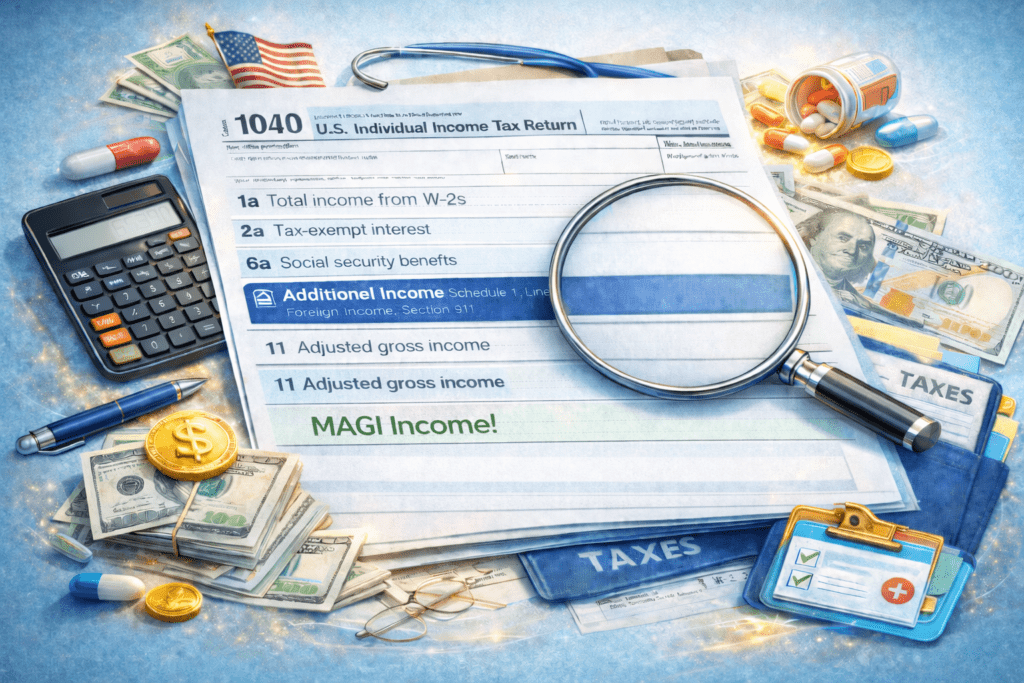

Covered CA MAGI Income #Rental Income & Losses

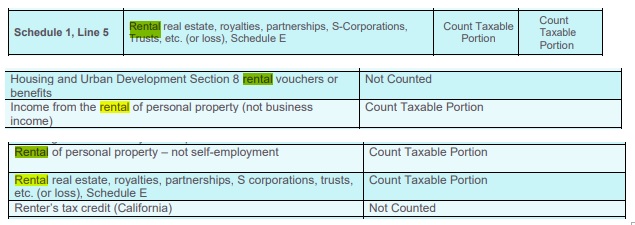

- Rental Income net after losses, shows up on your 1040 tax return, Schedule E, Schedule 1 and is counted towards MAGI income.

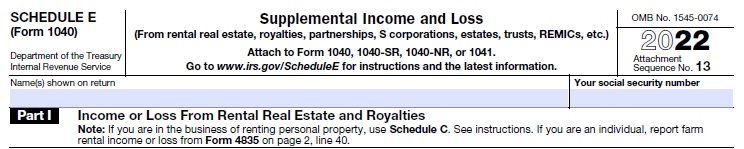

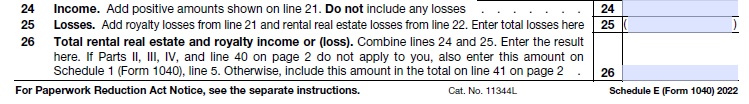

- Rental Property Income and Losses get calculated on Schedule E Supplemental Income & Loss

- Take the profit or loss from Schedule e and put it on Schedule 1 Line 5

- Put your income or loss from Schedule 1 on of your 1040.

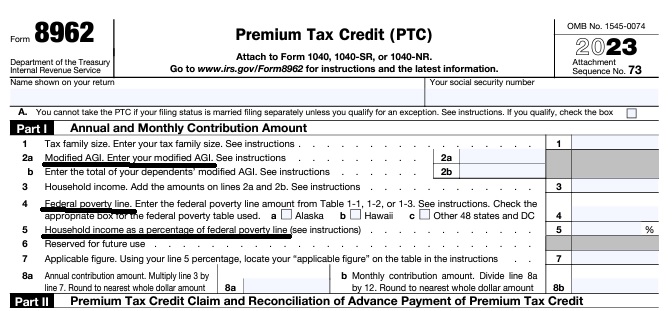

- Put your MAGI Modified Adjusted Gross income from your 1040 on line 2a of 8962 Premium Tax Credit

- Schedule E Supplemental Income & Loss

- Get Instant Covered CA Quotes

Rental income or a vacation home counts as taxable Covered California MAGI Income

What rights do your Tenant’s Have?

