Advance Payments of the Premium Tax Credit APTC

ARPA American Rescue Plan Act

How to get & qualify for Subsidies

Introduction to Subsidies – Premium Tax Credit

- ACA/Obamacare and tax subsidies APTC are one of the most confusing things you’ll ever come across. The simplest thing to do is just get an Instant quote. Enter your projected AGI Adjusted Gross Income, line 11 of your tax return, note that MAGI Modified Adjusted Gross Income has a few other things, your date of birth, zip code and then we can set a Zoom Meeting to go over all of it.

- How do you get the premium tax credit?

- Check out our quote engine, to get a preliminary indication of the amount of subsidies you’ll qualify for. There is no extra charge for our services, just appoint us as your broker.

- In a lot of ways subsidies are hocus pocus smoke & mirrors as you have to file Form 8962, Premium Tax Credit, with your tax return at the end of the year. You are also mandated to report changes within 30 days. So, at the end of the year if you make too much $$$ you might have to give it back. If you make less, you get money back on your taxes.

- Failing to file your tax return will prevent you from receiving advance credit payments in future years and can cause MAJOR PROBLEMS and coverage CANCELLATION!

- The premium tax credit is refundable so even if you hardly pay any taxes, you still benefit. The credit is generally paid in advance to a taxpayer’s insurance company to help cover the cost of premiums. IRS Website on “The Basics“

- Covered CA step by step guide to Health Insurance

FAQ’s, Links & Resources

- What can agents or brokers do to help prepare their clients who may be newly eligible for savings (Offers of Employer Coverage) on Covered CA plans?

- FAQ’s on IRS website

- Covered CA Brochure

- Tax Subsidy vs $1 Premium Credit

- What is Covered CA? Insure Me Kevin.com

- Covered CA Technical Broker Bulletins…

- If you qualify for Medicare… no subsidies

- Understanding Reasonable Opportunity Period (ROP) & Auto Discontinuance

- Portal Alert Notices Guide for Certified Enrollers

- Online Application Task Guide

- covered ca.com/documents-to-confirm-eligibility

- Tool Kits

- KFF Foundation FAQ’s

- irs.gov/affordable-care-act-tax-provisions

- VIDEO Introduction to Individual Plans for those coming from Employer Group Plans

- Pros – Cons – Complicated FAQ’s Research on staying with under 65 plan? Covered CA? vs Medicare

- Simple calculator to figure out your subsidy and enroll Online

- insure me kevin.com/did-your-covered-california-subsidy-suddenly-vanish

- insure me kevin.com/your-tax-return-is-not-linked-to-your-covered-california-account

- The Untold Story of the Workers Who Make the Affordable Care Act Work | Opinion

- Renewal Toolkit

- Open Enrollment Tool Kit

- Enrollment Dashboard Guide for Certified Enrollers

- FPL Chart

- Strike & Lockout

- QLE Major Life Changes

- Documents to Confirm Eligibility

- Income Section

- Certified Agent Briefing

- DACA Toolkit

- social press kit.com/lets-talk-health

- Daily Summary Notices Broker Portal

- Medi Cal to Covered CA

- 2024 End of the year briefing

- Forms - Including Paper Application

- 1095 toolkit

- how to generate and print plan summaries

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

Steve Shorr VIDEO on subsidies

Health Care Reform

CMS VIDEO explains the advance premium tax credit and the different ways in which you can apply it to lower the cost of insurance for you and your family.

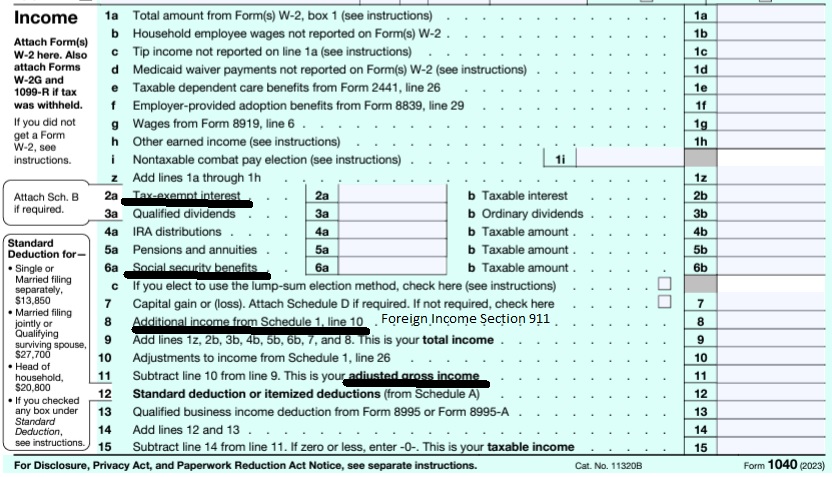

MAGI Modified Adjusted Gross Income

Calculate your Covered CA MAGI Income

take #Line8b 11 Adjusted Gross income then add line 2a, 6a & 8 (Foreign Income)

- 1040 IRS Annual Tax Form

- Schedule 1 Additional Income & Adjustments to Lower your MAGI Income

- Estimate next years MAGI Income?

