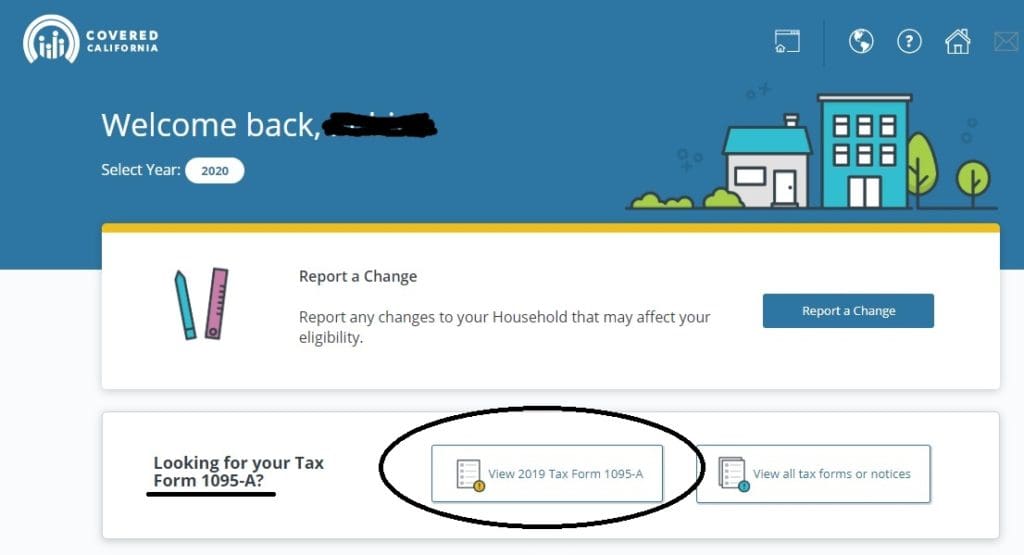

Where to find 1095 A in your Covered CA portal

Try turning your phone sideways to see the graphs & pdf's?

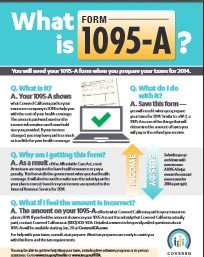

Covered CA will send you Form 1095 A &

FTB 3895

Covered CA will automatically send you Form 1095 A

There won’t be a FTB 3895 as no one got the CA Premium assistance subsidy, email dated 2.20.2023 * I guess due to ARPA and the inflation protection act.

- 1095 A Instructions * HTML *

- Covered CA 1095 Tool Kit

so that you can fill out Form 8962 to reconcile Premium Tax Credit – Subsidy. In addition this form will give you proof of coverage so that you don’t have to pay the California mandate penalty of 2.5% of income.

If you don’t get the form in the mail, just log into your Covered CA Account and get it. For personal year around service from Covered CA, just appoint us as your agent, by completing this form.

***********

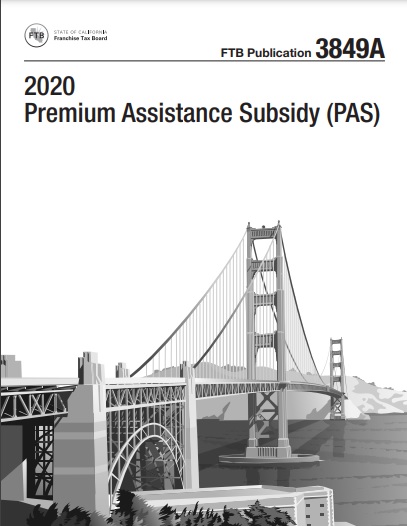

CA Franchise Tax Board FTB form # 3895 is proof of coverage so that you can claim the 600% Premium Assistance Subsidy (state subsidy) beyond the 400% Federal Subsidy and reconcile any advanced state subsidy received, form 8962 and to file an accurate tax return to avoid paying the state individual mandate penalty of 2.5% of income.. The amount displayed on the Form FTB 3895 reflect how much was paid to your Health Insurance Company Insurance as a subsidy, besides what you paid as Net Premium. Not currently applicable.

Email us [email protected] for the “Toolkit” or questions on this new form.

See our webpage on the California Mandate Penalty

Resources, Links & Bibliography

- Dispute 1095 Information?

- Covered CA IRS 1095 Tool Kit

- CMS Agent – Broker FAQ’s

-

IRS on Health Insurance Marketplace.

-

IRS FAQ’s Questions and Answers about 1095 a, b & c

-

If you got the WRONG 1095 A form, you don’t have to refile taxes per

- CA Health Line 2.25.2015

- 4.6.2015 tax filing reprieve

- IRS FAQ – wrong forms?

