Calif. State Disability Insurance Coverage ( #SDI )

Calculate your benefits

SDI State Disability Insurance for Business Owners

California State Disability Coverage for Business #Owners

- Information Sheet de 231 ec – 2 pages pdf

- Forms & Publications

- Sales Pamphlet #2565 DI Elective Coverage

- Pays up to 39 weeks – appears to pay as much as SDI for employees

- Weekly Benefit Amounts # de2589

- Calculating Benefit Amounts

- Enrollment Application #1378di 4 pages pdf

- Coverage can be denied if you are currently unable to do the duties of your regular job edd.gov

- For information call EDD @ 916-654-6288 – we don’t get compensated to help you with EDD.

- If you want our assistance – consulting fee – click here.

- See our webpage on Private Disability Coverage – where you can get higher and longer paying benefits.

Disability Insurance #Calculators

- Calculate your Personal Disability Quotient (PDQ) chances of being disabled and how much income loss there might be?

- Broad Ridge Advisors Tool

- Income Needs

- Chances of Becoming Disabled Quiz

- Social Security Administration – Estimate Your Potential Benefit Disability & Retirement Benefit

- whats my Earned Income Quotient.org How much might you earn in your future?

- Our webpages on:

Steve on Disability Income Protection

Video

- Email [email protected]

- Statistics from Disability Can Happen.org

- Our other Webpages on Disability & Unemployment Coverage

Private Disability Insurance

Links & Resources

- Disability can Happen.org * Blog *

- Where did your paycheck go - living confidently.com/protect-your-paycheck learn more about disability.

- About Disability Insurance.com

- Other stories from Life-Happens.org

- Disability Can Happen.org

- Disability Insurance 101 Six Page pdf

- defend your income.org/ ♦

- Los Angeles Department on Disability

Disability Buy – Sell

- Disability Benefits cannot be liened against, garnished or taken in Bankruptcy ( CCP §704.130, CA JCC Form EJ 155, CA Claim of Exemption Info.,)

- Guaranteed-Issue Multi-Life Disability Insurance Petersen

Consumer Links

- Other Coverage’s to pay for various types of Disability

- Mental Health Resources – Essential Benefit

- 106. (a) Disability Definition CA Insurance Code

- "health insurance" specified disease insurance workers' compensation Long-term care.

- policygenius.com/long-term-disability-insurance-faqs

- Disability Income – Pay Check Protection

Claims

- Art Fries claim advise can help you

- Disability Concepts.com - Gerry Katz - Disabilty Claim Consultant

- Top 10 Disability Claim Mistakes LA Times.com

- long term disability lawyer.com FAQs

- Covid - Long Haulers - Frustration

Technical Resources

- Law Help.org Disability

- Mortgage Loan.com on buying a home for people with Disabilities.

- Unum/Provident

- 2013 Disability Divide Employer Research Report

- BROKER ONLY

Introduction to SDI State Disability Insurance for Employees

Calif. State Disability Coverage ( #SDI )

How SDI works

SDI provides affordable, short-term benefits to eligible workers who suffer a loss of wages when they are unable to work due to a NON WORK-RELATED illness, injury, or a medically disabling condition from pregnancy or childbirth. Check out Worker’s Compensation if you were injured on the job. To learn more, scroll down and check out the official EDD brochure on SDI provisions # DE 2515

If you would like to get extra private coverage to pay in addition to SDI, here’s our webpage on private Disability Business owners can opt in to get SDI, scroll down for SDI for Biz Owners information.

When your SDI benefits run out you might try filing for Social Security -SSI, SSDI

General Information

- About Disability Insurance

- Disability Insurance Claim Process

- Am I Eligible for DI Benefits?

- FAQ from Website Visitor

- FAQ Partial Disability – Coordination with Employer Sick Leave?

-

Calculating SDI Benefit Payment Amounts

- Types of Claims (e.g. Pregnancy, Bonding, Care)

FAQ’s

- Disability Insurance FAQs

- Forms and Publications

- Employers and Self-Employed

- Physicians/Practitioners

- Voluntary Plans

- Form 1099G FAQs (Reporting Taxes)

How to File a Claim

- Options to File for DI Benefits (Online or by Mail)

- How to File a DI Claim in SDI Online

- How to File a DI Claim by Mail

- After You File for DI: Claim Processing

DI Fraud Investigations?

