What is the Social Security SSI DAC – Disabled Adult Child Program?

You can keep Medi-Cal

Get SSDI on your Parents Work History

Get a term life quote here,

to protect your loved one

DAC – Disabled Adult Child

Keep Medi Cal & Increased benefits from Parents Retirement Benefits

The DAC – Disabled Adult Child program provides full-scope, no cost Medi-Cal to qualifying adults who receive “Social Security Disabled Adult Child (DAC) benefits.”

An adult is entitled to receive Disabled Adult Child benefits if:

- that adult is unmarried;

- has a disability that began before the age of 22

- and was dependent on his or her parent at

- the time of application,

- the time of the parent’s death, or

- at the time the parent’s own period of disability began Sec. 216. Other definitions

To qualify as a Medi-Cal Disabled Adult Child an individual must be entitled to receive Title II Disabled Adult Child benefits and must have had and lost SSI because of eligibility for these Title II benefits.

Individuals first receive Social Security DAC payments at the time of the retirement, disability or death of a parent.

When this occurs, an individual who is receiving SSI can begin receiving a DAC payment that is higher than the SSI payment rate. This makes the individual ineligible for SSI and for SSI-linked Medi-Cal.

Individuals who receive “Social Security DAC” benefits can qualify for full-scope, no cost Medi-Cal if they:

• Received SSI in July 1987 or later;

• Initially qualified for Title II DAC benefits, or qualified for an increase in Title II DAC benefits, on or after June 1, 1987; and

• Would be eligible for SSI now but for either:

° the current receipt of Title II DAC benefits which they first became eligible for while they were receiving SSI, or

° the increase in Title II benefits because of COLAs since they last received both Title II benefits and SSI.

In order for an individual with Title II DAC benefits to continue to receive MediCal with no Share of Cost, the Social Security Title II income is disregarded when calculating Medi-Cal eligibility. Under federal law, the individual is treated for Medicaid purposes as if they were still an SSI beneficiary.

Getting and Keeping DAC Medi-Cal

Any individual described above who qualifies should be able to get Medi-Cal either as a continuing benefit when she loses SSI or, if later, as a new applicant under the Medi-Cal DAC Program. The state periodically sends counties lists of Title II DAC recipients whose SSI/SSP has been or is being terminated. The counties are required to contact the recipients to see if they need assistance in completing the forms required for the application process. Eligible individuals should remain eligible as long as they meet all the other SSI eligibility rules. DAC Program Page 84 – Non Magi Medi-Cal 3.71

****

Eligibility Group Requirements*: An individual who was receiving Supplemental Security Income (SSI) benefits and who meets the following:

• Is at least 18 years of age;

• Has blindness or a disability which began before the age of 22;

• Has been receiving Supplemental Security Income (SSI) based on blindness or disability; and

• Has lost Supplemental Security Income (SSI) due to the receipt of Social Security benefits on a parent’s record due to the retirement, death or disability of a parent.

*If the person meets all of the above criteria, they may qualify as a Disabled Adult Child under Section 1634 of the Social Security Act (regarding DAC). This designation comes from the Social Security Administration. Eligibility for Medicaid may continue as long as the person is determined blind or disabled. However, if the person receives income from another source or exceeds the resource limits, they may become ineligible for Medicaid coverage See the rest of the New Jersey 2 page explanation

Resources & Links

- See all our footnotes

- explanation on Sellers Law Firm website

- Hill & Ponton

- See the Official Social Security Booklet on benefits for Children with Disabilities

- See also Medicare Part B Premium Forgiveness

- IHSS In Home Supportive Services

- Department on Disability, on behalf of the City of Los Angeles

Get a term life quote here,

to protect your loved one

- Jump to section on

- #Social Security Disability Benefits Publication # 10029

- SSI Introduction Publication # 5-11000

- More than you ever wanted to know on SSI

Understanding SSI Publication # 17-008 120 pages - SSI in CA #11125

- What every woman should know Publication 10127

- 1 hour lecture

- Our webpage on

#Attorney 's that can help you through the Social Security Disability maze

- west coast disability.com/

- CA State Bar Attorney Referral Service

- Legal Match.com

- Sellers Law

- Hill & Ponton

- premier disability.com

- Cantrell & Green

- We don't necessarily know these attorney's...