- Get instant quotes, subsidy calculation and coverages

- NO ASSET TEST for MAGI based subsidies in Covered CA or MAGI Medi Cal Qualification. Steve's VIDEO

- Nor is there a lien against your estate for Covered CA or MAGI Medi Cal

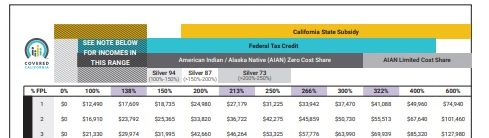

Federal Poverty Level &

Program Chart

Medi-Cal? Covered CA Subsidies? Enhanced Silver?

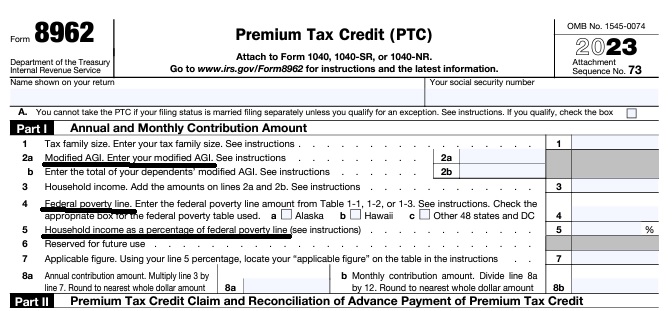

Federal IRS #Form8962 Instructions Premium Tax Credit

Reconciliation Form for Covered CA Subsidies attaches to 1040

Subsidy is IMHO hocus pocus - smoke & mirrors

it all comes out when you file taxes!

-

Introduction

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- Instructions for IRS Form #8962 Subsidy Reconcilation

- Tracking Your Covered California Subsidy on your 1040 Federal Tax Return Insure Me Kevin.com

- ARPA & Inflation Reduction Act of 2022

- Instead of increasing taxpayer audits, policymakers should simplify taxes across the board. That way, it would be easier for everyone to pay the correct amount to the government. heritage.org/who-those-87000-new-irs-agents-would-audit

- That 87,000 new tax agents estimate represents everything from IT techs to customer service people who answer the phone and help you file your return. Second, it includes attrition. So, the actual enforcement personnel is 5,000 LA Times * Mother Jones

- IRS backlog hits nearly 24 million returns, further imperiling the 2022 tax filing season

- ARPA Stimulus - you don't have to pay back 2020 overage on subsidies IRS.Gov *

- InsureMeKevin.com on subsidies & pay backs... 1.25.2022 update ARPA and 600% CA

- 1040 Instructions

- Overview FTB site

- How to Reconcile Subsidies FTB

- Calculate Pay Back

- Assistance Repaying California Subsidies

- covered ca.com/the most you might have to pay back

- 2022 Insure Me Kevin.com

- Our webpage on Form 8962 - Premium Tax Credit Subsidy Reconciliation

Report Changes

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

- Videos on how great agents are

Technical Links for

Premium Tax #Credits §136 B

CFR 136 B 3 – How is Tax Credit #Calculated

|

Kaiser Foundation Subsidy Explanation |

- § 1.36B-1 Premium tax credit definitions.

§ 1.36B-2 Eligibility for premium tax credit.

§ 1.36B-3 Computing the premium assistance credit amount.

§ 1.36B-4 Reconciling the premium tax credit with advance credit payments.

§ 1.36B-5 Information reporting by Exchanges.

§ 1.36B-6 Minimum value. - CFR 155.305 HTML Eligibility Standards

- 26 CFR 1 & 602

- §1.36b-1 Premium tax credit definitions

- law.cornell.edu/uscode 1396a

- final regulations,

- proposed regulations relating to minimum value of eligible sponsored plans

- Notice 2013-41, whether or when individuals are considered eligible for coverage under certain Medicaid, Medicare, CHIP, TRICARE, student health or state high-risk pool programs MR. Mip.

- final regulations on the reporting requirements for Marketplaces.

- HR 3590 Section 1001 HR 4872

- Code of Federal Regulations §1.36b-2Eligibility for premium tax credit.