Keep track of your Claim

- Manage Your Claim with SDI Online

- Request to Stop or Extend Your DI Benefits

- FAQs – DI Benefit Payments

- Reporting Your Wages

- Overpayments

- Appeals

EDD Website

- EDD Employers Guide 100 Pages

- Disability Benefits 101 on SDI

Voluntary SDI Plans?

Save $$$ Better Benefits

FAQ

Deadline to file Claim

Employer Contribution?

- Question My employee filed a claim for SDI, but he hasn’t worked here to two years!

- Will I as a business get surcharged for the claim like in Worker’s Compensation.

.

- Will I as a business get surcharged for the claim like in Worker’s Compensation.

- Response Video Explanation 49 day deadline

- Doesn’t appear to be employer surcharge if there are claims. It’s just 1.1% of wages, the employee pays.

EDD - CA Programs for Unemployed #DE2320

Los Angeles Times - Introductory Article on Unemployment 7.5.2022

- See our webpage on

- SDI State Disability Benefits - How to apply

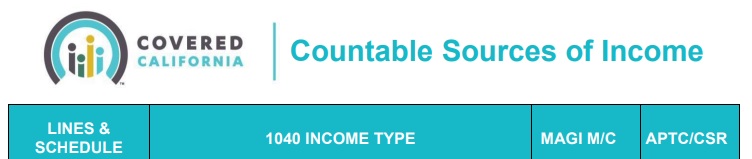

- Covered CA MAGI Income Unemployment ***** SDI

- Get Quote for Private Disability

- CA & Federal Paid Family Leave

- Pandemic Unemployment Assistance

- EDD - No Storefront Offices - Mass Shootings - Efficiency - Not Covid

- New laws for January 2022 faster service, prevent fraud LA Times 10.5.2022

- You should file for regular UC if you have an employer and you have been laid off, or your hours have been reduced through no fault of your own, or you cannot work because a medical or public official has directed you to quarantine or self-isolate because of COVID-19 exposure, symptoms, or a positive diagnosis; or you are caring for someone who is suspected of having or has tested positive for COVID-19.

Is SDI Taxable?

Part of MAGI Income for Covered CA Subsidies

SDI State Disability Insurance and

Long Term Disability MAGI Income Taxable ?

- Your DI benefits are taxable only if you receive DI Disability Income benefits in place of UI Unemployment Insurance benefits.

- In this case, your DI benefits are considered a substitution for your UI benefits, which are taxable. Federal Tax Regulation Section 1.85-1

- Thus, if you can’t work because of a disability and receive disability benefits, those benefits are not taxable.

- Learn More ⇒ edd.ca.gov/

- Federal Unemployment ends Labor Day Weekend 2021 NBC.com *

Covered CA (& Medi Cal) - Calculate - #Countable Sources of MAGI Income

Short Summary

True Freedom Home Health Care Benefits

True #Freedom Home Health Plans

True Freedom Plan Details - Brochure 1/2025

- Enrollment Form

- email [email protected] for fillable pdf

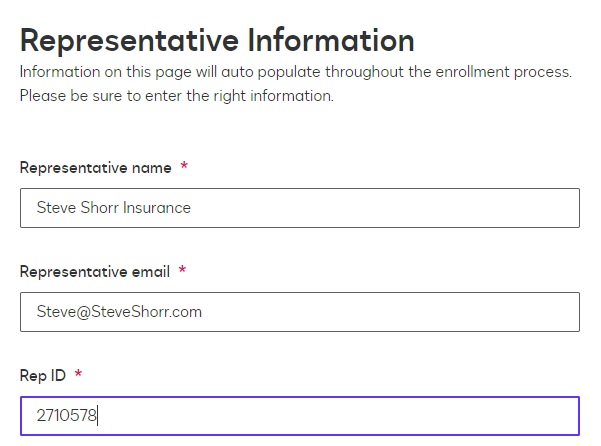

- ONLINE Enrollment - put in our agent information

- Rate Chart

- One page brochure

- VIDEO Explanation on True Freedom Plan

- The Long Road Ahead Video

- The application disclaimers

- FAQ's

- True Freedom website, but be sure to enroll with us!

"Prepaid Home Health Care?"