- Editorial: Lawyers are fighting innovative proposals for more affordable legal assistance. That’s wrong LA Times 1.30.2022

- We don't necessarily know these attorney's...

6 Steps to apply for Social Security #Disability

- Video 6 steps to apply

- ssa.gov/benefits/ssi/start

- SSI Child Disability Starter Kit (for children under age 18)

- Adult Disability Starter Kit(for children age 18 or older)

- What you need to know to get Social Secuirty Disabiltiy Benefits # 10153

- Disability Benefits # 10029

- How Social Security decides if you are still disabled # 10053

- Social Security Outline Court of Appeals 9th Circuit

Pickle Program

#Pickle Amendment

- When a person receives SSI and one of their parents retires, becomes disabled, or dies, the person switches from receiving SSI to receiving SSDI. Sometimes a person can receive both SSDI and SSI.

- Getting SSDI usually means you’ll get more money. When that happens, people are sometimes told that they will lose their Medi-Cal coverage, or that they will have to pay a higher share of cost because their income is too high. Some people are even told by staff at the Social Security Administration or Medi-Cal that they will lose their Medi-Cal.

- The Pickle amendment states that if an individual’s monthly income is over the SSI limit simply because they went from receiving the SSI stipend to the higher SSDI stipend, they maintain their eligibility for Medi-Cal – Medicaid. FAQ 2 page flyer

- The DAC Medi Cal program maintains the status quo with respect to Medi-Cal by continuing to provide categorical Medi-Cal so long as the individual would be eligible for SSI if the individual were not receiving the DAC Social Security payments. The DAC Medi-Cal program, like the Pickle program, also provides protection from loss of SSI-linked Medi-Cal caused by Social Security COLAs. This second part of the DAC Medi-Cal program is sometimes called the “Pickle DAC” or “pseudo Pickle DAC” program.

- The Employment for Disabled Americans Act of 1986 (Public Law 99-643) requires states to continue Medicaid coverage when an individual who became disabled before age 22 and received SSI becomes eligible for SSDI or has an increase in SSDI benefits. Such disabled adult children continue to be considered SSI recipients for Medicaid purposes.

- Disabled Adult Child (DAC) Medi-Cal Program Benefits

- A Quick and Easy Method of Screening for Medicaid Eligibility under the Pickle Amendment: 2023 Update

Instructions on how to move from SSI to SSDI and

#keep Medi Cal & Medicaid 2 pages

Pickle Amendment Screening Questions?

Resources & Links

- Learn More CA Disability 101

- Guide to Medi Cal Programs – Chcf Page 43

- Poverty Law.org

- Guide to Disability Rights Laws Ada.Gov

- special needs answers.com

- Craig vs Bonta lawsuit,

- Informational Package

- Rank vs Lynch

FAQ’s

Pickle Program

#Keeping Medi Cal after qualifying for SSDI

Question MEDI-CAL recipients are undergoing MEDI-CAL certification [redetermination]

My disable daughter is 34 years old and was previously on SSI and now receiving DAC payment from SSA.

On the MEDI-CAL recertification form:

- Do I need to include her DAC income?

- If she is receiving housing in-kind, what dollar amount will MEDI-CAL use to count as income?

- And will she lose her MEDI-CAL?

- FYI here is Medi Cal’s Contact Info

Her other income which MEDI-CAL is using is the $120.00 that Veteran Administration (VA) is paying me for having a disable child since I am receiving a disability pension from VA.

Answer See the pickle program above and here’s instructions

If your parent becomes disabled, retires or dies and they are or were receiving or could have received social security payments contact the social security office. Tell them what has changed.