#Report changes as they happen - within 30 days! 10 CCR California Code of Regulations § 6496

10 days for Medi Cal 22 CCR § 50185

Our webpage on ARPA & Unemployment Benefits - Silver 94

IRS Form 5152 - Report Changes

- Our VIDEO on how to report changes to Covered CA

- Lost your job? How to keep your Health Insurance. Shelter at Home VIDEO

- References & Links

- Here's instructions, job aid, reporting change in income

- Our webpage on the exact definition of MAGI Income

- If you've appointed us - instructions - as your broker, no extra charge, we can do it for you.

- Voter Registration

- Denial of benefits and possible criminal charges if you don't report changes in income!

- When Increasing Your Covered California Income Estimate Creates an Ethical Dilemma Insure Me Kevin.com

- Fudging Income?

- Western Poverty Law on reporting changes

- How to cancel coverage.

- agents and brokers who suspect or know a fraudulent application for insurance has been submitted to report the potential fraud to the California Department of Insurance Fraud Division. Read more >>> Wshblaw.com

- Visit our webpage on how to report changes

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

Tax #Estimators

American Rescue Plan Act (ARPA), The Inflation Reduction Act (IRA) & Build Back Better

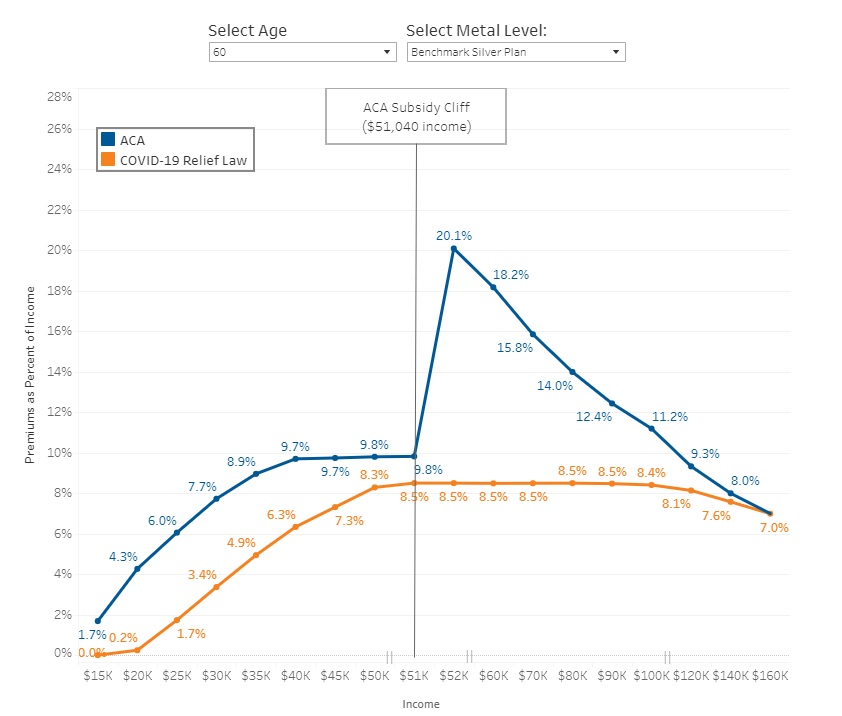

How do the Subsidies under ARPA compare to ACA?

HR 117 ARPA Premium Tax Credit

TAS Tax Tips: American Rescue Plan Act of 2021 individual tax changes summary by year

cnn.com/trump-health-care-complicated

Premium Problems if ARPA isn’t renewed

July 12, 2022 VIDEO will ARPA be renewed for January 2022?

- BIG problems with premiums for 2023 if ARPA isn’t continued! Learn More Fact Sheet NASHP

- Covered CA Summaries – Generally simpler, plain English and better summary

- newsweek.com/cut-health-not-inflation-opinion

- american progress.org/11-ways-the-inflation-reduction-act-will-help

- route-fifty.com/why-senate-deal-could-keep-millions-losing-health-insurance

- Millions to Lose Coverage if American Rescue Plan PTCs Expire

- Five Things to Know about the Possible Renewal of Extra Affordable Care Act Subsidies

- Projected Coverage and Subsidy Impacts If the American Rescue Plan’s Marketplace Provisions

Sunset in 2023 - Democrats are feeling increased pressure to extend health care subsidies approved during the pandemic

- Delays Extending The American Rescue Plan’s Health Insurance Subsidies Will Raise Premiums And Reduce Coverage

- Reducing Premiums Can Lead to Improved Insurance Coverage Considering the fact that the majority of low-income consumers owe small premiums, researchers suggested that lowering premiums by a few dollars monthly could improve insurance coverage.