- InsureMeKevin.com – amended tax returns?

- 1.25.2016 Rev.

- 2016 Revised 1095? Insure Me Kevin.Com

- 1095 A Dispute Form

- Check out the analysis of #1095 Form from our Friendly Competitor insure me kevin.com

- ♦ Tax Guidance on Friendly Competitors Blog

- How subsidy is calculated with FTB 3895 & 3849 Insure Me Kevin.com

- About 50% of people who got subsidies will have to return a portion of the $$$ CA Healthline 3.25.2015

- Covered CA Tool Kits

- VIDEO What is APTC Advance Premium Tax Credit

- Health Net VIDEO How to get subsidies – pay less for coverage

- Interactive Tax Assistant (ITA)

- Am I eligible to claim the Premium Tax Credit?

- IRS FAQ on Premium Tax Credit

Tax #Estimators

Jump to section on:

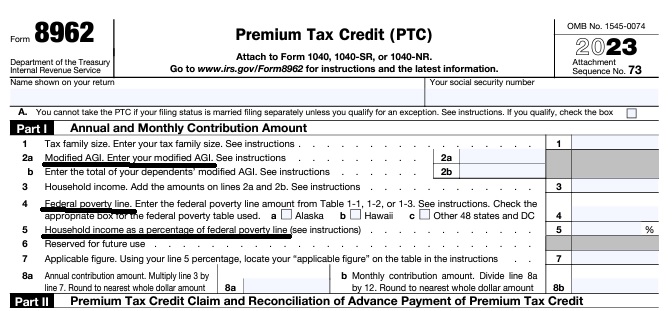

- Form 8962 1040 Reconciliation

- Premium Tax Credit Publication 974

Federal IRS #Form8962 Instructions Premium Tax Credit

Reconciliation Form for Covered CA Subsidies attaches to 1040

Subsidy is IMHO hocus pocus - smoke & mirrors

it all comes out when you file taxes!

-

Introduction

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- Instructions for IRS Form #8962 Subsidy Reconcilation

- Tracking Your Covered California Subsidy on your 1040 Federal Tax Return Insure Me Kevin.com

- ARPA & Inflation Reduction Act of 2022

- Instead of increasing taxpayer audits, policymakers should simplify taxes across the board. That way, it would be easier for everyone to pay the correct amount to the government. heritage.org/who-those-87000-new-irs-agents-would-audit

- That 87,000 new tax agents estimate represents everything from IT techs to customer service people who answer the phone and help you file your return. Second, it includes attrition. So, the actual enforcement personnel is 5,000 LA Times * Mother Jones

- IRS backlog hits nearly 24 million returns, further imperiling the 2022 tax filing season

- ARPA Stimulus - you don't have to pay back 2020 overage on subsidies IRS.Gov *

- InsureMeKevin.com on subsidies & pay backs... 1.25.2022 update ARPA and 600% CA

- 1040 Instructions

- Overview FTB site

- How to Reconcile Subsidies FTB

- Calculate Pay Back

- Assistance Repaying California Subsidies

- covered ca.com/the most you might have to pay back

- 2022 Insure Me Kevin.com

- Our webpage on Form 8962 - Premium Tax Credit Subsidy Reconciliation

- Open Enrollment Tool Kit

- Enrollment Dashboard Guide for Certified Enrollers

- FPL Chart

- Strike & Lockout

- QLE Major Life Changes

- Documents to Confirm Eligibility

- Income Section

- Certified Agent Briefing

- DACA Toolkit

- social press kit.com/lets-talk-health

- Daily Summary Notices Broker Portal

- Medi Cal to Covered CA

- 2024 End of the year briefing

- Forms - Including Paper Application

- 1095 toolkit

- how to generate and print plan summaries

The 1095 B shows proof that you had coverage from your employer’s health plan. While there is no longer a Federal Mandate Penalty there is a penalty for California. The California FTB Franchise Tax Board is in charge of working out all the rules and procedures. We’ll have to wait and see.

More

- Form 1095-B, Health Coverage

- Individuals who had health coverage for themselves or their family members that is not reported on Form 1095-A from Covered CA or Form 1095-C from Large Employers and Self Insured Plans

- Insurance companies outside Covered CA

- Government agencies such as Medicare or Medi Cal

- Medicare doesn’t issue 1095 unless you ask. You don’t need it to file taxes Medicare.Gov *

- Employers who provide certain kinds of health coverage, which is sometimes referred to as “self-insured coverage,” but are not required to send Form 1095-C.

- Health Coverage Providers –

- Use Form 1095-B for information on whether you and your family members had health coverage that satisfies the individual shared responsibility provision (Mandate Penalty).

