call us 310.519.1335 on various ways to increase your savings for retirement as Social Security is only considered the BASE for retirement benefits (estimator)

If you ever worked for a company or put money into a plan, but do not remember where it is, etc. try these ideas to locate your missing retirement funds.

Resources & Links

- Jackson National Retire on Purpose Resources

- Save for your Future.org

- Wade Pfau Retirement Blog

- Retire Stronger.com

- Nolo – IRA, 401k and other retirement plans

- AIG Retire Stronger

- $1 Million isn’t enough CNBC

- Save it like you mean it – Money Geek

- Smart Spending in Retirement

- ‘‘Securing a Strong Retirement Act of 2022’’

- Secure Act 19 page explanation Covisum

Defined Benefit Plans

Daily Breeze Article on San Diego’s unfunded liability

“America’s Finest City” is in a fine mess. Its unfunded pension liability — the gap between the value of its pension assets and its obligation to retirees — stood at $1.17 billion at the end of January. It faces anadditionalshortfall of $545 million for retiree medical benefits.The seaside city of 1.3 million people would need to double its pension contribution to $259 million next year — or about one-tenth of its annual budget — just to avoid falling further behind, said April Boling, who heads Mayor Dick Murphy’s Pension Reform Committee. That’s more than three times what it spends on parks and seven times what it gives libraries.

Later retirement age proposed

Boling, who is also Murphy’s campaign treasurer, isn’t shying away from the b-word. She says the city will need to sell $600 million in bonds over three years and raise the retirement age to 62 from 55, among other things. “If the city doesn’t follow our recommendations, we will be headed toward bankruptcy,” Boling said. “That is a fact.”

Will you have #enough for retirement?

Click on image to enlarge

Source = Money.com

Retirement #Calculators

- 360 Degrees of Financial Literacy

- American Institute of Certified Public Accountants - 401(k) plans

- American Institute of Certified Public Accountants - Retirement Planning Basics

- Blueprint Income - Build A Personal Pension Calculator

- Choose-to-Save - Ball Park E$timate

- Financial Calculators: Retirement Savings

- ssa.gov/estimator

- Estimate Your Life Expectancy

- Other Benefit Calculators

- When to Start Receiving Retirement Benefits #10147 SSA.Gov

- Other Things To Consider

- Retirement Toolkit DOL

- my Social Security account

- fairly geeky, there are good spreadsheets at www.analyze now/ but they are not easy

- Forbes 5 calculators

- Smart Asset.com Social Security Calculator

Publication 590 A

#Contributions to IRA's

-

Publication 590 Individual Retirement Arrangements (IRAs)

- Traditional IRAs

- Who Can Open a Traditional IRA?

- When Can a Traditional IRA Be Opened?

- How Can a Traditional IRA Be Opened?

- How Much Can Be Contributed?

- When Can Contributions Be Made?

- How Much Can You Deduct? What if You Inherit an IRA?

- Can You Move Retirement Plan Assets? When Can You Withdraw or Use Assets?

- What Acts Result in Penalties or Additional Taxes?

- What assets can you put into your IRA?

- Roth IRAs

- Publication 590-A HTML

-

and Publication 590-B Distributions from Individual Retirement Arrangements (IRAs)

- Simple IRA for Small Biz # 4334

- Payroll Deduction IRA for Small Biz # 4587

- Payroll Deduction IRAs

- Simple IRA Plan Checklist Publication # 4284

- SEP Retirement Plans for Small Biz # 4333

- SEP Check list # 4258

- Individual Retirement Arrangements (IRAs)

- Roth IRAs 401(k) Plans 403(b) Plans

- SIMPLE IRA Plans (Savings Incentive Match Plans for Employees)

Business #Retirement Plans # 3998 Rev 11/2023

- What you should know about your retirement plan dol.gov pdf

- Choosing a Retirement Solution for Your Small Business dol.gov

- Taking the Mystery Out of Retirement Planning dol.gov

- Top 10 Ways to Prepare for Retirement dol.gov

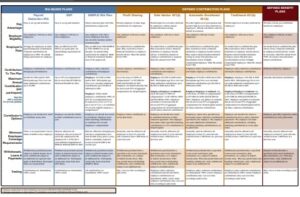

- Side by Side Chart of various retirement plans

- Retirement Plans for Small Biz

- irs.gov/retirement-plans/types-of-retirement-plans

IRS Publication 560

- Profit Sharing Plans for Small Biz Publication # 4806 Irs.gov pdf Website DOL.gov

- Profit-Sharing Plans Defined Benefit Plans

- Money Purchase Plans

- Employee Stock Ownership Plans (ESOPs)

- Governmental Plans 457 Plans

- Help with Choosing a Retirement Plan

- What you should know about your Retirement Plan DOL.Gov

401 K Plans for Small Business – IRS # 4222

-

Retirement Toolkit dol pdf

- Retirement Plans that don't have tax benefits - you can pick and choose who gets in!