- Falling off the Subsidy Cliff: How ACA Premiums Would Change for People Losing Rescue Plan Subsidies

- Costs will increase significantly for nearly 150,000 Californians if Congress lets federal subsidies expire LA Times

- Zero-dollar premiums could improve coverage on ACA exchanges compared to those paying small amount

- health payer intelligence.com/hhs-cms-extend-american-rescue-plan-funding-for-hcbs-another-year

- I don’t know if or how this might apply to Covered CA subsidies.

- There might – will be big increases in 2022 when subsidies are lost, especially the unemployment benefit.

- Covered California Leader Urges Renewal of Enhanced Federal Aid for Health Premiums CA Health Line.org

- Pressure to extend subsidies ARPA Fierce Health News 5.24.2022

- Healthcare spending could drop $11.4B next year if ACA premium subsidies expire Health Care Dive.com 5.26.2022

- beckers payer.com/ /weight-loss-drugs-1-factor-behind-aca-premium-increases-3-things-to-know/

- chief health care executive.com/maternal-health-abortion-rights-the-affordable-care-act-equity-and a-i

Legislation to renew ARPA, Inflation Reduction Act & Build Back Better

- Health Provisions in the 2025 Federal Budget Reconciliation Bill

- House Budget Bill and Tax Credit Expiration Will Make It Harder to Get and Afford Marketplace Health Plans Learn More Commonwealth Fund *

- Help for ACA health plans could be harder to get since RFK Jr. axed teams of ‘fixers’ NPR

- A New Rule to Limit ACA Enrollment Periods May Deter Sign-Ups and Worsen Risk Pools

- Marketplace Integrity and Affordability Proposed Rule” that proposes standards for the Health Insurance Marketplaces, as well as for health insurance issuers, brokers, and agents who connect millions of consumers to Affordable Care Act (ACA) coverage. The rule proposes additional safeguards to protect consumers from improper enrollments and changes to their health care coverage, as well as establish standards to ensure the integrity of the Marketplaces. Learn More

- Covered CA 4/11/2025 letter to HHS

- Cash-strapped states panic over end of Obamacare subsidies

The looming possibility of slashing Medicaid spending and not extending ACA subsidies has prompted a legislative scramble from Sacramento to Annapolis. Learn More Politico * - All 2.37 million Californians in the individual market will face higher premiums if Congress does not act by 2025

- What to expect from the Inflation Reduction Act in 2025

- Temporary subsidies were originally passed as part of the American Rescue Plan Act (ARPA) in 2021, which included two years of enhanced subsidies, 2021 and 2022. The Inflation Reduction Act (IRA), which passed in 2022, extended these enhanced subsidies for an additional three years, ending after 2025. Health Care Finance News *

- khn.org/changes-signed-into-law

- #Inflation Reduction Act of 2022 Wikipedia

- Text of HR 5376 Inflation Reduction Act

- Health Care, Climate and Taxes: Here’s What’s in the Inflation Reduction Act

- Health care budget bill to face open-ended ‘vote-a-rama’ Narrowed bill will be open for amendment on climate, taxes, child care and more

- white house.gov/by-the-numbers-the-inflation-reduction-act

- Insurers, providers exposed as clock winds down for enhanced ACA subsidies 7.22

- What’s in the Manchin-Schumer deal

- CMS to Congress: ‘Time is of the essence’ on extending boosted ACA subsidies 6.22.2022

- Build Back Better Act

#COVID19 Bill

The American Rescue Plan Act ARPA

2021 Federal Stimulus Package

March 2021

VIDEO Introduction to ARPA by Steve

- ARPA subsidies have been extended through 2025 Kff.org * Congress.Gov Section 12001 * under the Inflation Reduction Act signed by President Biden on 8.17.2022

- Covered California’s Insurance Deals Range From ‘No-Brainer’ to Sticker Shock

- The Coronavirus bill represents the biggest expansion of Federal Help – Subsidies, since ACA/Health Reform/Obamacare started in 2010!

- Use our Quote Subsidy Calculator Engine, to see how ARPA works for you.

- There are way more subsidies and there is no upper income limit chart (FPL) for 2021 and 2022.

ARPA Provides:

- Those enrolled in Covered California health plans will not have to pay more than 8.5% of their household income for the second lowest cost silver plan – Get Quotes

- If you are not in Covered CA, there is a special enrollment period to apply. If you stay with the same insurance company, your deductibles & co pays will transfer over!

- Any person in 2021 who received unemployment insurance for one week or more, and their total income qualifies for coverage through Covered California, will receive federal premium tax credit available for 138% of FPL Silver 94? for the duration of the Public Health Emergency in 2021.

