What are the Legal California Residency Requirements to

Qualify for

Medicare, Medicare Advantage Plan or Medi Gap – Supplemental,

Part D Rx and under 65 Covered CA – Obama Care?

Medicare #Advantage

You are eligible to enroll in an Medicare Advantage plan if you permanently reside in the service area (where the plan has doctors and hospitals signed up) of the plan. Vacations or temporary moves do not count. (CMS 20.3) blue shield EOC CMS allows each State to determine the rules for residency in their state.

Definition Residency

- to dwell permanently or continuously : occupy a place as one's legal domicile Webster *

- the act or fact of dwelling in a place for some time

- the place where one actually lives as distinguished from one's domicile or a place of temporary sojourn Webster *

- When the plain meaning of a word lends itself to only one reasonable interpretation, that interpretation controls Guide to Contract Interpretation *

- Be sure to check your ACTUAL EOC Evidence of Coverage Value and how to find

Links & Resources

- Our Webpage on complex Medicare Rules Enrollment Dates, Residency

- Income Tax & Medicare if you live out of country 26 USC 911

- CA Residency Guidelines Publication 1031 pdf

Potential Cancellation if not a CA Resident

Medicare Advantage Plans or Supplement may cancel you when you move out of their service area for more than six months. (Freedom Blue EOC) Check out the rules to keep your current coverage for up to one year. §20.3

See our FAQ’s or ask Questions?

Members Who Change Residence

MA organizations may offer (or continue to offer) extended “visitor” or “traveler” programs to members of coordinated care plans who have been out of the service area for up to 12 months. The MA organizations that offer such programs do not have to disenroll members in these extended programs who remain out of the service area for more than 6 months but less than 12 months. …Organizations offering MA-PFFS plans may allow continued enrollment of individuals absent from the plan service area for up to 12 months,…50.2.1

MA organizations offering plans without these programs must disenroll members who have been out of the service area for more than 6 months.

- A geographic area where a health insurance plan accepts members if it limits membership based on where people live. For plans that limit which doctors and hospitals you may use, it’s also generally the area where you can get routine (non-emergency) services. The plan may disenroll you if you move out of the plan’s service area. Medicare.Gov

- When you move within a state, state to state or return to USA, you are entitled to a SEP (Special Enrollment Period) where you may choose another Medi Gap or Advantage plan, with NO MEDICAL QUESTIONS. 50.2.1 MAPD Rules * Medi Gap * Covered CA & Direct Quotes * Individual & Family Enrollment Periods *

- Enrollment Periods Publication # 11219 Page 7

- Individual & Covered CA Special Enrollment

- Email us [email protected] or navigate this website with your specific questions & proposals if moving to or from CA.

- Jump to section on:

- What is a Service Area?

- Medicare if you live outside of USA

- Get a Medicare and Social Security Account – Address changes etc. Our webpage

CA Residency Guidelines #FTB1031 2023

- See our webpage on lawful presence & public charge

- A California resident is one who is in California for other than a temporary or transitory purpose; or Domiciled in California, but outside California for a temporary or transitory purpose. (ftb.ca.gov).

-

In using these factors, it is the strength of your ties and closest connections not just the number of ties, that determines your residency (ftb.ca.gov/)