As soon as you are approved for SSDI because of your parent, contact Medi-Cal * Benefits Cal and let them know the change in your income. Then ask about what kind of Medi-Cal you will be on. If someone tells you that you will have to pay for Medi-Cal or you are not eligible for Medi-Cal anymore, ask about Pickle Program Medi-Cal, or Aged and Disabled Federal Poverty Level Medi-Cal or California Working Disabled Medi-Cal. Instructions

Check with your CPA, Gifts – In Kind housing probably don’t count as income.

Survivor Benefits

DAC #Retirement – Survivor Benefits

Who can get survivors benefits based on a spouses or parents work records?

Children can get benefits at any age if they were disabled before age 22. Publication 10084

Adults Disabled Before Age 22

An adult disabled before age 22 may be eligible for child’s benefits if a parent is deceased or starts receiving retirement or disability benefits. We consider this a “child’s” benefit because it is paid on a parent’s Social Security earnings record.

The “adult child”—including an adopted child, or, in some cases, a stepchild, grandchild, or step grandchild—must be unmarried, age 18 or older, have a disability that started before age 22, and meet the definition of disability for adults.

It is not necessary that the adult child ever worked. Benefits are paid based on the parent’s earnings record.

- An adult child must not have substantial earnings. The amount of earnings we consider “substantial” increases each year. In 2020, this means working and earning more than $1,260 a month.

- First, the “adult disabled child” (the Social Security Administration’s (SSA) term for a person with a disability that manifested itself before age 22) must be completely disabled according to the SSA’s adult disability standards.

- Second, the disability must have occurred before the potential beneficiary turned 22.

- Third, the potential beneficiary’s parent must have paid into the Social Security system for the required number of quarters. Finally, and most importantly, the potential beneficiary’s parent must be either dead, permanently disabled, or receiving Social Security retirement benefits.

- If an adult disabled child and her parent meets all of these qualifications, then the “child” should be able to receive a substantial benefit, often greater than an SSI award. On top of the monetary gain, the child does not have to worry about her own unearned income or assets, since SSDI does not take these into account. Special Needs Answers *

What if the adult child is already receiving SSI benefits or disability benefits on his or her own record?

An adult child already receiving SSI benefits or disability benefits on his or her own record should still check to see if benefits may be payable on a parent’s earnings record. Higher benefits might be payable and entitlement to Medicare may be possible.

How do we decide if an adult “child” is disabled for SSDI benefits?

If a child is age 18 or older, we will evaluate his or her disability the same way we would evaluate the disability for any adult. We send the application to the Disability Determination Services in your state that completes the disability decision for us. ssa.gov

Applying for SSI payments or SSDI benefits and how you can help

You can apply for SSI payments or SSDI benefits for your child by calling Social Security toll-free at 1-800-772-1213 or by visiting your local Social Security office. Nolo.com * Publication 10026

Links & Resources

- Social Security #Survivors Benefits Publication # 10084

HTML Social Security Website

HTML Social Security Website- Benefits for Children # 10085

- How to apply for Child's Benefits

- Benefits for Children with Disabilities # 10026

- SSI & SSDI if disabled

- Parent's Benefits # 10036

- How Social Security can help when family member dies # 10008

- Our Webpages on

- What You Need to Know When You Get Retirement or Survivors Benefits #10077

Disability Qualification Rules

#Disability SSI & SSDI Publications, Resources & Links

- Disability Benefits #10029

- SSI Child Disability Starter Kit (for children under age 18)

- Adult Disability Starter Kit(for children age 18 or older)

- Benefits For Children under 18 With Disabilities

- Other Disability Publications

- Social Security Handbook

- Understanding Supplemental Security Income SSI For Children-- 2019 Edition

- Western Poverty Law Center - Coverage for Low Income California's DAC Program Page 84 - Non Magi Medi-Cal 3.71

- Our webpage on SSI & Medi Cal

- ObamaCare - Mental Health - One of 10 Essential Benefits

- New Jersey 2 page explanation

- ssa.gov Section 1634

- Social Security Disability Planner: Benefits for A Disabled Child

- Pickle Amendment Screening Q & A

- The State Council on Developmental Disabilities (SCDD) is established by state and federal law as an independent state agency to ensure that people with developmental disabilities and their families receive the services and supports they need.