Watch 3 minute simple plain English Video

- Email us for more information [email protected]

- Our webpage on Long Term & Home Health Care

- Our webpage on True Freedom

Medicare & #HomeHealth Care # 10969

TRUE FREEDOM - Home Health Care

No health questions asked

- Our webpage on Home Health & Long Term Care

- Medicare.Gov Home Health Provider Finder

- Resources to find Home Health & Nursing Care

- FAQ on Home Health Care Nurse - Medical Necessity - Wound Care

- The Medicare Home Health Benefit: An Unkept Promise

- Study Finds Medicare Advantage Patients Experience Worse Home Care Kff

- "Hospital at Home" Programs Improve Outcomes, Lower Costs But Face Resistance from Providers and Payers

- California Guide for Care Givers

Extra Benefits during the COVID Emergency Pandemic Disaster

If you’re on SDI State Disability Insurance

Sorry but The American Rescue Plan ARPA Our Main ARPA webpage * nor the #CARES Act provide the

extra $300 or $600/week if you are collecting SDI State Disability Insurance

You Must be ready able and willing to work!

Federal Unemployment ends Labor Day Weekend 2021 NBC.com * More detail and alternate plans like Medi Cal, Covered CA subsidies, Cal Fresh, Find a JobLos Angeles Times*

COVID-19 relief package: No stimulus checks but it offers a $300 bonus to unemployment benefits USA Today 12.15.2020

Why can’t you get SDI & the extra stimulus payment for unemployment?

I researched, googled & googled and looked & looked & don’t find anything to support one getting SDI to be able to get the additional $300/week under ARPA Guidance * ABC 10 * nor the prior $600/week PUA Pandemic Unemployment Assistance – FAQ’s uc.pa.gov/FPUC-FAQs see the footnotes in our research below for more detail. We are not authorized to approve or deny claims from any Insurance Company, State or Federal Authority.

The federal Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 provides for a temporary emergency increase in unemployment compensation (UC) benefits, referred to as the Federal Pandemic Unemployment Compensation (FPUC) program.

This program provides an eligible individual with $600 per week on top of the weekly benefit amount he or she receives from certain other UC programs. An individual must first be eligible for UC benefits to qualify for the additional $600 per week in benefits.

Individuals don’t need to do anything extra to receive the $600. Continue to file biweekly claims – benefits will be automatically updated. uc.pa.gov/FPUC-FAQs

One must be eligible to actually receive at least a nominal amount of regular UC unemployment compensation benefits to be eligible to receive the $600 payment:

ii. If the individual is eligible to receive at least one dollar ($1) of underlying benefits for the claimed week, the claimant will receive the full $600 Federal Pandemic Unemployment Compensation FPUC. Guidance 4.4.2020 15-20 * Littler.com

Individuals are only entitled to extra benefits, namely the $600 payment, if they are “no longer working through no fault of their own” and if they are “able and available to work.” employment law letter

The PUA benefits are also payable for certain people that normally don’t qualify for regular UI Unemployment benefits in California or another state and also do not qualify for State Disability Insurance or Paid Family Leave benefits. Namely,

SDI provides short-term benefit payments to eligible workers who have a full or partial loss of wages due to a non-work-related illness, injury, or pregnancy. Benefit amounts are approximately 60-70 percent of wages (depending on income) and range from $50-$1,300 a week.

SDI appears to pay much more than unemployment!

Unemployment Insurance (UI) benefit calculator will provide you with an estimate of your weekly UI benefit amount, which can range from $40 to $450 per week. borowitzclark.com/california-unemployment/ https://edd.ca.gov/Unemployment/UI-Calculator.htm

Might you be disabled for a long time, over a year? Check out SSDI Social Security Disability Income.

Check out our other webpages on this topic

- corona-virus-how-does-insurance-cover-it/

- sba-coronavirus-loans/

- unemployment-compensation-cant-find-job-corona-pandemic/

- Might your disability go in indefinitely – SDI – SSDI

- Be sure to review our FAQ’s below.

https://www.dol.gov/sites/dolgov/files/ebsa/about-ebsa/our-activities/resource-center/publications/disability-benefits-claim-filing.pdf

ssi ssdi ihss

Are Cities & Government Agencies required to contribute to SDI? Namely, the City of Vernon in California

Many public and government agencies are not required by the California Unemployment Insurance Code to join the SDI Program. These employers may elect coverage for all employees, but an election by the appropriate governing board and a written petition signed by a majority of the employees is required. Employees may not join as individuals.

Public agency employers may elect coverage for:

Employees who are part of an appropriate bargaining unit. The election must result from a negotiated agreement.

Management and confidential employees.

Employees who are not part of an appropriate bargaining unit. Learn More @ EDD.CA.Gov

I would imagine City of Vernon has an alternate program. Check out these links:

City of Vernon Human Resources

Employee Benefits – Current Employees

Benefits

Our webpage on SSDI Social Security Disability Insurance

Attorney’s that might help with Disability

If you want us to do more research, there is a nominal fee.

