Special Needs Trust for Disabled Adults – Heirs

in California

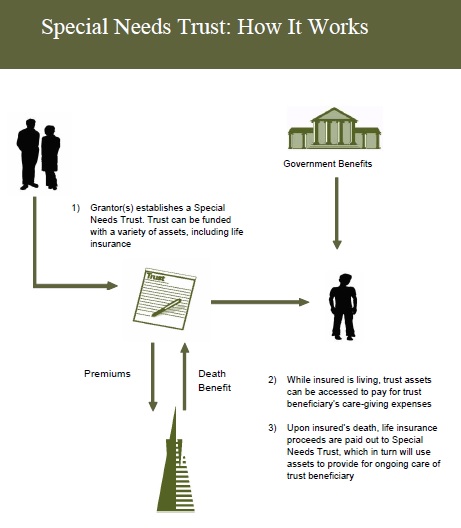

A Special Needs Trust (SNT)

A Special Needs Trust (SNT), sometimes called a Supplemental Needs Trust, is a legal arrangement in which a person or organization (like a bank) manages assets for a person with a disability. The person with the disability is called the “beneficiary” and the person who is managing the assets is the “trustee.” Many kinds of assets can be put into a trust, such as cash, stocks, bonds, and real estate. An SNT provides for the needs of a person with a disability without losing or reducing their benefits such as

- Supplemental Security Income (SSI),

- Medi-Cal,

- In-Home Support Services (IHSS), and HUD housing assistance.

Assets in an SNT won’t be counted toward the SSI, Medi-Cal and IHSS asset limit of $2000 for an individual.

Links & References

- CA Disability Benefits 101

- Transamerica Special Needs Trust Brochure

- kaiden elder law.com/special-needs-trusts

- Avoid taxes on earnings? FAQ

- Jewish LA Trust & Services * FAQ’s *

- South Eastern Trust Company

- CA Department of Health Care Services – Special Needs Trusts

- Abusive Trust Tax Evasion Schemes – Questions and Answers

- Earn your The Chartered Special Needs Consultant® (ChSNC®) Designation

- YouTube Videos on Special Needs Trusts & ABLE Accounts

- Probate Conservatorship to protect the adult child’s current assets.

See also Court Website for FAQ’s

- Our webpage on Probate Conservatorships

What Parents Need to Know about #Special Needs Trusts

Trans America

Special Needs Trust Brochure

#Nolo Special Needs Trusts

- Get Life Insurance Quote to fund the trust

- Our webpage on Special Needs Trusts

- Social Security Publication 10076 Guide for Representative Payees

- FAQ's

- When does the trust actually get funded, go into place, become effective?

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

- See chapter 2 for what payments and benefits the child can get

- See page 47 of Nolo's book on Special Needs Trusts - The best known way is to specify what assets go into the trust at your demise. Be careful of probate, page 48. See Revocable Living Trusts on Page 50. Where a living trust can fund a Special Needs trust at your passing. See page 140 about actually creating the Special Needs Trust

#SSI-Related Programs, Private Disability & Coverage Groups

Our web pages on:

- Aged and Disabled Federal Poverty Level Program

- Disability Income – Pay Check Protection

- Part D Rx Low Income Subsidy – LIS – Extra Help

- Hospice Coverage – Medicare

- SSI for Groups & Organizations Publication # 11015

- Regional Centers Department of Developmental Services

- City of Los Angeles - Disability

- Access - Transportation for disabled

- Law Research Guides Library of Congress

SSI #Resources & Income Limits

The Aged & Disabled Medi-Cal program uses SSI countable income rules as well as a few extra rules you should know. For more information, visit our webpages on the SSI & Medi Cal programs, and follow the various links on this page

- Medi-Cal section of the

- Countable resources are the things you own that count toward the resource limit. Many things you own do not count.

FLASH!!!

The asset limit in the Medi-Cal programs serving older adults and people with disabilities has been eliminated! Ooops, better double check that! CA Health Care Advocates * DHCS *

Have less than $2,000 in Countable assets for an individual ($3,000 for a couple).- Medi-Cal property limitations.

- asset questionnaire

- CANHR Fact Sheet

- Understanding Medi-Cal’s Asset Test for Seniors and People With Disabilities

- Western Poverty Law

- Nolo - SSI Income & Asset Limits

- Income SSA.Gov

- Will my settlement affect my government benefits? VIDEO

- dhcs.ca.gov/Asset-Limit-Changes-for-Non-MAGI-Medi-Cal

- california healthline.org/sset-test-elimination

- FAQ's

- Our webpage on SSI Resources & Income

- Have less than... of FPL in countable monthly income for an individual ... for a couple). ca health advocates.org ADFPL * AB 715 Fact Sheet * Western Poverty Law *

- Share of Cost if income is too high, but you qualify on asset test?

Contact Us - Ask Questions - Get More Information - Schedule a Zoom Meeting

[email protected]

By submitting the information below , you are agreeing to be contacted by Steve Shorr a Licensed Sales Agent by email, texting or Zoom to discuss Medicare or other Insurance Plans as relevant to your inquiry. This is a solicitation for Insurance

Find an Attorney

- Legal Match

- Findlaw.com

- American Bar Association

- Attorney Search Network

- Follow the links on this webpage. Many of them go to articles on Attorney Websites

- Also, see our appeals webpage

- Medi Cal Contact

- State Bar of California.com Attorney Referral Service

#Attorney 's --- Social Security Disability maze

- Sellers Law

- Hill & Ponton

- premier disability.com

- Cantrell & Green

-

- We don't necessarily know these attorney's...

- Editorial: Lawyers are fighting innovative proposals for more affordable legal assistance. That’s wrong LA Times 1.30.2022

Estate Planning

- We don't necessarily know these attorney's...

Related Pages

Life Insurance