- In California, individuals making between 138 percent and 150 percent of the federal poverty level — between $17,776 and $19,140 per year — will see their already-low premiums eliminated. San Diego Union * Covered CA FAQ for Brokers *

- 100% federal premium subsidy for COBRA coverage Blue Shield *

- Despite What the White House Says, Obamacare Is Deeply Troubled PRI Center for Economics & Innovation

- Get quotes to see how ARPA would work for you.

- ARPA is funded to the tune of $34 Billion for only two years and would change the formulas for health insurance tax credits to make them more generous for most people, and also allow a wider number of individuals to qualify.

- ARPA follows President Biden’s strategy of getting all Americans covered. Modern Health Care 3.8.2021 * NPR *

- Covered CA will automatically check if clients get more subsidies. BUT! your consent to allow Covered CA to check your finances in the Federal Hub, etc. must be up to date. Here’s their quick guide on how to do that.

- ARPA is comprehensive and there are several provisions that we are watching closely that would affect how people pay for their health insurance coverage:

- Removing the cap on subsidies for people earning more than 400% [600% in CA] of the Federal Poverty Level (FPL) –Currently those with a Modified Adjusted Gross Income (MAGI) of more than 400% of the FPL are not generally eligible for Advance Premium Tax Credits (APTC). Additionally, there is legislation that would make the removal of the 400% cap permanent.²

- Lower the maximum a person has to pay for the Benchmark Plan from 9.83% of MAGI to 8.5% of MAGI – This provision would drop the amount the insured person has to pay for insurance from 9.83% of his MAGI to 8.5%.

- Provide no-cost Silver Plans for people receiving unemployment insurance – Americans on unemployment insurance during 2021 would receive the Benchmark Silver Plan in their market for a $0 premium contribution while they are receiving unemployment insurance.⁴

- APRA COVID Stimulus bill will also pay your COBRA and Cal COBRA premium.

- All ages will be affected, but this bill will have the greatest impact on near-seniors, or those aged 55-64 because of the cost of their ACA coverage. Stephens Mathews Email 3.11.2021 *

Resources & Links

- HR 1319 on Congress.Gov

- Congressional Budget Report – Premium Tax Credit

- 242 page pdf of HR 1319

- Insure Me Kevin.com

- Kaiser Foundation Analysis & Summary 3.15.2021

- Cal Matters.org

- Affordability

- HHS Fact Sheet

- IRS Overview

- Covered CA Website on ARPA

- CC March 18th 22 page slide show

- Federal Data Services Hub

- Target Strategies

- Covered CA Broker Briefing April

- July 28,2021 Press Release

- Covered CA says subsidies are too big to ignore

- Sample – Messaging for on-exchange members with a subsidy

- Blue Cross Power Point Presentation

- Word & Brown Insurance Wholesaler Summary

- Unemployment Compensation Enhancements Silver 94

- Extensive FAQ from Anthem Webinar

- california healthline.org covered-california-insurance-deals-2022

- Impact of the American Rescue Plan Act on State-Based Health Insurance Marketplaces: Increased Affordability and Access for Consumers

- ACA Health Insurance Enrollment Sets New Record

- Covered CA ONLINE Application – Job Aid

Native American

Negative MAGI Income

FAQ's #Negative MAGI Income – Qualification for Medi Cal? Subsidies?”

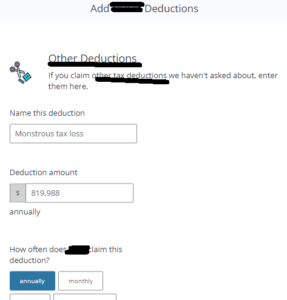

- Question If your MAGI Income is negative, can you still qualify for Covered CA subsidies APTC even if you have some income, before you get to line 11 of your 1040?

. - Answer - NO! See the income chart. Your MAGI Income - AGI needs to be over 138% of FPL Federal Poverty Level

- CFR 1.36 B C how APTC Premium Assistance is calculated

- We also have no idea how long a tax loss will show up on line 11 adjusted gross income line of your 1040? See the IRS publications on Long Term Capital gains, above.

- No problem getting health coverage, you just won’t get subsidies. Click here to get quotes and enroll online.

- Sources

- Western Poverty Law and go over them with appropriate counsel.

- How to calculate MAGI Income

- Q & A on Intuit Site

- See publication 536 Net Operating Loss

- Form 8962 Reconcile Premium Tax Credit You must enter your Modified Adjusted Gross Income MAGI

- IRS FAQ - What are the Income Limits

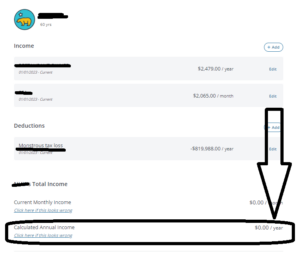

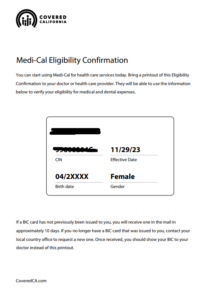

- Covered CA online application asks for Tax Deductions Email dated Wed 11/29/2023 8:54 AM Click on image to enlarge

- Question If your carry over net operating loss (from prior years) is allowed to be taken into account, is it part of the Federal Modified Adjusted Gross Income number ) or does California specifically require you to take it out of the equation?