How can I get some extra monthly money?

I’m not sure what your question is for me?

What is your disability? Can you get improvement and go back to work?

Did you want to check out other welfare programs, that I as a taxpayer, work for you and then you get extra $$$?

When I want extra $$$, I put in a few more hours in my job and this website.

Are there ways you can lower your expenses?

I was laid off from my job on March 19, 2020 dues to Covid. So I’m currently collecting Unemployment Insurance. If I become disabled and give up my Unemployment last quarter of earnings was the first quarter of 2020.

Would I qualify for SDI?

What might I collect?

Check our reply below.

Looks like we would need to know your earnings each quarter for the last 18 months. Then you could use the calculator here.

I have a hard time staying focused & paying attention to where I’m going in the car and I forget a lot frequently

I’m not sure what your question for me is

SDI Criteria

In order to be eligible for DI benefits, you must:

Be unable to do your regular or customary work for at least eight days.

Have lost wages because of your disability.

Be employed or actively looking for work at the time your disability begins.

Have earned at least $300 from which State Disability Insurance (SDI) deductions were withheld during your base period. Learn more with Calculating Benefit Payment Amounts.

Be under the care and treatment of a licensed physician/practitioner or accredited religious practitioner within the first eight days of your disability. The date your claim begins can be adjusted if it does not meet this requirement. You must remain under care and treatment to continue receiving benefits.

criteria for Social Security

Here’s our webpage on autism

Here’s our webpage on applying for SSI and SSDI

I’m on disability and not working.

How long can I stay on my employer’s health plan?

What can I do for health insurance, when the group plan runs out?

Can my employer fire me if I’m not able to show up for work?

How long you can stay on your Employer’s Health Plan would depend on what was requested when the Employer set up the plan.

Here’s the options with one typical company.

Check out all the various health insurance company Employer Applications

Also check out what is in your employee manual.

Try going to the administrative pages and administrative guides of the Insurance Companies and get more details on their rules.

I was in disability while the whole pandemic was going on

I had restrictions

would I have qualified for the extra $600 a week being on partial disability

What do you mean by Partial disability?

Please review the Q & A below and information above… there might be exceptions that you could collect.

I’m sorry what I meant by that was Short Time/Term Disability.

I had a Heart Attack And Was On Disability With Restrictions To Return Back To Work

Your question is beyond my expertise. Try turning in the claim and see what happens. Your question sounds very much like the one below

References:

https://www.edd.ca.gov/disability/faqs.htm

https://covid19.ca.gov/workers/

I have chf Congestive Heart Failure and am on Sdi because doctor says it’s too risky to go back to work because of covid-19 right now.

Am I eligible for the 600

So, if we didn’t have COVID 19, you wouldn’t be on SDI? If you were out of work, you would be on Unemployment, right?

The short answer is no – you can’t collect jobless benefits if you quit a job because of a general fear of the virus, experts say. “We’ve never had a pandemic since unemployment insurance has been in play, so we have to really be thinking about what the new rules for a pandemic are,”

If you quit your job because of a general worry about the virus, you won’t be able to access unemployment benefits

“Fear is not a legitimate reason to refuse to return,” says Justine Phillips, an employment attorney with the law firm Sheppard Mullin, “and state unemployment agencies can disqualify the individual for benefits if they refuse to accept suitable employment when offered.”

A worker who’s been collecting unemployment insurance and is particularly vulnerable because of underlying health conditions or a compromised immune system could apply for pandemic-related aid

if the job is truly unsafe, they may have grounds to refuse the reassignment

“I encourage people to check with the state agency before making a decision, because if they refuse work and their boss reports they refused, they can lose their unemployment check,” Evermore says. “It has to be clear … what suitable work is.”

“Again, the burden of proof … is on the worker,” Evermore says, “and some state agencies are going to take a harder line on this than others.”

USA Today

if your employer offers you your job back and you refuse it, generally speaking, you’re not supposed to be able to keep collecting unemployment benefits.

But there are strategies and special protections that workers should know about — in particular people with health conditions

if you have, say, diabetes, heart disease or an immune deficiency and your doctor advises against going to work during the pandemic, Congress voted to let people in that situation collect unemployment.

HR 748 CARES Act

“first contact your employer and explain why you can’t return to work.” She says to then explain the situation to your state’s unemployment office. And, she says, “you should be eligible to remain on unemployment assistance.” NPR

President Biden signed an order asking the U.S. Department of Labor to clarify that workers who refuse jobs due to unsafe working conditions can still receive unemployment insurance.