- If there are months when you or your family members did not have coverage, determine if you qualify for an exemption or must make an individual shared responsibility payment mandate penalty prior to 2019.

You don’t need to wait for your Form 1095- B to file your tax return. Do not attach Form 1095-B to your tax return – keep it with your tax records. Contact the issuer if you have questions about your Form 1095-B. Source HCTT-2016-81 IRS bulletin dated 12.21.2016

- Individuals who had health coverage for themselves or their family members that is not reported on Form 1095-A from Covered CA or Form 1095-C from Large Employers and Self Insured Plans

Visit our Employer Website & Get Quotes

- Medi Cal 1095 B

- FAQ’s CA Department of Health Care Services

- The Form 1095-B is an Internal Revenue Service (IRS) document that many, but not all, people who have Medi-Cal will receive. The Department of Health Care Services (DHCS) only sends Form 1095-B to people who had Medi-Cal benefits that met certain requirements, known as “minimum essential coverage,” at least one month during the tax year. READ MORE and the Rest of the FAQ’s

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage

- May request Social Security #‘s

- Minimum Essential Coverage

- Health Net Explanation

- Other Pages in this section

- Forms that Employers must provide to employees

- Questions and Answers on Information Reporting by Health Coverage Providers (Section 6055) IRS Website

- Our Webpage on 6055 & 6056 Reporting Requirements

FAQ’s

From Health Net

- What is Form 1095-B: Health Coverage?

- Why do I need Form 1095-B?

- When will I receive Form 1095-B?

- What do I need to do with Form 1095-B?

- Do I need to include my Form 1095-B when I file my taxes?

- How does the IRS know that I had minimum essential coverage in 2019?

- Does having Form 1095-B mean I won’t have a tax penalty?

- Where can I learn more about this law and my responsibility?

- How do I get another copy of my Form 1095-B?

- What should I do if the information on my Form 1095-B is incorrect?

- What if I have questions about the information on my Form 1095-B?

FAQ’s “#1095 B Confirmation of Employer, Medi-Cal & Non Covered CA Coverage”

- Question I was direct off exchange with Kaiser, not Covered CA. I called Kaiser and they say they don’t have my 1095 B form. What do I do?

. - Answer I don’t see that there is anything to do. You don’t have to file the form with your tax return. Did you have coverage for the full year? Do you have receipts or cancelled checks for your premium payments?

- Don’t include Form 1095-A, Form 1095-B, or Form 1095-C with your tax return.

irs.gov/instructions/i1040 - healthnet.com/form-1095b

- See our Kaiser webpage and scroll to member services

- If you appointed us as your broker, we might be able to go through Broker Support and help you.

- Don’t include Form 1095-A, Form 1095-B, or Form 1095-C with your tax return.

- Question Does Medi-Cal issue a 1095 B Form?

. - Answer Yes.

- Learn More ===>dhcs.ca.gov/medi-cal/eligibility

.

- Learn More ===>dhcs.ca.gov/medi-cal/eligibility

- Question What is the minimum income to qualify for a subsidy? Does withdrawal from ira count as income toward the qualifying amount?

- If I receive $12000 from disability and take$5000 from my Ira, Individual Retirement Account, do I qualify for a subsidy.(Assuming the qualifying amount is $17000.) Past years, be sure to verity the current year.

- Also, can I revise my previous year income tax and qualify for the previous subsidy as I mis-calculated originally and made $17000 .

.

- Answer 138% of poverty level – see chart. Get your income, subsidy and enhanced silver level calculated.

- IRA withdrawal would go on line 15. I don’t know how much of your distribution would be taxable.

- 2. Yes. See our page on definition of MAGI income for more detail. It may make a difference on what type of disability that you have. SSI, SSDI, SDI etc. It’s basically line 37 of your 1040 and then add back in line 20 a & b.

- 3. The issue is not what you made last year, but what you are expecting to earn in the upcoming year.

- Instructions to appoint us as your agent are on this page.

- Kaiser FAQ’s 1095 B

What is form 1095 C Proof of Coverage from a #Large Employer?

Form 1095-C is provided by a large employer to employees so they can prove they had coverage for the year and not get fined in CA for not having coverage, or so they can get coverage from Covered CA – no extra charge to use a broker, click on button below to get quotes and subsidy calculation, if no coverage is provide.

Form 1095-C provides information about the health coverage offered by your employer and, in some cases, about whether you enrolled in this coverage. Use Form 1095-C to help determine your eligibility for the premium tax credit.

- If you enrolled in a health plan in Covered CA, you may need the information in Part II of Form 1095-C to help determine your eligibility for the premium tax credit.