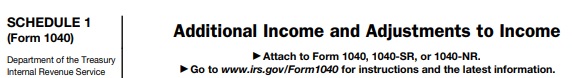

#Adjustments to Income - Schedule 1

#Schedule1 1040

- Part I Additional Income

- 2a Alimony received

- 3 Business income or (loss). Attach Schedule C

- Get Health Quote for your business

- 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

- 7 Unemployment compensation

- 8 Other income:

- a Net operating loss

- b Gambling income

- c Cancellation of debt

- d Foreign earned income exclusion from Form 2555

- e Taxable Health Savings Account distribution

- Part II Adjustments to Income

- 11 Educator expenses

- 13 Health savings account deduction. Attach Form 8889

- 15 Deductible part of self-employment tax. Attach Schedule SE

- Learn more about your Social Security Benefits

- 16 Self-employed SEP, SIMPLE, and qualified plans -

- 17 Self-employed health insurance deduction

- 19a Alimony paid

- 20 IRA Individual Retirement Account deduction

- 21 Student loan interest deduction

- Instant Business Health Insurance Proposals

Calculate your Covered CA MAGI Income

Take #Line8b 11 or your projected IRS 1040 Adjusted Gross income for the upcoming year then

add line 2a, 6a & 8 (Foreign Income)

Chat GBT isn't showing the numbers quite right, but you get the idea.

-

-

IMPORTANT!!!

The upcoming year - the future for what you tell Covered CA!

Sure, many people think it’s the past as Covered CA may ask for last years paperwork, but that’s BS! You might have to give back all the subsidies when you file Subsidy Reconciliation form #8962!

- Visit our MAIN webpage on MAGI Income

-

Federal IRS #Form8962 Reconciliation Form for Covered CA Subsidies

attaches to IRS 1040 it all comes out when you file taxes!

-

If you got too high a subsidy or too low, it gets reconciled at tax time on form 8962. If your subsidies were too high you may have to pay the excess back and maybe penalties, if too low, you can get a tax refund or lower the amount you have to pay. In a lot of ways, IMHO subsidies are hocus pocus, jiggery pokery - smoke and mirrors as it's all guesswork and promises. Be sure to report income and household changes within 30 days.

- See below or visit our 8962 Webpage for more information

- MAGI AGI Income, what is it our webpage?

Vacation Homes

Tax Cut & Jobs Act

IRS Tips

Dwelling Unit.

This may be a house, an apartment, condominium, mobile home, boat, vacation home or similar property. It’s possible to use more than one dwelling unit as a residence during the year.

Used as a Home.

The dwelling unit is considered to be used as a residence if the taxpayer uses it for personal purposes during the tax year for more than the greater of: 14 days or 10% of the total days rented to others at a fair rental price. Rental expenses cannot be more than the rent received.

Personal Use.

Personal use means use by the owner, owner’s family, friends, other property owners and their families. Personal use includes anyone paying less than a fair rental price.

Divide Expenses.

Special rules generally apply to the rental of a home, apartment or other dwelling unit that is used by the taxpayer as a residence during the taxable year. Usually, rental income must be reported in full, and any expenses need to be divided between personal and business purposes. Special deduction limits apply.

How to Report.

Use Schedule E to report rental income and rental expenses on Supplemental Income and Loss. Rental income may also be subject to Net Investment Income Tax. Use Schedule A to report deductible expenses for personal use on Itemized Deductions. This includes such costs as mortgage interest, property taxes and casualty losses.

Special Rules.

If the dwelling unit is rented out fewer than 15 days during the year, none of the rental income is reportable and none of the rental expenses are deductible. Find out more about these rules; see Publication 527, Residential Rental Property (Including Rental of Vacation Homes).

Additional IRS Resources:

- Tax Topic 415 – Renting Residential and Vacation Property

- irs.gov/know-the-tax-facts-about-renting-out-residential-property

- Rental Income and Expenses – Real Estate Tax Tips

- Is My Residential Rental Income Taxable and/or Are My Expenses Deductible? IRS

IRS Topic 414 Rental Income & Expenses

Tips

IRS Rental Income Publication #527 pdf

Form 1040, Schedule E (PDF), Supplemental Income and Loss, to report income and expenses related to real estate rentals

Turbo Tax Summary

All our Health plans are Guaranteed Issue with No Pre X Clause

Instant Quote & Subsidy #Calculation

There is No charge for our complementary services, we are paid by the Insurance Company.

- Our Quote Engine Takes all the complexity out of using pencil and paper to figure out the premiums per the Obamacare/ACA rules under CFR §1.36B-3 *

- We are authorized Brokers for Dental, Vision & Covered CA get instant quotes direct and in Covered CA with subsidy calculation for:

- Watch our 10 minute VIDEO that explains everything about getting a quote

Covered CA

#Vacation Homes MAGI Income?

Renting out a vacation property to others can be profitable. If you do this, you must normally report the rental income on your tax return. You may not have to report the rent, however, if the rental period is short and you also use the property as your home. Here are some tips that you should know:

- Vacation Home. A vacation home can be a house, apartment, condominium, mobile home, boat or similar property.

- Schedule E. You usually report rental income and rental expenses on Schedule E, Supplemental Income and Loss. Your rental income may also be subject to Net Investment Income Tax.