A DOL department spokesman told Reuters the agency is developing an Unemployment Insurance Program Letter – the usual mechanism for issuing guidelines or clarifying policies – in response to the order.

https://www.insurancejournal.com/news/national/2021/02/01/599452.htm

2.26.2021 Guidance Issued

https://www.insurancejournal.com/news/national/2021/02/26/602996.htm

https://wdr.doleta.gov/directives/corr_doc.cfm?DOCN=3202

I am on SDI right now. Will I receive the extra $600 per week from the CARES Act

We will answer that question in the page above

I had sdi last month because my doctor said I should be working, but I not getting my extra $600 a month

What should I do?

Can I apply PUA? Also?

I still can’t go back to work right now because of my Health condition

I have been diagnosed with covid – 19.

If I apply SDI, Can I receive $600?

Please help me how I apply for this one?

Thank you!

You’re question is beyond my pay grade. I don’t work for EDD or get compensated to help people with EDD claims.

It sure seems like you should be able to get the extra $600. If you were unemployed, you would for sure. Since your ill and can’t work it seems no, for the reasons cited on this webpage and the other FAQ’s.

It looks like you should file for unemployment and see what happens.

Check out these references and others on this page & FAQ’s

https://edd.ca.gov/about_edd/coronavirus-2019/pandemic-unemployment-assistance.htm

If you are unable to work and able to provide a written certification by a state or local health officer that you are infected with, or suspected of being infected with, COVID-19, you can file a Disability Insurance (DI) claim. DI provides short-term benefit payments to eligible workers who have a full or partial loss of wages due to a non-work-related illness, injury, or pregnancy. Benefit amounts are approximately 60-70 percent of wages (depending on income) and range from $50-$1,300 a week. edd.ca.gov/Disability/How_to_File_a_DI_Claim_in_SDI_Online

Would I qualify for benefits if I choose to stay home from work due to underlying health conditions and concerns about exposure to the virus?

You can be eligible for benefits if you choose to stay home. Once you file your claim, the EDD will contact you if we need more information.

Can I collect disability and unemployment benefits at the same time?

You have the right to apply and file a claim for unemployment and disability benefits at the same time, but you can only collect payments under one benefit program at a time. You’re encouraged to file a claim under one program based on your circumstances or file under both programs if you are unsure of which program is most appropriate. The EDD will review the facts and determine your eligibility for the appropriate program.

Can I start collecting unemployment benefits because I am laid off or have had my work hours reduced, and then switch to a disability claim if I become sick?

Yes. If you become sick while you are out of work, you can apply for a disability claim, which can provide a higher benefit amount if you’re eligible.

A medical certification is required to substantiate your illness. If you are approved for a Disability Insurance claim, your Unemployment Insurance (UI) claim will be suspended. If you recover but remain unemployed, you may then return to the remainder of your UI claim benefits as long as you remain out of work and are otherwise eligible. You will need to reapply to reopen your UI claim.

Will I be ineligible for unemployment benefits if I answer no to the question about looking for work on my certification for ongoing payments?

You should answer the question truthfully. Given the unique economic situation and lack of available work created by COVID-19, the EDD has been able to adjust our usual eligibility requirements to allow us to automatically process a large volume of claims. You will not be penalized if you answer “no” to the question about looking for work and will be paid benefits for that week if you meet all other eligibility requirements.

How much can I earn in disability benefits?

Benefit amounts are approximately 60-70 percent of wages (depending on income) and range from $50-$1,300 a week. The EDD provides a Disability Insurance Calculator to estimate your potential benefit amount. Disability benefits are paid through the date your doctor certifies or when you exhaust your available benefits, whichever comes first within a 52-week period.

The Governor’s Executive Order waives the one-week unpaid waiting period, so you can collect DI benefits for the first week you are out of work. If you are eligible, the EDD processes and issues payments within a few weeks of receiving a claim.

https://edd.ca.gov/about_edd/coronavirus-2019/faqs.htm#UIBenefits

I’ve been on SDI State Disability Insurance for 52 weeks, can it be extended beyond that due to virus circumstances?

I expected to be disabled maybe another 6 months?

I have treatment resistant major depressive disorder but it might be getting better

My first thought would be to suggest you go on SSDI, but it’s my understanding that you must have a condition expected to last at least a year. So, maybe a year and a half would count? Check our page on SSDI Social Security Disability.

If you were able to work, I’d say, check into Unemployment Coverage, see above.