- Lots of Benefits when you participate or set up an employee retirement plan Publication # 4118

- irs.gov/retirement-plans

- saving matters.dol.gov

- dol.gov/choosing-a-plan

- irs.gov/retirement-plans-for-small-entities-and-self-employed

- dol.gov/ask-a-question

- Small Business Retirement Savings Advisor DOL.gov

- QDROs The Division of Retirement Benefits Through Qualified Domestic Relations Orders Dol.gov pdf

- Get a Retirement Plan Proposal

- Department of Labor, Social Security & Medicare – Retirement Toolkit 9 pages

- BROKER ONLY iamsinc.com

- Our Web pages on:

Social Security Retirement Benefits

Related Pages in Pension and Retirement

Social Security #Retirementa Benefits

Publication # 10035

- Social Security Understanding the Benefits Publication # 10024 25 pages

- Self Employed & Social Security # 10022

- Retirement Check List # 10377

- Top Ten Facts about Social Security Center on Budget & Policy Priorities

- 2.5% increase for 2025

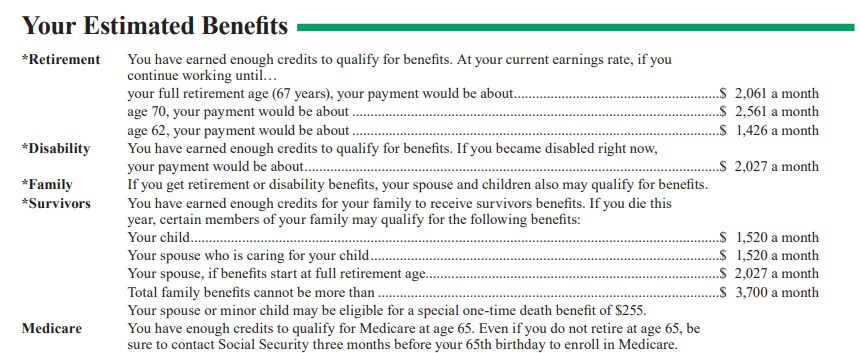

- Get an estimate of your Retirement benefits!

- 1st set up an ONLINE Social Security Account -

- You also need it to get enrolled in Medicare Parts A & B

- Your benefits will be in your account - example

- Or use this estimator on Social Security's Website

- Sample Your Social Security Statement

- Expand Social Security December 2024 - Double Dipping? Social Security Fairness Act

- 1st set up an ONLINE Social Security Account -

- 2022 COLA Cost of Living to increase 5.9% NewsMax.com *

- possible 9.6% Social Security cost-of-living adjustment in 2023 CNBC.com *

- Provisions Affecting Cost-of-Living Adjustment SSA.gov

- Money Geek - Introduction

- Links & Resources

- What you should know about your Retirement Plan DOL

- Proof of who you are

- History of Social Security

- History of Medicare on cms.gov

- govbooktalk.gpo.gov happy-birthday-medicare/

- Nolo - Social Security, Medicare, Medi Cal & Government Pensions Buy Book

- Our Webpages on Retirement

Taxation on Retirement Income

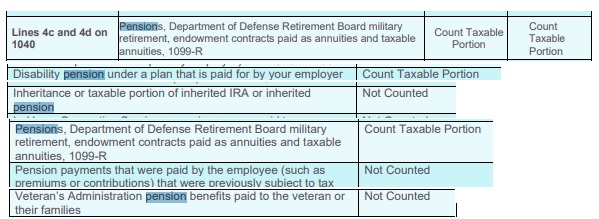

Covered CA (& Medi Cal) - Calculate - #Countable Sources of MAGI Income

Short Summary

#Pension & Annuity Income

Publication 575 pdf * HTML

- VIDEO Basic taxation of annuities BROKER ONLY

- About 1099-R

- Required Minimum Distributions FAQ's IRS.Gov

- Lifetime Income - Annuity Calculator

- Get your annuity from [email protected] just use the tool to get an instant idea of what the market is.

https://www.amazon.com/How-Retire-Not-Die-Young/dp/1544523726