Social Security Publications relating to Disability, SSI, SSDI

- What you need to know to get Social Secuirty Disabiltiy Benefits # 10153

- Disability Benefits # 10029

- Reviewing your Disability Publication # 10068

- How Social Security decides if you are still disabled # 10053

- Check list for what’s needed on the application 001

- Appeals Process 10041

- Medicare # 10043

- Supplemental Security Income # 11125

- CA State Supplementary Payment (SSI/SSP)

- Benefits for Children with Disabilities #10026

- Benefits for Children # 10085

- How to get a benefit verification letter # 10552

- The Red Book – Employment Support for SSDI and SSI

- Working while disabled 10095

- Ticket to Work Program

- Publication 3966, Living and Working with Disabilities

- Publication 907, Tax Highlights for Persons with Disabilities

- How International Agreements can help you # 10180

- Social Security for Foreign Governments # 10566

- MORE Social Security Publications on their website

- Nolo's Guide to Social Security Disability We do have a reference copy in our office

- Sleepy Girl Guide to Social Security Disability

-

Links & Resources

Disability Benefits 101 on SDI * SSI *

publication 10026 - Benefits for Children with Disability

- What must I do to Qualify?

- What is Social Security's eligibility process

- Where is Social Security's home page for disability

- Can I get a Disability "Starter Kit?

- Tell me more about the Ticket to Work Program which gives you more choice in obtaining the services one needs to be able to go back to work and achieve your employment goals.

- Where can I get more disability information?

- Can I get an estimate of my retirement benefits? Sample Calculation

- Nolo.com Disability Benefits

Medicare Coverage

- Can I get Medicare After 2 years on Social Security Disability #10029?

- Learn More @ * Medicare Interactive *

- I'm already on SSDI, where can I get more information?

- Can we see a sample response to a website visitors questions?

- Do I automatically get Medi - Cal? (Medicaid?)

- bet tzedek.org Free Legal Aid

#SocialSecurityDisability

Factors in Evaluating

Parents & Care Givers

Check out our webpage on getting your own private disability coverage, in addition to Social Security Disability or SDI State Disability Coverage

- Disability Income – Pay Check Protection

- SSI – Supplemental Security Benefits – Automatic Medi Cal – SSDI

FAQ's

- Deafness?

- Mental Health – ACA/Health Reform Mandated Essential Benefit

- nolo.com/guide-to-social-security-disability

DI 10115.000

Childhood Disability Benefits (CDB)

| Section | |

|---|---|

| DI 10115.001 | Requirements for Entitlement to Childhood Disability Benefits (CDB) |

| DI 10115.005 | Eligibility for Child’s Benefits Based on Disability |

| DI 10115.010 | Other Childhood Disability Benefits (CDB) Factors of Entitlement |

| DI 10115.015 | Hospital Insurance (HI) Based on Childhood Disability Benefit (CDB) Entitlement |

| DI 10115.020 | Application Forms for Childhood Disability Benefit (CDB) |

| DI 10115.022 | Work Activity and Childhood Disability Benefit (CDB) Entitlement |

| DI 10115.025 | Childhood Disability Benefit (CDB) First Month of Entitlement (MOET) |

| DI 10115.030 | Retroactivity and Childhood Disability Benefit (CDB) |

| DI 10115.035 | Requirements for Reentitlement |

| DI 10115.040 | Childhood Disability Benefit (CDB) Reentitlement & Trial Work Period (TWP) Issues |

| DI 10115.045 | Summary of Evidence and Forms Required for Reentitlement Based on a Disability Which Began After Age 18 |

| DI 10115.050 | Termination of Childhood Disability Benefit (CDB) Entitlement |

#My Medi-Cal

How to get the Health Care

You Need

24 pages

Smart Phones - try turning sideways to view pdf better

-

- More explanation

- Enroll with Benefits Cal

- What is Medi Cal - VIDEO

-

Medi-Cal Managed Care HMO – Health Care Options

- Benefits Cal is a one-stop-shop to apply for...