- If you did not enroll in a health plan in the Marketplace, the information in Part II of your Form 1095-C is not relevant to you.

Use Form 1095-C for information on whether you or any family members enrolled in certain kinds of coverage offered by your employer – sometimes referred to as “self-insured coverage”.

- If Form 1095-C shows coverage for you and everyone in your family for the entire year, check the full-year coverage box on your tax return.

- If there are months when you or your family members did not have coverage, determine if you qualify for an exemption or must make an individual shared responsibility payment – tax penalty.

You don’t need to wait for your Form 1095- C to file your tax return. Do not attach Form 1095-C to your tax return – keep it with your tax records. Contact the issuer if you have questions about your Form 1095-B.

Understanding Form 1095-C,

Employer-Provided Health Insurance Offer and Coverage

Employers with 50 or more full-time employees, including full-time equivalent employees, in the previous year use Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, to report the information required about offers of health coverage and enrollment in health coverage for their employees. Form 1095-C is used to report information about each employee. Employers that offer employer-sponsored self-insured coverage also use Form 1095-C to report information to the IRS and to employees about individuals who have minimum essential coverage under the employer plan and therefore are not liable for the individual shared responsibility payment for the months that they are covered under the plan. An employer must furnish a Form 1095-C to each of its full-time employees by January 31 of the year following the year to which the Form 1095-C relates. Employers will meet the requirement to furnish Form 1095-C to an employee if the form is properly addressed and mailed on or before the due date. If the regular due date falls on a Saturday, Sunday, or legal holiday, employers may file by the next business day. The Form 1095-C that employers send may include only the last four digits of the employee’s social security number, replacing the first five digits with asterisks or Xs. Forms 1095-C must be sent on paper by mail or hand delivered, unless the employee consents to receive the statement in an electronic format. The consent ensures that the employee can access the electronic statement. If mailed, the statement must be sent to the employee’s last known permanent address, or if no permanent address is known, to the employee’s temporary address. Individuals who worked for multiple employers that are required to file Form 1095-C may receive a Form 1095-C from each employer.

All our plans are Guaranteed Issue with No Pre X Clause

Quote & Subsidy #Calculation

There is No charge for our complementary services

Watch our 10 minute VIDEO

that explains everything about getting a quote

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- Get more detail on the Individual & Family Carriers available in CA

https://hbex.coveredca.com/toolkit/pdfs/1095_Toolkit.pdf

I need my 1095-A form but can’t recall my Password, and can’t answer ALL QUESTIONS SENT.

IRS IS REQUESING THIS FORM AS MY PARENTS CLAIMED ME IN 2019, AND CAN’T GET THEIR REFUND WITHOUT THIS DOCUMENT, WHICH WAS SENT TO WRONG ADDRESS SO I WAS TOLD.

I NEED HELP.

See above about appointing us as your broker. If nothing else, call Covered CA and ask that we get appointed as your broker. We can then easily get your 1095 for you.

If your parent were claiming you as a dependent, that might cause problems with the subsidy amount that you were getting.

Definition of household & all.

For the last one month I have been calling covered Ca to resolve the problem of getting form 1095 to submlt my tax return. Almost every time I had to waste almost half an hour but no luck. Yesterday I spent between two to three hours continuously in talking to one or the other person from covered ca.

They helped me in getting fresh password. Later the computer gets jammed. The the message comes site is down etc.

On Feb 20 I talked to one of their rep and I was promised that form will come in my mail in two weeks. I called on March 5 and was told to wait for one more day i.e till March 6. Still no luck

Today my son made a few attempts to log in to my account without any success. Then he tried to log in to his account. He too had the same kind of frustation.

Will you please get me form 1095 ASAP.

Also please submit this complaint to the highest authorities of covered Ca.

Needless to say covered ca is giving me this frustration. I would like to take up this complaint with head of covered Ca.

This is why I rarely talk to anyone. Those that do want to talk can set up an appointment, as long as they get a quote first and let me know what their questions are.

I will email all the higher ups at Covered CA know. I doubt we will get anywhere. If I’m lucky, I’m told that my concern has been forwarded to management. When I’m not lucky, Covered CA’s legal counsel threatened to terminate my contract “for cause” and keep my renewal commissions as I complained that I didn’t have time to deal with there BOZO the Clown, flea bitten website to enroll Medi Cal without any compensation.

So, if you have issues, just email us. I had no problem getting your 1095.

You might try your local elected representatives

We did have a client who reported that her local Congressperson helped her out and got the problem resolved.

house.gov/find-your-representative

nytimes.com/how-senators-and-representatives-can-help-constituents

Here’s our webpage on grievances.