Individual & Covered CA

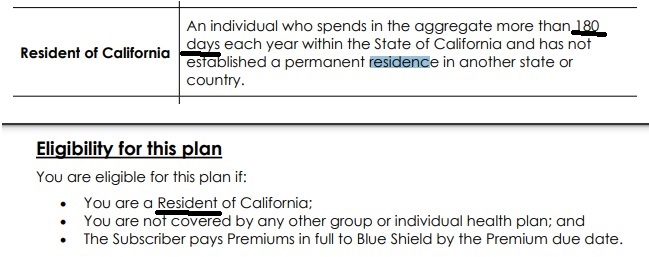

Covered CA & Individual Residency Requirements

Blue Shield – Covered CA Individual & Family

EOC Evidence of Coverage

|

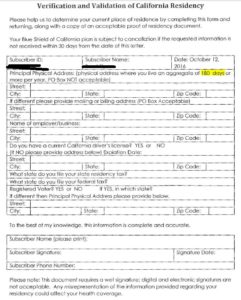

Blue Shield under 65 residency verification

|

Must Reside in the Service Area |

#Insubuy Travel Health Insurance

Instant Quotes, Details and ONLINE Enrollment

Steve talks about International Travel Insurance VIDEO

US State Department - Travel - Insurance

Our webpage on Travel Insurance

Medicare A & B if you don't #live in USA

Publication 11871

Medicare just visiting Out of County Publication # 11037

- medicare.gov/travel-outside-the-u.s.

- Our webpage on Medicare Coverage outside of USA

- FAQ - Buying Medi Gap if you live outside USA

- Get International Travel Quotes & Information

- Medi Gap - Covers up to $50k

- Medicare Advantage may cover unlimited ER and Urgent care - check the details

*********Social Security*****

Payments if you are living outside of USA # 10137

- Learn More

Our Webpages on:

FAQ’s

See our older information and archives Archive.org

Residency FAQ’s #a41

-

- earn enough to stay in Covered CA – See the Income Chart

- When you report lower income 138% of FPL Federal Poverty Level to Covered CA, they would put you in Medi Cal.

- Medi Cal and Covered CA only cover Urgent Care and Emergencies outside of CA – Service Area – Check your EOC Evidence of Coverage

- If you don’t have Medi Cal or Covered CA, you’re not outside the USA long enough to get an exemption from the CA Tax Penalty.

- You might want to consider Travel Coverage while you are in India, better service, not have to pay upfront and cover non emergencies.

- We really need to double check your actual EOC

FAQ

Puerto Rico

-

-

- Medicare.Gov agrees: If you have Original Medicare and you buy a Medigap policy, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap policy pays its share.

-

FAQ’s

Out of Country Residence

-

- At “EVERY” seminar I’ve ever been to, Medi Gap is touted as the solution to those who have grandchildren out of state for when they visit or those who travel in an RV Recreational Vehicle. PBS.org states that once you have a Medi Gap Plan, you can keep it, no matter where you live.

- I don’t see any mention of residency in Publication Medicare Medi Gap Guide

- The xyz 2017 Confidential Producer handbook page 10 states one must be a resident of the state in which they are applying. If they are going to cancel you for moving… it would have to be in their evidence of coverage. It’s not in Blue Shields.

- HICAP

- A Medi Gap wholesaler said the Insurance Companies go by the address on file with Medicare. They also point out, that Medicare is VERY limited outside USA. You might want to check out travel policies

- Reply from CA HICAP:

- A Medigap company can’t issue coverage out of the country, they aren’t licensed to do that outside the U.S. A Medigap can’t be used out of the country, except for the Medigap emergency benefit and that is not available to someone who lives outside the country.

- It sounds like he is trying to preserve his open enrollment opportunities and I don’t see a way for him to do that. If he has no serious health care conditions when he returns to the U.S., assuming he intends to return, he won’t have a guaranteed issue option but many insurers will sell him coverage at an underwritten rate.

- If he intends to ever return to the U.S., or visit frequently, he needs to apply for, and keep Medicare to ensure he has coverage when he returns, and that he will not be subject to any later premium penalties. If he is eligible for premium free Part A there are no premiums or late enrollment penalties for that part of Medicare, but there are for Part B, and even for Part C, the prescription drug benefit. Although this means he will pay premiums, even though Medicare will not pay for his care outside the U.S., these are serious premium penalties for delaying enrollment.

- He needs to consider what health care options he will have where he lives now if he intends to stay there, and whether that benefit will cover any care he might receive in the U.S. The consult or embassy where he lives may have some helpful information.

I hope this information is helpful.

- —

- Bonnie Burns

Training and Policy Specialist

California Health Advocates

- Bonnie Burns