- Briefing — Medi-Cal Explained: An Overview of Program Basics

- chcf.org/medi-cal-explained/

-

Here you can review and choose the HMO that you want to deliver your Medi-Cal health Care.

-

BIC Benefits Identification Card

Related pages in

[child-pages]

[sibling-pages]

Social Security – Retirement Benefits

- How are Social Security retirement benefits taxed?

- How are Social Security Benefits reduced if you are working?

- Optimum Age to start taking benefits 62 – 70?

- CPA take on Retirement

- Survivor – Death Benefits

Medi Cal

Medi Cal Contact Information

- #Email Addresses & Phone #'s

- Who to #contact at Medi Cal

- Main Email to Get a hold of Medi Cal --- [email protected]

- All inquiries related to Medi-Cal, including questions about terminating Medi-Cal coverage, must be referred to the beneficiary’s local county Social Services office.

- • Department of Health Care Services County Listings:

- • Covered California’s Medi-Cal page:.

- • Medi-Cal Reminders and When to Contact County Social Services:

- guide outlining information that certified enrollers can use when assisting Medi-Cal beneficiaries who may be eligible for and wish to enroll into a Covered California plan.

- • Department of Health Care Services County Listings:

- dhcs.ca.gov/medi-cal/Contacts

- health care options.dhcs.ca.gov/contact-us

- Medi-Cal Rx Customer Service Center

- Department of Health Care Services Contacts

- [email protected] regarding general Medi-Cal eligibility.

- If the question contains specific details the county or the district office that handles your case must answer.

- Benefits Cal - Enrollment Website

- • Assisting Medi-Cal Eligible Consumers FAQ:

- frequently asked questions and glossary terms to understand the Medi-Cal enrollment process and learn how to seek help for various scenarios.

- California Department of Health Care Services 1-844-253-0883

- Non MAGI Medi Cal 1.916.345.8675

- [email protected] Ms. Leslie Benson

- IHSS In Home Supportive Services

- Ombudsman Webpage

- Phone: 1-888-452-8609

- Email: [email protected]

- The Office of Ombudsman cannot approve/terminate/reinstate Medi-Cal eligibility; alter aid codes, change/update addresses, change/update name or initiate inter-county transfers.

- Complex Questions Assistance

-

- Health Consumer Alliance at 1-888-804-3536.

- Disability Rights California at 1-800-776-5746.

-

-

- HICAP – Health Insurance Counseling & Advocacy Program

- CA Health Care Advocates – 1-800-434-0222 Volunteer counselors can help you understand your specific rights and health care options

- CA Health Care Advocates – 1-800-434-0222 Volunteer counselors can help you understand your specific rights and health care options

- Medi Cal Consulting Services

- National Center on Law & Elder Rights

- VITA Volunteers Income Tax Assistance

- Bet Zdedek Legal Services

- Medi Cal - Technical Comprehensive Reference Materials

- Our webpage on education, research & tutoring for a fee

- aging.ca.gov/Medicare_& Medi Cal Counseling

- Elder Care locator

- medi helper.com

- Pdf Brochure - I was told their fee is $3k

- HICAP – Health Insurance Counseling & Advocacy Program

See our Main Webpage on Medi Cal contact information

Non MAGI Medi Cal

What Parents Need to Know about #Special Needs Trusts

VIDEO

Trans America

Special Needs Trust Brochure

#Nolo Special Needs Trusts

- Get Life Insurance Quote to fund the trust

- Our webpage on Special Needs Trusts

- Social Security Publication 10076 Guide for Representative Payees

- FAQ's

- When does the trust actually get funded, go into place, become effective?