In googling… I don’t see anything about the 52 weeks being able to be extended. You don’t have Corona Virus, so I don’t think you could start a new claim based on that.

Here’s Disability Benefits 101 on SDI.

Are you getting Medi Cal? They might be able to hook you up with Food Stamps, SNAP, General Relief etc.

You can set up an ONLINE Medi Cal account here.

How recent must I have been employed and paying taxes into SDI to collect? That is, if I paid in but then went into an industry that isn’t coverage by SDI, can I collect? Get both benefits?

Here’s the eligibility requirements page https://edd.ca.gov/Disability/Am_I_Eligible_for_DI_Benefits.htm

Here’s the part that recreates a problem:

Have earned at least $300 from which State Disability Insurance (SDI) deductions were withheld during your base period. For additional information visit, Calculating Benefit Payment Amounts.

https://edd.ca.gov/Disability/Calculating_DI_Benefit_Payment_Amounts.htm

Your weekly benefit amount (WBA) is approximately 60 to 70 percent (depending on income) of wages earned 5 to 18 months prior to your claim start date up to the maximum weekly benefit amount. You may receive up to 52 weeks of Disability Insurance (DI) benefits.

A base period covers 12 months and is divided into four consecutive quarters. The base period includes wages subject to SDI tax which were paid approximately 5 to 18 months before your disability claim began.

I’m not authorized to deny your benefits. You have nothing to lose, except time by filing a claim. Note also that if you were eligible, SDI would probably deduct the payments you would be getting from another public disability system or vice versa.

https://edd.ca.gov/Disability/FAQ_DI_Eligibility.htm

I worked for the government for a couple of years. Can I collect DI?

Perhaps. Some government workers, including school employees, may be eligible for DI benefits due to their collective bargaining contract. Also, if you have wages from a private employer during the base period, you may be eligible even though your present employer is a local government entity. The EDD encourages you to file a claim for benefits, even if you are unsure of your eligibility.

My 48 year old son in California has colorectal cancer that has matastasized to his liver. After several surgeries, he is in his second round of chemotherapy. This is expected to be more debilitating than the past treatments and cause him to have to reduce work hours as a licensed landscape architect in a medium sized firm. Throughout this, his firm has previously paid his full salary even though he has worked only part time some months.

I understand that he can recieve from California SDI up to 55% of his full time salary. If he was able to work 45% of the time while in chemo, could he recieve the 55% SDI and get the remaining 45% salary from the firm at the same time?

Please review these pages

edd.ca.gov/Disability/Am_I_Eligible_for_DI_Benefits.htm

edd.ca.gov/Disability/FAQs.htm

I am currently working, but my physician/practitioner tells me I must reduce my working hours due to my disability.

Can I file a claim for Disability Insurance (DI) benefits?

Yes. If you are losing wages, the Employment Development Department (EDD) suggests that you file a claim. After the EDD receives your properly completed claim, we will determine if you are otherwise eligible for DI benefits.

Can I receive accrued vacation from my employer and still receive DI benefits?

Yes. Vacation benefits are not in conflict with DI.

Can I receive sick leave from my employer and still receive DI benefits?

You cannot receive DI benefits for any period for which you also receive sick leave wages that are equivalent to your full or regular salary. If you are receiving only partial sick leave wages, however, you may be eligible for full or partial DI benefits.

Can I receive paid leave from my employer while I am receiving my DI benefits?

Yes, but depending on the type of paid leave and how much you receive, your DI benefits may be reduced. You should always report all the wages you receive from your employer on your claim form.

Can I receive DI benefits if my employer offers me unallocated leave or paid time off (PTO)?

No. PTO payments are considered the same as sick leave wages. However, if you are receiving partial PTO and still lose wages, you may be eligible to receive full or partial DI benefits.

I have cancer.

Can I get SDI.

How much is the benefit?

In order to be eligible for DI benefits, you must:

Be unable to do your regular or customary work for at least eight days. per EDD Eligibility Page

Your weekly benefit amount (WBA) is approximately 60 to 70 percent (depending on income) of wages earned 5 to 18 months prior to your claim start date up to the maximum weekly benefit amount. Learn More EDD Benefit amount page

What are the medical eligibility requirements for SDI?

Medical eligibility is for any illness or injury, either physical or mental, that prevents an individual from doing his or her usual or customary work. This definition also includes disabilities resulting from elective surgery, pregnancy, childbirth, or a related medical condition. CA Disability Benefits

How to file a claim.

Sample claim form