Pre-existing conditions (Uninsurable) clauses – exclusions

Pre-existing conditions (Uninsurable) clauses

- The Pre X clause no longer applies to Individual or Group Health Insurance as it’s prohibited under Health Care Reform 45 CFR §147.108 and all coverage is GUARANTEED ISSUE 29 USC § 1182. §2701

- Pre-existing condition exclusion means

- a limitation or exclusion of benefits

- In the past a Pre X clause (including a denial of coverage) was based on the fact that the condition – Medical Problem was present before covered began whether under a employer group health plan or individual health insurance coverage and often whether or not any medical advice, diagnosis, care, or treatment was recommended or received before that day. One needs to review the actual EOC Evidence of Coverage to know for sure.

- A preexisting condition exclusion includes any limitation or exclusion of benefits (including a denial of coverage) applicable to an individual as a result of information relating to an individual’s health status before the individual’s effective date of coverage … such as a condition identified as a result of a pre-enrollment questionnaire – application or physical examination given to the individual, or review of medical records relating to the pre-enrollment period. 54.9801-2 wikipedia.org Pre X

- Here’s some 2024 figures on Medi Cal and other spending on various illnesses.

Trump Great American Health Plan

- News Nation 1.2026

- Critics of Trump’s proposal say the framework is incomplete and does not account for people with preexisting conditions, a caveat White House press secretary Karoline Leavitt confirmed Thursday.

Our main webpage on Trumps Great Healthcare Plan

Obamacare PROHIBITS discrimination or

different rates based on health!

FAIR HEALTH INSURANCE PREMIUMS.

§2701 Page 37 HR 3590

‘‘(a) PROHIBITING DISCRIMINATORY PREMIUM RATES.—

‘‘(1) IN GENERAL.—With respect to the premium rate charged by a health insurance issuer for health insurance coverage offered in the individual or small group market—

(A) such rate shall vary with respect to the particular plan or coverage involved only by—

(i) whether such plan or coverage covers an individual or family;

(ii) rating area, [county – zip code] as established in accordance with paragraph (2);

Small Biz Rating Methods AB 1083

(iii) age, except that such rate shall not vary by more than 3 to 1 for adults (consistent with section 2707(c)); and

(iv) tobacco use, [Doesn’t apply in CA] except that such rate shall not vary by more than 1.5 to 1; and

(B) such rate shall not vary with respect to the particular plan or coverage involved by any other factor not described in subparagraph (A).

So does CA Law

A health insurer shall not establish rules for eligibility, including continued eligibility, of any individual to enroll under the terms of an individual health benefit plan based on any of the following factors:

(A) Health status.

(B) Medical condition, including physical and mental illnesses.

(C) Claims experience.

(D) Receipt of health care.

(E) Medical history.

(F) Genetic information.

(G) Evidence of insurability, including conditions arising out of acts of domestic violence.

(H) Disability.

(I) Any other health status-related factor as determined by any federal regulations, rules, or guidance issued pursuant to Section 2705 of the federal Public Health Service Act.

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Contact Us - Ask Questions - Get More Information

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Pre ACA/Obamacare Problems you could have been denied for

Underwriting Declinable Conditions Health Questions

Examples of Declinable Conditions Medical Underwriting Kff.org In the Medically Underwritten Individual Market, Before the Affordable Care Act – Group Market before AB 1672 1992 CA :

Condition Condition

AIDS/HIV Lupus

Alcohol abuse/ Drug abuse with recent treatment Mental disorders (severe, e.g. bipolar, eating disorder)

Alzheimer’s/dementia Multiple sclerosis

Arthritis (rheumatoid), fibromyalgia, other inflammatory joint disease Muscular dystrophy

Cancer within some period of time (e.g. 10 years, often other than basal skin cancer) Obesity, severe

Cerebral palsy Organ transplant

Congestive heart failure Paraplegia

Coronary artery/heart disease, bypass surgery Paralysis

Crohn’s disease/ ulcerative colitis Parkinson’s disease

Chronic obstructive pulmonary disease (COPD)/emphysema Pending surgery or hospitalization

Diabetes mellitus

Pneumocystic pneumonia

Epilepsy Pregnancy or expectant parent

Hemophilia Sleep apnea

Hepatitis (Hep C) Stroke

Kidney disease, renal failure

Transsexualism

Declinable Medications

Anti-Arthritic Medications

Adalimumab/Humira

Cyclosporine/Sandimmune

Methotrexate/Trexall

Ustekinumab/Stelara

others

Anti-Diabetic Medications

Avandia/Rosiglitazone

Glucagon

Humalog/Insulin products

Metformin HCL

others

Medications for HIV/AIDS or Hepatitis

Abacavir/Ziagen

Efavirenz/Atripla

Interferon

Lamivudine/Epivir

Ribavirin

Zidovudine/Retrovir

others

Anti-Cancer Medications

Anastrozole/Arimidex

Nolvadex/Tamoxifen

Femara

others

Anti-Psychotics, Autism, Other Central Nervous System Medications

Abilify/Ariprazole

Aricept/Donepezil

Clozapine/Clozaril

Haldol/Haldoperidol

Lithium

Requip/Ropinerole

Risperdal/Risperidone

Zyprexa

others

Anti-Coagulant/Anti-Thrombotic Medications

Clopidogrel/Plavix

Coumadin/Warfarin

Heparin

others

Miscellaneous Medications

Anginine (angina)

Clomid (fertility)

Epoetin/Epogen (anemia)

Genotropin (growth hormone)

Remicade (arthritis, ulcerative colitis)