- Used as a Home. If the property is “used as a home,” your rental expense deduction is limited. This means your deduction for rental expenses can’t be more than the rent you received. For more about these rules, see Publication 527, Residential Rental Property (Including Rental of Vacation Homes).

- Divide Expenses. If you personally use your property and also rent it to others, special rules apply. You must divide your expenses between rental use and personal use. To figure how to divide your costs, you must compare the number of days for each type of use with the total days of use.

- Personal Use. Personal use may include use by your family. It may also include use by any other property owners or their family. Use by anyone who pays less than a fair rental price is also considered personal use.

- Schedule A. Report deductible expenses for personal use on Schedule A, Itemized Deductions. These may include costs such as mortgage interest, property taxes and casualty losses.

- Rented Less than 15 Days. If the property is “used as a home” and you rent it out fewer than 15 days per year, you do not have to report the rental income. In this case you deduct your qualified expenses on Schedule A.

- Use IRS Free File. If you still need to file your 2015 tax return, you can use IRS Free File to make filing easier. Free File is available until Oct. 17. Free File is available only through the IRS.gov website.

IRS Tax Tips provide valuable information throughout the year. IRS.gov offers tax help and info on various topics including common tax scams, taxpayer rights and more.

Additional IRS Resources:

- Tax Topic 415 – Renting Residential and Vacation Property

- Rental Income and Expenses – Real Estate Tax Tips

- IRS Tax Tip 2018-79, May 22, 2018

- Publication 527 Residential Rental Property including VACATION HOMES

#Covered CA Certified Agent

No extra charge for complementary assistance

- Get Instant Health, Dental & Vision Quotes, Subsidy Calculation & Enroll

- Appoint us as your broker

- Get Instant Health Quotes, Subsidy Calculation & Enroll

Tenants & Condo Rights

California #Tenants Rights

- Los Angeles Mayor Karen Bass April 2023 NEW Protections for Renters

- 2025 Can’t ask for Credit Reports 2b 267

- LA Times – What to know about new Tenant’s protection Laws

- The County EAPE Program helps CalWORKs Welfare-to-Work (WtW) families who are behind in rent and/or utility bills due to a financial crisis which could lead to an eviction and homelessness. Effective October 1, 2020, the EAPE Program provides eligible families with a once-in-a-lifetime* maximum of up to $5,000 to pay for multiple months of their past due rent and/or utilities to help them keep their housing. EAPE also pays for utility reconnection fees, if the family’s’ utilities have been disconnected when the EAPE application is submitted. dpss.lacounty.gov

California Tenants & Landlords Rights & Responsibilities pdf

See our webpage on Small Claims Court & Mediation

CA Department of Real Estate Publications

- housing.lacity.org/renter-protections

- Quick Guide for Landlords Hiring a Property Manager Landlord Brochure 14-264

- Quick Guide for Tenants Renting a Home Tenant Brochure 14-264

- A Homeowner’s Guide to Foreclosure in California #RE 15 (New 7/10) Useful information for homeowners in financial distress who live in their homes.

- Financial Sense to White Picket Fence #RE 18 This brochure provides helpful hints and tips relating to real estate financial literacy.

- Eviction Process – Video

- dre.ca.gov/Complete List Publications

#Condo Publications

SUBDIVISION PUBLICATIONS

https://www.dre.ca.gov/Publications/CompleteListPublications.html

- Operating Cost Manual for Homeowners Associations

#RE 8 (1/16)

#RE 8 (1/16)

Contains guidelines and worksheets for budget preparation and calculation of reserves and assessments. - Operating Cost Manual Addendum

– (5/23)

– (5/23) - Reserve Study Guidelines for Homeowner Association Budgets

#RE 25 (Rev. 8/10)

#RE 25 (Rev. 8/10)

Explains how to determine sufficient reserve funds. - Subdivision Public Report Application Guide

#RE 9 (Rev. 6/11)

#RE 9 (Rev. 6/11)

Provides instructions and explains what is required to apply for a subdivision public report. - SOPRAS Guide

#RE 9A (Rev. 5/18)

#RE 9A (Rev. 5/18)

Subdivisions Online Public Report Application System (SOPRAS) Guide. - A Guide to Understanding Residential Subdivisions in California

Resource for everyone who has an interest in California subdivisions - Residential Subdivision Buyer’s Guide

Guide for consumers who are considering purchasing a home in a new subdivision in California - Living in a California Common Interest Development

#RE 39 (Rev. 8/16)

#RE 39 (Rev. 8/16)

Overview of rights, duties and responsibilities of homeowner associations and homeowners. Explains CC&Rs. - Our Condo Website on Web Archive November 2021

-

HOA – Condo ONLINE Education

-

Homeowners Associations: Last Week Tonight with John Oliver (HBO)

Instant Term Life Insurance Quote #naaipquote

- Schedule Zoom consultation

- Tools - Calculator to help you figure out how much you should get

- How much life insurance you really need?

#RE 8 (1/16)

#RE 8 (1/16)

You’ve been a tremendous help in providing this published documentation and I appreciate you.