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

- See chapter 2 for what payments and benefits the child can get

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

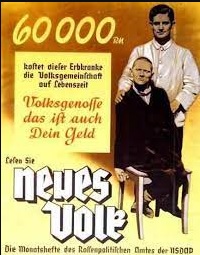

Hitler & Mental Health Disabilities T 4

Speak up! Do want you can to make sure this doesn't happen in the USA!

Translation for the poster below:

"This person suffering from hereditary defect costs the community $60,000 Reichsmark during his lifetime. Fellow German, that is your money, too. Translation & Image Courtesy of Psychology Fantom.com

Under the T 4 program, wikipedia.org T4 Certain German physicians were authorized to select patients "deemed incurably sick, after most critical medical examination" and then administer to them a "mercy death" (Gnadentod).[7] The T4 programme stemmed from the Nazi Party policy of "racial hygiene", a belief that the German people needed to be cleansed of racial enemies, which included anyone confined to a mental health facility and people with simple physical disabilities.[31] wikipedia.org T4

The annual cost for a bed in a CDCR-operated, inpatient psychiatric program is around $301,000 lao.ca.gov *

Did President Trump??? really say and mean this? Time.com

https://youtu.be/gpQQuGHD73Q?si=W5O6N-91jfrRLBaN

I have to get ssdi for my severely autistic nonverbal disabled daughter at the end of the month because her father is retiring.

She gets ssi and I get ihss to take care of her.

How do I insure she continues to get her ssi.

I’ve already been told by social security that she will lose it and I know that is not true. I need written paperwork on the pickle amendment and also if you know how to insure her paperwork is filled out correctly I would appreciate the help.

What the Pickle amendment is about, is that she will lose SSI and get SSDI – more $$$, BUT she still retains Medi Cal!

Let’s set up a Zoom meeting to discuss this in more detail next week.

See our section above on the Pickle Amendment

See our webpage on SSI & SSDI

I’m not an attorney and can’t give legal advice. Your argument is not with Social Security, but with Medi Cal, should they not realize the Pickle Amendment applies and deny you Medi Cal or IHSS In Home Supportive Services benefits.

Here’s our webpage on Medi Cal appeals.

Did you want to look at Dual Eligible or Chronic Needs Medicare Advantage Plans?

If you want “written paperwork” on the pickle amendment, just print off all our references.

Don’t feel bad. It’s confusing. What I learned in my year of law school was to read a law 3 times and then when you think you understand it, read it again.

Hello, I am 25, I live in San Francisco CA, and as of July 2020, I already was awarded SSI.

However, I found out I was potentially eligible for Disabled Adult Child DAC, as I have no work history besides 2 weeks spent working at a Dunkin Donuts at age 19, and have been disabled well before 22 years of age.

The current 2 disabilities I have that have made me eligible for SSI I have had since I was 12 and 17 years old, and my mom has been getting retirement benefits from the SSA for 4 years, and my dad has been receiving retirement benefits from the SSA for well over a year now, before I even turned in my application for SSI Supplemental Security Income that has since been approved.

However, when I first moved to San Francisco in 2018, I was told my father could no longer claim me as a dependent if I wanted to receive EBT or General Assistance Cash benefits, since I now receive SSI,

I don’t get any cash benefits and only receive $16 in EBT.

In order to apply for DAC, will my father have to claim me as a dependent again?

Do you know more about the DAC application process?

The SSA told me it must be done over the phone. Is that true?

I was wondering what this means, I found it on another website,

Can you please explain a little better what “Primary insurance amount is,” and what the family maximum is in the state of California, if you know the answer?

After that, I have one more question I wanted to ask after you’re done answering that question I just mentioned if you can.

Please and thank you.

The “primary insurance amount” (PIA) is the benefit (before rounding down to next lower whole dollar) a person would receive if he/she elects to begin receiving retirement benefits at his/her normal retirement age. At this age, the benefit is neither reduced for early retirement nor increased for delayed retirement.