- Answer Please see above on the definition of MAGI Income. I’m not aware of states having any authority over your Federal Tax return.

- Covered CA does not authorize agents to give tax advise. They suggest you get it from Volunteers at VITA.

- Note that the Income Chart says FEDERAL Poverty Level!

-

Do you really expect a clerk at Medi Cal to answer this kind of question?

-

We can help you with Covered CA when your income reaches 138% or more of FPL or if you go direct. Get quotes here.

- Answer Please see above on the definition of MAGI Income. I’m not aware of states having any authority over your Federal Tax return.

-

MAGI details from a Higher Up at Medi Cal

- Medi Cal agrees that MAGI can be negative and will educate the Counties...

- Good afternoon Steve,Thank you for raising this issue with DHCS. Without a signed Medi-Cal Authorized Representative form MC 382 on file with the county or provided to DHCS, I cannot speak to any specifics surrounding a Medi-Cal case.However, speaking in general terms, when a case is escalated to DHCS typically we will do direct outreach with the county involved and Covered California (if needed). If training issues are identified such as incorrect information being provided, then training and resources will be provided.

Additionally, DHCS has flagged “negative” reported loss income as a policy clarification area to provide further guidance on in future for counties, since it is not uncommon but can be a confusing area to make sure the information is captured correctly in the systems and the policy is clear.

Thank you for raising this and helping identify this opportunity for improvement, and have a wonderful rest of your day!

- Kathryn Floto, MPA | Health Program Specialist II

Medi-Cal Eligibility Division

California Department of Health Care Services -

Good morning,

For Modified Adjusted Gross Income (MAGI) Medi-Cal income and deductions policy, DHCS published All County Welfare Director’s Letter (ACWDL 21-04).

Page 2, Section 1 provides guidance on policy for countable income for MAGI program calculation, which is federal taxable income minus any allowable (post-tax) deductions under federal code. Page 3 links to an Income and Deductions chart tool to determine if a post-tax deduction can be used for MAGI-based Medi-Cal and for Covered California eligibility. Please note that the chart and the Covered California website deductions are post-tax deductions, and pre-tax deductions are already included when calculating AGI.

Tax loss is not considered an acceptable post-deduction for MAGI Medi-Cal or Covered California per federal code. The Centers for Medicare and Medicaid Services (CMS) has also published a document detailing MAGI rules with deduction information on page 7.

If the tax loss is considered as more of a capital gains/loss, or other loss such as real estate reported on Schedule E, then this amount should be entered into the system as an income with a negative (for example: -819,988). This will tell the system the income is actually at a loss and will reduce the income.

I would be happy to research your client’s case specifically if you can provide identifying information for me to look her up (name, DOB, SSN). Please let me know if you or your client are interested and I can initiate a secure e-mail and send over appropriate documents to share private information for your client to fill out in order for me to share back any results.

Thank you, and please let us know if you have any further questions.

Kathryn Floto, MPA | Health Program Specialist II

Medi-Cal Eligibility Division

California Department of Health Care Services

#Native Americans Heath Insurance subsidies, etc

No Health Care Expenses, Depending on Income

Federally recognized American Indians and Alaska Natives who earn less than 300 percent of the federal poverty level (see chart) will not have to pay certain out-of-pocket medical costs, such as copays and deductibles, if they purchase health insurance coverage through Covered California, no extra charge for use to help you. Get Quote

No Cost-Sharing for Covered Services Provided by an American Indian Health Provider or Clinic, Regardless of Income

There are no copays or deductibles for any covered services received directly through the federal Indian Health Service, tribes, tribal organizations or urban American Indian organizations.

Ability to Buy Insurance Anytime

American Indians and Alaska Natives can buy or change health insurance plans once a month through Covered California and are not subject to open-enrollment periods. Our webpage on special enrollment

Exemption from the Shared Responsibility Payment

All members of federally recognized tribes and all American Indians and Alaska Natives who are eligible for services through an Indian Health Service provider are eligible from an exemption from the shared responsibility payment (the tax penalty consumers pay if they do not have minimum essential health coverage).

more exemption information.