Xyrem (narcolepsy)

others

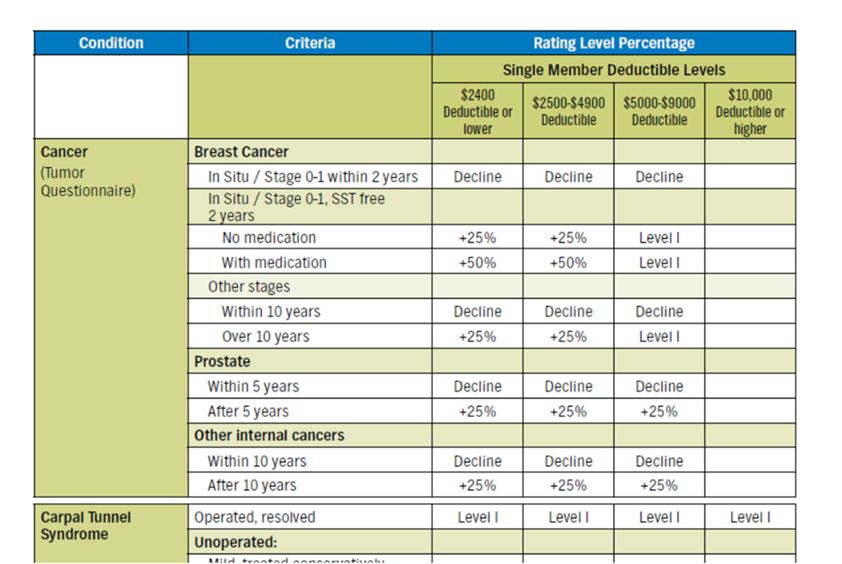

Pre X in Medi Gap?

When might there be a Pre-X clause in #Medi-Gap for California Policies

Maybe if there is Medical Underwriting. ACA/Health Care Reform didn’t change the rules for Medi Gap. No pre-x if you enroll during a guaranteed issue time.

Guaranteed issue rights (also called “Medigap protections”)— Rights you have in certain situations when insurance companies are required by law to sell or offer you a Medigap policy. In these situations, an insurance company can’t deny you a Medigap policy, or place conditions on a Medigap policy, like exclusions for preexisting conditions, and can’t charge you more for a Medigap policy because of a past or present health problem. Publication 02110 page 49

Introduction to #MediGap

Publication 02110

- 2025 Official Medicare Guide to choosing a Medi Gap Policy # 02110

- MORE Information and Links

- Matrix - Spreadsheet of what Medicare Pays, Medi Gap pays and what little you pay

Historical Information

& Reference

FAQ’s

- Are you repealing patient protections, including for people with pre-existing conditions?

- No. Americans should never be denied coverage or charged more because of a pre-existing condition.

- We preserve vital patient protections, such as (1) prohibiting health insurers from denying coverage to patients based on pre-existing conditions, and (2) lifting lifetime caps on medical care. housegop.leadpages.co/healthcare

- ***

- Thus, the rest of this page is pretty much Historical

- Seniors & Medicare Supplements

Medicare Advantage Plans

Part D – Rx – Prescriptions

- What about the Pre X clause in visitor and travel policies?

- Claims Issues?

- What if I have say Hypertension – how would it be determined if that was the nexus or aggravation of say a Heart Attack?

- Misc.

- Where can I find Federal Regulations §146.111 or §2590.701-3 on Pre-X limitations?

- Underwriting

- In Individual plans Insurance Companies generally have the right to decide to give you a policy on not. This is called Underwriting.

- CA Department of Insurance Listing of typical Pre-existing conditions

- One Page – Pre Underwriting FORMS

- Do NOT miss your HIPAA 63 day deadline!

- When must a health plan write me?

- In CA under AB 1672 Small Employer Health Act §10705 j you can not be excluded as an employee or dependent in a group plan for health status. Employer group of 2 or more are guaranteed coverage.

- Mr. MIP Guaranteed coverage for individuals rejected from standard plans.

- Obama’s Interim High Risk Guaranteed Pool However, this plan just ran out of funding.

- Guarantees for those who lost Employer Group Health Insurance

- COBRA and when that expires in 18 months or 36 months in California, then you can get a “HIPAA” policy

- Government Tools to help find coverage

- Case Law on Pre-Existing Conditions

- What if a don’t tell the Insurance Company about my medical history?

- Be sure to disclose whatever is asked for in the application, so that there isn’t a recession – cancellation later. Just because you paid cash or were treated by someone whose records are not available, doesn’t mean that just because it’s not on your “record” that it doesn’t count. In some cases, the Insurance Company will have your doctor verify your conditions on your first visit with your new coverage.

- Do NOT call or contact us in any way, if you plan to misrepresent yourself on an application for Insurance. We do not need the grief or the fine. We are mandated by law to certify that we do not know anything negative that is not on the application and that we explained to you how important it is to fill out an application correctly. We pride ourselves on helping the public get paid on LEGITIMATE claims and issues.

- Preexisting conditions, proximate cause

- When two causes join in causing injury, one of which is insured against, insured is covered by policy. Zimmerman v. Continental Life Ins. Co. (App. 1 Dist. 1929) 99 Cal.App. 723, 279 P. 464. Wiki Answers Ins.Code § 10320 exclusions must be listed in the policy itself.

- 10198.6. Preexisting Condition Provisions and Late Enrollees

10198.7. (a) - top

- /

- veterans disability lawyer site.com

- Preexisting Condition Exclusions, Lifetime and Annual Limits, Rescissions, and Patient Protections

- Regulation

- Fact Sheet

- Patient Protection Model Notice

- Lifetime Limits Model Notice

- (CA Healthline)

Brother - Sister - Sibling Side Pages Subpages

View our website with your Desktop or Tablet for the most information