All the “Google” research I just did, yes it appears that you must call Social Security. Non COVID, you could have visited them in person. See new material above as I did extensive updates to this page to answer your question.

You might also check with the Attorney’s listed above too.

Both my parents receive retirement benefits from the SSA, my mother for 4 years, my dad for over a year, way before the date of my application was even started or turned in

1. Do DAC and SSDI require separate applications?

I was already approved for SSI, but when I applied for SSI, I had a social worker help me, she filled out the application for me and claimed it was an application for both SSI and SSDI.

She never gave me the chance to review the application before she sent it, I was only just recently able to get it. She knew I’ve had Major Depression since I was 12, and PTSD since I was 17, and knew my parents were in their 60’s.

So when I found out I was eligible for DAC, I was very upset to see that she left the page blank that asks for my parents social security numbers, and left most of the page blank.

She answered only one of the questions on the page, meaning she saw the page. But she responded to none of the questions on the page related to DAC and never asked me nor my parents for their SSN’s, despite me having given her a release to speak to them.

She also claimed I took benzos recreationally when I told her I had been prescribed them, not that I had been taking them recreationally.

2. Is DAC a type of SSDI?

3. What are the limits for resources and income not including my SSI in California?

4. What are the limits for resources and income with DAC in California?

5. Is it true I can’t get married, unless I want to marry someone who also gets disability if I’m awarded DAC and want to keep it?

6. Is it true if I still want MediCal on DAC, Id need to continue to abide by SSI rules?

7. How can I get someone to help me apply for DAC without a similar incident happening like the one I had with the social worker?

8. Do my parents need to claim me as a dependent for me to get DAC?

9. What is Collateral Estoppel, the Pickle Amendment, SGA, COLA, and what are ABLE accounts? My parents are trying to get a special trust for me. Do you know much about that and how money can be distributed without problems from the SSA?

10 How do I switch from SSI to SSDI?

11 Since I didn’t get SSI till age 24, how do I show I was disabled prior to age 22?

my Major depression and PTSD is what got me awarded SSI, but for whatever reason, Social Security decided that they could only prove the onset of my disability started at the date of turning in my application, despite them having hundreds and hundreds of pages with diagnoses from many different hospitals and doctors going way back into my childhood

#3 & # 4 Resource Limits are on this page

# 7 I’m not sure really where to find help applying for benefits. Check all the links, citations and resources that we have on this DAC page along with the similar pages in this section.

# 9 Our information on the Pickle Program is on this page above

# 9 Here’s our webpage on Special Needs Trusts

# 9 Under the rules of collateral estoppel, Social Security will not again decide an issue we have already decided in a prior determination or decision, unless there are reasons to believe that the prior finding on the issue was wrong. See also How to Get On.com

# 2 DAC Screening is listed above under the Pickle Program

# 10 Applying for SSDI when parent dies or retires is explained above in the Retirement – Survivors section. There is a 15 page adult disability report, but Social Security says you have to call or pre COVID visit their office.

# 5 I guess being married is an issue with what your family income is. See our resources page.

My son receives DAC. He lives in Florida. If he moves to California, will amount of monthly deposit increase due to COLA?

TY!

I don’t know. It’s beyond my expertise.

https://howtogeton.wordpress.com/how-to-get-adult-disabled-child-benefits/

The SSA has numerous criteria you will have to meet In order to receive disability benefits. Calculations are estimates and may not be accurate. Actual benefit amounts may vary substantially.

Social Security Disability Insurance (SSDI)

Your SSDI benefits are based on the amount of income on which you have paid social security taxes. Your average earnings are called your Average Indexed Monthly Earnings (AIME). Using your AIME, the SSA will calculate your Primary Insurance Amount (PIA). As of 2014, the PIA is calculated by taking 90% of AIME under $816, 32% of AIME between $816 and $4917, and 15% of AIME greater than $4917. The final PIA amount is the maximum amount of SSDI benefits that you are entitled to.