Our webpage on CA Penalty *

Exemptions from CA Mandate Penalty

covered ca.com/documents-to-confirm-eligibility/american-indian-or-alaskan-native

Additional information that may be of interest to American Indians and Alaska Natives is available below:

- The Centers for Medicare and Medicaid Services’ “Outreach & Education Resources” page

- Information about the Affordable Care Act from the Indian Health Service

- The Centers for Medicare and Medicaid Services’ information page for special populations

- The California Rural Indian Health Board’s website about Covered California and the Affordable Care Act

- The California Consortium for Urban Indian Health

- Covered California Tribal Consultation

- healthcare.gov/american-indians-alaska-natives

- coveredca.com/american-indians

- USA Today – ACA hard sell for Native Americans 10.15.2013

- Tribal Pharmacy Dispenses Free Meds and Fills Gaps for Native Americans in the City KHN.org

- ca health advocates.org/tribal-nations-medicare/

More Links

- What tribe are you a member of?

- Check out these links:

- coveredca.com/american-indians/

- ihs.gov/aca/

- ihs.gov/ihcia/

- ihs.gov/forpatients/patientsrights/

- crihb.org/

- oag.ca.gov/native american

- Native American Patients Are Sent to Collections for Debts the Government Owes

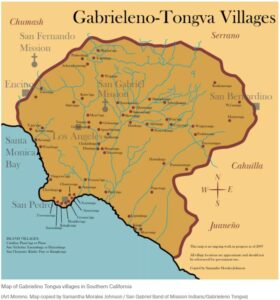

Southern CA

Tongva Territory

- mwgoe.org Many Winters Gathering of Elders – San Pedro, CA

- facebook.com/Many Winters Gathering of Elders/

- Map of Tongva Territory – Scroll Down

Trump Make America Healthy Again

Nearly half of the U.S. population is pre-diabetic or has type-2 diabetes. Every month, diabetes causes 13,000 new amputations, 5,000 new cases of kidney failure and up to 2,000 new cases of blindness in our country. In 1960, approximately 13 percent of American adults were obese. Now, more than 40 percent of Americans are obese, and more than 70 percent are either obese or overweight.

Even more shockingly, one-quarter of our teenagers today are pre-diabetic or have type-2 diabetes, and obesity is the leading medical reason that 71 percent of young Americans are disqualified from military service. Learn More >>> The Hill

6 positions

1. Mr. Kennedy has prioritized addressing chronic disease, which accounts for over $1 trillion in annual U.S. healthcare costs. He has stated that President-elect Trump seeks "measurable impacts" to combat the chronic disease epidemic within two years — a goal that has drawn attention from healthcare leaders, some of whom have praised its ambition while noting potential challenges.

Mr. Kennedy identified chronic disease as a key priority before his nomination to lead HHS. "I'm going to urge President Trump on day one to do the same thing they did in COVID, which is to declare a national emergency, but not for infectious disease, but for chronic disease," Mr. Kennedy said in a Sept. 26 interview, about one month after he dropped out of the presidential race.

His vision extends beyond healthcare delivery to address broader contributors to chronic disease. Mr. Kennedy has criticized the influence of the pharmaceutical and food industries, linking issues like obesity and diabetes to ultra-processed foods, federal subsidies and dietary guidelines. He has called for reforms targeting food additives, pesticides and environmental health risks, alongside overhauls of agencies like the CDC and FDA.

Health systems may find some common ground in Mr. Kennedy's focus on prevention and early intervention to reduce chronic disease burdens, which could align with some of their efforts to address social determinants of health. However, experts, including former CDC Director Tom Frieden, MD, caution against oversimplification. "There are some things that RFK Jr. gets right," Dr. Frieden told NPR. "We do have a chronic disease crisis in this country, but we need to avoid simplistic solutions and stick with the science."

2. He's called for an end to direct-to-consumer advertising for prescription drugs. Mr. Kennedy has criticized the advertising relationships between pharmaceutical companies and news outlets, arguing that pharmaceutical advertising influences editorial content and public discourse beyond its intended purpose of promoting products. When his campaign was active in early 2024, Mr. Kennedy said if elected he would issue an executive order on his first day in office to ban pharmaceutical advertising on television.

Direct-to-consumer advertising of prescription drugs surged after the FDA eased restrictions in 1997 and totaled nearly $10 billion in 2016. Proponents argue it educates consumers and empowers patient involvement, while critics warn it can misinform patients, drive inappropriate prescribing and inflate healthcare costs. Concerns also include promoting costly brand-name drugs over cheaper alternatives, straining patient-physician relationships.

3. He has expressed interest in redirecting Medicare spending toward promoting healthy behaviors rather than covering certain pharmaceuticals. Mr. Kennedy has been a vocal opponent of Medicare and Medicaid funding for GLP-1 drugs used for weight loss, arguing that these programs should instead prioritize covering gym memberships and healthier food options for enrollees.