Try asking one of the attorney’s above or CA Health Care Advocates. Contact Page

My brother is 40 years old. He has been disabled since birth. He now receives SSDI and medicaid that pays his day program and health insurance.

The question is How much can he earn without losing his benefits.

How your earnings affect your Social Security benefits

During the trial work period, test your ability to work for at least nine months there are no limits on your earnings.

During the 36-month extended period of eligibility, after the trial work period, you usually can make no more than $1,220 a month in 2019 or your benefits will stop

Expedited Reinstatement — If your benefits stop because of substantial earnings, you have five years to ask us to restart your benefits if you’re unable to keep working because of your condition.

You won’t have to file a new application or wait for your benefits to restart while we review your medical condition https://www.ssa.gov/pubs/EN-05-10095.pdf

My brother now has a part time job.

How much can he make without losing his benefits.

Social Services has given me such a run around he has even lost his benefits

Here’s our research so far:

Social Security Working While Disabled: How We Can Help Publication # 10095

DI 10115.022 Work Activity and Childhood Disability Benefit (CDB) Entitlement

Trial Work Period (TWP) Issues

How old is your brother?

When did he first become disabled?

Is he on SSI, SSDI or what?

My brother is 40 years old. He has been disabled since birth. He now receives SSDI and medicaid that pays his day program and health insurance.

The question is How much can he earn without losing his benefits.

How your earnings affect your Social Security benefits

During the trial work period, test your ability to work for at least nine months there are no limits on your earnings.

During the 36-month extended period of eligibility, after the trial work period, you usually can make no more than $1,220 a month in 2019 or your benefits will stop

Expedited Reinstatement — If your benefits stop because of substantial earnings, you have five years to ask us to restart your benefits if you’re unable to keep working because of your condition.

You won’t have to file a new application or wait for your benefits to restart while we review your medical condition https://www.ssa.gov/pubs/EN-05-10095.pdf

Here’s instructions on how to move from SSI to SSDI.

How do you do on these Pickle Amendment Screening Questions?

Screening is as follows:

Step 1. Ask the individual, “Are you now receiving a social security check?” If the answer is no, the individual is not Pickle eligible. If the answer is yes, go on to step 2.

Step 2. Ask the individual, “After April 1977, did you ever get an SSI check at the same time that you got social security, or did you get SSI in the month just before your social security started?” If the answer is no, the individual is not Pickle eligible. If the answer is yes, go on to step 3.

Step 3. Ask the individual, “What is the last month in which you received SSI?”

Step 4. Look up, in the table below, the month in which the individual last received SSI. Find the percentage that applies to that month. Multiply the present amount of the individual’s (and/or spouse’s) social security (OASDI) benefits by the applicable percentage.

Step 5. You have just calculated the individual’s countable social security income under the Pickle Amendment. Add the figure that you have just calculated to any other countable income the individual may have. If the resulting total is less than the current SSI income criteria in your state, the individual is Pickle eligible, from the standpoint of income, for Medicaid benefits. (The individual must still satisfy separate Medicaid resource and nonfinancial requirements.)

Example.

See below where we gave another website visitor the email address for Medi Cal Eligibility. How about emailing them, showing them how it’s done and see what they say?

If that doesn’t work, try one of the attorneys listed above on our page, or in the citations, in the upper right of where we got our information.

Try this website too https://specialneedsanswers.com/

I have been disabled since age two, and on SSI and Medi-Cal since eighteen.

About two years ago I applied for DAC and Medicare followed.

Then last year I was no longer receiving Medi-Cal.

According to this information that you have provided and other websites I have read, I never should of been disconnected from Medi-Cal. The SSA and the County of Los Angeles should have my long term records. I filled six forms for Medi-Cal to different SSA and County offices and seem to get nowhere.

Am I missing a correct office that I should contact?

Try the contact information on our Medi Cal website. [email protected]