"For half the price of Ozempic, we could purchase regeneratively raised, organic food for every American, three meals a day and a gym membership, for every obese American," Mr. Kennedy said during a Congressional roundtable in September, as reported by the Associated Press.

The Biden administration recently proposed broader coverage of GLP-1 and weight loss drugs for Americans with obesity, a move that could put Mr. Kennedy in a reactive position if he secures confirmation to lead HHS.

4. He is considering changes to the Medicare physician fee schedule. Mr. Kennedy and his advisers are considering an overhaul of Medicare's payment formula, four anonymous sources told The Washington Post in November. The move could mark a bid to shift the health system's incentives toward primary care and prevention.

The Medicare physician fee schedule was adopted in 1992, establishing a complex system of administrative pricing based on the resource inputs used in producing physician services. It influences not only Medicare payments, but also private insurance payment systems, which often mirror Medicare's methodologies.

Sources told The Post that discussions about the fee schedule are in their early stages and have involved a plan to review the thousands of billing codes that determine how much physicians get paid for performing procedures and services. These codes are integral to determining reimbursement rates and have faced criticism for historically favoring procedural and specialty care over primary care services. An overhaul could address these disparities and potentially reshape the economics of medical practice across the country.

5. He has raised controversial and widely challenged claims about vaccine safety for nearly 20 years. Mr. Kennedy's suspicion of vaccines dates back to at least 2005, when he published an article called "Deadly Immunity" in unusual publications for the topic: Rolling Stone magazine (print) and Salon (digital). The article claimed that thimerosal, eliminated in routine childhood vaccines in 2001, caused autism. The article was amended and corrected several times before, years later, Salon announced in 2011 that it was retracting "Deadly Immunity" in entirety. An explanation of that decision and the corrections made to Mr. Kennedy's article are detailed by Salon here.

More recently, Mr. Kennedy said in a 2023 podcast interview that, "There's no vaccine that is safe and effective." The nonprofit Mr. Kennedy was aligned with for nearly a decade, Children's Health Defense, has been a vocal critic of COVID-19 vaccines and public health mandates, with its claims frequently challenged by public health experts. The group has filed dozens of federal and state lawsuits since 2020, many challenging vaccines and public health mandates. Mr. Kennedy has been on leave from the group as its founder, chairman and chief litigation counsel since he announced his plans to run for president in April 2023.

When described as anti-vaccine, Mr. Kennedy has pushed back. Instead, he argues that he wants to improve the science of vaccine safety. "We're not going to take vaccines away from anybody," he told NPR in November. "We are going to make sure that Americans have good information. Right now the science on vaccine safety particularly has huge deficits in it, and we're going to make sure those scientific studies are done and that people can make informed choices about their vaccinations and their children's vaccinations."

6. He supports abortion rights up to the point of fetal viability, after which he favors restrictions. Mr. Kennedy believes abortion should be legal up to a point he describes as when the fetus becomes viable outside the womb, after which he supports restrictions. Mr. Kennedy clarified this position in a video released in June 2024, though he did not specify an exact number of weeks for viability. He acknowledged that his views on abortion have evolved over time as he continued to explore the issue. In May 2024, he had expressed support for a woman's right to choose an abortion at any stage of pregnancy, including full term.

Mr. Kennedy has also pointed to the importance of addressing economic factors in discussions about abortion and reproductive health. "We should be looking at why there are so many abortions in the first place," he said, emphasizing the need to understand the financial challenges and economic pressures that contribute to abortion rates among individuals and families.

Mr. Kennedy introduced a plan while running for president called "More Choices, More Life" that called for a subsidized daycare initiative aimed at making childcare more accessible. He said universal childcare has the capacity to add $1 trillion to the U.S. GDP. "And since economics is a major driver of abortion, this policy will do more to lower abortion rates than any coercive measure ever could," the website for the plan states. Becker Hospital Review *

2024 Rates?

Covered CA Press Releases

- Covered California to Launch State-Enhanced Cost-Sharing Reduction Program in 2024 to Improve Health Care Affordability for Enrollees

- Covered California’s Health Plans and Rates for 2024: More Affordability Support and Consumer Choices Will Shield Many From Rate Increase

- National Rates 6% average KFF

- top health items in Biden’s new fiscal 2024 proposed budget

https://hbex.coveredca.com/toolkit/downloads/Remote_Identity_Proofing_Guide.pdf

https://hbex.coveredca.com/toolkit/pdfs/Verifying_Identity_Acceptable_Documents_to_Upload_Guide.pdf